Market Outlook

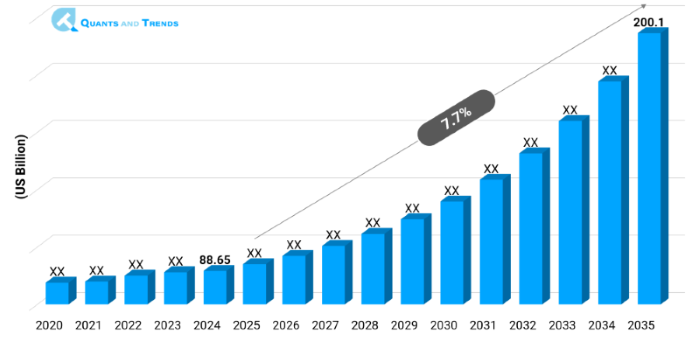

The global chronic pain management market was valued at approximately USD 88.65 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2035, reaching around USD 200.1 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Chronic Pain Management Market is currently experiencing a steady increase that can be attributed to the fact that prevalence of chronic conditions including arthritis and neuropathy is on its upswing. The latest statistics indicate that chronic pain affects more than 20 per cent of adults in the worldwide population thus increasing the demand of advanced treatment. According to the Chronic Pain Management Market Forecast, there is a trend of moving towards integrated care model accompanied by digital health and personalized medicine. The most important Trends in Chronic Pain Management revolve around the growing use of telehealth, Neuromodulation, and multidisciplinary pain programs. The Chronic Pain Management Market Report expects such an industry to keep on expanding due to aging populations and awareness until 2035.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 7.7% |

| Market Value In 2024 | USD 88.65 billion |

| Market Value In 2035 | USD 200.1 billion |

Introduction

Chronic and Pain Management Market refers to medicines and solutions meant to treat and eliminate lasting pain that could go on even after three months. It is a multidisciplinary topic consisting of pharmacological, interventional techniques, digital therapeutics, devices, and supportive care plans. Chronic Pain Management Industry Analysis is focused on the holistics that will involve medication and behavioral therapy in combination with innovation. The report on the Chronic Pain Management Market examines these transformations in trends, including neuromodulation implants and the mobile health platform, and identifies how patient-focused approaches are redefining therapy routes. This is an extensive report with qualitative information about the dynamics of the market, segmentation of the market, regional progress, and future investment scope.

Key Market Drivers: What’s Fueling the Chronic Pain Management Market Boom?

- Increasing Prevalence of Chronic Conditions: There is an escalating worldwide prevalence of such chronic conditions as osteoarthritis, fibromyalgia and even lower back pains attributed to demographical patterns as well as sedentary lifestyles. The conditions cause a lot of pain and disability which have led to the higher requirements of pain management therapies. The trend is a fundamental Chronic Pain Management Growth Driver & Challenge, which shapes new adoption patterns of treatment and diversification of therapy.

- Neuromodulation and Digital Health: Neuromodulation (spinal cord stimulators, peripheral nerve stimulators) are proving more effective solutions to pain with minimally invasive strategies lowering the need to be on opioids. At the same time, digital therapeutics featuring the administration of pain medicine including remote patient monitoring tools that are informed by telehealth support customized pain management. These Key Trends in Chronic Pain Management are enabled by the changing Technology Adoption in Chronic Pain Management, with predictable as well as data-driven care models.

- The concept of Integrated & Multidisciplinary Care: Healthcare delivery is moving away opioid-based intervention and embracing integrated care (mental health, physical therapy, and support care) systems. The outcomes focus by these programs is compliant with Regulatory & Policy Overview measures, which encourages safe and effective pain management, that discourages overprescribing, and focuses more on patient-reported outcomes.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The digital platforms and implantable devices lead to innovation in the Chronic Pain Management Market. Smartphone based applications of cognitive behavioral therapy are increasing in popularity as well as non invasive neuromodulation devices (e.g. transcutaneous electrical nerve stimulators). Artificial intelligence-based devices currently have the ability to anticipate pain surges thus making it possible to intervene ahead of time. Besides, new wearable biofeedback technologies provide real-time data that enable self-cure resulting in Emerging Opportunities in personalized, tech-enabled chronic pain treatment. These advancements hold the potential of safer, effective, and patient-centered care.

