Market Outlook

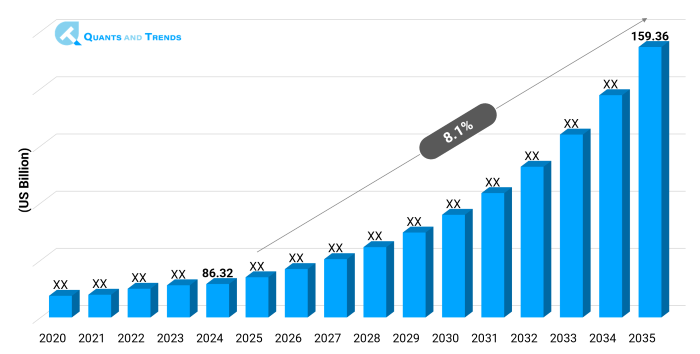

The global Vaccines market was valued at approximately USD 86.32 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035, reaching around USD 159.36 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

This growth has been attributed to the rising number of immunization programs, growing incidence of infectious diseases, and technological innovations that enhance the mode of vaccine delivery worldwide. Government sponsorship and campaigns organized by WHO are encouraging the demand in both in the developed and developing worlds. As recent Vaccines Market Report shows, innovations of biotechnology, mRNA-based platforms, and the expanded capability of cold-chain are refashioning the competition landscape. Areas of Key Trends in Vaccines are Personalized Immunization and combination Vaccines which shows a bright development prospect in the forecast period.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 8.1% |

| Market Value In 2024 | USD 86.32 billion |

| Market Value In 2035 | USD 159.36 billion |

Introduction

The Vaccines Market is a key player in ensuring the quality of the citizens, decreasing mortality and eliminating epidemic. The industry is a wide spectrum with different classes of products including conventional attenuated vaccines as well as innovative recombinant and nucleic acid-based vaccines. The increasing consciousness, better availability even in low- and middle-income countries, and the government financing is fanning up fast. The market forces indicate a trend towards the production of scale and speed of R&D and use of technology within vaccines and effective international collaboration to achieve worldwide equity.

Key Market Drivers: What’s Fueling the Vaccines Market Boom?

- Increasing Immunization Coverage and International Health Programs: Universal health stands through public health efforts like Gavi and its efforts in immunization campaigns which have significantly boosted the vaccine uptake. Routine immunization is being made mandatory by governments and now covers children as well as adults. This pressure is one of the driving forces on the whole Vaccines Market Size & Share.

- Innovation in Vaccine Development: The mRNA technology, AI-supported antigen optimization, and superior adjuvants are transforming the effectiveness of the vaccine and its increase in the rate of production. Those innovative advancements that play a significant role in Vaccines Industry Analysis are also reducing development processes but making it possible to provide quick response to a newly emerged pathogen.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The innovations across the Vaccines Market revolve around mRNA platforms, low-resource settings thermostable formulations, and needle-free mode of delivery. It is also utilizing AI and genomic sequencing to make the product of precision immunizations safer, more efficacious, simpler to transport around the globe.

Recent Developments:

In 2024, Pfizer reported increased capability in the production of mRNA to fulfil the pandemic preparedness targets worldwide.

Conclusion

Vaccines Market Forecast has shown continuous rise, which is supported by the increasing awareness on diseases, strengthening research and development pipeline, and enhancement in the overall distribution channels. Although regulatory and logistics hurdles remain, there is huge potential in mRNA technology, precision immunization. The possibility of the vaccines industry being able to combat the existing and emerging health problems of the world population is dependent on further investment in innovation and equitable access.

Related Reports

- The global Healthcare Supply Chain Management Market was valued at approximately USD 3.65 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 7.57 billion by the end of the forecast period.

- The global Infectious Disease Management Market was valued at approximately USD 21.7 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2035, reaching around USD 48.4 billion by the end of the forecast period.

