Market Outlook

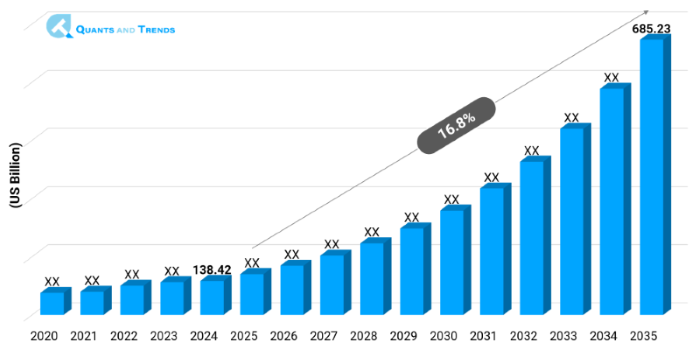

The global telemedicine market was valued at approximately USD 138.42 billion in 2024 and is projected to grow at a strong compound annual growth rate (CAGR) of 16.8% from 2025 to 2035, reaching over USD 685.23 billion by the end of the forecast period. The historical analysis spans from 2020 to 2023, with 2024 as the base year and forecasts extending through 2025 to 2035.

The telemedicine market is gaining momentum globally as healthcare systems shift toward more digital and remote solutions. Rising need for convenient and smart healthcare services has increased drastically, especially post-COVID-19 scenario, where people prefer online consultations. This market is fueled by rising smartphone usage, good internet access, and growing awareness of online e-health services. The telemedicine market report suggests steady growth as healthcare providers and governments invest in technology driven platforms. With patients going for remote diagnosis and follow-ups, telemedicine industry analysis highlights both urban and rural uptake. North America currently dominates, but emerging economies are growing up fast. This digital transformation is not just a trend but a long-term change in how healthcare is accessed and delivered.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 16.8% |

| Market Value In 2024 | USD 138.42 billion |

| Market Value In 2035 | USD 685.23 billion |

Introduction

The telemedicine market has converted from a support tool into a core healthcare delivery model. It fills gaps caused by distance, infrastructure, and doctor's unavailability by enabling virtual medical consultations and treatment. Patients in rural areas who previously had difficulty accessing high-quality healthcare also benefit from this paradigm, in addition to those who live in cities. Telemedicine is increasingly being used in routine treatment for everything from routine examinations to important follow-ups. As per the telemedicine market forecast, it is rapidly becoming popular across all age groups, helped along by regulatory changes and insurance companies. Telemedicine is opening the door to a networked, effective medical environment as the globe adjusts to smarter healthcare.

Key Market Drivers: What’s Fueling the Telemedicine Market Boom?

- Increasing Smartphone Penetration and Internet Access- With more than half of the world is using smartphones along with better internet network where patients can now approach doctors from remote areas too. Countries like India, Brazil, and Indonesia are seeing a surge in mobile health apps. These apps also let you have video calls, get digital prescriptions, and share test results all at the same time. This convenience is pushing the telemedicine market size and share forward, especially among tech-savvy youth and working professionals.

- Rising Chronic Diseases and Elderly Population-A growing number of people suffer from diabetes, heart issues, and mental health conditions that require regular monitoring. Telemedicine helps these patients to avoid frequent hospital visits, offering more comfort and reducing strain on healthcare infrastructure. Especially for elderly patients, real-time consultations and home monitoring through devices are becoming routine. This shift supports telemedicine investment opportunities in smart wearable tech and remote diagnostic tools.

- Government Initiatives and Regulatory Push- By implementing supportive laws, providing public funds, and investing in infrastructure, a number of countries are promoting telemedicine. For example, the U.S. expanded Medicare coverage for telehealth, and India launched the eSanjeevani platform to connect rural populations with qualified doctors. These regulatory shifts enhance trust and adoption, encouraging private players to invest more. The telemedicine competitive landscape is expected to grow stronger with such institutional backing, especially in Asia-Pacific and the Middle East.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation in the telemedicine market is escalating better patient outcomes and operational efficiency. AI-based diagnostic tools, real-time translation in multi-language consultations, and integration with wearables like smartwatches are changing the game. New-age startups are focusing on personalized telehealth experiences using machine learning and patient data analytics. Cloud-based technologies facilitate secure data storage, automatic medical history tracking, and enables immediate patient-doctor communication. These developments reduce the strain on actual hospitals while also increasing patient engagement. As more innovations emerge, especially around remote surgeries and mental health care, the telemedicine growth drivers and challenges are shifting rapidly toward digital-first solutions.

