Market Outlook

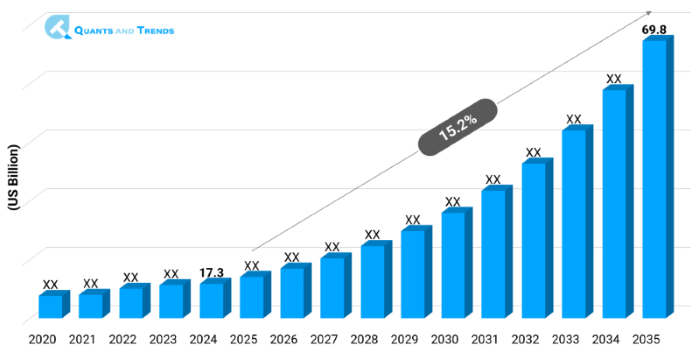

The global healthcare data security market was valued around USD 17.3 billion in 2024 and is anticipated to grow at a CAGR of 15.2% from 2025 to 2035, reaching nearby USD 69.8 billion by the end of the forecast period. The historical analysis captures 2020 to 2023, with 2024 as the base year and forecasts beginning from 2025 to 2035.

Protecting personal medical information has become crucial as the healthcare industry is growing more digital. Healthcare providers have been forced to implement strong security measures owing to the increase in cyberattacks, particularly ransomware that targets hospitals & clinics. The need for trustworthy data protection tools is expanding as a result of stringent regulatory frameworks and increased patient awareness worldwide. Data security is must, owing to the increase in vulnerabilities brought about by the move to cloud-based records, remote healthcare services and connected medical devices. This Healthcare data security Market Report highlights how security is no longer a compliance checkbox, but a key foundation of operational continuity in modern healthcare systems.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 15.2% |

| Market Value In 2024 | USD 17.3 billion |

| Market Value In 2035 | USD 69.8 billion |

Introduction

As healthcare continues to support digitalization data security has moved from a back office issue to a boardroom priority. The industry is increasingly vulnerable to cyberattacks and data breaches as a result of the integration of wearable technology, cloud platforms, telemedicine, and electronic health records (EHRs). Now a days, the healthcare data security market is seen as an important pillar in securing patient confidentiality, ensuring regulatory compliance and maintaining operational integrity. From ransomware ambush to insider threats, the stakes are high, making the implementation of cybersecurity systems a strategic requirement. This healthcare data security market report explores the dynamics, challenges and opportunities which is further shaping the industry and its business.

Key Market Drivers: What’s Fueling the Healthcare data security Market Boom?

- Surge in Cyberattacks and Data Breaches: One of the most popular industries for cybercriminals worldwide is healthcare. Over 720 data breaches were reported to the US Department of Health and Human Services in 2023 alone, affecting the records of over 100 million patients. These breaches result in significant financial losses and legal ramifications in addition to compromising personal health information (PHI). In order to fend off storms, hospitals particularly small and mid-sized ones are progressively implementing network defense systems, encryption programs and endpoint security. This increasing threat landscape is escalating the need for robust healthcare data security solutions.

- Regulatory Mandates and Compliance Pressures: To follow severe rules like the Digital Personal Data Protection Act (India), GDPR (Europe), and HIPAA (US), healthcare organizations need to set up strong data security systems. Non-compliance leads to heavy penalties and reputational & brand damage. As per analysis, the average cost of a healthcare data breach reached $10.93 million which is the highest across industries. Regulatory enforcement is compelling healthcare institutions to invest in identity & access management (IAM), risk & compliance tools, and encryption platforms. This demand is also encouraging innovation and the development of scalable, compliant-ready security solutions driving long-term growth across the Healthcare data security Market Forecast.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

AI driven threat detection, blockchain for audit trails and zero trust security approaches are all becoming more popular in the healthcare data security market. To improve answer times, both tech giants and startups are incorporating behavior-based anomaly detection and predictive analytics. Also, the migration to cloud native platforms has made the need for real-time data visibility and control even greater. These cutting-edge technologies are redefining how patient data is protected improving both resilience and agility across the healthcare ecosystem.

