Market Outlook

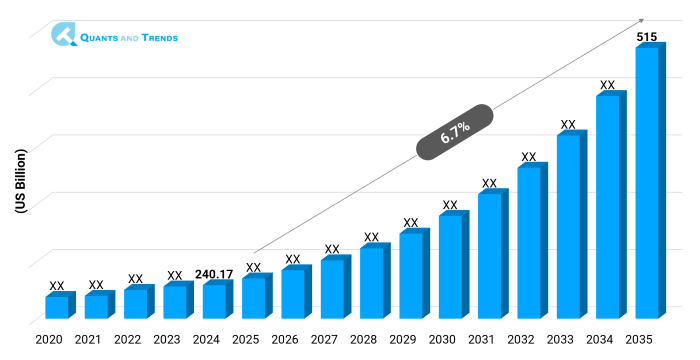

The global Healthcare Practices Market size was valued at USD 240.17 billion in 2024 and is anticipated to reach USD 515 billion by 2035, growing at a CAGR of 6.7% from 2025 to 2035. The historical analysis captures 2020 to 2023, with 2024 as the base year and forecasts beginning from 2025 to 2035.

The Healthcare Practices Market is moving from volume to value. Clinics and physician groups are redesigning care pathways around access, continuity, and measurable outcomes. Digital front doors, hybrid care models, and collaborative networks are no longer side projects; they are already the norm. Patients want reduced wait times, clear prices, and follow-ups that are coordinated between primary care, specialized care, and diagnostics. Payers and regulators are linking payment to quality indicators, which pushes practitioners to use evidence-based processes and share data. As these changes take hold, operational excellence capacity planning, referral optimization, and personnel productivity will be the key to success. This momentum underpins the Healthcare Practices Market: Forecast across regions and care settings.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 6.7% |

| Market Value In 2024 | USD 240.17 billion |

| Market Value In 2035 | USD 515 billion |

Introduction

Primary care, specialties, multispecialty centers, urgent care, and community health are all part of healthcare. They are the first place to go for prevention, early diagnosis, managing chronic diseases, and getting referrals. The market links clinical services with scheduling, revenue cycle, and population health tools that help providers stay financially stable and responsible for their patients' health. The rise of non-communicable diseases, the aging of the population, and patient expectations are changing the mix of services and how they are delivered. Healthcare practices that use technology now combine electronic records, remote monitoring, and AI-assisted triage with caring for people. This Healthcare Practices Market Report Highlights Market Segmentation, Market Dynamics, and the Healthcare Practices Competitive Landscape in clear, practical language.

Key Market Drivers: What’s Fueling the Healthcare Practices Market Boom?

- Aging populations & chronic disease burden- longer lifespans and lifestyle linked conditions are lifting baseline demand. By 2030, roughly 1 in 6 people globally will be 60+, increasing poly-chronic care and coordinated visits. Non-communicable diseases account for about three-quarters of global deaths, pushing practices to expand preventive care, diagnostics, and long-term disease management. This shifts appointment mix toward ongoing follow-ups, medication optimization, and allied health services. It also drives referral networks between Primary Care Practices and Specialty Practices to manage complexity efficiently key context for Healthcare Practices Industry Analysis and Healthcare Practices Growth Drivers & Challenges.

- Shift to hybrid and convenient access models-Patients now expect care on their terms. Same-day or next-day slots at Urgent Care Centers, plus telemedicine for triage and follow-ups, have reset the baseline. Post-pandemic, virtual encounters remain several times higher than in 2019 in many systems, while in-person visits returned for procedures and complex exams. Practices that orchestrate hybrid pathways, virtual intake, in-person diagnostics, remote monitoring, see better show rates and lower leakage. Clear navigation, price transparency, and integrated records reduce friction and improve outcomes. This is a central theme across Regional Insights and informs the Healthcare Practices Market: Size & Share discussions.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation is practical and patient-facing: automated intake, AI-assisted documentation, risk flags inside EHRs, remote vitals, and e-prescriptions that sync with pharmacy benefit data. Advanced scheduling balances clinician time with demand peaks. Community Health Practices use mobile units and remote kits to reach underserved groups. Data fabrics link Primary Care Practices to diagnostics and specialty consults, creating closed-loop care. The result is faster access, fewer duplicated tests, and measurable quality gains, tangible Healthcare Practices Investment Opportunities for operators and partners.

