Market Outlook

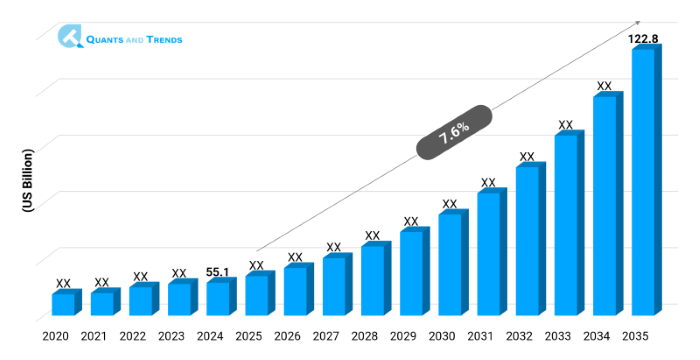

The global Healthcare Marketing Strategies Market was valued at approximately USD 55.1 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2035, reaching around USD 122.8 billion by the end of the forecast period. The historical analysis starts from 2020 to 2023 with 2024 as the base year and forecasts starts from 2025 to 2035.

The Healthcare Marketing Strategies Market is fast evolving owing to growing digitalization, growing patient-orientedness in communication, and competitive differentiation required by providers and payers. As healthcare moves toward the direction of consumerization, the organizations are utilizing multi-channel approaches, data analytics, and tools associated with automation in order to attract and retain patients. Global healthcare community in terms of its landscape in 2024 remains focused on individualized outreach, reputation management, and value-based content marketing. The major tendencies in healthcare marketing approaches are omnichannel interactions, AI-based campaign optimization, and HIPAA-providing CRM. Since the healthcare systems invest in the modernization of their outreach, Healthcare Marketing Strategies Market Forecast is expected to grow substantially based on the ROI-oriented models of communication and the use of technology in campaign performance.

| Base Year | 2024 |

|---|---|

| Forecast Period | 2025-2035 |

| Historical Period | 2020-2023 |

| CAGR | 7.6% |

| Market Value In 2024 | USD 55.1 billion |

| Market Value In 2035 | USD 122.8 billion |

Introduction

Healthcare Marketing Strategies Market is concerned with planning, execution, and analysis of marketing campaigns according to hospitals, clinics, pharmaceuticals, payers and medtech companies. The objective of these strategies is to enhance customer acquisition, retention, brand awareness and involvement in the field of digital and conventional media. The trend towards the replacement of generic campaigns with the data-driven, individualized campaigns is transforming the relationships between stakeholders and the care providers. These are all services that run on this market and include SEO, social media marketing, telehealth marketing, referral models, and branding based on influencers. The process of transformation of the volume to value-based care compounds this issue of targeted communication and, thus, the ability to implement technology into the marketing premises of healthcare is a key driver of ensuring competitiveness in the field.

Key Market Drivers: What’s Fueling the Healthcare Marketing Strategies Market Boom?

- Increasing Digital Patient and Consumer Behavior: The patients in hospitals and health care consumers today insist on transparency, access and personalization that appear in other service industries. Before they decide, patients extensively search online reviews, providers, and teleconsultation factors, among others. This transition is compelling the healthcare organizations towards the operation of integrated digital campaigns, real-time feedback systems as well as mobile-optimized engagement systems. This has led to consumer-driven outreach as one of the key strategic pillars in the growth of the Healthcare Marketing Strategies Industry Analysis.

- AI, CRM, and Analytics Tools Integration: The advanced analytics and AI algorithms and customer relationship management (CRM) systems become part of healthcare marketing processes. These technologies allow segmenting audiences, automation of delivering personalized content, and measurement of multi-platform performance. The AI chatbots, predictive models, and sentiment analysis tools are helping in improving the mapping of the patient journey. The integration facilitates measurable, scalable marketing efforts in any healthcare marketing strategies which creates new investment opportunities.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Innovation in Focus: How Manufacturers Are Raising the Bar?

