Market Outlook

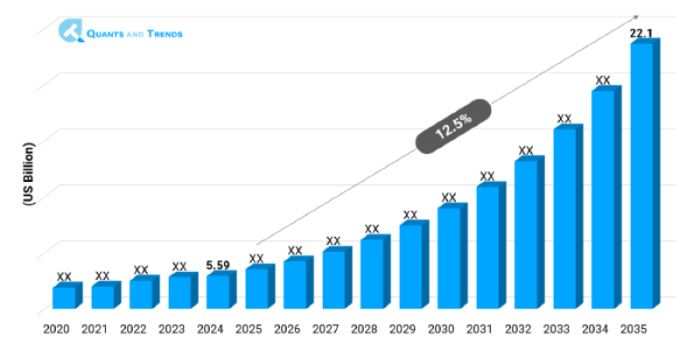

The global Chronic Disease Management market is anticipated to reach approximately USD 22.1 billion by 2035 growing at a CAGR of 12.5% from 2024 by USD 5.59 billion. The historical analysis captures 2020 to 2023, with 2024 as the base year and forecasts beginning from 2025 to 2035.

The global healthcare system is undergoing a massive shift, and chronic disease management is now at its center. As populations age and lifestyles change, conditions like diabetes, cardiovascular diseases, and respiratory issues have become long-term burdens. Governments, providers, and tech innovators are coming together to build solutions that are not just curative but preventative. These changes are driving a quiet but significant evolution. The Chronic Disease Management Market Report shows how health tech, accessibility, and proactive care are now converging to make long-term health more manageable than ever before.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 12.5% |

| Market Value In 2024 | USD 5.59 billion |

| Market Value In 2035 | USD 22.1 billion |

Introduction

Chronic diseases are no longer isolated health issues they’ve become part of everyday life for millions. Tackling them takes more than just medication; it also necessitates ongoing monitoring, lifestyle support, patient education & digital intervention. All of this is made possible by Chronic Disease Management systems. Solutions that bring care closer to the patient, such as cloud-based data tracking and mobile health apps, are shaping the market today. The rise in sedentary habits, urban stress & poor diet only amplify the need for integrated and sustainable solutions. This market is no longer a choice it is a necessity for long term health stability.

Key Market Drivers: What’s Fueling the Chronic Disease Management Market Boom?

- Rise in Disease Prevalence and Aging Population: Chronic diseases are rapidly increasing worldwide owing to the aging populations and changes in lifestyle. According to the WHO, chronic diseases account for 74% of all global deaths. Cardiovascular diseases alone cause 17.9 million deaths yearly. The rising older population is especially vulnerable. In countries like Japan and Italy, more than 28% of the population is 65 or older. This generational trend is escalating healthcare providers and governments to implement chronic disease management solutions that prioritize remote monitoring, real time information & ongoing treatment. These growing demands have a direct effect on the chronic disease management market size and share.

- Growing Technology Adoption and mHealth Integration: Today, technology is playing a vital role in handling chronic diseases. The arc of innovation is steep from wearable trackers to AI based predictive analytics. Apps for e-mobile health have completely changed the patient’s interaction with their treatment regimens. For instance, the number of downloads for diabetes management applications went up by 30% during the COVID-19 pandemic. Apps for controlling high blood pressure, real-time blood sugar monitoring, and mental health assistance are becoming a part of regular care. One of the main factor's influencing the growth and challenges of chronic disease management is the rise in digital engagement, which enhances both results & necessitates a strong infrastructure for data privacy and integration.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation in Chronic Disease Management is being driven by data, devices, and design. AI algorithms now predict patient deterioration before it happens, while cloud-based platforms allow real-time data sharing across systems. Telehealth and remote patient monitoring have made care less location-bound. Voice-enabled symptom trackers, behavior-coaching bots, and personalized care plans are just the beginning. These innovations reflect a shift from reactive care to proactive, predictive health engagement.

