Market Outlook

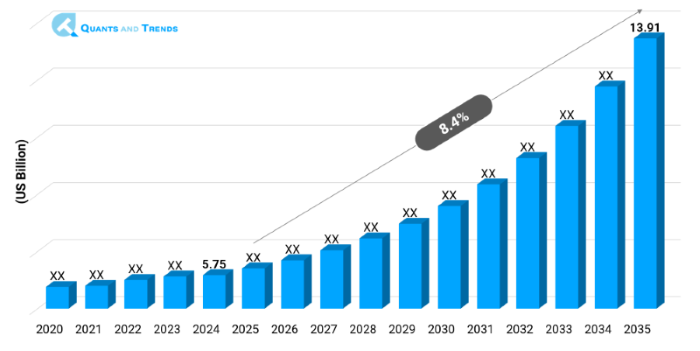

The global Healthcare Policy and Regulation market was valued at approximately USD 5.75 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035, reaching around USD 13.91 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Healthcare Policy and Regulation Market is undergoing fast paced transformations as governments develop regulatory systems, mandates of covering all citizens, and value-based care programs. Market Forecast: Healthcare Policy and Regulation shows that reforms of coverage of insurance, pricing of drugs, and health technology assessment will lead to a healthy growth in this market. Regulation is becoming increasingly aggressive as policymakers attempt to reduce prices and develop fair access. Price transparency regulations, the digital health approvals, and the quality-based reimbursement are the Key Trends in Healthcare Policy and Regulation. Such trends are encouraging healthcare providers, payers, and technology companies to be strategic in response to the changing governance environments across the world.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 8.4% |

| Market Value In 2024 | USD 5.75 billion |

| Market Value In 2035 | USD 13.91 billion |

Introduction

The Healthcare Policy and Regulation Market includes regulations and guidelines on health insurance, reimbursement, clinical guidelines, personal data and medical equipment. The market affects access to services, pricing, innovation and compliance within insurers, providers, and pharmaceutical players. Due to increasing costs and the need of outcome-oriented care, the regulatory policy is changing toward increased coverage, price regulation, and uniform health technology assessment. The development of the concept of digital health, telemedicine, data security is changing the landscape around these issues. Regulatory & Policy Overview currently becomes central in explaining the effects of reforms on the adoption of innovations, cost arrangements, and strategic planning in the sphere of healthcare ecosystems.

Key Market Drivers: What’s Fueling the Healthcare Policy and Regulation Market Boom?

- Focus to Cost Control and Value-Based Care: Payers and governments are under pressure to move off fee-for-service to value-based models by growing levels of healthcare spend and the aging population. The Healthcare Policy and Regulation Market Size & Share is growing because the policy makers are insisting on outcome-based incentives, bundled payments, and performance standards. Such reforms spur the utilisation of measurement schemes and quality reporting to recognise quality and efficiency in the provision of care delivery.

- Health Care Expanded and Universal Health Programs: Nations are making policies to expand health services to make them cheaper. Universal health coverage in the developing economies or expansion of Medicaid/Medicare initiatives are driving the demand towards regulated care ecosystems. Standardization of benefit design and licensing provides more transparent structures of adjudication and payor reimbursement- giving way to Healthcare Policy and Regulation Investment Opportunities in policy consulting, compliant tools, and payor systems.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The frontier in regulatory innovation lies in real-time compliance solutions, artificially intelligent surveillance technology, and blockchain technology to secure patient consent. Predictive analytics are becoming an attraction of government and compliance service providers to identify fraud in reimbursement and make the process of oversight more efficient. Real-world data tracking systems and smart registries allow the process of post-market surveillance to occur more quickly. These engagements are an indication of Emerging Opportunities in the use of technology to comply with policy, risk analytics, and regulatory reporting requirements, and these technologies will revolutionize the way healthcare systems manage and enforce policy as well as make policy cycles a lot quicker.

