Market Outlook

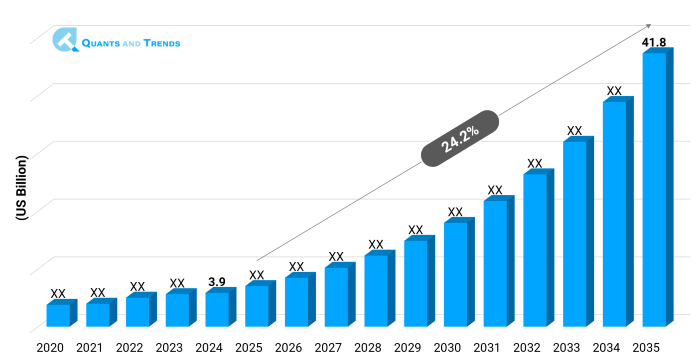

The global Ambient Intelligence in Healthcare Facilities market was valued at approximately USD 3.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 24.2% from 2025 to 2035, reaching around USD 41.8 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Ambient Intelligence in Healthcare Facilities Market has been experiencing a consistent growth due to the incorporation of cutting-edge IoT sensors, AI-driven systems, and real-time data tracking into a healthcare facility. Hospitals and clinics have been warming up to the ambient intelligence solution to enhance patient care, operational efficiency, and to save energy. The major trends in the field of Ambient Intelligence in Healthcare Facilities are the automation of patient monitoring, the use of predictive analysis of patient outcomes, and intelligent environmental control. According to the Ambient Intelligence in Healthcare Facilities Market Forecast, the increasing need in smart, connected healthcare infrastructure will keep fueling market growth the world over, particularly in technologically sophisticated areas.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 24.2% |

| Market Value In 2024 | USD 3.9 billion |

| Market Value In 2035 | USD 41.8 billion |

Introduction

The report on the market of Ambient Intelligence in Healthcare Facilities gives a detailed description of the implementation of smart devices in hospitals, clinics, and research institutions. Ambient intelligence is a combination of sensors, AI, and IoT that form adaptable and responsive environments, which increase patient experience, staff productivity, and energy efficiency. Raising awareness of patient safety, as well as regulatory and policy overview, and smart hospital efforts, contribute to the market expansion. At the report also touch upon the market dynamics, emerging opportunities and the technological adoption in the ambient intelligence systems. North America and Europe are on the lead in deployment with Asia-Pacific becoming a rapidly developing market.

Key Drivers: What’s Fueling the Ambient Intelligence in Healthcare Facilities Market Boom?

- Expanding the Use of Smart Healthcare Infrastructure: Hospitals are deploying ambient intelligence systems including automated lighting, temperature and occupancy control systems. These systems make patients feel comfortable, improve workflow efficiency and lower operational costs. Asset tracking, remote consultations, and predictive analytics to monitor patients are all made possible by technology adoption in the field of Ambient Intelligence in Healthcare Facilities. The growing popularity of interconnected, smart healthcare facilities underpins the Ambient Intelligence in Healthcare Facilities Market size and share facilitating the demand in developed and emerging economies.

- Increasing Attention to Patient Safety and Care Quality: The ambient intelligence solutions offer real-time patient vital monitoring, fall detection, and infection control. Patient safety and clinical decision-making are improved with the help of such applications. Smart environments enable efficient staffing, quicker and more effective responses in case of an emergency and personalized care. The Growth Drivers and Challenges of the Ambient Intelligence to Healthcare Facilities are based on the need to get through the privacy concerns and integration of the older hospital systems with the new, current Internet of Things, which, when administered correctly, offer immense investment potential.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The recent innovations in the Ambient Intelligence in Healthcare Facilities Market are AI-based predictive maintenance, advanced tracking systems of patients, and real-time data analytics. Wearable sensors, gesture recognition, voice-assisted controls, among other emerging technologies are improving the efficiency of operations and patient outcomes. The ability to connect to cloud resources and blockchain to store data securely is broadening the opportunities of telemedicine and virtual healthcare facilities to create new streams of investments and enhance competitiveness in the market.