Recent Developments:

- In 2024, A new AI-powered platform for managing diabetes and hypertension was introduced by Teladoc Health, which blends virtual coaching with wearable technology.

- Medtronic partnered with a cloud services provider to scale its remote cardiac monitoring tools across North America and Europe, expanding its Chronic Disease Management Investment Opportunities.

Conclusion

Chronic Disease Management is transforming in a way where the healthcare works by treating patients only when they are sick to providing care all the time. The need for more sophisticated management of lifestyle related disorders is increasing. Patient involvement, scalable technology, and rising awareness of preventative care are the main factors propelling the industry. Despite ongoing problems with infrastructure and data security, the innovation pipeline remains strong. According to the Chronic Disease Management Market Report, since health and our systems should not stop working, care will be personalized, digitized, and constantly available in the future.

Related Reports

- The global Preventive Healthcare Strategies Market was valued at approximately USD 112.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 232.6 billion by the end of the forecast period.

- The global Digital Therapeutics Market was valued at approximately USD 7.23 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 22.7% from 2025 to 2035, reaching around USD 54.43 billion by the end of the forecast period.

Key Market Players

A combination of well-known health tech giants, digital health start-ups along with specialized chronic care solutions providers, together all are shaping the rapidly expanding the Chronic Disease Management Competitive Landscape. Leaders in the industry are focusing strategically on Artificial intelligence driven analytics, integrated remote monitoring systems & seamless interoperability with EHR platforms to upgrade patient engagement & clinical efficiency. The market is witnessing increased consolidation through strategic mergers & acquisitions and partnerships, with a objective of broadening service portfolios and expanding global presence. Meanwhile, emerging startups are entering the space with app-based, personalized coaching models and digital therapeutics that serves to the rising demand for continuous, patient centric chronic care. Some of the key players in the Chronic Disease Management industry are as:

Koninklijke Philips N.V., Allscripts Healthcare Solutions, IBM Corporation, Medtronic, Cerner Corporation, Siemens Healthineers, Epic Systems Corporation, WellSky, Teladoc Health, DarioHealth, Omada Health, iHealth Labs, Health Catalyst, eClinicalWorks, Validic

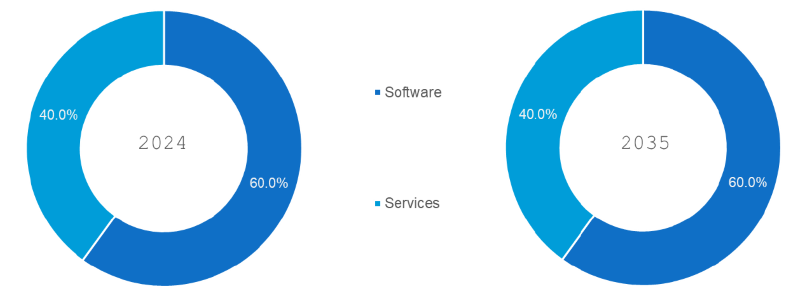

- Software- Dominates the segment due to rising adoption of Electronic Health Records (EHR) and analytics platforms.at the same time it is the fastest-growing as AI and predictive analytics gain traction.

- Services- These are very essential for implementation, patient onboarding, and continuous support. The segments growth is steady but slightly behind software due to scalability limitations.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- On-premise: Preferred by large hospital systems due to data control needs. Comparatively slow growth has been observed owing to the higher infrastructure cost.

- Cloud-based: Because of its cost-effectiveness, ease of deployment and remote access, it is the fastest and dominating both, particularly advantageous for patient-centered care and multi-site health networks.

Note: Charts and figures are illustrative only. Contact us for verified market data.