Recent Developments:

In 2024, new rules of price transparency were adopted in the U.S. CMS that demanded hospitals to report on negotiated rates, which was a reflection of Key Trends in Healthcare Policy and Regulation. Meanwhile, the EU integrated a single HTA system to start in 2025 to align technology appraisals among the EU member states consequently forming Healthcare Policy and Regulation Growth Drivers & Challenges. These transformations are stimulating the demand of compliance software, cross-border consultancy and in and out-real world evidence platforms into compatibility to policy decision-making.

Conclusion

Healthcare Policy and Regulation Market participates in the framing of healthcare access, innovation, and the cost of management all over the world. As regulatory landscapes extend beyond the pricing and reimbursement control to oversight of the digital health the stakeholders are required to explore complicated governance strategies. Market access and business strategy are further going to transform as there is the emergence of HTA, telehealth policy reform as well as transparency mandates. Companies that invest in regulatory intelligence, adaptive compliance technology, and related strategic policy affiliations are in a good position as robust growth is expected in North America and APAC. Contemplation and positioning of the changing frameworks, and matching the offerings to them will be vital in securing the investment and operating chances in the Hospital and Clinical Design Market.

Related Reports

- The global Healthcare Access and Equity Market size was assessed at USD 37.1 billion in 2024 and is expected to reach approximately USD 120.5 billion by 2035, growing at a CAGR of around 11.6% from 2025 to 2035.

- The global Healthcare Financing Market was valued at approximately USD 2.38 trillion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2035, reaching around USD 5.16 trillion by the end of the forecast period.

Key Market Players

The Healthcare Policy and Regulation Competitive Landscape involves providers of the compliance software, consulting companies, health IT vendors, and think tanks. The market leaders deal with regulatory intelligence, modeling costs and reimbursement analytics, and cross-jurisdictional monitoring of the policy. It is normal to form alliances with the government agencies and law firms to maneuver the changes in the rules. The platforms that provide live monitoring, audit and documentation tracking are becoming more popular. Firms are separating themselves in terms of geographic coverage, the realms of regulatory knowledge and technologically applicable knowledge. With changes in the regulatory framework, the competitive capability of agility and depth of domain is determining market positioning. Some of the key players in the Healthcare Policy and Regulation industry are as:

IQVIA, Deloitte, PwC Health Consulting, Ernst & Young (EY), KPMG Healthcare Advisory, Frost & Sullivan, McKinsey & Company (Healthcare), Accenture Health, Clarivate, NICE International, Health Technology Assessment International (HTAi), IMS Health (now IQVIA), Oracle Health, Optum Regulatory Consulting, GE HealthCare Regulatory Services

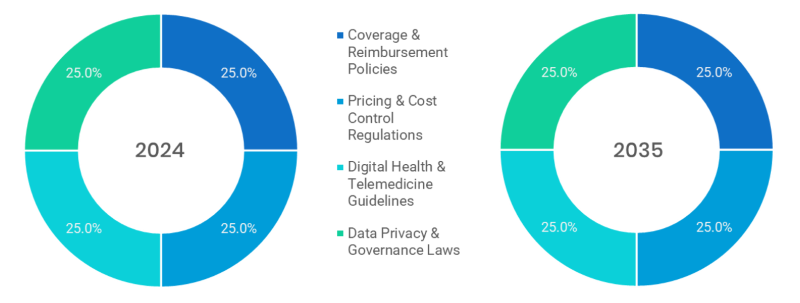

- Coverage & Reimbursement Policies (Dominate): Takes the form of rules that govern the treatment that patients can receive in the form of services covered by either a government or a commercial insurance policy, co-payments, and eligibility.

- Pricing & Cost Control Regulations: Govern pricing including limits on prices, reference pricing and cost-effectiveness analyses to ensure affordability is applicable in drug and treatment pricing.

- Digital Health & Telemedicine Policies (Fastest): Policies have standardized remote care delivery, secured licensing throughout different states, secured patient data, and clinical responsibilities through virtual platforms.

- Data Privacy & Governance Laws: As it requires compliance with frameworks such as HIPAA or GDPR and ensures the patient data is not misused, its confidentiality, and data security are guaranteed by the compliance with laws.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Government & Regulatory Bodies (Dominate): These comprise government agencies such as FDA or EMA, which formulate, apply and adopt national or regional healthcare policy and safety standards.

