Market Outlook

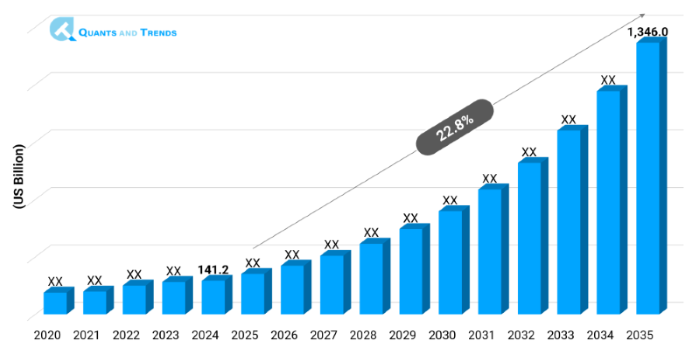

The global Integrative and Complementary Medicine market was valued at approximately USD 141.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 22.8% from 2025 to 2035, reaching around USD 1,346.0 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Integrative and Complementary Medicine Market is likely to achieve a steady growth with the influence of growing consumer awareness, the emergence of chronic diseases, and the tendency to focus on holistic wellness solutions. As the population in the world increasingly demands preventive and individualized healthcare services, the market is experiencing an increase in the adoption in developed economies and emerging markets. Market penetration is being done as well through technological incorporation, and government approvals, and cross-border partnership. In addition, the changing insurance patterns and clinical evidence of effectiveness are creating a firm basis of long-term growth. Integrative and Complementary Medicine Market Forecast believe that strong CAGR is possible till 2030, in both APAC and North America.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 22.8% |

| Market Value In 2024 | USD 141.2 billion |

| Market Value In 2035 | USD 1,346.0 billion |

Introduction

Integrative and Complementary Medicine Market covers an extensive range of medical treatment and products implemented in combination or as an alternative to mainstream medicine. The modalities that have been increasing within mainstream care models are the Ayurveda, Traditional Chinese Medicine (TCM), naturopathy and acupuncture. The rate of demand is increasing because of the changing attitude of the patients, rising healthcare spending, and the rising prevalence of lifestyle-related diseases. Having looped into holistic less-invasive trends, integrative care no longer resides only in the wellness centers and is moving into hospitals and clinical facilities all over the world. Wellness trends, research verifications, and digital interaction are driving the change in the direction of this market.

Key Market Drivers: What’s Fueling the Integrative and complementary medicine Market Boom?

- Increase in the number of chronic and lifestyle diseases: Diabetes, obesity, cardiovascular illnesses, and mental diseases are factors contributing to the number of patients willing to have alternative treatment that has fewer side effects and would have a long-lasting well-being. The Market size and share of Integrative and Complementary Medicine are expanding because practices such as acupuncture and herbal remedies are becoming useful in the treatment of pain, anxiety, and balancing metabolism, etc along with traditional methods.

- Strength of Consumerism in Natural and Preventive Care: There is an increase all around the world towards the use of preventive care and natural medications and this aspect has been redefining treatment procedures. The growth of organic, plant-based supplements and herbal formulas are in line with new consumer priorities with regard to self-care and sustainability. According to the Integrative and Complementary Medicine Industry Analysis, people increasingly prefer to include yoga, meditation and nutrition-related treatments in their lives in general, and after COVID-19 in particular.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Telemedicine, AI-enabled diagnostic instruments, and digital facilities are leading to improved access to conventional healthcare services. Businesses are incorporating data analytics to individualize treatment by using TCM, Ayurveda and other technologies. Information Technology adoption in Integrative and Complementary Medicine is changing the patient follow-ups and monitoring and block chain is under investigation to validate herbal medicine supply chain. Such innovations are generating confidence and clinical performance, particularly in digital primitive populations in cities.

Recent Developments:

In 2024, Himalaya Wellness introduced an artificial intelligence enhanced mobile application that provides personalized Ayurvedic plans in India and the U.S. with a focus on scaling digital wellness distribution. In the meantime, Tsumura & Co. collaborated with hospitals in the U.S. to bring Kampo (Japanese herbal) formulations into integrative oncology programs. These efforts indicate a larger embrace of and New Opportunities in cross-border therapeutic relationships and personalized integrative treatment.

