Market Outlook

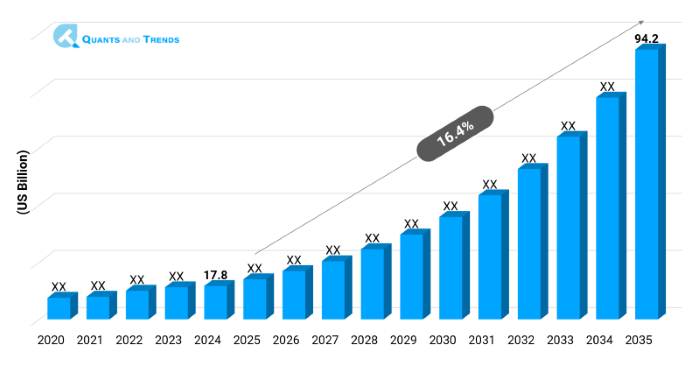

The global Healthcare Robotics market was valued at approximately USD 17.8 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 16.4% from 2025 to 2035, reaching around USD 94.2 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Healthcare Robotics Market is undergoing a groundbreaking revolution, which is the amalgamation of state-of-the-art robotics, AI, and healthcare innovation. These are enhancing the precision in surgery, post care procedures and making the hospital operations logistically nil. As healthcare costs continue to rise alongside the number of people continuing to age, hospitals and clinics are incorporating robotics to maximize efficiency and results. The Healthcare Robotics Market Size & Share will grow considerably over the next few years with the help of positive regulatory changes and use of technology. With the projected growth trend and surge predictable by the Healthcare Robotics Market Forecast models going forward, stakeholders are investing in scalable robotic interventions in regard to achieving universal clinical needs.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 16.4% |

| Market Value In 2024 | USD 17.8 billion |

| Market Value In 2035 | USD 94.2 billion |

Introduction

Healthcare robotics encompasses the use of robotic systems in healthcare and care to carry out complex tasks in a safe, highly precise and efficient manner. These are surgical robotic assistants, gait training exoskeletons, and automated drugs dispensaries. The increased focus on quick recovery and minimally invasive surgeries, as well as patient-centered approach, are the forces of the Healthcare Robotics Market. In addition, the necessity to drive down hospital-acquired infections and optimize the effectiveness of operations also encourages robotic automation. Healthcare Robotics Industry Analysis argues the industry is changing very fast due to the advancements in AI, sensor technologies, and machine learning and provides robots with more applications in enabling patient care delivery in a more autonomous and intelligent fashion.

Key Market Drivers: What’s Fueling the Healthcare Robotics Market Boom?

- Growing Requirement of Minimally Invasive Procedures: With the tendency among patients tilting more in a direction that is less invasive in terms of surgery, the idea of robotic-assisted surgeries is becoming increasingly popular. Such systems make surgical procedures precise, minimize recovery time of patients as well as complication rates, thereby making them appealing to both the practitioner and the patient. The Healthcare Robotics Market is enjoying escalating numbers of procedures which are performed using robot guidelines such as the robot-guided laparoscopic and orthopedic procedures.

- Growing Technology: AI, haptik feedback, and real time imaging have gained major technological progress, facilitating the use of robots to a large extent. Connection to cloud computing and IoT provides the possibility to control remotely and perform predictive maintenance and constant learning. Such evolutions enter the Healthcare Robotics Growth Drivers & Challenges by developing smarter and more accommodating systems to various medical situations.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Healthcare Robotics Market is all about technological innovation. Firms are engineering robots with autonomous navigation, ability to read emotions, and decision-making with AI. Projects by research labs and start-ups are emerging that consist of surgical platforms with augmented manual skills and real-time data processing. Such innovations will improve patient safety and operational accuracy and allow these to be deployed at scale.

Recent Developments:

In 2025, Stryker Corporation developed a new generation of robotic knee replacement technology, better haptic feedback and AI-integration. At the same time, Diligent Robotics has been implementing its own autonomous service robots in hospitals throughout the US, increasing the efficiency of the workflow and the productivity of staff members.

Conclusion

There is a potential high rate of change in the Healthcare Robotics Market led by technological advancement, demographic dynamics and the evolution of care. With problems like the cost barriers and compliance, opportunities arise in remote care, surgical robotics and hospital automations as the industry will make a new leap into these areas. Favorable Healthcare Robotics Market Forecasts mean that the stakeholders need to concentrate on scalable innovation, strategic alliances as well as value-based care integration. Healthcare robotics in the next decade will transition out of today As pilot projects into mainstream operation systems in the world.

