Market Outlook

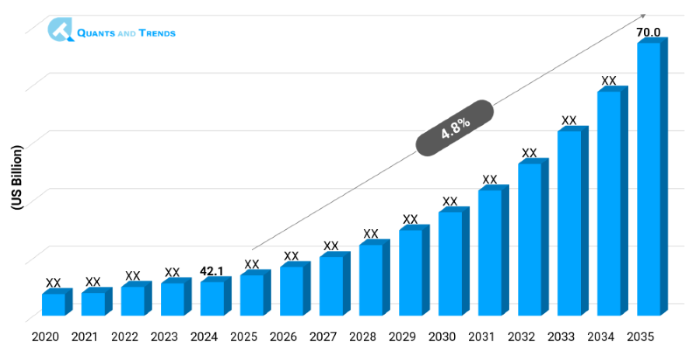

The global Medical Imaging Advances market was valued at approximately USD 42.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2025 to 2035, reaching around USD 70.0 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Medical Imaging Advances Market is projected to grow at high pace all over the world due to the fact that chronic diseases continue affecting the health of the population caused by illnesses like arthritis, fibromyalgia, and neuropathy. The increasing attention to the non opioid treatment pathways both in terms of awareness and regulatory requirements are fuelling the adoption of the integrated care strategies. The Medical Imaging Advances Market Report identifies that the market is dynamic, and innovative digital therapeutics, neuromodulation and value-based pain care emerge. The most important recent trends in the management of chronic pain are the increase of home-based models of care, use of technology and the concept of holistic treatment approaches. The Medical Imaging Advances Market Forecast signals a further increase up to 2035 with an upsurge in demand of patient-centered and long-term interventions.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 4.8% |

| Market Value In 2024 | USD 42.1 billion |

| Market Value In 2035 | USD 70.0 billion |

Introduction

Medical Imaging Advances Market focuses on the management of long-term pain issues in the multidisciplinary scope of therapeutic products and solutions, medical devices, and digital tools. Chronic pain has become a widespread global problem with more than 1.5 billion people being affected by it and has now been accepted as a multi-modal biopsychosocial disorder needing multi-modal intervention. The present report assesses the therapeutic innovations on a pharmacological, interventional, and behavioral level, providing an in-depth insight into the effects being created by Technology Adoption in Medical Imaging Advances on the management of care. The analysis of the Medical Imaging Advances Industry discusses the enhancements in delivery models and regulatory policies that promote the use of outcome-based care, and discusses new Emerging Opportunities and investment potential of the industry to the stakeholders.

Key Market Drivers: What’s Fueling the Medical Imaging Advances Market Boom?

- Digitalization of Healthcare Systems: The process of digitalizing healthcare services is one of the factors that has immensely contributed to the expansion in the Medical Imaging Advances Market. Electronic health records (EHR), wearables, and patient monitoring systems provide enormous amounts of data. When properly analyzed, these datasets can assist the stakeholders to make informed decisions and enhance clinical efficiencies, and minimize avoidable costs. Demand is further building when it comes to analytics tools that will be used to standardize information across a wide variety of platforms due to growing movements towards data centralization and interoperability.

- Policy and Regulatory Influence: Government programs and policies have played a big role in the adoption of analytics. Such mandates as the HITECH Act and MACRA in the United States, and GDPR in Europe, have resulted in a light compliance environment where analytics contribute to monitoring compliance and to the subsequent delivery of needed reports. Furthermore, patient health management, resource allocation and service delivery of countries are incorporating analytics talents in their national digital health missions and public health strategies.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The Medical Imaging Advances Market focuses on the idea of innovation involving hybrid-based care solutions that utilize all the three mentioned modalities that include digital therapeutics, implantable neuromodulation and AI-enabled diagnostics. The wearables are no longer limited to the monitoring of the bio feedback, but are now used to track the pain in real-time, whereas the spinal cord stimulators have become efficient tools with the closed-loop approach being in use. Individual digital interventions, like the virtual CBT and gamified treatment, are a new trend in the out-of-clinic-based Medical Imaging Advances. These improvements do not only enhance adherence and outcomes but also look at a long-term Medical Imaging Advances Investment Opportunities in smart connected health ecosystems.

Recent Developments:

In May 2025, Medtronic introduced its closed-loop spinal cord stimulator in adaptive feedback to chronic pain patients, which fits with Medical Imaging Advances Market Investment Opportunities.

