Market Outlook

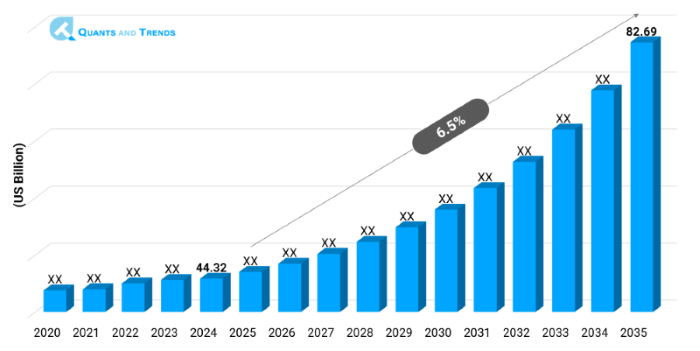

The global Healthcare Staffing and Workforce Trends Market was valued at approximately USD 44.32 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reaching around USD 82.69 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Healthcare staffing and workforce trends Market is experiencing revolutionizing development due to long-term labor shortages, increased need of healthcare, and changing care delivery strategies. With nursing and allied health and digital care establishments facing labor shortages, staffing companies and tech-enabled networks are filling the gap. The Healthcare staffing and workforce trends Market Forecast is also indicating that there are healthy demands in the acute care, long-term care, and remote care facilities. Besides, the focus on cost-effectiveness, regulatory adherence, and adaptive workforce requires is defining strategic staffing decisions. Technology acceptance and the increasing need in using contingent workforce solutions present this market.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 6.5% |

| Market Value In 2024 | USD 44.32 billion |

| Market Value In 2035 | USD 82.69 billion |

Introduction

The Healthcare staffing and workforce trends Market comprises staffing firms, workforce management systems, and consultancies that furnish clinicians, assistance staff, and administrators to healthcare providers. Workforce shortages have risen in significance as systems cope with increasing patient populations, aging populations and the digital revolution. To guarantee continuity, quality and compliance with the regulations, providers must have scaleable staffing models, including temporary manning to managed service programs. In the present state of disrupted pandemic-induced irregularity, there is a mushrooming of remote staffing and on‑demand workforce platforms, supported by Technology Adoption in Healthcare staffing and workforce trends and new workforce initiatives.

Key Market Drivers: What’s Fueling the Healthcare Staffing and Workforce Trends Market Boom?

- Development of Flexible Staffing and On‑Demand Workforce Platforms: Demand fluctuations (inside telehealth settings and the post-acute sector) have induced well-documented frustration in physicians and nurses, who will ultimately gravitate to on-demand workforce platforms that can reserve staff and increase workloads fast. These applications apply AI and predictive scheduling to minimise inefficiency, decrease cost, and enhance personnel satisfaction through enhanced shift management. This change corresponds to trends in Healthcare staffing and workforce Growth Drivers & Challenges seeing workforce agility as a critical issue in surge management, controlling overtime spending, and quality of care.

- Regulatory Pressures and Cost Containment: Regulatory requirements (i.e., staffing ratios requirements, licensure check-ins, bias reporting) are increasing the complexity under which operations are performed. In the meantime, increasing labor expenses and the fees for value-based payment are motivating providers to optimize workforce expenditure. Staffing agencies and workforce management solutions assist in complying with the requirements of the regulations and enhance cost-effectiveness of staffing. Such a trend is the driving force behind healthcare staffing and workforce trends Investment Opportunities, particularly in those areas where labor standards are particularly strict, and the value‑based reimbursement is implemented.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The market of healthcare staffing and workforce trends is changing due to the new technologies that use AI to provide scheduling, predictive demand analytics, credentialing platforms, and virtual workforce pools. On-demand staffing applications allow staff to bid on shifts, with automated license renewal being enabled by digital credential tracking applications. This leads to an optimized use of staff, quicker credential verification, and strategic staffing of the workforce, creating Emerging Opportunities of a digitalized workforce and workforce that can be delivered at scale.

