Market Outlook

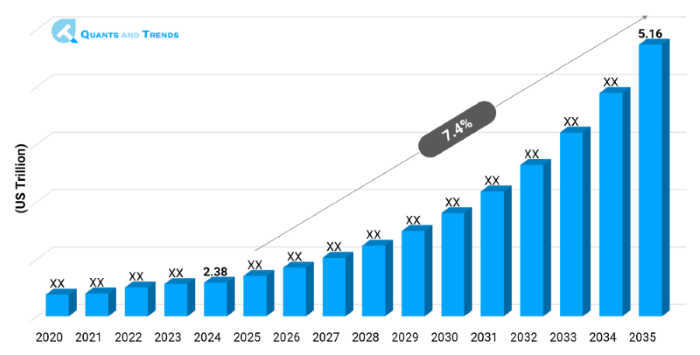

The global Healthcare Financing market was valued at approximately USD 2.38 trillion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2035, reaching around USD 5.16 trillion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Market for Healthcare Financing is showing a strong growth in the world market with surge in the healthcare spending more people are aging, and there is a surge in demand of medically insured services. The Healthcare Financing Market Report indicates new funding system, including value-based care, medical lending, and online insurance markets. Innovation is being spurred by tax encouragements, government assistance as well as personal investments. Local North American and APAC perspectives have found positive policy systems and health insurance coverage in the rising middle classes. As the telehealth payment systems and micro-insurance emerge, the Healthcare Financing Market Forecast indicates a continued growth in both mature and growing economics, owing to the dynamics in the market and altered patient behavior.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 7.4% |

| Market Value In 2024 | USD 2.38 trillion |

| Market Value In 2035 | USD 5.16 trillion |

Introduction

Healthcare Financing Market consists of the traditional health insurance, medical loans, and digital payment options, as well as alternative methods of patient care funding. The following industry analysis looks at the current sector trends, the value chain and investment opportunities. It discusses the cooperation between hospitals, governments, insurers, and fintech innovators to provide cheap, fair financing. Market drivers identified as the key force, including the reform of regulation, growing burden of chronic disease, and the adoption of technology, are projected. The report provides an idea of innovation in digital lending platform, peer-to-peer financing, and embedded insurance. It also predicts major trends in healthcare financing remodeling the patterns of service deliveries and the health results in various markets.

Key Market Drivers: What’s Fueling the Healthcare Financing Market Boom?

- Increased health care costs and out of pocket burden: As the cost of health care rises alongside enhanced diagnostics, treatment, and population aging factors patients are often hit by high cost of health care out of their pocket. Healthcare Financing Market Size & Share is growing because the consumers have resorted to loans, health credit lines, and insurance-based products. New financing plans are being encouraged by governments and by individual bodies, and this is causing further penetration of the point-of-care financing and credit-based payments.

- Regulatory Support and Policy Reform: Regulatory & policy overview shows that a majority of regions are making requirements to universal health coverage and reimbursement reforms. In Europe, North America, and APAC, there is the support of public policy efforts in subsidy models, regulation of premiums and digital claims processing. As the Healthcare Financing Industry Analysis indicates, such frameworks prompt the participation of both the private and public stakeholders to develop scalable insurance solutions to cut fraud and generate greater financial access.

- Digital Technology Adoption and Innovation: Adoption of technology in healthcare funding is spreading faster. Blockchain-based claims verification, AI-enabled credit scoring, mobile payment tools and Fintech platforms increase transparency and shorten the processing time. According to the Healthcare Financing Market Forecast, embedded insurance models, tele‑insurance patterns, and micro‑insurance models display the high momentum in emerging markets particularly. Market segment ability is driving towards the digital wallet and pay ‚here-or-later services targeting the unserved and underserved segments.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

To improve patient access, AI and big data analytics platforms are being combined with embedded payment platforms. Smart contracts using Blockchain technology facilitate the claims processing and alleviate fraud. Alternate credit paths come in the form of peer-to-peer and crowd-funding. New opportunities include telehealth connected financing, subscription based payment services and outcome based reimbursement. Such innovations are in line with major trends in healthcare funding, which addresses the fact that they can be approved quicker, are more cost-effective and more transparent among public and private stakeholders.

Recent Developments:

In 2024, A fintechoption programs joint venture of CareCredit with a major telehealth company makes virtual visits and in-home care instant financed.

