Market Outlook

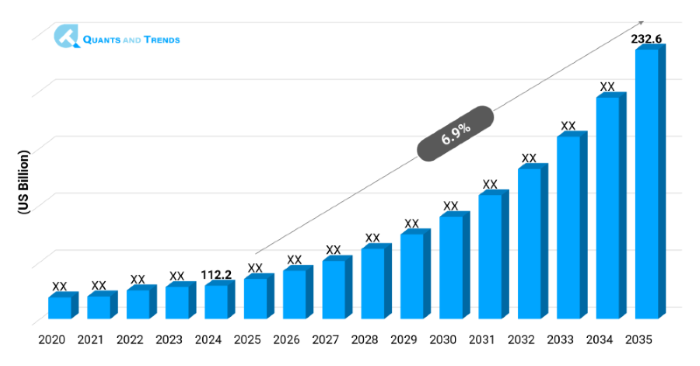

The Global Preventive Healthcare Strategies Market was valued at approximately USD 112.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 232.6 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecast starts from 2025 to 2035.

Preventive Healthcare Strategies Market faces a boost across the world due to the spread of awareness of prevention of chronic diseases in health care and evolution to the model of value-based care. The markets, now taking the form of a pillar of the public health infrastructure, are receiving investments on the part of the governments and the private sector to create an opportunity in this sector. Diagnostics, personalized medicine and the growth of digital health platforms are also fueling such proactive risk mitigation. Preventive healthcare integration into primary care and insurance reimbursement models are trends that are building the market dynamics. As per industry analyst, Preventive Healthcare Strategies Market Size & Share is projected to increase gradually since there are good policies and incremental costs to healthcare.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 6.9% |

| Market Value In 2024 | USD 112.2 billion |

| Market Value In 2035 | USD 232.6 billion |

Introduction

Preventive health practices involve several services by the health agencies to make improvement in reducing the occurrence or the intensity of diseases as well as their long-term consequences. Such a market consists of screenings, live interventions, vaccinations, and risk assessments offered through clinics, hospitals, mobile platforms, and telehealth services. Disease prevention has become the policy of nearly all countries due to rapid urbanization, life-style diseases, and graying of the population. There is the partnership between the public and the private sector and cross-sector collaborations enabling provision of preventive services even in underserved regions. According to the latest preventive healthcare strategies Industry Analysis, the innovation and the enhancements in market penetration are gaining pace and improving undergirded by the digital penetration and enabling regulations in both the developed and emerging markets.

Key Market Drivers: What’s Fueling the Preventive Healthcare strategies Market Boom?

- Increase in lifestyle-associated diseases and illnesses: Chronic diseases such as diabetes, obesity, and other diseases that are cardiovascular in nature are the most rising because of desk-life and poor eating habits. Preventative measures- starting on an annual check-up and proceeding to diagnostics in the initial stages- are the latest ones to find foothold as a cost-reducing option to services that cost a fortune. The trend is particularly evident in the urbanized economies that have aging populations.

- Government & Regulatory Support: Preventive healthcare is being supported by the governments around the world with incentivization in the policies, awareness creation, and inclusion in the national health insurance programs. By way of example, preventive care coverage is obligatory under the Affordable Care Act in the U.S., increasing coverage by a large margin. R&D in preventative diagnostics and vaccines have regulatory assistance as well.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The market in Innovations in the Preventive Healthcare Strategies is aimed at predictive genomics, wearable biosensors, and AI-based diagnostics. Firms are coming up with integrated platforms that integrate the use of electronic health records (EHR), risk profiling, and real-time alert to increase the use of early intervention. Blockchain is also being tested out in safe health data sharing. Increased clinical outcome are not only salubrious with regard to clinical outcome but costs associated to health care are decreased as well. With the advent of the 5G, cloud computing, IoT in prevention both in the medical field, Technology Adoption in Preventive Healthcare Strategies is likely to increase even more.

Recent Developments:

In 2024, Medtronic, together with a U.S. insurer, initiated a remote cardiovascular risk assessment program which expanded early detection services to rural areas. Simultaneously, Siemens Healthineers, in collaboration with the Indian government, launched mobile cancer screening vans with integrated AI diagnostics in tier-2 cities.

