Market Outlook

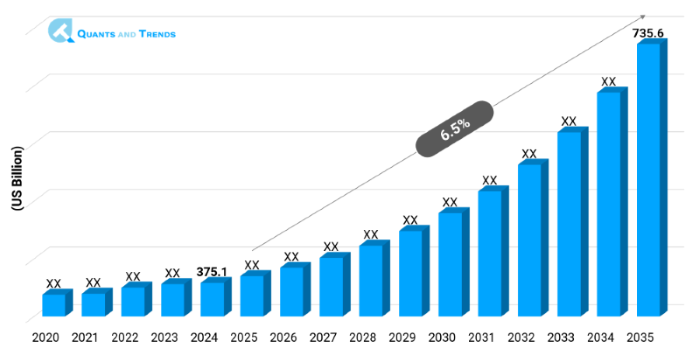

The global personalized medicine market was valued at approximately USD 375.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reaching around USD 735.6 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Personalized Medicine Market is witnessing a fundamental shift as healthcare increasingly moves away from a one size fits approach for all. This change is driven by advances in genomic science, AI-powered technologies, and next-generation diagnostics which provide patients with medicines customized to their genetic and molecular profiles. Healthcare systems are using precision-based tactics to improve results, eliminate side effects and increase cost efficiency. Additionally, this is not only reshaping traditional care models but also opening new personalized medicine investment opportunities for clinical & research stakeholders. The market is going to keep growing in the next few years because there is strong demand and new technology coming out all the time.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 6.5% |

| Market Value In 2024 | USD 375.1 billion |

| Market Value In 2035 | USD 735.6 billion |

Introduction

Personalized medicine is changing how doctors diagnose and treat patients by looking at how their genes, environment, and lifestyle are different from one other. Unlike traditional methods, personalized medicine tailors therapies based on a patients unique molecular profile which is further leading to improved outcomes and reduced side effects. The personalized medicine market size & share is growing across both developed and developing regions which supported by public health initiatives under government supervision and increasing use in chronic disease management. From oncology to infectious diseases this patient centric model is becoming central to modern healthcare delivery enabled by cutting edge technologies like pharmacogenomics, digital health platforms, and real time diagnostics.

Key Market Drivers: What’s Fueling the Personalized Medicine Market Boom?

- Surge in Chronic Diseases- One of the major factor driving the growth of the personalized medicine market has been the increasing incidence of chronic illnesses including diabetes, cancer, and cardiovascular disorders. As per WHO, 74 percent of fatalities worldwide are attributable to chronic illnesses. Personalized treatment allows early detection, actual monitoring and tailored care plans resulting in lesser disease burden and hospital costs.

- Advances in Genomic Technologies- Breakthroughs in next-generation sequencing, pharmacogenomics, and molecular diagnostics have accelerated the adoption of personalized medicine. With sequencing costs dropping from over $10,000 in 2011 to under $200 today, genetic profiling has become more adoptable. These tool allows for the precise identification of disease-causing genes and optimal drug responses, making them central to Personalized Medicine Growth Drivers & Challenges.

- Expanding Digital Health Infrastructure-The integration of AI, big data analytics and wearable technology is creating new avenues for data driven care. Digital tools that let clinicians check on patients from a distance and get real-time diagnostics are helping them make rapid, smart judgments. This trend is especially strong in North America and APAC where healthcare digitization is creating Emerging Opportunities in Personalized Medicine and reshaping the Personalized Medicine Competitive Landscape.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation in personalized medicine is evolving at the intersection of genomics, data science, and clinical applications. AI-powered platforms can now forecast how patients will respond to treatments, while wearable biosensors give health feedback all the time. Startups and pharma giants alike are investing in gene therapy, CRISPR, and bioinformatics. These innovations not only streamline diagnostics and treatment but also open up new Personalized Medicine Investment Opportunities, enhancing access to scalable, patient-specific care models globally.

