Market Outlook

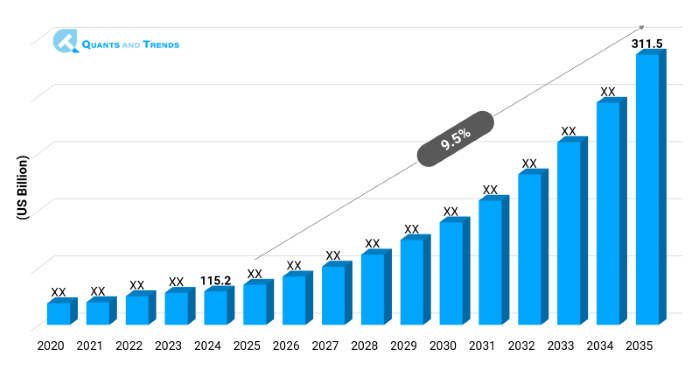

The global Biotechnology Innovations market was valued at approximately USD 115.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2025 to 2035, reaching around USD 311.5 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Biotechnology Innovations Market is on the threshold of an impressive growth spurt since the intersection of off-the-shelf gene therapies, synthetic biology, and AI-based drug discovery is transforming the capability in the industry. This report on Biotechnology Innovations emphasizes the increasing streams of capital investment in high-impact mediums including CRISPR, mRNA technologies and bioinformatics. As part of Key Trends in Biotechnology Innovations, more AI-driven pipelines and generative design are speeding up the R&D engines. According to the Biotechnology Innovations Market Forecast, the incoming growth is fostered by regulatory change and the development of the new sustainable forms of bioproduction.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 9.5% |

| Market Value In 2024 | USD 115.2 billion |

| Market Value In 2035 | USD 311.5 billion |

Introduction

Biotechnology Innovations Market Report offers a comprehensive qualitative overview of new scientific platforms- this includes the genome editing companies, personalized biologics, and digital biotech ecosystems. Contextualizing market dynamics, growth stimulants and ecosystem drivers, the Biotechnology Innovations Market overview puts into perspective the market dynamics. As part of the Biotechnology Innovations Industry Analysis, we assess the discoveries mediated by the AI, protein engineering, and green biotech. Biotechnology Innovations Market Size & Share context and further highlights of Biotechnology Innovations Investment Opportunities, anchors Forecast Methodology through a powerful mechanism of planning, linking strategic thinking with stakeholders planning.

Key Market Drivers: What’s Fueling the Biotechnology Innovations Market Boom?

- Revolution of AI and Computational Biology: The use of AI-The use of AI, in the form of generative models, to in silico drug discovery, is revolutionizing therapeutic development. New biotech companies in particular are also increasingly using deep learning to design candidates more efficiently and in less time as in the case of AI-based platforms generating molecules against previously undruggable targets. The outcome: shorter deadlines, decreasing research and development expenses, and a greater amount of precision.

- Gene Editing & Personalized Biologics: CRISPR-enabling therapies and the next generation of gene editing platforms are unlocking curative potential to offer rare genetic diseases. Gene therapy is growing through sophisticated delivery methods; thus the market enjoys the availability of target DNA and mRNA bikes of tissue specificity platforms which allow scalable biologics based on genomics of the patients.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Biotech innovation is characterized by AI-driven molecule design, CRISPR-based curative platform, and the decentralized biologics manufacturing. There are firms such as Generate Biomedicines whose investments in AI-enhanced protein engineering also include big pharma collaborations. At the same time, the clean tech innovations involving uses of enzymes are on the rise with sustainability as their driving principle indicating the Emerging Opportunities both in environmental and healthcare fields.

Recent Developments:

Backed by OpenAI, Chai Discovery announced a funding round of $70M to pursue AI-led molecule design featuring another wave of AI-biotech convergence.

