Market Outlook

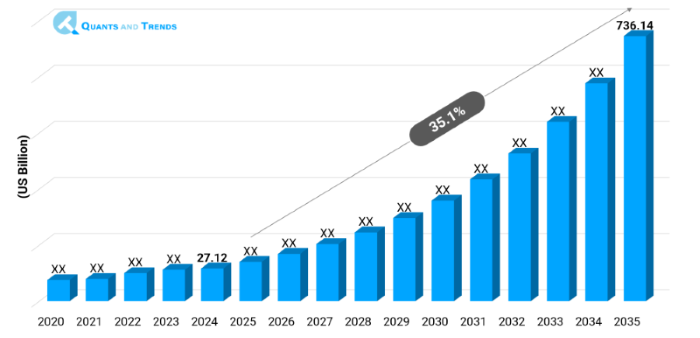

With a 35.1% CAGR, the global Healthcare Artificial Intelligence market is projected to grow from USD 27.12 billion in 2024 to approximately USD 736.14 billion by 2035. The historical analysis captures 2020 to 2023, with 2024 as the base year and forecasts beginning from 2025 to 2035.

The Healthcare Artificial Intelligence Market is rapidly evolving which is driven by increasing demand for faster diagnostics, enhanced patient care and rising workloads on healthcare professionals. AI tools are changing how doctors look at medical data, which helps them make decisions faster and more accurately. Hospitals and clinics are adopting AI to reduce operational inefficiencies and costs. The industry is predicted to develop a lot since chronic diseases are becoming more common and digital health platforms are getting bigger. This transformation is not just about automation but about making healthcare more predictive and personalized. As new innovations continue to emerge, AI is moving from supportive tech to a critical part of healthcare systems globally.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 35.1% |

| Market Value In 2024 | USD 27.12 billion |

| Market Value In 2035 | USD 736.14 billion |

Introduction

Artificial Intelligence in healthcare addresses to the use of intelligent algorithms and machine learning models to assist doctors, researchers and patients in solving complex and critical medical problems. It is being utilized more and more for administrative work, robotic surgery, personalized medicine, and diagnostics. The development of AI in the healthcare industry is being pushed by favorable government policies, increased computing ownership and the growing availability of healthcare data. The global landscape indicates increased collaboration between tech firms and healthcare providers to enhance outcomes. Artificial intelligence in healthcare is becoming an important tool for enhancing the effectiveness and quality of care overall from patient monitoring to revolutionary analytics.

Key Market Drivers: What’s Fueling the Healthcare data security Market Boom?

- Rising Demand for Improved Diagnostics and Imaging- By detecting earlier and more precise symptoms or conditions like cancer and neurological disorders, here artificial intelligence is advancing medical imaging. Identifying these diseases in X-rays and MRIs, AI algorithms have either matched or crossed radiologists, as per the Journal of the American Medical Association (JMA). Improved accuracy and quicker working speed limits the possibility of human mistakes, resulting in quick treatments and better patient results.

- Growing Pressure to Reduce Healthcare Costs-With global healthcare expenditure increasing, cost-efficiency is becoming serious topic to be taken care of. Daily tasks like scheduling, billing & patient documentation can be automated with AI, which lowers administrative costs. As per analysis, AI could help shed around $150 billion annually in the US healthcare system by 2027 through workflows automation & clinical decision support.

- Surge in Wearable Devices and Remote Monitoring: Vast data pools have been created by the surge of wearable technology & mobile health apps. AI helps analyze this real-time data for monitoring vitals, predicting potential health issues, and issuing timely alerts. During the pandemic, this trend geared up and is still widely used today.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

With the integration of real time decision engines, predictive analytics & large language models, AI innovation in healthcare is making tremendous progress. Generative AI is being noted by startups and research institutions for individualized treatment plans. AI in genomics that uses data to prepare customized medications and treatments is another area which is gaining popularity. Explainable AI (XAI), which offers transparency in healthcare decisions vital for patient trust & regulatory compliance in clinical settings is also becoming quite popular.

