Market Outlook

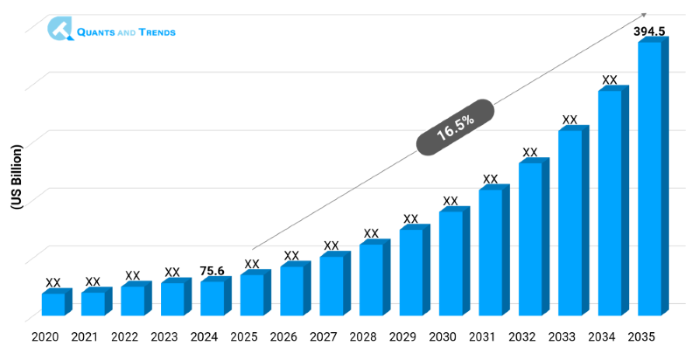

The global Wearable Health Technology market is anticipated to reach approximately USD 394.5 billion by 2035 growing at a CAGR of 16.5% from 2024 by USD 75.6 billion. The historical analysis captures 2020 to 2023, with 2024 as the base year and forecasts beginning from 2025 to 2035.

Wearable health technology has quietly moved from trend to necessity. These devices once considered fitness accessories are now helping people manage health in real-time. They serve as personal assistants that track, alert & sometimes even assist health changes. Whether monitoring heart rates or reminding users to hydrate, their silent presence is becoming important. In homes, hospitals & gyms, wearables are enabling better decisions and early interventions. These gadgets will continue to become increasingly integrated into daily life as awareness rises and healthcare becomes more interconnected, enhancing results without interfering with normal activities. It’s not just technology it is a lifestyle upgrade that’s gaining trust globally.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 16.5% |

| Market Value In 2024 | USD 75.6 billion |

| Market Value In 2035 | USD 394.5 billion |

Introduction

The market for wearable health technology is rapidly developing, using intelligent, portable gadgets to connect healthcare with everyday activities. By providing real-time health tracking these technologies enables individual to take control of their health. From smartwatches to biosensors, products are widely used across fitness, chronic care, remote monitoring & rehabilitation. This market is expanding owing to rising demand for comfort ie home based health solutions and increasing need for preventative healthcare. With the shift toward patient-centric care, these devices play a crucial role in collection of health data and remote diagnosis. The seamless integration of AI and wireless technology is further escalating interaction with health information.

Key Market Drivers: What’s Fueling the Wearable Health Technology Market Boom?

- Rise in Chronic Diseases and Remote Monitoring Demand: Chronic disease like diabetes, heart disease and hypertension affect over 1 in 3 adults globally. According to WHO, non communicable diseases account for 74% of global deaths annually. Owing to this technology, there is a growing need for real-time health tracking. Smart patches and ECG monitors are examples of wearable technology that enables early detection identification of any health condition where individuals get time to take prompt medical action. With remote monitoring, patients avoid frequent hospital visits and gain independence in managing their health. This demand has specially increased after the pandemic, making wearable health solutions a long term necessity rather than a luxury.

- Tech Innovation and Consumer Awareness: There is a growing shift toward proactive health management. Individual wants to know more about their own bodies for instance how much they sleep, walk, or how stressed they feel. Companies like Apple, Fitbit & Garmin are leading this shift. With continuous innovation such as non invasive glucose monitoring or AI-powered predictive alerts consumers are adopting wearables not just for fitness but for real health decisions. As per analysis more than 40% of people in developed markets used wearable technology for healthcare monitoring, in 2023. Global adoption of technology is increasing as it becomes more accessible and affordable, particularly among younger and older populations.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

Innovation in wearable health technology is moving beyond simple tracking. The latest advances involve AI-driven health analytics, flexible biosensors, and even skin-embedded micro-devices. Startups and giants alike are working on contactless ECG, cuff-less blood pressure monitors, and smart fabrics that detect hydration levels. Integration with telehealth platforms is also making these devices part of virtual care models. This convergence of digital tools allows real-time diagnosis, predictive care, and seamless sharing of health data, significantly improving how healthcare is delivered and accessed.

