Market Outlook

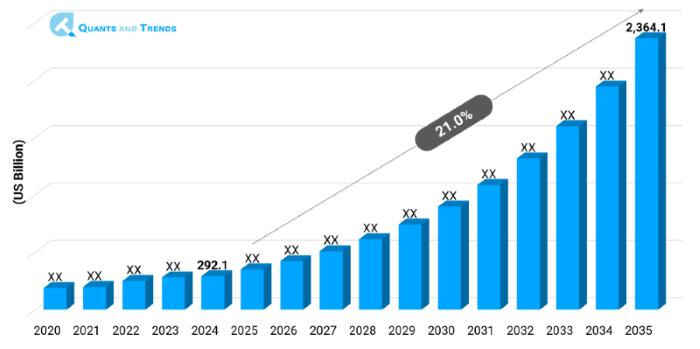

The global Digital Health Platforms Market was worth USD 292.1 billion in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 21.0% from 2025 to 2035, reaching around USD 2,364.1 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year, and forecasts begin from 2025 to 2035.

The Digital Health Platforms Market report is projected to grow steadily owing to increasing demand for virtual care, real-time health monitoring, and personalized medical services. The expansion of this market is chiefly attributable to the accelerated digitization of healthcare systems, the rising incorporation of telemedicine, and the widespread adoption of connected wearable health technologies. Concurrently, public authorities and healthcare organizations are channeling substantial resources into the development of resilient digital infrastructures, thereby enhancing both the availability of services and the overall quality of patient care.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 21.0% |

| Market Value In 2024 | USD 292.1 billion |

| Market Value In 2035 | USD 2,364.1 billion |

The Digital Health Platforms Market Industry Analysis encompasses cohesive, technology driven ecosystems that helps remote clinical services, diagnostics, continuous patient monitoring and data sharing among providers, payers and patients. By automating clinical workflows and furnishing immediate health insights, these platforms enhance care delivery and overall patient outcomes. Their importance has glorified following the COVID pandemic, as health systems have prioritized scalable, digitally oriented operational setup. Technological advancements in adoption of digital health platforms are enabling AI-based diagnostics, automated scheduling and mobile health services. Cloud-based infrastructures improves the data interoperability, which streamlines administrative processes.

Key Market Drivers: What’s Fueling the Digital Health Platforms Market Boom?

- Increase in Chronic Diseases and Aging Population: The demand for digital health platforms market is increasing as the burden of chronic diseases continues to rise alongside a rapidly growing elderly population. These platform supports ongoing remote surveillance and allow for tailoring of care pathways, which in turn optimizes clinical workflows and allocates resources more effectively. The reduction in avoidable hospital admissions, together with strengthened compliance with clinical guidelines, demonstrates how the technology is contributing to the achievement of superior health outcomes.

- Rise in Telemedicine and Remote Care Adoption: The digital health platforms market identifies telemedicine as a significant driver of growth in the wake of the pandemic. The increasing reliance on virtual consultations has particularly benefited rural and underserved populations, where historical access to specialist care has been constricted. With reimbursement policies now broadened and telecommunications infrastructure steadily maturing, these modalities permit both real-time and message-based patient-provider exchanges, thus streamlining the introduction of diagnostic and therapeutic services.

- Regulatory Favor and Increased Capital Flows: Supportive policies and dedicated funding streams are accelerating Digital Health Platforms Investment Opportunities. India’s National Digital Health Mission and the European Union’s digital health strategy, for instance, extend beyond the establishment of interoperable technical frameworks; they provide specific financial incentives engineered to drive the widespread adoption of digital health innovations throughout heterogeneous health systems. Conformance with data protection regimes including HIPAA and GDPR enhances user trust and establishes a predictable environment for all stakeholders.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation in Digital Health Platforms Market is propelled mainly by AI, Machine Learning and Predictive Analytics. Such technologies enable prompt disease detection, customized therapeutic pathways, and efficient automated triage. A number of newer enterprises are integrating advanced forecasting methodologies with blockchain-anchored health record systems, thus ensuring both durability of data and complete transparency. Concurrently, the sector is embracing digital twin technology, live analytic streams, and voice-interactive interfaces, which collectively enhance the speed and intelligence of decisions within diverse healthcare settings.

Recent Developments:

In March 2025, for emerging markets, Philips Healthcare launched a mobile first telehealth platform that allows for low bandwidth, multilingual video consultations. The goal of the solution is to provide care to more than 10 million underprivileged patients in Africa and APAC.

In April 2025, Cerner Corporation integrated AI triage and chatbot features into its Millennium EHR system, enhancing hospital workflow automation and reducing clinician burden. These innovations indicate that Digital Health Platforms Growth Drivers & Challenges will increasingly hinge on usability, scale, and tech adaptability.

