Market Outlook

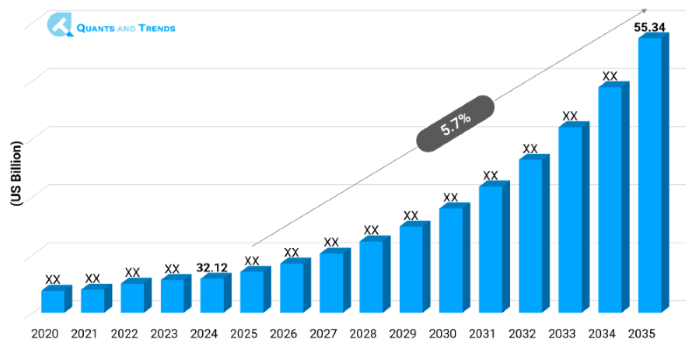

The global EHR and Health Information Systems Market was valued at approximately USD 32.12 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035, reaching around USD 55.34 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Digitalization of healthcare delivery, regulatory changes, and the growing care coordination demand are leading to a significant change in the EHR and Health Information Systems Market. As the amount of healthcare providers around the world changes to use electronic health records (EHRs), these electronic records are automating the clinical workflow processes and enhancing patient outcomes. The international need is also supported by the government requirements, extension of telehealth, and increase in the amount of medical data. The report titled the EHR and Health Information Systems Market Forecast shows that the industry is experiencing an increased rate of adoption of programs in both mature and developing markets, which is facilitated by the scope of interoperability, cloud computing, and integration of AI. With the data-driven healthcare, EHR platforms are also becoming intelligent and interoperable systems that are critical to the delivery of value-based care.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 5.7% |

| Market Value In 2024 | USD 32.12 billion |

| Market Value In 2035 | USD 55.34 billion |

Introduction

The EHR and Health Information Systems Market comprises software platforms and combined solutions that are used to manage the digital patient data, automate and facilitate clinical processes, and improve decision-making. The EHR systems offer the basis of the latest healthcare infrastructure, facilitating the exchange of data among laboratories, pharmacies and clinics and between various hospitals. Such systems facilitate real-time access of medical history, lab results, imaging, prescriptions and treatment plans. Drivers of demand include chronic diseases that have been on the rise, the need to focus on continuity of care, and administrative efficiency. As the world is now making massive investments in digital health infrastructure, the Technology Adoption in EHR and Health Information Systems has become a strategic concern in the world of healthcare ecosystems.

Key Market Drivers: What’s Fueling the EHR and Health Information Systems Market Boom?

- Government Initiatives and Compliance Regulations: The government-based mandates form one of the most influential factors that influence the EHR and Health Information Systems Market Size & Share. Manufacturing programs like the U.S. Meaningful Use program, the EU eHealth Digital Service Infrastructure, or India ABDM (Ayushman Bharat Digital Mission) make providers impose the use of digital health systems. Such regulations permit standardization, security and interoperability and are frequently subject to financial incentives or punishment, which hastens adoption.

- Emerging Chronic Disease Burden and Aging Population: The growing burden of chronic diseases around the world, including those related to diabetes, cardiovascular and respiratory diseases, in addition to an ageing population, is forcing medical systems to evolve to a longitudinal approach to patient monitoring and prevention. The EHR systems will allow managing health longitudinally and individual care. Therefore, their implementations become essential in population health targets thus opening new EHR and Health Information Systems Investment Opportunities both in hospitals-owned and ambulatory care networks.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

These include AI, cloud computing, natural language processing, and blockchain as Innovations in EHR and Health Information Systems Market. Voice dictation, predictive alerts and automated coding enabled by AI are making clinician productivity grow. Blockchain enables safe transportation and decentralized availability of the health data as the cloud-hosted systems offer scalability and emergency access. These developments are quickly gaining momentum to replace old systems and convert them into state-of-the-art systems and represent Emerging Opportunities via clinical decision support, real-time usage of analytics and telehealth integration.

Recent Developments:

In July 2024, Oracle Cerner was introduced with its new integrated health data environment that incorporates EHR and financial systems with features of AI to enhance population cohort health outcomes. These trends are indications of Key Trends in EHR and Health Information Systems, including consumer empowerment, value-based outcomes, and connected ecosystems, and herald a decentralized, patient-centric EHR and health information systems and digital health model.

Conclusion

EHR and Health Information Systems Market is the leader in healthcare digitalization that has facilitated integrated, value-based, and data-driven care. Over the increased patient demands and expectations, data complexity and clinical needs, EHR systems are moving towards dynamic and AI-powered platforms of care. With the digital requirement implemented by the government and the cloud-native solutions becoming widespread, both small practices and large hospitals are spending on intelligent systems to improve patient safety and efficiency of operations. Interoperability, security, and user experience are the key aspects of the market of the future, and they present extensive growth opportunities in different geographies and care settings.

