Market Outlook

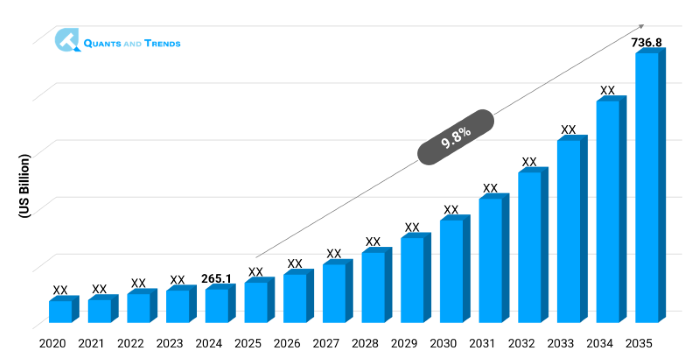

The global Oncology and Cancer care market was valued at approximately USD 265.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 9.8% from 2025 to 2035, reaching around USD 736.8 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The level of momentum that the Oncology and cancer care market is marking in the world marketplace is perturbed by the correlation of having elevated rates of cancer cases, change in modes of dealing with them and the level of healthcare spending. Data released by the WHO indicate that almost all the 10 million deaths in 2022 can be attributed to cancer, indicating that governments and non-governmental actors should invest in effective cancer care facilities. The market has also been boosted by other recent technologies like precision medicine, immunotherapy, and those based on AI to detect and diagnose ailments. The beneficial reimbursement models and government programs that are geared toward timely diagnosis and patient-driven care also contribute to this shift. Oncology and Cancer Care Market Forecast should tap into a favorable improvement in the market with the swelling volume of individualized treatment procedures and the adoption of new diagnostics platform, thereby driving the market forward in both mature and developing markets.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 9.8% |

| Market Value In 2024 | USD 265.1 billion |

| Market Value In 2035 | USD 736.8 billion |

Introduction

The Oncology and Cancer Care Market has a comprehensive range of services, products, drugs, and technology that are targeted at cancer prevention, diagnosis, treatment, and post-therapeutic management. The most important ones are the chemotherapeutic, radiation equipment, surgery, and support systems. Value-based healthcare is a new trend; therefore, with increased awareness and early screening initiatives, the face of treatment will have changed. Further oncology is getting personalized as more genomic testing and biomarker therapy become included in the oncological process. Consequently, this has seen the market being defined by dynamic regulatory pathways, various treatment modalities and also immense investment opportunities among pharmaceutical and healthcare technology firms.

Key Market Drivers: What’s Fueling the Oncology and Cancer care Market Boom?

- Increasing Global Incidence of Cancer: The growing impact of cancer globally acts as a key driver of Oncology and Cancer Care Market. The Global Cancer Observatory (GLOBOCAN) has estimated that the number of new cancer cases will be over 28 million in the year 2040, which is projected to be a 2 million increase on what was recorded in 2022 (20 million). This has been promoted by factors like aging populations, sedentary lifestyle and environmental exposure. This increasing disease burden necessitates an all-inclusive care model that can incorporate the elements of diagnostics, therapeutics and palliative services and that will broaden the oncology care across the value chain.

- Technology Advancements in Diagnostics and Therapeutics: Informed by the use of technology in Oncology and Cancer Care, diagnostic and therapeutic processes are being transformed. The emergence of technologies such as liquid biopsies, AI used to analyze imaging assessment, and next-generation sequencing achieved the breakthrough in earlier detection of cancer, as well as adopting a personalized approach to therapy. There is also the evolution of immunotherapy, CAR-T cell and targeted therapy on the treatment side, which have resulted in enhanced outcomes of patients and increased survival time. Not only these innovations are increasing the clinical precision, they are decreasing the toxicity and increasing the quality of life making them primary force in the Oncology and Cancer Care Industry Analysis.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The Oncology and Cancer Care Market is being transformed by innovation, which is defining care delivery, especially in precision oncology and integration of digital health. Currently, AI-based algorithms support radiology, pathology, and treatment planning, eliminating some inaccuracies in diagnosing. In addition to this, theragnostic advances are making it possible to monitor the effects of therapy in real time. The clinical trials are already becoming adaptive and biomarker-based providing better optimization of the patient selection and treatment response. All these innovations present Emerging Opportunities to achieve better results, cost-effective measures, and patient-centered care models.