Conclusion

To summarize, the Healthcare Financing Market Forecast indicates the direction of an increase in demand due to aging populations, the adoption of digital, and a changing healthcare model. Value-based care, micro-insurance, and online lending make matters better in terms of affordability and access. New prospects in telehealth‑connected payment and embedded credit platforms are quite promising. The traditional insurance form is still leading in advanced markets whereas digital finance models are the most rapidly developing in Asia‑Pacific and Latin America. Inclusive and sustainable healthcare financing has been coined by key trends in healthcare financing, including the technologies-driven loan disbursement and regulations. These trends provide value to the healthcare environment in terms of transformation and achievement of better results, both in the sphere of public and private health care.

Related Reports

- The global Healthcare Policy and Regulation Market was valued at approximately USD 5.75 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035, reaching around USD 13.91 billion by the end of the forecast period.

- The global Healthcare Access and Equity Market size was assessed at USD 37.1 billion in 2024 and is expected to reach approximately USD 120.5 billion by 2035, growing at a CAGR of around 11.6% from 2025 to 2035.

Key Market Players

Healthcare Financing Competitive Landscape will be determined by incumbent insurers, banks, fintech companies, and government initiatives to create novel funding methods to work together. Digital disruptors CareCredit, Medici, and ZestHealth, as well as Credgenics, complement traditional payers such as UnitedHealthcare, Anthem, Aetna, and Cigna. This combination is fuelling pricing innovation, expedited approvals and individual plans. There is a potential in investment in digital lending, embedded insurance, and products in healthcare savings. Competition also promotes collaborations between the insurers and the fintech startups seeking to increase their presence and user experience at various locations. Some of the key players in the Healthcare Financing industry are as:

UnitedHealthcare, Anthem, Inc., Aetna (CVS Health), Cigna Corporation, CareCredit (Synchrony Financial), Medici (digital health financing), ZestHealth, Credgenics, Maven Clinic (women’s health financing), Oscar Health (insurance financing), AXA Health, Bupa Global, Allianz Care, Prudential Healthcare (Asia), Bajaj Finserv (India)

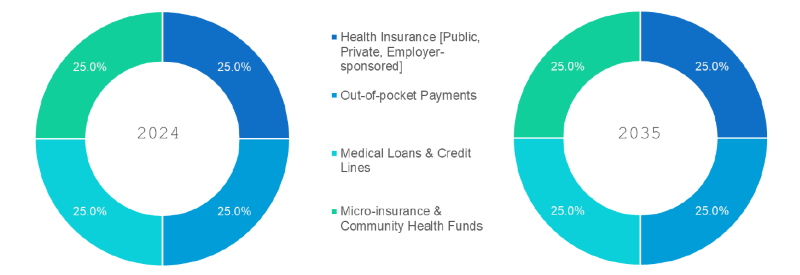

- Health Insurance (Public, Private, Employer-paid) (Dominating): Health insurance covers financial burden on medical costs by lowering the financial burden of the patient with either investor or government premium payment.

- Out-of-pocket Payments: Patients are squarely forced to cover the healthcare expenses themselves with no external assistance which in some instances can be distressing, particularly among the lower income groups and the underinsured people.

- Medical Loans & Credit Lines (Fastest-Growing): This type of financing solution gives the patient with structured repayment options on costly procedures, and is typically executed by banks, NBFCs, or the fintech sector.

- Micro-insurance & Community Health Funds: Low cost, localized insurance programs, with collective pooling of funds, provide a small amount of protection of basic health services to the underserved rural or urban groups.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Government/Public Health Programs: State financed efforts include the governments of states that finance their own efforts to provide universal access to basic medical services including subsidies and financing.

- Private Insurers (Dominating): These include individuals who have more customized health programs where the programs are based on premiums; specialized services, speed, and expanded treatment coverage.

- Hospitals & Health System: Current development includes providers offering hospitals on house payment structures or merging with a financial institution to provide a loan to allow patients more payment flexibility and help increase patient numbers.

- Fintech & Alternative Finance Providers (Fastest-Growing): Fintech-driven platforms offer instant medical loans, EMIs and online insurance policies, making them accessible to more people and ensuring their transparent financial dealings.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospital/Clinic based Financing (Dominating): Direct point-of-care financing allows patients to have access to credit or installment plans by working with lending institutions in the medical facilities.

- Digital Platforms (Web & Mobile Apps) (Fastest-Growing): Web and mobile applications provide an easy way of processing, authorizations and release of funds on medical loans resulting in the real time access of funds anywhere 24/7.

- Aggregators Third party Aggregators and brokers: Aggregators and brokers note the available finance choices, comparing and offering various alternatives that connect the patients with appropriate insurers or lenders depending on the need and eligibility.

