Market Outlook

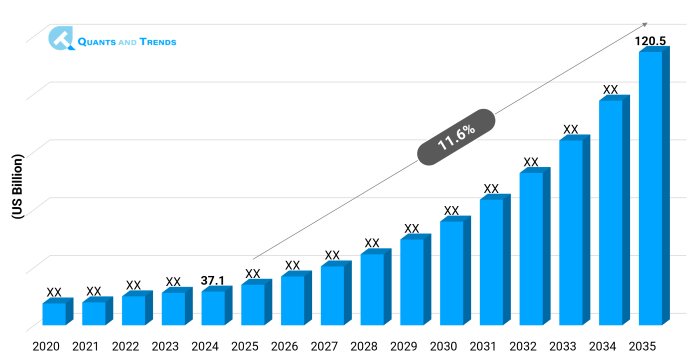

The global Healthcare Access & Equity Market size was assessed at USD 37.1 billion in 2024 and is expected to reach approximately USD 120.5 billion by 2035, growing at a CAGR of around 11.6% from 2025 to 2035. Using 2024 as the base year, the historical study covers 2020–2023, with predictions starting in 2025–2035.

The Healthcare Access & Equity Market is gaining attention as health systems, governments, and communities aim to remove barriers that prevent people from receiving quality care. Growing awareness of health disparities, the rise in chronic illnesses along with the push for fairer distribution of medical resources are driving this momentum. The goal is to make care more approachable, culturally aware and lesser expensive for all groups, irrespective of background, location or income. The shift towards equity is not just a social goal it is becoming a strategic priority for healthcare providers, payers and policymakers seeking better patient outcomes and long term sustainability.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 11.6% |

| Market Value In 2024 | USD 37.1 billion |

| Market Value In 2035 | USD 120.5 billion |

Introduction

Beyond just making services available, healthcare equity and access guarantee that everyone receives care that is individualized for them without prejudice. This market involves solutions and services that remove economic, cultural, and systemic barriers, enabling equal opportunities for treatment. Rising global health inequalities, especially in rural and low-income communities, highlight the urgency for strategic interventions. To bridge care gaps, programs now use technology, community partnerships & policy changes. Investment in equal access is becoming more & more recognized as a moral duty and a quantifiable factor in enhancing public health and lowering long term expenses as healthcare system changes.

Key Market Drivers: What’s Fueling the Healthcare Access & Equity Market Boom?

- Rising Burden of Chronic Diseases-One of the main factor escalating the growth of chronic disease management and posing challenges to the healthcare access and equity market is the rise in chronic illnesses like diabetes, cardiovascular disease & respiratory disorders. Globally, over 74% of deaths each year are caused by chronic diseases, many of which can be avoided with early intervention, according to the WHO. Higher mortality rates among marginalized populations have resulted from unequal access to prompt diagnosis and treatment. The growing emphasis on targeted interventions, mobile health units, and telemedicine is improving outreach, especially in rural areas, thereby enhancing the Healthcare Access and Equity Market Size & Share.

- Policy and Regulatory Push for Health Equity-Governments and health agencies are increasingly implementing policies to cover access gaps. For example, the US Department of Health and Human Services has included equity goals in its plans to improve the quality of healthcare in the US, while the European Commission has set aside money for health projects that span borders. These programs foster an environment that is conducive to the development of inclusive care models by providers and IT firms. Such Chronic Disease Management Investment Opportunities are not just regulatory compliance efforts they are becoming competitive differentiators. Clear regulatory frameworks and financing channels are likely to speed up innovation and uptake in areas that don't get enough of them.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation in the healthcare access and equity market comes from personalized treatment models, community-based outreach and the use of technology. AI powered analytics can now find high risk populations which makes it possible to target interventions more effectively. Digital health platforms include language translation, teleconsultations, and health literacy resources to help people who don't have access to these services. Another model is the public private partnerships, quite promising which combines resources, technology and uses local networks to increase reach. These developments are turning equity from a theoretical idea in policy into quantifiable, expandable results.