Key Market Players

The existing drugs giants, bio companies’ innovators, and local manufacturers characterize the Vaccines Competitive Landscape. The rivalry takes place in terms of innovation, prices, volume of manufacturing and access to distribution. Transactions are frequent in form of mergers, acquisitions and licensing agreements with the focus being on increases of pipelines and penetration in emerging markets. Some of the key players in the Vaccines industry are as:

Pfizer Inc., Moderna Inc., GlaxoSmithKline plc, Sanofi S.A., Merck & Co. Inc., Johnson & Johnson, Bharat Biotech, Serum Institute of India Pvt. Ltd., AstraZeneca plc, Novavax Inc., Sinovac Biotech Ltd., CSL Limited, Emergent BioSolutions Inc., Daiichi Sankyo Company Ltd., Vaxart Inc.

Segmentation By Type

- Live Attenuated Vaccines: This type of vaccine contains attenuated pathogens, which give a highly protective and long-term immune response, and usually fewer doses are needed before they could get effective results to prevent and control the disease.

- Inactivated Vaccines: Abuse killed pathogens, safe and can be used to trigger immunity without causing the illness, which could be used in people who have impaired immunity or in people with some medical conditions.

- Subunit, Recombinant, Polysaccharide and Conjugate Vaccines: Contain specific pathogen antigens to induce immunity, they provide a narrow scope of protection with fewer side effects and enhanced safety records even in fragile demographics.

- Nucleic Acid (mRNA and DNA) Vaccines: Provides genetic instructions to manufacture antigens, and so it is scalable, quick to develop, and highly effective against a widely-recognized range of infectious disease.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Influenza: Flu vaccinations every year guard against a developing virus and minimize the severity of the illness, hospitalization, and seasonal outbreak-related healthcare demands.

- HPV: Inhibits infection with human papillomavirus which causes risks of cervical and anal cancer and others, especially in young women and adults.

- MMR: It offers composite protection against 3 types of viral diseases and compliments mass childhood immunization campaigns as well as outbreak control efforts.

- COVID-19: Prevents infection by SARS-CoV-2 preventing the spread of the virus, serious disease, and death and helps efforts to control the pandemic worldwide.

- Others: includes a range of diseases, as each vaccine is developed to target a particular pathogen and prevent complications and enhance the state of the population health in the world.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Pediatric: Aimed at protecting children and infants, building up the early immunity against perilous diseases, promoting long-term health of the population and preventing outbreaks.

- Adult: It covers preventive and booster shots and it is with the continued coverage of the immunity not to mention the at-risk workers, travelers and people who have chronic disorders.

- Geriatric: This remedy is typically used to treat declines of the immune system that come as a result of age, safeguarding elderly citizens against major infections, lessening instances of hospitalization, and enhancing the standard of life.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics: Focused on routine care, offer vaccines professionally provided and administered, as well as addressed according to all vaccine storage requirements and integrated with other healthcare services.

- Retail pharmacies: Provide walk-in access to vaccines, and in many cases, no appointments, increasing access to immunization in communities and the busy individual.

- Government Immunization Programs: Give free or subsidized vaccines, with the focus on mass immunization, prevention of diseases, and enhancement of people health by means of concerted national actions.

- Online Platforms: Help with making vaccine appointment bookings, accessing information and conducting telehealth consultations, which enhance the effectiveness of resultant appointments and patient awareness.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America dominates the market of Vaccines because of the developed healthcare system, healthcare expenditure on R&D, and regulatory structures. Asia-Pacific is the most rapidly expanding region since it is propelled by mass immunization, high populations and a rising trend in government spending on preventive healthcare. As stated in Regional Insights, the steady uptake in regions of the world such as Africa and Latin America is being driven by international aid and vaccine diplomacy.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Vaccines Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Distribution Channels

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Vaccines Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Vaccines Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Vaccines Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Vaccines Market – By Type

5.1. Overview

5.1.1. Segment Share Analysis, By Type, 2024 & 2035 (%)

5.1.2. Live Attenuated Vaccines

5.1.3. Inactivated Vaccines

5.1.4. Subunit, Recombinant, Polysaccharide, and Conjugate Vaccines

5.1.5. Nucleic Acids Vaccines

(presents market segmentation By Type, guiding the client on the categories that are expected to drive demand and shape future revenue streams)