Conclusion

The Digital Health Platforms Market is entering a new phase of accelerated digital transformation across health care settings. These platforms have the potential to completely transform the way healthcare is delivered around the world owing to their robust regulatory support, growing patient acceptance and ongoing innovation.

Digital platforms provide an effective, simply accessible and tailored care model when chronic diseases progress and patient expectations shift. To remain competitive, market participants need to give cybersecurity, interoperability, and patient engagement tools top emphasis. Success in this field will depend on cross-sector collaborations, inclusive digital strategies for the next generation of care, and adaptive technology, according to the Digital Health Platforms Market Report.

Related Reports

- The global Healthcare Analytics Market was valued at approximately USD 49.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 17.9% from 2025 to 2035, reaching around USD 248.36 billion by the end of the forecast period.

- The global Telemedicine Market was valued at approximately USD 138.42 billion in 2024 and is projected to grow at a strong compound annual growth rate (CAGR) of 16.8% from 2025 to 2035, reaching over USD 685.23 billion by the end of the forecast period.

Key Market Players

The Digital Health Platforms Competitive Landscape is strong featuring a mix of tech giants, healthcare giants and digitally set up new players. Strategic mergers, AI-enabled product launches, and EHR platform expansions define the competitive arena. Players are heavily investing in platform security, UI/UX, and AI-based diagnostics to boost stickiness and emerging opportunities. Some of the key players in the Digital Health Platforms industry are:

Teladoc Health Inc., Philips Healthcare, Cerner Corporation, Siemens Healthineers, American Well Corporation, Epic Systems Corporation, GE Healthcare, Allscripts Healthcare Solutions, Medtronic plc, Babylon Health, Cisco Systems, Inc., HealthTap, Inc., eClinicalWorks LLC, IBM Watson Health, Athenahealth, Inc.

- Telehealth Platforms (Dominant): Essential for virtual consultations and ongoing management, these solutions facilitate real-time clinical interactions, minimize the necessity of in-person attendance, and broaden care reach in both densely populated and underserved regions.

- AI-Enabled Clinical Decision Support: Leveraging vast datasets and predictive modeling, these applications aid healthcare professionals in diagnosis and therapeutic strategies, thereby curtailing clinical errors and reinforcing adherence to evidence-centric guidelines.

- Mobile Health Applications: Smartphone applications empower users to monitor health metrics, receive medication alerts, and access preventative guidance, thereby fostering personal health management and encouraging ongoing participation in both chronic and preventive care regimens.

- Health Information Exchange Networks (Fastest Growing): Accelerating in technology adoption in Digital Health Platform to meet pressing interoperability demands, these secure infrastructures promote uniform data exchange among providers, enhancing clinical coordination, curtailing repetitive testing, and supporting the transition to value-driven care frameworks.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Chronic Disease Management (Fastest-Growing Segment): The most rapidly moving area in chronic disease management is coming with technologies allowing full-time, not-in-person management of chronic medical conditions, primarily diabetes and hypertension. The immediate transfer of biometric data to clinical personnel enables the timely fiscal offset to care plans and is linked with the prevention of unnecessary hospital stays.

- Preventive Health Program: Concurrently, preventive health programs emphasize comprehensive diagnostic evaluation and the detection of early vulnerability indicators, equipping patients to enact specific lifestyle modifications that can substantially diminish the likelihood of future disease onset.

- Remote Diagnostics (Dominating Segment): Patients today can execute standard diagnostic procedures in their residences and relay the results digitally to clinicians, effectively contracting the diagnostic intervals and enhancing patient-centered convenience.

- Mental Health & Wellness: In response to the increasing need for easily accessible, remote mental wellness care, digital platforms that offer therapy sessions, cognitive behavioral therapy exercises and well being tracking have become very popular specially in the rise of the pandemic time.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Web-based Platforms (Dominant): They are popular because they are easy to set up and can be accessed from any browser. This makes platform cost effective and good for places that don't have a lot of budget for IT resources and infrastructure.

- Cloud-based Platforms (Fastest Growing): These platforms are popular owing to they can be scaled up and accessed in real time. They make it easy to take out data from multiple locations, provide treatment from a distance and keep data well up to date.

- On-Premise Solutions: These are installed on hospital servers, which means they are more expensive up front and less flexible than cloud models. However, they are preferred because they give hospitals full control over their data.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Health Systems (Dominant): The biggest one to implement owing to there are a lot of patients with complicated and sophisticated needs & the IT department can set up a full digital platform across all departments.

- Home Care Settings (Fastest Growing): Driven by demographics that increasingly feature aging individuals and the rising burden of chronic health conditions, these digital ecosystems now enable continuous at-home patient surveillance, seamless video consultations, and integrated participation of family caregivers in care plans.