Recent Developments:

In 2024, Roche introduced the next-gen liquid biopsy test that could detect more than 20 kinds of cancer in their early stages, making diagnosis more precise. Also, Bristol-Myers Squibb and Tempus AI formed a strategic alliance to enable the company to apply real-world oncology intelligence to the design of clinical trials.

Conclusion

Oncology and Cancer Care Market have a long-term horizon of growth due to the evolution of technology, rising prevalence rates of diseases and favorable policy conditions. As personalized medicine and AI-powered diagnostics become the norm and new models of care delivery take shape, the market is shifting to personal and data-driven treatments. The companies investing into new technologies, globalization, and patient-based activity will acquire a competitive advantage. The future of this dynamic and life-saving industry would include strategic cooperation, constant updating, and flexible regulatory structure. The market presents humongous possibilities to market players in all pharmaceutical sectors, diagnostics and digital health solutions.

Related Reports

- The global Biosimilar Market was valued at approximately USD 32.56 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2035, reaching around USD 67.95 billion by the end of the forecast period.

- The global Personalized Medicine Market was valued at approximately USD 375.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reaching around USD 735.6 billion by the end of the forecast period.

Key Market Players

The Oncology and Cancer Care Market competitive landscape has been characterized by active R&D, M&A transactions and strategic partnerships in efforts to grow the therapeutic portfolio as well as the capabilities needed to diagnose the condition. Firms are also venturing in immunology-oncology, digital health solutions, and AI-based diagnostic devices in a bid to improve clinical efficacy and patient engagement. Pharma enterprises and technology companies are increasing their collaborations to co-design precision oncology oncology solutions. Such regulatory acceleration measures as the Breakthrough Therapy Designation of the FDA are facilitating faster time-to-market of new therapies. The market is highly fragmented as there are international players as well as domestic companies with local solutions to problems. Some of the key players in the Oncology and Cancer care industry are as:

Roche Holding AG, Bristol-Myers Squibb, Johnson & Johnson, Novartis AG, Pfizer Inc., Merck & Co., Inc., AstraZeneca, Eli Lilly and Company, AbbVie Inc., Amgen Inc., Bayer AG, Siemens Healthineers, GE Healthcare, Varian Medical Systems, Thermo Fisher Scientific

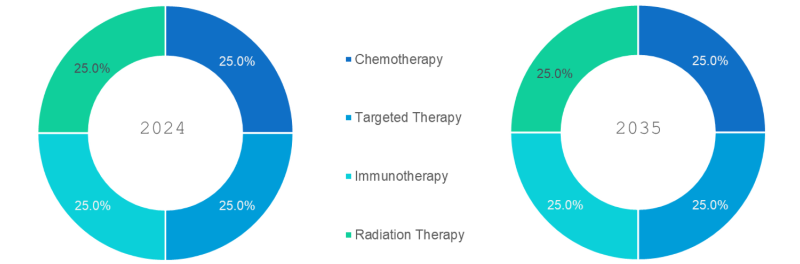

- Chemotherapy (Dominated): It is successful in killing fast growing cancer cells with the use of cytotoxic drugs. It continues to be a first-line therapy on all counts because of its general applicability on several types of cancer and because it is cheap.

- Targeted Therapy (fastest): It aims at a particular restrained target associated with the growth of the cancer. It indicates more efficacy and a smaller number of side effects when compared to traditional chemotherapy, particularly in patients whose natures are profiled.

- Immunotherapy: It boosts the ability of the immune system of the patient to identify and kill the cancer cells. It is revolutionizing the treatment of melanoma, lung and blood cancer with a long-term survival advantage.

