Market Outlook

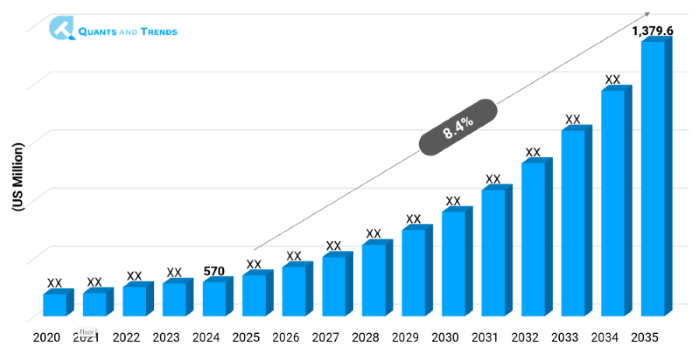

The global Hospital and Clinical Design Market was valued at approximately USD 570 Million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035, reaching around USD 1,379.6 Million by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

Hospital and Clinical Design Market is advanced at a high speed due to client-focused design, sustainability and technology-driven layouts in the health care centers. The Hospital and Clinical Design Market Forecast reveals that there is an increase in the investments on modern facility planning because of the ageing populations, increased burden of chronic diseases, and infection-control design. Other emerging trends in hospital and clinical design are biophilic interiors, intelligent building systems, and accessibility and safety-related regulatory focus. These aspects are influencing the investment in healthcare infrastructure in the world.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 8.4% |

| Market Value In 2024 | USD 570 Million |

| Market Value In 2035 | USD 1,379.6 Million |

Introduction

Hospital and Clinical Design Market covers design and implementation of the architecture of healthcare facilities, interior design and space planning, and environmental workflow. Due to changes in the healthcare delivery models toward value‑based care and patient experience, design is no longer about aesthetics, it is part of strategic infrastructure. Technology Adoption in Hospital and Clinical Design with innovations in modular building and flexible zoning and smart building technologies are strengthening the provider of these capabilities to increase capacity, control infection is due to utilization of smart building technology and regulate operational efficiency.

Key Market Drivers: What’s Fueling the Hospital and Clinical Design Market Boom?

- Increasing Need of Patient-Diagnosed and Adaptable Spaces: Patients no longer only require clinical attention- they require therapeutic settings, with natural light, privacy and wellness facilities. They use relaxing designs, quiet settings, and decentralized nursing desks. The use of flexible layouts facilitates the ability to repurpose spaces, formerly as inpatient pods to be utilized as telemedicine pods to increase the capacity to appropriately address the volume of patients.

- Smart Building Technology and Operations: Buildings are combining IoT sensors, energy efficient HVAC, digital way finding to facilitate workflow. occupancy and air quality as well as patient flow are tracked through real-time analytics. These innovations aid the working effectiveness of the staff and improve resource utilisation so that they bring Hospital and Clinical Design Investment Opportunities on digitally-empowered infrastructure.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

New trends are modular, prefabricated wards which will speed up the construction process, biophilic design that helps speed up the healing process, and flexible infrastructure to easily transform using a plug and play model. The safety and resilience of the operations can be promoted through smart building technologies such as occupancy sensing, automated disinfection robots, or real-time asset tracking. The virtual reality tools are also used to test the layouts and simulate the flow of patients prior to the construction. These innovations are according to Emerging Opportunities in flexible clinical spaces that need to change as care model changes and to enhance patient experience.

Recent Developments:

In 2024, another modular hospital under HDR, Inc. was built in the U.S. The prefabricated hospital used modular wards that lowered construction time by 30%. In the meantime Perkins+Will introduced its own AI based design tool that would simulate high flows of patients and optimize wayfinding in the outpatient clinic layouts. Such examples represent Key Trends in Hospital and Clinical design, demonstrating how fast hospitals and clinical spaces innovate in modular construction and digital planning as the main drivers of Hospital and Clinical Design Growth Drivers & Challenges.