Recent Developments:

In 2024, Google Health announced that its AI powered diagnostic platform would spread throughout Asia Pacific, helping undeveloped hospitals in achieving better imaging outcomes. In the meantime, IBM Watson & the Mayo Clinic worked together to evaluate a revolutionary AI model for cancer treatment planning. These results reveals that major giants are focusing on disease specific solutions and global scalability. Investors trust in long-term healthcare Artificial Intelligence investment opportunities & rational solutions is additionally proven by the ongoing funding of health AI businesses.

Conclusion

The Healthcare Artificial Intelligence Market Report reflects an industry undergoing major transformation. AI is becoming vital, from early diagnosis to more individualized treatment regimens. Overall, AI is a key enabler as hospitals work to target more with lesser resources. The full potential of AI in healthcare is being supported by governmental support, breakthroughs in AI algorithms & rising public private partnerships. Even though problems like data privacy and interoperability still exist, the future guarantees a more sophisticated, efficient, and patient-focused healthcare system driven by artificial intelligence innovation.

Related Reports

- The global Digital Health Platforms Market was worth USD 292.1 billion in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 21.0% from 2025 to 2035, reaching around USD 2,364.1 billion by the end of the forecast period.

- The global Healthcare Analytics Market was valued at approximately USD 49.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 17.9% from 2025 to 2035, reaching around USD 248.36 billion by the end of the forecast period.

Key Market Players

The Healthcare Artificial Intelligence Competitive Landscape is shaped by tech giants, healthcare organizations and agile startups. To obtain an advantage, businesses are concentrating on partnerships with hospitals, mergers & the enhancement of AI capabilities. Custom AI modules, interoperability features, and cloud integration are emerging as key competitive levers. The market is dynamic, with new competitors frequently upending established firms. As competition heats up, R&D investment stays strong. Emerging Opportunities in Healthcare Artificial Intelligence include specialized AI chips and explainable AI tools tailored for clinical environments. Some of the key players in the Healthcare data security industry are as:

IBM Watson Health, Google Health (Alphabet), Microsoft Azure Health, GE Healthcare, Siemens Healthineers, Philips Healthcare, NVIDIA Corporation, Medtronic, Amazon Web Services (AWS), Cerner Corporation, Epic Systems, Nuance Communications, Tempus, Zebra Medical Vision, Aidoc

- Hardware: Includes sensors, processors, and servers that power AI systems in hospitals. Though foundational, it accounts for a smaller share.

- Software (Dominating segment): Owing to its scalable nature and continuous updates. AI platforms used for imaging, diagnostics & virtual assistants pushing this. Tools such as IBM Watson & Google Health AI are altering diagnosis and treatment delivery.

- Services (Fastest-growing): As hospital requires throughout assistance for implementing sophisticated AI systems and guaranteeing implementation to changing regulations, services like AI consulting, integration, and maintenance are expanding quickly.

Note: Charts and figures are illustrative only. Contact us for verified market data.

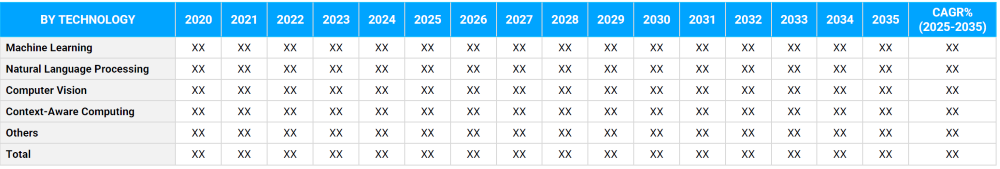

- Machine Learning (Dominating segment): It is the backbone of most AI applications in healthcare industry, enabling very accurate data predictions and patient risk stratification. It dominates due to its wide applicability across the globe.

- Natural Language Processing (NLP): The fastest growing field is natural language processing (NLP), which enables robots to understand clinical writing and translate it into actionable findings. Medical transcripts, voice assistants & chatbots all use it globally.

- Computer Vision: Important for deciphering CT, MRI, and X-ray scans, which are frequently used in radiology.

- Context-Aware Computing & Others: Applied to healthcare workflows for individualized experiences and advanced analytics.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Medical Imaging & Diagnostics (Dominating): This is the largest one owing to its AI tools which are good at diagnosis diseases early, particularly in radiology and pathology.

- Drug Discovery: This segment is likely to be growing at a faster rate owing to the leveraging AI to identify novel drugs target, optimizing molecular synthesis, and it reduce the time and cost of bringing new therapies to the market.