Related Reports

- The global Healthcare Analytics Market was valued at approximately USD 49.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 17.9% from 2025 to 2035, reaching around USD 248.36 billion by the end of the forecast period.

- The global Healthcare Data Security Market was valued around USD 17.3 billion in 2024 and is anticipated to grow at a CAGR of 15.2% from 2025 to 2035, reaching nearby USD 69.8 billion by the end of the forecast period.

Key Market Players

EHR and Health Information Systems Ecosystem the EHR and Health Information Systems Competitive Landscape is characterized by large incumbents and niche vendors/distributors with a distinct lack of digital health natives. The market leaders are investing in enhanced interoperability, AI-based interface, and cloud connectivity to keep up with the changing expectations of the providers. Strategic partnering or strategic collaboration, Mergers and Acquisitions, and expansion of geography is also typical, particularly in reaction to demand flexibility combined with scaling capability. Vendors are spending on R&Ds in order to distinguish between platforms that enhance user-friendly interfaces, voice support and predictive analytics. Some of the key players in the EHR and Health Information Systems industry are as:

Epic Systems Corporation, Cerner Corporation (Oracle), Allscripts Healthcare Solutions, Meditech, Athenahealth, GE HealthCare, eClinicalWorks, NextGen Healthcare, McKesson Corporation, CPSI, AdvancedMD, Medhost, Greenway Health, Siemens Healthineers, Philips Healthcare

- On-Premise: Provides complete data and infrastructure control and is the best choice of organizations with rigorous compliance requirements and prior investments in IT resources, but it is less scalable than cloud-based solutions.

- Cloud-Based (Dominant): It is superior with respect to the costs involved, the simplicity of scaling the services and remote accessibility where it is the most popular by small to mid-sized providers who seek to reduce the desperation of involving huge infrastructure costs and overhead expenses in maintenance.

- Hybrid Solutions (Fastest Growing): Hybrid Solutions are the fastest growing to combine the flexibility of the clouds with the control of in-house systems that will allow large health care systems to customize their data storage without sacrificing secure, scalable operations.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Clinical Data Management (Dominant): At the heart of EHRs, which allows secure storage of patient records, their retrieval, and exchange, essential in coordinated care, used in tracking outcomes, and complying with value-based healthcare requirements.

- Billing & Revenue Cycle: Automates the non-clinical work of claims processing and reimbursements and enhances cash flow efficiency and operational efficiency of healthcare providers.

- Patient Scheduling: Optimizes efficiency of appointment booking, resource management and patient experience, which enhances care delivery and efficiency of clinical workflows.

- e-Prescribing (Fastest Growing): The fastest developing because of requirements of medicine prescriptions and the control of the errors in the organization of prescriptions, as well as the increase in the accuracy and the improvement of efficiency and controls.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Chronic Disease Management (Dominant): Monopolizes the field with the opportunity to monitor and optimally coordinate care all the time in such conditions as diabetes and heart disease which need the constant monitoring of health.

- Population Health Management: Facilitates data-informed solutions to enhance the health outcomes of specific populations by assessing the health trends, risks, and interventive procedures on demographics.

- Emergency Services: It is employed on real time questions that require important patient data in case of emergencies to improve speed and quality of emergency health care decisions.

- Behavioral Health (Fastest Growing): The fastest rising since the integration to better diagnose, continuity of care, and coordination of care in both the psychiatric and psychological services through the incorporation of mental health to EHRs.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals (Dominant): Are the heavy users who have complex workflow, multi-specialty integration, and regulatory needs, in which all of them demand full-featured enterprise level EHR.

- Clinics: Employ EHRs to achieve the simplification of patient records, prescriptions and integration, particularly in family medicine, primary care and outpatient treatment settings with specialists.

- Ambulatory Surgical Centers (ASCs) (Fastest Growing): They are rapidly expanding as cost effective, outpatient models are able to deal with the pre-op, intra-op, and post-op processes using EHRs.

- Long-Term Care Facilities: Adopt EHRs to administer the patient history, medicines, and the progress care strategy, essential to the older folks and those with chronic issues.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is the leading region in the EHR and Health Information Systems Market due to the strong base in digital infrastructure, regulatory provisions, and sophisticated payer-provider networks. U.S. still sets the stage in both EHR penetration and innovation, and penetration is significant both in the public and the private sector. Meanwhile, Asia-Pacific (APAC) is becoming the most rapidly growing region powered by the government digital health policies, the growth of the number of investments into healthcare, and the further rural access.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. EHR and Health Information Systems Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. EHR and Health Information Systems Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. EHR and Health Information Systems Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. EHR and Health Information Systems Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Deployment Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. EHR and Health Information Systems Market – By Deployment Type

