Market Outlook

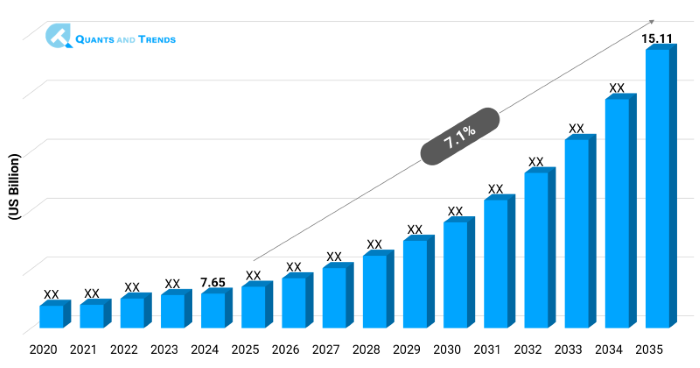

The global Pharmacovigilance market was valued at approximately USD 7.65 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2025 to 2035, reaching around USD 15.11 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Pharmacovigilance Market is growing at a very high rate, indicating growth in regulatory scrutiny and sensitivity of drug safety among various healthcare systems of globally operating nations. In this Pharmacovigilance Market Report, keen Pharmacovigilance surveillance work will be indicated to improve the safety profile of drugs after market surveillance. The increasing sophistication of pharmacotherapy and pharmacovigilance regulations are transforming the behaviour of the industry. Valuable Trends in Pharmacovigilance are the real-time reporting systems and AI-powered adverse events airing mechanisms. Pharmacovigilance Market Forecast flags the future longevity since industry players pay much attention to the safety of patients, risk assessment, and monitoring of adverse events in a systematic process.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 7.1% |

| Market Value In 2024 | USD 7.65 billion |

| Market Value In 2035 | USD 15.11 billion |

Introduction

The Pharmacovigilance Market Report consists of detailed qualitative research of the systems and services devoted to drug safety monitoring. The areas covered by the Pharmacovigilance Market include software providers, the service providers and compliance tools to facilitate reports of adverse events and risk management. Under the Pharmacovigilance Industry Analysis, the report discusses the impact of regulations, integration of technologies and capabilities of the stakeholders. It constitutes Pharmacovigilance Market Size and Share estimates and delves into the digital transition-fueled Pharmacovigilance Investment Opportunities facilitated by AI-driven workflows, with a firm approach toward Forecast Methodology.

Key Market Drivers: What’s Fueling the Pharmacovigilance Market Boom?

- Regulatory and Safety Requirements: Health authorities around the world are requiring stronger standards of pharmacovigilance, which are forcing drug companies to improve their reporting and require investments to be made in compliance. Amplified post-marketing surveillance and periodic updates of safety are essential to market access and brand trust.

- Safety Monitoring: Digital Transformation: Pharmacovigilance is transformational as it adopts AI, machine learning, and cloud platforms. The real-time generation of reports, automated calculation of predictive safety signals and adverse events detection (particularly useful in dealing with slow-moving signals) radically accelerate reactions and operations efficiency.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The trend in the Pharmacovigilance Market is the development of AI technologies to find the signal, mobile reporter applications, and safety logs that can be supported by blockchain to ensure the integrity of data. New platforms combine the real world evidence of electronic health records, wearables, and social media analytics to broaden the surveillance of adverse events. Such Emerging Opportunities offer multi-channel surveillance and minimise underreporting to improve the responsiveness of pharmacovigilance and protection of the general population.

Recent Developments:

In 2025, ArisGlobal introduced a signal detection module, enhanced by an AI system, which enhances the early safety signal prediction and minimises the number of manual reviews required.

Conclusion

The market of Pharmacovigilance is migrating toward an enabling proactive safety ecosystem, which is digitally facilitated. As a result of AI-powered systems and widespread data incorporation, pharmacovigilance is shifting towards the big-data enabled system of predicting risk. Pharmacovigilance Investment Opportunities are in cloud-native systems, real-world evidence capabilities and scalable reporting tools. During the process of regulatory evolution and growing global portfolio of drugs, utilizing Robust Forecast Methodology and multi-source data integration will be critical. The ready stakeholders to integrate innovation and safety necessities can move the next-generation pharmacovigilance to better patient outcomes and operational insights.