Recent Developments:

In 2024, AMN Healthcare, for instance, set into motion a new sophisticated cloud clinician credentialing and scheduling system which features AI-driven shift forecasting for enhanced fill rates and compliance. At the same time, Nomad Health expanded its on-demand clinician platform internationally through collaborations with telehealth networks in Europe and APAC. These actions highlight important changing characteristics regarding the staffing and healthcare workforce; in particular, the global expansion of digital staffing marketplace, the use of technology for real-time workforce optimization, foretelling new available prospects in cross-border staffing and platform-enabled clinician pools.

Conclusion

The Healthcare staffing and workforce trends Market seems to have reached an inevitable stage at which the issue of workforce shortages, digital transformation, and changes in care delivery interact. With providers demanding flexibility in the staff, adherence to regulatory policies and efficient operations based on low cost, digital solutions and solutions that enable analytics are becoming invaluable. As telehealth, home care and aging populations continue to grow the strategic importance of optimized workforce delivery will continue to grow. Innovation, integration and agility represents the most compulsive strategies of long-term success by stakeholders such as healthcare systems, staffing companies and technology providers in this fast-changing market.

Related Reports

- The global Hospital and Clinical Design Market was valued at approximately USD 570 Million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035, reaching around USD 1,379.6 Million by the end of the forecast period.

- The global Healthcare Practices Market size was valued at USD 240.17 billion in 2024 and is anticipated to reach USD 515 billion by 2035, growing at a CAGR of 6.7% from 2025 to 2035.

Key Market Players

The workforce and staffing trends Competitive Landscape is a combination of traditional staffing companies, niche digital technology companies and vendors of workforce software. M&A is operating within staffing and workforce analytics. The areas of competition among companies are the speed of filling, tracking compliance, data-driven scheduling, and user interface. Managed service programmes and growth of virtual staffing networks are transforming staffing delivery in care settings. Some of the key players in the Healthcare Staffing and Workforce Trends industry are as:

AMN Healthcare, Cross Country Healthcare, Adecco Medical & Science, Randstad Healthcare, Aya Healthcare, CHG Healthcare (CompHealth), Maxim Healthcare Services, FlexCare Medical Staffing, Trustaff, StaffDNA (Allego Health), ShiftKey, Nomad Health, IntelyCare, CareRev, Health Carousel

- Contract Staffing (Dominant): Hospitals and health systems are willing to long-term contracts to fulfill the patient care staffing needs in areas where their permanent patient care staffing needs to meet long-term contract needs, such as nursing and allied health that can provide continuity and stability in the patient care provision.

- Permanent Placement: Permanent placements are the best option when hiring an executive and specialist, although recruitment of such positions cannot solve a shortage of frontline workers.

- Per Diem/Temp Staffing: The option provides flexibility to respond to changes in requirement on a daily or seasonal basis, particularly due to pandemics or spikes in demand at a holiday time.

- On Demand Platform Staffing: The most rapid model, which implements tech-based platform opportunities to pair clinicians with facilities in real-time and provides scalable and cost-effective resources to cover any shifts.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Nursing Staff (Dominant): The group of workers that is the most sought-after due to a constant shortage, exhaustion, and the necessity of their presence in every venue of care delivery.

- Allied Health Professionals: Consists of technicians and therapists; this segment is driven by the rising specialization in the diagnostics, rehabilitative, and telehealth services both in outpatient and home-based environments.

- Physicians: There are evolving staffing requirements (part-time, locum tenens, and telemedicine) in the face of the changing physician care models and burnout.

- Administrative Staff: These are needed to perform back-office services such as billing administrative, and scheduling services; they are associated with an increase in staffing as digitization proceeds, and/ or with complex patient throughput.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Sourcing & Recruitment (Dominant): Basic service provided by the staffing companies to meet high-volume, rapidly-changing needs, in particular hospitals and clinics experiencing retention issues.