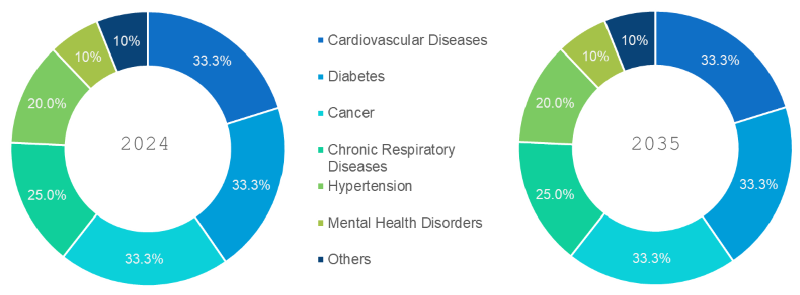

- Cardiovascular Diseases: Dominates due to high global prevalence (17.9 million deaths/year).

- Diabetes: Fastest-growing, especially with rising cases in Asia-Pacific and North America.

- Cancer, Respiratory Diseases, Hypertension, Mental Health Disorders, Others: Each one of the diseases represents a growing focus area, with mental health and hypertension gaining traction due to digital due to digital therapeutic platforms.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Web-based: Widely used by providers for record-keeping and monitoring dashboards.

- App-based: The segment is the fastest growing, especially among tech-savvy patients who are taking care of their heart, mind, and diabetes.

- Telephonic: Useful in rural and elderly populations; steady growth due to human interaction preference.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Healthcare Providers: Largest market share as hospitals and clinics directly implement solutions.

- Payers: Fast-growing due to value-based care incentives.

- Patients: Gaining control via mobile apps and telehealth, especially in urban areas.

- Government Organizations & Others: Impact funding and policy orientation, the segment's growth is steady but slower in growing market.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America dominates the Chronic Disease Management Market owing to the high healthcare expenditure, early technology adoption & favorable policy environments.90% of the USD 4.5 trillion spent on healthcare in the US alone each year goes toward treating chronic illnesses. But thanks to a growing middle class, digital health startups, and a booming smartphone market, Asia-Pacific is expanding at the fastest rate. India and China are investing heavily in mobile-based chronic care solutions, which are improving access even in semi-urban areas. Europe has a developed but stable market share because to robust public health and regulatory support.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Chronic Disease Management Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Chronic Disease Management Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Chronic Disease Management Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Chronic Disease Management Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Disease Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Chronic Disease Management Market – By Delivery Mode

5.1. Overview

5.1.1. Segment Share Analysis, By Delivery Mode, 2024 & 2035 (%)

5.1.2. On-premise

5.1.3. Cloud-based

(presents market segmentation by Delivery Mode, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Chronic Disease Management Market – By Component

6.1. Overview

6.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

6.1.2. Software

6.1.3. Services

(breaks down the market by Component, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Chronic Disease Management Market – By Disease Type

7.1. Overview

7.1.1. Segment Share Analysis, By Disease Type, 2024 & 2035 (%)

7.1.2. Cardiovascular Diseases

7.1.3. Diabetes

7.1.4. Cancer

7.1.5. Chronic Respiratory Diseases

7.1.6. Hypertension

7.1.7. Mental Health Disorders

7.1.8. Others

(focuses on market segmentation by Disease Type, helping the client prioritize specific crop Delivery Modes or end-use areas that offer significant business opportunities)

8. Chronic Disease Management Market – By Deployment

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Web-based

8.1.3. App-based

8.1.4. Telephonic

(breaks down the market by type of Deployment, helping stakeholders understand user accessibility preferences and compatibility trends across regions and use-cases)

9. Chronic Disease Management Market – By End-User

9.1. Overview

9.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

9.1.2. Healthcare Providers

9.1.3. Payers

9.1.4. Patients

9.1.5. Government Organizations

9.1.6. Others

(describes the market division by End-User of Disease Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

10. Chronic Disease Management Market– By Geography

10.1. Introduction

10.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

10.2. North America

10.2.1. Regional Overview & Trends

10.2.2. Chronic Disease Management Key Manufacturers in North America

10.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

10.2.4. North America Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

10.2.5. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.6. North America Market Size and Forecast, By Deployment, 2024 - 2035 (US$ Million)

10.2.7.