The Healthcare Marketing Strategies Market is also notable when it comes to the innovation in the industry, including AI-based content personalization, programmatic advertising, and predictive patient engagement. Hyper-targeted advertisements, real-time messaging, and automation of campaigns are now possible across several platforms with the help of Martech solutions. Ensuring the data security of patients through marketing workflows is also coming in the form of Blockchain. Because every organization is seeking to attain ROI and quantifiable KPIs, innovation in marketing will be centered toward agility, customization, and platform and regulations friendly, with the emergence of new opportunities in healthcare marketing strategy at the payer, provider and pharmaceutical business levels.

Recent Developments:

In 2024, Scorpion Healthcare introduced an AI-based platform that personalizes patient engagement using the behavior pattern and past data to increase the accuracy of the campaign. In the meantime, Healthgrades collaborated with Google Cloud to enhance real-time integration and automation of patient feedback and response on behalf of providers. Such trends are indicative of how healthcare marketing strategies are undergoing adoption of technology and how more and more reliance is being placed on Artificial intelligence, Cloud solutions, and Automation in how their campaigns are managed and how they engage with the audience in a rapidly evolving and compliance-driven marketing environment.

Conclusion

Healthcare Marketing Strategies Market Digital transformation is being presented by patient expectation, regulatory requirements, and ROI-based strategies. With the shift towards a consumer-first model, marketing is no longer an extracurricular or a side activity of the organization, but piece and parcel of care delivery and revenue generation. As competition increases and AI-based engagement as well as data-safe sites are in place, the market can expect long term innovation and development. A change will be spearheaded by firms that are open to the collaboration of technology, compliance, and personalization. The market is characterized by strong opportunities through which the stakeholders will develop brand loyalty, build patient volume, and generate quantifiable value in the healthcare continuum.

Related Reports

- The global Healthcare Innovation Ecosystem Market was valued at approximately USD 205.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 18.4% from 2025 to 2035, reaching around USD 1,306.5 billion by the end of the forecast period.

- The global Healthcare Practices Market size was valued at USD 240.17 billion in 2024 and is anticipated to reach USD 515 billion by 2035, growing at a CAGR of 6.7% from 2025 to 2035.

Key Market Players

The Healthcare Marketing Strategies Market Competitive Landscape has the features of strategic cooperation, mergers, and differentiation accelerated by technology. The martech solution providers, consulting agencies, and digital agencies are going head-to-head to provide a turnkey service around branding, automation, and compliance. Players are placing their emphasis on the martech incorporation, patient review analytics, and HIPAA/GDPR convergence. AI-based patient journey mapping and influencer marketing services are provided by new entrants. Conventional companies are improving customization of content. Competing on differentiation comes in the terms of industry knowledge, the ease of interoperability of platforms, and the establishment of an ROI. It is an emerging environment which is influencing the predictive model that will be tracked within the healthcare marketing strategies basing on end-to-end communication frameworks with the interests of the patients. Some of the key players in the Healthcare Marketing Strategies industry are as:

Healthgrades, WebMD, Practice Builders, Binary Fountain, PatientPop, DoctorLogic, Scorpion Healthcare, NRC Health, Cardinal Digital Marketing, Influence Health, Simon Associates Management Consultants, MedTouch, Reputation.com, Geonetric, Optum (UnitedHealth Group)

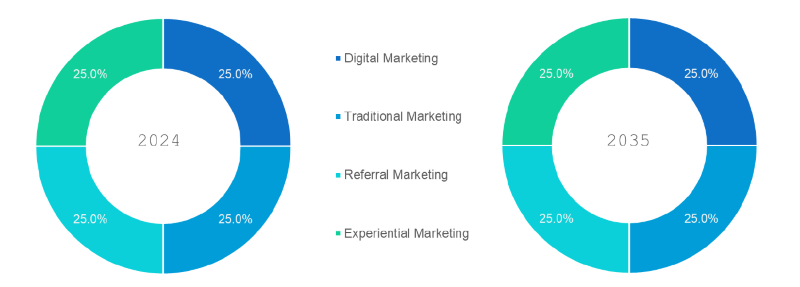

- Digital Marketing (Dominated): Uses internet technology to its benefit, including search engines, social media and websites to send targeted healthcare audiences personal and real-time communications measurable business results.

