Market Outlook

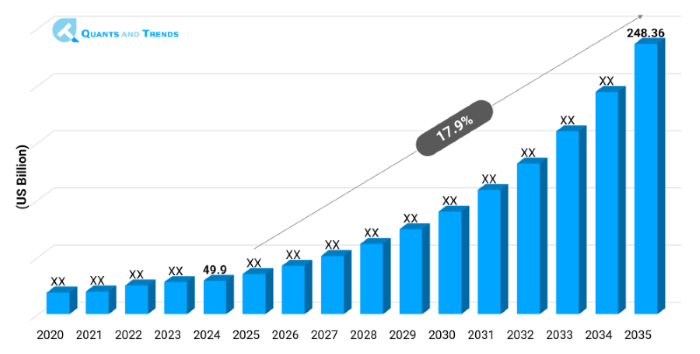

The global healthcare analytics market was valued at approximately USD 49.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 17.9% from 2025 to 2035, reaching around USD 248.36 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Healthcare Analytics Market is going through a transitionary period, due to the increasing requirement of cost-effective as well as patient-oriented delivery of healthcare. That need in real-time, predictive, and prescriptive information is transforming clinical, operational, and administrative routines. According to the latest Healthcare Analytics Market Reports, the organizations have focused on the priority of the analytics to reach operational efficiency, as well as improve patient results and regulatory compliance. The Healthcare Analytics Market Forecast is an indication that this pace will heighten as the industry journeys through value-based care models.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 17.9% |

| Market Value In 2024 | USD 49.9 billion |

| Market Value In 2035 | USD 248.36 billion |

Introduction

Healthcare Analytics Market comprises a wide variety of analysis tools and platforms that can be used to derive actionable insights out of healthcare data. Providers, payers, and life sciences organizations are becoming more and more inclined to utilizing these tools in an attempt to streamline the provision of care, patient health population, and financial performance. As it can be seen in many Healthcare Analytics Market Reports, the interconnection of cloud computing, IoT, and artificial intelligence is opening new possibilities of innovation, which has never been seen.

Key Market Drivers: What’s Fueling the Healthcare Analytics Market Boom?

- Digitalization of Healthcare Systems: One of the main reasons the Healthcare Analytics Market is growing so quickly is that healthcare services are using more and more technology. In the healthcare area, electronic health records, wearable devices and patient monitoring platforms all creates a huge amount of data. These datasets, when analyzed effectively, help stakeholders make informed decisions that improve clinical efficiency and reduce unnecessary costs. People desire analytics tools that can make sense of data from diverse platforms even more since they want data to be stored in one place and work with other platforms.

- Policy and Regulatory Influence: Government policies & programs have had a big impact on the use of analytics. A compliance heavy environment has been created by mandates such as the HITECH Act and MACRA in the United States and the GDPR in Europe. Analytics are used to track adherence and produce the required reports. Additionally, analytics capabilities are being incorporated more and more into national digital health missions and public health strategies to enhance public health surveillance, resource allocation, and service delivery.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

AI, machine learning, and data science are those advancements of innovation that influence the Healthcare Analytics Market. Smart algorithms are even making real-time diagnosis, screening early signs of the disease, and optimizing operations possible. Embedded analytics and clinical workflows on a mobile-based care platform that delivers care has redefined the paradigm of care delivery. Also, the emergence of explainable AI is making sure that analytics do not merely generate results but also provide interpretability, which is a really vital issue in the regulated health care setting. These advances are turning analytics easier, scalable as well as actionable.

Recent Developments:

In June 2025, the European Union launched the European Health Data Space (EHDS) which requires cross-border health data sharing as well as the infrastructure for electronic health records.

Conclusion

In Conclusion, The Healthcare Analytics Market is developing at a rapid pace and is being influenced by the triumvirate of technology, policy, and demand of value-driven care. Analytics is increasingly becoming the core of all the layers of the healthcare value chain, including operational optimization and clinical excellence. As advanced analytics adoption is high in North America, growth in the Asia-Pacific hints at democratization of advanced analytics tools across the globe. The future competition will consist of cloud-native deployments, AI integration, and ethical management of data.

Related Reports

- The global Digital Health Platforms Market was worth USD 292.1 billion in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 21.0% from 2025 to 2035, reaching around USD 2,364.1 billion by the end of the forecast period.

- With a 35.1% CAGR, the global Healthcare Artificial Intelligence Market is projected to grow from USD 27.12 billion in 2024 to approximately USD 736.14 billion by 2035.