Related Reports

- The global Pharmaceutical Industry Market size was valued at USD 1,640.5 billion in 2024 and is expected to reach around USD 2,900.5 billion by 2035, growing at a CAGR of 6% from 2025 to 2035.

- The global Biosimilar Market was valued at approximately USD 32.56 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2035, reaching around USD 67.95 billion by the end of the forecast period.

Key Market Players

The Pharmacovigilance Competitive Landscape contains software vendors, CROs, and IT-service experts around the world that provide integrated safety services. Its main competitive advantages are that it is AI-enabled and has the ability to cover the analytics in regulatory compliance along with the volume of cases around the globe. The providers do work with the pharma companies to make reporting more efficient, and acquisitions and alliances help to strengthen the capabilities. Competitive advantage is platform scalability, regulatory intelligence and the capability to serve multiple regions and multilingual and multi-jurisdictional support. Some of the key players in the Pharmacovigilance industry are as:

IQVIA, Parexel, ArisGlobal, Oracle Health (formerly Argus), Accenture (Life Sciences services), Cognizant (PV operations), Veeva Systems, Ennov, EXL Service, Genpact , Oracle, Clarivate Life Sciences, Lhasa Limited, PrimeVigilance, Indegene

- Spontaneous Reporting: The adverse drug reaction reports by a healthcare professional or consumers to the government or manufacturers that were not requested (unsolicited).

- Intensified ADR Reporting (dominated): Dedicated surveillance in individual environments to detect rare as well as unknown adverse events through an active method of data collection.

- Targeted Spontaneous Reporting: Surveillance of a given drug or the patient population to increase the detection rate of adverse events in targeted procedures of safety surveillance.

- Cohort Event Monitoring (Fastest): Monitors specified patient cohorts after exposure to the drug over a period, thereby determining the drug's safety characteristics and patterns of newly presenting risk.

- EHR Mining: It is a process of extracting data on adverse drug reactions by using AI tools in electronic health records to assist in post-market surveillance.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Preclinical: Safety profiles in animals and in-vitro, prior to introduction in humans begin early stages of drug development.

- Phase I (Dominated): Tracks safety and dose in a few individuals of healthy volunteers at initial exposure of a drug in humans trials.

- Phase II: Determines the safety and preliminary outcome of therapeutic evaluation of efficacy and adverse effects of a bigger cohort of patients.

- Phase III (fastest): Provides confirmation of effectiveness, observes on adverse effects as well as comparison to standard treatments prior to regulatory approval.

- Phase IV: Post-marketing surveillance to detect the long-term adverse effects and to certify the drug safety in general population.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- In-house (fastest): Pharmaceutical firms have their own pharmacovigilance system and as such have an in-housing process of control of safety operations and safety compliance.

- Contract Outsourcing (Dominated): Contract outsourcing Contract vendors or CROs perform pharmacovigilance services, relieving operation load and providing scalable expertise.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Pharmaceutical Companies (Fastest): They should carry out a safety monitoring of new and old medications to meet the regulation frames and provide patient security.

- Biotechnology Companies (Dominated): Keep an eye on biologics, gene therapies, and novel treatments to be able to monitor complex safety signals and adverse trends to emerge.

- Medical Device Manufacturers: Connect to manage reporting of adverse events that involve devices in order to learn about their problems and become aware of their expectation to meet international safety regulations.

- Contract Research Organizations (CROs): Provide outsourced pharmacovigilance services to the sponsors, with pharmacovigilance data handling being handled effectively in terms of safety reporting and regulatory submissions.

- Hospitals: Collect and report adverse drug reactions as frontline clinical data sources in pharmacovigilance programs.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America occupies the leading position in Pharmacovigilance Market due to its well-developed regulatory framework, developed digital health implantation, and a dense safety reporting culture. Asia-Pacific has been witnessing the fastest growth due to growing pharmaceutical markets, as well as, new regulations. Regional Insights Regional insiders point out North America is leading in terms of innovation and compliance solutions, and in the APAC region, opportunities in the region are rapidly expanding, as drug production and localization of safety regulations continue to expand. Designing approaches in these regions may define global pharmacovigilance approaches.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Pharmacovigilance Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Pharmacovigilance Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Pharmacovigilance Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Service Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Pharmacovigilance Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Service Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Pharmacovigilance Market – By Service Type