- Traditional Marketing: These are offline methods of reaching the customers who include: print advertisements, TV, radio and bill board, which are still being greatly utilized by hospitals located in rural or ageing populations to create brand awareness and credibility.

- Referral Marketing (Fastest): Entices the service of encouraging new leads through physician or patient referrals. Adequate in development of trust and obtaining high quality patients especially where there is high level of specialization in treatment centers and clinics.

- Experiential Marketing: Concentrates on face-to-face or virtual live events such as health camps, webinars, or patient-professional interactive workshops, establishing the direct relations of trust with patients and professionals.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Search Engine Optimization (SEO) (Dominated): Makes healthcare websites visible in organic search traffic so as to drive traffic to the websites as well as to generate more patients through sensible writing of health-related material.

- Social Media Marketing: Energizes target markets in such key mediums as Facebook, Instagram, and LinkedIn by providing news, healthy tips, and advertisements, which enhances brand communication and awareness.

- Email Marketing (Fastest): Messages are sent to segmented groups of patients and contain newsletters, reminders, or wellness information presenting great returns on the investment due to direct, trackable, personalized form of communication.

- Content Marketing: Employs blogs, video, white papers, and information graphics to inform and draw in patients, as well as to create brand expertise and authority on given topics related to health.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Software Platforms (Dominated): Key campaign tools that include both campaign design and automation and even tracking the various digital channels to make sure that messaging is consistent and compliance up to date in real time.

- Marketing Services: Integrates the support of the strategy, content, ad buying, and analytics by means of agency support. Frequently outsourced to smaller clinics or start-ups that do not have a team.

- Analytics Tools (fastest): Estimate the performance of a campaign, patient engagement, and conversion. Provide the marketers with the insights that could be taken into the action to maximize their budget and outreach approaches.

- Campaign Management Tools: Allows multi-channel campaigns to be managed centrally and automates scheduling, testing, and reporting to enhance coordination and the effectiveness of the campaigns.

Note: Charts and figures are illustrative only. Contact us for verified market data.

- Hospitals & Clinics (Dominated): This category of consumers will use marketing solutions more than any other type of consumer in order to attract their patients, promote their services as well as ensure there is improved local and online presence through integrated marketing strategies.

- Pharmaceutical Companies (fastest): Employ marketing to provide information to doctors, introduce drugs, and promote adoption of therapy especially on chronic diseases treatment or pharmaceutical specialty drugs.

- Health Insurance Providers: Offer market advantage plans, wellness and preventative care programs and initiatives to both individual consumers and employer groups with an omnichannel approach to communication.

- Medical Device Firms: Create awareness of diagnostic and therapeutic equipment by conducting customized campaigns, webinars, online demonstrations to an audience of medical practitioners and institutions.

Note: Charts and figures are illustrative only. Contact us for verified market data.

Segmentation By Region

Where the Market is Growing Fastest?

The market is endowed by North America, which has currently dominated in the Healthcare Marketing Strategies Market due to extensive digital penetration, advanced healthcare infrastructure as well as heavy investments in patient engagement. U.S. companies are ahead in HIPAA-compliant CRM platforms, an investment in heavy digital advertisement, and top toxic martech companies making personal contact. Asia-Pacific is the most rapidly growing region, with its growth fueled by an increasing number of investment in healthcare services or products by the privates, usage of cell phones, social media, and its use in the emerging markets such as India, China, and Indonesia. The rising competition between medical tourism centers and private hospitals stimulates the investment into marketing strategies. Such regional perspectives underline worldwide propensities, as dictated by consumer anticipations, adequate innovations, and wellbeing changes.

The following nations and regions will be covered in the report:

• North America: U.S., Canada and Mexico

• Asia Pacific: China, India, Japan, South Korea, Australia, among others

• Europe: Germany, France, Italy, Spain, UK, Russia, Rest of Europe

• Latin America: Brazil, Argentina, Colombia

• Middle East & Africa: Saudi Arabia, UAE, South Africa, Israel, Turkey

Note: Charts and figures are illustrative only. Contact us for verified market data.

