Market Outlook

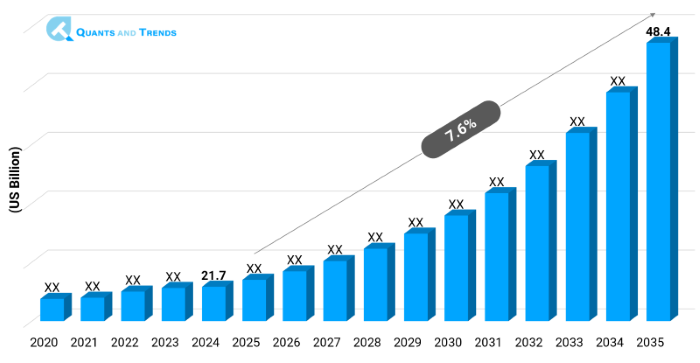

The global Infectious Disease management market was valued at approximately USD 21.7 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2035, reaching around USD 48.4 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Infectious Disease Management Market is bound to grow massively due to the increased infectious risks seen across the globe and the ongoing diagnosis infrastructure as well as community health policies which support the market. This Infectious Disease Management Market Report highlights the ways in which inbuilt genomics, quick sampling, and digitized surveillance are restructuring structures of prevention and response. In Key Trends in Infectious Disease Management, there is a trend toward an immediate use of data analytics and where AI takes a leading role in diagnostics. The market forecast in Infectious Disease Management is rapidly changing, in response to risks of outbreaks and stakeholders should track this pattern to ensure an effective allocation of strategies and investment.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 7.6% |

| Market Value In 2024 | USD 21.7 billion |

| Market Value In 2035 | USD 48.4 billion |

Introduction

Infectious Disease Management Market Report focuses on a broad qualitative investigation of diagnosis equipment, treatment interventions, and containment approaches as the infectious disease environment changes. The Infectious Disease Management Market overview is a synthesis of demand forces, budgetary capacities, and emanating health risks. The report also assesses the ability to do rapid diagnostics, digital surveillance, and preparedness infrastructure with a strong focus on Infectious Disease Management Industry Analysis. It also finds out Infectious Disease Management Market Size & Share and the Infectious Disease Management Investment Opportunities giving a clue to the future growth direction backed by strong Forecast Methodology.

Key Market Drivers: What’s Fueling the Infectious Disease management Market Boom?

- Emerging & Re-Emerging: Emerging pathogens and newly emerged ones (e.g. novel viruses, antibiotic-resistant bacteria) drive frequent outbreaks that put pressure on health systems and require vigilant surveillance and efficient management capabilities. Large investments in the scale-up of diagnostic and outbreak-response systems at the public and private levels in addition to further direct overall market growth have become reality.

- Developments in Rapid Point-of-Care Diagnostics: New technologies allow one to detect pathogens in near real-time through the application of lateral-flow assays, CRISPR-based assays, and next-gen polymerase chains. Such developments facilitate the concept of decentralized care, facilitated interventions through community and clinical facilities what is needed in a resource-scarce area on a timely basis.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The modern face of innovation in the industry is characterized by miniaturized rapid tests, mobile-genomic sequencing, and artificial intelligence embedded in surveillance platforms. Portable molecular diagnostics would make it feasible to deploy testing in the field upfront during an outbreak, and tele-infectious-disease platforms would provide off-site triage, with patients triaged by chatbots and virtual consults. These Emerging Opportunities are an indication of the way the infectious disease management market is being transformed, and they will result in a move to tools that are real-time, accessible and adaptive which enables both the clinicians and communities across the globe.

Recent Developments:

In January 2025, BioMerieux introduced a portable PCR multiplex system that allows several pathogens to be detected simultaneously in point-of-care settings, making outbreak response more agile.

Conclusion

To conclude, the Infectious Disease Management Market is going to be assessed as strategically uncertain, driven by digital diagnostics, rapid testing and integrated surveillance. Agile technologies and scalable platforms should be a guiding concept of Infectious Disease Management Investment Opportunities as an area of investment by the investors and a decision by the decision-makers. The policy, infrastructure and innovation have to be in tune with each other due to changing world threats and regional changes as experienced in the APAC region.

Related Reports

- The global Healthcare Access and Equity Market size was assessed at USD 37.1 billion in 2024 and is expected to reach approximately USD 120.5 billion by 2035, growing at a CAGR of around 11.6% from 2025 to 2035.