Recent Developments:

In 2024, Apple introduced a non-invasive blood glucose monitoring prototype which signaled an important advancement for diabetic users. At the same time, Biobeat and Sheba Medical Center collaborated to incorporate wearable ECG monitors driven by AI for cardiac patients in home care environments. Both initiatives indicate the markets tendency toward continuous, clinical-grade monitoring free of invasive procedures. These advancements highlight the ways in which major developments in wearable health technology are redefining the distinction between diagnostic-grade health systems and wellness tools.

Conclusion

Wearable health technology is no longer just an accessory; it's becoming a part of your everyday health routine. Devices influence on healthcare is increasing as they get smaller, smarter & more precise. Wearable technology provides instant interventions and improved self-management in light of the growing prevalence of chronic disease, old populations & the need for home care. Innovations like AI integration and cloud connectivity are making these devices more useful in medical settings too. The future promises more personalized, predictive, and preventive healthcare delivered quietly from a wrist, patch, or shirt. The market is not just growing it’s reshaping how we view health itself.

Related Reports

- The global Chronic Disease Management Market is anticipated to reach approximately USD 22.1 billion by 2035 growing at a CAGR of 12.5% from 2024 by USD 5.59 billion.

- The global Preventive Healthcare Strategies Market was valued at approximately USD 112.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, reaching around USD 232.6 billion by the end of the forecast period.

Key Market Players

The Wearable Health Technology Competitive Landscape features a mix of tech giants, health innovators, and startups. Accuracy, battery life, user experience, and healthcare integration are the main factors driving competition. Partnerships with insurers and hospitals are growing. Businesses are deep intensifying their product lines by utilizing AI capabilities and condition specific devices. The ongoing innovation & mergers set the industry standards. Investment opportunities are created by both hardware advancements and AI powered health data services. Some of the key players in the Wearable Health Technology industry are as:

Apple Inc., Fitbit (Google), Garmin Ltd., Samsung Electronics, Huawei Technologies, Philips Healthcare, Withings, Omron Healthcare, Biobeat, VitalConnect, Hexoskin, Masimo Corporation, Polar Electro, Zephyr Technology, Xiaomi Corporation

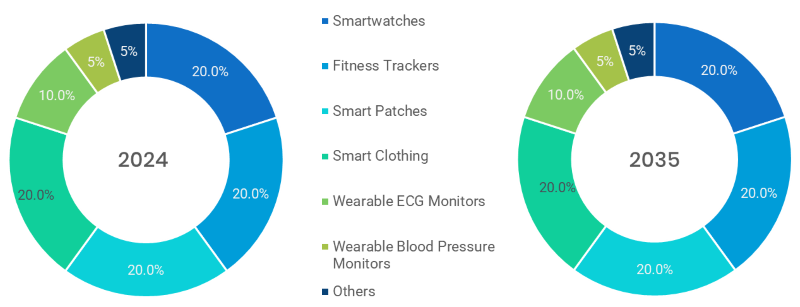

- Smartwatches (Dominating Segment): These amazing products which counts exercise, track sleep, and heart rate, are the industry leaders. They are favored by a variety of age groups due to their fashionable appearance and strong brand recognition.

- Fitness Trackers: These are better known for their affordability and simplicity and are ideal for casual fitness enthusiasts and first-time users.

- Smart Patches (Fastest Growing): These small, sticky gadgets are becoming popular for tracking chronic illnesses. They are non-intrusive of medical quality & appropriate for long-term use.

- Smart Clothing: These clothes, however nonetheless specialized, are utilized in elite sports and rehabilitation and incorporate biosensors.

- Wearable ECG Monitors: These devices cater to patients needing real-time heart health data, primarily in clinical or home settings.

- Wearable Blood Pressure Monitors: These are becoming more and more popular for managing hypertension at home because they are portable and non-invasive.

- Others: This includes new innovations like smart rings, glasses and biosensing jewelry.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hardware (Dominating): It consists of the device's physical components, such as sensors, batteries, screens and casings.