Conclusion

To conclude, the Biotechnology Innovations Market is going to be assessed as strategically uncertain, driven by digital diagnostics, rapid testing and integrated surveillance. Agile technologies and scalable platforms should be a guiding concept of Biotechnology Innovations Investment Opportunities as an area of investment by the investors and a decision by the decision-makers. The policy, infrastructure and innovation have to be in tune with each other due to changing world threats and regional changes as experienced in the APAC region.

Related Reports

- The global Personalized Medicine Market was valued at approximately USD 375.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reaching around USD 735.6 billion by the end of the forecast period.

- The global Drug Discovery Services Market was valued at approximately USD 21.5 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 14.6% from 2025 to 2035, reaching around USD 96.3 billion by the end of the forecast period.

Key Market Players

The Biotechnology Innovations Competitive Landscape is an agglomeration of new-school startups and the old school bio. Generative AI has been in the process of formation in start-ups such as Generate Biomedicines and modular mRNA manufacturing systems- it is in use by companies such as BioNTech. The situation is marked by partnerships, AI tools licensing, and scaling created through the application of the platform. Some of the key players in the Biotechnology Innovations industry are as:

Thermo Fisher Scientific, Illumina Inc., Genentech (Roche), CRISPR Therapeutics, Moderna Inc., Bio-Rad Laboratories, Agilent Technologies, Biogen, Gilead Sciences, Amgen, Novozymes, Editas Medicine, Merck KGaA, Bayer CropScience, Regeneron Pharmaceuticals

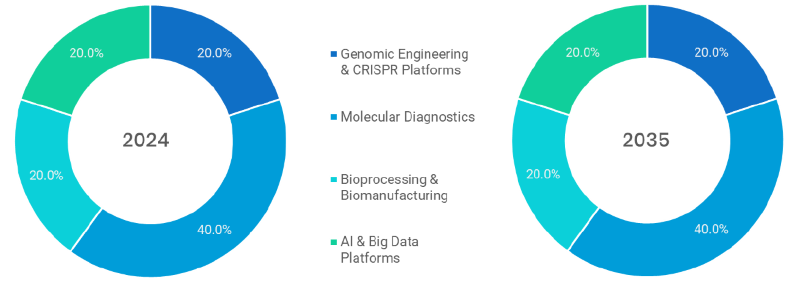

- Genomic Engineering & CRISPR Platforms: Genomic Engineering allows the precise engineering of DNA as a means to correct disease, modify agricultural processes and even synthesize biology by leveraging advanced technologies mediated by gene-modification.

- Molecular Diagnostics: Automate disease diagnosis, enabling early and correct disease diagnosis through biomarker identification, PCR and next-generation sequencing.

- Bioprocessing & Biomanufacturing: Facilitate production of biologic, vaccine and bio-similar production at scale by supporting fermentation, purification, and quality control platforms.

- AI & Big Data Platforms: Work with large volumes of biological data to analyze, optimize drug discovery, diagnostics and treatment with machine learning algorithms to accelerate this process.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Oncology: Stall on cancer genomic, immunotherapy and the use of biomarkers to guide personalized classifications to improve patient efficacy outcomes and survival.

- Neurological Disorders: Works on Alzheimer, Parkinson, and rare brain diseases using gene therapy, neural mapping and regenerative biotech engineering.

- Agricultural Biotechnology: Use of GMOs, biofertilizers, and precise genetic modification could enhance the yield of crops, their resistance to pests and adapting in a climatic condition.

- Infectious Diseases: Helps to develop a vaccine quickly, study antimicrobial resistance, and have global tracking that is formerly conducted through diagnostic and synthetic biology tools.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospital-based Biotech Solutions: These are built into clinical practices, and provide in-hospital diagnostics, gene therapies, and administration of biologics in critical care.

