Ascorbic acid (Vitamin C), an essential nutrient found mainly in fruits and vegetables. The body requires ascorbic acid in order to form and maintain bones, blood vessels, and skin. Ascorbic acid also promotes the healing of cuts, abrasions and wounds; helps fight infections; inhibits conversion of irritants in smog, tobacco smoke, and certain foods into cancer-causing substances; appears to lessen the risk of developing high blood pressure and heart disease; helps regulate cholesterol levels; prevents the development of scurvy; appears to lower the risk of developing cataracts; and aids in iron absorption. Ascorbic acid can cause adverse reactions when taken with some drugs.

China is the largest Production countries of vitamin C, with a production market share more than 80.82%. The vitamin C is classified into the food grade, pharmaceutical grade, feed grade. As of 2019, food grade vitamin C segment dominates the market contributing about 64.0% of the total market share.

Vitamin C is major applied in Food & Beverage, Pharmaceuticals & Healthcare, Feed, Cosmetics industry, in 2019, demand for Food & Beverage industry occupied the largest market, with 57.7% share, while Pharmaceuticals & Healthcare and Feed share 32.5% and 7.8% respectively. The vitamin C market is very concentrated market; key players include DSM, CSPC Pharma, Northeast Pharma, Shandong Luwei, Shandong Tianli, Anhui Tiger, Ningxia Qiyuan, Zhengzhou Tuoyang, Henan Huaxing; the revenue of top five manufacturers accounts about 82.3% of the total revenue.

This report is a detailed and comprehensive analysis for global Vitamin C market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Vitamin C market size and forecasts, in consumption value ($ Million), sales quantity (Kg), and average selling prices (USD/Kg), 2018-2029

Global Vitamin C market size and forecasts by region and country, in consumption value ($ Million), sales quantity (Kg), and average selling prices (USD/Kg), 2018-2029

Global Vitamin C market size and forecasts, by Type and by Application, in consumption value ($ Million), sales quantity (Kg), and average selling prices (USD/Kg), 2018-2029

Global Vitamin C market shares of main players, shipments in revenue ($ Million), sales quantity (Kg), and ASP (USD/Kg), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Vitamin C

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Vitamin C market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

DSM

CSPC Pharma

Northeast Pharma

Shandong Luwei

Shandong Tianli

Anhui Tiger

Ningxia Qiyuan

Zhengzhou Tuoyang

Henan Huaxing

Segmentation By Type

Food Grade Vitamin C

Pharmaceutical Grade Vitamin C

Feed Grade Vitamin C

Segmentation By Application

Food & Beverage

Pharmaceuticals & Healthcare

Feed

Cosmetics

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Vitamin C market in 2025?

The Vitamin C market in 2025 benefits from increasing consumer awareness about its health benefits, especially in boosting immunity. There's also growing demand for dietary supplements, which is driving market growth. With innovations in delivery formats like gummies and effervescent tablets, the market can appeal to a broader audience.

What are the weaknesses of the Vitamin C market in 2025?

Despite its popularity, the Vitamin C market faces challenges related to raw material sourcing, as it relies heavily on citrus fruits, which can be affected by climate change. Moreover, over-saturation of supplements can lead to consumer skepticism, limiting growth potential in some regions.

What opportunities exist for the Vitamin C market in 2025?

The growing trend of self-care and preventive healthcare offers a significant opportunity for Vitamin C supplements. Additionally, the increasing integration of Vitamin C into cosmetic products for its antioxidant properties creates a diverse market expansion. There's also potential for increased demand from emerging markets due to rising disposable incomes.

What are the threats to the Vitamin C market in 2025?

Rising competition from synthetic alternatives, especially with the increasing focus on natural ingredients, can challenge the market. Additionally, stringent regulations around supplements and fluctuating agricultural conditions could disrupt the supply chain, affecting prices and availability.

Market PESTEL Analysis

What are the political factors affecting the Vitamin C market in 2025?

Government regulations on the supplement industry, particularly regarding quality control and labeling, play a key role in the Vitamin C market. Additionally, policies around agriculture, such as subsidies for citrus farmers, can influence the availability and cost of raw materials used in Vitamin C production.

What are the economic factors affecting the Vitamin C market in 2025?

The increasing disposable income in emerging markets is contributing to the growth of the Vitamin C market. On the other hand, economic downturns or recessions could limit consumer spending on non-essential supplements, affecting market demand. Fluctuations in raw material prices due to supply chain disruptions can also impact the overall cost structure.

What are the social factors affecting the Vitamin C market in 2025?

Growing consumer awareness about health and wellness, especially regarding immunity-boosting supplements, significantly boosts the Vitamin C market. Additionally, changing lifestyles and increased health-consciousness post-pandemic have accelerated the demand for Vitamin C, both in supplement form and in fortified food products.