Recent Developments:

In April 2025, Cisco announced the launch of a zero-trust solution tailored for hospital networks, ensuring seamless access with maximum protection. In the meantime, IBM Security implemented blockchain-enabled audit trails for clinical research data in partnership with a significant U.S. health system. These innovations highlight the increased focus on proactive and transparent data protection strategies, providing scalable healthcare data security investment opportunities to ecosystem stakeholders.

Conclusion

The Healthcare data security market size & share is set to expand significantly as increase in threat activities and digital healthcare evolves. Investing in data protection methods is now mandatory owing to the increasing cybercrimes and stricter requirements. The market’s future will be shaped by cloud adoption, AI-driven security, and policy enforcement. From hospitals to insurers to pharma companies, all across the supply chain must rethink their data strategies. This Healthcare data security industry analysis updates that active planning, tech alignment and regulatory readiness will define success in this critical digital era.

Related Reports

- The global Healthcare Policy and Regulation Market was valued at approximately USD 5.75 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035, reaching around USD 13.91 billion by the end of the forecast period.

- The global EHR and Health Information Systems Market was valued at approximately USD 32.12 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035, reaching around USD 55.34 billion by the end of the forecast period.

Key Market Players

The Healthcare data security Competitive Landscape is highly dynamic, featuring a mix of global cybersecurity firms and niche healthcare IT vendors. The key players are focusing on AI based analytics, cloud-native security and compliance based offerings. Market positions are changing as a result of M&A activity, technological advancements, and strategic alliances with healthcare providers. The two main differentiators continue to be innovation and regulatory compliance. Some of the key players in the Healthcare data security industry are as:

IBM Corporation, Cisco Systems Inc., Symantec (Broadcom), Fortinet Inc., McAfee LLC, Palo Alto Networks, Microsoft Corporation, Trend Micro Inc., Thales Group. Check Point Software Technologies, Sophos Group, FireEye Inc., Imprivata Inc., DXC Technology, Dell Technologies

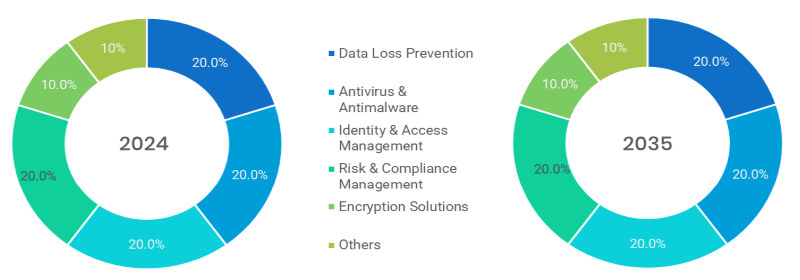

- Data Loss Prevention (Dominating Segment): DLP solutions are used frequently to keep an eye on, find & stop unauthorized data transfers, especially in hospitals & payer organizations. This is because insider threats and accidental data leaks are on the rise globally.

- Identity & Access Management (Fastest Growing Segment): IAM technologies that allow secure login, role-based access and multi-factor authentication are becoming more in demand as more people use telehealth and work from home.

- Encryption Solutions: Widely used for safeguarding data in transit and at rest, encryption ensures patient confidentiality and regulatory compliance.

- Antivirus & Antimalware: Continues to be crucial for safeguarding systems against ransomware and specific healthcare malware.

- Risk & Compliance Management: This solution type offers audit readiness and threat assessments, which are essential for guaranteeing compliance with HIPAA and GDPR.

- Others: Includes emerging AI-driven security tools and threat intelligence platforms.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- On-Premise: Preferred by organizations like research institutes, labs and private hospitals that requires a high level of control and data residency.