- Workforce Management Services: Integrated payroll for efficiency in operations and compliances and shift optimization tools to boost operational efficiency and to lessen administrative burden.

- Credentialing and compliance: Certifies that healthcare professionals comply with regulations and licensure guidances, which become of growing importance due to cross-border staffing and the growth of telemedicine.

- Scheduling & Analytics: A rapidly expanding service on the basis of AI-powered platforms to determine the needs in staffing, optimize its schedule, and increase staff utilization and control costs.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals (Dominant): Staffing demand is mainly based in this setting because it is a complex environment, acuity levels, and staffing ratios are required in intensive and emergency health departments.

- Long -Term Care Facilities: Need sustained support staffing, especially geriatrics, due to the increasing trail of chronic illnesses and the ageing of the population.

- Ambulatory Care & Clinics: Require flexible and part time staffing where outpatient services, preventive healthcare and day surgeries are concerned.

- Home Health & Telehealth: The speediest developing portion due to the remote medicinal practice, management in stores, and developing value of virtual health administrations.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is the leading region in the Healthcare staffing and workforce trends Market due to well-developed healthcare frameworks, staffing ratio mandates by regulatory bodies, and established networks of staffing agencies. The Healthcare staffing and workforce trends Market Forecast REPORT reveals that there is a high degree of acceptance of managed staffing and digital workforce platforms among the U.S. and Canadian providers. Nevertheless, the fastest growing region is in Asia-Pacific (APAC) due to the increase in the demand of healthcare services, workforce problem in the aging big economies and fast adoption of digital platforms in tele-health and staffing in home care. Regional Insight indicates the marked growth in India, China, and Australia and that governments are teaming up to close the workforce gaps through workforce providers within the country and beyond.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Staffing and Workforce Trends Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Care settings

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare staffing and workforce trends Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare staffing and workforce trends Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare staffing and workforce trends Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Staffing Model type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare staffing and workforce trends Market – By Staffing Model type

5.1. Overview

5.1.1. Segment Share Analysis, By Staffing Model type, 2024 & 2035 (%)

5.1.2. Contract Staffing

5.1.3. Permanent Placement

5.1.4. Per Diem/Temp Staffing

5.1.5. On‑Demand Platform Staffing

(presents market segmentation by Staffing Model type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare staffing and workforce trends Market – By Role or Discipline

6.1. Overview

6.1.1. Segment Share Analysis, By Role or Discipline, 2024 & 2035 (%)

6.1.2. Nursing Staff

6.1.3. Allied Health Professionals

6.1.4. Physicians

6.1.5. Administrative Staff

(breaks down the market by Role or Discipline, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare staffing and workforce trends Market – By Service Type

7.1. Overview

7.1.1. Segment Share Analysis, By Service Type, 2024 & 2035 (%)

7.1.2. Sourcing & Recruitment

7.1.3. Workforce Management Services

7.1.4. Credentialing & Compliance

7.1.5. Scheduling & Analytics

(focuses on market segmentation by Service Type, helping the client prioritize specific crop Staffing Model types or end-use areas that offer significant business opportunities)

8. Healthcare staffing and workforce trends Market – By Care setting

8.1. Overview

8.1.1. Segment Share Analysis, By Care setting, 2024 & 2035 (%)

8.1.2. Hospitals

8.1.3. Long‑Term Care Facilities

8.1.4. Ambulatory Care & Clinics

8.1.5. Home Health & Telehealth

(describes the market division by Care setting of Staffing Model type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare staffing and workforce trends Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare staffing and workforce trends Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Staffing Model type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Role or Discipline, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Care setting, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Staffing Model type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Role or Discipline, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Care setting, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Staffing Model type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Role or Discipline, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Care setting, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Staffing Model type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Role or Discipline, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Care setting, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare staffing and workforce trends Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. AMN Healthcare