Conclusion

The Hospital and Clinical Design Market is progressing fast where such aspects like patient-centered environment, operational flexibility, and smart infrastructure are prioritized by the providers. Innovation in facility planning is pressured by regulatory pressures and integration of technology; with modular and digital-first solutions speeding up the project delivery. The inpatient facilities are still fundamental, but the outpatient facilities and smart-enabled settings are growing rapidly. Putting strategies in place to specialize on flexible, evidence-based designs that increase healing, efficiency and scalability provide massive benefits to architects, designers as well as healthcare operators.

Related Reports

- The global Patient Engagement and Experience Market was valued at approximately USD 28.18 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 18.4% from 2025 to 2035, reaching around USD 178.14 billion by the end of the forecast period.

- The global Healthcare Staffing and Workforce Trends Market was valued at approximately USD 44.32 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reaching around USD 82.69 billion by the end of the forecast period.

Key Market Players

Hospital and Clinical Design Competitive Landscape comprises international design firms, design consultancies specializing in healthcare as well as engineering companies that incorporate technology in the layouts. Important differentiators are experience regulatory compliance experience in integrating smart buildings and experience based design methodology. It is frequent to partner with health systems and modular building companies. Its new competitors aim at digital simulation, VR-planning and sustainable materials. Some of the key players in the Hospital and Clinical Design industry are as:

HOK, Perkins+Will, HDR, Inc., CannonDesign, Gensler, Foster + Partners (Healthcare), Stantec Architecture, BVN (Australia), HKS Inc., NBBJ, ZGF Architects, SmithGroup, IBI Group, Populous (Healthcare), HKS Architects

- Inpatient Facilities (Dominant): Multi-story hospital buildings that offer 24-hour medical services to patients, surgical services and convalescence facilities with a full support system.

- Outpatient Clinics: Smaller care facilities that do not provide overnight stays and work primarily on consultation, diagnosis and minor procedures offering preventative care and routine care.

- Ambulatory Surgery Centers (Fastest Growing): Exclusive locations of same day surgery facilities designed to provide cost-effective efficient surgical care as alternative to conventional hospitals based surgeries.

- Diagnostic Centers: The buildings devoted to such services as imaging, pathology, and lab testing aids, which can aid in diagnosis, monitoring, and planning treatment.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Biophilic & Healing Environments (Dominant): These are built designs that are integrated with nature, light, and other soothing influences in order to boost care responses, patient healing, and the recovery of their emotions.

- Modular/Prefabricated Construction (Fastest Growing): Off-site construction is prefabricated in modules, which are reassembled on the site, and such construction decreases the project periods, building expenses, and business disturbances that may arise due to facility expansion.

- Smart Technology-driven Design: This includes engines the ability to use IoT, automation, and analytics of infrastructure to streamline patient flow, energy, and facility safety.

- Renovation/Adaptive Reuse: This renovates current non-clinical/obsolete sections and modernizes the outdated health care facilities in a cost-efficient way.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- New Build Projects (Fastest Growing): The development of healthcare facilities opening on the ground and integrating all modern design features, technological infrastructure, and patient care preparedness into the future.

- Renovation of old structures (Dominant): Updating and developing old hospitals in such a way that they continue with their structure but with better efficiency, compliance, safety, and enjoyability of patients.

- Decentralization: Decentralizing services to enhance workflow of the interiors such as decentralizing nurse stations and check-in points.

- Expansion & Retrofit: Expanding volumes through new wings or retrofitting the infrastructure new specialties, technology advancement, or compliance requirements.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospital Owners and Operators (Dominant): Decision-makers are funding, managing, and coordinating facility design with institutional models of care and key hospital strategies.

- Healthcare Architects & Designers Firms (Fastest Growing): Designers and specialists at the design of functional, safe, and aesthetically-pleasing care environment to incorporate patient-centered and regulatory concerns.

- Facility Management Companies: Direct the activity of a hospital, maintenance and physical plant improvement, so that the design would have a good life and the hospital would be efficient.