- Employer-based Health Financing: Health benefits or insurance covers are offered as pre-paid by the companies to the employees, usually with wellness services and wellness prevention plans.

Note: Charts and figures are illustrative only. Contact us for verified market data.

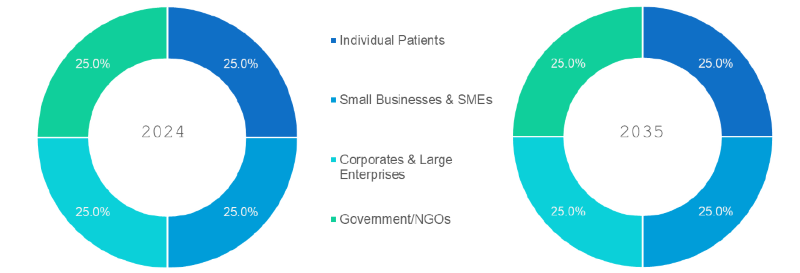

- Single Patients (Dominating): People utilize financing to meet anticipated or accidental medical expenses, particularly with surgeries, long-term treatment or chronic sickness.

- Small Businesses & SMEs (Fastest-Growing): Consider providing low cost low cover health packages or group health insurance to its employees and this helps to increase the retention of its workforce, as well as help to reduce the costs of health related absentees.

- Corporates and Large Enterprises: Repurpose the staff health by implementing well-suited financing and wellness systems with frequent integration with the HR and insurance management systems.

- Government/NGOs: Support financing programs or health subsidies on underserved communities, particularly in rural and vulnerable populations in cities.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The regional dynamics are quite diverse: North America leads Healthcare Financing Market because the established insurance system, high level of healthcare spending, and regulation is present in the country. In the meantime, the region with the highest growth is the Asia-Pacific, which is caused by the increasing cost of healthcare, low levels of insurance coverage, and active fintech implementation. The local report shows that Latin America and MEA are the regions that incorporate a digital credit and micro-insurance model quite swiftly. In Europe, participation of mature public-private programs and adherence of policies are other contributions. Regulatory & policy overview underlines positive framework in different regions to encourage inclusive funding and scalable projects to address access to financial barrier in healthcare.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Financing Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Financing Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Financing Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Financing Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Financing Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Financing Market – By Financing Type

5.1. Overview

5.1.1. Segment Share Analysis, By Financing Type, 2024 & 2035 (%)

5.1.2. Health Insurance

5.1.3. Out-of-pocket Payments

5.1.4. Medical Loans & Credit Lines

5.1.5. Micro-insurance & Community Health Funds

(presents market segmentation by Financing Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Financing Market – By Service Provider

6.1. Overview

6.1.1. Segment Share Analysis, By Service Provider, 2024 & 2035 (%)

6.1.2. Government/Public Health Programs

6.1.3. Private Insurers

6.1.4. Hospitals & Health Systems

6.1.5. Fintech & Alternative Finance Providers

(breaks down the market by Service Provider, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Financing Market – By Delivery Mode

7.1. Overview

7.1.1. Segment Share Analysis, By Delivery Mode, 2024 & 2035 (%)

7.1.2. Hospital/Clinic-based Financing

7.1.3. Digital Platforms (Web & Mobile Apps)

7.1.4. Third-party Aggregators & Brokers

7.1.5. Employer-integrated Health Financing

(focuses on market segmentation by Delivery Mode, helping the client prioritize specific crop Financing Types or end-use areas that offer significant business opportunities)

8. Healthcare Financing Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Individual Patients

8.1.3. Small Businesses & SMEs

8.1.4. Corporates & Large Enterprises

8.1.5. Government/NGOs

(describes the market division by End-User of Financing Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Financing Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Financing Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Trillion)

9.2.4. North America Market Size and Forecast, By Financing Type, 2024 - 2035 (US$ Trillion)

9.2.5. North America Market Size and Forecast, By Service Provider, 2024 - 2035 (US$ Trillion)

9.2.6. North America Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Trillion)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Trillion)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Financing Type, 2024 - 2035 (US$ Trillion)

9.2.8.3. U.S. Market Size and Forecast, By Service Provider, 2024 - 2035 (US$ Trillion)

9.2.8.4. U.S. Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Trillion)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Trillion)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Financing Type, 2024 - 2035 (US$ Trillion)

9.2.9.3. Canada Market Size and Forecast, By Service Provider, 2024 - 2035 (US$ Trillion)

9.2.9.4. Canada Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Trillion)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Trillion)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Financing Type, 2024 - 2035 (US$ Trillion)

