Market Outlook

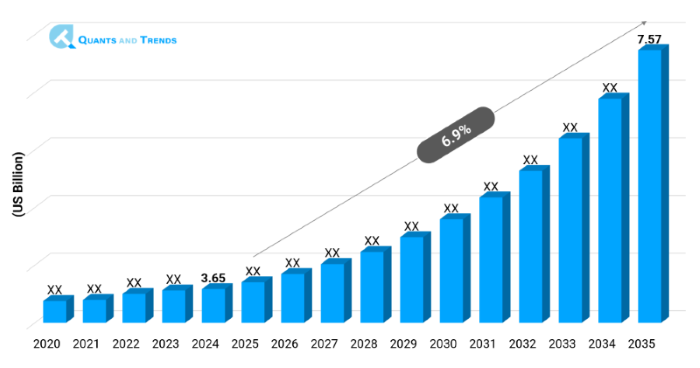

The global Healthcare Supply Chain Management Market was valued at approximately USD 3.65 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 7.57 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The emergence of the Healthcare Supply Chain Management Market involves a great deal of transformation in the market which has been brought on by the need to create transparency, efficiency, and real-time tracking of inventory within the health systems to globalize. The ultra-fast pace of digitalization, the growing regulatory pressure, and the pressure on providers to reduce their expenses have turned supply chain resilience into one of the highest priorities. In addition, the COVID-19 pandemic highlighted the weaknesses of traditional supply chain systems and instead introduced the digital and predictive approaches.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 6.9% |

| Market Value In 2024 | USD 3.65 billion |

| Market Value In 2035 | USD 7.57 billion |

Introduction

The Healthcare Supply Chain Management Market is a vast sphere which includes numerous technologies, software interfaces, and operational models which help supply, pack and distribute pharmaceuticals, medical equipment, and health services. The more care delivery becomes data-driven, the more well-advanced technologies, such as IoT, cloud-based inventory systems, and predictive analytics, are transforming the way in which healthcare organizations run their logistical operations.

Key Market Drivers: What’s Fueling the Healthcare Supply chain Management Market Boom?

- Digital Transformation of Hospital Logistics: Digital transformation of hospital logistics is a major driver towards growth as it involves incorporation of cloud computing platforms, data analytics, and IoT in healthcare logistics. To enhance the supply and prevent a shortage that may be of crucial level, hospitals switch to automated inventory systems and AI-based demand forecasting software. To illustrate, predictive modeling platforms have the potential to eliminate stock-outs of critical medicines before they occur by accessing real-time data on patients and consumption patterns. This does not only enhance the quality of care but also saves a lot of operational costs.

- Increasing Focus on Regulatory Compliance: Regulation like the Drug Supply Chain Security Act (DSCSA) in the U.S. and EU Falsified Medicines Directive (FMD) have driven the need to build a track and trace system complete with serialization promotion among healthcare stakeholders. It has resulted in further adaptation of blockchain and RFID technology which provides secure and verifiable products tracking. Superior codes of compliance have promoted honesty and responsibility within the chain of supply especially within the pharmaceutical industry.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The market of healthcare supply chain management is focused on innovation based on the use of AI-powered logistics, the tracing to blockchain, and the cloud-native platforms. These technologies are making wiser decisions, enhancing supplier partnership and automating manual processes. Furthermore, there are some emerging technologies such as augmented reality (AR) and robotics in the warehouse management with a view to enhancing order fulfillment accuracy.

Recent Developments:

SAP unveiled improvements of SAP Intelligent Healthcare Network in 2024 with a prediction and integration around AI based solutions with EHR solutions. The goal of these upgrades consists in maintaining supply chain activities that are more predictive and data rich.

Conclusion

Healthcare Supply Chain Management Market has transitioned into a strategic transformation, which has been driven by digital transformation, regulation, operational resiliency. Cloud platforms, blockchain, and AI investments are allowing healthcare providers to optimize procurement by complementing patient safety and capping down confronting costs. As more people seek personalized services and experience quicker delivery dates, dynamic and open chains will be the key to defining the future of healthcare logistics. With the changes in the global health systems, there is a need in markets to be constantly innovative in offering products and services that they can win and to keep up with the regulatory and technology-driven environment.