Recent Developments:

The Healthcare Practices Market has seen notable technology-led improvements in recent years. A rapid rollout of hybrid scheduling models (virtual triage combined with in-person diagnostics) is helping practices cut wait times and reduce patient no-shows. At the same time, the adoption of AI-assisted documentation and coding tools is streamlining note-taking, boosting clinician productivity, and improving revenue accuracy. These innovations, accelerating since 2023, are expected to significantly shape workflow efficiency and open new Healthcare Practices Investment Opportunities during the forecast period.

Conclusion

Healthcare practices are standardizing care while keeping room for personal clinical judgment. Primary care anchors continuity; integrated and group models accelerate growth. Diagnostics, therapeutics, and hybrid delivery underpin revenue and access. The Healthcare Practices Market: Report shows clear Healthcare Practices Investment Opportunities in referral optimization, virtual follow-ups, and documentation automation. With policy incentives tied to measurable outcomes, winners will be practices that blend human care with smart systems, simple access, reliable quality, and clear communication, across every encounter.

Related Reports

- The global Integrative and Complementary Medicine Market was valued at approximately USD 141.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 22.8% from 2025 to 2035, reaching around USD 1,346.0 billion by the end of the forecast period.

- The global Preventive Healthcare Strategies Market was valued at approximately USD 112.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 232.6 billion by the end of the forecast period.

Key Market Players

Competition brings together global platforms and local operators. Big hospital-affiliated networks and corporate chains set the rules, while tech-enabled groups compete on how well they treat patients and how easy it is for them to get care. It's customary to work with diagnostic, pharmaceutical, and virtual care companies. Using data to plan appointments, handle referrals, and automate the revenue cycle all help to enhance margins. In this Healthcare Practices Competitive Landscape, players aim to balance clinician time with demand variability while sustaining quality metrics. Some of the key players in the Healthcare Practices industry are as:

Mayo Clinic, Cleveland Clinic, Kaiser Permanente, HCA Healthcare, Tenet Healthcare, Universal Health Services, Apollo Hospitals, Fortis Healthcare, Ramsay Health Care, IHH Healthcare, Mediclinic, U.S. Dermatology Partners, One Medical, Carbon Health, Oak Street Health

- Primary Care Practices: These are still the most common type of practice by patient volume because they are the first place people go for prevention, early diagnosis, and managing chronic diseases. As gatekeepers in insurer and payer models, they make guarantee that care continues over time. This makes them the backbone of the Healthcare Practices Market: Report.

- Specialty Practices: There is a lot of need for cardiology, oncology, endocrinology, dermatology, and behavioral health. As people get older and problems get more complicated, specialty practices get increasingly valuable interventions.

- Multispecialty Clinics: These are the fastest-growing type of practice. They offer integrated services including diagnostics and specialty consultations all in one place. These integrated setups speed up referrals, make things run more smoothly, and make patients happier, which leads to quick growth.

- Urgent Care Centers: These are becoming more popular in cities and suburbs since they can help with minor injuries, after-hours requirements, and acute episodes, which means people don't have to go to the emergency room as often.

- Community Health Practices: These are important providers in communities that don't have enough of them, and they often get funding through outreach programs and value-based care initiatives.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Independent Practices: Operate with agility and focus on relationship-driven care, though rising costs of compliance and technology adoption pressure margins.

- Group Practices: The fastest-growing ownership model, since pooling resources allows better purchasing power, staffing, and shared IT infrastructure. Their consolidation trend strengthens bargaining ability and improves resilience.

- Hospital-Affiliated Practices: Represent the dominating ownership model in many urban centers. These practices benefit from strong referral pipelines, payer leverage, and closer alignment with hospital networks.

- Corporate/Chain Practices: Expanding through acquisitions and standardized processes, especially across urgent care, ophthalmology, dermatology, and dental sectors.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Preventive Care: Includes vaccinations, screening programs, and lifestyle wellness initiatives.