5.1. Overview

5.1.1. Segment Share Analysis, By Deployment Type , 2024 & 2035 (%)

5.1.2. On-Premise

5.1.3. Cloud-Based

5.1.4. Hybrid Solutions

(presents market segmentation by Deployment Type , guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. EHR and Health Information Systems Market – By Functionality

6.1. Overview

6.1.1. Segment Share Analysis, By Functionality, 2024 & 2035 (%)

6.1.2. Clinical Data Management

6.1.3. Billing & Revenue Cycle

6.1.4. Patient Scheduling

6.1.5. e-Prescribing

(breaks down the market by Functionality, assisting the client in identifying material or origin preferences and emerging growth segments)

7. EHR and Health Information Systems Market – By Application

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

7.1.2. Chronic Disease Management

7.1.3. Population Health Management

7.1.4. Emergency Services

7.1.5. Behavioral Health

(focuses on market segmentation by Application, helping the client prioritize specific crop Deployment Type s or end-use areas that offer significant business opportunities)

8. EHR and Health Information Systems Market – By End User

8.1. Overview

8.1.1. Segment Share Analysis, By End User, 2024 & 2035 (%)

8.1.2. Hospitals

8.1.3. Clinics

8.1.4. Ambulatory Surgical Centers (ASCs)

8.1.5. Long-Term Care Facilities

(describes the market division by End User enabling the client to understand which usage methods are preferred and where future demand may rise)

9. EHR and Health Information Systems Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. EHR and Health Information Systems Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Deployment Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Deployment Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Deployment Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Deployment Type , 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Functionality, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. EHR and Health Information Systems Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Epic Systems Corporation

10.3.2. Cerner Corporation (Oracle)

10.3.3. Allscripts Healthcare Solutions

10.3.4. Meditech

10.3.5. Athenahealth

10.3.6. GE HealthCare

10.3.7. eClinicalWorks

10.3.8. NextGen Healthcare

10.3.9. McKesson Corporation

10.3.10. CPSI

10.3.11. AdvancedMD

10.3.12. Medhost

10.3.13. Greenway Health

10.3.14. Siemens Healthineers

10.3.15. Philips Healthcare

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. EHR and Health Information Systems Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. EHR and Health Information Systems Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. EHR and Health Information Systems Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: EHR and Health Information Systems Market: Deployment Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Deployment Type

TABLE 6: Global EHR and Health Information Systems Market, by Deployment Type 2022–2035 (USD Billion)

TABLE 7: EHR and Health Information Systems Market: Functionality Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Functionality

TABLE 9: Global EHR and Health Information Systems Market, by Functionality 2022–2035 (USD Billion)

TABLE 10: EHR and Health Information Systems Market: Application Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Application Type

TABLE 12: Global EHR and Health Information Systems Market, by Application 2022–2035 (USD Billion)

TABLE 13: EHR and Health Information Systems Market: End UserSnapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End User

TABLE 15: Global EHR and Health Information Systems Market, by End User 2022–2035 (USD Billion)

TABLE 16: EHR and Health Information Systems Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global EHR and Health Information Systems Market, by Region 2022–2035 (USD Billion)

TABLE 19: EHR and Health Information Systems Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: EHR and Health Information Systems Market, by Deployment Type (NA), 2022–2035 (USD Billion)

TABLE 21: EHR and Health Information Systems Market, by Functionality (NA), 2022–2035 (USD Billion)

TABLE 22: EHR and Health Information Systems Market, by Application (NA), 2024–2035 (USD Billion)

TABLE 23: EHR and Health Information Systems Market, by End User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 25: U.S. EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 26: U.S. EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 27: U.S. EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 28: Canada EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 29: Canada EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 30: Canada EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 31: Canada EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 32: Mexico EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 33: Mexico EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 34: Mexico EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 35: Mexico EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 36: EHR and Health Information Systems Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: EHR and Health Information Systems Market, by Deployment Type (Europe), 2022–2035 (USD Billion)

TABLE 38: EHR and Health Information Systems Market, by Functionality (Europe), 2022–2035 (USD Billion)

TABLE 39: EHR and Health Information Systems Market, by Application(Europe), 2022–2035 (USD Billion)

TABLE 40: EHR and Health Information Systems Market, by End User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 42: Germany EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 43: Germany EHR and Health Information Systems Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 45: Italy EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 46: Italy EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 47: Italy EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 48: Italy EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 50: United Kingdom EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 51: United Kingdom EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 52: United Kingdom EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 53: France EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 54: France EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 55: France EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 56: France EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 57: Russia EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 58: Russia EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 59: Russia EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 60: Russia EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 61: Poland EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 62: Poland EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 63: Poland EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 64: Poland EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 66: Rest of Europe EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 69: EHR and Health Information Systems Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: EHR and Health Information Systems Market, by Deployment Type (APAC), 2022–2035 (USD Billion)