- The global Vaccines Market was valued at approximately USD 86.32 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035, reaching around USD 159.36 billion by the end of the forecast period.

Key Market Players

The Infectious Disease Management Competitive Landscape is quite vibrant with activities in the form of multinational diagnostics corporations; digital health startups and contact service providers. The point of competitive operations focuses on technological separation, readiness to react to outbreaks and regulatory conformity. Big players are able to exploit both broad distribution and local testing proficiency, whereas agile competitors are utilizing AIs and fast assays in order to ensure that they can capture niche markets. The competitive environment is also defined by multi-stakeholder coalitions, such as public-partnerships, public-private partnerships and cross-licensing, which promote both interflowing innovation and invasion of market by the collaborators. Some of the key players in the Infectious Disease management industry are as:

Roche Diagnostics, BD (Becton, Dickinson & Co.), Abbott Laboratories, Thermo Fisher Scientific, Cepheid (Danaher), QIAGEN, BioMérieux, Hologic, Siemens Healthineers, DiaSorin, mobile Molecular Diagnostics consortium, Bio-Rad Laboratories, PerkinElmer, Meridian Bioscience, Alere

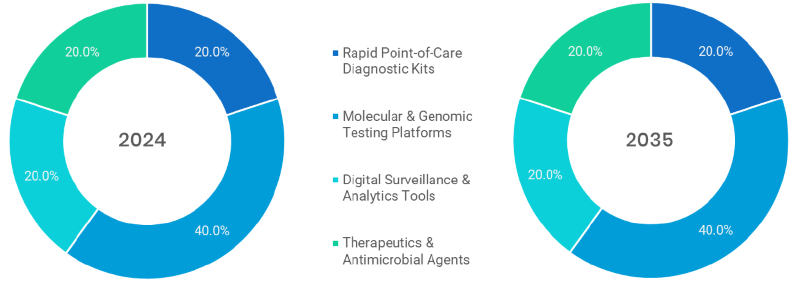

- Rapid Point-of-Care Testing Kits (Dominated): Allows decentral point-of-care testing where tests can be performed at the place of patients, with the advantage of an increased rate at which the disease can be detected and the increased availability of point-of-care testing, particularly in remote or resource-constrained situations.

- Molecular & Genomic Testing Platforms: Molecular and genomic platforms have high-sensitivity pathogen detection and genotyping to support precise and personalized treatments and are currently widespread in clinical labs to track and accurately diagnose.

- Digital Surveillance & Analytics Tools (Fastest): Employs the use of AI and real-time monitoring of data to monitor outbreaks, forecast trends as well as aid in intervention and resource distribution in public health.

- Therapeutics & Antimicrobial Agents: This area covers the antivirals, antibiotics and biologics against the infectious pathogens and equivalent resistance, and enhancements to treatment.

Note: Charts and figures are illustrative only. Contact us for verified market data.

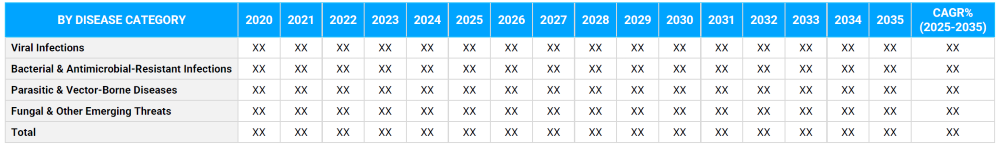

- Viral Infections: Facilitates innovation in diagnostic and vaccine development, focusing on early detections, surveillance, and pandemic preparedness within the global and regional health systems.

- Bacterial & Antimicrobial-Resistant Infections (dominated): A dire source of burden because of acquired infections in hospitals; this leads to both a continuous need in the development of new antibiotics and in stewardship program development care.

- Parasitic & Vector-Borne Diseases (Fastest): Prevalent in the tropics; there is increased need of rapid tests and portable applications in the face of climate-driven changes in vectors habitat and patterns of disease.

- Fungus Infections & Other Emerging Threats: Fungus and Other Emerging Threats are largely underdiagnosed and it is necessitating specialized testing platforms because infections increase in immunocompromised cohorts and critical care units.

Note: Charts and figures are illustrative only. Contact us for verified market data.