- Healthcare Providers Systems: Hospitals and clinics should be able to adhere to clinical procedures, reporting requirements, and infrastructure regulations that are consistent with regulatory requirements.

- Payers & Insurance Companies: Insurance companies represent payers as they interact with regulators to establish the scopes of cover, reimbursement processes, fraud-related barriers and patterns of financial risk-sharing.

- Health IT & Technology Vendors (Fastest): Healthcare platform-related right and services offered by vendors comply with technical standards, including interoperability, patient consent management, and compliance with cybersecurity.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Licensing & Accreditation (Dominate): Policies that address safety, quality, and ethical standards of medical professionals, and the facilities they work in and audit their compliance with safety and quality standards on a periodic basis by providing security fire services.

- Monitoring & Compliance Enforcement: Involves systems of auditing clinical practices, penalty of breaches and assessment of adherence with standards by surveillance and inspection.

- Health Technology Assessment (HTA) (Fastest): Reviews Medical technologies to determine safety, cost-effectiveness and their effect in society to inform policy and reimbursement actions.

- Fraud Detection & Abuse: Prevention Policies utilize policies, reporting systems, analysis and auditing in detecting fraud in billing, overutilization or abuse of healthcare services.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- National Healthcare Regulations (Fastest): There are laws relating to the way the government will regulate the health programs, mandates programs on insurance, approval of drugs, etc.

- International and Cross-Border Systems: Inter-country agreements establish medical practice uniformity, pharmaceutical import and export and national health community reaction to an international health menace.

- Developed Market Policies (Dominate): Aim at universal coefficients, drug price reforms, through value based care, and adoption of digital health with well-established oversight mechanisms.

- Emerging Market Reforms: Places the focus on availability of healthcare, building regulatory capacity, building partnerships between the public and the private, as well as dealing with underserved segments of the population using as systemic changes.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The Healthcare Policy and Regulation Market is dominated by North America that comprises extensive policies regarding insurance requirements, drug prices, and digital health regulations. Healthcare Policy and Regulation Market Forecast indicates a strong output in terms of rulemaking by CMS, FDA, and the state regulators. The fastest-growing region is yet Asia-Pacific (APAC), where the countries such as India, China, and the countries of Southeast Asia establish unified coverage policies, embrace HTA frameworks, and telemedicine regulation. Regional Insights outline the new Evolving Regulations on reimbursement, cross-border health requirements and digital health privacy, providing substantial Market Dynamics and entry opportunities, in policy consultation and tool compliance.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Policy and Regulation Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Regional Scopes

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Policy and Regulation Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Policy and Regulation Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Policy and Regulation Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Policy Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Policy and Regulation Market – By Policy Type

5.1. Overview

5.1.1. Segment Share Analysis, By Policy Type, 2024 & 2035 (%)

5.1.2. Coverage & Reimbursement Policies

5.1.3. Pricing & Cost Control Regulations

5.1.4. Digital Health & Telemedicine Guidelines

5.1.5. Data Privacy & Governance Laws

(presents market segmentation by Policy Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Policy and Regulation Market – By Stakeholder

6.1. Overview

6.1.1. Segment Share Analysis, By Stakeholder, 2024 & 2035 (%)

6.1.2. Government & Regulatory Bodies

6.1.3. Healthcare Providers & Systems

6.1.4. Payers & Insurance Companies

6.1.5. Health IT & Technology Vendors

(breaks down the market by Stakeholder, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Policy and Regulation Market – By Regulatory Function

7.1. Overview

7.1.1. Segment Share Analysis, By Regulatory Function, 2024 & 2035 (%)

7.1.2. Licensing & Accreditation

7.1.3. Monitoring & Compliance Enforcement

7.1.4. Health Technology Assessment (HTA)

7.1.5. Fraud Detection & Abuse Prevention

(focuses on market segmentation by Regulatory Function, helping the client prioritize specific crop Policy Types or end-use areas that offer significant business opportunities)