Recent Developments:

In 2025, Teladoc Health started a multilingual telehealth service that was aimed at rural and immigrant populations. It had tools for translation and cultural adaption. Philips Healthcare worked with a public health agency in Southeast Asia the same year to set up mobile clinics with diagnostic imaging and maternal care services. These steps are in line with a larger trend in the sector toward localized, equity-focused solutions that leverage technology, outreach, and preventative care. This is in line with both governmental requirements and the opportunity for market growth.

Conclusion

The Healthcare Access & Equity Market is becoming an important part of the modern health systems, moving far above to get results that can be evaluated. As chronic illness grows more prevalent, more stringent regulations must be followed along with technology advances where stakeholders are emphasizing justice as a means of advancing. The combination of solutions, services, and targeted initiatives is filling in care gaps that have existed for a long time, especially in communities that are at risk. The market will keep growing as investments increase and new ideas become more mature. This will create big chances for people who can find a balance between scalability, cultural sensitivity, and cost-effectiveness in their Healthcare Access & Equity Market Forecast plans.

Related Reports

- The global Healthcare Policy and Regulation Market was valued at approximately USD 5.75 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035, reaching around USD 13.91 billion by the end of the forecast period.

- The global Healthcare Financing Market was valued at approximately USD 2.38 trillion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2035, reaching around USD 5.16 trillion by the end of the forecast period.

Key Market Players

The Healthcare Access & Equity Market Competitive Landscape includes technology companies, healthcare systems, payers and nonprofits that all want to close care gaps and making it easier for people who don't have enough access to care. Market participants are coming up with new ideas by using integrated care platforms, multilingual support tools, telehealth solutions and community outreach programs that are made to fit the needs of each area. Strategic mergers & acquisitions and partnerships across sectors are making it possible to offer more services and have better data capabilities. A lot of businesses are also aligning their products with policy driven equity initiatives to get money and more people to use them. Some of the most important people in the Healthcare Access & Equity field are as:

Cerner Corporation, Epic Systems, Philips Healthcare, Allscripts Healthcare Solutions, UnitedHealth Group, Optum, McKesson Corporation, Athenahealth, GE Healthcare, Medtronic, Siemens Healthineers, Change Healthcare, eClinicalWorks, NextGen Healthcare, Teladoc Health

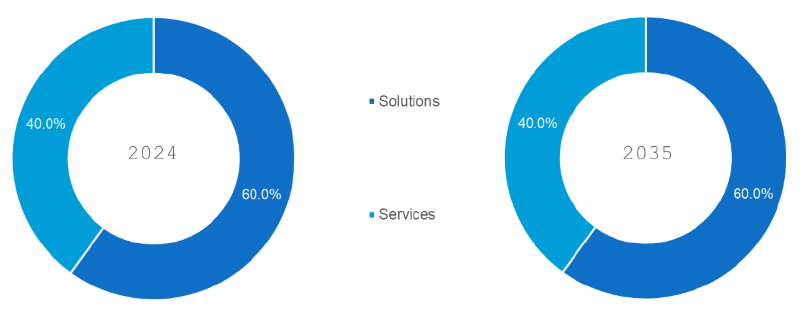

- Solutions: Digital platforms, data analytics tools, and patient engagement portals designed to track disparities, improve care delivery, and align with equity initiatives. Dominating segment, as most providers prioritize scalable, tech-enabled solutions.

- Services: Consulting, community outreach, training, and operational support programs that help organizations implement access and equity strategies effectively. Fastest-growing segment, driven by demand for human-led, on-ground interventions alongside digital adoption.

Note: Charts and figures are illustrative only. Contact us for verified market data.

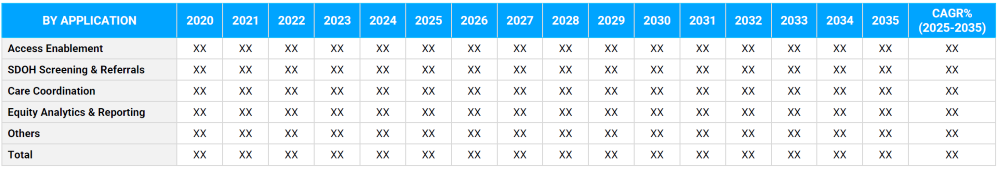

Segmentation By Application

- Access Enablement: Programs and platforms that simplify appointment booking, provider matching, and telehealth access for underserved populations. Dominates market share due to direct impact on patient reach and engagement.