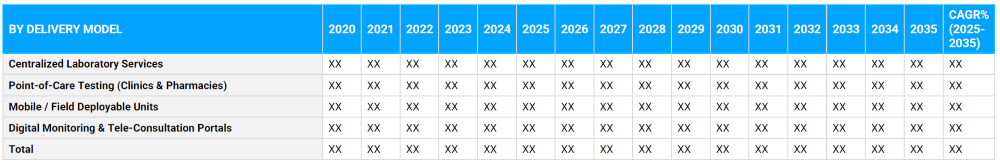

- Centralized Laboratory Services (Fastest): These have been in control since they operated by well-established infrastructure and regulatory requirements as well as having capacity to perform bulk diagnostics and epidemiological data analysis.

- Point-Of-Care Testing (Dominated): Bridges access gaps, which provide convenient varieties of diagnosis at retail and community clinics, particularly of use in case of an early stage of infection.

- Mobile/Field Deployable Units: Needed to contain an outbreak in distant regions or when there is an emergency, assisting on-site testing, vaccination and infrastructure of basic treatment.

- Digital Monitoring & Tele-Consultation Portals: Enables exposure of monitoring, triaging, and engagement of patients remotely who are affected by an infectious outbreak through digital leverages.

Note: Charts and figures are illustrative only. Contact us for verified market data.

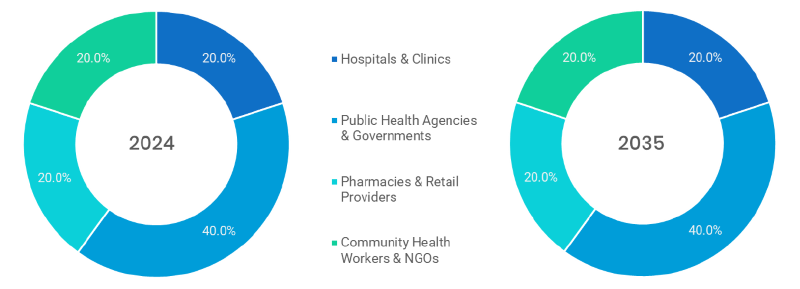

- Hospitals and Clinics (Domianted): The major center of diagnostics and management of infectious diseases; stimulates demand in integrated platforms, antibiotics, and antimicrobial stewardship.

- Public Health Agencies & Governments: Agencies charged with national surveillance systems, outbreak response, national buy-in of diagnostics and therapeutics relevant to population-scale disease control.

- Pharmacies & Retail Providers (Fastest): Provide convenient sites to administer tests, vaccination, and access medication so they can reach more people and have them become part of the activities to control the infection.

- CHWs and NGOs: Rural and underserved communities can be assisted with the implementation of mobile solutions and diagnostic tools to monitor disease at the local levels and provide prevention.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is highest in Infectious Disease Management Market dominated by healthcare infrastructure, R&D investment, and guidelines on efficient regulatory pathways. At the same time, the fastest pace is observed in APAC (Asia-Pacific) due to the growth of infectious risks, widespread expansion of diagnostic networks, and the expansion of the use of digital resources in health sectors of emerging economies. The Regional Insights are meanwhile built on the significance of the localizes approach: The saturated markets in North America develop Yet more and more innovation, and the expansions in APAC are still built on the capacity development and demand. These various regional trends should be taken into account by policymakers and industry players in their move to establish resilience across the globe.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Infectious Disease Management Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Infectious Disease Management Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Infectious Disease Management Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Technology Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Infectious Disease Management Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Technology Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Infectious Disease Management Market – By Technology Type

5.1. Overview

5.1.1. Segment Share Analysis, By Technology Type, 2024 & 2035 (%)

5.1.2. Rapid Point‑of‑Care Diagnostic Kits

5.1.3. Molecular & Genomic Testing Platforms

5.1.4. Digital Surveillance & Analytics Tools

5.1.5. Therapeutics & Antimicrobial Agents

(presents market segmentation By Technology Type, guiding the client on the Technology categories that are expected to drive demand and shape future revenue streams)

6. Infectious Disease Management Market – By Disease

6.1. Overview

6.1.1. Segment Share Analysis, By Disease, 2024 & 2035 (%)

6.1.2. Viral Infections (e.g., Influenza, COVID‑19)

6.1.3. Bacterial & Antimicrobial‑Resistant Infections

6.1.4. Parasitic & Vector‑Borne Diseases

6.1.5. Fungal & Other Emerging Threats

(breaks down the market by Disease, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Infectious Disease Management Market – By Delivery Mode