Recent Developments:

In 2024, Roche announced the launch of a new AI-integrated diagnostic tool for oncology patients, enabling faster and more accurate treatment planning. In the meantime, Thermo Fisher and Pfizer collaborated to use next generation sequencing platforms to speed up customized medicine products pipelines. These advancements shows the increasing collaboration among digital technology, pharmaceuticals and diagnostics that drives innovation in the personalized medicine industry analysis. In an effort to expedite the release of customized treatments, regulatory agencies around the world are also implementing fast track clearances for companion diagnostics.

Conclusion

The ability of personalized medicine to convert complicated health data into useful clinical action will determine its future. Personalized care is quickly becoming the norm, from remote monitoring to customized medication development. As the market expands, stakeholders must balance innovation with ethical data use, accessibility and compliance. The rise in genomic technology, increasing healthcare consumerism and demand for individualized treatment pathways will continue to shape the Personalized Medicine Market Forecast. In the end, it's a change from "one size fits all" to "one size fits one," offering patients around the world safer, more intelligent, and more efficient care.

Related Reports

- The global Drug Discovery Services Market was valued at approximately USD 21.5 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 14.6% from 2025 to 2035, reaching around USD 96.3 billion by the end of the forecast period.

- The global Biotechnology Innovations Market was valued at approximately USD 115.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2025 to 2035, reaching around USD 311.5 billion by the end of the forecast period.

Key Market Players

The competitive landscape of personalized medicine is made up of a mix of well known pharmaceutical giants, diagnostics sector leaders, and innovative biotech entrepreneurs. The key players focus on alliances, creative product manufacturing and precision clinical trials. Many are investing in companion diagnostics regulatory approvals, AI-powered technologies, and molecular profiling. Strategic alliances and continuous innovation determine the market dynamics. Some of the key players in the Personalized Medicine industry are as:

Roche, Thermo Fisher Scientific, Illumina, Qiagen, Novartis, Pfizer, Foundation Medicine, GE Healthcare, Bio-Rad Laboratories, Bayer, Abbott Laboratories, GSK, AstraZeneca, Medtronic, Myriad Genetics

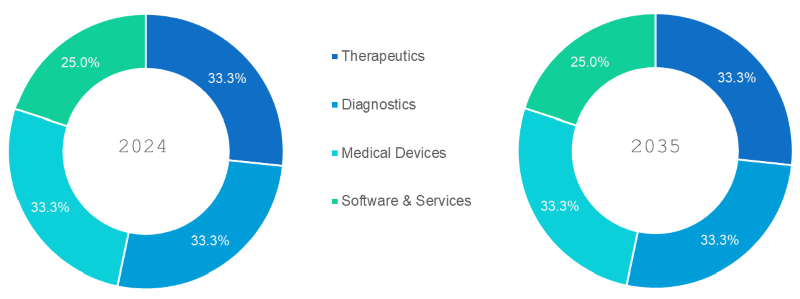

- Therapeutics (Dominating Segment): Personalized therapeutics dominate the market owing to their strong foothold in cancer, neurological disorders and rare disease management. These therapies which are frequently founded on genomic profiling, have enhanced patient outcomes and decreased prescription trial and error. Their consistent adoption across developed regions keeps this segment ahead in terms of market value.

- Diagnostics (Fastest-Growing Segment): As precision care gains traction, diagnostic tools like pharmacogenetic testing and companion diagnostics are witnessing sharp demand. The increased emphasis on early disease diagnosis, combined with governmental support for precision diagnostics, has resulted in the fastest-growing segment.

- Medical Devices: Wearable diagnostics, implanted sensors, and personalized monitoring tools can be added to care pathways to make real time data and individualized interventions possible.

- Software & Services: include AI-powered decision-making tools, telehealth apps, and digital platforms for data analysis to give the care that is needed.

Note: Charts and figures are illustrative only. Contact us for verified market data.

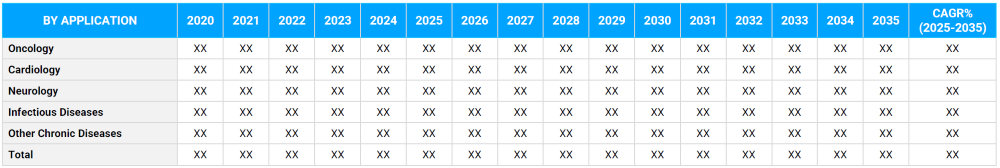

Segmentation By Application

- Oncology (Dominating Segment): Cancer, the most mature application for personalized treatments. From targeted therapies to biomarker driven trials, oncology leverages the full spectrum of technologies in this area.