- SDOH Screening & Referrals: Tools and workflows for identifying social determinants of health and connecting patients to relevant community services. Fastest-growing segment, supported by policy mandates and payer incentives.

- Care Coordination: Integrated solutions that link multiple providers, ensuring continuity of care and better patient outcomes.

- Equity Analytics & Reporting: Dashboards and reporting systems to track disparities, measure program effectiveness, and meet compliance requirements.

- Others: Includes benefits & payer navigation, transportation and housing assistance, digital inclusion programs, health literacy campaigns, quality measurement tools, and risk stratification solutions.

Note: Charts and figures are illustrative only. Contact us for verified market data.

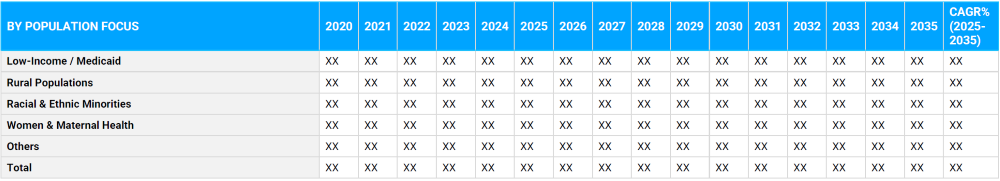

- Low-Income / Medicaid: Programs tailored for affordability, preventive care, and improved health literacy. Dominates segment share, as financial barriers remain a major access challenge.

- Rural Populations: Telehealth and mobile health clinics bridging care gaps in remote areas. Fastest-growing segment, fueled by broadband expansion and mobile care adoption.

- Racial & Ethnic Minorities: Culturally tailored services and multilingual support to overcome language and trust barriers.

- Women & Maternal Health: Initiatives focused on prenatal, postnatal, and reproductive health access.

- Others: Children & adolescents, elderly populations, people with disabilities, LGBTQ+ communities, and migrants & refugees, each with specialized access and equity requirements.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Providers: Hospitals, clinics, and primary care centers implementing solutions to improve patient access and reduce disparities. Dominating end-user group due to their central role in patient interaction.

- Payers: Insurance companies incorporating equity metrics into plan benefits and reimbursement structures.

- Public Health Agencies: Government and municipal bodies focusing on large-scale equity programs and public health interventions. Fastest-growing user group, boosted by public funding and national health policy support.

- NGOs / Non-profits: Organizations delivering targeted outreach, education, and support services in high-need communities.

- Others: Employers, life sciences firms, and community-based organizations addressing workplace health equity and local population health needs.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America dominates the Healthcare Access & Equity Market owing to the advanced infrastructure, strong policy frameworks and significant investment in Chronic Disease Management Industry Analysis. With their extensive insurance plans and community health initiatives, the US and Canada sets the standard. This is due to its vast underserved population, rapid adoption of technology & government measures to expand access to healthcare in rural areas, Asia-Pacific is the region with the fastest rate of growth. The region is a top target for Chronic Disease Management Investment Opportunities during the next ten years because nations like China, India, and Indonesia are putting public-private partnerships and mobile health programs into place.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Access & Equity Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Access & Equity Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Access & Equity Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Access & Equity Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. End-User & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Access & Equity Market – By Offering

5.1. Overview

5.1.1. Segment Share Analysis, By Offering, 2024 & 2035 (%)

5.1.2. Solutions

5.1.3. Services

(presents market segmentation by Offering, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Access & Equity Market – By Application

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

6.1.2. Access Enablement

6.1.3. SDOH Screening & Referrals

6.1.4. Care Coordination

6.1.5. Equity Analytics & Reporting

6.1.6. Others

(breaks down the market by Application, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Access & Equity Market – By End-User