1. Healthcare Marketing Strategies Market: Market Introduction & Context

1.1. Market Definition

1.2. Scope of the Study

1.3. Research Methodology

1.3.1. Primary Data Collection

1.3.2. Secondary Data Sourcing

1.3.3. External Industry Collaborations

1.3.4. In-House Research Databases

1.3.5. Analytical Frameworks & Forecasting End-Users

1.3.6. Data Validation and Final Report Publishing

1.4. Key Assumptions

1.5. Market Ecosystem Overview

1.6. Stakeholder Analysis (Manufacturers, Suppliers, Growers, Distributors, Retailers)

(introduces the report’s scope, methodology, and assumptions to help the client clearly understand the study's coverage, data sources, and reliability)

2. Healthcare Marketing Strategies Market: Executive Summary

2.1. Key Insights & Market Snapshots

2.2. Analyst Viewpoint

2.3. Market Attractiveness Index

(offers a brief yet insightful market summary, giving the client a quick grasp of key trends, market potential, and strategic highlights)

3. Healthcare Marketing Strategies Market: Market Dynamics & Outlook

3.1. Drivers and their impact analysis

3.2. Restraints and their impact analysis

3.3. Opportunities and their impact analysis (Emerging Markets, New Product Categories)

3.4. Patent & Innovation Analysis (2020–2024)

(explains the major drivers, restraints, opportunities, and challenges shaping the market, enabling the client to assess both growth prospects and potential risks)

4. Healthcare Marketing Strategies Market: Market Environment & Industry

4.1. PESTEL Analysis

4.1.1. Political

4.1.2. Economic

4.1.3. Social

4.1.4. Technological

4.1.5. Environmental

4.1.6. Legal

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers

4.2.3. Bargaining Power of Suppliers

4.2.4. Substitution Risk

4.2.5. Competitive Rivalry

4.3. Pricing Trend Analysis by Region (2024–2030)

4.4. Value Chain & Supply Chain Analysis

4.5. Impact of Digitalization

4.6. Marketing Type & Innovation Landscape

4.7. Regulatory Framework Analysis

4.7.1. Global & Regional Regulations

4.7.1.1. North America

4.7.1.2. Europe

4.7.1.3. APAC

4.7.1.4. LATAM

4.7.1.5. MEA

4.8. Import/Export Restrictions & Tariff Impact

4.9. Government Initiatives

4.10. Impact of Escalating Geopolitical Tensions

(provides an overview of the industry landscape, covering market dynamics, technological advancements, pricing trends, and regulatory influences for informed decision-making)

5. Healthcare Marketing Strategies Market – By Marketing Type

5.1. Overview

5.1.1. Segment Share Analysis, By Marketing Type, 2024 & 2035 (%)

5.1.2. Digital Marketing

5.1.3. Traditional Marketing

5.1.4. Referral Marketing

5.1.5. Experiential Marketing

(presents market segmentation By Marketing Type, guiding the client on the types that are expected to drive demand and shape future revenue streams)

6. Healthcare Marketing Strategies Market – By Channel

6.1. Overview

6.1.1. Segment Share Analysis, By Channel, 2024 & 2035 (%)

6.1.2. Search Engine Optimization (SEO)

6.1.3. Social Media Marketing

6.1.4. Email Marketing

6.1.5. Content Marketing

(breaks down the market by Channel, assisting the client in identifying channel or origin preferences and emerging growth segments)

7. Healthcare Marketing Strategies Market – By Solution

7.1. Overview

7.1.1. Segment Share Analysis, By Solution, 2024 & 2035 (%)

7.1.2. Software Platforms

7.1.3. Marketing Services

7.1.4. Analytics Tools

7.1.5. Campaign Management Tools

(focuses on market segmentation by Solution, helping the client prioritize specific solutions or end-use areas that offer significant business opportunities)