- Radiation Therapy: Uses rays of high energies to kill tumors or reduce their size. It is most frequently applied with surgery or chemotherapy but when applied in localized and inoperable cases of cancer, it is vital.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Imaging (Dominated): Used to give non-invasive imaging of the size, location and extent of the tumor. It plays a crucial role in both cancer staging and planning of all care phases in treatment.

- Biopsy: Pathological analysis is done to questionable tissue and removed surgically or with a needle. It is the gold standard of proving a malignancy prior to the treatment commencement.

- Genetic Testing (fastest): Examines mutation-related DNA with respect to certain types of cancer. Allows the use of individualized approaches to medical care and aids in diagnosing inherited cancer syndromes in potentially susceptible groups.

- Blood-Based Tests: The detection of the tumor DNA and biomarkers in blood. Provides an option that is minimally invasive to enable early detection, monitoring and establishing response to treatment.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Pharmaceuticals (Dominated): Chemotherapy, immunotherapy, and hormone therapy are included. Achieve the biggest market share because of high consumption, prices and an increasing pipeline of new oncology medicines.

- Medical Devices (fastest): The segment contains radiation delivery, and surgical equipment and infusion pumps. Assist in the diagnosis, treatment, and the post-operative stages in different cancers.

- Software: AI-based systems for X-ray, CT-Scan, MR, etc. diagnostic imaging, treatment planning, patient care. Improve the efficiency, accuracy, and personalization of workflow in the delivery of oncology.

- Services: These include treating plans, psychological consultation, and telemedicine consultations. Facilitate sustained patient success and connectivity with care wherever they are or in resource-constrained areas.

Note: Charts and figures are illustrative only. Contact us for verified market data.

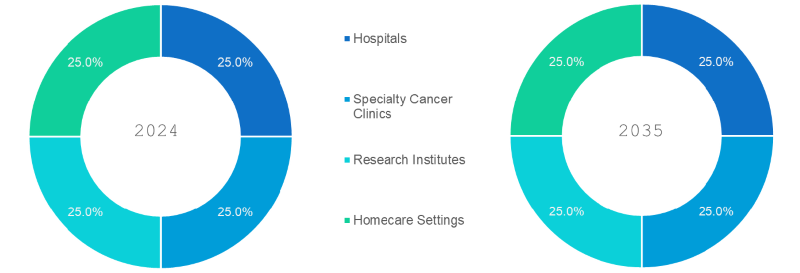

- Hospitals (Dominated): Offer all forms of cancer treatments such as surgery, chemotherapy, and radiations in the same building. They enjoy hegemony on the basis of infrastructure, multi-disciplinary teams and superior treatment technologies.

- Exclusive Cancer Clinics: Provide only oncology care and only with the option of outpatient chemotherapy and outpatient diagnostics and follow-ups. More desirable due to individual care and low expenses unlike hospitals systems.

- Research Institutes (fastest): Undertake clinically translational research, as well as clinical trials in the field of oncology. Have a major role in the development of drugs, finding of biomarkers and testing of new medicines at unit phases.

- Homecare: Support cancer treatment in the home, such as palliative treatment, medicine, and distant monitoring. This is good where pathological patients are in terminal or long term care and want convenience and comfort.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The leading portion of the Oncology and Cancer Care Market is with the North American region, the leading market because of the presence of robust healthcare infrastructure, progressive reimbursements policies, and the higher incidence level of cancer. Innovation and accessibility are also boosted by the presence of other huge players in the field of pharmaceuticals and biotechnology. But, the Asia-Pacific has the highest growth rate attributable to the soaring industries in healthcare, awareness, and cancer control initiatives run by the government in nations such as China, India, and Japan. The eruption of medical tourism, enhancement of diagnostic systems, and an increase in clinical trials in this region also stimulate the regional growth even more. These Regional Insights show strategic opportunities in geographies, migrating as it does between mature and emerging markets.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Oncology and Cancer care Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Oncology and Cancer care Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Oncology and Cancer care Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Oncology and Cancer care Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Therapy Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Oncology and Cancer care Market – By Therapy Type