- Infectious Diseases (Fastest-Growing Segment): Personalized immunological and antiviral treatments are becoming more and more necessary after the pandemic, particularly for long-lasting COVID. The management of infectious diseases is changing as a result of technological developments in customized medicine.

- Cardiology: Gene-based risk scoring and tailored cholesterol or hypertension treatments are reshaping how cardiac care is delivered.

- Neurology: Precision in treating epilepsy, Alzheimer’s, and Parkinson’s is improving, with genomic tools enhancing early detection.

- Other Chronic Diseases: Includes diabetes, autoimmune conditions, and respiratory illnesses where patient specific treatment rules are gaining traction.

Note: Charts and figures are illustrative only. Contact us for verified market data.

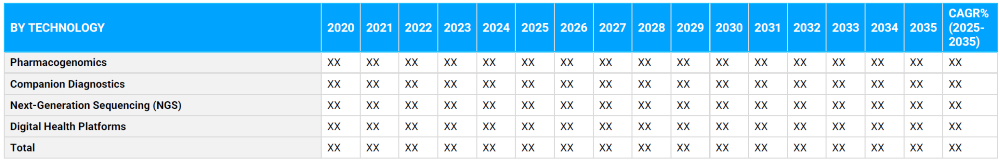

- Next-Generation Sequencing (NGS) (Dominating Segment): Rapid and precise DNA analysis is made possible by NGS which serves as the foundation for individualized treatment planning in both hospitals and research.

- Companion Diagnostics (Fastest-Growing Segment): Regulatory bodies increasingly mandate these tools for drug approvals. They identify suitable groups, enhancing safety and efficacy

- Pharmacogenomics: A vital tool for predicting drug response, helping prevent adverse reactions and improving therapeutic success.

- Digital Health Platforms: These facilitate clinical decision-making, data integration, and remote monitoring in line with important developments in customized medicine.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics (Dominating Segment): Hospitals are the focal point of customized medicine care delivery owing to their infrastructure, funding and access to advanced techniques.

- Pharmaceutical & Biotech Companies (Fastest-Growing Segment): These organizations are spending in R&D, real-world data and clinical trials to expand the Personalized Medicine Market Size & Share.

- Diagnostic Laboratories: It is essential to the use of sophisticated proteome and genomic testing.

- Academic and Research Institutes: Promote creativity and provide significant contributions to new prospects in customized medicine.

- Others: These comprise telehealth providers and contract research organizations that serves the larger ecosystem.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America remains the dominant region in the Personalized Medicine Market due to strong regulatory frameworks, funding for genomics, and presence of top biotech firms. According to industry experts, the U.S. makes up around 45% of the market. Asia-Pacific, on the other hand, is increasing the fastest. This is because healthcare is getting better, chronic diseases are on the rise and research funding and spending is increasing, especially in China, India and Japan. Germany and the UK are two European countries that are also making progress in adopting new technologies and integrating digital health, which gives us strong Regional Insights in Personalized Medicine.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Personalized Medicine Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Personalized Medicine Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Personalized Medicine Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Personalized Medicine Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Technology & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Personalized Medicine Market – By Product Type

5.1. Overview

5.1.1. Segment Share Analysis, By Product Type, 2024 & 2035 (%)

5.1.2. Therapeutics

5.1.3. Diagnostics

5.1.4. Medical Devices

5.1.5. Software & Services

(presents market segmentation by Product Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Personalized Medicine Market – By Application

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

6.1.2. Oncology

6.1.3. Cardiology

6.1.4. Neurology

6.1.5. Infectious Diseases

6.1.6. Other Chronic Diseases

(breaks down the market by Application, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Personalized Medicine Market – By Technology