8. Healthcare Marketing Strategies Market – By End-User

8.1. Overview

8.1.1. Segment Share Analysis, By End-User, 2024 & 2035 (%)

8.1.2. Hospitals & Clinics

8.1.3. Pharmaceutical Companies

8.1.4. Health Insurance Providers

8.1.5. Medical Device Firms

(describes the market division by End-User , enabling the client to understand which usage methods are preferred and where future demand may rise)

9. Healthcare Marketing Strategies Market– By Geography

9.1. Introduction

9.1.1. Segment Share Analysis, By Geography, 2024 & 2035 (%)

9.2. North America

9.2.1. Regional Overview & Trends

9.2.2. Healthcare Marketing Strategies Key Manufacturers in North America

9.2.3. North America Market Size and Forecast, By Country, 2024 - 2035 (US$ Million)

9.2.4. North America Market Size and Forecast, By Marketing Type, 2024 - 2035 (US$ Million)

9.2.5. North America Market Size and Forecast, By Channel, 2024 - 2035 (US$ Million)

9.2.6. North America Market Size and Forecast, By Solution, 2024 - 2035 (US$ Million)

9.2.7. North America Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.8. U.S.

9.2.8.1. Overview

9.2.8.2. U.S. Market Size and Forecast, By Marketing Type, 2024 - 2035 (US$ Million)

9.2.8.3. U.S. Market Size and Forecast, By Channel, 2024 - 2035 (US$ Million)

9.2.8.4. U.S. Market Size and Forecast, By Solution, 2024 - 2035 (US$ Million)

9.2.8.5. U.S. Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.9. Canada

9.2.9.1. Overview

9.2.9.2. Canada Market Size and Forecast, By Marketing Type, 2024 - 2035 (US$ Million)

9.2.9.3. Canada Market Size and Forecast, By Channel, 2024 - 2035 (US$ Million)

9.2.9.4. Canada Market Size and Forecast, By Solution, 2024 - 2035 (US$ Million)

9.2.9.5. Canada Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

9.2.10. Mexico

9.2.10.1. Overview

9.2.10.2. Mexico Market Size and Forecast, By Marketing Type, 2024 - 2035 (US$ Million)

9.2.10.3. Mexico Market Size and Forecast, By Channel, 2024 - 2035 (US$ Million)

9.2.10.4. Mexico Market Size and Forecast, By Solution, 2024 - 2035 (US$ Million)

9.2.10.5. Mexico Market Size and Forecast, By End-User, 2024 - 2035 (US$ Million)

Note: Similar information and analysis will be provided for all other regions (Europe, APAC, LATAM and MEA) and countries listed in the subsequent sections.

9.3. Europe

9.3.1. Germany

9.3.2. Italy

9.3.3. United Kingdom

9.3.4. France

9.3.5. Russia

9.3.6. Poland

9.3.7. Rest of Europe

9.4. Asia Pacific (APAC)

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of APAC

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of LATAM

9.6. Middle East and Africa

9.6.1. Israel

9.6.2. Turkey

9.6.3. Egypt

9.6.4. Rest of MEA

(delivers a detailed regional and country-level analysis, supporting the client in recognizing growth hotspots and strategically allocating resources across geographies)

10. Healthcare Marketing Strategies Market: Competitive Landscape & Company Profiles

10.1. Market Share Analysis (2024)

10.2. Company Positioning Matrix (Leaders, Innovators, Emerging Players)

10.3. Company Profiles (Key Players: Overview, Products, Strategies, Financials, Recent Developments)

10.3.1. Healthgrades

10.3.2. WebMD

10.3.3. Practice Builders

10.3.4. Binary Fountain

10.3.5. PatientPop

10.3.6. DoctorLogic

10.3.7. Scorpion Healthcare

10.3.8. NRC Health

10.3.9. Cardinal Digital Marketing

10.3.10. Influence Health

10.3.11. Simon Associates Management Consultants

10.3.12. MedTouch

10.3.13. Reputation.com

10.3.14. Geonetric

10.3.15. Optum (UnitedHealth Group)

10.3.16. Others

Note: All company profiles will include details under the standard heads mentioned in section 10.3 - Overview, Products, Strategies, Financials, and Recent Developments. We also offer customization of the company profiling section based on your specific requirements.