- Diagnostic Services: A dominating service category, as imaging, lab testing, and EHR-integrated diagnostics are essential for accurate treatment decisions and generate frequent, recurring demand.

- Therapeutic Services: Cover chronic disease care, rehabilitation, and behavioral health, forming another steady revenue base.

- Surgical Services: Ambulatory surgeries and day-care procedures continue to expand, supported by patient preference for minimally invasive settings.

- Telehealth Services: The fastest-growing service category, scaling quickly as patients adopt virtual visits, remote follow-ups, and digital triage, which also reduce costs and no-show rates.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- In-Person Consultations: Still the dominating delivery mode, as physical examinations, imaging, and procedures cannot be replaced virtually. They remain critical to the structure of healthcare delivery worldwide.

- Telemedicine/Virtual Care: The fastest-growing mode of delivery, expanding in mental health, chronic care follow-ups, and triage. Improved reimbursement parity and growing patient comfort with digital consultations accelerate adoption.

- Home Healthcare Services: Gaining traction in eldercare, post-acute recovery, and chronic disease monitoring, often supported by wearable devices and IoT.

- Hybrid Care Models: Combining digital and in-person care to balance efficiency and patient access. These models improve clinician productivity while maintaining continuity of care.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is the most dominating region owing to as people spends a lot of money per person, payer contracts are well-established, and technology is widely used. Urbanization, more insurance coverage, and the rapid growth of clinic networks are all helping Asia-Pacific develop the fastest. Europe is still stable, with good primary care and a Regulatory & Policy Overview that focuses on access and quality. Latin America is making progress through private chains and telemedicine in areas that don't have enough services. As new clinics, diagnostic hubs, and digital pathways grow, the Middle East and Africa are getting better. These Regional Insights shape the Healthcare Practices Market Size & Share narrative across stakeholders.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Practices Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Mode of Deliverys

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Practices Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Practices Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Practices Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Services Offered & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Practices Market – By Type of Practices

5.1. Overview

5.1.1. Segment Share Analysis, By Type of Practices, 2024 & 2035 (%)

5.1.2. Primary Care Practices

5.1.3. Specialty Practices

5.1.4. Multispecialty Clinics

5.1.5. Urgent Care Centers

5.1.6. Community Health Practices

(presents market segmentation by Type of Practices, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Practices Market – By Ownership Model

6.1. Overview

6.1.1. Segment Share Analysis, By Ownership Model, 2024 & 2035 (%)

6.1.2. Independent Practices

6.1.3. Group Practices

6.1.4. Hospital-Affiliated Practices

6.1.5. Corporate/Chain Practices

(breaks down the market by Ownership Model, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Practices Market – By Services Offered

7.1. Overview

7.1.1. Segment Share Analysis, By Services Offered, 2024 & 2035 (%)

7.1.2. Preventive Care

7.1.3. Diagnostic Services

7.1.4. Therapeutic Services

7.1.5. Surgical Services

7.1.6. Telehealth Services

(focuses on market segmentation by Services Offered, helping the client prioritize areas that offer significant business opportunities)

8. Healthcare Practices Market – By Mode of Delivery

8.1. Overview

8.1.1. Segment Share Analysis, By Mode of Delivery, 2024 & 2035 (%)

8.1.2. In-Person Consultations

8.1.3. Telemedicine/Virtual Care

8.1.4. Home Healthcare Services

8.1.5. Hybrid Care Models

(breaks down the market by type of Mode of Delivery, helping stakeholders understand user accessibility preferences and compatibility trends across regions and use-cases)

(describes the market division by Mode of Delivery of Services Offered, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Practices Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Practices Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Type of Practices, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Ownership Model, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.7.