Related Reports

- The global Vaccines Market was valued at approximately USD 86.32 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035, reaching around USD 159.36 billion by the end of the forecast period.

- The global Pharmaceutical Manufacturing Market was valued at approximately USD 584.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 12.4% from 2025 to 2035, reaching around USD 2,110.9 billion by the end of the forecast period.

Key Market Players

The global Healthcare Supply Chain Management Market is continuously experiencing high competition among global and regional players who are concentrating more on the aspects of innovation, strategic alliance, and verticalization. Businesses are spending money on AI, IoT, and blockchain, to gain transparency and efficiency. Merger and acquisition activity and M&A growth, supplier consolidation, and emergent cloud-native solution providers are changing the market environment. Some of the key players in the Healthcare Supply chain Management industry are as:

Oracle Corporation, SAP SE, McKesson Corporation, Tecsys Inc., Global Healthcare Exchange (GHX), Manhattan Associates, Cardinal Health, Jump Technologies, IBM Corporation, Microsoft Corporation, Infor Inc., Smith & Nephew, Medtronic, Syft (a GHX company), LogiTag Systems

- Software Platforms: They allow central purchasing, workflow automation, vendor management and compliance tracking in an efficient manner with regards to hospital systems, and thus software platforms play a crucial role of providing visibility of operations and cost control.

- Hardware: Enable the real-time monitoring of medical supplies and equipment reducing loss, proper inventory counts and better logistics inside healthcare facility.

- Services: Offer high-level advisory and IT systems integration to ensure efficiency in supply chain management, demand forecasting and vendor performance, which is of great use where such hospitals lack an expertise in-house.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Cloud-Based: Provide extensible, real-time supply chain information-access options, reduced IT support expenses, and EHR- and procurement system-integration capability with the benefit of suiting modern hospital networks.

- On-Premise: Available physically on premise to institutions requiring that data be controlled and that internal access to a server be relatively high, usually in legacies or in an environment with strict regulation inhibiting cloud adoption.

- Hybrid: Make use of cloud flexibility alongside the on-premise control as it serves large systems in healthcare and needs data flexibility, high security, and adherence/personalization of infrastructure.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Inventory Management: Manages inventory in real time, minimizes waste and facilitates automated restocking of essential medical provisions and medication.

- Procurement and Sourcing: Manages the selection and negotiation of vendors, automating purchase orders, and is able to streamline sourcing, and drive down costs.

- Compliance / Risk Management: Here ensures that all standards regulatorily are followed, reduces supply chain failure and supplies supplier risks by use of analytics and audit-ability.

- Order Fulfillment & Transportation: The technologies and procedures that guarantee pharmaceuticals, medical supplies, and equipment are delivered precisely and on schedule to their destination are the focus of the Order Fulfillment & Transportation segment of the healthcare supply chain management market. This entails overseeing order processing, planning the best routes for deliveries, and making sure that stringent guidelines for product traceability and temperature control are followed.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics: Depend extensively on SCM tools to keep various inventories within control, organize vendors, and avoid situations when the supplies needed get short and directly affect the care provided to the patients and continuity of operation.

- Pharmaceutical Companies: The platforms constructed by SCM are used to trace raw material, compliance, recall, and follow up on the global transportation process between production and packaging.

- Distributors & Logistics Providers: Streamline warehousing, transport, and just-in-time delivery channels with highly sophisticated supply chain solutions that will match the dynamic inventory requirements of the providers.