- Consultancy/Engineering Firms: Organizations that have been assigned the task of providing specialized services such as HVAC, MEP, seismic, and sustainability engineering according to the codes of healthcare design.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

With an excellent healthcare infrastructure, a strict regulation, and patient experience investment, North America has cornered the Hospital and Clinical Design Market. Hospital modernization and adoption of smart design are the pillars of the Hospital and Clinical Design Market Size & Share in the U.S. and Canada. The Asia-Pacific (APAC) region is the most rapidly developing one, where such countries as China, India and Australia invest in new hospitals, modular buildings and sustainable design to satisfy the rising demand.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Hospital and Clinical Design Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Hospital and Clinical Design Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Hospital and Clinical Design Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Hospital and Clinical Design Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Facility Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Hospital and Clinical Design Market – By Facility Type

5.1. Overview

5.1.1. Segment Share Analysis, By Facility Type, 2024 & 2035 (%)

5.1.2. Inpatient Facilities

5.1.3. Outpatient Clinics

5.1.4. Ambulatory Surgery Centers

5.1.5. Diagnostic Centers

(presents market segmentation by Facility Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Hospital and Clinical Design Market – By Design Style

6.1. Overview

6.1.1. Segment Share Analysis, By Design Style, 2024 & 2035 (%)

6.1.2. Biophilic & Healing Environments

6.1.3. Modular/Prefabricated Construction

6.1.4. Smart Technology–Driven Design

6.1.5. Renovation/Adaptive Reuse

(breaks down the market by Design Style, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Hospital and Clinical Design Market – By Project

7.1. Overview

7.1.1. Segment Share Analysis, By Project, 2024 & 2035 (%)

7.1.2. New Build Projects

7.1.3. Renovation of Existing Structures

7.1.4. Decentralization

7.1.5. Expansion & Retrofit

(focuses on market segmentation by Project , helping the client prioritize specific crop Facility Types or end-use areas that offer significant business opportunities)

8. Hospital and Clinical Design Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospital Owners & Operators

8.1.3. Healthcare Architects & Design Firms

8.1.4. Facility Management Companies

8.1.5. Consultancy/Engineering Firms

(describes the market division by End-User of Facility Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Hospital and Clinical Design Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Hospital and Clinical Design Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Facility Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Design Style, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Project, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Facility Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Design Style, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Project , 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Facility Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Design Style, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Project , 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Facility Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Design Style, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Project , 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Hospital and Clinical Design Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. HOK

10.3.2. Perkins+Will

10.3.3. HDR, Inc.

10.3.4. CannonDesign

10.3.5. Gensler

10.3.6. Foster + Partners (Healthcare)

10.3.7. Stantec Architecture

10.3.8. BVN (Australia)

10.3.9. HKS Inc.

10.3.10. NBBJ

10.3.11. ZGF Architects

10.3.12. SmithGroup

10.3.13. IBI Group

10.3.14. Populous (Healthcare)

10.3.15. HKS Architects

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Hospital and Clinical Design Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Hospital and Clinical Design Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Hospital and Clinical Design Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Hospital and Clinical Design Market: Facility Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Facility Type

TABLE 6: Global Hospital and Clinical Design Market, by Facility Type 2022–2035 (USD Billion)

TABLE 7: Hospital and Clinical Design Market: Design Style Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Design Style

TABLE 9: Global Hospital and Clinical Design Market, by Design Style 2022–2035 (USD Billion)

TABLE 10: Hospital and Clinical Design Market: Facility Type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Facility Type

TABLE 12: Global Hospital and Clinical Design Market, by Project 2022–2035 (USD Billion)

TABLE 13: Hospital and Clinical Design Market: Project Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Hospital and Clinical Design Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Hospital and Clinical Design Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Hospital and Clinical Design Market, by Region 2022–2035 (USD Billion)

TABLE 19: Hospital and Clinical Design Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Hospital and Clinical Design Market, by Facility Type (NA), 2022–2035 (USD Billion)

TABLE 21: Hospital and Clinical Design Market, by Design Style (NA), 2022–2035 (USD Billion)

TABLE 22: Hospital and Clinical Design Market, by Project (NA), 2024–2035 (USD Billion)

TABLE 23: Hospital and Clinical Design Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 26: U.S. Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 27: U.S. Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 29: Canada Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 30: Canada Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 31: Canada Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 34: Mexico Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 35: Mexico Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Hospital and Clinical Design Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Hospital and Clinical Design Market, by Facility Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Hospital and Clinical Design Market, by Design Style (Europe), 2022–2035 (USD Billion)

TABLE 39: Hospital and Clinical Design Market, by Project (Europe), 2022–2035 (USD Billion)

TABLE 40: Hospital and Clinical Design Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 42: Germany Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 43: Germany Hospital and Clinical Design Market, by Project, 2022–2035 (USD Billion)