- Direct-to-Consumer Platforms: Empower through the direct-to-consumer delivery of genetic testing kits, diagnostics (wellness and health insights), and direct-to-the consumer healthcare products without any clinical intermediary.

- Contract Research & Manufacturing Services (CRAMS): Provide outsourcing R&D and manufacturing services to biopharma companies and get the benefits of cheaper and quicker development of biotech products.

- Academic/Research Collaboratives: The main solution to solve and bring early-stage biotech discoveries and translational research via a university-industry collaboration with the grants of existing protocols in the scientific field.

Note: Charts and figures are illustrative only. Contact us for verified market data.

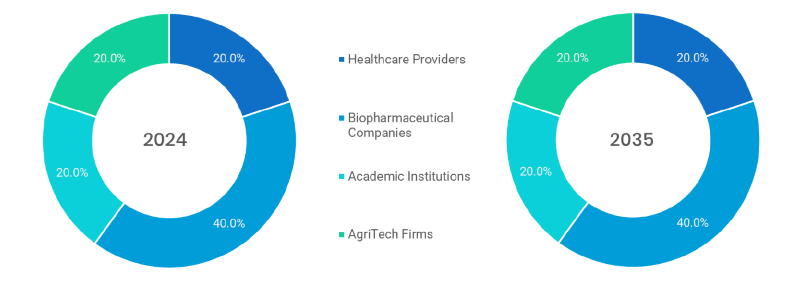

- Healthcare Providers: Leverage biotech diagnostics, therapies and monitoring to offer personalized care, enhance patient-outcomes.

- Biopharmaceutical Companies: Create, commercialise, and produce biologics, gene therapies, and biosimilars on serviceable raised biotech platforms.

- Academic Institutions: Leading-edge discovery of relevant innovations in the field of biotechnology, including genome editing and disease modeling, which frequently have collaborated with industry.

- AgriTech Companies: Utilise bio technologies to make crops more sustainable and resistant to pesticide contamination by minimising pesticide use and taking massive strides towards sustainable agricultural production.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is highest in Biotechnology Innovations market dominated by healthcare infrastructure, R&D investment, and guidelines on efficient regulatory pathways. At the same time, the fastest pace is observed in APAC (Asia-Pacific) due to the growth of infectious risks, widespread expansion of diagnostic networks, and the expansion of the use of digital resources in health sectors of emerging economies. The Regional Insights are meanwhile built on the significance of the localizes approach: The saturated markets in North America develop Yet more and more innovation, and the expansions in APAC are still built on the capacity development and demand. These various regional trends should be taken into account by policymakers and industry players in their move to establish resilience across the globe.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Biotechnology Innovations Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Biotechnology Innovations Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Biotechnology Innovations Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Technology Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Biotechnology Innovations Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Technology Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Biotechnology Innovations Market – By Technology Type

5.1. Overview

5.1.1. Segment Share Analysis, By Technology Type, 2024 & 2035 (%)

5.1.2. Genomic Engineering & CRISPR Platforms

5.1.3. Molecular Diagnostics

5.1.4. Bioprocessing & Biomanufacturing

5.1.5. AI & Big Data Platforms

(presents market segmentation By Technology Type, guiding the client on the Technology categories that are expected to drive demand and shape future revenue streams)

6. Biotechnology Innovations Market – By Application

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

6.1.2. Oncology

6.1.3. Neurological Disorders

6.1.4. Agricultural Biotechnology

6.1.5. Infectious Diseases

(breaks down the market by Application, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Biotechnology Innovations Market – By Delivery Model

7.1. Overview

7.1.1. Segment Share Analysis, By Delivery Model, 2024 & 2035 (%)

7.1.2. Hospital-based Biotech Solutions

7.1.3. Direct-to-Consumer Platforms

7.1.4. Contract Research & Manufacturing Services (CRAMS)

7.1.5. Academic/Research Collaboratives

(focuses on market segmentation by Delivery Model, helping the client prioritize specific Delivery Models or end-use areas that offer significant business opportunities)