Conclusion

The Medical Imaging Advances Market is on the rise, and it is exposed to technology trends, patient expectations, and policy changes. Although pharmacological treatments are still needed, the market is steadily shifting to digital pharmaceutical paradigm, device-assisted model, and integrative model. In the context of regional approach, strategies should be adapted to this aspect as North America has taken the leading role and Asia-Pacific being the best improver. The future of pain management is the result of investments in digital therapeutics, custom implants, and AI-based platforms. The Medical Imaging Advances Market Forecast describes an industry that has Lots of Emerging Opportunities, which can be complemented with real-world evidence and outcome-based care-based models.

Related Reports

- The global Medical Device Innovations Market was valued at approximately USD 650.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035, reaching around USD 1,185.2 billion by the end of the forecast period.

- The global Oncology and Cancer Care Market was valued at approximately USD 265.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 9.8% from 2025 to 2035, reaching around USD 736.8 billion by the end of the forecast period.

Key Market Players

The Medical Imaging Advances Competitive Landscape consists of drug companies, medical device innovation companies and digital health companies. Firms are gaining investments in implants, AI platforms, and mixed interventions of pain. Efficacy, patient adherence outcome and pricing strategy is what drives competition. The partnership between pharma firms and medtech firms is growing product lines. Increased availability of startups that provide app based therapies is also emerging in the market, which justifies a solution based on integrated care. Organizations are aligning to the value-based care objectives to enable them to comply with the payer demand, as well as the unmet clinical needs. Some of the key players in the Medical Imaging Advances industry are as:

GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings, Hologic, Inc., Mindray Medical International, Samsung Medison, Carestream Health, Shimadzu Corporation, Agfa-Gevaert, United Imaging Healthcare, Hitachi Medical Corporation, Agilent Technologies, EOS Imaging

- X-ray Imaging: X-ray imaging is the most frequently applied diagnostic instrument, which is fast and cheaper medium to provide image like broken bones, examination of the chest, and examination of the teeth with the additional benefit of digital radiographer that provides a clearer picture and an easy storage of the image.

- Computed Tomography (CT): CT scans are cross-sectional images and very important in traumatic, cancerous and heart disorders diagnosis.

- Magnetic Resonance Imaging (MRI): MRI provides high-quality images of soft tissues, brain and spinal cord that do not use any means of ionizing radiation.

- Ultrasound Imaging: Ultrasound imaging is a reflection-based procedure that has wide application in diagnostic abdominal examinations and cardiology along with prenatal care.

- Nuclear Imaging: Nuclear imaging methods, such as PET and SPECT show metabolism in the body using radioactive agents, or radiotracers, to observe disease at in its earliest stages, particularly diagnosis of malignancies, neurologic disorders, and cardiovascular disorders.

Note: Charts and figures are illustrative only. Contact us for verified market data.

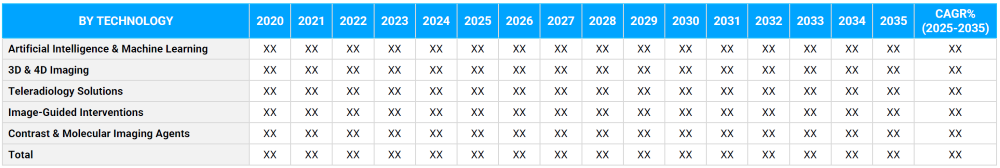

- Artificial Intelligence & Machine Learning: AI enhances the accuracy of the diagnosis, automatic interpretation of images, patient outcomes, which enables the radiologist to cope with a high volume of imaging by providing real-time decisions.

- 3D & 4D Imaging: 3D imaging can be used to create three dimensional images of anatomical structures, volumetric reconstructions of organs and anatomical structures. 4D imaging can further be used to track the movements of the structures, which can further be used in surgery and prenatal diagnostic.

- Teleradiology Solutions: Teleradiology is used to enable the reading of images and diagnostics at distances (in particularly underserved areas).

- Image-Guided Interventions: These systems serve to provide real-time visual guidance to minimally invasive procedures based on CT, ultrasound, or fluoroscopy, common in tumor ablations, and in vascular treatments.

- Contrast & Molecular Imaging Agents: Enhanced contrast agents can increase the clarity of the image and can also focus on a particular tissue or molecules thus allowing the detection of the disease at an earlier stage and also improving the assessment of the therapy.