Recent Developments:

Philips introduced a cloud-computed ambient intelligence system that consolidated patient surveillance and AI-directed streamlining of workflows in hospitals throughout North America.

Conclusion

The market of the Ambient Intelligence in Healthcare Facilities is going to keep growing because of the intersect of AI, IoT, and immersive technologies. The market is controlled by hospitals and clinics, and has great potential in patient monitoring, energy management, and telemedicine. Providers can improve operational efficiency and patient outcomes with software platform innovations, VR/AR applications and secure data management. This is evidenced by regional adoption trends which show North America to be dominant and Asia-Pacific to lead in the growth. The long-term growth and competitive positioning in the world ambient intelligence market is guaranteed by strategic investments, technological partnerships, and new applications.

Key Market Players

Ambient Intelligence in healthcare facilities Competitive Landscape is influenced by large technology providers and healthcare integrators working on the issues of innovation, system integration, and strategic alliances. The main initiatives are artificial intelligence development platforms, growth of IoT-based services, and partnerships with hospitals to streamline patients care. R&D, cloud computer, and secure data management investments are essential to differentiation. Mergers and acquisitions by companies are also aimed at enriching the regional presence and technological power to bolster the Ambient Intelligence in Healthcare Facilities Market Forecast and secure long-term development. Some of the key players in the Ambient Intelligence in Healthcare Facilities industry are as:

Philips Healthcare, Siemens Healthineers, GE Healthcare, Honeywell International Inc., Cisco Systems Inc., IBM Watson Health, Medtronic, Zebra Technologies, Johnson Controls International, Koninklijke DSM N.V., Qualcomm Technologies, Microsoft Healthcare, Abbott Laboratories, VMware, Epic Systems Corporation

- Hardware (Dominant): Hardware is defined as the components of ambient intelligence systems that include the use of sensors, wearable devices, smart lighting, and imaging devices.

- Software & Platforms (Fastest-growing): Cloud elements, AI analytics and blockchain-based healthcare management are escalating at a very rapid rate due to the digital adoption.

- Services: It requires consulting services, integration and training services to allow easy deployment and user adoption.

Segmentation By Application

- Patient Monitoring and Care (Dominant): Fall detection, real-time vital tracking and emergency alerts system is very common.

- Clinical Decision Support (Fastest-growing): AI-based recommendations, predictive analytics, and workflow automation are quickly becoming more popular.

- Asset and Facility Management: Smarter lights, equipment tracker automation and smarter energy-saving.

- Telemedicine & Virtual Care: Televisits and interactive patient care.

- Hospitals & Clinics (Dominant): It is the most widespread one due to the ready infrastructure and the large flow of patients.

- Academic/ Research Institutes (Fastest-growing): Adopt ambient intelligence training, simulation and innovation.

- Pharmaceutical Companies: Use digital twins and virtual trials to streamline R&D.

- Patients & Individuals: Online health monitoring and home-based services are new niches.

Segmentation By Region

Where the Market is Growing Fastest?

The Ambient Intelligence in Healthcare Facilities Market is dominated by North America because it has developed healthcare infrastructure, well-adopted technologies in IoT and AI, and good regulatory policies. The fastest growing region is Asia-Pacific driven by the increasing health care investments, hospital modernization initiatives, and the growing government spending on promoting smart health facilities. Europe is also well-established in the market based on energy efficiency requirements, the sustainability, and the novel hospital designs. Local experiences are pointing out to a potential of the emerging players to gain market access by forming technology alliances and cross-border alliances.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Ambient Intelligence in Healthcare Facilities Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Ambient Intelligence in Healthcare Facilities Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Ambient Intelligence in Healthcare Facilities Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Ambient Intelligence in Healthcare Facilities Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Component & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for decision-making)