What are the technological factors affecting the Vitamin C market in 2025?

Advances in technology are allowing for better extraction and formulation processes, improving the efficiency and quality of Vitamin C production. New product formats, like powders, gummies, and enhanced absorption methods, are also expanding the market, allowing for broader consumer appeal.

What are the environmental factors affecting the Vitamin C market in 2025?

Environmental concerns, particularly climate change, could affect the availability of citrus crops, a primary source of Vitamin C. Additionally, consumers are increasingly focused on sustainability, pushing companies to adopt eco-friendly packaging and sustainable sourcing practices, which could influence market dynamics.

What are the legal factors affecting the Vitamin C market in 2025?

The Vitamin C market must comply with various legal frameworks, such as health claims regulations and safety standards for supplements. As countries strengthen laws on product efficacy and consumer protection, companies must ensure they meet all legal requirements to avoid penalties or product recalls, impacting market operations.

Market SIPOC Analysis

Who are the suppliers in the Vitamin C market in 2025?

Suppliers in the Vitamin C market include agricultural producers of citrus fruits, manufacturers of synthetic Vitamin C, packaging companies, and suppliers of raw materials like ascorbic acid. Suppliers also include technology providers that support the development of innovative delivery systems for Vitamin C products.

What are the inputs in the Vitamin C market in 2025?

The inputs include raw materials like citrus fruits and synthetic Vitamin C, manufacturing equipment, packaging materials, research and development resources, and labor for production. Regulatory and marketing resources are also necessary to ensure the products meet consumer expectations and legal requirements.

Who are the process owners in the Vitamin C market in 2025?

Process owners in the Vitamin C market are the companies involved in production, quality control, packaging, and distribution of Vitamin C supplements and fortified products. This includes supplement manufacturers, food and beverage companies, and cosmetic product manufacturers that integrate Vitamin C into their formulations.

What are the outputs in the Vitamin C market in 2025?

Outputs of the Vitamin C market include Vitamin C supplements, fortified foods and beverages, cosmetic products, and pharmaceutical-grade Vitamin C products. These products are made available in various forms, such as tablets, powders, gummies, and creams, catering to a wide range of consumer preferences.

Who are the customers in the Vitamin C market in 2025?

Customers in the Vitamin C market include health-conscious consumers seeking immunity-boosting supplements, individuals looking for beauty products with antioxidant properties, and the healthcare sector that uses Vitamin C for medical treatments. Retailers, e-commerce platforms, and health stores also serve as intermediaries in reaching end customers.

Market Porter's Five Forces

What is the threat of new entrants in the Vitamin C market in 2025?

The threat of new entrants is moderate in the Vitamin C market. While there is a growing demand for Vitamin C supplements, the barriers to entry, such as the need for quality production standards, regulatory compliance, and distribution networks, can be significant. However, with the rise of online retail platforms, smaller companies can still enter the market with innovative products.

What is the bargaining power of suppliers in the Vitamin C market in 2025?

The bargaining power of suppliers is relatively high. Raw materials, such as citrus fruits and synthetic Vitamin C, are essential for production, and supply chain disruptions can affect the availability and price of these inputs. Additionally, environmental factors like climate change can further increase supplier power by impacting crop yields and availability.

What is the bargaining power of buyers in the Vitamin C market in 2025?

The bargaining power of buyers is moderate to high. Consumers have a wide range of options when it comes to Vitamin C supplements, and with increasing health-consciousness, they can easily switch between brands or products. However, brand loyalty, product efficacy, and perceived quality can mitigate the influence of buyer power to some extent.

What is the threat of substitute products in the Vitamin C market in 2025?

The threat of substitute products is moderate. Alternatives to Vitamin C supplements include other immune-boosting supplements like vitamin D, zinc, and herbal remedies. Additionally, fortified foods and beverages that provide Vitamin C could serve as substitutes. However, the specific benefits and targeted health outcomes of Vitamin C help maintain its strong position.

What is the intensity of competitive rivalry in the Vitamin C market in 2025?

The intensity of competitive rivalry is high. The market is fragmented with numerous established brands, especially in the supplement sector. Competition is driven by factors like price, product quality, and innovation in delivery formats. As consumer preferences evolve, companies are continually innovating to stay ahead, making the market highly competitive.

Market Upstream Analysis

What are the key upstream factors in the Vitamin C market in 2025?

Key upstream factors include the availability and cost of raw materials like citrus fruits and synthetic ascorbic acid. The supply chain for these materials is influenced by agricultural conditions, climate change, and technological advancements in production processes. Regulatory changes around sourcing and quality control also play a role.

How does the supply of raw materials impact the Vitamin C market in 2025?