Note: Charts and figures are illustrative only. Contact us for verified market data.

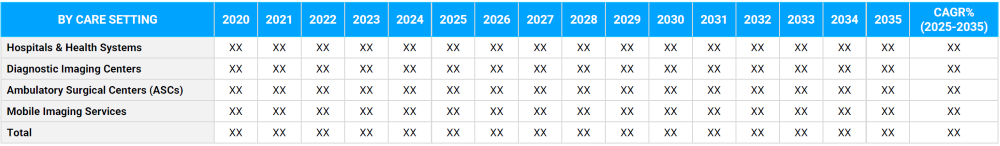

- Hospitals & Health Systems: The hospital will continue to be the major destination of complex imaging exams or emergency diagnostics and combine high-end modalities with interventional radiology to offer end-to-end care.

- Diagnostic Imaging Centers: Independent imaging centers are cost-effective, provide timely services, which include, but are not limited to, MRI, CT, and mammography, and are used to serve outpatients and elective diagnostics with a reduced wait time.

- Ambulatory Surgical Centers (ASCs): ASCs use imaging as part of the pre-surgical planning and intra-operator support with orthopedic, ophthalmology and pain treatment and an increasing tendency towards outpatient surgery.

- Mobile Imaging Services: Mobile vehicles offer innovative imaging such as MRI and mammography services in far-flung regions hence enhancing their accessibility even as they supplement the temporary or overflow capacity of the existing facilities.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Oncology Imaging: Oncology imaging promises to be instrumental in detecting cancer early, staging its disease, and managing them with the use of PET/CT, MRI, and molecular imaging technology to develop tailored treatment plans.

- Cardiology Imaging: Cardiac imaging encompasses echocardiography, cardiac CT and MRI, which can be used to provide non-invasive analysis of the coronary artery disease, heart failure, and structural malformation.

- Neurology Imaging: Through neuroimaging, a condition such as stroke, multiple sclerosis or brain tumor is diagnosed using high-resolution imaging; this is because MRI and PET allow a clear picture of the structure and performance of the brain.

- Orthopedic & Musculoskeletal Imaging: The sub-segment also assists in broken bone recognition, joint wear and tear, and soft tissue damage employing the X rays, CT scan, and MRI, which are utilised mostly in sports medicine and geriatrics.

- Obstetrics & Gynecology Imaging: The womans health imaging refers to 3D/4D ultrasound use during fetal monitoring and MRI imaging to determine the uterus Abnormalities, endometriosis, and pelvic disorders.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America forms the biggest market in Medical Imaging Advances Market because of good health care set up, prevalence of the disease and the hike in regulations to curtail abuse of opioids. The U.S. is the best in terms of device innovation and therapy integration. Europe is next with its interest in multidisciplinary care and evidence-based care. But, Asia-Pacific is the fastest growing region, which is backed by booming medical infrastructure, increased health awareness, and increasing geriatric populations. Regional Insights share that the market growth is hastened in the region by the adoption of digital health and state-sponsored programs in India, China, and Southeast Asia.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Medical Imaging Advances Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Medical Imaging Advances Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Medical Imaging Advances Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Medical Imaging Advances Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Imaging Modality & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Medical Imaging Advances Market – By Imaging Modality

5.1. Overview

5.1.1. Segment Share Analysis, By Imaging Modality, 2024 & 2035 (%)

5.1.2. X-ray Imaging

5.1.3. Computed Tomography (CT)

5.1.4. Magnetic Resonance Imaging (MRI)

5.1.5. Ultrasound Imaging

5.1.6. Nuclear Imaging (PET, SPECT)

(presents market segmentation by Imaging Modality, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Medical Imaging Advances Market – By Technology

6.1. Overview

6.1.1. Segment Share Analysis, By Technology, 2024 & 2035 (%)

6.1.2. Artificial Intelligence & Machine Learning

6.1.3. 3D & 4D Imaging

6.1.4. Teleradiology Solutions

6.1.5. Image-Guided Interventions

6.1.6. Contrast & Molecular Imaging Agents

(breaks down the market by Technology, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Medical Imaging Advances Market – By Care Setting

7.1. Overview

7.1.1. Segment Share Analysis, By Care Setting, 2024 & 2035 (%)

7.1.2. Hospitals & Health Systems

7.1.3. Diagnostic Imaging Centers

7.1.4. Ambulatory Surgical Centers (ASCs)

7.1.5. Mobile Imaging Services

(focuses on market segmentation by Care Setting, helping the client prioritize specific crop Imaging Modalitys or end-use areas that offer significant business opportunities)