5. Ambient Intelligence in Healthcare Facilities Market – By Component

5.1. Overview

5.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

5.1.2. Hardware

5.1.3. Software & Platforms

5.1.4. Services

(presents market segmentation By Component, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Ambient Intelligence in Healthcare Facilities Market – End Use

6.1. Overview

6.1.1. Segment Share Analysis, End Use, 2024 & 2035 (%)

6.1.2. Hospitals & Clinics

6.1.3. Academic/Research Institutes

6.1.4. Pharmaceutical Companies

6.1.5. Patients & Individuals

(breaks down the market End Use, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Ambient Intelligence in Healthcare Facilities Market – By Application

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

7.1.2. Patient Monitoring & Care

7.1.3. Clinical Decision Support

7.1.4. Asset & Facility Management

7.1.5. Telemedicine & Virtual Care

(focuses on market segmentation by Application, helping the client prioritize specific Applications or end-use areas that offer significant business opportunities)

8. Ambient Intelligence in Healthcare Facilities Market– By Geography

8.1. Introduction

8.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

8.2. North America

8.2.1. Regional Overview & Trends

8.2.2. Ambient Intelligence in Healthcare Facilities Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

8.2.4. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

8.2.5. North America Market Size and Forecast, End Use, 2024 - 2035 (US$ Million)

8.2.6. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.7. U.S.

8.2.7.1. Overview

8.2.7.2. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

8.2.7.3. U.S. Market Size and Forecast, End Use, 2024 - 2035 (US$ Million)

8.2.7.4. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.8. Canada

8.2.8.1. Overview

8.2.8.2. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

8.2.8.3. Canada Market Size and Forecast, End Use, 2024 - 2035 (US$ Million)

8.2.8.4. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.9. Mexico

8.2.9.1. Overview

8.2.9.2. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

8.2.9.3. Mexico Market Size and Forecast, End Use, 2024 - 2035 (US$ Million)

8.2.9.4. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

8.3. Europe

8.3.1. Germany

8.3.2. Italy

8.3.3. United Kingdom

8.3.4. France

8.3.5. Russia

8.3.6. Poland

8.3.7. Rest of Europe

8.4. Asia Pacific (APAC)

8.4.1. India

8.4.2. China

8.4.3. Japan

8.4.4. South Korea

8.4.5. Australia

8.4.6. Rest of APAC

8.5. Latin America

8.5.1. Brazil

8.5.2. Argentina

8.5.3. Colombia

8.5.4. Rest of LATAM

8.6. Middle East and Africa

8.6.1. Israel

8.6.2. Turkey

8.6.3. Egypt

8.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

9. Ambient Intelligence in Healthcare Facilities Market: Competitive Landscape & Company Profiles

9.1. Market Share Analysis (2024)

9.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

9.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

9.3.1. Philips Healthcare

9.3.2. Siemens Healthineers

9.3.3. GE Healthcare

9.3.4. Honeywell International Inc.

9.3.5. Cisco Systems Inc.

9.3.6. IBM Watson Health

9.3.7. Medtronic

9.3.8. Zebra Technologies

9.3.9. Johnson Controls International

9.3.10. Koninklijke DSM N.V.

9.3.11. Qualcomm Technologies

9.3.12. Microsoft Healthcare

9.3.13. Abbott Laboratories

9.3.14. VMware

9.3.15. Epic Systems Corporation.

9.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

10. Ambient Intelligence in Healthcare Facilities Market: Future Market Outlook (2025–2035)

10.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

10.1.2. Disruptive Technologies Impact

10.1.3. Emerging Business Trends

10.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

11. Ambient Intelligence in Healthcare Facilities Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make information business decisions that maximize growth and minimize risks)

12. Ambient Intelligence in Healthcare Facilities Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Ambient Intelligence in Healthcare Facilities Market: Component Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Component

TABLE 6: Global Ambient Intelligence in Healthcare Facilities Market, By Component 2022–2035 (USD Billion)

TABLE 7: Ambient Intelligence in Healthcare Facilities Market: End Use Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, End Use

