Market Outlook

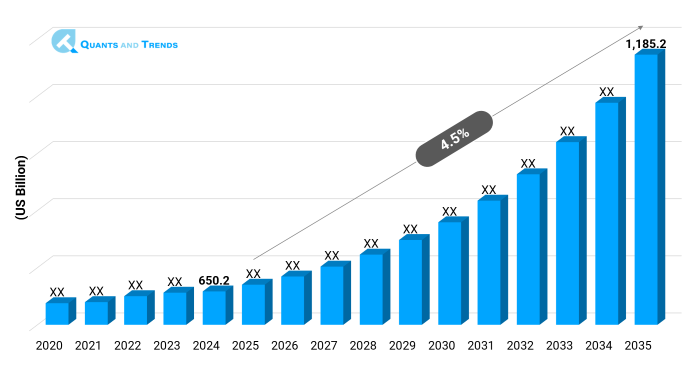

The global Medical Device Innovations market was valued at approximately USD 650.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035, reaching around USD 1,185.2 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Medical Device Innovations Market is on the verge of highly-paced changes due to the introduction of technologies, regulatory progress, and the transition to the patient-centered approach to healthcare realization. The rise of the use of AI and devices supported by the internet of things and the use of less invasive treatment devices is redefining diagnostics as well as the manner of delivering therapy. Market potential is also improved by positive reimbursement schemes in developed economies, and increasing expenditures on digital health platforms. There is increased penetration in home healthcare and telemedicine enablement treatment setting in the industry.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 4.5% |

| Market Value In 2024 | USD 650.2 billion |

| Market Value In 2035 | USD 1,185.2 billion |

Introduction

The Medical Device Innovations Market Report discusses the future of the advanced healthcare technology and its changing medical device environment that has transformed the path of healthcare delivery throughout the world. The market in question is broad, including numerous devices and covering diagnostics, therapeutic solutions, surgical, and monitoring systems that can improve the outcomes of the treatment and the situation of patients. The competitors are targeting precision engineering, individualized medicine and online integration in an attempt to achieve competitive advantages. Innovation is shifting toward home-based and community-based care with increased spending in healthcare, an aging population and increased chronic conditions.

Key Market Drivers: What’s Fueling the Medical Device Innovations Market Boom?

- Medical device technological innovation: Medical Device Innovations Market is driven by the constant innovation in the field of imaging, wearable technology, and AI diagnostics in medical devices. AI-based devices foster early disease diagnosis whereas IoT-based devices facilitate the real-time patient monitoring. These developments both aid preventive health measures and enable clinicians with sound-proof informed decision making.

- Trend to Minimally Invasive and Non-Invasive Procedures: The consumers and providers are becoming more inclined toward minimally invasive or non-invasive equipment to minimize the recovery period, lower the procedural hazards, and experience better comfort. Technology led solutions such as robotic assisted surgeries and catheter based treatment solutions are some of the solutions of Medical Device Innovations Growth Drivers & Challenges balancing demand with training needs.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Smart sensors, digital connectivity, and biocompatible materials are among the driving forces in innovation in the Medical Device Innovations Market. The manufacturers are propping up hybrids that have diagnostic, treatment and monitoring functions within the same platform. One more significant trend is to become more sustainable, that is, to build recyclability into their products and employ environmentally responsible production technologies. Such innovations will make way towards individuality, affordability, and sustainability of healthcare, making this field the model of Technology Adoption in Medical Device Innovations.

Recent Developments:

In 2024, A fintechoption programs joint venture of CareCredit with a major telehealth company makes virtual visits and in-home care instant financed.

Conclusion

Technological convergence, growing healthcare needs, and the world moving towards preventive, and personalized care promise to drive growth in the MDI Market on a long-term basis. The new realms of therapeutic and diagnostic potential are provided by rapid developments in AI, IoT, and material sciences. The area covered by both developed and emerging economies have opportunities in North America, which is the most advanced region, and in the Asia-Pacific region which offers high growth opportunities.

Related Reports

- The global Medical Imaging Advances Market was valued at approximately USD 42.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2025 to 2035, reaching around USD 70.0 billion by the end of the forecast period.

- The global Healthcare Robotics Market was valued at approximately USD 17.8 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 16.4% from 2025 to 2035, reaching around USD 94.2 billion by the end of the forecast period.