Conclusion

Integrative and Complementary Medicine Market is in the state of transformation to move towards the mainstream component of healthcare. With the help of regulatory progress, customer endorsement, and technological empowerment, its future is gleaming on clinical and well-being vistas. As it gains more scientific approval, strategic alliances and online activities, the market is likely to experience continued worldwide boom. Improving Forecast Methodology frameworks, and increasing data-driven decisions will result in both, the private and public healthcare systems getting more invested in the integrative models of delivering good healthcare outcomes, paving the way to better health globally.

Related Reports

- The Global Preventive Healthcare Strategies Market was valued at approximately USD 112.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 232.6 billion by the end of the forecast period.

- The global Chronic Pain Management Market was valued at approximately USD 88.65 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2035, reaching around USD 200.1 billion by the end of the forecast period.

Key Market Players

The Integrative and Complementary Medicine Competitive Landscape is slightly fragmented as there is the mixture of traditional medicine companies, wellness technology startups, and pharmaceutical actors that are expanding their presence into natural and herbal treatments. Firms are focusing on innovation, regulatory compliance and individual wellness programs. The most important strategic movements are mergers, new products and international distribution agreements. The competitive matrix is further being shaped by clinical trials, international certifications (such as GMP or ISO of herbal products) and vertical integration. This market is still receiving venture capital which is a pointer to its mainstream. Some of the key players in the Integrative and complementary medicine industry are as:

Himalaya Wellness, Weleda AG, Sanofi (Boiron Homeopathic), Dabur, Dr. Willmar Schwabe, Traditional Medicinals, Biogetica, Nature’s Way, Blackmores, Nelsons Natural World, Jarrow Formulas, Zandu (Emami Group), Helixor Heilmittel GmbH, Tsumura & Co., Integrative Therapeutics

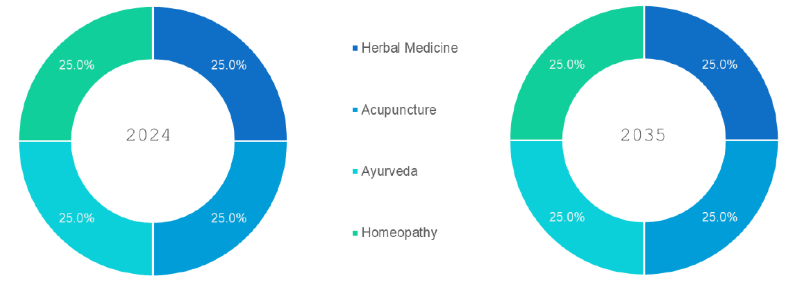

- Herbal Medicine (Dominant): This has been a common drug mostly because of its natural composition, easy accessibility and efficiency in treating chronic and lifestyle diseases.

- Acupuncture (Fastest Growing): Increasingly getting a foothold in the modern clinical practice as a method of pain relief, stress management, and even insurance coverage.

- Ayurveda: An ancient Indian methodology in which balance in the body is accomplished through the elements of herbs, diet and lifestyle; becoming more widely acknowledged worldwide in the chronic well-being areas.

- Homeopathy: Uses very diluted preparations to cause the curative effect; well known to treat allergies, anxiety and chronic fatigue without invasion.

Note: Charts and figures are illustrative only. Contact us for verified market data.

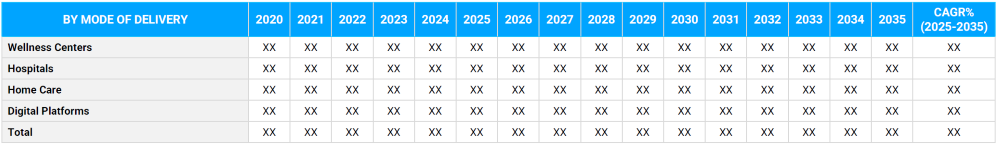

- Wellness Centers (Dominant): Provide comprehensive or holistic and integrative treatments within the same facility, better suited when personalized health and wellness programs need to be followed.