8. Medical Imaging Advances Market – By Clinical Application

8.1. Overview

8.1.1. Segment Share Analysis, By Clinical Application, 2024 & 2035 (%)

8.1.2. Oncology Imaging

8.1.3. Cardiology Imaging

8.1.4. Neurology Imaging

8.1.5. Orthopedic & Musculoskeletal Imaging

8.1.6. Obstetrics & Gynecology Imaging

(describes the market division by Clinical Application of Imaging Modality, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Medical Imaging Advances Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Medical Imaging Advances Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Imaging Modality, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Care Settings, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Clinical Application, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Imaging Modality, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Care Settings, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Clinical Application, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Imaging Modality, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Care Settings, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Clinical Application, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Imaging Modality, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Care Settings, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Clinical Application, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Medical Imaging Advances Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. GE Healthcare

10.3.2. Siemens Healthineers

10.3.3. Philips Healthcare

10.3.4. Canon Medical Systems

10.3.5. Fujifilm Holdings

10.3.6. Hologic, Inc.

10.3.7. Mindray Medical International

10.3.8. Samsung Medison

10.3.9. Carestream Health

10.3.10. Shimadzu Corporation

10.3.11. Agfa-Gevaert

10.3.12. United Imaging Healthcare

10.3.13. Hitachi Medical Corporation

10.3.14. Agilent Technologies

10.3.15. EOS Imaging

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Medical Imaging Advances Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Medical Imaging Advances Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Medical Imaging Advances Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Medical Imaging Advances Market: Imaging Modality Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Imaging Modality

TABLE 6: Global Medical Imaging Advances Market, by Imaging Modality 2022–2035 (USD Billion)

TABLE 7: Medical Imaging Advances Market: Technology Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Technology

TABLE 9: Global Medical Imaging Advances Market, by Technology 2022–2035 (USD Billion)

TABLE 10: Medical Imaging Advances Market: Care Settings Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Care Settings

TABLE 12: Global Medical Imaging Advances Market, by Care Settings2022–2035 (USD Billion)

TABLE 13: Medical Imaging Advances Market: Care Settings Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Clinical Application

TABLE 15: Global Medical Imaging Advances Market, by Clinical Application 2022–2035 (USD Billion)

TABLE 16: Medical Imaging Advances Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Medical Imaging Advances Market, by Region 2022–2035 (USD Billion)

TABLE 19: Medical Imaging Advances Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Medical Imaging Advances Market, by Imaging Modality (NA), 2022–2035 (USD Billion)

TABLE 21: Medical Imaging Advances Market, by Technology (NA), 2022–2035 (USD Billion)

TABLE 22: Medical Imaging Advances Market, by Care Setting (NA), 2024–2035 (USD Billion)

TABLE 23: Medical Imaging Advances Market, by Clinical Application (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 25: U.S. Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 26: U.S. Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 27: U.S. Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 28: Canada Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 29: Canada Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 30: Canada Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 31: Canada Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 32: Mexico Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 33: Mexico Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 34: Mexico Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 35: Mexico Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 36: Medical Imaging Advances Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Medical Imaging Advances Market, by Imaging Modality (Europe), 2022–2035 (USD Billion)

TABLE 38: Medical Imaging Advances Market, by Technology (Europe), 2022–2035 (USD Billion)

TABLE 39: Medical Imaging Advances Market, by Care Setting(Europe), 2022–2035 (USD Billion)

TABLE 40: Medical Imaging Advances Market, by Clinical Application (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 42: Germany Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 43: Germany Medical Imaging Advances Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 45: Italy Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 46: Italy Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 47: Italy Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 48: Italy Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 53: France Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 54: France Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 55: France Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 56: France Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 57: Russia Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 58: Russia Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 59: Russia Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 60: Russia Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 61: Poland Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 62: Poland Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 63: Poland Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 64: Poland Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 69: Medical Imaging Advances Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Medical Imaging Advances Market, by Imaging Modality (APAC), 2022–2035 (USD Billion)

TABLE 71: Medical Imaging Advances Market, by Technology (APAC), 2022–2035 (USD Billion)

TABLE 72: Medical Imaging Advances Market, by Care Setting(APAC), 2022–2035 (USD Billion)

TABLE 73: Medical Imaging Advances Market, by Clinical Application (APAC), 2022–2035 (USD Billion)