7.1. Overview

7.1.1. Segment Share Analysis, By Delivery Mode, 2024 & 2035 (%)

7.1.2. Centralized Laboratory Services

7.1.3. Point‑of‑Care Testing (Clinics & Pharmacies)

7.1.4. Mobile / Field Deployable Units

7.1.5. Digital Monitoring & Tele‑Consultation Portals

(focuses on market segmentation by Delivery Mode, helping the client prioritize specific Delivery Modes or end-use areas that offer significant business opportunities)

8. Infectious Disease Management Market – By End user

8.1. Overview

8.1.1. Segment Share Analysis, By End user, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Public Health Agencies & Governments

8.1.4. Pharmacies & Retail Providers

8.1.5. Community Health Workers & NGOs

(describes the market division by End user of Technology Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Infectious Disease Management Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Infectious Disease management Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Disease, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End user, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Disease, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End user, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Disease, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End user, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Technology Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Disease, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End user, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Infectious Disease Management Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Technology, Strategies, Financials, Recent Developments)

10.3.1. Roche Diagnostics

10.3.2. BD (Becton, Dickinson & Co.)

10.3.3. Abbott Laboratories

10.3.4. Thermo Fisher Scientific

10.3.5. Cepheid (Danaher)

10.3.6. QIAGEN

10.3.7. BioMérieux

10.3.8. Hologic

10.3.9. Siemens Healthineers

10.3.10. DiaSorin

10.3.11. Qiagen

10.3.12. Bio-Rad Laboratories

10.3.13. PerkinElmer

10.3.14. Meridian Bioscience

10.3.15. Alere

10.3.16. mobile Molecular Diagnostics consortium

10.3.17. Cepheid.

10.3.18. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Technology, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Infectious Disease Management Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Infectious Disease Management Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Infectious Disease Management Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Infectious Disease management Market: Technology Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Technology Type

TABLE 6: Global Infectious Disease management Market, By Technology Type 2022–2035 (USD Billion)

TABLE 7: Infectious Disease management Market: Disease Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Disease

TABLE 9: Global Infectious Disease management Market, by Disease 2022–2035 (USD Billion)

TABLE 10: Infectious Disease management Market: Delivery Mode Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Delivery Mode

TABLE 12: Global Infectious Disease management Market, by Delivery Mode 2022–2035 (USD Billion)

TABLE 13: Infectious Disease management Market: End user Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End user

TABLE 15: Global Infectious Disease management Market, by End user 2022–2035 (USD Billion)

TABLE 16: Infectious Disease management Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Infectious Disease management Market, by Region 2022–2035 (USD Billion)

TABLE 19: Infectious Disease management Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Infectious Disease management Market, By Technology Type (NA), 2022–2035 (USD Billion)

TABLE 21: Infectious Disease management Market, by Disease (NA), 2022–2035 (USD Billion)

TABLE 22: Infectious Disease management Market, by Delivery Mode (NA), 2024–2035 (USD Billion)

TABLE 23: Infectious Disease management Market, by End user (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 26: U.S. Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 27: U.S. Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 28: Canada Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 29: Canada Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 30: Canada Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 31: Canada Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 32: Mexico Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 34: Mexico Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 35: Mexico Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 36: Infectious Disease management Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Infectious Disease management Market, By Technology Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Infectious Disease management Market, by Disease (Europe), 2022–2035 (USD Billion)

TABLE 39: Infectious Disease management Market, by Delivery Mode(Europe), 2022–2035 (USD Billion)

TABLE 40: Infectious Disease management Market, by End user (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 42: Germany Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 43: Germany Infectious Disease management Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 45: Italy Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 46: Italy Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 47: Italy Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 48: Italy Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 53: France Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 54: France Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 55: France Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 56: France Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 57: Russia Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 58: Russia Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 59: Russia Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 60: Russia Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 61: Poland Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 62: Poland Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 63: Poland Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 64: Poland Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 69: Infectious Disease management Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Infectious Disease management Market, By Technology Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Infectious Disease management Market, by Disease (APAC), 2022–2035 (USD Billion)

TABLE 72: Infectious Disease management Market, by Delivery Mode(APAC), 2022–2035 (USD Billion)