9.2.10.3. Mexico Market Size and Forecast, By Service Provider, 2024 - 2035 (US$ Trillion)

9.2.10.4. Mexico Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Trillion)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Trillion)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Financing Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. UnitedHealthcare

10.3.2. Anthem, Inc.

10.3.3. Aetna (CVS Health)

10.3.4. Cigna Corporation

10.3.5. CareCredit (Synchrony Financial)

10.3.6. Medici (digital health financing)

10.3.7. ZestHealth

10.3.8. Credgenics

10.3.9. Maven Clinic (women’s health financing)

10.3.10. Oscar Health (insurance financing)

10.3.11. AXA Health

10.3.12. Bupa Global

10.3.13. Allianz Care

10.3.14. Prudential Healthcare (Asia)

10.3.15. Bajaj Finserv

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Financing Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Financing Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Financing Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Financing Market: Financing Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Financing Type

TABLE 6: Global Healthcare Financing Market, by Financing Type 2022–2035 (USD Trillion)

TABLE 7: Healthcare Financing Market: Service Provider Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Service Provider

TABLE 9: Global Healthcare Financing Market, by Service Provider 2022–2035 (USD Trillion)

TABLE 10: Healthcare Financing Market: Delivery Mode Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Delivery Mode

TABLE 12: Global Healthcare Financing Market, by Delivery Mode 2022–2035 (USD Trillion)

TABLE 13: Healthcare Financing Market: End-User Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Healthcare Financing Market, by End-User 2022–2035 (USD Trillion)

TABLE 16: Healthcare Financing Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Financing Market, by Region 2022–2035 (USD Trillion)

TABLE 19: Healthcare Financing Market, by Country (NA), 2022–2035 (USD Trillion)

TABLE 20: Healthcare Financing Market, by Financing Type (NA), 2022–2035 (USD Trillion)

TABLE 21: Healthcare Financing Market, by Service Provider (NA), 2022–2035 (USD Trillion)

TABLE 22: Healthcare Financing Market, by Delivery Mode (NA), 2024–2035 (USD Trillion)

TABLE 23: Healthcare Financing Market, by End-User (NA), 2022–2035 (USD Trillion)

TABLE 24: U.S. Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 25: U.S. Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 26: U.S. Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 27: U.S. Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 28: Canada Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 29: Canada Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 30: Canada Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 31: Canada Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 32: Mexico Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 33: Mexico Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 34: Mexico Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 35: Mexico Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 36: Healthcare Financing Market, by Country (Europe), 2022–2035 (USD Trillion)

TABLE 37: Healthcare Financing Market, by Financing Type (Europe), 2022–2035 (USD Trillion)

TABLE 38: Healthcare Financing Market, by Service Provider (Europe), 2022–2035 (USD Trillion)

TABLE 39: Healthcare Financing Market, by Delivery Mode(Europe), 2022–2035 (USD Trillion)

TABLE 40: Healthcare Financing Market, by End-User (Europe), 2022–2035 (USD Trillion)

TABLE 41: Germany Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 42: Germany Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 43: Germany Healthcare Financing Market, by v, 2022–2035 (USD Trillion)

TABLE 44: Germany Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 45: Italy Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 46: Italy Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 47: Italy Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 48: Italy Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 49: United Kingdom Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 50: United Kingdom Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 51: United Kingdom Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 52: United Kingdom Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 53: France Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 54: France Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 55: France Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 56: France Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 57: Russia Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 58: Russia Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 59: Russia Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 60: Russia Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 61: Poland Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 62: Poland Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 63: Poland Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 64: Poland Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 65: Rest of Europe Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 66: Rest of Europe Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 67: Rest of Europe Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 68: Rest of Europe Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 69: Healthcare Financing Market, by Country (APAC), 2022–2035 (USD Trillion)

TABLE 70: Healthcare Financing Market, by Financing Type (APAC), 2022–2035 (USD Trillion)

TABLE 71: Healthcare Financing Market, by Service Provider (APAC), 2022–2035 (USD Trillion)

TABLE 72: Healthcare Financing Market, by Delivery Mode(APAC), 2022–2035 (USD Trillion)

TABLE 73: Healthcare Financing Market, by End-User (APAC), 2022–2035 (USD Trillion)