TABLE 74: India Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 75: India Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 76: India Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 77: India Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 78: China Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 79: China Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 80: China Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 81: China Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 82: Japan Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 83: Japan Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 84: Japan Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 85: Japan Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 86: South Korea Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 87: South Korea Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 88: South Korea Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 89: South Korea Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 90: Australia Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 91: Australia Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 92: Australia Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 93: Australia Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 98: Brazil Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 99: Brazil Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 100: Brazil Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 101: Brazil Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 102: Argentina Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 103: Argentina Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 104: Argentina Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 105: Argentina Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 106: Colombia Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 107: Colombia Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 108: Colombia Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 109: Colombia Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 114: Israel Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 115: Israel Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 116: Israel Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 117: Israel Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 118: Turkey Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 119: Turkey Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 120: Turkey Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 121: Turkey Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 122: Egypt Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 123: Egypt Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 124: Egypt Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 125: Egypt Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Medical Imaging Advances Market, by Imaging Modality, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Medical Imaging Advances Market, by Technology, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Medical Imaging Advances Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Medical Imaging Advances Market, by Clinical Application, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Medical Imaging Advances Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Imaging Modality Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Imaging Modality Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Technology Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Technology Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Imaging Modality Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Imaging Modality Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Clinical Application Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Clinical Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Medical Imaging Advances Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Medical Imaging Advances Market Share and Leading Players, 2024

FIGURE 23: Latin America Medical Imaging Advances Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Medical Imaging Advances Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Medical Imaging Advances Market Share Analysis by Country, 2023

FIGURE 30: Germany Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Medical Imaging Advances Market Share Analysis by Country, 2023

FIGURE 39: India Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Medical Imaging Advances Market Share Analysis by Country, 2023

FIGURE 47: Brazil Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Medical Imaging Advances Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Medical Imaging Advances Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "This report gave our team a solid foundation for understanding the trajectory of advanced imaging modalities, especially around AI-enabled diagnostics and hybrid imaging systems. We were assessing upgrades to our radiology infrastructure, and the vendor comparison matrix and modality-specific adoption trends helped us build a compelling case for capital expenditure. It was evident that the insights were built on real-world clinical input and not just abstract forecasts."

- Dr. Laura Simmons, Chief Radiology Officer, Multi-Specialty Healthcare Group (USA)

- "We leveraged the Medical Imaging Advances Market Research Report to shape our go-to-market strategy for our next-gen diagnostic imaging equipment. The regional breakdown of hospital procurement patterns, as well as the regulatory landscape across the EU and North America, was invaluable. The level of technical specificity paired with commercial foresight made this report one of the most reliable tools in our market planning arsenal."

- Markus Schneider, VP, Market Intelligence, Medical Device Manufacturer (Germany)

- "As investors in imaging-centric medtech innovations, we used this report during our pre-deal diligence process. It provided in-depth insights into growth hotspots, AI integration maturity, and clinical workflow challenges in Asia-Pacific markets. The detailed segmentation by use-case (oncology, cardiology, neurology) helped us assess technology-market fit for portfolio companies. This report reflects genuine expertise and on-ground understanding of the imaging ecosystem."

- Dr. Aisha Tanaka, Partner, Healthcare & MedTech Investments, Private Equity Firm (Singapore)

The Medical Imaging Advances Market 2025 report has been meticulously developed by the expert research team at Quants & Trends, a trusted provider of healthcare market intelligence with specialized focus on imaging technologies, diagnostic innovation, and AI-driven clinical solutions.

With over a decade of domain experience in medical devices and imaging systems, our analysts combine deep technical knowledge with commercial insight. The team includes former imaging product managers, radiology consultants, and healthcare economists who understand both the clinical and market-facing sides of diagnostic innovation. This report is the product of months of structured primary interviews with radiologists, imaging directors, procurement specialists, and medtech investors, complemented by proprietary data modeling and regulatory landscape tracking across the U.S., Europe, and Asia-Pacific.

This research goes far beyond market sizing. It captures key shifts in modality adoption (CT, MRI, PET-CT, ultrasound), the rise of AI-enabled image interpretation, hybrid systems, workflow optimization tools, and real-time diagnostics. Whether you're a health system executive assessing capital equipment investments, a medtech innovator planning your next product roadmap, or a venture partner evaluating high-growth imaging platforms, this report is tailored to inform high-stakes decisions with clarity and precision.

To learn more about our research methodology, areas of expertise, and industry engagement, connect with us on our official LinkedIn page.