- Software: The fastest growing software facilitates data processing, visualization, device functionality, and interface with digital health platforms.

- Services: Offers remote medical help, app connectivity and technical support.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Application

- Remote Patient Monitoring: Gadgets that gather and send physicians real-time health data outside of clinical settings. Due to post-pandemic shifts toward decentralized care and fewer hospital visits, this segment is expanding at the fastest rate.

- Sports & Fitness: These are the wearables that monitor heart rate, calories burnt, activity levels and other parameters. Due to mass-market acceptance and consumer lifestyle trends, this area continues to dominate by volume.

- Home Healthcare: This includes devices which are used for patient at home, enabling basic monitoring and support for recovery & chronic illness.

- Diagnosis & Screening: Medical-grade tools that aids early detection and assessment of various health parameters.

- Chronic Disease Management: Devices supporting long-term tracking and alerts for conditions like diabetes, cardiac issues, and hypertension.

- Rehabilitation: Wearables that help monitor physical therapy, motion tracking, and recovery progress.

- Others: These includes niche applications like fertility, mental health, sleep and stress monitoring.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Bluetooth: Widely adopted for its very simple pairing and low energy usage making it the dominating segment in mainstream wearables.

- Wi-Fi: Allows fast syncing with health applications and cloud storage, suitable for very high-data use.

- Cellular Network: Allows devices to work independently without a smartphone. The need for standalone performance and emergency warnings is escalating this segment quickest growth.

- Others: Covers NFC, ANT+, Zigbee, and proprietary technologies catering to specific device needs.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics: The dominating end user segment, these institutions use wearables for patient monitoring, diagnosis and integration with EMR systems.

- Fitness & Sports Institutions: Leverage wearables to enhance training, monitor health metrics, and prevent injuries.

- Home Users: This is the fastest-growing group owing to more people are becoming aware of and able to use self-monitoring tools, which will keep growing quickly.

- Others: (e.g., Ambulatory Surgical Centers): These are the smaller care providers and specialized centers using wearables for post op tracking and outpatient care.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America remains the dominant region in the Wearable Health Technology Market owing to high taking on rates, advanced healthcare infrastructure and strong presence of technology firms. The US leads globally in both consumer usage and clinical integration. The fastest-growing market, however, is Asia-Pacific, driven by government digital health initiatives in China, Japan, and India as well as growing health consciousness and smartphone usage. With active R&D and regulatory alignment, Europe is not far behind. These regional observation shows that innovation and acceptance are fast expanding throughout both developed & emerging economies denoting a worldwide expanding footprint.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Wearable Health Technology Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Wearable Health Technology Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Wearable Health Technology Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Wearable Health Technology Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Application & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Wearable Health Technology Market – By Product Type

5.1. Overview

5.1.1. Segment Share Analysis, By Product Type, 2024 & 2035 (%)

5.1.2. Smartwatches

5.1.3. Fitness Trackers

5.1.4. Smart Patches

5.1.5. Smart Clothing

5.1.6. Wearable ECG Monitors

5.1.7. Wearable Blood Pressure Monitors

5.1.8. Others

(presents market segmentation by Product Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Wearable Health Technology Market – By Component

6.1. Overview

6.1.1. Segment Share Analysis, By Component, 2024 & 2035 (%)

6.1.2. Hardware

6.1.3. Software

6.1.4. Services

(breaks down the market by Component, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Wearable Health Technology Market – By Application

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2024 & 2035 (%)

7.1.2. Remote Patient Monitoring

7.1.3. Sports & Fitness

7.1.4. Home Healthcare

7.1.5. Diagnosis & Screening

7.1.6. Chronic Disease Management

7.1.7. Rehabilitation

7.1.8. Others

(focuses on market segmentation by Application, helping the client prioritize specific crop Product Types or end-use areas that offer significant business opportunities)

8. Wearable Health Technology Market – By Connectivity

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Bluetooth

8.1.3. Wi-Fi

8.1.4. Cellular Network

8.1.5. Others

(breaks down the market by type of connectivity, helping stakeholders understand user accessibility preferences and compatibility trends across regions and use-cases)