10.2.8. North America Market Size and Forecast, By Disease Type, 2024 - 2035 (US$ Million)

10.2.9. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

10.2.10. U.S.

10.2.10.1. Overview

10.2.10.2. U.S. Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

10.2.10.3. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.10.4. U.S. Market Size and Forecast, By Disease Type, 2024 - 2035 (US$ Million)

10.2.10.5. U.S. Market Size and Forecast, By Deployment, 2024 - 2035 (US$ Million)

10.2.10.6.

10.2.10.7. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

10.2.11. Canada

10.2.11.1. Overview

10.2.11.2. Canada Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

10.2.11.3. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.11.4. Canada Market Size and Forecast, By Disease Type, 2024 - 2035 (US$ Million)

10.2.11.5. Canada Market Size and Forecast, By Deployment, 2024 - 2035 (US$ Million)

10.2.11.6. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

10.2.12. Mexico

10.2.12.1. Overview

10.2.12.2. Mexico Market Size and Forecast, By Delivery Mode, 2024 - 2035 (US$ Million)

10.2.12.3. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.12.4. Mexico Market Size and Forecast, By Disease Type, 2024 - 2035 (US$ Million)

10.2.12.5. Mexico Market Size and Forecast, By Deployment, 2024 - 2035 (US$ Million)

10.2.12.6. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

10.3. Europe

10.3.1. Germany

10.3.2. Italy

10.3.3. United Kingdom

10.3.4. France

10.3.5. Russia

10.3.6. Poland

10.3.7. Rest of Europe

10.4. Asia Pacific (APAC)

10.4.1. India

10.4.2. China

10.4.3. Japan

10.4.4. South Korea

10.4.5. Australia

10.4.6. Rest of APAC

10.5. Latin America

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Colombia

10.5.4. Rest of LATAM

10.6. Middle East and Africa

10.6.1. Israel

10.6.2. Turkey

10.6.3. Egypt

10.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

11. Chronic Disease Management Market: Competitive Landscape & Company Profiles

11.1. Market Share Analysis (2024)

11.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

11.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

11.3.1. Koninklijke Philips N.V.

11.3.2. Allscripts Healthcare Solutions

11.3.3. IBM Corporation

11.3.4. Medtronic

11.3.5. Cerner Corporation

11.3.6. Siemens Healthineers

11.3.7. Epic Systems Corporation

11.3.8. WellSky

11.3.9. Teladoc Health

11.3.10. DarioHealth

11.3.11. Omada Health

11.3.12. iHealth Labs

11.3.13. Health Catalyst

11.3.14. eClinicalWorks

11.3.15. Validic

11.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

12. Chronic Disease Management Market: Future Market Outlook (2025–2035)

12.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

12.2. Disruptive Technologies Impact

12.3. Emerging Business Trends

12.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

13. Chronic Disease Management Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

14. Chronic Disease Management Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Chronic Disease Management Market: Delivery Mode Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Delivery Mode

TABLE 6: Global Chronic Disease Management Market, by Delivery Mode 2022–2035 (USD Million)

TABLE 7: Chronic Disease Management Market: Component Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Component

TABLE 9: Global Chronic Disease Management Market, by Component 2022–2035 (USD Million)

TABLE 10: Chronic Disease Management Market: Disease Type Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Disease Type

TABLE 12: Global Chronic Disease Management Market, by Disease Type 2022–2035 (USD Million)

TABLE 13: Chronic Disease Management Market: Deployment Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Deployment

TABLE 15: Global Chronic Disease Management Market, by Deployment 2022–2035 (USD Million)

TABLE 16: Chronic Disease Management Market: End-User Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by End-User