5.1. Overview

5.1.1. Segment Share Analysis, By Service Type, 2024 & 2035 (%)

5.1.2. Spontaneous Reporting

5.1.3. Intensified ADR Reporting

5.1.4. Targeted Spontaneous Reporting

5.1.5. Cohort Event Monitoring

5.1.6. EHR Mining

(presents market segmentation By Service Type, guiding the client on the Service categories that are expected to drive demand and shape future revenue streams)

6. Pharmacovigilance Market – By Clinical Trial Phase

6.1. Overview

6.1.1. Segment Share Analysis, By Clinical Trial Phase, 2024 & 2035 (%)

6.1.2. Preclinical

6.1.3. Phase I

6.1.4. Phase II

6.1.5. Phase III

6.1.6. Phase IV

(breaks down the market by Clinical Trial Phase, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Pharmacovigilance Market – By Provider Type

7.1. Overview

7.1.1. Segment Share Analysis, By Provider Type, 2024 & 2035 (%)

7.1.2. In-house

7.1.3. Contract Outsourcing

(focuses on market segmentation by Provider Type, helping the client prioritize specific Provider Types or end-use areas that offer significant business opportunities)

8. Pharmacovigilance Market – By End User

8.1. Overview

8.1.1. Segment Share Analysis, By End User, 2024 & 2035 (%)

8.1.2. Pharmaceutical Companies

8.1.3. Biotechnology Companies

8.1.4. Medical Device Manufacturers

8.1.5. Contract Research Organizations (CROs)

8.1.6. Hospitals

(describes the market division by End User of Service Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Pharmacovigilance Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Pharmacovigilance Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Clinical Trial Phase, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Provider Type, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Clinical Trial Phase, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Provider Type, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Clinical Trial Phase, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Provider Type, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Service Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Clinical Trial Phase, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Provider Type, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Pharmacovigilance Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Services, Strategies, Financials, Recent Developments)

10.3.1. IQVIA

10.3.2. Parexel

10.3.3. ArisGlobal

10.3.4. Oracle Health (formerly Argus)

10.3.5. Accenture (Life Sciences services)

10.3.6. Cognizant (PV operations)

10.3.7. Veeva Systems

10.3.8. Ennov

10.3.9. EXL Service

10.3.10. Genpact

10.3.11. Oracle

10.3.12. Clarivate Life Sciences

10.3.13. Lhasa Limited

10.3.14. PrimeVigilance

10.3.15. Indegene.

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Services, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Pharmacovigilance Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Pharmacovigilance Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Pharmacovigilance Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Pharmacovigilance Market: Service Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Service Type

TABLE 6: Global Pharmacovigilance Market, By Service Type 2022–2035 (USD Billion)

TABLE 7: Pharmacovigilance Market: Clinical Trial Phase Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Clinical Trial Phase

TABLE 9: Global Pharmacovigilance Market, by Clinical Trial Phase 2022–2035 (USD Billion)

TABLE 10: Pharmacovigilance Market: Provider Type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Provider Type

TABLE 12: Global Pharmacovigilance Market, by Provider Type 2022–2035 (USD Billion)

TABLE 13: Pharmacovigilance Market: End User Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End User

TABLE 15: Global Pharmacovigilance Market, by End User 2022–2035 (USD Billion)

TABLE 16: Pharmacovigilance Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Pharmacovigilance Market, by Region 2022–2035 (USD Billion)

TABLE 19: Pharmacovigilance Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Pharmacovigilance Market, By Service Type (NA), 2022–2035 (USD Billion)

TABLE 21: Pharmacovigilance Market, by Clinical Trial Phase (NA), 2022–2035 (USD Billion)

TABLE 22: Pharmacovigilance Market, by Provider Type (NA), 2024–2035 (USD Billion)

TABLE 23: Pharmacovigilance Market, by End User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 26: U.S. Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 27: U.S. Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 28: Canada Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 29: Canada Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 30: Canada Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 31: Canada Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 32: Mexico Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 34: Mexico Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 35: Mexico Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 36: Pharmacovigilance Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Pharmacovigilance Market, By Service Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Pharmacovigilance Market, by Clinical Trial Phase (Europe), 2022–2035 (USD Billion)

TABLE 39: Pharmacovigilance Market, by Provider Type(Europe), 2022–2035 (USD Billion)

TABLE 40: Pharmacovigilance Market, by End User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 42: Germany Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 43: Germany Pharmacovigilance Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 45: Italy Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 46: Italy Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 47: Italy Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 48: Italy Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 53: France Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 54: France Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 55: France Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 56: France Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 57: Russia Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 58: Russia Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 59: Russia Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 60: Russia Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 61: Poland Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 62: Poland Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 63: Poland Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 64: Poland Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 69: Pharmacovigilance Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Pharmacovigilance Market, By Service Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Pharmacovigilance Market, by Clinical Trial Phase (APAC), 2022–2035 (USD Billion)

