Market Outlook

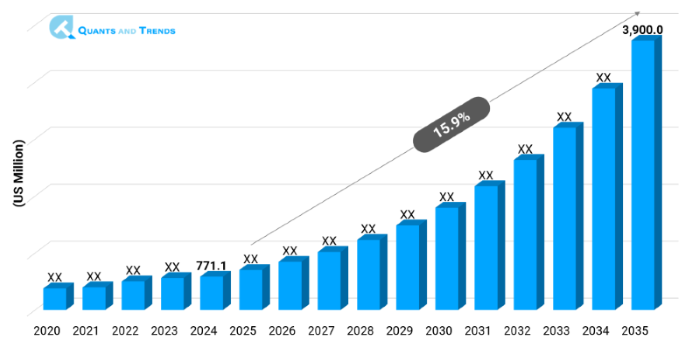

The Global Health Technology Assessment Market was valued at approximately USD 771.1 Million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 15.9% from 2025 to 2035, reaching around USD 3,900.0 Million by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The growing market of Health Technology Assessment is influenced by such factors as evidence-based care decision making, the concern of healthcare cost, and the optimization of treatment outcome. With growing spending on healthcare that is becoming value-for-money to payers, HTA has come into the focus of reimbursement decisions, policy development, and clinical adoption. According to the Health Technology Assessment Market Forecast, the market is witnessing strong impetus by the developed and new economies supported with regulatory requirements, digital health transformation and the increased complexity of emerging therapeutics and devices. As more is put on quality adjusted life years (QALYs) and budget impact modeling, HTA is taking on a very important role in the healthcare value chain.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 15.9% |

| Market Value In 2024 | USD 771.1 Million |

| Market Value In 2035 | USD 3,900.0 Million |

Introduction

The Health Technology Assessment Market is associated with formal appraisal of any medical technologies namely pharmaceuticals, devices, diagnostics, and clinical procedures on the base of their clinical efficacy and cost-effectiveness. HTA assists policymakers, healthcare providers, insurers, and manufacturers, among other interested stakeholders, in making decisions all through the product lifecycle. With global health systems undergoing the shift toward the value-based system over a volume-based system, the need to have transparent and standardized approaches to HTA is gaining pace. The impact of increased costs of healthcare, the need to justify innovations, and the necessity to coordinate the coverage decision in different markets is the stimulus triggering the development of this market. HTA delivery models are being transformed by the use of AI, real-world evidence, and global data sets to integrate them.

Key Market Drivers: What’s Fueling the Health technology Assessment Market Boom?

- Increasing Pressure to be Cost-Effective in Healthcare: As healthcare costs rise, governments and other private payers face pressure to guarantee that the best resource allocation is made. HTA is used as a strategy of measuring the value of new methods and technologies based on the clinical outcomes and spendings. In such countries as the UK and Germany, HTA is centralized in reimbursement decisions. It has caused the adoption of HTA by a significant number of the public and private stakeholders to rise. Cost-effectiveness analysis as pointed out in the Health Technology Assessment Market Report guarantees that the interventions having high values can have access to the market.

- Increased Use of Individualized and Complicated Treatments: With the spread of biologics, gene therapies, precision medicine, the determination of the clinical and economic effectiveness of these high costs of treatment has become imperative. To support real-world evidence (RWE) and future, long-term treatment efficacy prediction, HTA frameworks are adapting to the emergence of these demand. The Health Technology Assessment Market Size & Share is proceeding apace with the regulatory interest in RWE and adaptive pricing models to evaluate breakthrough treatment entities.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The Technology Adoption in Health Technology assessment is gaining speed with blending of AI/ML into predictive modelling, NLP to automate literature reviews, and cloud platforms to collaborate on such assessments. Other innovations like the virtual HTA panels, real-world data platforms are making the HTA delivery faster, scalable, and transparent. Also, blockchain is developing as means to provide traceability of clinical and economical information utilized in HTA and this is an indication of major Emerging Opportunities in the tech-driven individuals providers.

Recent Developments:

In 2024, IQVIA introduced a cloud-based HTA modeling and preparation simulation platform to conduct modeling as well as prepare evidence submissions faster. In the meantime, ICON plc acquired a prominent European consultancy firm on HTA in order to venture into global markets, especially in treatment of cancer and rare illnesses.