Key Market Players

Handling of R&D, mergers & acquisitions and alliances to widen their rich technological portfolios defines the Medical Device Innovations Competitive Landscape. Major corporations are concentrating on the combination of AI, IoT, and advanced biomaterials into their product line. Partnerships with research institutions helps to speed up the product creation process, and the growth to the emerging markets provides a long-term resource. Players are also enhancing the provision of after- sales support and training initiatives so that there will be increased use and adherence to devices. Some of the key players in the Medical Device Innovations industry are as:

UnitedHealthcare, Anthem Inc., Aetna (CVS Health), Cigna Corporation, CareCredit (Synchrony Financial), Medici (digital health financing), ZestHealth, Credgenics, Maven Clinic (women’s health financing), Oscar Health (insurance financing), AXA Health, Bupa Global, Allianz Care, Prudential Healthcare (Asia), Bajaj Finserv (India)

- Diagnostic Devices: This is a device that helps to spot the disease in its earliest stages by the use of sophisticated imaging that gives more penetrating results, placing biomarkers, and testing that are non-invasive to help in making better decisions regarding a clinical procedure.

- Therapeutic Devices: Equipment that provides focused treatment, allows the patient to recover faster and also spends less time doing so with less risks related to having received such treatments.

- Monitoring Devices: Real time patient health monitoring devices which can be used to continuously monitor patients and optimize treatment plans and allow proactive interventions based on the fight of the patient.

- Surgical Instruments: Tools designed with surgical precision making the surgery process more minimally invasive and accurate, as to cause less physical trauma on patients.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Cardiology: Equipment to aid in the diagnosis and treatment of diseases associated with the cardiovascular system including imaging, stent, pacemakers, and remote monitoring equipment.

- Orthopedics: Modern implants, prosthetics, and surgical devices that get movement back in motion and enhance musculoskeletal health outcomes.

- Neurology: Developed neurostimulation, imaging and monitoring systems that help in the management of such disorders as neurological disorders effectively.

- Oncology: Devices that help detect cancer early, accurately administer the treatment, and monitor it to enhance survival.

- General Surgery: Universal equipment which can be used in many surgical specialties, precision and use of safety with the patient.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics: Major adoption spots that have large number of patients, multi-complex cases and well integrated equipment.

- Ambulatory Surgical Centers: Facilities offering cost-effective, same-day procedures with high-quality care standards.

- Diagnostic Centers: Specialized hubs for accurate disease detection and health monitoring through advanced diagnostic tools.

- Home Healthcare Settings: Devices supporting remote patient care, chronic disease management, and elderly assistance at home.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The Medical Device Innovations Market Size and Share majorly belong to North America with its superior healthcare infrastructure, significant spending on research and development, and more commitment to recent technology. The U.S. is first in innovation and regulatory approvals which stimulate share growth in the market. Asia-Pacific is the most rapidly increasing region which is attributed by the expanding access to the healthcare, good government policy, and the growth in number of the medical tourism into countries such as India, China and Singapore. Europe continues to soar steadily due to the harmonization of regulations as well as robust government healthcare.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Medical Device Innovations Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Distribution Channels

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Medical Device Innovations Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Medical Device Innovations Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Medical Device Innovations Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Product type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Medical Device Innovations Market – By Product type

5.1. Overview

5.1.1. Segment Share Analysis, By Product type, 2024 & 2035 (%)

5.1.2. Diagnostic Devices

5.1.3. Therapeutic Devices

5.1.4. Monitoring Devices

5.1.5. Surgical Instruments

(presents market segmentation By Product type, guiding the client on the categories that are expected to drive demand and shape future revenue streams)

6. Medical Device Innovations Market – By Application

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

6.1.2. Cardiology

6.1.3. Orthopedics

6.1.4. Neurology

6.1.5. Oncology

6.1.6. General Surgery

(breaks down the market by Application, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Medical Device Innovations Market – By End User

7.1. Overview

7.1.1. Segment Share Analysis, By End User, 2024 & 2035 (%)

7.1.2. Hospitals & Clinics

7.1.3. Ambulatory Surgical Centers

7.1.4. Diagnostic Centers

7.1.5. Home Healthcare Settings

(focuses on market segmentation by End User, helping the client prioritize specific End Users or end-use areas that offer significant business opportunities)

8. Medical Device Innovations Market– By Geography

8.1. Introduction

8.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

8.2. North America

8.2.1. Regional Overview & Trends

8.2.2. Medical Device Innovations Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product type, 2024 - 2035 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.6. North America Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

8.2.7. U.S.

8.2.7.1. Overview

8.2.7.2. U.S. Market Size and Forecast, By Product type, 2024 - 2035 (US$ Million)

8.2.7.3. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.7.4. U.S. Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