Key Market Players

The HCL health care analytics market is typified by established technology vendors and industry-specific healthcare analytics companies. Strategic mergers, partnerships, and platform upgrading among key players are underway as a way of winning more market shares. The concept of competitive positioning revolves around cloud integration, AI enablement and regional expansion. Although legacy companies offer end-to-end analytics ecosystems, lean startups are launching modular, low-code applications focused by use case such as remote monitoring or drug discovery. Some of the key players in the Healthcare analytics industry are as:

IBM (Merative), Oracle (Cerner), Optum (UnitedHealth Group), SAS Institute, IQVIA, Siemens Healthineers, Philips Healthcare, Microsoft, Google (Alphabet), Amazon Web Services (AWS), McKesson, Allscripts, Innovaccer, Qure.ai, ValueCare

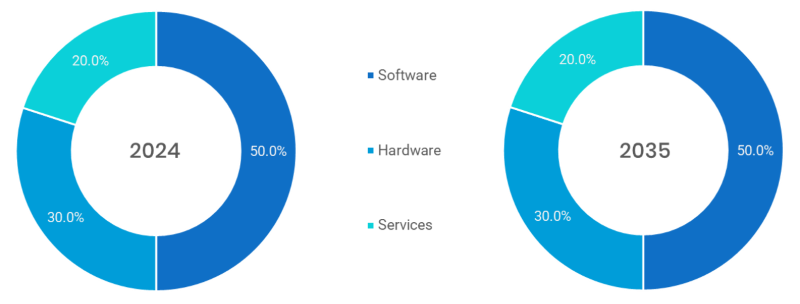

- Software (Dominated): Healthcare analytics systems contain content management systems, which use analytics software to capture, analyze and visualize patient and operational data. All of these tools work with EHRs, use AI algorithms to provide clinical insight, and assist in the use of real-time decision support dashboards, optimizing performance and enhancing the accuracy of diagnoses.

- Services (Fastest growing): Implantation, customization and continuing analogy of analytics systems are offered by the service providers. These are data integration, compliance consultation, training, and analytics process outsourcing.

- Hardware: It is a physical infrastructure sub-segment, which constitutes server, storage and networking system that is needed to process large amount of healthcare data. Hardware takes cloud and on-premises analytics and makes data safe and responsive as well as its processing.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- On-Premise (Dominating): On-premise implementation is one that keeps analytics systems in local servers of the healthcare organization. It is fully controllable in terms of security and infrastructure but usually needs greater capital outlay, qualified IT divisions, and delays in deployment.

- Web-Based: The web-based solutions are deployed outside and accessed through web browsers. They are flexible, mid-range scalable, and can be accessed easily without significant investments in infrastructure, so they are appropriate in mid-sized institutions that move off legacy operations.

- Cloud-Based (Fastest growing): The constructions of cloud-based analytics platforms are Software-as-a-Service (SaaS). They are cost effective, scalable and remote. The providers will be able to combine data of various sources, make it possible to conduct real-time analytics, and implement modern tools of artificial intelligence at a very low cost so far.

Note: Charts and figures are illustrative only. Contact us for verified market data.

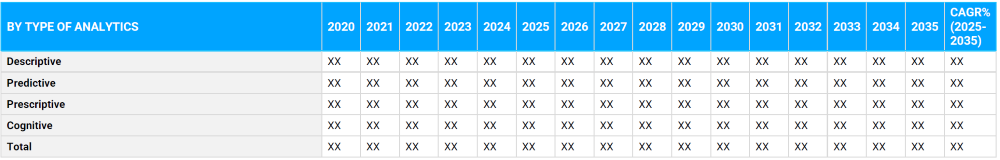

- Descriptive Analytics (Dominating): Descriptive analytics is used to summarize past health care historical data to give a summary of past trends and historical trends. It helps to report, track the KPIs, and benchmark, and allows the providers to recognize inefficiencies and grasp care delivery performance.

- Predictive Analytics (Fastest growing): Predictive analytics is the combination of statistical models and machine learning to predict future events, such as the risk of a certain disease, the rehospitalization, or medication compliance. It allows effective skilled delivery of proactive interventions and population health leadership strategies, leading to better care results.

- Prescriptive Analytics: Prescriptive analytics is more than prediction as it provides strategies that can be easily acted upon. It incorporates simulation and optimization algorithms to propose treatment plans, staffing schedules, or resources allocation on data that places predicted information about outcomes.

- Cognitive analytics: Cognitive analytics captures the ability of human reasoning as it uses unstructured and structured data to analyze in real time. It employs natural language processing (NLP) and adaptive learning within clinical decision support systems to help individualize treatment plans and makes them dynamic.

Note: Charts and figures are illustrative only. Contact us for verified market data.