7.1. Overview

7.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

7.1.2. Providers

7.1.3. Payers

7.1.4. Public Health Agencies

7.1.5. NGOs / Non-profits

7.1.6. Others

(focuses on market segmentation by End-User, helping the client prioritize specific crop Offerings or end-use areas that offer significant business opportunities)

8. Healthcare Access & Equity Market – By Population Focus

8.1. Overview

8.1.1. Segment Share Analysis, By Population Focus, 2024 & 2035 (%)

8.1.2. Low-Income / Medicaid

8.1.3. Rural Populations

8.1.4. Racial & Ethnic Minorities

8.1.5. Women & Maternal Health

8.1.6. Others

(breaks down the market by type of Population Focus, helping stakeholders understand user accessibility preferences and compatibility trends across regions and use-cases)

9. Healthcare Access & Equity Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Access & Equity Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Offering, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Population Focus, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Offering, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Population Focus, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Offering, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Population Focus, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Offering, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Population Focus, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Access & Equity Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Koninklijke Philips N.V.

10.3.2. Allscripts Healthcare Solutions

10.3.3. IBM Corporation

10.3.4. Medtronic

10.3.5. Cerner Corporation

10.3.6. Siemens Healthineers

10.3.7. Epic Systems Corporation

10.3.8. WellSky

10.3.9. Teladoc Health

10.3.10. DarioHealth

10.3.11. Omada Health

10.3.12. iHealth Labs

10.3.13. Health Catalyst

10.3.14. eClinicalWorks

10.3.15. Validic

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Access & Equity Market: Future Market Outlook (2025–2035)

11.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.2. Disruptive Technologies Impact

11.3. Emerging Business Trends

11.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Access & Equity Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Access & Equity Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Access & Equity Market: Offering Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Offering

TABLE 6: Global Healthcare Access & Equity Market, by Offering 2022–2035 (USD Million)

TABLE 7: Healthcare Access & Equity Market: Application Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Application

TABLE 9: Global Healthcare Access & Equity Market, by Application 2022–2035 (USD Million)

TABLE 10: Healthcare Access & Equity Market: End-User Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by End-User

TABLE 12: Global Healthcare Access & Equity Market, by End-User 2022–2035 (USD Million)

TABLE 13: Healthcare Access & Equity Market: Population Focus Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Population Focus

TABLE 15: Global Healthcare Access & Equity Market, by Population Focus 2022–2035 (USD Million)

TABLE 16: Healthcare Access & Equity Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Access & Equity Market, by Region 2022–2035 (USD Million)

TABLE 19: Healthcare Access & Equity Market, by Country (North America), 2022–2035 (USD Million)

TABLE 20: Healthcare Access & Equity Market, by Offering (North America), 2022–2035 (USD Million)

TABLE 21: Healthcare Access & Equity Market, by Application (North America), 2022–2035 (USD Million)

TABLE 22: Healthcare Access & Equity Market, by Population Focus (North America), 2022–2035 (USD Million)

TABLE 23: Healthcare Access & Equity Market, by End-User (North America), 2022–2035 (USD Million)

TABLE 24: U.S. Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 25: U.S. Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 26: U.S. Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 27: U.S. Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 28: Canada Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 29: Canada Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 30: Canada Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 31: Canada Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 32: Mexico Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 33: Mexico Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 34: Mexico Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 35: Mexico Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 36: China Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 37: China Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 38: China Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 39: China Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 40: India Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 41: India Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 42: India Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 43: India Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 44: Japan Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 45: Japan Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 46: Japan Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 47: Japan Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 48: South Korea Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 49: South Korea Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 50: South Korea Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 51: South Korea Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 52: Australia Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 53: Australia Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 54: Australia Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 55: Australia Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 56: Germany Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 57: Germany Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 58: Germany Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 59: Germany Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 60: France Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 61: France Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 62: France Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 63: France Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 64: Italy Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 65: Italy Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 66: Italy Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 67: Italy Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 68: Spain Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 69: Spain Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 70: Spain Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 71: Spain Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 72: U.K. Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 73: U.K. Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 74: U.K. Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 75: U.K. Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 76: Russia Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 77: Russia Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 78: Russia Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 79: Russia Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 80: Brazil Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 81: Brazil Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 82: Brazil Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 83: Brazil Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 84: Argentina Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 85: Argentina Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 86: Argentina Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 87: Argentina Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 88: Colombia Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 89: Colombia Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 90: Colombia Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 91: Colombia Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 92: Saudi Arabia Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 93: Saudi Arabia Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 94: Saudi Arabia Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 95: Saudi Arabia Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 96: UAE Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 97: UAE Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 98: UAE Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 99: UAE Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 100: South Africa Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 101: South Africa Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 102: South Africa Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 103: South Africa Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 104: Israel Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 105: Israel Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 106: Israel Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 107: Israel Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