8.2.8. Canada

8.2.8.1. Overview

8.2.8.2. Canada Market Size and Forecast, By Product type, 2024 - 2035 (US$ Million)

8.2.8.3. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.8.4. Canada Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

8.2.9. Mexico

8.2.9.1. Overview

8.2.9.2. Mexico Market Size and Forecast, By Product type, 2024 - 2035 (US$ Million)

8.2.9.3. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

8.2.9.4. Mexico Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

8.3. Europe

8.3.1. Germany

8.3.2. Italy

8.3.3. United Kingdom

8.3.4. France

8.3.5. Russia

8.3.6. Poland

8.3.7. Rest of Europe

8.4. Asia Pacific (APAC)

8.4.1. India

8.4.2. China

8.4.3. Japan

8.4.4. South Korea

8.4.5. Australia

8.4.6. Rest of APAC

8.5. Latin America

8.5.1. Brazil

8.5.2. Argentina

8.5.3. Colombia

8.5.4. Rest of LATAM

8.6. Middle East and Africa

8.6.1. Israel

8.6.2. Turkey

8.6.3. Egypt

8.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

9. Medical Device Innovations Market: Competitive Landscape & Company Profiles

9.1. Market Share Analysis (2024)

9.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

9.3. Company Profiles (Key Players: Overview, s, Strategies, Financials, Recent Developments)

9.3.1. UnitedHealthcare

9.3.2. Anthem, Inc.

9.3.3. Aetna (CVS Health)

9.3.4. Cigna Corporation

9.3.5. CareCredit (Synchrony Financial)

9.3.6. Medici (digital health financing)

9.3.7. ZestHealth

9.3.8. Credgenics

9.3.9. Maven Clinic (women’s health financing)

9.3.10. Oscar Health (insurance financing)

9.3.11. AXA Health

9.3.12. Bupa Global

9.3.13. Allianz Care

9.3.14. Prudential Healthcare (Asia)

9.3.15. Bajaj Finserv (India)

9.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, s, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

10. Medical Device Innovations Market: Future Market Outlook (2025–2035)

10.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

10.1.2. Disruptive Technologies Impact

10.1.3. Emerging Business Trends

10.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

11. Medical Device Innovations Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

12. Medical Device Innovations Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Medical Device Innovations Market: Product type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Product type

TABLE 6: Global Medical Device Innovations Market, By Product type 2022–2035 (USD Billion)

TABLE 7: Medical Device Innovations Market: Application Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Application

TABLE 9: Global Medical Device Innovations Market, by Application 2022–2035 (USD Billion)

TABLE 10: Medical Device Innovations Market: End User Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By End User

TABLE 12: Global Medical Device Innovations Market, by End User 2022–2035 (USD Billion)

TABLE 13: Medical Device Innovations Market: End User Snapshot (2024)

TABLE 16: Medical Device Innovations Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Medical Device Innovations Market, by Region 2022–2035 (USD Billion)

TABLE 19: Medical Device Innovations Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Medical Device Innovations Market, By Product type (NA), 2022–2035 (USD Billion)

TABLE 21: Medical Device Innovations Market, by Application (NA), 2022–2035 (USD Billion)

TABLE 22: Medical Device Innovations Market, by End User (NA), 2024–2035 (USD Billion)

TABLE 23: U.S. Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 24: U.S. Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 25: U.S. Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 26: Canada Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 27: Canada Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 28: Canada Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 29: Mexico Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 30: Mexico Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 31: Mexico Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 32: Medical Device Innovations Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 33: Medical Device Innovations Market, By Product type (Europe), 2022–2035 (USD Billion)

TABLE 34: Medical Device Innovations Market, by Application (Europe), 2022–2035 (USD Billion)

TABLE 35: Medical Device Innovations Market, by End User(Europe), 2022–2035 (USD Billion)

TABLE 36: Germany Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 37: Germany Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 38: Germany Medical Device Innovations Market, by v, 2022–2035 (USD Billion)

TABLE 39: Italy Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 40: Italy Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 41: Italy Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 42: United Kingdom Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 43: United Kingdom Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 44: United Kingdom Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 45: France Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 46: France Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 47: France Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 48: Russia Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 49: Russia Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 50: Russia Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 51: Poland Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 52: Poland Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 53: Poland Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 54: Rest of Europe Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 55: Rest of Europe Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 56: Rest of Europe Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 57: Medical Device Innovations Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 58: Medical Device Innovations Market, By Product type (APAC), 2022–2035 (USD Billion)

TABLE 59: Medical Device Innovations Market, by Application (APAC), 2022–2035 (USD Billion)

TABLE 60: Medical Device Innovations Market, by End User(APAC), 2022–2035 (USD Billion)