- Cloud-Based – Fastest-Growing Segment: Rapid cloud adoption is being driven by growing need for flexible data access and telemedicine. Scalability, cross-system integration and real-time protection are made possible by cloud-native platforms.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Network Security – Dominating Segment: Essential to stopping intrusions on networks, connected devices, and internal data flows.

- Cloud Security – Fastest-Growing Segment: As health IT shifts to the cloud, securing cloud environments and SaaS platforms is a top priority.

- Application Security: focuses on preventing vulnerabilities in mobile apps and healthcare software.

- Endpoint Security: Ensures protection for devices like tablets, wearables, and physician workstations.

- Database Security: Protects EHRs and sensitive patient data stored in relational databases.

Note: Charts and figures are illustrative only. Contact us for verified market data.

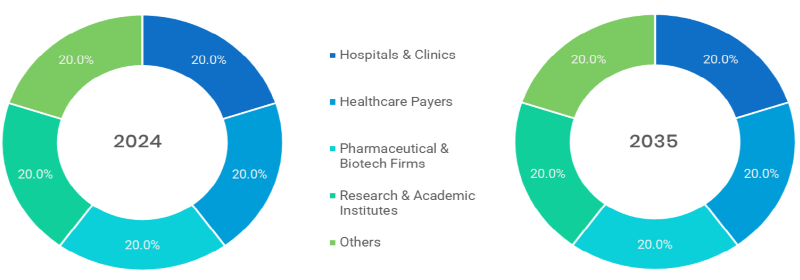

- Hospitals & Clinics – Dominating Segment: With the highest patient data volume and digital infrastructure, they lead in cybersecurity spending.

- Pharmaceutical & Biotech Firms – Fastest-Growing Segment: Digital trials and sensitive R&D data demand advanced protection and IP security.

- Healthcare Payers: Invest in securing claims systems and member data.

- Research & Academic Institutes: Require layered security for shared access environments.

- Others: Include digital health startups and telemedicine platforms.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America dominates the global healthcare data security market, for more than 45% of the revenue in 2024. This is owing to higher cybersecurity spending, strong regulatory frameworks for example HIPAA and sophisticated digital healthcare infrastructure. Europe is next in line, but Asia-Pacific is expanding at the fastest rate thanks to a rise in health-tech businesses, government initiatives to promote digital health, and massive patient data sets. Countries like India, China, and Singapore are rapidly modernizing their healthcare systems, making them fertile ground for technology adoption in Healthcare data security. Regional Insights suggest that strategic expansion in Asia-Pacific will unlock substantial investment returns over the forecast period.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Data Security Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Data Security Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Data Security Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Data Security Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Security Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Data Security Market – By Solution Type

5.1. Overview

5.1.1. Segment Share Analysis, By Solution Type, 2024 & 2035 (%)

5.1.2. Data Loss Prevention (DLP)

5.1.3. Antivirus & Antimalware

5.1.4. Identity & Access Management (IAM)

5.1.5. Risk & Compliance Management

5.1.6. Encryption Solutions

5.1.7. Others

(presents market segmentation by Solution Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Data Security Market – By Deployment Mode

6.1. Overview

6.1.1. Segment Share Analysis, By Deployment Mode, 2024 & 2035 (%)

6.1.2. On-Premise

6.1.3. Cloud-Based

(breaks down the market by Deployment Mode, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Data Security Market – By Security Type

7.1. Overview

7.1.1. Segment Share Analysis, By Security Type, 2024 & 2035 (%)

7.1.2. Application Security

7.1.3. Endpoint Security

7.1.4. Network Security

7.1.5. Cloud Security

7.1.6. Database Security

(focuses on market segmentation by Security Type, helping the client prioritize specific crop Solution Types or end-use areas that offer significant business opportunities)

8. Healthcare Data Security Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Healthcare Payers

8.1.4. Pharmaceutical & Biotech Firms

8.1.5. Research & Academic Institutes

8.1.6. Others

(describes the market division by End-User of Security Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Data Security Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Data Security Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Solution Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Security Type, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Solution Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Security Type, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Solution Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Security Type, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Solution Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Deployment Mode, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Security Type, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Data Security Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. IBM Corporation