Conclusion

Health Technology Assessment Market is turning out to be unavoidable in realization of value-based healthcare on the planet. Increasing accountability of payers, emerging innovative treatments that challenge budget resources, and, therefore, stringent decision-making practices, which are ensured by HTA. Real-world data, digital analytics, and convergence in international regulations are the factors that will define the future of HTA. Its use in influencing the clinical and pricing outcomes will further be improved by the incorporation of AI, collaboration modeling and the automation of the evidence synthesis. Due to the increasing adoption in emerging markets, the increasing regulatory requirements and their ever-growing innovation, the market can be a great potential to stakeholders who want to reconcile innovation with low costs and low barriers to access.

Related Reports

- The global Healthcare Innovation Ecosystem Market was valued at approximately USD 205.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 18.4% from 2025 to 2035, reaching around USD 1,306.5 billion by the end of the forecast period.

- The global Digital Health Platforms Market was worth USD 292.1 billion in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 21.0% from 2025 to 2035, reaching around USD 2,364.1 billion by the end of the forecast period.

Key Market Players

The Health Technology Assessment Competitive Landscape is a blend of CROs, consulting firms, technology platforms and health economics experts. The collaboration of HTA bodies and non-state entities is evolving as a way to hasten acquisitions and slow down assessment periods. To find competitive advantage, companies invest into AI-based tools, multilingual evidence tools, and international research networks. The number of M&A deals is growing, especially on the side of niche- and tech-enabled HTA services providers. Individualization, adherence, and the turn-around cycle are fundamental hallmarks throughout HTA ecosystem. Some of the key players in the Health technology Assessment industry are as:

IQVIA, Syneos Health, Evidera (PPD), Optum Life Sciences, ICON plc, McKesson Health Economics, BresMed Health Solutions, Clarivate (DRG), HealthCore (Anthem), Cello Health (Adelphi), BluePrint Research Group, Xcenda, Costello Medical, Pharmerit International, Covance Market Access Services

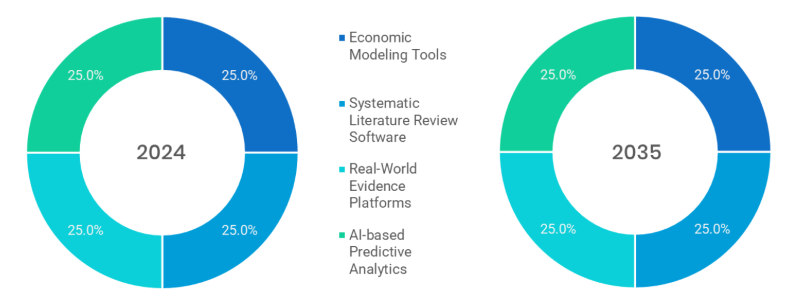

- Economic Modeling Tools: Economic modeling tools are also important to calculate budget impact and cost-effectiveness effects so that HTA bodies can be able to simulate real world results and identify whether a technology delivers quantifiable health systems value.

- SLR software: these programs automate the search (using huge medical databases) and read evidence into a formatted evidence synthesis. This leads to a clear, realistic, evidence synthesis basis of both clinical efficacy and economic benefit on which to base the HTA.

- Real-World Evidence Platforms (Dominant): The real-world evidence platforms are more popular because it leads to substantial increases in the applicability and validity of HTA conclusions to make long-term decisions about safety, adherence, and outcomes data.

- AI-Based Predictive Analytics (Fastest Growing): The fastest growing area of analytics by machine learning provides the prediction of clinical trial outcomes, patient reactions, and cost-effectiveness, simplifying the processes of HTA, and minimizing uncertainties during technology adoption.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Software Platforms: Software platforms of HTA provide automated modeling, evidence repositories and submission-ready templates that enhance efficiency and regulatory compliance by organizations that conduct internal evaluations or even when they consult payers.

- Service-Based Assessments (Dominant): Most firms are doing service-based assessments which include tailoring specific evaluations to payer submissions, price strategy, and lifecycle management of drugs, devices, and diagnostics in international markets.

- Consulting Solutions: Consulting firms offer all parts of HTA support and suggestions, such as literature review, modeling, engagement with stakeholders, and the making of submissions, to guide their clients through the multi-country evaluation frameworks and the environment of policy.