TABLE 74: India Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 75: India Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 76: India Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 77: India Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 78: China Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 79: China Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 80: China Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 81: China Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 82: Japan Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 83: Japan Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 84: Japan Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 85: Japan Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 86: South Korea Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 87: South Korea Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 88: South Korea Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 89: South Korea Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 90: Australia Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 91: Australia Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 92: Australia Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 93: Australia Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 94: Rest of APAC Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 95: Rest of APAC Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 96: Rest of APAC Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 97: Rest of APAC Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 98: Brazil Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 99: Brazil Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 100: Brazil Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 101: Brazil Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 102: Argentina Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 103: Argentina Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 104: Argentina Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 105: Argentina Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 106: Colombia Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 107: Colombia Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 108: Colombia Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 109: Colombia Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 110: Rest of LATAM Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 111: Rest of LATAM Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 112: Rest of LATAM Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 113: Rest of LATAM Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 114: Israel Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 115: Israel Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 116: Israel Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 117: Israel Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 118: Turkey Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 119: Turkey Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 120: Turkey Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 121: Turkey Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 122: Egypt Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 123: Egypt Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 124: Egypt Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 125: Egypt Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

TABLE 126: Rest of MEA Healthcare Financing Market, by Financing Type, 2022–2035 (USD Trillion)

TABLE 127: Rest of MEA Healthcare Financing Market, by Service Provider, 2022–2035 (USD Trillion)

TABLE 128: Rest of MEA Healthcare Financing Market, by Delivery Mode, 2022–2035 (USD Trillion)

TABLE 129: Rest of MEA Healthcare Financing Market, by End-User, 2022–2035 (USD Trillion)

List of Figures

FIGURE 1: Healthcare Financing Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Financing Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Financing Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 12: Service Provider Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Service Provider Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 14: Financing Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Financing Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Financing Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Financing Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Financing Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Financing Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 27: Canada Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 28: Mexico Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 29: Europe Healthcare Financing Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 31: Spain Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 32: Italy Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 33: France Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 34: UK Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 35: Russia Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 36: Poland Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 37: Rest of Europe Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 38: Asia Pacific Healthcare Financing Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 40: China Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 41: Japan Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 42: South Korea Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 43: Australia Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 44: Rest of APAC Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 45: Latin America Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 46: Latin America Healthcare Financing Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 48: Argentina Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 49: Colombia Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 50: Rest of LATAM Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 51: Middle East and Africa Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 52: Middle East and Africa Healthcare Financing Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 54: Israel Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 55: Turkey Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 56: Egypt Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

FIGURE 57: Rest of MEA Healthcare Financing Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Trillion)

- "Navigating the complexities of healthcare financing models in the U.S. has always been a challenge. This report gave us the clarity we needed. It offered in-depth segmentation of reimbursement structures, payer-provider dynamics, and emerging funding models like value-based care and capitation. The competitive intelligence helped us reframe our partnership roadmap with more confidence. It’s not just data, it’s direction."

- Emily Sanders, Director of Strategic Partnerships, Healthcare Payer (USA)

- "The Healthcare Financing Market Research Report delivered a highly structured view into the evolving landscape of financing mechanisms across Europe. The team’s insight into cross-border regulatory frameworks, public-private payment systems, and digital reimbursement pathways was incredibly valuable for our due diligence process. It gave us the foresight we needed to greenlight a funding round for a digital health financing platform in the DACH region."

- Lukas Meyer, Investment Analyst, Healthcare Venture Fund (Germany)

- "This report was instrumental in shaping our funding strategy for a portfolio of startups working on low-cost diagnostics and telehealth. It provided a well-balanced analysis of both traditional healthcare financing models and newer fintech integrations relevant to emerging markets. The regional forecasting and risk mapping made it easy to tailor approaches for government grants, CSR health financing, and insurance-led innovation. Highly recommended for stakeholders in Asia-Pacific healthcare ecosystems."

- Dr. Aruna Deshmukh, Policy Advisor, HealthTech Incubator (India)

This Healthcare Financing Market 2025 report has been meticulously researched and authored by the senior healthcare economics and policy analysis team at Quants & Trends, a leading intelligence partner to healthcare decision-makers across the globe. With over a decade of hands-on experience in healthcare financial modeling, payer-provider dynamics, and health systems funding structures, the authoring team combines deep domain expertise with practical insights drawn from years of supporting health insurers, provider groups, venture capitalists, and policy advisors.

Our analysts continuously track regulatory reforms, reimbursement frameworks, risk-sharing mechanisms, and capital investment trends shaping the future of healthcare financing across the U.S., Europe, Asia, and emerging markets. The methodology used in this report integrates macroeconomic indicators, payer mix data, capital flow tracking, and scenario-based forecasting to deliver actionable intelligence that supports C-suite decisions, investment strategies, pricing models, and policy alignment.

Whether you're a hospital CFO evaluating new funding mechanisms, an investor assessing risk across payer systems, or a startup looking to position a fintech health solution, this report offers grounded, evidence-backed foresight tailored for strategic impact.

To learn more about our healthcare market research capabilities and connect with our analysts, visit our official LinkedIn page.