- Virtual Assistants: The growth of this segment is powered by improving patient engagement through AI-powered chatbots and assistants. These solutions serve to offload tasks from clinical staffs.

- Surgery: This is major segment focused on integrating AI into robotic platform for real-time guidance, risk assessment, and precision during complex process.

- Workflow Management: This segment uses AI for back-office optimization, which includes automating documentation, claims processing, billing, and supply chain logistics. Its value lies in improving operational efficiency and reducing administrative waste for providers.

- Patient Monitoring (fastest-growing): This market is expanding quickly due to the growth of wearable technology and telehealth.

- Cybersecurity: AI is employed in cybersecurity to autonomously detect, predict, and respond to sophisticated cyber threats against sensitive patient data (EHRs). This segment is growing due to the increasing volume of data and strict HIPAA/GDPR compliance requirements.

- Others: As AI penetrates every angle of healthcare, significant adoption rates are also observed in robotic-assisted surgery, drug development, virtual assistants, cybersecurity, hospital workflow, and other domains.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Healthcare Providers (Dominating): These organizations are the main users of AI solutions to enhance patient care, procedures, and diagnostics.

- Pharma & Biotech companies (Fastest-growing): Pharmaceutical and biotech companies are utilizing AI for research and development at a rapid pace, particularly in drug development and trial simulations.

- Patients: The Direct-to-Consumer (D2C) segment is growing rapidly, driven by patient-facing apps and wearables for mental health, fitness, and basic triage.

- Payers: The key drivers for the payers segment include utilizing AI for fraud, waste, and abuse (FWA) detection and optimizing claims processing and reimbursement models.

- Research Institutes: This segment, comprising academic centers and research labs, is a major early adopter of advanced AI for genomics, proteomics, and large-scale predictive modeling.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America leads the healthcare artificial intelligence industry analysis pushed by early tech adoption, strong R&D expenditure and favorable government initiatives. The region dominates owing to the presence of major players and digital first hospitals. However, the Asia-Pacific area is the fastest-growing, propelled by expanding healthcare infrastructure, rising chronic diseases, and significant investments in digital health in nations like India, China, and Japan. Moving ahead, Europe also sees constant adoption, especially in the UK, Germany and France. In the healthcare artificial intelligence market forecast, regulatory frameworks are evolving globally, promising responsible AI stationing and boosting regional competitiveness.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Artificial Intelligence Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Artificial Intelligence Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Artificial Intelligence Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Artificial Intelligence Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Application & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Artificial Intelligence Market – By Component

5.1. Overview

5.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

5.1.2. Hardware

5.1.3. Software

5.1.4. Services

(presents market segmentation by Component, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Artificial Intelligence Market – By Technology

6.1. Overview

6.1.1. Segment Share Analysis, By Technology, 2024 & 2035 (%)

6.1.2. Machine Learning

6.1.3. Natural Language Processing

6.1.4. Computer Vision

6.1.5. Context-Aware Computing

6.1.6. Others

(breaks down the market by Technology, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Artificial Intelligence Market – By Application

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

7.1.2. Medical Imaging & Diagnostics

7.1.3. Drug Discovery

7.1.4. Virtual Assistants

7.1.5. Robot-Assisted Surgery

7.1.6. Emergency Room & Hospital Workflow

7.1.7. Remote Patient Monitoring

7.1.8. Cybersecurity

7.1.9. Other Applications

(focuses on market segmentation by Application, helping the client prioritize specific crop Components or end-use areas that offer significant business opportunities)

8. Healthcare Artificial Intelligence Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Healthcare Providers

8.1.3. Pharmaceutical & Biotechnology Companies

8.1.4. Patients

8.1.5. Healthcare Payers

8.1.6. Academic & Research Institutions

8.1.7. Others

(describes the market division by End-User of Application, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Artificial Intelligence Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Artificial Intelligence Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Artificial Intelligence Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. IBM Watson Health