TABLE 9: Global Ambient Intelligence in Healthcare Facilities Market, End Use 2022–2035 (USD Billion)

TABLE 10: Ambient Intelligence in Healthcare Facilities Market: Application Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Application

TABLE 12: Global Ambient Intelligence in Healthcare Facilities Market, by Application 2022–2035 (USD Billion)

TABLE 13: Ambient Intelligence in Healthcare Facilities Market: Regional Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Region

TABLE 15: Global Ambient Intelligence in Healthcare Facilities Market, by Region 2022–2035 (USD Billion)

TABLE 16: Ambient Intelligence in Healthcare Facilities Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 17: Ambient Intelligence in Healthcare Facilities Market, By Component (NA), 2022–2035 (USD Billion)

TABLE 18: Ambient Intelligence in Healthcare Facilities Market, End Use (NA), 2022–2035 (USD Billion)

TABLE 19: Ambient Intelligence in Healthcare Facilities Market, by Application (NA), 2024–2035 (USD Billion)

TABLE 20: U.S. Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 21: U.S. Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 22: U.S. Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 23: Canada Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 24: Canada Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 25: Canada Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 26: Mexico Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 27: Mexico Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 28: Mexico Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 29: Ambient Intelligence in Healthcare Facilities Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 30: Ambient Intelligence in Healthcare Facilities Market, By Component (Europe), 2022–2035 (USD Billion)

TABLE 31: Ambient Intelligence in Healthcare Facilities Market, End Use (Europe), 2022–2035 (USD Billion)

TABLE 32: Ambient Intelligence in Healthcare Facilities Market, by Application (Europe), 2022–2035 (USD Billion)

TABLE 33: Germany Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 34: Germany Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 35: Germany Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 36: Italy Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 37: Italy Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 38: Italy Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 39: United Kingdom Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 40: United Kingdom Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 41: United Kingdom Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 42: France Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 43: France Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 44: France Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 45: Russia Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 46: Russia Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 47: Russia Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 48: Poland Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 49: Poland Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 50: Poland Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 51: Rest of Europe Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 52: Rest of Europe Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 53: Rest of Europe Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 54: Ambient Intelligence in Healthcare Facilities Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 55: Ambient Intelligence in Healthcare Facilities Market, By Component (APAC), 2022–2035 (USD Billion)

TABLE 56: Ambient Intelligence in Healthcare Facilities Market, End Use (APAC), 2022–2035 (USD Billion)

TABLE 57: Ambient Intelligence in Healthcare Facilities Market, by Application (APAC), 2022–2035 (USD Billion)

TABLE 58: India Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 59: India Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 60: India Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 61: China Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 62: China Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 63: China Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 64: Japan Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 65: Japan Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 66: Japan Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 67: South Korea Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 68: South Korea Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 69: South Korea Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 70: Australia Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 71: Australia Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 72: Australia Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 73: Rest of APAC Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 74: Rest of APAC Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 75: Rest of APAC Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 76: Brazil Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 77: Brazil Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 78: Brazil Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 79: Argentina Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 80: Argentina Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 81: Argentina Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 82: Colombia Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 83: Colombia Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 84: Colombia Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 85: Rest of LATAM Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 86: Rest of LATAM Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 87: Rest of LATAM Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 88: Israel Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 89: Israel Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 90: Israel Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 91: Turkey Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 92: Turkey Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 93: Turkey Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 94: Egypt Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 95: Egypt Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 96: Egypt Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

TABLE 97: Rest of MEA Ambient Intelligence in Healthcare Facilities Market, By Component, 2022–2035 (USD Billion)

TABLE 98: Rest of MEA Ambient Intelligence in Healthcare Facilities Market, End Use, 2022–2035 (USD Billion)

TABLE 99: Rest of MEA Ambient Intelligence in Healthcare Facilities Market, by Application, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Ambient Intelligence in Healthcare Facilities Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Technology Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Technology Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: North America Ambient Intelligence in Healthcare Facilities Market Share and Leading Players, 2024

FIGURE 19: Europe Ambient Intelligence in Healthcare Facilities Market Share and Leading Players, 2024