5.1. Overview

5.1.1. Segment Share Analysis, By Therapy Type, 2024 & 2035 (%)

5.1.2. Chemotherapy

5.1.3. Targeted Therapy

5.1.4. Immunotherapy

5.1.5. Radiation Therapy

(presents market segmentation By Therapy Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Oncology and Cancer care Market – By Diagnostic Method

6.1. Overview

6.1.1. Segment Share Analysis, By Diagnostic Method, 2024 & 2035 (%)

6.1.2. Imaging

6.1.3. Biopsy

6.1.4. Genetic Testing

6.1.5. Blood-Based Tests

(breaks down the market by Diagnostic Method, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Oncology and Cancer care Market – By Product Type

7.1. Overview

7.1.1. Segment Share Analysis, By Product Type, 2024 & 2035 (%)

7.1.2. Pharmaceuticals

7.1.3. Medical Devices

7.1.4. Software

7.1.5. Services

(focuses on market segmentation by Product Type, helping the client prioritize specific product type or end-use areas that offer significant business opportunities)

8. Oncology and Cancer care Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals

8.1.3. Exclusive Cancer Clinics

8.1.4. Research Institutes

8.1.5. Homecare

(describes the market division by End-User of Therapy Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Oncology and Cancer care Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Oncology and Cancer care Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Diagnostic Method, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Diagnostic Method, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Diagnostic Method, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Diagnostic Method, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Oncology and Cancer care Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Roche Holding AG

10.3.2. Bristol-Myers Squibb

10.3.3. Johnson & Johnson

10.3.4. Novartis AG

10.3.5. Pfizer Inc.

10.3.6. Merck & Co., Inc.

10.3.7. AstraZeneca

10.3.8. Eli Lilly and Company

10.3.9. AbbVie Inc.

10.3.10. Amgen Inc.

10.3.11. Bayer AG

10.3.12. Siemens Healthineers

10.3.13. GE Healthcar

10.3.14. Varian Medical Systems

10.3.15. Thermo Fisher Scientific

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Oncology and Cancer care Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Oncology and Cancer care Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Oncology and Cancer care Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Oncology and Cancer care Market: Therapy Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Therapy Type

TABLE 6: Global Oncology and Cancer care Market, By Therapy Type 2022–2035 (USD Billion)

TABLE 7: Oncology and Cancer care Market: Diagnostic Method Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Diagnostic Method

TABLE 9: Global Oncology and Cancer care Market, by Diagnostic Method 2022–2035 (USD Billion)

TABLE 10: Oncology and Cancer care Market: Product Type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Product Type

TABLE 12: Global Oncology and Cancer care Market, by Product Type 2022–2035 (USD Billion)

TABLE 13: Oncology and Cancer care Market: End User Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Oncology and Cancer care Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Oncology and Cancer care Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Oncology and Cancer care Market, by Region 2022–2035 (USD Billion)

TABLE 19: Oncology and Cancer care Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Oncology and Cancer care Market, By Therapy Type (NA), 2022–2035 (USD Billion)

TABLE 21: Oncology and Cancer care Market, by Diagnostic Method (NA), 2022–2035 (USD Billion)

TABLE 22: Oncology and Cancer care Market, by Product Type (NA), 2024–2035 (USD Billion)

TABLE 23: Oncology and Cancer care Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 26: U.S. Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 27: U.S. Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 29: Canada Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 30: Canada Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 31: Canada Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 34: Mexico Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 35: Mexico Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Oncology and Cancer care Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Oncology and Cancer care Market, By Therapy Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Oncology and Cancer care Market, by Diagnostic Method (Europe), 2022–2035 (USD Billion)

TABLE 39: Oncology and Cancer care Market, by Product Type(Europe), 2022–2035 (USD Billion)

TABLE 40: Oncology and Cancer care Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 42: Germany Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 43: Germany Oncology and Cancer care Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 46: Italy Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 47: Italy Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 48: Italy Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 54: France Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 55: France Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 56: France Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 58: Russia Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 59: Russia Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 60: Russia Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 62: Poland Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 63: Poland Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 64: Poland Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Oncology and Cancer care Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Oncology and Cancer care Market, By Therapy Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Oncology and Cancer care Market, by Diagnostic Method (APAC), 2022–2035 (USD Billion)