TABLE 72: Pharmacovigilance Market, by Provider Type(APAC), 2022–2035 (USD Billion)

TABLE 73: Pharmacovigilance Market, by End User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 75: India Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 76: India Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 77: India Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 78: China Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 79: China Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 80: China Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 81: China Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 82: Japan Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 83: Japan Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 84: Japan Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 85: Japan Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 86: South Korea Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 88: South Korea Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 89: South Korea Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 90: Australia Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 91: Australia Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 92: Australia Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 93: Australia Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 98: Brazil Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 100: Brazil Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 101: Brazil Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 102: Argentina Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 104: Argentina Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 105: Argentina Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 106: Colombia Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 108: Colombia Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 109: Colombia Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 114: Israel Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 115: Israel Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 116: Israel Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 117: Israel Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 118: Turkey Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 120: Turkey Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 121: Turkey Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 122: Egypt Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 124: Egypt Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 125: Egypt Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Pharmacovigilance Market, By Service Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Pharmacovigilance Market, by Clinical Trial Phase, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Pharmacovigilance Market, by Provider Type, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Pharmacovigilance Market, by End User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Pharmacovigilance Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Service Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Service Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Clinical Trial Phase Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Clinical Trial Phase Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Service Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Service Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Pharmacovigilance Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Pharmacovigilance Market Share and Leading Players, 2024

FIGURE 23: Latin America Pharmacovigilance Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Pharmacovigilance Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Pharmacovigilance Market Share Analysis by Country, 2023

FIGURE 30: Germany Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Pharmacovigilance Market Share Analysis by Country, 2023

FIGURE 39: India Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Pharmacovigilance Market Share Analysis by Country, 2023

FIGURE 47: Brazil Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Pharmacovigilance Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Pharmacovigilance Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The Pharmacovigilance Market Research Report provided by Quants & Trends was instrumental in reshaping our drug safety strategy for the next five years. The detailed regulatory landscape analysis, combined with clear competitive benchmarking, allowed us to confidently allocate resources to high-priority markets while ensuring full compliance with evolving FDA guidelines. The blend of market intelligence and practical recommendations made it far more valuable than a standard data dump, it directly influenced our operational and investment decisions."

- Sarah Mitchell, Regulatory Affairs Director, United States

- "As a European healthcare executive, I have seen many market reports, but this one stood out for its precision and depth. The section on post-marketing surveillance trends in the EU and UK was backed by real-world case studies, giving our leadership team a realistic view of both the risks and opportunities. We used these insights to fine-tune our pharmacovigilance outsourcing strategy, which resulted in measurable cost efficiencies and improved compliance readiness."

- Dr. Markus Reinhardt, Head of Clinical Risk Management, Germany

- "The APAC-focused analysis in this report was exceptional, particularly the detailed insights on Japan’s PMDA regulatory framework and its evolving expectations for risk management plans. The market forecasts and vendor landscape helped us evaluate strategic partnerships for pharmacovigilance services within the region. This forward-looking intelligence gave our team the confidence to propose a multi-year roadmap that aligns with both local compliance and global safety standards."

- Haruto Takahashi, Senior Drug Safety Analyst, Japan

This Pharmacovigilance Market 2025 report is authored by the senior research team at Quants & Trends, a trusted name in global healthcare market intelligence. With over a decade of specialized expertise in drug safety monitoring, regulatory compliance, and market forecasting, our analysts combine deep industry knowledge with rigorous data validation to deliver insights that are both credible and actionable.

Our research methodology goes beyond surface-level market trends. We engage with regulatory agencies, industry stakeholders, and pharmacovigilance experts to capture the evolving landscape of drug safety and post-marketing surveillance. This ensures that every forecast, competitive benchmark, and strategic recommendation in the report is backed by verifiable data and real-world perspectives.

For decision-makers in pharmaceutical companies, CROs, and healthcare technology providers, this report serves as a strategic compass, helping you identify growth opportunities, navigate complex regulatory environments, and optimize risk management strategies. Clients have used our pharmacovigilance insights to refine market entry plans, strengthen compliance frameworks, and streamline vendor selection processes.

By combining robust quantitative analysis with qualitative intelligence, Quants & Trends ensures that you have not just the what and where of market trends, but also the why, critical for making confident, forward-looking business decisions.

You can learn more about our research expertise and connect with our analysts through our company LinkedIn page.