9.2.8. North America Market Size and Forecast, By Services Offered, 2024 - 2035 (US$ Million)

9.2.9. U.S.

9.2.9.1. Overview

9.2.9.2. U.S. Market Size and Forecast, By Type of Practices, 2024 - 2035 (US$ Million)

9.2.9.3. U.S. Market Size and Forecast, By Ownership Model, 2024 - 2035 (US$ Million)

9.2.9.4. U.S. Market Size and Forecast, By Services Offered, 2024 - 2035 (US$ Million)

9.2.9.5. U.S. Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.10. Canada

9.2.10.1. Overview

9.2.10.2. Canada Market Size and Forecast, By Type of Practices, 2024 - 2035 (US$ Million)

9.2.10.3. Canada Market Size and Forecast, By Ownership Model, 2024 - 2035 (US$ Million)

9.2.10.4. Canada Market Size and Forecast, By Services Offered, 2024 - 2035 (US$ Million)

9.2.10.5. Canada Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

9.2.11. Mexico

9.2.11.1. Overview

9.2.11.2. Mexico Market Size and Forecast, By Type of Practices, 2024 - 2035 (US$ Million)

9.2.11.3. Mexico Market Size and Forecast, By Ownership Model, 2024 - 2035 (US$ Million)

9.2.11.4. Mexico Market Size and Forecast, By Services Offered, 2024 - 2035 (US$ Million)

9.2.11.5. Mexico Market Size and Forecast, By Mode of Delivery, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Practices Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Mayo Clinic

10.3.2. Cleveland Clinic

10.3.3. Kaiser Permanente

10.3.4. HCA Healthcare

10.3.5. Tenet Healthcare

10.3.6. Universal Health Services

10.3.7. Apollo Hospitals

10.3.8. Fortis Healthcare

10.3.9. Ramsay Health Care

10.3.10. IHH Healthcare

10.3.11. Mediclinic

10.3.12. U.S. Dermatology Partners

10.3.13. One Medical

10.3.14. Carbon Health

10.3.15. Oak Street Health

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Practices Market: Future Market Outlook (2025–2035)

11.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.2. Disruptive Technologies Impact

11.3. Emerging Business Trends

11.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Practices Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Practices Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Practices Market: Type of Practices Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Type of Practices

TABLE 6: Global Healthcare Practices Market, by Type of Practices 2022–2035 (USD Million)

TABLE 7: Healthcare Practices Market: Ownership Model Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Ownership Model

TABLE 9: Global Healthcare Practices Market, by Ownership Model 2022–2035 (USD Million)

TABLE 10: Healthcare Practices Market: Services Offered Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Services Offered

TABLE 12: Global Healthcare Practices Market, by Services Offered 2022–2035 (USD Million)

TABLE 13: Healthcare Practices Market: Mode of Delivery Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Mode of Delivery

TABLE 15: Global Healthcare Practices Market, by Mode of Delivery 2022–2035 (USD Million)

TABLE 16: Healthcare Practices Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Practices Market, by Region 2022–2035 (USD Million)

TABLE 19: Healthcare Practices Market, by Country (North America), 2022–2035 (USD Million)

TABLE 20: Healthcare Practices Market, by Type of Practices (North America), 2022–2035 (USD Million)

TABLE 21: Healthcare Practices Market, by Ownership Model (North America), 2022–2035 (USD Million)

TABLE 22: Healthcare Practices Market, by Mode of Delivery (North America), 2022–2035 (USD Million)

TABLE 23: Healthcare Practices Market, by Services Offered (North America), 2022–2035 (USD Million)

TABLE 24: U.S. Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 25: U.S. Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 26: U.S. Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 27: U.S. Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 28: Canada Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 29: Canada Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 30: Canada Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 31: Canada Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 32: Mexico Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 33: Mexico Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 34: Mexico Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 35: Mexico Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 36: China Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 37: China Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 38: China Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 39: China Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 40: India Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 41: India Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 42: India Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 43: India Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 44: Japan Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 45: Japan Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 46: Japan Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 47: Japan Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 48: South Korea Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 49: South Korea Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 50: South Korea Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 51: South Korea Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 52: Australia Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 53: Australia Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 54: Australia Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 55: Australia Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 56: Germany Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 57: Germany Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 58: Germany Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 59: Germany Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 60: France Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 61: France Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 62: France Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 63: France Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 64: Italy Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 65: Italy Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 66: Italy Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 67: Italy Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 68: Spain Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 69: Spain Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 70: Spain Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 71: Spain Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 72: U.K. Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 73: U.K. Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 74: U.K. Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 75: U.K. Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 76: Russia Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 77: Russia Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 78: Russia Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 79: Russia Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 80: Brazil Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 81: Brazil Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 82: Brazil Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 83: Brazil Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 84: Argentina Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 85: Argentina Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 86: Argentina Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 87: Argentina Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 88: Colombia Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 89: Colombia Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 90: Colombia Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 91: Colombia Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 92: Saudi Arabia Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 93: Saudi Arabia Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 94: Saudi Arabia Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 95: Saudi Arabia Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 96: UAE Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 97: UAE Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 98: UAE Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 99: UAE Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 100: South Africa Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 101: South Africa Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 102: South Africa Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 103: South Africa Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 104: Israel Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 105: Israel Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 106: Israel Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 107: Israel Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