8. Biotechnology Innovations Market – By End User

8.1. Overview

8.1.1. Segment Share Analysis, By End User, 2024 & 2035 (%)

8.1.2. Healthcare Providers

8.1.3. Biopharmaceutical Companies

8.1.4. Academic Institutions

8.1.5. AgriTech Firms

(describes the market division by End User of Technology Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Biotechnology Innovations Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Biotechnology Innovations Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Delivery Model, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Delivery Model, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Delivery Model, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Delivery Model, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Biotechnology Innovations Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Technology’s, Strategies, Financials, Recent Developments)

10.3.1. Thermo Fisher Scientific

10.3.2. Illumina Inc.

10.3.3. Genentech (Roche)

10.3.4. CRISPR Therapeutics

10.3.5. Moderna Inc.

10.3.6. Bio-Rad Laboratories

10.3.7. Agilent Technologies

10.3.8. Biogen

10.3.9. Gilead Sciences

10.3.10. Amgen

10.3.11. Novozymes

10.3.12. Editas Medicine

10.3.13. Merck KGaA

10.3.14. Bayer CropScience

10.3.15. Regeneron Pharmaceuticals.

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Technology’s, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Biotechnology Innovations Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Biotechnology Innovations Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Biotechnology Innovations Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Biotechnology Innovations Market: Technology Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Technology Type

TABLE 6: Global Biotechnology Innovations Market, By Technology Type 2022–2035 (USD Billion)

TABLE 7: Biotechnology Innovations Market: Application Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Application

TABLE 9: Global Biotechnology Innovations Market, by Application 2022–2035 (USD Billion)

TABLE 10: Biotechnology Innovations Market: Delivery Model Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Delivery Model

TABLE 12: Global Biotechnology Innovations Market, by Delivery Model 2022–2035 (USD Billion)

TABLE 13: Biotechnology Innovations Market: End User Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End User

TABLE 15: Global Biotechnology Innovations Market, by End User 2022–2035 (USD Billion)

TABLE 16: Biotechnology Innovations Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Biotechnology Innovations Market, by Region 2022–2035 (USD Billion)

TABLE 19: Biotechnology Innovations Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Biotechnology Innovations Market, By Technology Type (NA), 2022–2035 (USD Billion)

TABLE 21: Biotechnology Innovations Market, by Application (NA), 2022–2035 (USD Billion)

TABLE 22: Biotechnology Innovations Market, by Delivery Model (NA), 2024–2035 (USD Billion)

TABLE 23: Biotechnology Innovations Market, by End User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 26: U.S. Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 27: U.S. Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 28: Canada Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 29: Canada Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 30: Canada Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 31: Canada Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 32: Mexico Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 34: Mexico Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 35: Mexico Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 36: Biotechnology Innovations Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Biotechnology Innovations Market, By Technology Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Biotechnology Innovations Market, by Application (Europe), 2022–2035 (USD Billion)

TABLE 39: Biotechnology Innovations Market, by Delivery Model(Europe), 2022–2035 (USD Billion)

TABLE 40: Biotechnology Innovations Market, by End User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 42: Germany Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 43: Germany Biotechnology Innovations Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 45: Italy Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 46: Italy Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 47: Italy Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 48: Italy Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 53: France Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 54: France Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 55: France Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 56: France Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 57: Russia Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 58: Russia Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 59: Russia Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 60: Russia Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 61: Poland Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 62: Poland Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 63: Poland Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 64: Poland Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 69: Biotechnology Innovations Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Biotechnology Innovations Market, By Technology Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Biotechnology Innovations Market, by Application (APAC), 2022–2035 (USD Billion)

TABLE 72: Biotechnology Innovations Market, by Delivery Model(APAC), 2022–2035 (USD Billion)