TABLE 18: Global Chronic Disease Management Market, by End-User 2022–2035 (USD Million)

TABLE 19: Chronic Disease Management Market: Regional Snapshot (2024)

TABLE 20: Segment Dashboard; Definition and Scope, by Region

TABLE 21: Global Chronic Disease Management Market, by Region 2022–2035 (USD Million)

TABLE 22: Chronic Disease Management Market, by Country (North America), 2022–2035 (USD Million)

TABLE 23: Chronic Disease Management Market, by Delivery Mode (North America), 2022–2035 (USD Million)

TABLE 24: Chronic Disease Management Market, by Component (North America), 2022–2035 (USD Million)

TABLE 25: Chronic Disease Management Market, by Deployment (North America), 2022–2035 (USD Million)

TABLE 26: Chronic Disease Management Market, by Disease Type (North America), 2022–2035 (USD Million)

TABLE 27: Chronic Disease Management Market, by End-User (North America), 2022–2035 (USD Million)

TABLE 28: U.S. Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 29: U.S. Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 30: U.S. Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 31: U.S. Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 32: U.S. Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 33: Canada Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 34: Canada Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 35: Canada Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 36: Canada Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 37: Canada Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 38: Mexico Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 39: Mexico Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 40: Mexico Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 41: Mexico Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 42: Mexico Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 43: China Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 44: China Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 45: China Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 46: China Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 47: China Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 48: India Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 49: India Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 50: India Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 51: India Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 52: India Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 53: Japan Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 54: Japan Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 55: Japan Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 56: Japan Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 57: Japan Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 58: South Korea Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 59: South Korea Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 60: South Korea Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 61: South Korea Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 62: South Korea Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 63: Australia Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 64: Australia Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 65: Australia Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 66: Australia Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 67: Australia Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 68: Germany Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 69: Germany Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 70: Germany Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 71: Germany Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 72: Germany Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 73: France Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 74: France Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 75: France Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 76: France Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 77: France Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 78: Italy Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 79: Italy Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 80: Italy Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 81: Italy Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 82: Italy Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 83: Spain Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 84: Spain Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 85: Spain Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 86: Spain Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 87: Spain Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 88: U.K. Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 89: U.K. Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 90: U.K. Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 91: U.K. Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 92: U.K. Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 93: Russia Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 94: Russia Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 95: Russia Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 96: Russia Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 97: Russia Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 98: Brazil Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 99: Brazil Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 100: Brazil Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 101: Brazil Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 102: Brazil Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 103: Argentina Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 104: Argentina Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 105: Argentina Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 106: Argentina Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 107: Argentina Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 108: Colombia Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 109: Colombia Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 110: Colombia Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 111: Colombia Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 112: Colombia Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 113: Saudi Arabia Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 114: Saudi Arabia Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 115: Saudi Arabia Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 116: Saudi Arabia Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 117: Saudi Arabia Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 118: UAE Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 119: UAE Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 120: UAE Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 121: UAE Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 122: UAE Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 123: South Africa Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 124: South Africa Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 125: South Africa Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 126: South Africa Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 127: South Africa Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 128: Israel Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 129: Israel Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 130: Israel Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 131: Israel Chronic Disease Management Market, by Disease Type, 2022–2035 (USD Million)

TABLE 132: Israel Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

TABLE 133: Turkey Chronic Disease Management Market, by Delivery Mode, 2022–2035 (USD Million)

TABLE 134: Turkey Chronic Disease Management Market, by Component, 2022–2035 (USD Million)

TABLE 135: Turkey Chronic Disease Management Market, by Deployment, 2022–2035 (USD Million)

TABLE 136: Turkey Chronic Disease Management Market, by End-User, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Chronic Disease Management Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Delivery Mode Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Delivery Mode Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Disease Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Disease Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: Deployment Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Deployment Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 19: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 21: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 22: North America Chronic Disease Management Market Share and Leading Players, 2024

FIGURE 23: Europe Chronic Disease Management Market Share and Leading Players, 2024

FIGURE 24: Asia Pacific Chronic Disease Management Market Share and Leading Players, 2024