- Evidence libraries with Subscriptions (Fastest Growing): The fastest-growing category with increased demand in on-demand, dynamically evolving HTA-relevant data to enable the decision-making process and to facilitate real-time adjustment to changing regulatory and reimbursement environment.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Oncology (Dominant): Oncology is another powerful area, where the treatment of cancer is very demanding and very expensive, to the point where HTA is vital to assessing the clinical efficacy, life-extending benefits, and financial feasibility of any possible approvement and reimbursement.

- Rare Diseases (Fastest Growing): One of the most rapidly developing areas is rare disease HTA, concentrating on gene therapies, which have been deemed prohibitively costly; to convey a patient-centric and societal value, an adaptive model and multi-criteria decision analysis (MCDA) will be required.

- Cardiovascular Care: Cardiovascular interventions may be subjected to HTA to establish cost-effectiveness of stents, implants and drugs especially in populations of an aging population whose resource allocation is of great interest to payers.

- Neurology: Treatments of Alzheimer, Parkinson, multiple sclerosis are the topics of HTA in neurology based on cost-quality-of-life tradeoffs’ calculation due to the increasing prevalence and the high costs of new remedies entering the market.

- Chronic Disease Management: HTA considers the technologies of diabetes, hypertension, and COPD to improve their outcomes in the long-term run and economical performance, with an accent on the therapies preventing hospitalization and promoting the patient compliance at affordable rates.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Government Agencies (Dominant): Government agencies have spearheaded the use of HTA and institutionalized its use as part of the national reimbursement systems by requiring that the public funds are spent on the technologies that have measurable level of effectiveness, safety, and long term cost savings.

- Payers / Insurers: There is increasingly close association between HTA and coverage envisaged by insurers, with reimbursement to evidence-based clinical outcomes more specifically to costly therapies such as biologics, where assessment of value-for-money is very important.

- Healthcare Providers: Hospitals and health care systems employ HTA frameworks to inform the choice of clinical protocols, in deciding the purchase of a technology, and in making formulary choices, how to align treatment choices with budget and patient outcome goals.

- Pharma & MedTech Companies (Fastest Growing): It is the most rapidly-growing user segment, with manufacturers commissioning HTA studies in ever-greater numbers to support the pricing negotiation process, facilitate formulary placement and product positioning as part of the market access planning process.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The Health Technology Assessment Market is dominated by Europe, which is supported by centralized HTA systems such as NICE (UK), G-BA (Germany) and the upcoming EU HTA regulation. The regulatory requirements and the established evaluation pathways promote mass adoption. Asia-Pacific (APAC) is however the most fast-growing area and its growth is linked with the growing healthcare facilities, drug spending and the creation of national HTA agencies (e.g., HITAP in Thailand, MaHTAS in Malaysia). According to Regional Insights, U.S. is transforming its approaches to broader HTA integration through ICER and payer-led assessments, which indicates Market Dynamics.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Health Technology Assessment Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Applications

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Health Technology Assessment Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Health Technology Assessment Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Health Technology Assessment Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Technology Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Health Technology Assessment Market – By Technology Type

5.1. Overview

5.1.1. Segment Share Analysis, By Technology Type, 2024 & 2035 (%)

5.1.2. Economic Modeling Tools

5.1.3. Systematic Literature Review Software

5.1.4. Real-World Evidence Platforms

5.1.5. AI-based Predictive Analytics

(presents market segmentation by Technology Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Health Technology Assessment Market – By End-User Type

6.1. Overview

6.1.1. Segment Share Analysis, By End-User Type, 2024 & 2035 (%)

6.1.2. Government Agencies

6.1.3. Payers & Insurers

6.1.4. Healthcare Providers

6.1.5. Pharma & MedTech Companies

(breaks down the market by End-User Type, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Health Technology Assessment Market – By Product Type

7.1. Overview

7.1.1. Segment Share Analysis, By Product Type, 2024 & 2035 (%)

7.1.2. Software Platforms

7.1.3. Service-Based Assessments

7.1.4. Consulting Solutions

7.1.5. Subscription-Based Evidence Libraries

(focuses on market segmentation by Product Type, helping the client prioritize specific crop Technology Types or end-use areas that offer significant business opportunities)