TABLE 108: Turkey Healthcare Access & Equity Market, by Offering, 2022–2035 (USD Million)

TABLE 109: Turkey Healthcare Access & Equity Market, by Application, 2022–2035 (USD Million)

TABLE 110: Turkey Healthcare Access & Equity Market, by Population Focus, 2022–2035 (USD Million)

TABLE 111: Turkey Healthcare Access & Equity Market, by End-User, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Healthcare Access & Equity Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Offering Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Offering Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 15: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: Population Focus Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Population Focus Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Healthcare Access & Equity Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Access & Equity Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Access & Equity Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Access & Equity Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Access & Equity Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Healthcare Access & Equity Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: UK Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Healthcare Access & Equity Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Healthcare Access & Equity Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Healthcare Access & Equity Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Healthcare Access & Equity Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "As a healthcare policy advisor in Washington, I found the Healthcare Access and Equity Market Research Report particularly impactful. The analysis on disparities in rural versus urban healthcare delivery, coupled with quantitative data on patient access barriers, provided a strong foundation for shaping funding proposals. What set this report apart was its ability to bridge evidence with actionable recommendations, helping our team prioritize which equity-driven initiatives could realistically succeed within the current policy and reimbursement frameworks. It gave us the confidence to present a data-driven strategy to stakeholders who demand accountability and measurable outcomes."

- Dr. Melissa Grant, Healthcare Policy Advisor, United States

- "In the UK, where national health priorities emphasize equitable care, this report provided invaluable insights. The Healthcare Access and Equity Market Research Report outlined regional differences in care availability, detailed the socioeconomic factors influencing uptake, and benchmarked best practices across European systems. As part of a non-profit healthcare consortium in London, we used these findings to refine our equity programs and reallocate resources toward underserved populations. The transparency of methodology and depth of case studies made it a trusted reference for our board and reinforced our confidence in implementing data-driven interventions."

- James Whitmore, Program Development Director, United Kingdom

- "Working as a strategy lead for a healthcare technology firm in Tokyo, I needed clarity on how digital solutions could improve access in underserved communities across APAC. The Healthcare Access and Equity Market Research Report offered detailed, country-level insights on infrastructure gaps, telemedicine adoption rates, and regulatory enablers in Japan, South Korea, and Southeast Asia. The actionable intelligence allowed us to identify high-priority markets and form partnerships with local providers. What I appreciated most was how the report translated complex equity challenges into practical business opportunities, giving us the confidence to align our innovation strategy with real societal needs."

- Kenji Watanabe, Healthcare Strategy Lead, Japan

The Healthcare Access and Equity Market 2025 report has been authored by a dedicated team of healthcare market research professionals with extensive experience in analyzing disparities in healthcare delivery, policy frameworks, and patient access outcomes across global markets. With more than a decade of expertise in health economics, public health research, and market intelligence, our analysts bring a unique perspective that blends data rigor with a deep understanding of healthcare systems worldwide.

Our research process integrates primary interviews with policymakers, payers, providers, and industry leaders, alongside secondary research from validated healthcare databases and peer-reviewed studies. This multi-source approach ensures that the insights presented are both evidence-based and strategically relevant.

The report goes beyond highlighting trends, it translates findings into actionable guidance for decision-makers. Whether you are a policy advisor seeking to close equity gaps, a healthcare provider designing outreach programs, or an investor evaluating socially responsible opportunities, this report offers data-driven clarity to support impactful, real-world business and policy decisions.

By bridging market intelligence with equity-focused strategies, this report empowers organizations to build inclusive healthcare solutions that align with both societal needs and sustainable business growth.

To explore more of our healthcare market research expertise and stay updated on our latest insights, connect with us on LinkedIn.