9. Wearable Health Technology Market – By End-User

9.1. Overview

9.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

9.1.2. Hospitals & Clinics

9.1.3. Fitness & Sports Institutions

9.1.4. Home Users

9.1.5. Others (Ambulatory Surgical Centres)

(describes the market division by End-User of Application, enabling the client to understand which usage methods are preferred and where future demand may rise)

10. Wearable Health Technology Market– By Geography

10.1. Introduction

10.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

10.2. North America

10.2.1. Regional Overview & Trends

10.2.2. Wearable Health Technology Key Manufacturers in North America

10.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

10.2.4. North America Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

10.2.5. North America Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.6. North America Market Size and Forecast, By Connectivity, 2024 - 2035 (US$ Million)

10.2.7.

10.2.8. North America Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

10.2.9. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

10.2.10. U.S.

10.2.10.1. Overview

10.2.10.2. U.S. Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

10.2.10.3. U.S. Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.10.4. U.S. Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

10.2.10.5. U.S. Market Size and Forecast, By Connectivity, 2024 - 2035 (US$ Million)

10.2.10.6.

10.2.10.7. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

10.2.11. Canada

10.2.11.1. Overview

10.2.11.2. Canada Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

10.2.11.3. Canada Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.11.4. Canada Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

10.2.11.5. Canada Market Size and Forecast, By Connectivity, 2024 - 2035 (US$ Million)

10.2.11.6. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

10.2.12. Mexico

10.2.12.1. Overview

10.2.12.2. Mexico Market Size and Forecast, By Product Type, 2024 - 2035 (US$ Million)

10.2.12.3. Mexico Market Size and Forecast, By Component, 2024 - 2035 (US$ Million)

10.2.12.4. Mexico Market Size and Forecast, By Application, 2024 - 2035 (US$ Million)

10.2.12.5. Mexico Market Size and Forecast, By Connectivity, 2024 - 2035 (US$ Million)

10.2.12.6. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

10.3. Europe

10.3.1. Germany

10.3.2. Italy

10.3.3. United Kingdom

10.3.4. France

10.3.5. Russia

10.3.6. Poland

10.3.7. Rest of Europe

10.4. Asia Pacific (APAC)

10.4.1. India

10.4.2. China

10.4.3. Japan

10.4.4. South Korea

10.4.5. Australia

10.4.6. Rest of APAC

10.5. Latin America

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Colombia

10.5.4. Rest of LATAM

10.6. Middle East and Africa

10.6.1. Israel

10.6.2. Turkey

10.6.3. Egypt

10.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

11. Wearable Health Technology Market: Competitive Landscape & Company Profiles

11.1. Market Share Analysis (2024)

11.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

11.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

11.3.1. Apple Inc.

11.3.2. Fitbit (Google)

11.3.3. Garmin Ltd.

11.3.4. Samsung Electronics

11.3.5. Huawei Technologies

11.3.6. Philips Healthcare

11.3.7. Withings

11.3.8. Omron Healthcare

11.3.9. Biobeat

11.3.10. VitalConnect

11.3.11. Hexoskin

11.3.12. Masimo Corporation

11.3.13. Polar Electro

11.3.14. Zephyr Technology

11.3.15. Xiaomi Corporation

11.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

12. Wearable Health Technology Market: Future Market Outlook (2025–2035)

12.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

12.2. Disruptive Technologies Impact

12.3. Emerging Business Trends

12.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

13. Wearable Health Technology Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

14. Wearable Health Technology Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Wearable Health Technology Market: Product Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Product Type

TABLE 6: Global Wearable Health Technology Market, by Product Type 2022–2035 (USD Million)

TABLE 7: Wearable Health Technology Market: Component Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Component

TABLE 9: Global Wearable Health Technology Market, by Component 2022–2035 (USD Million)

TABLE 10: Wearable Health Technology Market: Application Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Application

TABLE 12: Global Wearable Health Technology Market, by Application 2022–2035 (USD Million)