TABLE 71: EHR and Health Information Systems Market, by Functionality (APAC), 2022–2035 (USD Billion)

TABLE 72: EHR and Health Information Systems Market, by Application(APAC), 2022–2035 (USD Billion)

TABLE 73: EHR and Health Information Systems Market, by End User (APAC), 2022–2035 (USD Billion)

TABLE 74: India EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 75: India EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 76: India EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 77: India EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 78: China EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 79: China EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 80: China EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 81: China EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 82: Japan EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 83: Japan EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 84: Japan EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 85: Japan EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 86: South Korea EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 87: South Korea EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 88: South Korea EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 89: South Korea EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 90: Australia EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 91: Australia EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 92: Australia EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 93: Australia EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 95: Rest of APAC EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 98: Brazil EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 99: Brazil EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 100: Brazil EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 101: Brazil EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 102: Argentina EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 103: Argentina EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 104: Argentina EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 105: Argentina EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 106: Colombia EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 107: Colombia EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 108: Colombia EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 109: Colombia EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 114: Israel EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 115: Israel EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 116: Israel EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 117: Israel EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 118: Turkey EHR and Health Information Systems Market, by Deployment Type , 2022–2035 (USD Billion)

TABLE 119: Turkey EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 120: Turkey EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 121: Turkey EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 122: Egypt EHR and Health Information Systems Market, by Deployment Type, 2022–2035 (USD Billion)

TABLE 123: Egypt EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 124: Egypt EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 125: Egypt EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA EHR and Health Information Systems Market, by Deployment Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA EHR and Health Information Systems Market, by Functionality, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA EHR and Health Information Systems Market, by Application, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA EHR and Health Information Systems Market, by End User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: EHR and Health Information Systems Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Deployment Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Deployment Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Functionality Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Functionality Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Deployment Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Deployment Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe EHR and Health Information Systems Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific EHR and Health Information Systems Market Share and Leading Players, 2024

FIGURE 23: Latin America EHR and Health Information Systems Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa EHR and Health Information Systems Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe EHR and Health Information Systems Market Share Analysis by Country, 2023

FIGURE 30: Germany EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific EHR and Health Information Systems Market Share Analysis by Country, 2023

FIGURE 39: India EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America EHR and Health Information Systems Market Share Analysis by Country, 2023

FIGURE 47: Brazil EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa EHR and Health Information Systems Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA EHR and Health Information Systems Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "This report was pivotal in shaping our 3-year roadmap for EHR modernization. The granular insights into interoperability challenges, regional vendor performance, and emerging FHIR standards gave us the clarity we needed to evaluate technology partnerships. It wasn’t just market data, it was strategic foresight. I’ve rarely seen such depth and relevance in a syndicated report."

- Michael Reyes, Director of Health IT Strategy, United States

- "As someone overseeing digital transformation in a complex multi-hospital ecosystem, I found this research to be a goldmine. The regional analysis across Europe, vendor segmentation, and regulatory mapping were spot-on. It helped us identify scalable HIS platforms while remaining compliant with the evolving EU data protection landscape. Highly recommended for any policy-aligned implementation decisions."

- Dr. Annika Stein, Chief Digital Health Officer, Germany

- "Our team was evaluating market entry strategies for cloud-based health IT solutions in Southeast Asia, and this report gave us the precision we needed. It outlined investment trends, integration barriers, and end-user adoption patterns in a way that made immediate business sense. We used its vendor ecosystem analysis directly in our investor pitch. Worth every dollar."

- Arjun Mehta, Senior Manager, Clinical Informatics, Singapore

The EHR and Health Information Systems Market 2025 report is authored by the expert research team at Quants & Trends, a leading provider of healthcare market intelligence specializing in digital health transformation, clinical informatics, and health IT adoption trends.

With over a decade of experience in evaluating healthcare technologies, our analysts bring a unique blend of domain expertise, regulatory understanding, and commercial insight. This report draws on extensive primary research, interviews with CIOs, CMIOs, hospital administrators, EHR vendors, and regulatory bodies, combined with proprietary market modeling and global trend analysis.

Our research delves beyond market size, offering an in-depth look at interoperability advancements, FHIR implementation, AI-driven clinical decision support, cloud migration strategies, and vendor performance benchmarks. By mapping regulatory landscapes and adoption curves across the U.S., Europe, and Asia-Pacific, we provide strategic clarity for stakeholders navigating complex technology choices.

Whether you are a healthcare provider modernizing legacy systems, a health IT vendor refining your go-to-market strategy, or an investor assessing digital health growth opportunities, this report delivers actionable intelligence for high-impact decisions.

To learn more about our methodology, expertise, and ongoing thought leadership in healthcare technology markets, connect with us on our official LinkedIn page.