TABLE 44: Germany Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 46: Italy Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 47: Italy Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 48: Italy Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 52: United Kingdom Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 54: France Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 55: France Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 56: France Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 58: Russia Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 59: Russia Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 60: Russia Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 62: Poland Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 63: Poland Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 64: Poland Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Hospital and Clinical Design Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Hospital and Clinical Design Market, by Facility Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Hospital and Clinical Design Market, by Design Style (APAC), 2022–2035 (USD Billion)

TABLE 72: Hospital and Clinical Design Market, by Project (APAC), 2022–2035 (USD Billion)

TABLE 73: Hospital and Clinical Design Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 75: India Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 76: India Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 77: India Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 79: China Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 80: China Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 81: China Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 83: Japan Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 84: Japan Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 85: Japan Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 88: South Korea Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 89: South Korea Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 91: Australia Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 92: Australia Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 93: Australia Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 100: Brazil Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 101: Brazil Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 104: Argentina Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 105: Argentina Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 108: Colombia Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 109: Colombia Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 115: Israel Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 116: Israel Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 117: Israel Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 120: Turkey Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 121: Turkey Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 124: Egypt Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 125: Egypt Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Hospital and Clinical Design Market, by Facility Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Hospital and Clinical Design Market, by Design Style, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Hospital and Clinical Design Market, by Project , 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Hospital and Clinical Design Market, by End-User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Hospital and Clinical Design Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Facility Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Facility Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Design Style Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Design Style Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Facility Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Facility Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Hospital and Clinical Design Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Hospital and Clinical Design Market Share and Leading Players, 2024

FIGURE 23: Latin America Hospital and Clinical Design Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Hospital and Clinical Design Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Hospital and Clinical Design Market Share Analysis by Country, 2023

FIGURE 30: Germany Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Hospital and Clinical Design Market Share Analysis by Country, 2023

FIGURE 39: India Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Hospital and Clinical Design Market Share Analysis by Country, 2023

FIGURE 47: Brazil Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Hospital and Clinical Design Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Hospital and Clinical Design Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The insights from the Hospital and Clinical Design Market Research Report were instrumental in refining our capital planning for a multi-campus facility revamp. The depth of analysis around modular construction trends, patient-centric design innovations, and region-specific regulatory considerations helped us align our architectural decisions with future-proof, value-based care models. It’s clear this report was authored by professionals who understand both healthcare delivery and the operational challenges of hospital environments."

- Olivia Hayes, Director of Healthcare Infrastructure Planning, USA

- "I’ve reviewed numerous reports over the years, but this one stood out for its practical relevance and technical clarity. The benchmarking of green building certifications, digital twin integration, and space optimization practices across Europe helped our team win a competitive tender for a major clinical refurbishment. This report isn't just academic, it provides market intelligence that is actually applicable on the ground."

- Dr. Lukas Meier, Healthcare Architect & Sustainability Consultant, Germany

- "This report helped our leadership team confidently move forward with investments in hybrid OR layouts and telemedicine-ready outpatient zones. The predictive modeling around demographic shifts and clinical throughput was especially helpful in our long-term master planning. The detail and expertise in this research made it feel like a true strategic advisory document rather than just a market snapshot."

- Ananya Iwasaki, Head of Hospital Strategy and Design, Japan

This report has been meticulously developed by a team of seasoned healthcare market analysts, infrastructure strategists, and data scientists at Quants & Trends, a trusted authority in global healthcare market research. With over a decade of experience in tracking shifts in hospital architecture, smart facility integration, and patient-centric design standards, our analysts bring a unique blend of evidence-based research and real-world insight to every publication.

The "Hospital and Clinical Design Market 2025" report is backed by in-depth primary research, validated data models, and regional stakeholder interviews, ensuring that every insight is both actionable and rooted in present-day market realities. Our team has worked extensively with healthcare architects, medical planners, procurement leaders, and hospital CFOs to understand the evolving blueprint of modern care environments.

This report is crafted to support real-world business decisions, be it in capital project planning, medical infrastructure investments, sustainability integration, or digital health facility upgrades. Whether you're a hospital administrator, design consultant, equipment supplier, or investor, the intelligence contained herein is designed to guide your strategic roadmap with clarity and confidence.

To learn more about our research team, explore our latest insights, and follow industry updates, connect with us on LinkedIn.