10.3.2. Google Health (Alphabet)

10.3.3. Microsoft Azure Health

10.3.4. GE Healthcare

10.3.5. Siemens Healthineers

10.3.6. Philips Healthcare

10.3.7. NVIDIA Corporation

10.3.8. Medtronic

10.3.9. Amazon Web Services (AWS)

10.3.10. Cerner Corporation

10.3.11. Epic Systems

10.3.12. Nuance Communications

10.3.13. Tempus

10.3.14. Zebra Medical Vision

10.3.15. Aidoc

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Artificial Intelligence Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Artificial Intelligence Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Artificial Intelligence Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Artificial Intelligence Market: Component Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Component

TABLE 6: Global Healthcare Artificial Intelligence Market, by Component 2022–2035 (USD Million)

TABLE 7: Healthcare Artificial Intelligence Market: Technology Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Technology

TABLE 9: Global Healthcare Artificial Intelligence Market, by Technology 2022–2035 (USD Million)

TABLE 10: Healthcare Artificial Intelligence Market: Application Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Application

TABLE 12: Global Healthcare Artificial Intelligence Market, by Application 2022–2035 (USD Million)

TABLE 13: Healthcare Artificial Intelligence Market: Application Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Healthcare Artificial Intelligence Market, by End-User 2022–2035 (USD Million)

TABLE 16: Healthcare Artificial Intelligence Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Artificial Intelligence Market, by Region 2022–2035 (USD Million)

TABLE 19: Healthcare Artificial Intelligence Market, by Country (NA), 2022–2035 (USD Million)

TABLE 20: Healthcare Artificial Intelligence Market, by Component (NA), 2022–2035 (USD Million)

TABLE 21: Healthcare Artificial Intelligence Market, by Technology (NA), 2022–2035 (USD Million)

TABLE 22: Healthcare Artificial Intelligence Market, by Application (NA), 2024–2035 (USD Million)

TABLE 23: Healthcare Artificial Intelligence Market, by End-User (NA), 2022–2035 (USD Million)

TABLE 24: U.S. Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 25: U.S. Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 26: U.S. Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 27: U.S. Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 28: Canada Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 29: Canada Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 30: Canada Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 31: Canada Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 32: Mexico Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 33: Mexico Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 34: Mexico Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 35: Mexico Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 36: Healthcare Artificial Intelligence Market, by Country (Europe), 2022–2035 (USD Million)

TABLE 37: Healthcare Artificial Intelligence Market, by Component (Europe), 2022–2035 (USD Million)

TABLE 38: Healthcare Artificial Intelligence Market, by Technology (Europe), 2022–2035 (USD Million)

TABLE 39: Healthcare Artificial Intelligence Market, by Application (Europe), 2022–2035 (USD Million)

TABLE 40: Healthcare Artificial Intelligence Market, by End-User (Europe), 2022–2035 (USD Million)

TABLE 41: Germany Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 42: Germany Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 43: Germany Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 44: Germany Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 45: Italy Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 46: Italy Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 47: Italy Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 48: Italy Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 49: United Kingdom Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 50: United Kingdom Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 51: United Kingdom Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 52: United Kingdom Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 53: France Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 54: France Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 55: France Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 56: France Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 57: Russia Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 58: Russia Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 59: Russia Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 60: Russia Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 61: Poland Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 62: Poland Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 63: Poland Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 64: Poland Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 65: Rest of Europe Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 66: Rest of Europe Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 67: Rest of Europe Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 68: Rest of Europe Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 69: Healthcare Artificial Intelligence Market, by Country (APAC), 2022–2035 (USD Million)

TABLE 70: Healthcare Artificial Intelligence Market, by Component (APAC), 2022–2035 (USD Million)

TABLE 71: Healthcare Artificial Intelligence Market, by Technology (APAC), 2022–2035 (USD Million)

TABLE 72: Healthcare Artificial Intelligence Market, by Application (APAC), 2022–2035 (USD Million)

TABLE 73: Healthcare Artificial Intelligence Market, by End-User (APAC), 2022–2035 (USD Million)

TABLE 74: India Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 75: India Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 76: India Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 77: India Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 78: China Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 79: China Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 80: China Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 81: China Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 82: Japan Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 83: Japan Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 84: Japan Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 85: Japan Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 86: South Korea Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 87: South Korea Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 88: South Korea Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 89: South Korea Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 90: Australia Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 91: Australia Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 92: Australia Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 93: Australia Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 94: Rest of APAC Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 95: Rest of APAC Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 96: Rest of APAC Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 97: Rest of APAC Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 98: Brazil Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 99: Brazil Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 100: Brazil Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 101: Brazil Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 102: Argentina Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 103: Argentina Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 104: Argentina Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 105: Argentina Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 106: Colombia Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 107: Colombia Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 108: Colombia Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 109: Colombia Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 110: Rest of LATAM Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 111: Rest of LATAM Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 112: Rest of LATAM Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 113: Rest of LATAM Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 114: Israel Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 115: Israel Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 116: Israel Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 117: Israel Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 118: Turkey Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 119: Turkey Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