Recent Developments:

- In 2024, Teladoc Health partnered with Microsoft to enhance AI-driven teleconsultations using Azure Cloud for secure data handling.

- Practo launched a multilingual platform in India supporting 12 regional languages, aimed at expanding rural access to telemedicine.

Conclusion

The telemedicine market is no longer an alternative it is fast becoming a mainstream channel for healthcare delivery. Its worldwide use is expected to increase further due to innovation, favorable policies, and rising digital awareness. This industry offers a plethora of investment options as players improve their products and new models appear. Telemedicine is streamlining access and filling important gaps in the current healthcare system, whether it be for routine care, mental health, or chronic diseases.

Related Reports

- The global Digital Health Platforms Market was worth USD 292.1 billion in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 21.0% from 2025 to 2035, reaching around USD 2,364.1 billion by the end of the forecast period.

- The global Patient Engagement and Experience Market was valued at approximately USD 28.18 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 18.4% from 2025 to 2035, reaching around USD 178.14 billion by the end of the forecast period.

Key Market Players

The telemedicine market competitive landscape is rapidly changing with both established players & start-ups competing on innovation, pricing, and regional coverage. Businesses are concentrating on integrated EMR's (Electronic Medical Records), multilingual assistance, and Artificial Intelligence based systems. It is typical for hospitals and IT companies to form strategic alliances. Global firms are entering emerging markets through M&A and joint ventures. The emphasis is on improving accessibility, speed, and personalization. This ecosystem is highly dynamic, with companies investing heavily in cloud infrastructure and cybersecurity. Some of the key players in the Telemedicine industry are as:

Teladoc Health, MDLIVE, Doctor on Demand, Amwell, Practo, 1mg (Tata Digital), Medlife, Philips Healthcare, GE Healthcare, Siemens Healthineers, Babylon Health, Kry, HealthTap, eVisit, American Well Corporation

Segmentation By Type

This segmentation looks at the two core areas that telemedicine covers: the physical tools that make remote care possible and the services offered through them.

- Products: include software platforms, diagnostic devices, and mobile health apps. The product segment is the fastest-growing, driven by demand for wearable health tech and AI-integrated systems.

- Services: comprises consultations, remote monitoring, and support, services currently dominate the market. This is largely because patients are increasingly opting for virtual consultations for speed and convenience.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

This segmentation refers to the specific medical areas where telemedicine is being applied. This segmentation helps understand where telehealth is seeing the most adoption.

- Teleradiology (Dominating): Most widely used for transmitting X-rays, MRIs, and CT scans between locations for expert analysis.

- Telepsychiatry (Fastest-growing): Mental health care is gaining traction as more patients prefer private, remote sessions.

- Telecardiology, Teledermatology, and Telepathology: These are steadily growing in use, especially in urban centers where access to specialists is possible through digital platforms.

Note: Charts and figures are illustrative only. Contact us for verified market data.

This segmentation breaks down how the telemedicine service is delivered either in real time or stored and shared for later review.

- Real-Time (Dominating): The most common modality used for live video or phone consultations, especially for initial assessments.

- Store-and-Forward (Fastest-growing): This method allows sharing of diagnostic data like images or reports, which the doctor can review later ideal for radiology and dermatology cases.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Understanding who is using telemedicine healthcare providers or individual patients helps in targeting services and innovations better.

- Healthcare Facilities (Dominating): Hospitals, clinics, and diagnostic centers use telemedicine to extend reach and manage large patient volumes.

- Homecare (Fastest-growing): Increasingly preferred by elderly patients and those with chronic conditions, home-based setups allow ongoing monitoring without hospital visits.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The North America currently leads the telemedicine market owing to its very strong digital presence, supportive infrastructure and favorable reimbursement practices. This further adds high healthcare spending across the region. With government programs promoting online care, the US dominates the world in adoption. Europe follows closely, with nations like the UK and Germany putting national telehealth policies into place. However, APAC region is the fastest growing region fueled by a vast population base, increasing internet penetration, emerging opportunities and government programs like India’s "eHealth Mission". Emerging markets in Latin America and the Middle East are also seeing increased adoption, especially in urban clusters. This regional insight indicates that while the West is mature, the real growth lies in APAC and beyond.