TABLE 13: Wearable Health Technology Market: Connectivity Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Connectivity

TABLE 15: Global Wearable Health Technology Market, by Connectivity 2022–2035 (USD Million)

TABLE 16: Wearable Health Technology Market: End-User Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by End-User

TABLE 18: Global Wearable Health Technology Market, by End-User 2022–2035 (USD Million)

TABLE 19: Wearable Health Technology Market: Regional Snapshot (2024)

TABLE 20: Segment Dashboard; Definition and Scope, by Region

TABLE 21: Global Wearable Health Technology Market, by Region 2022–2035 (USD Million)

TABLE 22: Wearable Health Technology Market, by Country (North America), 2022–2035 (USD Million)

TABLE 23: Wearable Health Technology Market, by Product Type (North America), 2022–2035 (USD Million)

TABLE 24: Wearable Health Technology Market, by Component (North America), 2022–2035 (USD Million)

TABLE 25: Wearable Health Technology Market, by Connectivity (North America), 2022–2035 (USD Million)

TABLE 26: Wearable Health Technology Market, by Application (North America), 2022–2035 (USD Million)

TABLE 27: Wearable Health Technology Market, by End-User (North America), 2022–2035 (USD Million)

TABLE 28: U.S. Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 29: U.S. Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 30: U.S. Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 31: U.S. Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 32: U.S. Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 33: Canada Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 34: Canada Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 35: Canada Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 36: Canada Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 37: Canada Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 38: Mexico Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 39: Mexico Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 40: Mexico Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 41: Mexico Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 42: Mexico Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 43: China Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 44: China Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 45: China Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 46: China Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 47: China Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 48: India Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 49: India Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 50: India Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 51: India Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 52: India Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 53: Japan Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 54: Japan Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 55: Japan Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 56: Japan Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 57: Japan Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 58: South Korea Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 59: South Korea Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 60: South Korea Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 61: South Korea Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 62: South Korea Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 63: Australia Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 64: Australia Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 65: Australia Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 66: Australia Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 67: Australia Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 68: Germany Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 69: Germany Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 70: Germany Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 71: Germany Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 72: Germany Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 73: France Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 74: France Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 75: France Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 76: France Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 77: France Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 78: Italy Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 79: Italy Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 80: Italy Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 81: Italy Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 82: Italy Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 83: Spain Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 84: Spain Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 85: Spain Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 86: Spain Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 87: Spain Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 88: U.K. Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 89: U.K. Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 90: U.K. Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 91: U.K. Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 92: U.K. Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 93: Russia Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 94: Russia Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 95: Russia Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 96: Russia Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 97: Russia Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 98: Brazil Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 99: Brazil Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 100: Brazil Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 101: Brazil Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 102: Brazil Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 103: Argentina Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 104: Argentina Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 105: Argentina Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 106: Argentina Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 107: Argentina Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 108: Colombia Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 109: Colombia Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 110: Colombia Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 111: Colombia Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 112: Colombia Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 113: Saudi Arabia Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 114: Saudi Arabia Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 115: Saudi Arabia Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 116: Saudi Arabia Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 117: Saudi Arabia Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 118: UAE Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 119: UAE Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 120: UAE Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 121: UAE Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 122: UAE Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 123: South Africa Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 124: South Africa Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 125: South Africa Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 126: South Africa Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 127: South Africa Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 128: Israel Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 129: Israel Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 130: Israel Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 131: Israel Wearable Health Technology Market, by Application, 2022–2035 (USD Million)

TABLE 132: Israel Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

TABLE 133: Turkey Wearable Health Technology Market, by Product Type, 2022–2035 (USD Million)

TABLE 134: Turkey Wearable Health Technology Market, by Component, 2022–2035 (USD Million)

TABLE 135: Turkey Wearable Health Technology Market, by Connectivity, 2022–2035 (USD Million)

TABLE 136: Turkey Wearable Health Technology Market, by End-User, 2022–2035 (USD Million)

List of Figures

FIGURE 1: Wearable Health Technology Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Product Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Product Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 12: Component Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Component Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 14: Application Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Application Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 16: Connectivity Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Connectivity Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 18: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 19: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 20: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 21: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 22: North America Wearable Health Technology Market Share and Leading Players, 2024