Recent Developments:

In June 2025, Medtronic introduced a next-gen rechargeable spinal cord stimulator with closed-loop sensing in order to adapt stimulation based on real-time neural response, indicating a continued commitment to development of neuromodulation devices.

Conclusion

The Chronic Pain Management Market is on its way to dramatic change, being subject to the forces of demographics, therapeutic innovations as well as changing care paradigms. The core market is Canada and the US but the Asian‑Pacific turns out to be the fastest-growing region. The moving-in integrated, technology-enabled and home-based care is a part of the Market Dynamics and their changing expectations of patients. With safe, outcome-oriented methods becoming the focus of healthcare systems across the board, the next epoch in the development of Chronic Pain Management Market will be hinged on innovation and cross-functional strategies that will open up new investment and patient-care ventures.

Related Reports

- The global Integrative and Complementary Medicine Market was valued at approximately USD 141.2 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 22.8% from 2025 to 2035, reaching around USD 1,346.0 billion by the end of the forecast period.

- The global Mental Health Market was worth around USD 450.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 3.1% from 2025 to 2035, reaching nearby USD 611.8 billion by the end of the forecast period.

Key Market Players

The HCL health care analytics market is typified by established technology vendors and industry-specific Chronic Pain Management companies. Strategic mergers, partnerships, and platform upgrading among key players are underway as a way of winning more market shares. The concept of competitive positioning revolves around cloud integration, AI enablement and regional expansion. Although legacy companies offer end-to-end analytics ecosystems, lean startups are launching modular, low-code applications focused by use case such as remote monitoring or drug discovery. Some of the key players in the Chronic Pain Management industry are as:

Pfizer, Johnson & Johnson, Medtronic, Abbott, Becton Dickinson, Boston Scientific, Nevro, Axonics, Boston Scientific, Mallinckrodt Pharmaceuticals, Teva, Stryker, ChloeCare (Digital therapeutic startup), Kaia Health (Digital therapeutic), Abbott

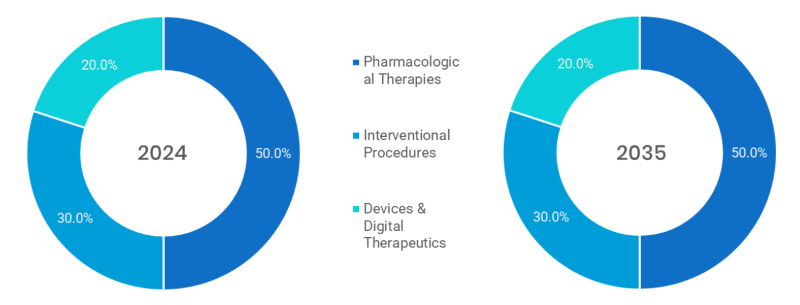

- Pharmacological Therapies (Dominant): They include NSAIDs, opioids, antidepressants and anticonvulsants. These are the most widely used and therefore dominant ones because of their proven functionality.

- Interventional Procedures (Fastest-growing): These are steroid injection, nerve block, and radiofrequency ablation. Most rapidly-developing, under impetus of demand in minimally invasive, selective procedures.

- Devices & digital Therapeutics: These will consist of neuromodulation implants, TENS units and apps based pain management devices. They provide non-pharmacological options and assist in individual care.

Note: Charts and figures are illustrative only. Contact us for verified market data.

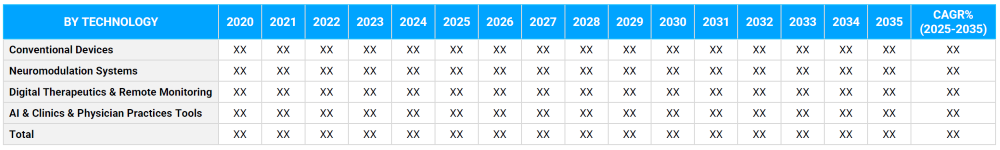

- Conventional equipment (Dominant): These include TENS and ultrasound therapeutics, common and popular.