TABLE 108: Turkey Healthcare Practices Market, by Type of Practices, 2022–2035 (USD Million)

TABLE 109: Turkey Healthcare Practices Market, by Ownership Model, 2022–2035 (USD Million)

TABLE 110: Turkey Healthcare Practices Market, by Mode of Delivery, 2022–2035 (USD Million)

TABLE 111: Turkey Healthcare Practices Market, by Services Offered, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Healthcare Practices Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Type of Practices Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Type of Practices Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Ownership Model Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Ownership Model Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Services Offered Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Services Offered Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: Mode of Delivery Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Mode of Delivery Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Healthcare Practices Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Practices Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Practices Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Practices Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Practices Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Healthcare Practices Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: U.K. Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Healthcare Practices Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Healthcare Practices Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Healthcare Practices Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Healthcare Practices Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "As an operations director at a multi-specialty healthcare network in Chicago, I found the Healthcare Practices Market Research Report exceptionally insightful. The deep dive into evolving care models, particularly value-based care and integrated practice management, helped us identify operational gaps and align our practices with upcoming reimbursement reforms. The benchmarking data and forward-looking projections gave our leadership the confidence to restructure service lines and invest in digital health tools that directly improved patient engagement. It wasn’t just research; it became a practical guide for shaping our strategy."

- Laura Mitchell, Operations Director, United States

- "In Spain, where healthcare practices must balance public and private system dynamics, the Healthcare Practices Market Research Report offered clarity that few sources provide. The report’s detailed analysis of practice consolidation trends, digital adoption rates, and regulatory updates across European markets allowed us to adapt our expansion model. We used the findings to support board-level discussions on cross-border collaboration and to justify resource allocation for outpatient practice growth. The credibility of the data and the depth of regional insights made it a trusted reference in our planning process."

- Javier Moreno, Strategic Planning Lead, Spain

- "As a business development manager at a healthcare consultancy in Singapore, I relied on the Healthcare Practices Market Research Report to understand shifting patient preferences and practice models across Southeast Asia. The granular country-level insights, particularly on telehealth adoption, outpatient care, and regulatory alignment, helped us advise clients on where to invest and how to structure partnerships. What I valued most was how the report translated complex market dynamics into actionable recommendations, enabling us to deliver strategies that resonated with both local providers and international investors."

- Alicia Tan, Business Development Manager, Singapore

The Healthcare Practices Market 2025 report has been developed by a team of seasoned healthcare market research professionals with extensive expertise in healthcare delivery models, practice management, and global care innovation. With over a decade of experience analyzing clinical operations, reimbursement trends, and digital health adoption, our analysts combine deep sector knowledge with practical business acumen to deliver intelligence that drives strategic decision-making.

Our research methodology integrates primary interviews with healthcare practitioners, administrators, and policymakers alongside secondary data from trusted industry databases and peer-reviewed sources. This balanced approach ensures that every insight is not only evidence-based but also enriched with real-world context.

This report is designed to support decision-makers across the healthcare ecosystem, whether you are a practice owner evaluating operational efficiencies, an investor exploring emerging care models, or a strategy lead shaping multi-market expansion plans. By providing a clear view of practice consolidation trends, technology integration, patient engagement drivers, and policy influences, the report translates complex market dynamics into actionable strategies.

At its core, the Healthcare Practices Market 2025 report bridges data with decision-making, helping stakeholders anticipate changes, mitigate risks, and seize growth opportunities with confidence.

To learn more about our healthcare research expertise and stay updated on our latest insights, connect with us on LinkedIn.