8. Health technology Assessment Market – By Application

8.1. Overview

8.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

8.1.2. Oncology

8.1.3. Rare Diseases

8.1.4. Cardiovascular Care

8.1.5. Neurology

8.1.6. Chronic Disease Management

(describes the market division by Application of Technology Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Health technology Assessment Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Health technology Assessment Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By End-User Type, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By End-User Type, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By End-User Type, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By End-User Type, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Health technology Assessment Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. IQVIA

10.3.2. Syneos Health

10.3.3. Evidera (PPD)

10.3.4. Optum Life Sciences

10.3.5. ICON plc

10.3.6. McKesson Health Economics

10.3.7. BresMed Health Solutions

10.3.8. Clarivate (DRG)

10.3.9. HealthCore (Anthem)

10.3.10. Cello Health (Adelphi)

10.3.11. BluePrint Research Group

10.3.12. Xcenda

10.3.13. Costello Medical

10.3.14. Pharmerit International

10.3.15. Covance Market Access Services

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Health technology Assessment Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Health technology Assessment Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Health technology Assessment Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Health technology Assessment Market: Technology Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Technology Type

TABLE 6: Global Health technology Assessment Market, by Technology Type 2022–2035 (USD Million)

TABLE 7: Health technology Assessment Market: End-User Type Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by End-User Type

TABLE 9: Global Health technology Assessment Market, by End-User Type 2022–2035 (USD Million)

TABLE 10: Health technology Assessment Market: Product Type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Product Type

TABLE 12: Global Health technology Assessment Market, by Product Type 2022–2035 (USD Million)

TABLE 13: Health technology Assessment Market: Product Type Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Application

TABLE 15: Global Health technology Assessment Market, by Application 2022–2035 (USD Million)

TABLE 16: Health technology Assessment Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Health technology Assessment Market, by Region 2022–2035 (USD Million)

TABLE 19: Health technology Assessment Market, by Country (NA), 2022–2035 (USD Million)

TABLE 20: Health technology Assessment Market, by Technology Type (NA), 2022–2035 (USD Million)

TABLE 21: Health technology Assessment Market, by End-User Type (NA), 2022–2035 (USD Million)

TABLE 22: Health technology Assessment Market, by Product Type (NA), 2024–2035 (USD Million)

TABLE 23: Health technology Assessment Market, by Application (NA), 2022–2035 (USD Million)

TABLE 24: U.S. Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 25: U.S. Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 26: U.S. Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 27: U.S. Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 28: Canada Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 29: Canada Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 30: Canada Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 31: Canada Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 32: Mexico Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 33: Mexico Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 34: Mexico Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 35: Mexico Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 36: Health technology Assessment Market, by Country (Europe), 2022–2035 (USD Million)

TABLE 37: Health technology Assessment Market, by Technology Type (Europe), 2022–2035 (USD Million)

TABLE 38: Health technology Assessment Market, by End-User Type (Europe), 2022–2035 (USD Million)

TABLE 39: Health technology Assessment Market, by Product Type(Europe), 2022–2035 (USD Million)

TABLE 40: Health technology Assessment Market, by Application (Europe), 2022–2035 (USD Million)

TABLE 41: Germany Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 42: Germany Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 43: Germany Health technology Assessment Market, by v, 2022–2035 (USD Million)

TABLE 44: Germany Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 45: Italy Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 46: Italy Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 47: Italy Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 48: Italy Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 49: United Kingdom Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 50: United Kingdom Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 51: United Kingdom Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 52: United Kingdom Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 53: France Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 54: France Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 55: France Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 56: France Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 57: Russia Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 58: Russia Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 59: Russia Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 60: Russia Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 61: Poland Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 62: Poland Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 63: Poland Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 64: Poland Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 65: Rest of Europe Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 66: Rest of Europe Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 67: Rest of Europe Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 68: Rest of Europe Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 69: Health technology Assessment Market, by Country (APAC), 2022–2035 (USD Million)

TABLE 70: Health technology Assessment Market, by Technology Type (APAC), 2022–2035 (USD Million)

TABLE 71: Health technology Assessment Market, by End-User Type (APAC), 2022–2035 (USD Million)

TABLE 72: Health technology Assessment Market, by Product Type(APAC), 2022–2035 (USD Million)

TABLE 73: Health technology Assessment Market, by Application (APAC), 2022–2035 (USD Million)