- Ambulatory Surgical Centers: Digital solutions simplify the preoperative and postoperative care continuum, reducing time burdens and ensuring consistent upkeep of patient records while also fostering seamless collaboration among the dedicated surgical and specialty teams.

- Insurance and Payers: Payers and insurers need to combine automated workflows for claims processing, risk analysis, and care coordination. Such steps synchronizes operations and reduces the frequency of fraudulent activities and claims thereby strengthening reimbursement models and ensuring their long term viability.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America leads the Digital Health Platforms Market Size & Share because of efficient infrastructures, good reimbursement policies, and early acceptance of technology. The overall healthcare IT infrastructure is robust in the region and it consistently invests in virtual care platforms, which are some of the reasons why the region leads the market. Nevertheless, Asia-Pacific holds the most promising growth because it is being stimulated by a rising number of smartphone users, a proliferation of internet access, or endeavours such as the Ayushman Bharat Digital Mission, by the government of India. Regional Insights indicate that regional participants are striking the rural market with low-bandwidth, multilingual, and mobile-first channels. This is the dynamic movement that is breaking down scalable growth and digital inclusion.

The following nations and regions will be covered in the report:

• North America: U.S., Canada, and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Digital Health Platforms Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Digital Health Platforms Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Digital Health Platforms Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Digital Health Platforms Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Technology & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Digital Health Platforms Market – By Platform Type

5.1. Overview

5.1.1. Segment Share Analysis, By Platform type, 2024 & 2035 (%)

5.1.2. Telehealth Platforms

5.1.3. AI-Enabled Clinical Decision Tools

5.1.4. mHealth Apps

5.1.5. Health Information Exchange Systems

(presents market segmentation by Platform Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Digital Health Platforms Market – By Application

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

6.1.2. Chronic Disease Management

6.1.3. Preventive Health

6.1.4. Remote Diagnostics

6.1.5. Mental Health & Wellness

(breaks down the market by Application, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Digital Health Platforms Market – By Delivery Mode

7.1. Overview

7.1.1. Segment Share Analysis, By Delivery Mode, 2024 & 2035 (%)

7.1.2. Web-based Platforms

7.1.3. Cloud-based Platforms

7.1.4. On-Premise Solutions

(focuses on market segmentation by Delivery mode, helping the client prioritize specific crop Product Types or end-use areas that offer significant business opportunities)

8. Digital Health Platforms Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Health Systems

8.1.3. Home Care Settings

8.1.4. Ambulatory Surgical Centers

8.1.5. Insurance & Payers

(describes the market division by End-User of Technology, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Digital Health Platforms Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Digital Health Platforms Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Platform type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Platform type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Platform type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Platform type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Digital Health Platforms Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Teladoc Health Inc.

10.3.2. Philips Healthcare

10.3.3. Cerner Corporation

10.3.4. Siemens Healthineers

10.3.5. American Well Corporation

10.3.6. Epic Systems Corporation

10.3.7. GE Healthcare

10.3.8. Allscripts Healthcare Solutions

10.3.9. Medtronic plc

10.3.10. Babylon Health

10.3.11. Cisco Systems, Inc.

10.3.12. HealthTap, Inc.

10.3.13. eClinicalWorks LLC

10.3.14. IBM Watson Health

10.3.15. Athenahealth, Inc

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Digital Health Platforms Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Digital Health Platforms Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Digital Health Platforms Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Digital Health Platforms Market: Product Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Platform type

TABLE 6: Global Digital Health Platforms Market, By Platform type 2022–2035 (USD Billion)

TABLE 7: Digital Health Platforms Market: Application Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Application

TABLE 9: Global Digital Health Platforms Market, by Application 2022–2035 (USD Billion)

TABLE 10: Digital Health Platforms Market: Technology Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Delivery Mode

TABLE 12: Global Digital Health Platforms Market, By Delivery Mode 2022–2035 (USD Billion)

TABLE 13: Digital Health Platforms Market: Technology Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Digital Health Platforms Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Digital Health Platforms Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Digital Health Platforms Market, by Region 2022–2035 (USD Billion)

TABLE 19: Digital Health Platforms Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Digital Health Platforms Market, By Platform type (NA), 2022–2035 (USD Billion)

TABLE 21: Digital Health Platforms Market, by Application (NA), 2022–2035 (USD Billion)

TABLE 22: Digital Health Platforms Market, By Delivery Mode (NA), 2024–2035 (USD Billion)

TABLE 23: Digital Health Platforms Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 25: U.S. Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 26: U.S. Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 27: U.S. Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 29: Canada Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 30: Canada Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 31: Canada Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 33: Mexico Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 34: Mexico Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 35: Mexico Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Digital Health Platforms Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Digital Health Platforms Market, By Platform type (Europe), 2022–2035 (USD Billion)