Conclusion

The Preventive Healthcare Strategies Market Report highlights the increase in the significance of the sector in order to realise the long term sustainability of healthcare. With disease burdens, supportive regulation and digital disruption, the market moves beyond the niche wellness programs to become a mainstream healthcare pillar. With the scales of technology reaching and increasing accuracy, preventive healthcare is going to be broadened even further, in geographies and demographics. It will be important to invest in infrastructure, policy reconstruction, and cooperation with stakeholders. Investment opportunities will increase in preventive healthcare strategies that incorporate areas such as AI integration, models of community care, and digital health solutions that will transform how health systems treat patients.

Related Reports

- The global Wearable Health Technology Market is anticipated to reach approximately USD 394.5 billion by 2035 growing at a CAGR of 16.5% from 2024 by USD 75.6 billion.

- The global Nutritional Science and Dietetics Market was valued at approximately USD 435.5 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2035, reaching around USD 854.3 billion by the end of the forecast period.

Key Market Players

Competitors in the Preventive Healthcare Strategies Competitive Landscape consist of the global leaders in healthcare as well as local companies with specialization in diagnostics, wellness, and digital health. The competition is determined by mergers, public-private partnerships, and technology investments. Insurance providers are working with governments and companies to be able to reach more markets. AI, wearables, and data analytics to offer customized prevention services are being used by startups. A large number of players provide vertically integrated services in diagnostics to interventions. Investment in biomarkers predictive, screening, and behavioral science is also ramping up. All in all, it is a dynamic landscape, as players are in a hurry to offer scalable, accessible and cost-effective solutions to regulatory and reimbursement frameworks. Some of the key players in the Preventive Healthcare strategies industry are as:

Johnson & Johnson, Pfizer Inc., Medtronic plc, Siemens Healthineers, GE Healthcare, Abbott Laboratories, Quest Diagnostics, Cerner Corporation, Allscripts Healthcare Solutions, GSK plc, Omron Healthcare, Teladoc Health Inc., BioTelemetry, Inc., Apple Inc. (Healthcare Division), Roche Diagnostics

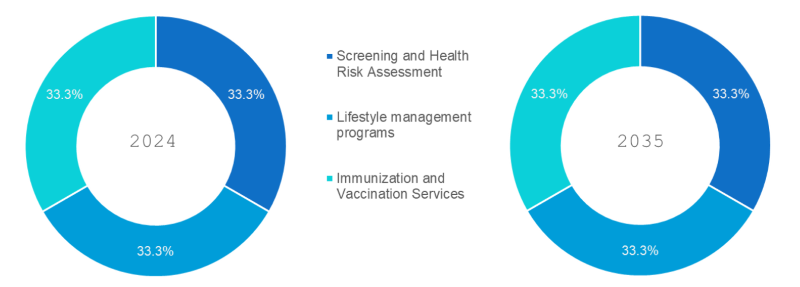

- Screening and Health Risk Assessment (Fastest): This is provided in the form of early screening of chronic diseases such as diabetes, high blood pressure, heart diseases, annual screening, blood tests and physical examination. These programs are marketed by the insurers and providers to minimise long-term treatment expenses.

- Lifestyle management programs (Dominated): These involve weight management programs, nutrition guidance, smoking, and fitness with respect to changing some behaviors. Employers and payers use their money to invest in these services in an effort to be more productive and lessen absenteeism.

- Immunization and Vaccination Services: Vaccination against COVID-19, HPV, hepatitis, and influenza are included in this. This has been a prevailing segment especially among the pediatrics and the geriatrics following the immunization campaigns and the influence that public health has exerted throughout the world.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- In-person Preventive Care (Fastest): These are the most common since they are provided through clinics; hospitals; and, primary care units. Examples are physical visit, screening tests, and immunization. This segment is contributed by infrastructure building and accessibility of healthcare in the countryside.