FIGURE 25: Latin America Chronic Disease Management Market Share and Leading Players, 2024

FIGURE 26: Middle East and Africa Chronic Disease Management Market Share and Leading Players, 2024

FIGURE 27: North America Market Share Analysis by Country, 2024

FIGURE 28: U.S. Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Canada Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 30: Mexico Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Europe Chronic Disease Management Market Share Analysis by Country, 2023

FIGURE 32: Germany Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: Spain Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: Italy Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: France Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: UK Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Russia Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Poland Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 39: Rest of Europe Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: Asia Pacific Chronic Disease Management Market Share Analysis by Country, 2023

FIGURE 41: India Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: China Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Japan Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: South Korea Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Australia Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Rest of APAC Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 47: Latin America Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Latin America Chronic Disease Management Market Share Analysis by Country, 2023

FIGURE 49: Brazil Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Argentina Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Colombia Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Rest of LATAM Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 53: Middle East and Africa Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Middle East and Africa Chronic Disease Management Market Share Analysis by Country, 2023

FIGURE 55: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Israel Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Turkey Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 58: Egypt Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 59: Rest of MEA Chronic Disease Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "As someone responsible for long-term care model planning in a multi-state health network, the insights in the Chronic Disease Management Market Report were nothing short of indispensable. The segment-wise breakdown of telehealth integration, remote monitoring advancements, and payer-provider collaboration gave us a strong evidence base to shape our population health strategy through 2030. The forecast data and regional trends helped us identify where to prioritize chronic care programs, especially for diabetes and hypertension. I highly recommend this report to any healthcare executive seeking to future-proof their care delivery roadmap."

- Jessica Barnes, MPH, Strategic Healthcare Planner, USA

- "This report stands out for its clinical relevance and its real-world business applicability. The intersectional analysis between digital therapeutics, health informatics, and government reimbursement strategies in chronic care was exceptionally well presented. We used the report’s Europe-focused section to support our recommendations for regional pilot programs in chronic respiratory disease management. The authors clearly understand both the macroeconomic forces and the regulatory nuances shaping the chronic care landscape. A trusted, evidence-backed source for any policymaker or innovation strategist in the healthtech domain."

- Dr. Erik Schneider, Public Health Analyst, Germany

- "What impressed me most about this report was the depth of coverage on APAC’s emerging digital chronic care models. From AI-powered risk stratification to community-based hypertension care models, the case studies and growth forecasts were spot-on. Our strategic team used this intelligence to realign our product positioning and partnership development across Southeast Asia. It’s rare to find a report that marries scientific understanding with market foresight so seamlessly. This research has clearly been crafted by experts who understand the complexity of chronic disease ecosystems."

- Meera Tanaka, Director of Healthcare Innovation, Singapore

This Chronic Disease Management Market 2025 report has been authored by a team of seasoned healthcare market analysts at Quants & Trends, with deep expertise in global chronic care delivery models, healthcare economics, and healthtech innovation. With over a decade of combined experience analyzing patient-centric care trends, evolving reimbursement frameworks, and digital health adoption curves, our analysts bring forward a uniquely informed perspective that blends clinical insight with strategic foresight.

Our research methodology integrates primary interviews with healthcare providers, payers, digital health vendors, and policy advisors across North America, Europe, and Asia-Pacific. These insights are enriched by rigorous secondary data validation, proprietary forecasting models, and a contextual understanding of real-world implementation challenges in chronic disease prevention and management.

The insights in this report are especially valuable for hospital executives, public health planners, pharmaceutical decision-makers, digital health innovators, and investors aiming to assess opportunity landscapes and mitigate risk in a rapidly shifting care delivery environment. Whether you are looking to design a chronic care solution, assess ROI on remote monitoring technologies, or align your strategy with regulatory and reimbursement trends, this report offers data-backed clarity to support your decision-making.

To explore our latest healthcare insights and stay connected with our analysts, follow us on LinkedIn.