8. Healthcare Policy and Regulation Market – By Regional Scope

8.1. Overview

8.1.1. Segment Share Analysis, By Regional Scope, 2024 & 2035 (%)

8.1.2. National Healthcare Regulations

8.1.3. International & Cross-Border Frameworks

8.1.4. Developed Market Policies

8.1.5. Emerging Market Reforms

(describes the market division by Regional Scope of Policy Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Policy and Regulation Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Policy and Regulation Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Policy Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Stakeholder, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Regulatory Function, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Regional Scope, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Policy Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Stakeholder, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Regulatory Function, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Regional Scope, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Policy Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Stakeholder, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Regulatory Function, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Regional Scope, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Policy Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Stakeholder, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Regulatory Function, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Regional Scope, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Policy and Regulation Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. IQVIA

10.3.2. Deloitte

10.3.3. PwC Health Consulting

10.3.4. Ernst & Young (EY)

10.3.5. KPMG Healthcare Advisory

10.3.6. Frost & Sullivan

10.3.7. McKinsey & Company (Healthcare)

10.3.8. Accenture Health

10.3.9. Clarivate

10.3.10. NICE International

10.3.11. Health Technology Assessment International (HTAi)

10.3.12. IMS Health (now IQVIA)

10.3.13. Oracle Health

10.3.14. Optum Regulatory Consulting

10.3.15. GE HealthCare Regulatory Services

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Policy and Regulation Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Policy and Regulation Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Policy and Regulation Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Policy and Regulation Market: Policy Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Policy Type

TABLE 6: Global Healthcare Policy and Regulation Market, by Policy Type 2022–2035 (USD Billion)

TABLE 7: Healthcare Policy and Regulation Market: Stakeholder Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Stakeholder

TABLE 9: Global Healthcare Policy and Regulation Market, by Stakeholder2022–2035 (USD Billion)

TABLE 10: Healthcare Policy and Regulation Market: Regulatory Function Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Regulatory Function

TABLE 12: Global Healthcare Policy and Regulation Market, by Regulatory Function 2022–2035 (USD Billion)

TABLE 13: Healthcare Policy and Regulation Market: Regional Scope Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Regional Scope

TABLE 15: Global Healthcare Policy and Regulation Market, by Regional Scope 2022–2035 (USD Billion)

TABLE 16: Healthcare Policy and Regulation Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Policy and Regulation Market, by Region 2022–2035 (USD Billion)

TABLE 19: Healthcare Policy and Regulation Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Healthcare Policy and Regulation Market, by Policy Type (NA), 2022–2035 (USD Billion)

TABLE 21: Healthcare Policy and Regulation Market, by Stakeholder(NA), 2022–2035 (USD Billion)

TABLE 22: Healthcare Policy and Regulation Market, by Regulatory Function (NA), 2024–2035 (USD Billion)

TABLE 23: Healthcare Policy and Regulation Market, by Regional Scope (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 26: U.S. Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 27: U.S. Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 28: Canada Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 29: Canada Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 30: Canada Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 31: Canada Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 32: Mexico Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 34: Mexico Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 35: Mexico Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 36: Healthcare Policy and Regulation Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Healthcare Policy and Regulation Market, by Policy Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Healthcare Policy and Regulation Market, by Stakeholder(Europe), 2022–2035 (USD Billion)

TABLE 39: Healthcare Policy and Regulation Market, by Regulatory Function(Europe), 2022–2035 (USD Billion)

TABLE 40: Healthcare Policy and Regulation Market, by Regional Scope (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 42: Germany Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 43: Germany Healthcare Policy and Regulation Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 45: Italy Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 46: Italy Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 47: Italy Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 48: Italy Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 53: France Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 54: France Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 55: France Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 56: France Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 57: Russia Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 58: Russia Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 59: Russia Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 60: Russia Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 61: Poland Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 62: Poland Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 63: Poland Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 64: Poland Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 69: Healthcare Policy and Regulation Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Healthcare Policy and Regulation Market, by Policy Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Healthcare Policy and Regulation Market, by Stakeholder(APAC), 2022–2035 (USD Billion)

TABLE 72: Healthcare Policy and Regulation Market, by Regulatory Function(APAC), 2022–2035 (USD Billion)