Related Reports

- The global Medical Device Innovations Market was valued at approximately USD 650.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035, reaching around USD 1,185.2 billion by the end of the forecast period.

- The global Lab Automation Market was valued at approximately USD 7.15 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2025 to 2035, reaching around USD 14.9 billion by the end of the forecast period.

Key Market Players

The Healthcare Robotics Competitive Landscape comprises incumbents and start-ups developing robotic platforms targeting surgical, diagnostic and caregiving use-cases. M&A, strategic partnerships, R&D investments are the hallmarks of competition. In order to keep up, companies are putting their attention on usability, safety compliance, and upgrading software. Innovation-centric differentiation characterizes the market which is moderately consolidated. Some of the key players in the Healthcare Robotics industry are as:

Intuitive Surgical, Stryker Corporation, Medtronic, Zimmer Biomet, Siemens Healthineers, Smith & Nephew, Ekso Bionics, ReWalk Robotics, Panasonic Healthcare, Myomo Inc., Diligent Robotics, Cyberdyne Inc., Titan Medical, Aethon Inc., Bionik Laboratories

Segmentation By Type

- Surgical Robots (Fastest): They help the surgeon to carry out complex surgeries with more precision, less invasiveness, and better visualization resulting in faster recovery and fewer post-surgery complications.

- Rehabilitation Robots: Assist in physical therapy by providing repetitive and selective movements with patients with neurological or musculoskeletal deficits and hence, motor recovery and individualized rehabilitation programs.

- Diagnostic Robots (Dominated): Automation of the diagnostic processes like blood sampling, imagery required, to make the job more accurate, workload-reducing and reducing the speed of clinical decisions in the hospitals and laboratory.

- Telepresence Robots: Provide remote treatment of doctor to patient due to its ability to allow physicians to engage in consultation, monitoring and diagnosis using video-connected robotic mobility frames in places that do not require the patient to be present.

- Disinfection Robots: Designed using UV-C light sources or chemical spray to disinfect the hospital surfaces and rooms and reduce the risk of healthcare-related diseases and keep the staff of the frontline health facilities safe.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Minimally Invasive Surgery (fastest): Allow easily controlled surgical procedures by using little cumbersome incisions, which lessen the damage brought about by patient trauma, blood loss, and hospital stay, and also increase the effectiveness and accuracy of the procedure.

- Elderly Care and Assisted Living: Offer mobility aids, health management, and social interaction devices to enhance the independency and living standards of ageing populations at home or between the facility.

- Diagnostics & Imaging (Dominated): Streamline detection and imaging procedures by implementing robotics in the environment of sample management, radiology and pathology labs and providing more timely and trustworthy diagnostic results.

- Infection Control: Implement automated disinfection and sterilization technologies in clinical settings to minimize the transmission of pathogen and assist in attaining infection prevention regulations in critical areas.

- Physical Therapy & Rehabilitation: Provide the patient with customized therapy regimen via robotic exoskeletons or assistive devices and empower a patient, regardless of their age or health status, to get functional mobility after injury, stroke, or operation.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hardware (Dominated): Encompasses actuators, sensors, robotic arms, and raw control systems that constitute the physical component of medical robots applied in surgeries and diagnostics as well as patient aids.

- Software: Includes control algorithms, navigation systems and user-interfaces to allow robots to be used, analyze data and interface with electronic medical record systems.

- Services (Fastest): This will include maintenance, upgrade of the services, training, and system integration services to guarantee effective deployment of robots and their use over an extended period of use in healthcare facilities.

- AI and Machine Learning Modules: Provide the capability of healthcare robots to learn to adapt over time and predictive diagnostics and intelligent automation in healthcare, providing better decision-making and operational performance driven by data-driven intelligence.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics (Dominated): Prolific users of robotics in surgeries, diagnostics, and disinfection with a goal of enhancing patient care, throughput of procedures and efficiency in departments.

- Ambulatory Surgical Centers: Apply surgical and diagnostic robots to simplify out-patient administration, speed recovery of patients, and continue high accuracy with the limit on cost in care.

- Rehabilitation Centers: Use assistive robots to provide repetitive, monitored therapy to perform neuromuscular and orthopedic recovery and provide an enhanced return-on-therapy ratio to patients as well as reducing the workload burden on therapists.