- Group Purchasing Organizations: Group Purchasing Organizations (GPO) consolidate hospital purchasing, contract suppliers and manage procurement through custom SCM systems to achieve transparency and compliance with supplier prices and contract management.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America occupies the Healthcare Supply Chain Management Market, owing to the strict regulatory requirement, immense use of technology, and large investments on the healthcare infrastructure. The U.S. is in the lead as there are well-developed digital supply chain systems and the widespread application of AI and IoT in the delivery process. The fastest-growing region is Asia-Pacific, and such countries as China and India are investing in the development of healthcare facilities, digitalization, and their own production of drugs.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Supply Chain Management Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Supply Chain Management Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Supply Chain Management Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Supply Chain Management Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Component & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Supply Chain Management Market – By Component

5.1. Overview

5.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

5.1.2. Software

5.1.3. Hardware

5.1.4. Services

(presents market segmentation by Component, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Supply Chain Management Market – By Deployment Mode

6.1. Overview

6.1.1. Segment Share Analysis, By Deployment Mode, 2024 & 2035 (%)

6.1.2. Cloud-Based

6.1.3. On-Premise

6.1.4. Hybrid

(breaks down the market by Deployment Mode, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Supply Chain Management Market – By Functionality

7.1. Overview

7.1.1. Segment Share Analysis, By Functionality, 2024 & 2035 (%)

7.1.2. Inventory Management

7.1.3. Procurement & Sourcing

7.1.4. Compliance & Risk Management

7.1.5. Order Fulfillment & Transportation

(focuses on market segmentation by Functionality, helping the client prioritize specific crop Components or end-use areas that offer significant business opportunities)

8. Healthcare Supply Chain Management Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Pharmaceutical Companies

8.1.4. Distributors & Logistics Providers

8.1.5. Group Purchasing Organizations (GPOs)

(describes the market division by End-User of Component, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Supply Chain Management Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Supply Chain Management Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Supply Chain Management Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Oracle Corporation

10.3.2. SAP SE

10.3.3. McKesson Corporation

10.3.4. Tecsys Inc.

10.3.5. Global Healthcare Exchange (GHX)

10.3.6. Manhattan Associates

10.3.7. Cardinal Health

10.3.8. Jump Technologies

10.3.9. IBM Corporation

10.3.10. Microsoft Corporation

10.3.11. Infor Inc.

10.3.12. Smith & Nephew

10.3.13. Medtronic

10.3.14. Syft (a GHX company)

10.3.15. LogiTag Systems

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Supply Chain Management Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Supply Chain Management Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Supply Chain Management Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Supply Chain Management Market: Component Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Component

TABLE 6: Global Healthcare Supply Chain Management Market, by Component 2022–2035 (USD Billion)

TABLE 7: Healthcare Supply Chain Management Market: Deployment Mode Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Deployment Mode

TABLE 9: Global Healthcare Supply Chain Management Market, by Deployment Mode 2022–2035 (USD Billion)

TABLE 10: Healthcare Supply Chain Management Market: Functionality Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Functionality

TABLE 12: Global Healthcare Supply Chain Management Market, by Functionality 2022–2035 (USD Billion)

TABLE 13: Healthcare Supply Chain Management Market: End-User Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Healthcare Supply Chain Management Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Healthcare Supply Chain Management Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Supply Chain Management Market, by Region 2022–2035 (USD Billion)

TABLE 19: Healthcare Supply Chain Management Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Healthcare Supply Chain Management Market, by Component (NA), 2022–2035 (USD Billion)

TABLE 21: Healthcare Supply Chain Management Market, by Deployment Mode (NA), 2022–2035 (USD Billion)

TABLE 22: Healthcare Supply Chain Management Market, by Functionality (NA), 2024–2035 (USD Billion)

TABLE 23: Healthcare Supply Chain Management Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 25: U.S. Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 26: U.S. Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 27: U.S. Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 29: Canada Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 30: Canada Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 31: Canada Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 33: Mexico Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 34: Mexico Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 35: Mexico Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Healthcare Supply Chain Management Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Healthcare Supply Chain Management Market, by Component (Europe), 2022–2035 (USD Billion)

TABLE 38: Healthcare Supply Chain Management Market, by Deployment Mode (Europe), 2022–2035 (USD Billion)

TABLE 39: Healthcare Supply Chain Management Market, by Functionality(Europe), 2022–2035 (USD Billion)

TABLE 40: Healthcare Supply Chain Management Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 42: Germany Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 43: Germany Healthcare Supply Chain Management Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 46: Italy Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 47: Italy Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 48: Italy Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 54: France Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 55: France Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 56: France Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 58: Russia Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 59: Russia Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 60: Russia Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 62: Poland Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 63: Poland Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 64: Poland Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Healthcare Supply Chain Management Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Healthcare Supply Chain Management Market, by Component (APAC), 2022–2035 (USD Billion)