- Digital & Telehealth Services (Dominated): As more people learn to use smartphones and wearable devices, this segment is fast growing. The services consist of remote follow-up, teleconsultations, wellness coaching, and AI diagnostics. It is a sub-segment that is growing the fastest after COVID.

- Community Based Programs: These comprise mobile health clinic, outreach camps and the awareness programs organized by NGOs particularly in low-income areas. They are used because they are cost effective and reach underserved populations which promotes growth.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Geriatric Population (Dominated): It is an old age population where due to the demographic of the aging population, seniors require preventive screening in terms of osteoporosis, cardiovascular risks, and cancers. The other areas of focus are fall prevention and cognitive health. This population group is overwhelming because of increased consumption of healthcare.

- Working Adults (Fastest): Employers use wellness programs to minimize risk of chronic ailments in the working age employees. The most popular options are stress management, monitoring of the physical activity, and biometric screening.

- Children & Adolescents: The pediatrics vaccination schedule, oral health program and nutrition consulting occupy the main slot in this segment. This segment is facilitated by school-based health initiatives and state and national immunization campaigns.

- At-risk/High-risk Groups: These are populations that have genetic inclination, Lifestyle vulnerability or occupation-related risks. Individual preventivity and regular screenings are being promoted. This is the sub-segment that is experiencing the fastest growth since personalized medicine is picking up.

Note: Charts and figures are illustrative only. Contact us for verified market data.

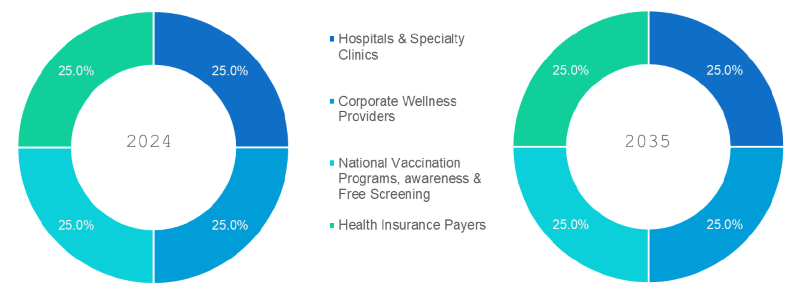

- Hospitals & Specialty Clinics (Dominated): They are the most complete preventive care providers as they under the same roof provide diagnostic measures, management of chronic diseases, and also immunization. They are dominant because of good infrastructure and EHR-integration.

- Corporate Wellness Providers: Employers are spending on preventive care to include physical and mental health screenings and fitness programs that are provided by third-party vendors. One of the drivers is ROI on employee health.

- National vaccination programs, awareness & free screening: These form part of government and Public Health Agencies. National health lives depend on such efforts to provide access to underrepresented populations, most of which are undertaken on a public level.

- Health Insurance Payers (Fastest): Payers are actually giving incentives and coverage of preventive care so as to reduce burden of claims. Their insight into analytics assists them in singling out risky patients who are to be given precise measures. They also have a major influence in the reimbursement models.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The Preventive Healthcare Strategies Market is mainly dominated by North America, which is further boosted by strong insurance infrastructure, high-end infrastructure, and citizens who are tech-savvy. Europe is right behind them, and it insists on the universal access to health and population health management. Asia-Pacific is however the rapidly emerging region and it is founded on smart city project, mobile health and greater country investments in healthcare by citizens such as India and China. Regional Insights show that Africa and Latin America exhibit potential emerging markets which is attributed to the worldwide donor initiatives and improvement of infrastructure. Localized innovations in preventive care can be explored with equal chances because of the decrease in regional disparities due to the exposure of telehealth and mobile-first strategies.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Preventive Healthcare Strategies Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Preventive Healthcare Strategies Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Preventive Healthcare Strategies Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Preventive Healthcare Strategies Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Service Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Preventive Healthcare Strategies Market – By Service Type

5.1. Overview

5.1.1. Segment Share Analysis, By Service Type, 2024 & 2035 (%)

5.1.2. Screening and Health Risk Assessment

5.1.3. Lifestyle management programs

5.1.4. Immunization and Vaccination Services

(presents market segmentation by Service Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Preventive Healthcare Strategies Market – By Delivery Mode