TABLE 61: India Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 62: India Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 63: India Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 64: China Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 65: China Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 66: China Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 67: Japan Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 68: Japan Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 69: Japan Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 70: South Korea Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 71: South Korea Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 72: South Korea Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 73: Australia Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 74: Australia Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 75: Australia Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 76: Rest of APAC Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 77: Rest of APAC Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 78: Rest of APAC Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 79: Brazil Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 80: Brazil Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 81: Brazil Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 82: Argentina Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 83: Argentina Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 84: Argentina Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 85: Colombia Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 86: Colombia Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 87: Colombia Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 88: Rest of LATAM Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 89: Rest of LATAM Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 90: Rest of LATAM Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 91: Israel Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 92: Israel Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 93: Israel Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 94: Turkey Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 95: Turkey Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 96: Turkey Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 97: Egypt Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 98: Egypt Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 99: Egypt Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

TABLE 100: Rest of MEA Medical Device Innovations Market, By Product type, 2022–2035 (USD Billion)

TABLE 101: Rest of MEA Medical Device Innovations Market, by Application, 2022–2035 (USD Billion)

TABLE 102: Rest of MEA Medical Device Innovations Market, by End User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Medical Device Innovations Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Product type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Product type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: End User Segment Market Share Analysis, 2023 & 2035

FIGURE 15: End User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Medical Device Innovations Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Medical Device Innovations Market Share and Leading Players, 2024

FIGURE 23: Latin America Medical Device Innovations Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Medical Device Innovations Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Medical Device Innovations Market Share Analysis by Country, 2023

FIGURE 30: Germany Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Medical Device Innovations Market Share Analysis by Country, 2023

FIGURE 39: India Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Medical Device Innovations Market Share Analysis by Country, 2023

FIGURE 47: Brazil Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Medical Device Innovations Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Medical Device Innovations Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As a senior strategy manager at a mid-sized medical technology firm in Boston, I found the Medical Device Innovations Market Research Report invaluable. The depth of competitive intelligence, particularly around emerging wearable diagnostic devices and AI-enabled imaging tools, helped us validate our product roadmap and avoid costly missteps. What stood out was not just the data, but the clarity of analysis and actionable insights, which gave our leadership team the confidence to prioritize R&D investments for the next 18 months. It felt less like a generic report and more like a trusted advisory resource."

- Michael Turner, Healthcare Strategy Professional, United States

- "Operating in the European medtech ecosystem, where regulatory alignment and market adoption timelines are critical, we needed more than surface-level trends. The Medical Device Innovations Market Research Report offered a detailed breakdown of CE-mark approval pathways, adoption drivers in digital surgery, and case studies that mirrored real-world scenarios in our sector. This level of granularity allowed us to refine our go-to-market strategy in Germany and neighboring markets. The report’s credibility was evident through its transparent data sources and expert commentary, which reassured our executive board during strategic planning."

- Dr. Anna Keller, Director of Market Access, Germany

- "For a regional distributor based in Singapore, navigating the APAC medical device landscape can be complex due to diverse regulations and fragmented demand. The Medical Device Innovations Market Research Report was instrumental in mapping out opportunities in minimally invasive devices and digital therapeutics across Southeast Asia. The country-level analysis, combined with expert projections, gave us a clear understanding of where to allocate resources and form strategic partnerships. What I appreciated most was how the report connected macro trends to actionable business implications—we were able to move forward with confidence in a highly competitive market."

- Ravi Menon, Business Development Lead, Singapore

Medical Device Innovations market report has been authored by a team of senior healthcare market research analysts with over a decade of experience in tracking the global medical technology landscape. Our expertise lies at the intersection of healthcare innovation, regulatory frameworks, and market access strategies, ensuring that every insight is backed by rigorous data validation and domain-specific knowledge.

With backgrounds spanning clinical research, health economics, and competitive intelligence, our analysts have supported decision-makers across medtech manufacturers, investors, and healthcare providers. Each section of the Medical Device Innovations Market 2025 report is designed not only to highlight emerging trends, such as AI-driven diagnostics, digital surgery, and next-generation therapeutic devices, but also to translate those findings into actionable business strategies.

Our methodology combines primary interviews with industry stakeholders, secondary research from credible databases, and proprietary forecasting models. This multi-layered approach ensures that the insights presented go beyond surface-level trends, providing stakeholders with the clarity needed to make informed investment, R&D, and market entry decisions.

Whether you are a strategy head evaluating innovation pipelines, an investor conducting due diligence, or a business development leader navigating complex regional markets, this report delivers decision-grade intelligence tailored to your needs.

To learn more about our team, expertise, and ongoing healthcare market research updates, connect with us on LinkedIn.