TABLE 71: Healthcare Supply Chain Management Market, by Deployment Mode (APAC), 2022–2035 (USD Billion)

TABLE 72: Healthcare Supply Chain Management Market, by Functionality(APAC), 2022–2035 (USD Billion)

TABLE 73: Healthcare Supply Chain Management Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 75: India Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 76: India Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 77: India Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 79: China Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 80: China Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 81: China Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 83: Japan Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 84: Japan Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 85: Japan Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 87: South Korea Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 88: South Korea Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 89: South Korea Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 91: Australia Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 92: Australia Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 93: Australia Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 99: Brazil Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 100: Brazil Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 101: Brazil Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 103: Argentina Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 104: Argentina Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 105: Argentina Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 107: Colombia Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 108: Colombia Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 109: Colombia Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 115: Israel Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 116: Israel Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 117: Israel Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 119: Turkey Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 120: Turkey Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 121: Turkey Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 123: Egypt Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 124: Egypt Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 125: Egypt Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Healthcare Supply Chain Management Market, by Component, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Healthcare Supply Chain Management Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Healthcare Supply Chain Management Market, by Functionality, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Healthcare Supply Chain Management Market, by End-User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Healthcare Supply Chain Management Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Deployment Mode Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Deployment Mode Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Supply Chain Management Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Supply Chain Management Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Supply Chain Management Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Supply Chain Management Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Healthcare Supply Chain Management Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Healthcare Supply Chain Management Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Healthcare Supply Chain Management Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Healthcare Supply Chain Management Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Healthcare Supply Chain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As the head of procurement for a major hospital network in the Midwest, understanding global disruptions, cost-efficiency models, and digitization trends is critical. The Healthcare Supply Chain Management Market Research Report provided incredibly detailed insights on vendor consolidation, logistics automation, and regional bottlenecks. The data was not only current but deeply contextualized, far more practical than generic reports. It directly informed our RFP strategy for the coming fiscal year."

- Emily Carson, Director of Strategic Sourcing, USA

- "We were in the process of upgrading our warehousing and distribution system across multiple EU countries. This report offered a nuanced analysis of regulatory shifts, cross-border compliance requirements, and AI-based inventory tracking in the healthcare sector. It gave us clarity on competitive benchmarks and investment feasibility that we hadn’t seen elsewhere. It saved us weeks of internal analysis and helped our executive board approve a €12M systems overhaul."

- Lukas Mertens, Healthcare Operations Consultant, Germany

- "With healthcare demand rising across Southeast Asia, we needed strong insights into scalable and sustainable supply chain models. This report went beyond surface-level statistics and unpacked critical elements, like last-mile delivery, cold chain logistics for biologics, and digital integration across supplier ecosystems. The competitive intelligence section especially helped us re-evaluate vendor partnerships. It’s become a go-to document for our quarterly planning cycles."

- Dr. Rina Yamada, Healthcare Supply Chain Strategist, Singapore

This report on the Healthcare Supply Chain Management Market 2025 has been developed by a team of seasoned healthcare analysts at Quants & Trends, who bring over a decade of combined experience in global healthcare logistics, procurement intelligence, and digital transformation trends. Our experts specialize in tracking evolving supply chain architectures across pharmaceuticals, medical devices, hospital networks, and third-party logistics (3PL) ecosystems.

Every insight presented in this report is backed by rigorous primary research, in-depth interviews with supply chain professionals, and real-world data analysis from global healthcare operations. Our analysts have worked closely with hospital administrators, technology solution providers, and procurement teams to ensure the findings are not only statistically sound but also strategically actionable.

The report is designed to help senior executives, supply chain heads, and healthcare consultants make informed decisions about vendor alignment, risk mitigation, inventory planning, and automation investments. Whether you're restructuring your logistics network, evaluating cold chain technologies, or assessing regional supplier performance, this report offers granular and forward-looking perspectives you can trust.

To learn more about our work and connect with our analysts, visit the Quants & Trends LinkedIn page for updates, expert commentary, and insights across the healthcare research landscape.