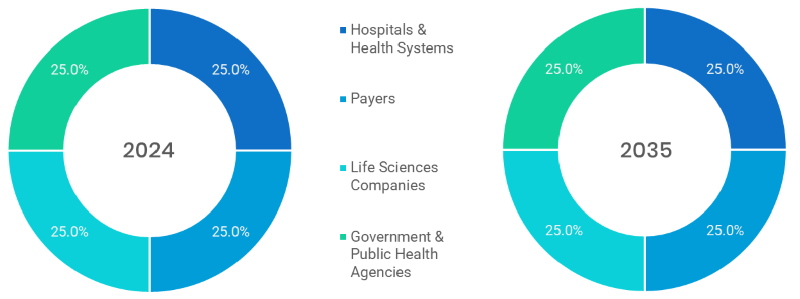

- Healthcare Providers (Dominating): Analytics can assist hospitals, clinics and physician networks to enhance clinical performance, operational performance and compliance. The greatest consumers are providers who use the tools in both the patient care and administrative segments.

- Payers: Insurance firms have been using the analytics in claims processing, risk ratings, fraud busting, and pricing. Payers rely on the strong data systems to control the member health plans and requisiteness.

- Life Sciences & Pharma (Fastest growing): Life sciences organizations use analytics in drug development, clinical trial design and real-world evidence creation. It speeds the time to market, makes safety monitoring available, and submits to the regulatory process.

- Government & Public Health Agencies: These actors utilize analytics to monitor epidemics; system performance and they use it to distribute healthcare resources in a more effective fashion. Analytics is used by public health agencies in surveillance, policymaking and health equity initiatives.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America dominates the Healthcare Analytics Market in regional context since it has a mature healthcare IT infrastructure and high digital acceptance, accompanied by considerable policy support. Asia-Pacific on the other hand is poised to develop as the most-growing area and this is due to modernization of the healthcare facilities in countries such as China, India and Singapore. Europe maintains a stable course as regulations and national health digitalization strategies support it. Latin America and the Middle East are at a slightly earlier level of adoption and indicate growing interest in an analytics-driven transformation.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Analytics Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Analytics Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Analytics Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Analytics Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Component & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Analytics Market – By Component

5.1. Overview

5.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

5.1.2. Software

5.1.3. Services

5.1.4. Hardware

(presents market segmentation by Component, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Analytics Market – By Deployment Mode

6.1. Overview

6.1.1. Segment Share Analysis, By Deployment Mode, 2024 & 2035 (%)

6.1.2. On-Premise

6.1.3. Web-Based

6.1.4. Cloud-Based

(breaks down the market by Deployment Mode, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Analytics Market – By Type of Analytics

7.1. Overview

7.1.1. Segment Share Analysis, By Type of Analytics, 2024 & 2035 (%)

7.1.2. Descriptive Analytics

7.1.3. Predictive Analytics

7.1.4. Prescriptive Analytics

7.1.5. Cognitive Analytics

(focuses on market segmentation by Type of Analytics, helping the client prioritize specific crop Components or end-use areas that offer significant business opportunities)

8. Healthcare Analytics Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Healthcare Providers

8.1.3. Payers

8.1.4. Life Sciences & Pharma

8.1.5. Government & Public Health Agencies

(describes the market division by End-User of Component, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Analytics Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Analytics Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Type of Analytics, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Type of Analytics, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Type of Analytics, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Type of Analytics, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Analytics Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. IBM (Merative)

10.3.2. Oracle (Cerner)

10.3.3. Optum (UnitedHealth Group)

10.3.4. SAS Institute

10.3.5. IQVIA

10.3.6. Siemens Healthineers

10.3.7. Philips Healthcare

10.3.8. Microsoft

10.3.9. Google (Alphabet)

10.3.10. Amazon Web Services (AWS)

10.3.11. McKesson

10.3.12. Allscripts

10.3.13. Innovaccer

10.3.14. Qure.ai

10.3.15. ValueCare

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Analytics Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Analytics Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Analytics Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Analytics Market: Component Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Component

TABLE 6: Global Healthcare Analytics Market, by Component 2022–2035 (USD Billion)

TABLE 7: Healthcare Analytics Market: Deployment Mode Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Deployment Mode

TABLE 9: Global Healthcare Analytics Market, by Deployment Mode 2022–2035 (USD Billion)

TABLE 10: Healthcare Analytics Market: Component Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Component

TABLE 12: Global Healthcare Analytics Market, by Type of Analytics2022–2035 (USD Billion)

TABLE 13: Healthcare Analytics Market: Type of AnalyticsSnapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Healthcare Analytics Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Healthcare Analytics Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Analytics Market, by Region 2022–2035 (USD Billion)

TABLE 19: Healthcare Analytics Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Healthcare Analytics Market, by Component (NA), 2022–2035 (USD Billion)

TABLE 21: Healthcare Analytics Market, by Deployment Mode (NA), 2022–2035 (USD Billion)

TABLE 22: Healthcare Analytics Market, by Type of Analytics (NA), 2024–2035 (USD Billion)