The report will cover the following region and countries:

- North America: U.S., Canada and Mexico

- Asia Pacific: China, India, Japan, South Korea, Australia, among others

- Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

- Latin America: Brazil, Argentina, Colombia

- Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Telemedicine Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Userls

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Telemedicine Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Telemedicine Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Telemedicine Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Technology & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Telemedicine Market – By Type

5.1. Overview

5.1.1. Segment Share Analysis, By Type, 2024 & 2035 (%)

5.1.2. Product

5.1.3. Services

(presents market segmentation by Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Telemedicine Market – By Modality

6.1. Overview

6.1.1. Segment Share Analysis, By Modality, 2024 & 2035 (%)

6.1.2. Store-and Forward

6.1.3. Real Time

(breaks down the market by Modality, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Telemedicine Market – By Application

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

7.1.2. Teleradiology

7.1.3. Telepathology

7.1.4. Teledermatology

7.1.5. Telepsychiatry

7.1.6. Telecardiology

(focuses on market segmentation by application, helping the client prioritize specific crop types or end-use areas that offer significant business opportunities)

8. Telemedicine Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Healthcare Facilities

8.1.3. Homecare

(describes the market division by End-User of application, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Telemedicine Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Telemedicine Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Modality, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Modality, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Modality, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Modality, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Telemedicine Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Teladoc Health

10.3.2. MDLIVE

10.3.3. Doctor on Demand

10.3.4. Amwell

10.3.5. Practo

10.3.6. 1mg (Tata Digital)

10.3.7. Medlife

10.3.8. Philips Healthcare

10.3.9. GE Healthcare

10.3.10. Siemens Healthineers

10.3.11. Babylon Health

10.3.12. Kry

10.3.13. HealthTap

10.3.14. eVisit

10.3.15. American Well Corporation

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Telemedicine Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Telemedicine Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Telemedicine Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Telemedicine Market: Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Type

TABLE 6: Global Telemedicine Market, by Type 2022–2035 (USD Million)

TABLE 7: Telemedicine Market: Modality Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Modality

TABLE 9: Global Telemedicine Market, by Modality 2022–2035 (USD Million)

TABLE 10: Telemedicine Market: Application Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Application

TABLE 12: Global Telemedicine Market, by Application 2022–2035 (USD Million)

TABLE 13: Telemedicine Market: Technology Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Telemedicine Market, by End-User 2022–2035 (USD Million)

TABLE 16: Telemedicine Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Telemedicine Market, by Region 2022–2035 (USD Million)

TABLE 19: Telemedicine Market, by Country (NA), 2022–2035 (USD Million)

TABLE 20: Telemedicine Market, by Type (NA), 2022–2035 (USD Million)

TABLE 21: Telemedicine Market, by Modality (NA), 2022–2035 (USD Million)

TABLE 22: Telemedicine Market, by Application (NA), 2024–2035 (USD Million)

TABLE 23: Telemedicine Market, by End-User (NA), 2022–2035 (USD Million)

TABLE 24: U.S. Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 25: U.S. Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 26: U.S. Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 27: U.S. Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 28: Canada Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 29: Canada Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 30: Canada Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 31: Canada Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 32: Mexico Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 33: Mexico Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 34: Mexico Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 35: Mexico Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 36: Telemedicine Market, by Country (Europe), 2022–2035 (USD Million)

TABLE 37: Telemedicine Market, by Type (Europe), 2022–2035 (USD Million)

TABLE 38: Telemedicine Market, by Modality (Europe), 2022–2035 (USD Million)

TABLE 39: Telemedicine Market, by Application (Europe), 2022–2035 (USD Million)

TABLE 40: Telemedicine Market, by End-User (Europe), 2022–2035 (USD Million)

TABLE 41: Germany Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 42: Germany Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 43: Germany Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 44: Germany Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 45: Italy Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 46: Italy Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 47: Italy Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 48: Italy Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 49: United Kingdom Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 50: United Kingdom Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 51: United Kingdom Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 52: United Kingdom Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 53: France Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 54: France Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 55: France Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 56: France Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 57: Russia Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 58: Russia Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 59: Russia Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 60: Russia Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 61: Poland Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 62: Poland Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 63: Poland Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 64: Poland Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 65: Rest of Europe Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 66: Rest of Europe Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 67: Rest of Europe Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 68: Rest of Europe Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 69: Telemedicine Market, by Country (APAC), 2022–2035 (USD Million)