- Homecare Settings (Fastest): Repurposing robotic solutions to the setting and using smaller robot aids can be used to remind people about their medications, assist mobility, and provide telehealth services to maintain autonomous living and telemonitoring.

- Academic and Research Centers/Institutions: Engaged in the development of the design, testing, and integration of robotics toward surgical, rehabilitation, and diagnostic applications with innovation and clinical validation.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America presently commands the Healthcare Robotics Market due to robust investment ecosystem and backing by law. Asia-Pacific represents the fastest-growing region with its constant expansion of healthcare infrastructure and rising numbers of elderly populations in such countries as Japan and China. In Europe there are also good results, specifically in robotics surgery and automation in care of the elderly. According to Regional Insights, there is an increasing investment by the governments across these geographies as well as the increase in the number of private investments as well.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Robotics Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Robotics Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Robotics Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Technology Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Robotics Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Robotics Market – By Type

5.1. Overview

5.1.1. Segment Share Analysis, By Type, 2024 & 2035 (%)

5.1.2. Surgical Robots

5.1.3. Rehabilitation Robots

5.1.4. Diagnostic Robots

5.1.5. Telepresence Robots

5.1.6. Disinfection Robots

(presents market segmentation By Type, guiding the client on the Technology categories that are expected to drive demand and shape future revenue streams)

6. Healthcare Robotics Market – By Application

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

6.1.2. Minimally Invasive Surgery

6.1.3. Elderly Care & Assisted Living

6.1.4. Diagnostics & Imaging

6.1.5. Infection Control

6.1.6. Physical Therapy & Rehabilitation

(breaks down the market by Application, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Healthcare Robotics Market – By Component

7.1. Overview

7.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

7.1.2. Hardware

7.1.3. Software

7.1.4. Services

7.1.5. AI & Machine Learning Modules

(focuses on market segmentation by Component, helping the client prioritize specific Components or end-use areas that offer significant business opportunities)

8. Healthcare Robotics Market – By End User

8.1. Overview

8.1.1. Segment Share Analysis, By End User, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Ambulatory Surgical Centers

8.1.4. Rehabilitation Centers

8.1.5. Homecare Settings

8.1.6. Academic & Research Institutions

(describes the market division by End User of Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Robotics Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Robotics Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Robotics Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Technologys, Strategies, Financials, Recent Developments)

10.3.1. Intuitive Surgical

10.3.2. Stryker Corporation

10.3.3. Medtronic

10.3.4. Zimmer Biomet

10.3.5. Siemens Healthineers

10.3.6. Smith & Nephew

10.3.7. Ekso Bionics

10.3.8. ReWalk Robotics

10.3.9. Panasonic Healthcare

10.3.10. Myomo Inc.

10.3.11. Diligent Robotics

10.3.12. Cyberdyne Inc.

10.3.13. Titan Medical

10.3.14. Aethon Inc.

10.3.15. Bionik Laboratories.

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Technology’s, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Robotics Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Robotics Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Robotics Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Robotics Market: Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Type

TABLE 6: Global Healthcare Robotics Market, By Type 2022–2035 (USD Billion)

TABLE 7: Healthcare Robotics Market: Application Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Application

TABLE 9: Global Healthcare Robotics Market, by Application 2022–2035 (USD Billion)

TABLE 10: Healthcare Robotics Market: Component Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Component

TABLE 12: Global Healthcare Robotics Market, by Component 2022–2035 (USD Billion)

TABLE 13: Healthcare Robotics Market: Component Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End User

TABLE 15: Global Healthcare Robotics Market, by End User 2022–2035 (USD Billion)

TABLE 16: Healthcare Robotics Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Robotics Market, by Region 2022–2035 (USD Billion)

TABLE 19: Healthcare Robotics Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Healthcare Robotics Market, By Type (NA), 2022–2035 (USD Billion)

TABLE 21: Healthcare Robotics Market, by Application (NA), 2022–2035 (USD Billion)

TABLE 22: Healthcare Robotics Market, by Component (NA), 2024–2035 (USD Billion)

TABLE 23: Healthcare Robotics Market, by End User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 26: U.S. Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 27: U.S. Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 28: Canada Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 29: Canada Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 30: Canada Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 31: Canada Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 32: Mexico Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 34: Mexico Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 35: Mexico Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 36: Healthcare Robotics Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Healthcare Robotics Market, By Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Healthcare Robotics Market, by Application (Europe), 2022–2035 (USD Billion)