FIGURE 23: Europe Wearable Health Technology Market Share and Leading Players, 2024

FIGURE 24: Asia Pacific Wearable Health Technology Market Share and Leading Players, 2024

FIGURE 25: Latin America Wearable Health Technology Market Share and Leading Players, 2024

FIGURE 26: Middle East and Africa Wearable Health Technology Market Share and Leading Players, 2024

FIGURE 27: North America Market Share Analysis by Country, 2024

FIGURE 28: U.S. Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 29: Canada Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 30: Mexico Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 31: Europe Wearable Health Technology Market Share Analysis by Country, 2023

FIGURE 32: Germany Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 33: Spain Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 34: Italy Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 35: France Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 36: UK Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 37: Russia Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 38: Poland Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 39: Rest of Europe Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 40: Asia Pacific Wearable Health Technology Market Share Analysis by Country, 2023

FIGURE 41: India Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 42: China Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 43: Japan Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 44: South Korea Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 45: Australia Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 46: Rest of APAC Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 47: Latin America Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 48: Latin America Wearable Health Technology Market Share Analysis by Country, 2023

FIGURE 49: Brazil Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 50: Argentina Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 51: Colombia Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 52: Rest of LATAM Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 53: Middle East and Africa Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 54: Middle East and Africa Wearable Health Technology Market Share Analysis by Country, 2023

FIGURE 55: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 56: Israel Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 57: Turkey Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 58: Egypt Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

FIGURE 59: Rest of MEA Wearable Health Technology Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Million)

- "We were preparing to expand our product portfolio in the digital wellness space, and the Wearable Health Technology Market Research Report turned out to be a strategic asset. The depth of analysis on sensor innovation, user behavior trends, and integration with telehealth platforms was exactly what we needed. The regional insights and competitive benchmarking helped us realign our R&D investments and refine our GTM approach. This report saved us weeks of internal research and gave us the clarity to move fast and confidently."

- Jessica Martinez, Director of Digital Health Strategy, U.S.A.

- "As someone responsible for shaping future-ready medtech strategies, I found this report to be one of the most data-rich and analytically sound pieces of market intelligence in the wearable segment. From reimbursement pathways for remote patient monitoring to regulatory guidance across key EU markets, everything was covered with precision. It gave our team a framework to assess risk, identify unmet needs, and prioritize pipeline projects accordingly. Highly recommended for stakeholders in healthcare digitization."

- Dr. Lars Koenig, Head of Innovation, Medical Devices Division, Germany

- "With Asia-Pacific emerging as a hotbed for wearable tech adoption, we needed sharp, localized insights. This report delivered just that, with deep dives into consumer health trends, partnerships, and policy drivers across China, India, Japan, and ASEAN markets. The predictive modeling for market sizing and vendor strategies helped us justify a regional expansion plan and identify potential licensing partners. It’s rare to find a report that blends market data, clinical context, and commercial implications so seamlessly."

- Meera Tanaka, Market Intelligence Lead, APAC Region, Singapore

This Wearable Health Technology Market 2025 report has been meticulously developed by a team of senior healthcare market analysts and technology foresight experts at Quants & Trends. With over a decade of focused expertise in digital health ecosystems, medical device innovation, and connected care platforms, our research team brings a unique blend of industry insight and analytical depth.

The lead author holds advanced degrees in biomedical engineering and healthcare economics, coupled with extensive experience advising global medtech firms, wellness tech startups, and healthcare policymakers on emerging market dynamics. Our analysts have closely tracked the evolution of wearable technologies, from basic fitness trackers to clinically validated biosensors and AI-integrated smart wearables, enabling them to provide a grounded perspective on both technological readiness and commercial viability.

This report is built on a foundation of rigorous primary interviews, proprietary data modeling, and regulatory trend tracking, delivering practical value to stakeholders across product development, investment, strategy, and market entry planning. Whether you're assessing partnership opportunities, forecasting adoption rates, or aligning your product roadmap, this report offers actionable intelligence that empowers real-world business decisions.

To know more about our healthcare research methodology and insights across medical innovation markets, we invite you to connect with us on LinkedIn.