TABLE 23: Healthcare Analytics Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 25: U.S. Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 26: U.S. Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 27: U.S. Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 29: Canada Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 30: Canada Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 31: Canada Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 33: Mexico Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 34: Mexico Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 35: Mexico Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Healthcare Analytics Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Healthcare Analytics Market, by Component (Europe), 2022–2035 (USD Billion)

TABLE 38: Healthcare Analytics Market, by Deployment Mode (Europe), 2022–2035 (USD Billion)

TABLE 39: Healthcare Analytics Market, by Type of Analytics(Europe), 2022–2035 (USD Billion)

TABLE 40: Healthcare Analytics Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 42: Germany Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 43: Germany Healthcare Analytics Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 46: Italy Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 47: Italy Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 48: Italy Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 54: France Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 55: France Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 56: France Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 58: Russia Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 59: Russia Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 60: Russia Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 62: Poland Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 63: Poland Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 64: Poland Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Healthcare Analytics Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Healthcare Analytics Market, by Component (APAC), 2022–2035 (USD Billion)

TABLE 71: Healthcare Analytics Market, by Deployment Mode (APAC), 2022–2035 (USD Billion)

TABLE 72: Healthcare Analytics Market, by Type of Analytics(APAC), 2022–2035 (USD Billion)

TABLE 73: Healthcare Analytics Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 75: India Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 76: India Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 77: India Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 79: China Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 80: China Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 81: China Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 83: Japan Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 84: Japan Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 85: Japan Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 87: South Korea Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 88: South Korea Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 89: South Korea Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 91: Australia Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 92: Australia Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 93: Australia Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 99: Brazil Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 100: Brazil Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 101: Brazil Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 103: Argentina Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 104: Argentina Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 105: Argentina Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 107: Colombia Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 108: Colombia Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 109: Colombia Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 115: Israel Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 116: Israel Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 117: Israel Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 119: Turkey Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 120: Turkey Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 121: Turkey Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 123: Egypt Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 124: Egypt Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 125: Egypt Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Healthcare Analytics Market, by Component, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Healthcare Analytics Market, by Deployment Mode, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Healthcare Analytics Market, by Type of Analytics, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Healthcare Analytics Market, by End-User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Healthcare Analytics Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Deployment Mode Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Deployment Mode Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Analytics Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Analytics Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Analytics Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Analytics Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Healthcare Analytics Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Healthcare Analytics Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Healthcare Analytics Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Healthcare Analytics Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Healthcare Analytics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The Healthcare Analytics Market Research Report provided us with a comprehensive understanding of where the market is heading, especially with regard to value-based care models and predictive analytics integration. The vendor landscape mapping and regional readiness scores helped us fine-tune our analytics platform selection process. The level of technical and strategic insight in this report is exactly what our executive leadership needed to drive investment in next-gen analytics capabilities."

- Michael Turner, VP, Data Strategy & Insights, Integrated Health Network (USA)

- "This report offered a detailed and balanced view of the healthcare analytics ecosystem in Europe and globally. The coverage on real-world data (RWD), interoperability challenges, and AI-powered clinical decision support systems was particularly useful for our policy evaluation work. It also helped us benchmark regional adoption and maturity levels across various digital health initiatives. You can tell it was written by professionals with a deep understanding of healthcare data dynamics."

- Emilie Dubois, Chief Digital Health Officer, Public Health Consortium (France)

- "We used the Healthcare Analytics Market Research Report as part of our due diligence process for several analytics-focused startups. The report’s detailed segmentation by analytics type, descriptive, predictive, and prescriptive, helped us identify where commercial traction was growing and which niches still had gaps. The insights on regulatory data frameworks and payer-provider alignment across APAC markets made this a strategic resource for both our investment thesis and portfolio support."

- Arjun Rao, Director, Healthcare Innovation & Investments, HealthTech VC Firm (India)

The Healthcare Analytics Market 2025 report is authored by the research and insights team at Quants & Trends, a leading healthcare market intelligence firm with a dedicated focus on digital health, data-driven care transformation, and analytics adoption across payer, provider, and life sciences ecosystems.

With over a decade of experience in tracking global healthcare technology markets, our analysts bring together cross-functional expertise in health informatics, clinical operations, population health, and predictive modeling. This report is the result of months of meticulous research involving structured primary interviews with health system CIOs, data science leads, and regulatory experts, combined with proprietary data modeling and deep competitive benchmarking.

The report offers actionable intelligence on how descriptive, predictive, and prescriptive analytics are reshaping healthcare delivery, cost optimization, clinical outcomes, and policy compliance. It helps decision-makers evaluate vendor capabilities, prioritize investment in analytics infrastructure, and align their data strategy with evolving regulatory frameworks and patient-centric care models.

Whether you're a health IT strategist at a provider organization, a product lead at a healthtech firm, or an investor assessing analytics-driven innovation, this report is designed to support critical business decisions with precision and confidence.

To learn more about our team, methodology, and the latest updates on digital health intelligence, connect with us on our official LinkedIn page.