7.1. Overview

7.1.1. Segment Share Analysis, By Technology, 2024 & 2035 (%)

7.1.2. Pharmacogenomics

7.1.3. Companion Diagnostics

7.1.4. Next-Generation Sequencing (NGS)

7.1.5. Digital Health Platforms

(focuses on market segmentation by Technology, helping the client prioritize specific crop Product Types or end-use areas that offer significant business opportunities)

8. Personalized Medicine Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Diagnostic Laboratories

8.1.4. Research & Academic Institutes

8.1.5. Pharmaceutical & Biotech Companies

8.1.6. Others

(describes the market division by End-User of Technology, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Personalized Medicine Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Personalized Medicine Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Personalized Medicine Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Roche

10.3.2. Thermo Fisher Scientific

10.3.3. Illumina

10.3.4. Qiagen

10.3.5. Novartis

10.3.6. Pfizer

10.3.7. Foundation Medicine

10.3.8. GE Healthcare

10.3.9. Bio-Rad Laboratories

10.3.10. Bayer

10.3.11. Abbott Laboratories

10.3.12. GSK

10.3.13. AstraZeneca

10.3.14. Medtronic

10.3.15. Myriad Genetics

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Personalized Medicine Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Personalized Medicine Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Personalized Medicine Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Personalized Medicine Market: Product Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Product Type

TABLE 6: Global Personalized Medicine Market, by Product Type 2022–2035 (USD Million)

TABLE 7: Personalized Medicine Market: Application Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Application

TABLE 9: Global Personalized Medicine Market, by Application 2022–2035 (USD Million)

TABLE 10: Personalized Medicine Market: Technology Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Technology

TABLE 12: Global Personalized Medicine Market, by Technology 2022–2035 (USD Million)

TABLE 13: Personalized Medicine Market: Technology Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Personalized Medicine Market, by End-User 2022–2035 (USD Million)

TABLE 16: Personalized Medicine Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Personalized Medicine Market, by Region 2022–2035 (USD Million)

TABLE 19: Personalized Medicine Market, by Country (NA), 2022–2035 (USD Million)

TABLE 20: Personalized Medicine Market, by Product Type (NA), 2022–2035 (USD Million)

TABLE 21: Personalized Medicine Market, by Application (NA), 2022–2035 (USD Million)

TABLE 22: Personalized Medicine Market, by Technology (NA), 2024–2035 (USD Million)

TABLE 23: Personalized Medicine Market, by End-User (NA), 2022–2035 (USD Million)

TABLE 24: U.S. Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 25: U.S. Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 26: U.S. Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 27: U.S. Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 28: Canada Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 29: Canada Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 30: Canada Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 31: Canada Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 32: Mexico Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 33: Mexico Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 34: Mexico Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 35: Mexico Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 36: Personalized Medicine Market, by Country (Europe), 2022–2035 (USD Million)

TABLE 37: Personalized Medicine Market, by Product Type (Europe), 2022–2035 (USD Million)

TABLE 38: Personalized Medicine Market, by Application (Europe), 2022–2035 (USD Million)

TABLE 39: Personalized Medicine Market, by Technology (Europe), 2022–2035 (USD Million)

TABLE 40: Personalized Medicine Market, by End-User (Europe), 2022–2035 (USD Million)

TABLE 41: Germany Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 42: Germany Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 43: Germany Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 44: Germany Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 45: Italy Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 46: Italy Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 47: Italy Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 48: Italy Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 49: United Kingdom Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 50: United Kingdom Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 51: United Kingdom Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 52: United Kingdom Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 53: France Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 54: France Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 55: France Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 56: France Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 57: Russia Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 58: Russia Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 59: Russia Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 60: Russia Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 61: Poland Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 62: Poland Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 63: Poland Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 64: Poland Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 65: Rest of Europe Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 66: Rest of Europe Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 67: Rest of Europe Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 68: Rest of Europe Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 69: Personalized Medicine Market, by Country (APAC), 2022–2035 (USD Million)

TABLE 70: Personalized Medicine Market, by Product Type (APAC), 2022–2035 (USD Million)

TABLE 71: Personalized Medicine Market, by Application (APAC), 2022–2035 (USD Million)

TABLE 72: Personalized Medicine Market, by Technology (APAC), 2022–2035 (USD Million)

TABLE 73: Personalized Medicine Market, by End-User (APAC), 2022–2035 (USD Million)