6. Vaccines Market – By Disease Indication

6.1. Overview

6.1.1. Segment Share Analysis, By Disease Indication, 2024 & 2035 (%)

6.1.2. Influenza

6.1.3. HPV (Human Papillomavirus)

6.1.4. MMR (Measles, Mumps, Rubella)

6.1.5. COVID-19

6.1.6. Others

(breaks down the market by Disease Indication, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Vaccines Market – By Age Group

7.1. Overview

7.1.1. Segment Share Analysis, By Age Group, 2024 & 2035 (%)

7.1.2. Pediatric

7.1.3. Adult

7.1.4. Geriatric

(focuses on market segmentation by Age Group, helping the client prioritize specific Age Groups or end-use areas that offer significant business opportunities)

8. Vaccines Market – By Distribution Channel

8.1. Overview

8.1.1. Segment Share Analysis, By Distribution Channel, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Retail Pharmacies

8.1.4. Government Immunization Programs

8.1.5. Online Platforms

(describes the market division by Distribution Channel, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Vaccines Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Vaccines Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Age Group, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Distribution Channel, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Age Group, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Distribution Channel, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Age Group, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Distribution Channel, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Age Group, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Distribution Channel, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Vaccines Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, s, Strategies, Financials, Recent Developments)

10.3.1. Pfizer Inc.

10.3.2. Moderna Inc.

10.3.3. GlaxoSmithKline plc

10.3.4. Sanofi S.A.

10.3.5. Merck & Co., Inc.

10.3.6. Johnson & Johnson

10.3.7. Bharat Biotech

10.3.8. Serum Institute of India Pvt. Ltd.

10.3.9. AstraZeneca plc

10.3.10. Novavax, Inc

10.3.11. Sinovac Biotech Ltd.

10.3.12. CSL Limited

10.3.13. Emergent BioSolutions Inc.

10.3.14. Daiichi Sankyo Company, Ltd.

10.3.15. Vaxart, Inc.

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, s, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Vaccines Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Vaccines Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Vaccines Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Vaccines Market: Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Type

TABLE 6: Global Vaccines Market, By Type 2022–2035 (USD Billion)

TABLE 7: Vaccines Market: Disease Indication Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Disease Indication

TABLE 9: Global Vaccines Market, by Disease Indication 2022–2035 (USD Billion)

TABLE 10: Vaccines Market: Age Group Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Age Group

TABLE 12: Global Vaccines Market, by Age Group 2022–2035 (USD Billion)

TABLE 13: Vaccines Market: Age Group Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Distribution Channel

TABLE 15: Global Vaccines Market, by Distribution Channel 2022–2035 (USD Billion)

TABLE 16: Vaccines Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Vaccines Market, by Region 2022–2035 (USD Billion)

TABLE 19: Vaccines Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Vaccines Market, By Type (NA), 2022–2035 (USD Billion)

TABLE 21: Vaccines Market, by Disease Indication (NA), 2022–2035 (USD Billion)

TABLE 22: Vaccines Market, by Age Group (NA), 2024–2035 (USD Billion)

TABLE 23: Vaccines Market, by Distribution Channel (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 26: U.S. Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 27: U.S. Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 28: Canada Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 29: Canada Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 30: Canada Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 31: Canada Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 32: Mexico Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 34: Mexico Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 35: Mexico Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 36: Vaccines Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Vaccines Market, By Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Vaccines Market, by Disease Indication (Europe), 2022–2035 (USD Billion)

TABLE 39: Vaccines Market, by Age Group(Europe), 2022–2035 (USD Billion)

TABLE 40: Vaccines Market, by Distribution Channel (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 42: Germany Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 43: Germany Vaccines Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 45: Italy Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 46: Italy Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 47: Italy Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 48: Italy Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 53: France Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 54: France Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 55: France Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 56: France Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 57: Russia Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 58: Russia Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 59: Russia Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 60: Russia Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 61: Poland Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 62: Poland Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 63: Poland Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 64: Poland Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 69: Vaccines Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Vaccines Market, By Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Vaccines Market, by Disease Indication (APAC), 2022–2035 (USD Billion)

TABLE 72: Vaccines Market, by Age Group(APAC), 2022–2035 (USD Billion)

TABLE 73: Vaccines Market, by Distribution Channel (APAC), 2022–2035 (USD Billion)