6.1. Overview

6.1.1. Segment Share Analysis, By Delivery Mode, 2024 & 2035 (%)

6.1.2. In-person Preventive Care

6.1.3. Digital & Telehealth Services

6.1.4. Community Based Programs

(breaks down the market by Delivery Mode, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Preventive Healthcare Strategies Market – By Target Population

7.1. Overview

7.1.1. Segment Share Analysis, By Target Population, 2024 & 2035 (%)

7.1.2. Geriatric Population

7.1.3. Working Adults

7.1.4. Children & Adolescents

7.1.5. At-risk/High-risk Groups

(focuses on market segmentation by Target Population, helping the client prioritize specific crop Service Types or end-use areas that offer significant business opportunities)

8. Preventive Healthcare Strategies Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Specialty Clinics

8.1.3. Corporate Wellness Providers

8.1.4. National vaccination programs, awareness & free screening

8.1.5. Health Insurance Payers

(describes the market division by End-User of Service Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Preventive Healthcare Strategies Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Preventive Healthcare Strategies Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Target Population, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Target Population, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Target Population, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Target Population, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Preventive Healthcare strategies Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Johnson & Johnson

10.3.2. Pfizer Inc.

10.3.3. Medtronic plc

10.3.4. Siemens Healthineers

10.3.5. GE Healthcare

10.3.6. Abbott Laboratories

10.3.7. Quest Diagnostics

10.3.8. Cerner Corporation

10.3.9. Allscripts Healthcare Solutions

10.3.10. GSK plc

10.3.11. Omron Healthcare

10.3.12. Teladoc Health Inc.

10.3.13. BioTelemetry, Inc.

10.3.14. Apple Inc. (Healthcare Division)

10.3.15. Roche Diagnostics

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Preventive Healthcare strategies Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Preventive Healthcare strategies Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Preventive Healthcare strategies Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Preventive Healthcare strategies Market: Service Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Service Type

TABLE 6: Global Preventive Healthcare strategies Market, by Service Type 2022–2035 (USD Billion)

TABLE 7: Preventive Healthcare strategies Market: Delivery Mode Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Delivery Mode

TABLE 9: Global Preventive Healthcare strategies Market, by Delivery Mode 2022–2035 (USD Billion)

TABLE 10: Preventive Healthcare strategies Market: Target Population Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Target Population

TABLE 12: Global Preventive Healthcare strategies Market, by Target Population 2022–2035 (USD Billion)

TABLE 13: Preventive Healthcare strategies Market: Target Population Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Preventive Healthcare strategies Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Preventive Healthcare strategies Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Preventive Healthcare strategies Market, by Region 2022–2035 (USD Billion)

TABLE 19: Preventive Healthcare strategies Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Preventive Healthcare strategies Market, by Service Type (NA), 2022–2035 (USD Billion)

TABLE 21: Preventive Healthcare strategies Market, by Delivery Mode (NA), 2022–2035 (USD Billion)

TABLE 22: Preventive Healthcare strategies Market, by Target Population (NA), 2024–2035 (USD Billion)

TABLE 23: Preventive Healthcare strategies Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 26: U.S. Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 27: U.S. Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 29: Canada Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 30: Canada Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 31: Canada Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 34: Mexico Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 35: Mexico Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Preventive Healthcare strategies Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Preventive Healthcare strategies Market, by Service Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Preventive Healthcare strategies Market, by Delivery Mode (Europe), 2022–2035 (USD Billion)

TABLE 39: Preventive Healthcare strategies Market, by Target Population(Europe), 2022–2035 (USD Billion)

TABLE 40: Preventive Healthcare strategies Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 42: Germany Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 43: Germany Preventive Healthcare strategies Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 46: Italy Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 47: Italy Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 48: Italy Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 54: France Preventive Healthcare Strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 55: France Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 56: France Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 58: Russia Preventive Healthcare Strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 59: Russia Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 60: Russia Preventive Healthcare Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 62: Poland Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 63: Poland Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 64: Poland Preventive Healthcare Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Preventive Healthcare strategies Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Preventive Healthcare strategies Market, by Service Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Preventive Healthcare strategies Market, by Delivery Mode (APAC), 2022–2035 (USD Billion)