FIGURE 20: Asia Pacific Ambient Intelligence in Healthcare Facilities Market Share and Leading Players, 2024

FIGURE 21: Latin America Ambient Intelligence in Healthcare Facilities Market Share and Leading Players, 2024

FIGURE 22: Middle East and Africa Ambient Intelligence in Healthcare Facilities Market Share and Leading Players, 2024

FIGURE 23: North America Market Share Analysis by Country, 2024

FIGURE 24: U.S. Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 25: Canada Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 26: Mexico Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Europe Ambient Intelligence in Healthcare Facilities Market Share Analysis by Country, 2023

FIGURE 28: Germany Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Spain Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 30: Italy Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: France Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: UK Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: Russia Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: Poland Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Rest of Europe Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Asia Pacific Ambient Intelligence in Healthcare Facilities Market Share Analysis by Country, 2023

FIGURE 37: India Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: China Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 39: Japan Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: South Korea Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Australia Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: Rest of APAC Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Latin America Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Latin America Ambient Intelligence in Healthcare Facilities Market Share Analysis by Country, 2023

FIGURE 45: Brazil Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Argentina Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 47: Colombia Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Rest of LATAM Ambient Intelligence in Healthcare Facilities Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As a senior facilities manager at a large hospital network in Chicago, the Ambient Intelligence in Healthcare Facilities Market Research Report was invaluable in shaping our technology roadmap. The detailed insights on smart monitoring systems, predictive maintenance, and AI-driven patient flow optimization allowed us to prioritize investments in the most impactful technologies. By leveraging the report’s forecasts and case studies, we were able to present a robust business case to senior leadership, ensuring budget approvals for initiatives that enhanced patient experience and operational efficiency."

- Karen Mitchell, Senior Facilities Manager, United States

- "In the Netherlands, where healthcare infrastructure modernization is closely tied to regulatory compliance and sustainability goals, this report provided critical clarity. The Ambient Intelligence in Healthcare Facilities Market Research Report offered deep analysis of sensor-enabled environments, energy optimization, and patient-centered automation across European hospitals. Our planning team used these insights to design pilot programs in two major facilities, optimizing both workflow efficiency and patient safety. The credibility of the research and actionable recommendations made it a trusted guide for strategic decision-making."

- Dr. Willem de Vries, Director of Innovation, Netherlands

- "As a technology strategy lead at a healthcare consulting firm in Singapore, I found the report exceptionally useful for APAC market planning. The country-specific analysis, covering adoption rates of AI-powered monitoring, ambient assisted living, and predictive analytics, enabled us to advise hospital clients on technology investments that align with operational priorities and patient care standards. The combination of quantitative data, regional trends, and expert commentary allowed our team to make confident, evidence-backed recommendations for both short-term upgrades and long-term infrastructure planning."

- Li Wei Tan, Technology Strategy Lead, Singapore

The Ambient Intelligence in Healthcare Facilities Market 2025 report has been authored by a team of seasoned healthcare market research analysts with extensive experience in smart healthcare technologies, hospital operations, and facility management innovation. With over a decade of expertise analyzing digital health solutions, IoT-enabled environments, and AI-powered patient care systems, our analysts deliver intelligence that is both evidence-based and strategically actionable.

Our research methodology integrates primary interviews with hospital administrators, clinical staff, and technology vendors, alongside validated secondary data and proprietary forecasting models. This rigorous, multi-source approach ensures that every insight presented is accurate, reliable, and directly applicable to real-world operational and strategic decisions.

The report is designed to support healthcare executives, technology planners, and investors. Whether evaluating capital investments in AI-driven patient monitoring, planning facility upgrades, or shaping long-term innovation strategies, the findings provide clarity, reduce uncertainty, and empower stakeholders to make confident, data-driven decisions.

By bridging detailed market intelligence with practical business implications, the Ambient Intelligence in Healthcare Facilities Market 2025 report helps organizations optimize operations, enhance patient experiences, and implement future-ready healthcare environments.

To explore more of our healthcare research expertise and stay updated on our latest insights, connect with us on LinkedIn.