TABLE 73: Infectious Disease management Market, by End user (APAC), 2022–2035 (USD Billion)

TABLE 74: India Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 75: India Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 76: India Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 77: India Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 78: China Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 79: China Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 80: China Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 81: China Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 82: Japan Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 83: Japan Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 84: Japan Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 85: Japan Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 86: South Korea Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 88: South Korea Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 89: South Korea Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 90: Australia Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 91: Australia Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 92: Australia Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 93: Australia Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 98: Brazil Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 100: Brazil Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 101: Brazil Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 102: Argentina Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 104: Argentina Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 105: Argentina Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 106: Colombia Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 108: Colombia Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 109: Colombia Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 114: Israel Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 115: Israel Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 116: Israel Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 117: Israel Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 118: Turkey Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 120: Turkey Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 121: Turkey Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 122: Egypt Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 124: Egypt Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 125: Egypt Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Infectious Disease management Market, By Technology Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Infectious Disease management Market, by Disease, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Infectious Disease management Market, by Delivery Mode, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Infectious Disease management Market, by End user, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Infectious Disease management Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Technology Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Technology Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Disease Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Disease Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Technology Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Technology Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End user Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End user Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Infectious Disease management Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Infectious Disease management Market Share and Leading Players, 2024

FIGURE 23: Latin America Infectious Disease management Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Infectious Disease management Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Infectious Disease management Market Share Analysis by Country, 2023

FIGURE 30: Germany Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Infectious Disease management Market Share Analysis by Country, 2023

FIGURE 39: India Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Infectious Disease management Market Share Analysis by Country, 2023

FIGURE 47: Brazil Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Infectious Disease management Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Infectious Disease management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The Infectious Disease Management Market Research Report was an invaluable resource for our strategic planning team. Its comprehensive analysis of emerging pathogen trends and evolving treatment protocols enabled us to anticipate market shifts and invest wisely in diagnostic technologies. The report’s insights into vaccine adoption rates and antimicrobial resistance patterns helped us prioritize product development that aligns with current public health demands. This report truly bridges data with actionable healthcare outcomes."

- Sarah Mitchell, Senior Epidemiology Consultant, United States

- "As a healthcare policymaker focused on infectious disease control in Europe, I found this report’s detailed coverage of regional regulatory frameworks and reimbursement landscapes extremely beneficial. The granular forecasts for countries like Denmark, Italy, and the Netherlands allowed us to tailor intervention strategies to local healthcare systems. Moreover, the in-depth analysis of novel therapeutics and diagnostics pipelines provided critical intelligence that guided our budget allocation and partnership decisions. It’s a highly trusted document within our policy circles."

- Dr. Henrik Larsen, Director of Infectious Disease Programs, Denmark

- "Navigating the complex infectious disease market across Asia-Pacific requires nuanced insights, and this report delivered precisely that. The sections on evolving healthcare infrastructure in India, South Korea, and Indonesia were particularly enlightening, offering early visibility into government funding priorities and clinical adoption trends. We leveraged these insights to refine our regional market entry plans, optimize resource deployment, and accelerate stakeholder engagement. The combination of scientific rigor and commercial relevance makes this report essential for anyone operating in APAC."

- Ananya Rao, Head of Market Development, India

The Infectious Disease Management Market 2025 report is authored by the expert healthcare research team at Quants and Trends, renowned for delivering high-quality, data-driven market insights with over a decade of experience in infectious disease, epidemiology, and healthcare innovation research. Our analysts bring a unique blend of scientific expertise, regulatory knowledge, and market strategy acumen to provide a comprehensive view of this critical and rapidly evolving sector.

This report is grounded in robust primary research, including interviews with leading infectious disease specialists, public health officials, and industry executives across North America, Europe, and Asia-Pacific. Additionally, it integrates extensive secondary research from clinical studies, government publications, and global health organizations to ensure a 360-degree perspective.

Designed for healthcare providers, pharmaceutical developers, policy planners, and investors, this report empowers decision-makers to navigate the complexities of infectious disease management, from forecasting treatment adoption and resistance trends to assessing regulatory shifts and funding landscapes. The actionable insights help reduce risk, optimize resource allocation, and accelerate the development and deployment of effective therapeutics and diagnostics worldwide.

Our unwavering commitment to accuracy, transparency, and real-world relevance has established us as a trusted partner for organizations seeking reliable intelligence to drive sustainable growth. To connect with our team and explore more in-depth research, visit our company LinkedIn page.