TABLE 72: Preventive Healthcare strategies Market, by Target Population(APAC), 2022–2035 (USD Billion)

TABLE 73: Preventive Healthcare strategies Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 75: India Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 76: India Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 77: India Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Preventive Healthcare Strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 79: China Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 80: China Preventive Healthcare Strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 81: China Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Preventive Healthcare Strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 83: Japan Preventive Healthcare Strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 84: Japan Preventive Healthcare Strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 85: Japan Preventive Healthcare Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 88: South Korea Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 89: South Korea Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 91: Australia Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 92: Australia Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 93: Australia Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 100: Brazil Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 101: Brazil Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 104: Argentina Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 105: Argentina Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 108: Colombia Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 109: Colombia Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 115: Israel Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 116: Israel Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 117: Israel Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 120: Turkey Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 121: Turkey Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 124: Egypt Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 125: Egypt Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Preventive Healthcare strategies Market, by Service Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Preventive Healthcare strategies Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Preventive Healthcare strategies Market, by Target Population, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Preventive Healthcare strategies Market, by End-User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Preventive Healthcare strategies Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Service Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Service Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Delivery Mode Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Delivery Mode Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Service Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Service Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Preventive Healthcare strategies Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Preventive Healthcare strategies Market Share and Leading Players, 2024

FIGURE 23: Latin America Preventive Healthcare strategies Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Preventive Healthcare strategies Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Preventive Healthcare strategies Market Share Analysis by Country, 2023

FIGURE 30: Germany Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Preventive Healthcare strategies Market Share Analysis by Country, 2023

FIGURE 39: India Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Preventive Healthcare strategies Market Share Analysis by Country, 2023

FIGURE 47: Brazil Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Preventive Healthcare strategies Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Preventive Healthcare strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "This report was instrumental in helping our leadership team align our value-based care model with emerging preventive healthcare strategies. The deep dive into region-specific disease burden projections and cost-avoidance analytics gave us a clear ROI framework. I particularly appreciated the segment on employer-led wellness programs and digital engagement trends, it supported our pitch to stakeholders for expanding early screening services. Highly credible and methodologically sound research."

- Michael A. Reynolds, Director of Population Health, United States

- "As a consultant supporting public-private partnerships in preventive health, I rely heavily on well-sourced, data-driven insights. This report provided not only global and EU-level regulatory updates but also covered granular data on behavioral health prevention, digital therapeutics, and reimbursement dynamics. It directly informed our roadmap for integrating community-based interventions into municipal health budgets. This is not just theory, it’s policy-ready intelligence."

- Dr. Helena Voigt, Strategic Health Planner, Germany

- "The Preventive Healthcare Strategies Market Research Report from this team is easily one of the most comprehensive we’ve worked with. The inclusion of culturally relevant strategies for Asia-Pacific markets, especially around chronic lifestyle diseases and preventive tech adoption, helped us recalibrate our employee wellness initiatives. It gave our executive board the confidence to invest in predictive analytics tools and proactive health screening programs."

- Ryoichi Tanaka, VP, Corporate Health Strategy, Japan

This report on the Preventive Healthcare Strategies Market 2025 has been meticulously developed by the in-house healthcare research team at Quants & Trends, a trusted provider of strategic market intelligence in the healthcare sector. With over a decade of experience analyzing global health systems, reimbursement policies, population health trends, and value-based care models, our research experts specialize in translating complex datasets into actionable insights for public and private stakeholders.

The lead analysts behind this report possess deep subject matter expertise in preventive medicine, digital health transformation, health economics, and chronic disease management. Their work has guided healthcare providers, insurers, policymakers, pharmaceutical firms, and digital health startups in making informed, forward-looking decisions rooted in evidence and market realities.

This report not only delivers a clear outlook on the preventive healthcare ecosystem, including risk stratification models, early screening technologies, wellness economics, and population health analytics, but also equips decision-makers with validated forecasts and market scenarios that can shape long-term planning, investment strategy, and policy design.

Quants & Trends maintains a strong commitment to research transparency, data accuracy, and continuous industry engagement. To learn more about our team, current reports, and collaborative projects, visit our official LinkedIn page.