TABLE 74: India Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 75: India Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 76: India Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 77: India Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 78: China Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 79: China Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 80: China Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 81: China Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 82: Japan Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 83: Japan Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 84: Japan Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 85: Japan Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 86: South Korea Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 88: South Korea Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 89: South Korea Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 90: Australia Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 91: Australia Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 92: Australia Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 93: Australia Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 98: Brazil Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 100: Brazil Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 101: Brazil Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 102: Argentina Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 104: Argentina Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 105: Argentina Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 106: Colombia Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 108: Colombia Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 109: Colombia Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 114: Israel Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 115: Israel Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 116: Israel Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 117: Israel Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 118: Turkey Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 120: Turkey Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 121: Turkey Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 122: Egypt Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 124: Egypt Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 125: Egypt Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Vaccines Market, By Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Vaccines Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Vaccines Market, by Age Group, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Vaccines Market, by Distribution Channel, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Vaccines Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Disease Indication Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Disease Indication Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Distribution Channel Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Distribution Channel Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Vaccines Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Vaccines Market Share and Leading Players, 2024

FIGURE 23: Latin America Vaccines Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Vaccines Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Vaccines Market Share Analysis by Country, 2023

FIGURE 30: Germany Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Vaccines Market Share Analysis by Country, 2023

FIGURE 39: India Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Vaccines Market Share Analysis by Country, 2023

FIGURE 47: Brazil Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Vaccines Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Vaccines Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As a public health strategist working with a vaccine manufacturer in New Jersey, I relied heavily on the Vaccines Market Research Report to assess the evolving competitive landscape in mRNA and recombinant platforms. The report’s detailed analysis of clinical pipelines, manufacturing scalability, and regulatory updates in the U.S. and Latin America provided our team with the evidence needed to prioritize investment in next-generation vaccine candidates. What impressed me most was how the report blended quantitative forecasts with expert-level commentary, making it easier for our leadership to make confident, data-backed strategic decisions."

- Jennifer Collins, Public Health Strategy Lead, United States

"In Europe, where pricing pressures and procurement policies can significantly influence vaccine adoption, this report offered unparalleled clarity. The Vaccines Market Research Report provided a granular view of EU immunization programs, tendering frameworks, and market share trajectories of leading vaccine categories. As part of a mid-sized biotech firm in Lyon, we used this intelligence to fine-tune our market access strategy and build a stronger case for our upcoming vaccine candidate. The credibility of sources, regulatory insights, and practical recommendations made it more than just a report, it became a reference tool for our entire market access team."

- Dr. Philippe Laurent, Market Access Director, France- "Working as a business development lead in a healthcare distribution company in Mumbai, I found the Vaccines Market Research Report particularly relevant for the APAC market. The country-level insights on India, Southeast Asia, and China helped us identify emerging opportunities in pediatric and adult vaccination programs. The demand projections, coupled with regulatory pathway analysis, gave us the confidence to expand partnerships with regional suppliers. What I valued most was the practical, actionable nature of the report, it helped us move beyond assumptions and make decisions grounded in data and expert interpretation."

- Rohit Mehra, Business Development Manager, India

The Vaccines Market 2025 report has been developed by a team of senior healthcare market research analysts with extensive expertise in vaccine development, regulatory science, and global health economics. With over a decade of experience tracking immunization programs, manufacturing innovations, and evolving policy landscapes, our analysts bring a unique blend of scientific depth and commercial insight to this study.

Our research methodology combines direct interviews with key stakeholders, including clinicians, manufacturers, and policy experts, with comprehensive secondary data validation and advanced forecasting models. This multi-dimensional approach ensures that the insights presented are not just data points, but actionable intelligence that stakeholders can rely on for critical decision-making.

This report is designed to serve as a practical tool for executives, investors, and policymakers. Whether you are evaluating next-generation vaccine technologies, planning regional expansion, or assessing procurement opportunities, the findings provide clarity on competitive positioning, demand dynamics, and regulatory considerations. By bridging market intelligence with real-world implications, the report equips organizations to make informed, strategic choices in a rapidly evolving landscape.

To learn more about our research expertise and connect with our analysts for ongoing updates in healthcare markets, visit us on LinkedIn.