TABLE 74: India Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 75: India Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 76: India Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 77: India Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 78: China Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 79: China Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 80: China Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 81: China Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 82: Japan Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 83: Japan Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 84: Japan Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 85: Japan Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 86: South Korea Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 87: South Korea Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 88: South Korea Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 89: South Korea Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 90: Australia Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 91: Australia Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 92: Australia Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 93: Australia Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 94: Rest of APAC Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 95: Rest of APAC Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 96: Rest of APAC Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 97: Rest of APAC Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 98: Brazil Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 99: Brazil Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 100: Brazil Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 101: Brazil Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 102: Argentina Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 103: Argentina Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 104: Argentina Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 105: Argentina Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 106: Colombia Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 107: Colombia Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 108: Colombia Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 109: Colombia Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 110: Rest of LATAM Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 111: Rest of LATAM Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 112: Rest of LATAM Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 113: Rest of LATAM Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 114: Israel Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 115: Israel Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 116: Israel Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 117: Israel Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 118: Turkey Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 119: Turkey Personalized Medicine Market, by Application, 2022–2035 (USD Million)

TABLE 120: Turkey Personalized Medicine Market, by Technology, 2022–2035 (USD Million)

TABLE 121: Turkey Personalized Medicine Market, by End-User, 2022–2035 (USD Million)

TABLE 122: Egypt Personalized Medicine Market, by Product Type, 2022–2035 (USD Million)

TABLE 123: Egypt Personalized Medicine Market, by Application, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Personalized Medicine Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Product Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Product Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Technology Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Technology Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Personalized Medicine Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Personalized Medicine Market Share and Leading Players, 2024

FIGURE 23: Latin America Personalized Medicine Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Personalized Medicine Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Personalized Medicine Market Share Analysis by Country, 2023

FIGURE 30: Germany Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: UK Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Personalized Medicine Market Share Analysis by Country, 2023

FIGURE 39: India Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Personalized Medicine Market Share Analysis by Country, 2023

FIGURE 47: Brazil Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Personalized Medicine Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Personalized Medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- “The Personalized Medicine Market Research Report provided our leadership team with timely, data-backed insights that directly influenced our roadmap for implementing targeted therapeutics. The depth of analysis on biomarker-driven treatments, payer coverage trends, and companion diagnostics was exactly what we needed to refine our clinical investment priorities. It’s an indispensable resource for anyone operating at the intersection of care delivery and innovation.”

- Dr. Laura Bennett, Director of Precision Oncology Programs, Integrated Health System (USA)

- “This report was instrumental in shaping our strategic pitch to investors. The detailed segmentation by technology platform and therapeutic area, combined with pipeline analysis, gave us a clear picture of where our product could stand out. What we appreciated most was the section on regulatory considerations and market access, insights we hadn’t found elsewhere. It gave our executive team the clarity to move forward with confidence.”

- Rajiv Nair, Market Intelligence Manager, Biotech Research Start-up (South Asia)

- “We regularly review industry reports, but few match the strategic depth and real-world relevance of this one. The Personalized Medicine Market Research Report not only mapped emerging trends in pharmacogenomics and AI integration but also helped us benchmark our growth plans against global competitors. It played a critical role in our 2025 expansion strategy planning sessions.”

- Elena Fischer, VP of Corporate Strategy, EU-based Genomics Platform Company (Europe)

The Personalized Medicine Market 2025 report has been authored by the healthcare research team at Quants & Trends, composed of senior analysts with deep domain expertise in genomics, biotechnology, clinical diagnostics, and precision health innovation. With over 10 years of experience in tracking the evolution of personalized healthcare, our experts bring a rare blend of scientific understanding and market foresight.

Our lead analysts have worked with biotech innovators, hospital systems, diagnostics developers, and life sciences investors to decode complex trends in pharmacogenomics, AI-enabled treatment pathways, and molecular diagnostics. This insider perspective ensures the report provides not only granular data, but also meaningful, real-world business context to support executive decisions.

From helping R&D teams identify high-growth therapeutic segments, to guiding strategic market entries, this report is crafted to enable actionable decisions across the healthcare value chain. The insights are grounded in rigorous primary and secondary research, competitive benchmarking, and global pipeline analysis.

We invite you to follow Quants & Trends on LinkedIn to stay updated with our latest insights, expert commentaries, and new report releases.