TABLE 70: Telemedicine Market, by Type (APAC), 2022–2035 (USD Million)

TABLE 71: Telemedicine Market, by Modality (APAC), 2022–2035 (USD Million)

TABLE 72: Telemedicine Market, by Application (APAC), 2022–2035 (USD Million)

TABLE 73: Telemedicine Market, by End-User (APAC), 2022–2035 (USD Million)

TABLE 74: India Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 75: India Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 76: India Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 77: India Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 78: China Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 79: China Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 80: China Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 81: China Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 82: Japan Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 83: Japan Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 84: Japan Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 85: Japan Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 86: South Korea Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 87: South Korea Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 88: South Korea Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 89: South Korea Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 90: Australia Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 91: Australia Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 92: Australia Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 93: Australia Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 94: Rest of APAC Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 95: Rest of APAC Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 96: Rest of APAC Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 97: Rest of APAC Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 98: Brazil Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 99: Brazil Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 100: Brazil Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 101: Brazil Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 102: Argentina Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 103: Argentina Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 104: Argentina Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 105: Argentina Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 106: Colombia Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 107: Colombia Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 108: Colombia Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 109: Colombia Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 110: Rest of LATAM Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 111: Rest of LATAM Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 112: Rest of LATAM Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 113: Rest of LATAM Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 114: Israel Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 115: Israel Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 116: Israel Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 117: Israel Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 118: Turkey Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 119: Turkey Telemedicine Market, by Modality, 2022–2035 (USD Million)

TABLE 120: Turkey Telemedicine Market, by Application, 2022–2035 (USD Million)

TABLE 121: Turkey Telemedicine Market, by End-User, 2022–2035 (USD Million)

TABLE 122: Egypt Telemedicine Market, by Type, 2022–2035 (USD Million)

TABLE 123: Egypt Telemedicine Market, by Modality, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Telemedicine Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Modality Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Modality Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Telemedicine Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Telemedicine Market Share and Leading Players, 2024

FIGURE 23: Latin America Telemedicine Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Telemedicine Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Telemedicine Market Share Analysis by Country, 2023

FIGURE 30: Germany Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: UK Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Telemedicine Market Share Analysis by Country, 2023

FIGURE 39: India Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Telemedicine Market Share Analysis by Country, 2023

FIGURE 47: Brazil Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Telemedicine Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Telemedicine Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "The Telemedicine Market Research Report provided far more than market sizing, it offered a clear view of how reimbursement models, patient adoption, and competitive dynamics will evolve through 2025. This depth of insight helped us confidently justify expanding virtual care services across new regions and secured executive buy‑in for our digital transformation roadmap."

-Ethan Sullivan, Director of Strategy, Regional Hospital Group (USA)

- "We relied on the report's segmented forecasts and competitor analysis to shape our Series B investment pitch. The data on regional growth hotspots and payer trends enabled us to demonstrate a robust, evidence‑based revenue model to investors. It played a pivotal role in refining our product roadmap and long‑term strategy."

-Lukas Hoffmann, VP of Business Development, Global MedTech Firm (Europe)

- "What set this report apart was its blend of quantitative forecasts with practical, analyst‑driven insights. The sections on regulatory outlook and platform differentiation helped us fine‑tune our go‑to‑market approach in Asia‑Pacific. It became an essential reference in our strategic planning sessions."

- Amrita Patel, Senior Market Analyst, Digital Health Start‑up (South Asia)

The Telemedicine Market 2025 report has been developed by the Quants and Trends Healthcare Research Team, known for its deep specialization in digital health, virtual care platforms, and healthcare technology markets.

With over a decade of collective expertise, our analysts combine rigorous quantitative modeling with qualitative insights from healthcare executives, payers, and technology leaders.

This report goes beyond basic market figures: it helps strategy teams, product managers, and investors understand the forces driving adoption, the evolving reimbursement landscape, and competitive shifts that will shape the telemedicine industry by 2025.

Clients have used our data and forecasts to:

- Build compelling business cases for new service lines

- Support board-level investment decisions and budgeting

- Identify high-growth regional markets for expansion

- Align product roadmaps with future patient demand trends

At Quants and Trends, we believe real expertise shows in analysis that clients can apply immediately to real-world business planning, not just read and forget.

To explore more of our healthcare market research and industry updates, visit our LinkedIn page, where we regularly share insights and commentary trusted by healthcare providers, digital health innovators, and investment teams worldwide.