10.3.2. Cross Country Healthcare

10.3.3. Adecco Medical & Science

10.3.4. Randstad Healthcare

10.3.5. Aya Healthcare

10.3.6. CHG Healthcare (CompHealth)

10.3.7. Maxim Healthcare Services

10.3.8. FlexCare Medical Staffing

10.3.9. Trustaff

10.3.10. StaffDNA (Allego Health)

10.3.11. ShiftKey

10.3.12. Nomad Health

10.3.13. IntelyCare

10.3.14. CareRev

10.3.15. Health Carousel

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare staffing and workforce trends Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare staffing and workforce trends Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare staffing and workforce trends Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare staffing and workforce trends Market: Staffing Model type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Staffing Model type

TABLE 6: Global Healthcare staffing and workforce trends Market, by Staffing Model type 2022–2035 (USD Billion)

TABLE 7: Healthcare staffing and workforce trends Market: Role or Discipline Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Role or Discipline

TABLE 9: Global Healthcare staffing and workforce trends Market, by Role or Discipline 2022–2035 (USD Billion)

TABLE 10: Healthcare staffing and workforce trends Market: Service type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Service Type

TABLE 12: Global Healthcare staffing and workforce trends Market, by Service Type 2022–2035 (USD Billion)

TABLE 13: Healthcare staffing and workforce trends Market: Care setting

Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Care setting

TABLE 15: Global Healthcare staffing and workforce trends Market, by Care setting 2022–2035 (USD Billion)

TABLE 16: Healthcare staffing and workforce trends Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare staffing and workforce trends Market, by Region 2022–2035 (USD Billion)

TABLE 19: Healthcare staffing and workforce trends Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Healthcare staffing and workforce trends Market, by Staffing Model type (NA), 2022–2035 (USD Billion)

TABLE 21: Healthcare staffing and workforce trends Market, by Role or Discipline (NA), 2022–2035 (USD Billion)

TABLE 22: Healthcare staffing and workforce trends Market, by Service Type (NA), 2024–2035 (USD Billion)

TABLE 23: Healthcare staffing and workforce trends Market, by Care setting (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 25: U.S. Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 26: U.S. Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 27: U.S. Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 28: Canada Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 29: Canada Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 30: Canada Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 31: Canada Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 32: Mexico Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 33: Mexico Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 34: Mexico Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 35: Mexico Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 36: Healthcare staffing and workforce trends Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Healthcare staffing and workforce trends Market, by Staffing Model type (Europe), 2022–2035 (USD Billion)

TABLE 38: Healthcare staffing and workforce trends Market, by Role or Discipline (Europe), 2022–2035 (USD Billion)

TABLE 39: Healthcare staffing and workforce trends Market, by Service Type(Europe), 2022–2035 (USD Billion)

TABLE 40: Healthcare staffing and workforce trends Market, by Care setting (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 42: Germany Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 43: Germany Healthcare staffing and workforce trends Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 45: Italy Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 46: Italy Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 47: Italy Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 48: Italy Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 53: France Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 54: France Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 55: France Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 56: France Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 57: Russia Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 58: Russia Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 59: Russia Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 60: Russia Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 61: Poland Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 62: Poland Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 63: Poland Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 64: Poland Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 69: Healthcare staffing and workforce trends Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Healthcare staffing and workforce trends Market, by Staffing Model type (APAC), 2022–2035 (USD Billion)

TABLE 71: Healthcare staffing and workforce trends Market, by Role or Discipline (APAC), 2022–2035 (USD Billion)

TABLE 72: Healthcare staffing and workforce trends Market, by Service Type(APAC), 2022–2035 (USD Billion)

TABLE 73: Healthcare staffing and workforce trends Market, by Care setting (APAC), 2022–2035 (USD Billion)