TABLE 72: Oncology and Cancer care Market, by Product Type(APAC), 2022–2035 (USD Billion)

TABLE 73: Oncology and Cancer care Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 75: India Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 76: India Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 77: India Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 79: China Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 80: China Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 81: China Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 83: Japan Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 84: Japan Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 85: Japan Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 88: South Korea Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 89: South Korea Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 91: Australia Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 92: Australia Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 93: Australia Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 100: Brazil Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 101: Brazil Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 104: Argentina Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 105: Argentina Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 108: Colombia Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 109: Colombia Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 115: Israel Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 116: Israel Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 117: Israel Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 120: Turkey Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 121: Turkey Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 124: Egypt Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 125: Egypt Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Oncology and Cancer care Market, By Therapy Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Oncology and Cancer care Market, by Diagnostic Method, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Oncology and Cancer care Market, by Product Type, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Oncology and Cancer care Market, by End-User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Oncology and Cancer care Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Therapy Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Therapy Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Diagnostic Method Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Diagnostic Method Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Therapy Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Therapy Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Oncology and Cancer care Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Oncology and Cancer care Market Share and Leading Players, 2024

FIGURE 23: Latin America Oncology and Cancer care Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Oncology and Cancer care Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Oncology and Cancer care Market Share Analysis by Country, 2023

FIGURE 30: Germany Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Oncology and Cancer care Market Share Analysis by Country, 2023

FIGURE 39: India Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Oncology and Cancer care Market Share Analysis by Country, 2023

FIGURE 47: Brazil Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Oncology and Cancer care Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Oncology and Cancer care Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The Oncology and Cancer Care Market Research Report provided an exceptional level of depth and precision. The segmentation by treatment modalities, emerging technologies, and regional reimbursement dynamics allowed our team to identify high-growth areas for investment. The evidence-based forecasts and patient outcome data were instrumental in shaping our oncology service expansion plan. This report was not just market data, it was a strategic playbook we could confidently present to our board."

- Sarah Mitchell, Healthcare Strategy Director, United States

- "As someone advising on oncology innovation in Europe, I found the level of clinical and commercial integration in this report outstanding. The authors clearly understand both the regulatory nuances and the real-world application of cancer care advancements. The comparative analysis between targeted therapies, immuno-oncology agents, and supportive care solutions gave us a competitive advantage in planning our next-generation oncology product pipeline. It’s the kind of intelligence you rarely find in generic market studies."

- Dr. Lukas Reinhardt, Medical Innovation Advisor, Germany

- "This report went far beyond surface-level market overviews. The detailed projections, backed by interviews with oncologists, hospital procurement teams, and biotech innovators, gave us the confidence to reallocate capital into specific oncology technology segments. The regional breakdowns, particularly for Asia-Pacific, were incredibly accurate and aligned with our own field intelligence. It’s rare to see a market research report with such actionable value for both operational and investment decisions."

- Priya Tanaka, Senior Healthcare Investment Analyst, Singapore

The Oncology and Cancer Care Market 2025 report has been authored by a seasoned team of healthcare market analysts, clinical researchers, and strategic consultants with over a decade of experience in the global life sciences sector. Our analysts specialize in translating complex oncology market data, spanning drug pipelines, treatment innovations, reimbursement models, and patient care delivery, into clear, actionable insights for decision-makers.

Drawing from a blend of proprietary data sources, peer-reviewed clinical studies, and in-depth interviews with oncologists, hospital procurement specialists, biotech innovators, and policy experts, this report goes beyond market sizing. It delivers a comprehensive view of the evolving oncology landscape, enabling healthcare providers, investors, and technology developers to identify profitable growth segments, anticipate regulatory shifts, and align their strategies with emerging patient care needs.

The expertise behind this report ensures that every forecast is grounded in real-world trends and validated by industry stakeholders. Whether you are evaluating investment opportunities in immuno-oncology, planning the rollout of precision medicine solutions, or exploring new models for cancer care delivery, this report serves as a practical roadmap for strategic planning.

For more information about our research methodology, expertise, and ongoing healthcare market insights, connect with us on LinkedIn.