TABLE 120: Turkey Healthcare Artificial Intelligence Market, by Application, 2022–2035 (USD Million)

TABLE 121: Turkey Healthcare Artificial Intelligence Market, by End-User, 2022–2035 (USD Million)

TABLE 122: Egypt Healthcare Artificial Intelligence Market, by Component, 2022–2035 (USD Million)

TABLE 123: Egypt Healthcare Artificial Intelligence Market, by Technology, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Healthcare Artificial Intelligence Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Technology Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Technology Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Artificial Intelligence Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Artificial Intelligence Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Artificial Intelligence Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Artificial Intelligence Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 27: Canada Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 28: Mexico Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Europe Healthcare Artificial Intelligence Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Spain Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 32: Italy Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: France Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: UK Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: Russia Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: Poland Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Rest of Europe Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Asia Pacific Healthcare Artificial Intelligence Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: China Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 41: Japan Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: South Korea Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Australia Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: Rest of APAC Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Latin America Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Latin America Healthcare Artificial Intelligence Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Argentina Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 49: Colombia Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Rest of LATAM Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Middle East and Africa Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Middle East and Africa Healthcare Artificial Intelligence Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Israel Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 55: Turkey Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Egypt Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Rest of MEA Healthcare Artificial Intelligence Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "This report was instrumental in shaping our 3-year AI adoption roadmap. The detailed segmentation across clinical decision support, medical imaging, and patient engagement AI tools helped us identify areas with the highest ROI. What stood out was the clarity in vendor analysis and regulatory preparedness, two factors often missing in other syndicated reports. It gave us both strategic confidence and operational direction for our enterprise-wide AI transformation."

- Daniel Brooks, Chief Digital Health Officer, Integrated Health System (USA)

- "We used the Healthcare AI Market Research Report to evaluate funding proposals for startups operating in diagnostics and predictive analytics. The maturity model and regional adoption framework were especially valuable in assessing risk-adjusted potential. The report went beyond high-level forecasts, it connected market dynamics with regulatory alignment, infrastructure gaps, and data interoperability trends. It’s a clear reflection of deep industry knowledge and policy awareness."

- Elena Richter, Head of Innovation & AI Strategy, National Health Innovation Fund (Germany)

- "We’ve been exploring AI integration for imaging and workflow automation, and this report provided the most structured and evidence-based insights we’ve encountered. It helped us assess market-leading solutions, understand reimbursement pathways, and prioritize areas for piloting. The Asia-Pacific specific regulatory updates and comparative vendor landscape gave us the assurance we needed to proceed with confidence. It’s a rare report that truly understands the clinical and operational realities of AI adoption in healthcare."

- Dr. Akira Watanabe, Director, AI Integration & Clinical Solutions, Academic Hospital Network (Japan)

This report on the Healthcare Artificial Intelligence Market 2025 has been meticulously researched and authored by a dedicated team of senior healthcare analysts at Quants & Trends, with deep domain expertise at the intersection of AI, digital health, and medical technology transformation. With over a decade of experience tracking emerging technologies in global healthcare ecosystems, our team brings a blend of academic rigor, commercial insight, and regulatory awareness that ensures each data point and strategic analysis in this report is grounded in real-world applicability.

Our analysts have worked closely with AI-driven health tech innovators, hospital CIOs, policy think tanks, and investment professionals to understand how artificial intelligence is truly reshaping care delivery, diagnostics, clinical workflows, and healthcare operations worldwide. This report reflects not only current market sizing and forecasts but also includes forward-looking insights into algorithmic maturity, ethical AI compliance, reimbursement frameworks, and regional adoption disparities, all critical for stakeholders making high-stakes strategic decisions.

Whether you are a digital health executive, an investor assessing scalability, or a policy advisor shaping future AI guidelines, this report provides the strategic clarity and evidence-backed depth required to drive informed decisions.

To learn more about our research approach and to stay updated with our latest insights, connect with us via our official Quants & Trends LinkedIn page.