- Hospitals: Integrate alternative treatments in both standard care or oncology, in pain, and rehabilitation.

- Home Care: Assists further access of therapy by the elderly and chronically ill thereby enhancing compliance and comfort.

- Digital Platforms(Fastest Growing): Remote access through mobile/ web apps of practitioners, custom health plans, and consultation on the use of herbal products.

Note: Charts and figures are illustrative only. Contact us for verified market data.

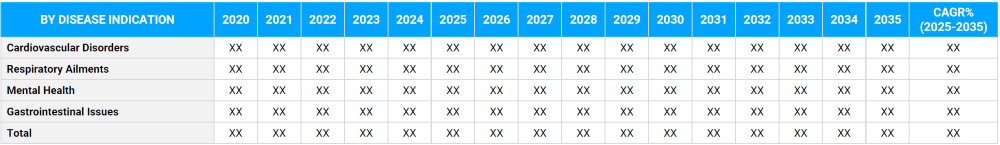

- Cardiovascular Diseases: The treatment of cardiovascular disorders includes the use of yoga and Ayurveda that lowers the blood pressure, cholesterol and heart functions.

- Diseases of the respiratory system: Asthma, bronchitis, and strengthening the immune system are subject to herbal treatment, acupuncture, and pranayama.

- Mental Health (Dominant): Anxiety, depression and stress-related conditions are well assisted with meditation, biofeedback, and adaptogenic herbs.

- Gastrointestinal Ailments (Fastest Growing): Treatment based on the diet and herbs enhances digestion and controls IBS and corrects the microbiome of the gut.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Pediatric: Adjuvant in case of strengthening immunity, allergies, and improving sleep using non-toxic and mild treatment.

- Adult (Dominant): The best susceptible group because of the persistence of stress, metabolic syndromes and their tendencies to take the matter of wellness into their own hands.

- Geriatric (Fastest Growing): Prefers natural, less hazardous remedies towards joint pain, memory care and age-related fatigue.

- Women Health: Addresses the issues related to the hormonal balance, reproductive health and assisting with menopause through individualized prescription of herbal and mind-body treatments.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is the leader in Integrative and Complementary Medicine Market due to an increasingly liberal insurance policy, research validation, and institutionalization of treatment such as chiropractic care and naturopathy. Yet, the fastest-growing region is turning out to be Asia-Pacific (APAC) which is being fueled by the legacies of traditional medicines, a governmental push, and huge local demand, particularly in India, China, and Japan. According to Regional Insights, Europe is also characterized by a significant growth with the reasons being the regulatory laxity and acceptability in wellness tourism. Both infrastructure development and the growing number of clinical trials that support efficacy catalyze that growth.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Integrative and complementary medicine Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Consumer Demographics

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Integrative and complementary medicine Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Integrative and complementary medicine Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Integrative and complementary medicine Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Therapy Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Integrative and complementary medicine Market – By Therapy Type

5.1. Overview

5.1.1. Segment Share Analysis, By Therapy Type, 2024 & 2035 (%)

5.1.2. Herbal Medicine

5.1.3. Acupuncture

5.1.4. Ayurveda

5.1.5. Homeopathy

(presents market segmentation by Therapy Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Integrative and complementary medicine Market – By Mode of Delivery

6.1. Overview

6.1.1. Segment Share Analysis, By Mode of Delivery, 2024 & 2035 (%)

6.1.2. Wellness Centers

6.1.3. Hospitals

6.1.4. Home Care

6.1.5. Digital Platforms

(breaks down the market by Mode of Delivery, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Integrative and complementary medicine Market – By Disease Indication

7.1. Overview

7.1.1. Segment Share Analysis, By Disease Indication, 2024 & 2035 (%)

7.1.2. Cardiovascular Disorders

7.1.3. Respiratory Ailments

7.1.4. Mental Health,

7.1.5. Gastrointestinal Issues

(focuses on market segmentation by Disease Indication, helping the client prioritize specific crop Therapy Types or end-use areas that offer significant business opportunities)