- Neuromodulation Systems (Fastest-growing): Neuromodulation such as spinal cord stimulinators are the fastest growing devices as a result of breakthrough in technology and reimbursement policy support.

- Digital Therapeutics & Remote Monitoring Applications: Digital Therapeutics and remote monitoring applications are growing fast and represent low cost, massively scalable and patient-friendly solutions with telehealth dynamic in favor.

- AI & Predictive tools: These are new technologies that predict pain events and help to optimize treatment: primarily undergoing early adoption.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Health Systems (Dominant): Main-stream purveyors of interventional and multifaceted management of pain-biggest share.

- Physician Practices/Clinics: Utilization of pharmacological treatment and small procedures is widespread.

- Home & Remote Care (Fastest-growing): Consists of self-monitored devices and applications; the fastest-growing since patients like its convenience and quality of care continuity.

Note: Charts and figures are illustrative only. Contact us for verified market data.

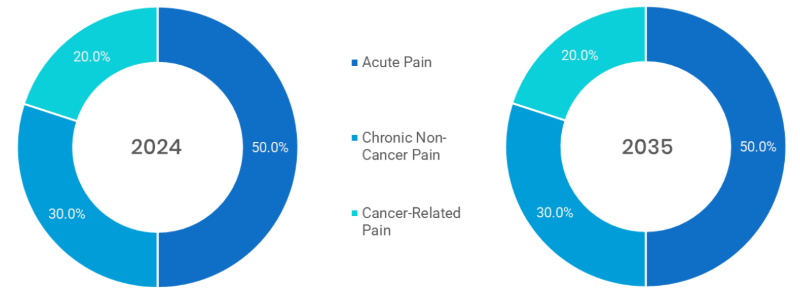

- Acute Pain Management (Dominant): Pain that follows the aftermath of surgery or injury, and is dominant in hospitals.

- Chronic Non-Cancer Pain (Fastest-growing): Such conditions as back pain or arthritis; are expanding at the quickest rate since more cases and chronic care models are increasing.

- Cancer-Related Pain & Palliative Care: It remains smaller but continues to expand due to needs of supportive oncology care.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

North America is the leading market since opioid innovations, reimbursement models, and well-developed healthcare health services facilitate prescription of treatments and investments. Europe is not far behind showing more and more interest in multimodal pain treatment and better access to neuromodulation. The Asia-Pacific region is the fastest-growing region driven by chronically increasing incidences of diseases, increased middle-class healthcare expenditure, and a positive stance towards digital health policies. Latin America and MEA demonstrate a growing potential due to the urbanization-first programs and the spread of pain care awareness.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Chronic Pain Management Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting Therapeutic Modalitys

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Chronic Pain Management Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Chronic Pain Management Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Chronic Pain Management Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Treatment Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Chronic Pain Management Market – By Treatment Type

5.1. Overview

5.1.1. Segment Share Analysis, By Treatment Type, 2024 & 2035 (%)

5.1.2. Pharmacological Therapies

5.1.3. Interventional Procedures

5.1.4. Devices & Digital Therapeutics

5.1.5. Psychological & Rehabilitation Therapies

(presents market segmentation by Treatment Type, guiding the client on the product categories that are expected to drive demand and shape future revenue streams)

6. Chronic Pain Management Market – By Technology

6.1. Overview

6.1.1. Segment Share Analysis, By Technology, 2024 & 2035 (%)

6.1.2. Conventional Devices

6.1.3. Neuromodulation Systems

6.1.4. Digital Therapeutics & Remote Monitoring

6.1.5. AI & Predictive Tools

(breaks down the market by Technology, assisting the client in identifying material or origin preferences and emerging growth segments)

7. Chronic Pain Management Market – By Care Setting

7.1. Overview

7.1.1. Segment Share Analysis, By Care Setting, 2024 & 2035 (%)

7.1.2. Hospitals & Health Systems

7.1.3. Clinics & Physician Practices

7.1.4. Home & Remote Care

7.1.5. Pain Rehabilitation Centers

(focuses on market segmentation by Care Setting, helping the client prioritize specific crop Treatment Types or end-use areas that offer significant business opportunities)