(provides an assessment of key competitors, market shares, and strategic developments, giving the client essential insights to benchmark against or collaborate with industry leaders)

11. Healthcare Marketing Strategies Market: Future Market Outlook (2025–2035)

11.1.1. Scenario Analysis (Optimistic, Realistic, Pessimistic)

11.1.2. Disruptive Technologies Impact

11.1.3. Emerging Business Trends

11.1.4. Business Opportunities for startups and existing players

(presents market forecasts and future outlook scenarios, preparing the client for upcoming trends, innovations, and potential shifts in market structure)

12. Healthcare Marketing Strategies Market: Strategic Recommendations

(offers strategic recommendations for various stakeholders, enabling the client to make informed business decisions that maximize growth and minimize risks)

13. Healthcare Marketing Strategies Market: Disclaimer

(states the report’s disclaimers and legal boundaries, ensuring the client understands the terms of use, limitations, and responsibilities associated with the report)

List of Tables

TABLE 1: List of Data Sources

TABLE 2: Market Drivers; Impact Analysis

TABLE 3: Market Restraints; Impact Analysis

TABLE 4: Healthcare Marketing Strategies Market: Marketing Type Snapshot (2024)

TABLE 5: Segment Dashboard; Definition and Scope, By Marketing Type

TABLE 6: Global Healthcare Marketing Strategies Market, By Marketing Type 2022–2035 (USD Billion)

TABLE 7: Healthcare Marketing Strategies Market: Channel Snapshot (2024)

TABLE 8: Segment Dashboard; Definition and Scope, by Channel

TABLE 9: Global Healthcare Marketing Strategies Market, by Channel 2022–2035 (USD Billion)

TABLE 10: Healthcare Marketing Strategies Market: Solution Snapshot (2024)

TABLE 11: Segment Dashboard; Definition and Scope, By Solution

TABLE 12: Global Healthcare Marketing Strategies Market, by Solution 2022–2035 (USD Billion)

TABLE 13: Healthcare Marketing Strategies Market: End-User Snapshot (2024)

TABLE 14: Segment Dashboard; Definition and Scope, by End-User

TABLE 15: Global Healthcare Marketing Strategies Market, by End-User 2022–2035 (USD Billion)

TABLE 16: Healthcare Marketing Strategies Market: Regional Snapshot (2024)

TABLE 17: Segment Dashboard; Definition and Scope, by Region

TABLE 18: Global Healthcare Marketing Strategies Market, by Region 2022–2035 (USD Billion)

TABLE 19: Healthcare Marketing Strategies Market, by Country (NA), 2022–2035 (USD Billion)

TABLE 20: Healthcare Marketing Strategies Market, By Marketing Type (NA), 2022–2035 (USD Billion)

TABLE 21: Healthcare Marketing Strategies Market, by Channel (NA), 2022–2035 (USD Billion)

TABLE 22: Healthcare Marketing Strategies Market, by Solution (NA), 2024–2035 (USD Billion)

TABLE 23: Healthcare Marketing Strategies Market, by End-User (NA), 2022–2035 (USD Billion)

TABLE 24: U.S. Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 25: U.S. Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 26: U.S. Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 27: U.S. Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 28: Canada Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 29: Canada Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 30: Canada Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 31: Canada Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 32: Mexico Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 33: Mexico Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 34: Mexico Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 35: Mexico Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 36: Healthcare Marketing Strategies Market, by Country (Europe), 2022–2035 (USD Billion)

TABLE 37: Healthcare Marketing Strategies Market, By Marketing Type (Europe), 2022–2035 (USD Billion)

TABLE 38: Healthcare Marketing Strategies Market, by Channel (Europe), 2022–2035 (USD Billion)

TABLE 39: Healthcare Marketing Strategies Market, by Solution(Europe), 2022–2035 (USD Billion)

TABLE 40: Healthcare Marketing Strategies Market, by End-User (Europe), 2022–2035 (USD Billion)