8. Integrative and complementary medicine Market – By Consumer Demographic

8.1. Overview

8.1.1. Segment Share Analysis, By Consumer Demographic, 2024 & 2035 (%)

8.1.2. Pediatric

8.1.3. Adult

8.1.4. Geriatric,

8.1.5. Women’s Health

(describes the market division by Consumer Demographic of Therapy Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Integrative and complementary medicine Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Integrative and complementary medicine Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Consumer Demographic, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Consumer Demographic, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Consumer Demographic, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Therapy Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Disease Indication, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Consumer Demographic, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Integrative and complementary medicine Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Himalaya Wellness

10.3.2. Weleda AG

10.3.3. Sanofi (Boiron Homeopathic)

10.3.4. Dabur

10.3.5. Dr. Willmar Schwabe

10.3.6. Traditional Medicinals

10.3.7. Biogetica

10.3.8. Nature’s Way

10.3.9. Blackmores

10.3.10. Nelsons Natural World

10.3.11. Jarrow Formulas

10.3.12. Zandu (Emami Group)

10.3.13. Helixor Heilmittel GmbH

10.3.14. Tsumura & Co.

10.3.15. Integrative Therapeutics

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Integrative and complementary medicine Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Integrative and complementary medicine Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Integrative and complementary medicine Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Integrative and complementary medicine Market: Therapy Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Therapy Type

TABLE 6: Global Integrative and Complementary Medicine Market, by Therapy Type 2022–2035 (USD Billion)

TABLE 7: Integrative and complementary medicine Market: Mode of Delivery Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Mode of Delivery

TABLE 9: Global Integrative and complementary medicine Market, by Mode of Delivery 2022–2035 (USD Billion)

TABLE 10: Integrative and complementary medicine Market: Disease Indication Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Disease Indication

TABLE 12: Global Integrative and complementary medicine Market, by Disease Indication2022–2035 (USD Billion)

TABLE 13: Integrative and complementary medicine Market: Disease Indication Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Consumer Demographic

TABLE 15: Global Integrative and complementary medicine Market, by Consumer Demographic 2022–2035 (USD Billion)

TABLE 16: Integrative and complementary medicine Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Integrative and complementary medicine Market, by Region 2022–2035 (USD Billion)

TABLE 19: Integrative and complementary medicine Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Integrative and complementary medicine Market, by Therapy Type (NA), 2022–2035 (USD Billion)

TABLE 21: Integrative and complementary medicine Market, by Mode of Delivery (NA), 2022–2035 (USD Billion)

TABLE 22: Integrative and complementary medicine Market, by Disease Indication (NA), 2024–2035 (USD Billion)

TABLE 23: Integrative and complementary medicine Market, by Consumer Demographic (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 26: U.S. Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 27: U.S. Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 28: Canada Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 29: Canada Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 30: Canada Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 31: Canada Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 32: Mexico Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 34: Mexico Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 35: Mexico Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 36: Integrative and complementary medicine Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Integrative and complementary medicine Market, by Therapy Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Integrative and complementary medicine Market, by Mode of Delivery (Europe), 2022–2035 (USD Billion)

TABLE 39: Integrative and complementary medicine Market, by Disease Indication(Europe), 2022–2035 (USD Billion)

TABLE 40: Integrative and complementary medicine Market, by Consumer Demographic (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 42: Germany Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 43: Germany Integrative and complementary medicine Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 45: Italy Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 46: Italy Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 47: Italy Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 48: Italy Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 53: France Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 54: France Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 55: France Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 56: France Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 57: Russia Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 58: Russia Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 59: Russia Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 60: Russia Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 61: Poland Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 62: Poland Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 63: Poland Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 64: Poland Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 69: Integrative and complementary medicine Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Integrative and complementary medicine Market, by Therapy Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Integrative and complementary medicine Market, by Mode of Delivery (APAC), 2022–2035 (USD Billion)

TABLE 72: Integrative and complementary medicine Market, by Disease Indication(APAC), 2022–2035 (USD Billion)

TABLE 73: Integrative and complementary medicine Market, by Consumer Demographic (APAC), 2022–2035 (USD Billion)