8. Chronic Pain Management Market – By Therapeutic Modality

8.1. Overview

8.1.1. Segment Share Analysis, By Therapeutic Modality, 2024 & 2035 (%)

8.1.2. Acute Pain

8.1.3. Chronic non-Cancer Pain

8.1.4. Cancer-Related Pain

8.1.5. Post-Surgical Pain

(describes the market division by Therapeutic Modality of Treatment Type, enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Chronic Pain Management Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Chronic Pain Management Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Treatment Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Care Setting, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By Therapeutic Modality, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Treatment Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Care Setting, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By Therapeutic Modality, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Treatment Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Care Setting, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By Therapeutic Modality, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Treatment Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Technology, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Care Setting, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By Therapeutic Modality, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Chronic Pain Management Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Pfizer

10.3.2. Johnson & Johnson

10.3.3. Medtronic

10.3.4. Abbott

10.3.5. Becton Dickinson

10.3.6. Boston Scientific

10.3.7. Nevro

10.3.8. Axonics

10.3.9. Boston Scientific

10.3.10. Mallinckrodt Pharmaceuticals

10.3.11. Teva

10.3.12. Stryker

10.3.13. ChloeCare (Digital therapeutic startup)

10.3.14. Kaia Health (Digital therapeutic)

10.3.15. Abbot

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Chronic Pain Management Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Chronic Pain Management Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Chronic Pain Management Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Chronic Pain Management Market: Treatment Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, by Treatment Type

TABLE 6: Global Chronic Pain Management Market, by Treatment Type 2022–2035 (USD Billion)

TABLE 7: Chronic Pain Management Market: Technology Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Technology

TABLE 9: Global Chronic Pain Management Market, by Technology 2022–2035 (USD Billion)

TABLE 10: Chronic Pain Management Market: Care Setting Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, by Care Setting

TABLE 12: Global Chronic Pain Management Market, by Care Setting 2022–2035 (USD Billion)

TABLE 13: Chronic Pain Management Market: Care Setting Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by Therapeutic Modality

TABLE 15: Global Chronic Pain Management Market, by Therapeutic Modality 2022–2035 (USD Billion)

TABLE 16: Chronic Pain Management Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Chronic Pain Management Market, by Region 2022–2035 (USD Billion)

TABLE 19: Chronic Pain Management Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Chronic Pain Management Market, by Treatment Type (NA), 2022–2035 (USD Billion)

TABLE 21: Chronic Pain Management Market, by Technology (NA), 2022–2035 (USD Billion)

TABLE 22: Chronic Pain Management Market, by Care Setting (NA), 2024–2035 (USD Billion)

TABLE 23: Chronic Pain Management Market, by Therapeutic Modality (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 26: U.S. Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 27: U.S. Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 28: Canada Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 29: Canada Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 30: Canada Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 31: Canada Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 32: Mexico Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 34: Mexico Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 35: Mexico Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 36: Chronic Pain Management Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Chronic Pain Management Market, by Treatment Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Chronic Pain Management Market, by Technology (Europe), 2022–2035 (USD Billion)

TABLE 39: Chronic Pain Management Market, by Care Setting(Europe), 2022–2035 (USD Billion)

TABLE 40: Chronic Pain Management Market, by Therapeutic Modality (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 42: Germany Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 43: Germany Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 44: Germany Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 45: Italy Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 46: Italy Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 47: Italy Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 48: Italy Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 53: France Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 54: France Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 55: France Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 56: France Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 57: Russia Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 58: Russia Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 59: Russia Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 60: Russia Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 61: Poland Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 62: Poland Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 63: Poland Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 64: Poland Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 69: Chronic Pain Management Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Chronic Pain Management Market, by Treatment Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Chronic Pain Management Market, by Technology (APAC), 2022–2035 (USD Billion)

TABLE 72: Chronic Pain Management Market, by Care Setting(APAC), 2022–2035 (USD Billion)

TABLE 73: Chronic Pain Management Market, by Therapeutic Modality (APAC), 2022–2035 (USD Billion)