TABLE 41: Germany Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 42: Germany Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 43: Germany Healthcare Marketing Strategies Market, by v, 2022–2035 (USD Billion)

TABLE 44: Germany Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 45: Italy Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 46: Italy Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 47: Italy Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 48: Italy Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 49: United Kingdom Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 50: United Kingdom Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 51: United Kingdom Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 52: United Kingdom Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 53: France Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 54: France Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 55: France Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 56: France Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 57: Russia Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 58: Russia Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 59: Russia Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 60: Russia Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 61: Poland Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 62: Poland Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 63: Poland Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 64: Poland Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 65: Rest of Europe Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 66: Rest of Europe Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 67: Rest of Europe Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 68: Rest of Europe Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 69: Healthcare Marketing Strategies Market, by Country (APAC), 2022–2035 (USD Billion)

TABLE 70: Healthcare Marketing Strategies Market, By Marketing Type (APAC), 2022–2035 (USD Billion)

TABLE 71: Healthcare Marketing Strategies Market, by Channel (APAC), 2022–2035 (USD Billion)

TABLE 72: Healthcare Marketing Strategies Market, by Solution(APAC), 2022–2035 (USD Billion)

TABLE 73: Healthcare Marketing Strategies Market, by End-User (APAC), 2022–2035 (USD Billion)

TABLE 74: India Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 75: India Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 76: India Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 77: India Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 78: China Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 79: China Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 80: China Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 81: China Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 82: Japan Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 83: Japan Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 84: Japan Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 85: Japan Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 86: South Korea Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 87: South Korea Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 88: South Korea Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 89: South Korea Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 90: Australia Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 91: Australia Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 92: Australia Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 93: Australia Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 94: Rest of APAC Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 95: Rest of APAC Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 96: Rest of APAC Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 97: Rest of APAC Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 98: Brazil Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 99: Brazil Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 100: Brazil Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 101: Brazil Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 102: Argentina Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 103: Argentina Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 104: Argentina Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 105: Argentina Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 106: Colombia Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 107: Colombia Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 108: Colombia Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 109: Colombia Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 110: Rest of LATAM Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 111: Rest of LATAM Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 112: Rest of LATAM Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 113: Rest of LATAM Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 114: Israel Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 115: Israel Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 116: Israel Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 117: Israel Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 118: Turkey Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 119: Turkey Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 120: Turkey Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 121: Turkey Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 122: Egypt Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 123: Egypt Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 124: Egypt Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 125: Egypt Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

TABLE 126: Rest of MEA Healthcare Marketing Strategies Market, By Marketing Type, 2022–2035 (USD Billion)

TABLE 127: Rest of MEA Healthcare Marketing Strategies Market, by Channel, 2022–2035 (USD Billion)

TABLE 128: Rest of MEA Healthcare Marketing Strategies Market, by Solution, 2022–2035 (USD Billion)

TABLE 129: Rest of MEA Healthcare Marketing Strategies Market, by End-User, 2022–2035 (USD Billion)

List of Figures

FIGURE 1: Healthcare Marketing Strategies Market Segmentation

FIGURE 2: Market Research Methodology

FIGURE 3: Value Chain Analysis

FIGURE 4: PESTLE Analysis

FIGURE 5: Porter’s Five Forces Analysis

FIGURE 6: Market Attractiveness Analysis

FIGURE 7: Market Dynamics

FIGURE 8: Innovation & Patent Landscape (2020–2024)

FIGURE 9: Competitive Landscape; Key Company Market Share Analysis, 2023

FIGURE 10: Marketing Type Segment Market Share Analysis, 2023 & 2035

FIGURE 11: Marketing Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 12: Channel Segment Market Share Analysis, 2023 & 2035

FIGURE 13: Channel Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 14: Marketing Type Segment Market Share Analysis, 2023 & 2035

FIGURE 15: Marketing Type Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 16: End-User Segment Market Share Analysis, 2023 & 2035

FIGURE 17: End-User Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 18: Regional Segment Market Share Analysis, 2023 & 2035

FIGURE 19: Regional Segment Market Size Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 20: North America Agricultural Biological Market Share and Leading Players, 2024

FIGURE 21: Europe Healthcare Marketing Strategies Market Share and Leading Players, 2024