TABLE 74: India Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 75: India Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 76: India Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 77: India Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 78: China Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 79: China Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 80: China Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 81: China Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 82: Japan Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 83: Japan Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 84: Japan Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 85: Japan Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 86: South Korea Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 87: South Korea Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 88: South Korea Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 89: South Korea Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 90: Australia Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 91: Australia Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 92: Australia Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 93: Australia Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 98: Brazil Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 99: Brazil Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 100: Brazil Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 101: Brazil Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 102: Argentina Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 103: Argentina Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 104: Argentina Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 105: Argentina Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 106: Colombia Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 107: Colombia Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 108: Colombia Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 109: Colombia Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 114: Israel Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 115: Israel Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 116: Israel Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 117: Israel Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 118: Turkey Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 119: Turkey Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 120: Turkey Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 121: Turkey Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 122: Egypt Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 123: Egypt Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 124: Egypt Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 125: Egypt Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Healthcare staffing and workforce trends Market, by Staffing Model type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Healthcare staffing and workforce trends Market, by Role or Discipline, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Healthcare staffing and workforce trends Market, by Service Type, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Healthcare staffing and workforce trends Market, by Care setting, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Healthcare staffing and workforce trends Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Staffing Model type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Staffing Model type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Role or Discipline Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Role or Discipline Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Staffing Model type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Staffing Model type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Care setting Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Care setting Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare staffing and workforce trends Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare staffing and workforce trends Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare staffing and workforce trends Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare staffing and workforce trends Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Healthcare staffing and workforce trends Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Healthcare staffing and workforce trends Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Healthcare staffing and workforce trends Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Healthcare staffing and workforce trends Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Healthcare staffing and workforce trends Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As the Director of Talent Acquisition at a U.S.-based hospital network, navigating post-pandemic workforce volatility was a major challenge. This report gave us the clarity we needed on shifting staffing trends, contract labor costs, and regional skill shortages. The data on nursing attrition rates and allied health workforce mobility was especially impactful. We realigned our hiring strategies for 2025 based on this report’s forecasts, and it’s already improving our retention metrics."

- Michelle Reynolds, Workforce Strategy Lead, United States

- "We are a healthcare consulting firm advising regional hospitals in Germany, and this report became a strategic asset in 2025 planning. The insights into EU regulatory changes, locum tenens staffing shifts, and the rising gig workforce in healthcare helped us guide our clients with precision. It’s not just numbers, it’s the context and clarity that sets this research apart. Highly recommended for HR leaders and hospital administrators alike."

- Lukas Meier, Healthcare Workforce Analyst, Germany

- "In Southeast Asia, where healthcare systems are rapidly evolving, talent shortages are a critical bottleneck. This market research report provided region-specific data on workforce supply-demand gaps, nurse migration trends, and tech-enabled staffing solutions. Thanks to these actionable insights, we were able to secure funding for a hybrid staffing initiative in 2025 aligned with projected needs. Invaluable resource!"

- Ananya Patel, Strategic Planning Officer, Singapore

This report has been meticulously authored by the Healthcare Insights & Strategy Team at Quants & Trends, a trusted name in healthcare market intelligence. With over a decade of experience in decoding workforce patterns and staffing economics, our analysts bring deep domain expertise in healthcare operations, labor market dynamics, regulatory compliance, and digital workforce transformation.

Our team includes healthcare economists, workforce planners, and policy analysts who specialize in tracking macro- and micro-trends that impact provider networks, staffing agencies, telehealth platforms, and public health institutions. The insights in this report are backed by rigorous primary research, interviews with healthcare HR decision-makers, and real-world data from over 20 global markets.

The Healthcare Staffing and Workforce Trends Market 2025 report is crafted to help stakeholders, whether hospital administrators, HR executives, workforce tech providers, or investors, make informed, strategic decisions in a rapidly evolving employment landscape. From contract labor cost inflation to nurse retention strategies and AI-assisted scheduling tools, this report offers clarity in complexity.

If you're looking to build competitive strategies, reduce attrition, or expand staffing operations in the healthcare sector, this research offers not just data, but foresight.

Connect with us on LinkedIn to stay updated with our latest healthcare market insights and future reports.