TABLE 74: India Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 75: India Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 76: India Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 77: India Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 78: China Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 79: China Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 80: China Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 81: China Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 82: Japan Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 83: Japan Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 84: Japan Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 85: Japan Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 86: South Korea Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 88: South Korea Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 89: South Korea Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 90: Australia Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 91: Australia Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 92: Australia Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 93: Australia Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 98: Brazil Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 100: Brazil Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 101: Brazil Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 102: Argentina Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 104: Argentina Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 105: Argentina Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 106: Colombia Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 108: Colombia Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 109: Colombia Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 114: Israel Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 115: Israel Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 116: Israel Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 117: Israel Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 118: Turkey Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 120: Turkey Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 121: Turkey Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 122: Egypt Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 124: Egypt Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 125: Egypt Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Chronic Pain Management Market, by Treatment Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Chronic Pain Management Market, by Technology, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Chronic Pain Management Market, by Care Setting, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Chronic Pain Management Market, by Therapeutic Modality, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Chronic Pain Management Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Treatment Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Treatment Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Technology Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Technology Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Treatment Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Treatment Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: Therapeutic Modality Segment Market Share Analysis, 2023 & 2035

FIGURE 17: Therapeutic Modality Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Chronic Pain Management Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Chronic Pain Management Market Share and Leading Players, 2024

FIGURE 23: Latin America Chronic Pain Management Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Chronic Pain Management Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Chronic Pain Management Market Share Analysis by Country, 2023

FIGURE 30: Germany Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Chronic Pain Management Market Share Analysis by Country, 2023

FIGURE 39: India Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Chronic Pain Management Market Share Analysis by Country, 2023

FIGURE 47: Brazil Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Chronic Pain Management Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Chronic Pain Management Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "The Chronic Pain Management Market Research Report provided the clarity we needed to expand our multidisciplinary pain program. The report’s deep dive into device-based therapies, non-opioid pharmacological solutions, and digital pain management platforms helped us align our care offerings with the most evidence-backed and scalable approaches. It also supported our internal strategy to seek payer collaboration for value-based pain care models. In a field that’s often fragmented, this research brought structure and insight."

- Dr. Amanda Collins, Medical Director, Pain & Wellness Center (USA)

- "We used this report extensively to shape our market entry strategy for a novel neuromodulation solution targeting chronic pain. The competitive landscape analysis, reimbursement trends across Europe, and patient segmentation data were invaluable. It gave our commercial and regulatory teams a unified view of where the real opportunities lie, especially in underpenetrated chronic pain subcategories. The research clearly comes from a team with strong domain understanding and practical foresight."

- Henrik Jansson, VP, Market Access & Strategy, Medical Device Innovator (Sweden)

- "This report was central to our investment review of several chronic pain management startups in Asia. It provided not only market sizing and growth forecasts, but also a critical view of technology maturity, clinical acceptance, and regulatory variation across APAC regions. The integration of traditional medicine trends with modern therapeutic modalities was a unique strength of this research. It gave us the confidence to move forward with targeted funding and partnership discussions."

- Dr. Nishant Verma, Principal Analyst, Healthcare VC Firm (India)

The Chronic Pain Management Market 2025 report is developed by the expert healthcare research team at Quants & Trends, a leading provider of healthcare market intelligence with a specialized focus on pain therapeutics, medical technologies, and multidisciplinary care models.

With over a decade of experience tracking the evolution of chronic care delivery, our analysts bring together clinical insight, regulatory knowledge, and commercial foresight. This report reflects extensive primary research, including in-depth interviews with pain specialists, physiatrists, neuromodulation experts, reimbursement consultants, and executives from device and pharmaceutical sectors. Backed by robust data modeling and global trend analysis, this study offers practical intelligence for stakeholders navigating one of the most complex and rapidly evolving areas of modern healthcare.

Our report examines the entire chronic pain management spectrum, from non-opioid pharmacological therapies and neuromodulation devices to digital therapeutics, integrative interventions, and payer-backed value-based care programs. Whether you are a medical device innovator, a hospital executive expanding pain services, a pharmaceutical strategist, or a healthtech investor, this report equips you with the actionable insights needed to make informed, future-facing business decisions.

To explore our methodology, research team, and thought leadership in healthcare innovation, connect with us on our official LinkedIn page.