TABLE 38: Digital Health Platforms Market, by Application (Europe), 2022–2035 (USD Billion)

TABLE 39: Digital Health Platforms Market, By Delivery Mode (Europe), 2022–2035 (USD Billion)

TABLE 40: Digital Health Platforms Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 42: Germany Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 43: Germany Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 44: Germany Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 46: Italy Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 47: Italy Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 48: Italy Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 54: France Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 55: France Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 56: France Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 58: Russia Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 59: Russia Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 60: Russia Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 62: Poland Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 63: Poland Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 64: Poland Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Digital Health Platforms Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Digital Health Platforms Market, By Platform type (APAC), 2022–2035 (USD Billion)

TABLE 71: Digital Health Platforms Market, by Application (APAC), 2022–2035 (USD Billion)

TABLE 72: Digital Health Platforms Market, By Delivery Mode (APAC), 2022–2035 (USD Billion)

TABLE 73: Digital Health Platforms Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 75: India Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 76: India Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 77: India Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 79: China Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 80: China Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 81: China Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 83: Japan Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 84: Japan Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 85: Japan Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 87: South Korea Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 88: South Korea Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 89: South Korea Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 91: Australia Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 92: Australia Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 93: Australia Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 99: Brazil Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 100: Brazil Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 101: Brazil Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 103: Argentina Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 104: Argentina Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 105: Argentina Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 107: Colombia Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 108: Colombia Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 109: Colombia Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 115: Israel Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 116: Israel Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 117: Israel Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 119: Turkey Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

TABLE 120: Turkey Digital Health Platforms Market, By Delivery Mode, 2022–2035 (USD Billion)

TABLE 121: Turkey Digital Health Platforms Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Digital Health Platforms Market, By Platform type, 2022–2035 (USD Billion)

TABLE 123: Egypt Digital Health Platforms Market, by Application, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Digital Health Platforms Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Product Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Product Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Technology Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Technology Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Digital Health Platforms Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Digital Health Platforms Market Share and Leading Players, 2024

FIGURE 23: Latin America Digital Health Platforms Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Digital Health Platforms Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Digital Health Platforms Market Share Analysis by Country, 2023

FIGURE 30: Germany Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Digital Health Platforms Market Share Analysis by Country, 2023

FIGURE 39: India Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Digital Health Platforms Market Share Analysis by Country, 2023

FIGURE 47: Brazil Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Digital Health Platforms Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Digital Health Platforms Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- “This report provided exactly the kind of granular analysis we needed while mapping our digital health platform’s expansion roadmap. The breakdown of platform interoperability, patient engagement tools, and teleconsultation workflows gave our product and strategy teams a critical edge in market positioning. We used the competitive benchmarking section to refine our go-to-market pitch for investors.”

- Jennifer Collins, Director of Product Strategy, HealthTech Firm (USA)

- “In a rapidly shifting digital healthcare environment, this report served as a highly credible source to evaluate platform technologies and startup activity across Europe and North America. The insights on AI-based clinical decision support, SaaS adoption trends, and reimbursement ecosystems helped inform both our investment thesis and mentoring strategy for early-stage ventures.”

- Sophie Baumann, VP of Market Intelligence, European Digital Health Accelerator (France)

- “The depth of this research exceeded our expectations. It not only mapped the digital health platform landscape across emerging and mature markets but also addressed nuanced issues like data integration challenges, EMR compatibility, and regional compliance norms. It played a key role in helping us shape our recommendations for a major client looking to invest in virtual care infrastructure.”

- Rohan Iyer, Senior Analyst, Healthcare IT Consultancy (Singapore)

The Digital Health Platforms Market 2025 report is authored by the healthcare technology research division at Quants & Trends, a specialist in delivering high-impact, data-driven market insights across the digital health ecosystem.

Our lead analysts bring over a decade of domain-specific experience in tracking the evolution of healthcare IT, telemedicine, AI-driven care delivery, patient engagement platforms, and value-based care models. With backgrounds in clinical informatics, market intelligence, and digital transformation, the team has worked closely with stakeholders across the healthcare value chain, from hospital CIOs and digital health startups to private equity analysts and policy advisors.

This report was meticulously developed using primary interviews, industry surveys, patent landscape mapping, and competitor analysis. It addresses critical decision points such as platform integration capabilities, patient-centric app functionalities, compliance frameworks (HIPAA, GDPR), and the future of virtual-first care delivery.

The insights provided here are designed to support real-world decisions, including investment planning, product development, partnership strategies, and market entry assessments. Whether you're shaping your digital roadmap or benchmarking platform vendors, this report serves as a strategic asset rooted in actionable intelligence.

For more updates on our healthcare research, insights, and strategic perspectives, follow Quants & Trends on LinkedIn.