TABLE 73: Biotechnology Innovations Market, by End User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 75: India Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 76: India Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 77: India Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 78: China Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 79: China Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 80: China Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 81: China Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 82: Japan Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 83: Japan Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 84: Japan Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 85: Japan Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 86: South Korea Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 88: South Korea Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 89: South Korea Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 90: Australia Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 91: Australia Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 92: Australia Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 93: Australia Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 98: Brazil Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 100: Brazil Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 101: Brazil Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 102: Argentina Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 104: Argentina Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 105: Argentina Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 106: Colombia Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 108: Colombia Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 109: Colombia Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 114: Israel Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 115: Israel Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 116: Israel Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 117: Israel Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 118: Turkey Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 120: Turkey Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 121: Turkey Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 122: Egypt Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 124: Egypt Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 125: Egypt Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Biotechnology Innovations Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Biotechnology Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Biotechnology Innovations Market, by Delivery Model, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Biotechnology Innovations Market, by End User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Biotechnology Innovations Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Technology Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Technology Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Technology Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Technology Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Biotechnology Innovations Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Biotechnology Innovations Market Share and Leading Players, 2024

FIGURE 23: Latin America Biotechnology Innovations Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Biotechnology Innovations Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Biotechnology Innovations Market Share Analysis by Country, 2023

FIGURE 30: Germany Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Biotechnology Innovations Market Share Analysis by Country, 2023

FIGURE 39: India Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Biotechnology Innovations Market Share Analysis by Country, 2023

FIGURE 47: Brazil Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Biotechnology Innovations Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Biotechnology Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The Biotechnology Innovations Market Research Report provided by this team was instrumental in shaping our five-year innovation roadmap. The depth of the competitive landscape analysis helped us identify niche segments in gene-editing applications and pinpoint untapped opportunities in rare disease therapeutics. The real-world case studies and regulatory insights were particularly valuable for aligning our product development with evolving FDA guidelines. This report is far more than market data, it’s a strategic decision-making tool."

- Jonathan Reeves, Senior R&D Strategy Manager, United States

- "In the fast-evolving biotechnology sector, timely and accurate intelligence is crucial. This report delivered comprehensive coverage of emerging biomanufacturing technologies, venture capital trends, and partnership models in Europe and beyond. The team’s analysis of policy changes in the EU and their projected market impact enabled us to adapt our investment priorities with confidence. The level of scientific depth combined with business relevance makes this research uniquely actionable."

- Elise Moreau, Head of Market Intelligence, France

- "Biotechnology innovation moves quickly, and without the right insights, opportunities can easily be missed. This report’s deep dive into APAC market dynamics, especially advancements in synthetic biology and personalized medicine, helped us identify collaborative opportunities with leading research institutes in Japan and Australia. The inclusion of market entry strategies for cross-border expansion was a game-changer for our planning. The credibility and analytical rigor behind the findings gave our leadership the assurance to move forward with bold initiatives."

- Arjun Mehta, Director of Innovation Partnerships, Singapore

The Biotechnology Innovations Market 2025 report is authored by a dedicated team of senior healthcare market analysts and biotechnology specialists with over a decade of combined experience in industry research, strategic consulting, and technology trend analysis. Our experts have worked closely with global stakeholders, including research institutions, biotech startups, and multinational healthcare enterprises, providing data-driven insights that have directly informed investment strategies, R&D prioritization, and market entry plans.

Drawing on deep domain knowledge in gene editing, regenerative medicine, synthetic biology, and advanced biomanufacturing, the authors have synthesized complex market intelligence into actionable strategies for decision-makers. Each data point, forecast, and competitive mapping in this report is backed by rigorous primary research, secondary data validation, and real-world case examples to ensure accuracy and strategic relevance.

The Biotechnology Innovations Market 2025 report is designed to empower executives, innovators, and investors with clear, evidence-based perspectives on emerging technologies, evolving regulatory landscapes, and competitive shifts. From identifying high-growth segments to understanding the commercialization potential of breakthrough therapies, this research enables confident, future-focused business decisions.

For more insights, market trends, and research expertise from our team, connect with us on LinkedIn.