TABLE 39: Healthcare Robotics Market, by Component(Europe), 2022–2035 (USD Billion)

TABLE 40: Healthcare Robotics Market, by End User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 42: Germany Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 43: Germany Healthcare Robotics Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 45: Italy Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 46: Italy Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 47: Italy Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 48: Italy Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 53: France Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 54: France Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 55: France Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 56: France Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 57: Russia Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 58: Russia Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 59: Russia Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 60: Russia Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 61: Poland Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 62: Poland Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 63: Poland Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 64: Poland Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 69: Healthcare Robotics Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Healthcare Robotics Market, By Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Healthcare Robotics Market, by Application (APAC), 2022–2035 (USD Billion)

TABLE 72: Healthcare Robotics Market, by Component(APAC), 2022–2035 (USD Billion)

TABLE 73: Healthcare Robotics Market, by End User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 75: India Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 76: India Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 77: India Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 78: China Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 79: China Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 80: China Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 81: China Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 82: Japan Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 83: Japan Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 84: Japan Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 85: Japan Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 86: South Korea Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 88: South Korea Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 89: South Korea Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 90: Australia Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 91: Australia Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 92: Australia Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 93: Australia Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 98: Brazil Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 100: Brazil Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 101: Brazil Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 102: Argentina Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 104: Argentina Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 105: Argentina Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 106: Colombia Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 108: Colombia Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 109: Colombia Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 114: Israel Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 115: Israel Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 116: Israel Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 117: Israel Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 118: Turkey Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 120: Turkey Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 121: Turkey Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 122: Egypt Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 124: Egypt Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 125: Egypt Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Healthcare Robotics Market, By Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Healthcare Robotics Market, by Application, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Healthcare Robotics Market, by Component, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Healthcare Robotics Market, by End User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Healthcare Robotics Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Robotics Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Robotics Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Robotics Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Robotics Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Healthcare Robotics Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Healthcare Robotics Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Healthcare Robotics Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Healthcare Robotics Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Healthcare Robotics Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "This report was a turning point for our strategic roadmap. The depth of analysis on surgical robotics, rehabilitation systems, and AI-driven automation gave us a clear picture of where the market is heading. The competitive landscape section was particularly valuable in benchmarking our capabilities against global leaders. We used the market sizing and adoption trend data to fine-tune our product development priorities and secure board approval for a multi-million-dollar investment in advanced robotics."

- Emily Carter, Healthcare Technology Strategist, United States

- "The Healthcare Robotics Market Research Report stood out for its precision and objectivity. The detailed breakdown of European regulatory pathways, coupled with insights into procurement patterns across different healthcare settings, allowed us to identify high-potential markets we had previously overlooked. The case studies on successful robotic implementation in hospitals provided real-world validation that helped strengthen our pitch to stakeholders and win funding for our expansion strategy."

- Lukas Meyer, Medical Device Innovation Lead, Germany

- "What impressed me most was how the report connected market trends with practical commercialization strategies. The APAC-specific analysis, especially on aging populations and government healthcare automation initiatives, was directly applicable to our growth plans. By aligning our robotics portfolio with the key drivers identified in this research, we were able to fast-track partnerships with regional healthcare providers and improve our revenue forecasts with far greater accuracy."

- Aisha Tan, Healthcare Business Development Director, Singapore

The Healthcare Robotics Market 2025 report has been meticulously developed by the senior research team at Quants & Trends, a leading provider of healthcare market intelligence with over a decade of experience in analyzing emerging technologies and their commercial impact. Our analysts bring a unique blend of medical industry expertise, technology assessment skills, and data-driven market forecasting to deliver insights that go beyond surface-level trends.

This research is the result of extensive primary interviews with industry leaders, robotics engineers, hospital procurement heads, and regulatory experts, combined with secondary data from trusted industry databases and peer-reviewed publications. The report offers decision-makers actionable intelligence, covering surgical robotics, rehabilitation systems, hospital automation, and AI-integrated devices, to support strategic investments, product development, and market entry planning.

From identifying untapped market segments in Europe, to assessing APAC’s government-led healthcare automation initiatives, the Healthcare Robotics Market 2025 report equips executives, innovators, and investors with the clarity they need to navigate competitive pressures and capture emerging growth opportunities.

To learn more about our research capabilities and industry expertise, visit our company LinkedIn page, where we regularly share market updates, thought leadership articles, and data-driven perspectives on the future of healthcare innovation.