TABLE 74: India Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 75: India Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 76: India Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 77: India Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 78: China Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 79: China Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 80: China Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 81: China Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 82: Japan Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 83: Japan Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 84: Japan Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 85: Japan Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 86: South Korea Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 88: South Korea Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 89: South Korea Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 90: Australia Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 91: Australia Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 92: Australia Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 93: Australia Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 98: Brazil Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 100: Brazil Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 101: Brazil Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 102: Argentina Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 104: Argentina Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 105: Argentina Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 106: Colombia Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 108: Colombia Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 109: Colombia Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 114: Israel Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 115: Israel Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 116: Israel Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 117: Israel Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 118: Turkey Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 120: Turkey Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 121: Turkey Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 122: Egypt Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 124: Egypt Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 125: Egypt Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Integrative and complementary medicine Market, by Therapy Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Integrative and complementary medicine Market, by Mode of Delivery, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Integrative and complementary medicine Market, by Disease Indication, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Integrative and complementary medicine Market, by Consumer Demographic, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Integrative and complementary medicine Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Therapy Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Therapy Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Mode of Delivery Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Mode of Delivery Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Therapy Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Therapy Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Consumer Demographic Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Consumer Demographic Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Integrative and complementary medicine Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Integrative and complementary medicine Market Share and Leading Players, 2024

FIGURE 23: Latin America Integrative and complementary medicine Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Integrative and complementary medicine Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Integrative and complementary medicine Market Share Analysis by Country, 2023

FIGURE 30: Germany Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Integrative and complementary medicine Market Share Analysis by Country, 2023

FIGURE 39: India Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Integrative and complementary medicine Market Share Analysis by Country, 2023

FIGURE 47: Brazil Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Integrative and complementary medicine Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Integrative and complementary medicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As integrative health gains traction in mainstream medicine, we needed a clear, data-backed understanding of where the market is headed. This report delivered just that. The insights on consumer behavior, modality adoption trends (like acupuncture, naturopathy, and herbal medicine), and reimbursement dynamics helped us shape a multi-year strategic plan for expanding our complementary care offerings. It’s rare to find such a balanced view that bridges clinical efficacy, market growth, and regulatory evolution."

- Jessica Harper, Director of Wellness Strategy, National Health Network (USA)

- "We used the Integrative and Complementary Medicine Market Research Report to support our product portfolio diversification strategy in Europe. The regional regulatory analysis, consumer demand segmentation, and practitioner network insights were extremely helpful. It allowed us to validate assumptions, identify new distribution opportunities, and align our roadmap with emerging therapeutic preferences. The report reflects deep subject-matter expertise and was worth every page."

- Dr. Erik Hoffmann, Head of Business Development, Natural Therapies Manufacturer (Germany)

- "This report helped us sharpen our investment thesis in the fast-evolving integrative medicine landscape across Asia. The breakdown of service delivery models, from Ayurveda and traditional Chinese medicine to tech-integrated wellness platforms, was exceptionally thorough. We appreciated the evidence-based approach, including scientific validation trends and patient adoption data. It gave us the confidence to move forward with two key partnerships in the space."

- Meera Satoh, Senior Investment Analyst, Holistic Health Ventures (Japan)

The Integrative and Complementary Medicine Market 2025 report is authored by the dedicated healthcare research team at Quants & Trends, a trusted provider of market intelligence specializing in emerging health models, evidence-based wellness solutions, and global healthcare innovation.

With more than a decade of experience tracking the convergence of traditional medicine, wellness, and clinical practice, our analysts bring unique cross-disciplinary expertise, from health economics and policy analysis to ethnobotany, CAM regulation, and consumer behavior trends. This report reflects months of primary research, including expert interviews with integrative medicine practitioners, wellness entrepreneurs, healthcare administrators, and product developers across North America, Europe, and Asia-Pacific.

We have studied the evolving landscape of modalities such as naturopathy, Ayurveda, traditional Chinese medicine, mind-body interventions, herbal therapeutics, and functional nutrition. The report offers strategic insight into regulatory frameworks, practitioner networks, reimbursement shifts, digital health integration, and consumer adoption patterns. Whether you are a wellness brand looking to expand regionally, a hospital system considering integrative service lines, or an investor seeking scalable, evidence-informed opportunities, this report delivers actionable intelligence that supports real-world business decisions.

To learn more about our research methodology, areas of specialization, and the experts behind our insights, connect with us on our official LinkedIn page.