FIGURE 22: Asia Pacific Healthcare Marketing Strategies Market Share and Leading Players, 2024

FIGURE 23: Latin America Healthcare Marketing Strategies Market Share and Leading Players, 2024

FIGURE 24: Middle East and Africa Healthcare Marketing Strategies Market Share and Leading Players, 2024

FIGURE 25: North America Market Share Analysis by Country, 2024

FIGURE 26: U.S. Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 27: Canada Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 28: Mexico Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 29: Europe Healthcare Marketing Strategies Market Share Analysis by Country, 2023

FIGURE 30: Germany Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 31: Spain Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 32: Italy Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 33: France Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 34: UK Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 35: Russia Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 36: Poland Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 37: Rest of Europe Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 38: Asia Pacific Healthcare Marketing Strategies Market Share Analysis by Country, 2023

FIGURE 39: India Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 40: China Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 41: Japan Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 42: South Korea Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 43: Australia Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 44: Rest of APAC Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 45: Latin America Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 46: Latin America Healthcare Marketing Strategies Market Share Analysis by Country, 2023

FIGURE 47: Brazil Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 48: Argentina Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 49: Colombia Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 50: Rest of LATAM Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 51: Middle East and Africa Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 52: Middle East and Africa Healthcare Marketing Strategies Market Share Analysis by Country, 2023

FIGURE 53: GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 54: Israel Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 55: Turkey Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 56: Egypt Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

FIGURE 57: Rest of MEA Healthcare Marketing Strategies Market Size, Forecast and Trend Analysis, 2024 to 2035 (USD Billion)

- "As someone responsible for shaping our hospital network’s marketing campaigns, I found this report invaluable. The in-depth segmentation of digital vs. traditional outreach strategies, combined with region-specific patient engagement trends, gave us a clear direction for allocating our budget. Within three months of implementing the recommended tactics, we saw a measurable increase in patient inquiries and brand recognition. This research wasn’t just theory, it gave us practical, data-backed strategies we could put into action immediately."

- Michael Thompson, Marketing Director, United States

- "The Healthcare Marketing Strategies Market Research Report exceeded my expectations in terms of both depth and accuracy. The competitive landscape analysis and the section on evolving compliance requirements in Europe were particularly insightful. We used the findings to reposition our brand messaging, ensuring both regulatory alignment and stronger patient trust. The data-driven approach allowed our leadership team to make confident marketing investment decisions backed by solid evidence."

- Anna Müller, Business Development Manager, Germany

- "In Japan’s rapidly evolving healthcare sector, marketing must balance cultural sensitivity with modern engagement tools. This report’s insights on localized patient communication, AI-driven outreach, and omnichannel strategy adoption were exceptionally relevant. We used its recommendations to refine a national awareness campaign for a healthcare client, leading to a significant boost in patient engagement and trust. The actionable intelligence in this report gave us a competitive edge that raw market data alone could never provide."

- Haruto Tanaka, Senior Strategy Consultant, Japan

This Healthcare Marketing Strategies Market 2025 report has been authored by a team of seasoned healthcare market analysts and industry strategists with over a decade of experience in tracking, analyzing, and forecasting trends that shape patient engagement and healthcare brand growth worldwide. Our research team combines deep expertise in healthcare economics, digital transformation, regulatory frameworks, and competitive positioning to deliver insights that are both data-driven and strategically actionable.

The report reflects extensive primary and secondary research, including in-depth interviews with marketing directors, healthcare administrators, technology providers, and compliance experts across North America, Europe, and Asia-Pacific. Every chapter is crafted to help decision-makers navigate the evolving marketing landscape, from leveraging AI-driven patient outreach and omnichannel engagement to understanding cultural nuances in brand positioning.

Healthcare executives, marketing leaders, and strategic consultants rely on our analysis to make informed investment decisions, improve campaign ROI, and future-proof their marketing strategies in a highly competitive, regulation-bound sector. The actionable frameworks and real-world case insights in this report are designed to translate directly into measurable results.

Our mission is to equip you with clarity, foresight, and confidence in your marketing strategy decisions. You can learn more about our research expertise and connect with our analysts on our company LinkedIn page.