10.3.2. Cisco Systems Inc.

10.3.3. Symantec (Broadcom)

10.3.4. Fortinet Inc.

10.3.5. McAfee LLC

10.3.6. Palo Alto Networks

10.3.7. Microsoft Corporation

10.3.8. Trend Micro Inc.

10.3.9. Thales Group

10.3.10. Check Point Software Technologies

10.3.11. Sophos Group

10.3.12. FireEye Inc.

10.3.13. Imprivata Inc.

10.3.14. DXC Technology

10.3.15. Dell Technologies

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Data Security Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Data Security Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Data Security Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Data Security Market: Solution Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Solution Type

TABLE 6: Global Healthcare Data Security Market, by Solution Type 2022–2035 (USD Million)

TABLE 7: Healthcare Data Security Market: Deployment Mode Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Deployment Mode

TABLE 9: Global Healthcare Data Security Market, by Deployment Mode 2022–2035 (USD Million)

TABLE 10: Healthcare Data Security Market: Security Type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Security Type

TABLE 12: Global Healthcare Data Security Market, by Security Type 2022–2035 (USD Million)

TABLE 13: Healthcare Data Security Market: Security Type Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Healthcare Data Security Market, by End-User 2022–2035 (USD Million)

TABLE 16: Healthcare Data Security Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Data Security Market, by Region 2022–2035 (USD Million)

TABLE 19: Healthcare Data Security Market, by Country (NA), 2022–2035 (USD Million)

TABLE 20: Healthcare Data Security Market, by Solution Type (NA), 2022–2035 (USD Million)

TABLE 21: Healthcare Data Security Market, by Deployment Mode (NA), 2022–2035 (USD Million)

TABLE 22: Healthcare Data Security Market, by Security Type (NA), 2024–2035 (USD Million)

TABLE 23: Healthcare Data Security Market, by End-User (NA), 2022–2035 (USD Million)

TABLE 24: U.S. Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 25: U.S. Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 26: U.S. Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 27: U.S. Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 28: Canada Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 29: Canada Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 30: Canada Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 31: Canada Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 32: Mexico Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 33: Mexico Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 34: Mexico Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 35: Mexico Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 36: Healthcare Data Security Market, by Country (Europe), 2022–2035 (USD Million)

TABLE 37: Healthcare Data Security Market, by Solution Type (Europe), 2022–2035 (USD Million)

TABLE 38: Healthcare Data Security Market, by Deployment Mode (Europe), 2022–2035 (USD Million)

TABLE 39: Healthcare Data Security Market, by Security Type (Europe), 2022–2035 (USD Million)

TABLE 40: Healthcare Data Security Market, by End-User (Europe), 2022–2035 (USD Million)

TABLE 41: Germany Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 42: Germany Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 43: Germany Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 44: Germany Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 45: Italy Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 46: Italy Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 47: Italy Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 48: Italy Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 49: United Kingdom Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 50: United Kingdom Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 51: United Kingdom Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 52: United Kingdom Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 53: France Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 54: France Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 55: France Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 56: France Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 57: Russia Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 58: Russia Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 59: Russia Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 60: Russia Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 61: Poland Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 62: Poland Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 63: Poland Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 64: Poland Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 65: Rest of Europe Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 66: Rest of Europe Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 67: Rest of Europe Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 68: Rest of Europe Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 69: Healthcare Data Security Market, by Country (APAC), 2022–2035 (USD Million)

TABLE 70: Healthcare Data Security Market, by Solution Type (APAC), 2022–2035 (USD Million)

TABLE 71: Healthcare Data Security Market, by Deployment Mode (APAC), 2022–2035 (USD Million)

TABLE 72: Healthcare Data Security Market, by Security Type (APAC), 2022–2035 (USD Million)

TABLE 73: Healthcare Data Security Market, by End-User (APAC), 2022–2035 (USD Million)