TABLE 73: Healthcare Policy and Regulation Market, by Regional Scope (APAC), 2022–2035 (USD Billion)

TABLE 74: India Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 75: India Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 76: India Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 77: India Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 78: China Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 79: China Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 80: China Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 81: China Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 82: Japan Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 83: Japan Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 84: Japan Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 85: Japan Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 86: South Korea Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 88: South Korea Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 89: South Korea Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 90: Australia Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 91: Australia Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 92: Australia Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 93: Australia Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 98: Brazil Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 100: Brazil Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 101: Brazil Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 102: Argentina Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 104: Argentina Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 105: Argentina Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 106: Colombia Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 108: Colombia Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 109: Colombia Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 114: Israel Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 115: Israel Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 116: Israel Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 117: Israel Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 118: Turkey Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 120: Turkey Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 121: Turkey Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 122: Egypt Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 124: Egypt Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 125: Egypt Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Healthcare Policy and Regulation Market, by Policy Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Healthcare Policy and Regulation Market, by Stakeholder, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Healthcare Policy and Regulation Market, by Regulatory Function, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Healthcare Policy and Regulation Market, by Regional Scope, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Healthcare Policy and Regulation Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Policy Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Policy Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Stakeholder Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Stakeholder Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Policy Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Policy Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Regional Scope Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Regional Scope Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Policy and Regulation Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Policy and Regulation Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Policy and Regulation Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Policy and Regulation Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Healthcare Policy and Regulation Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Healthcare Policy and Regulation Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Healthcare Policy and Regulation Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Healthcare Policy and Regulation Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Healthcare Policy and Regulation Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "This report provided exactly the kind of clarity we needed to assess shifting regulatory frameworks at both federal and state levels. It helped our compliance and policy teams anticipate upcoming policy shifts around data privacy, reimbursement reform, and payer-provider alignment. The strategic takeaways supported internal planning for risk mitigation and payer strategy. It’s rare to find research that combines such legal depth with business relevance, this was a standout."

- Karen Mitchell, SVP, Regulatory Affairs, Managed Care Organization (USA)

- "The Healthcare Policy and Regulation Market Research Report gave us a well-structured, comparative view of regulatory movements across the EU and UK, especially post-Brexit. The analysis of digital health regulations, HTA frameworks, and reimbursement reforms was thorough and timely. We used it to guide our policy engagement strategy and support our member companies in adapting their market access roadmaps. It’s evident the authors have deep regulatory insight and a practical understanding of policy impact."

- Thomas Neumann, Director, Public Policy & Market Access, MedTech Association (Germany)

- "We support global healthtech firms entering Asian markets, and this report served as an essential tool for mapping regulatory risk and opportunity across India, ASEAN, and East Asia. The layered insights on health data laws, digital health regulations, and government procurement policy helped us advise clients with accuracy and confidence. It’s one of the few reports that connects policy evolution with market behavior in a meaningful way."

- Dr. Aarti Deshmukh, Principal Consultant, Health Policy & Regulatory Intelligence, Advisory Group (India)

The Healthcare Policy and Regulation Market 2025 report is produced by the seasoned research team at Quants & Trends, a leading healthcare intelligence provider with deep specialization in health policy, regulatory affairs, compliance frameworks, and market access dynamics across global markets.

Our analysts bring over a decade of multidisciplinary expertise spanning public health policy, regulatory science, reimbursement strategy, and digital health governance. This report is the result of rigorous analysis grounded in primary interviews with policymakers, regulatory experts, compliance officers, legal advisors, and industry executives operating in diverse geographies including the U.S., Europe, and Asia-Pacific.

Designed for healthcare leaders navigating policy complexity, the report offers actionable insights into regulatory reform trajectories, compliance burdens, payer reforms, privacy frameworks, and digital health regulations. It helps executives, regulatory strategists, market access teams, and investors understand how evolving policy landscapes directly impact product approvals, reimbursement success, partnership decisions, and risk mitigation planning.

Whether you're evaluating the launch of a healthtech product in a regulated market, building a reimbursement case for a medical device, or tracking payer policy trends to inform corporate strategy, this report serves as a strategic compass for real-world business decisions.

To learn more about our research approach, subject-matter experts, and latest policy insights, connect with us on our official LinkedIn page.