TABLE 74: India Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 75: India Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 76: India Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 77: India Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 78: China Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 79: China Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 80: China Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 81: China Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 82: Japan Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 83: Japan Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 84: Japan Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 85: Japan Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 86: South Korea Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 87: South Korea Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 88: South Korea Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 89: South Korea Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 90: Australia Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 91: Australia Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 92: Australia Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 93: Australia Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 94: Rest of APAC Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 95: Rest of APAC Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 96: Rest of APAC Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 97: Rest of APAC Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 98: Brazil Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 99: Brazil Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 100: Brazil Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 101: Brazil Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 102: Argentina Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 103: Argentina Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 104: Argentina Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 105: Argentina Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 106: Colombia Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 107: Colombia Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 108: Colombia Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 109: Colombia Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 110: Rest of LATAM Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 111: Rest of LATAM Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 112: Rest of LATAM Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 113: Rest of LATAM Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 114: Israel Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 115: Israel Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 116: Israel Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 117: Israel Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 118: Turkey Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 119: Turkey Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 120: Turkey Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 121: Turkey Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 122: Egypt Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 123: Egypt Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 124: Egypt Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 125: Egypt Health technology Assessment Market, by Application, 2022–2035 (USD Million)

TABLE 126: Rest of MEA Health technology Assessment Market, by Technology Type, 2022–2035 (USD Million)

TABLE 127: Rest of MEA Health technology Assessment Market, by End-User Type, 2022–2035 (USD Million)

TABLE 128: Rest of MEA Health technology Assessment Market, by Product Type, 2022–2035 (USD Million)

TABLE 129: Rest of MEA Health technology Assessment Market, by Application, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Health technology Assessment Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Technology Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Technology Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: End-User Type Segment Market Share Analysis, 2023 & 2035

FIGURE 13: End-User Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Technology Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Technology Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Health technology Assessment Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Health technology Assessment Market Share and Leading Players, 2024

FIGURE 23: Latin America Health technology Assessment Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Health technology Assessment Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Health technology Assessment Market Share Analysis by Country, 2023

FIGURE 30: Germany Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: UK Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Health technology Assessment Market Share Analysis by Country, 2023

FIGURE 39: India Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Health technology Assessment Market Share Analysis by Country, 2023

FIGURE 47: Brazil Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Health technology Assessment Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Health technology Assessment Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "This HTA market report was instrumental in helping our executive team evaluate the reimbursement potential of an upcoming digital therapeutic. The clarity with which it mapped payer evaluation frameworks, cost-effectiveness benchmarks, and national HTA guidelines across major markets was impressive. The section on emerging HTA pathways in the U.S. and Europe gave us a competitive edge during early-stage policy engagement."

- Dr. Emily Harper, Director of Market Access Strategy, Boston, USA

- "As a public health economist in the EU, I’ve reviewed many HTA-related studies, but few are as methodologically rigorous and strategically practical as this report. It helped our hospital consortium align procurement priorities with long-term clinical outcomes and budget impact models. The breakdown of HTA agency methodologies, like those of NICE, HAS, and IQWiG, was particularly useful for internal stakeholder education."

- Lukas Meijer, Senior Health Economist, Utrecht, Netherlands

- "This report allowed us to refine our go-to-market approach for a novel diagnostic device in Southeast Asia. The insights on country-specific HTA evolution, particularly Thailand’s HITAP model and Japan’s reimbursement reform, were eye-opening. We used these insights to preemptively align clinical value dossiers for local submissions. Highly recommended for anyone working in regulatory or health economics roles in Asia."

- Ananya Rao, Regulatory Affairs & Health Policy Lead, Bengaluru, India

This Health Technology Assessment (HTA) Market 2025 report has been authored by a seasoned team of healthcare economists, regulatory policy analysts, and market access strategists at Quants & Trends, with over a decade of experience in delivering data-backed insights to global healthcare stakeholders. Our analysts specialize in tracking policy shifts, reimbursement frameworks, and value-based healthcare transitions across North America, Europe, and the Asia-Pacific region.

The authoring team brings together cross-functional expertise in HTA methodologies, from cost-effectiveness modeling and budget impact assessments to comparative effectiveness research and payer engagement strategies. With a strong foundation in real-world data evaluation and clinical value assessments, our research is meticulously curated to support executives, policymakers, consultants, and health tech innovators in navigating HTA landscapes for strategic decision-making.

Whether you're a medtech firm exploring European market entry, a pharmaceutical company preparing a reimbursement dossier, or a healthcare investor evaluating HTA-driven adoption trends, this report provides actionable intelligence grounded in regulatory context, stakeholder behavior, and economic impact.

To learn more about our latest healthcare market insights and industry collaborations, connect with us on our official LinkedIn page.