TABLE 74: India Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 75: India Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 76: India Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 77: India Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 78: China Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 79: China Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 80: China Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 81: China Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 82: Japan Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 83: Japan Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 84: Japan Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 85: Japan Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 86: South Korea Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 87: South Korea Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 88: South Korea Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 89: South Korea Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 90: Australia Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 91: Australia Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 92: Australia Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 93: Australia Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 94: Rest of APAC Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 95: Rest of APAC Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 96: Rest of APAC Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 97: Rest of APAC Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 98: Brazil Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 99: Brazil Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 100: Brazil Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 101: Brazil Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 102: Argentina Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 103: Argentina Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 104: Argentina Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 105: Argentina Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 106: Colombia Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 107: Colombia Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 108: Colombia Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 109: Colombia Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 110: Rest of LATAM Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 111: Rest of LATAM Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 112: Rest of LATAM Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 113: Rest of LATAM Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 114: Israel Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 115: Israel Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 116: Israel Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 117: Israel Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 118: Turkey Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 119: Turkey Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

TABLE 120: Turkey Healthcare Data Security Market, by Security Type, 2022–2035 (USD Million)

TABLE 121: Turkey Healthcare Data Security Market, by End-User, 2022–2035 (USD Million)

TABLE 122: Egypt Healthcare Data Security Market, by Solution Type, 2022–2035 (USD Million)

TABLE 123: Egypt Healthcare Data Security Market, by Deployment Mode, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Healthcare Data Security Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Solution Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Solution Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Deployment Mode Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Deployment Mode Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Security Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Security Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Data Security Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Data Security Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Data Security Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Data Security Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Healthcare Data Security Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: UK Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Healthcare Data Security Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Healthcare Data Security Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Healthcare Data Security Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Healthcare Data Security Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- “With increasing regulatory scrutiny and ransomware threats, our executive team needed a clear, data-driven view of where the healthcare data security market was headed. This report was a game-changer, it offered not only a sharp analysis of vendor landscapes and emerging technologies but also a regional breakdown of compliance trends that helped us align our cybersecurity investments across North America. Highly actionable and strategically sound.”

- Michael Torres, Chief Information Security Officer, Healthcare IT Services Firm (USA)

- “We needed a robust framework to evaluate digital security solutions for our healthcare clients, and this report delivered precisely that. Its evaluation of vendor capabilities, regulatory risks, and cyber insurance dynamics was far superior to any generic tech report. It’s clear that this was built by analysts with deep healthcare domain knowledge, something our team truly values when making strategic recommendations.”

- Tobias Richter, VP of Risk Management, European Healthcare Consulting Firm (Germany)

- “The insights in this report were instrumental as we prepared for a strategic partnership in the APAC region. The section on encryption technologies, cloud vulnerabilities, and EHR-related data breaches gave our team a realistic picture of the challenges and opportunities ahead. It directly influenced how we structured our product’s security roadmap and helped us engage more confidently with investors.”

- Anika Mehra, Strategy Lead, HealthTech Startup (India)

The Healthcare Data Security Market 2025 report is authored by the senior research team at Quants & Trends, a trusted name in healthcare market intelligence. Our analysts specialize in digital health ecosystems, cybersecurity trends, regulatory dynamics (HIPAA, GDPR, HITECH), and risk mitigation strategies impacting healthcare organizations worldwide.

With over a decade of combined experience in analyzing healthcare infrastructure, cloud computing, EHR security, and ransomware trends, our team brings a high level of subject-matter expertise and real-world insight. This report is the product of rigorous primary interviews with CISOs, compliance officers, and cybersecurity vendors, complemented by deep secondary research and competitive intelligence.

The insights presented in this report are designed to support real-world decisions, from technology adoption and vendor evaluation to regulatory risk assessment and investment prioritization. Whether you’re a digital health startup, a hospital IT executive, or a consulting strategist, this report offers a practical, data-driven foundation to navigate the complex landscape of healthcare data security.

To stay up-to-date on our latest research and industry perspectives, follow Quants & Trends on LinkedIn.