The supply of raw materials is critical to the Vitamin C market as disruptions in agricultural production (due to weather events or disease) can affect the cost and availability of citrus fruits, a primary source. Additionally, reliance on synthetic production processes requires access to specific chemicals and technologies, which can be impacted by changes in regulations or supplier availability.

What role do suppliers and manufacturers play in the Vitamin C market's upstream activities in 2025?

Suppliers and manufacturers are integral to the Vitamin C market's upstream activities, as they provide the raw materials, production technologies, and expertise needed to produce high-quality Vitamin C. Suppliers of agricultural produce, like citrus growers, as well as manufacturers of synthetic Vitamin C, must ensure consistent supply to meet market demand. Technological advancements by manufacturers can also affect the efficiency of production, impacting costs and delivery timelines.

What external factors influence upstream activities in the Vitamin C market in 2025?

External factors such as climate change, international trade regulations, and geopolitical tensions can significantly affect upstream activities. For example, adverse weather conditions can reduce citrus yields, while trade tariffs or changing agricultural policies may impact the cost and availability of raw materials. Additionally, research and development in production technologies could either lower costs or lead to new product innovations, affecting upstream dynamics.

How do upstream activities impact the pricing of Vitamin C products in 2025?

Upstream activities have a direct impact on the pricing of Vitamin C products. Fluctuations in the cost of raw materials, such as citrus fruits, or disruptions in the supply chain can lead to increased production costs. These higher costs are typically passed on to consumers through increased retail prices. Conversely, improvements in production efficiency or better sourcing strategies could help stabilize or reduce prices.

Market Midstream Analysis

What are the key midstream activities in the Vitamin C market in 2025?

Key midstream activities in the Vitamin C market involve the processing and manufacturing of Vitamin C from raw materials (like citrus fruits and synthetic ascorbic acid) into finished products, such as supplements, fortified foods, and cosmetics. Packaging, quality control, and branding also play an important role in the midstream segment, helping to ensure product consistency and market appeal.

How do manufacturers influence the Vitamin C market's midstream activities in 2025?

Manufacturers are central to midstream activities as they take raw materials and convert them into consumer-ready products. The efficiency of manufacturing processes, product formulations, and packaging innovations can influence both cost structures and consumer preferences. Additionally, manufacturers are responsible for meeting quality standards and regulatory requirements, which directly impacts market trust.

What role does distribution play in the midstream activities of the Vitamin C market in 2025?

Distribution plays a critical role in ensuring Vitamin C products reach consumers efficiently. This includes wholesalers, retailers, and e-commerce platforms, all of which need to maintain effective supply chain management. Distribution channels help determine the product’s price, availability, and reach in various regions, which directly impacts market penetration and competition.

How do marketing and branding impact the midstream activities of the Vitamin C market in 2025?

Marketing and branding are key to differentiating products in the crowded Vitamin C market. Companies use advertising, health claims, and packaging design to attract consumers and build brand loyalty. The strength of a brand can influence consumer trust and purchasing decisions, making it a critical factor in the midstream operations of the Vitamin C market.

What challenges do midstream activities face in the Vitamin C market in 2025?

Midstream activities face challenges such as maintaining product quality amid fluctuating raw material prices, ensuring compliance with increasingly stringent regulations, and adapting to changing consumer preferences. Additionally, competition in packaging and delivery innovation creates pressure on companies to continuously improve efficiency and appeal.

Market Downstream Analysis

What are the key downstream activities in the Vitamin C market in 2025?

Key downstream activities in the Vitamin C market involve retail sales, consumer education, and after-sales services. This includes product distribution to health stores, pharmacies, supermarkets, and online platforms. Additionally, downstream activities include post-purchase support such as customer service and product reviews, which influence future consumer choices.

How do retailers influence the Vitamin C market's downstream activities in 2025?

Retailers are crucial in the downstream segment, as they are the primary point of contact between the product and the consumer. They impact pricing, product availability, and visibility. Retail strategies such as promotions, product placement, and offering diverse delivery options can significantly shape consumer purchasing behavior and overall market demand.

What role does consumer feedback play in downstream activities in the Vitamin C market in 2025?

Consumer feedback plays a significant role in shaping the downstream activities of the Vitamin C market. Positive reviews and word-of-mouth marketing can drive sales and enhance brand loyalty. Negative feedback, on the other hand, can prompt improvements in product formulations, packaging, or customer service. Companies monitor feedback closely to adapt their offerings and meet consumer expectations.

How does the demand from end consumers affect downstream activities in the Vitamin C market in 2025?

The demand from end consumers directly influences production cycles, marketing efforts, and retail strategies. Growing consumer interest in health and wellness, particularly in immune-boosting supplements, increases demand for Vitamin C products. Retailers and manufacturers must quickly adapt to trends, ensuring that products are available in the right formats, at the right price points, and in locations where consumers are most likely to purchase.

What challenges do downstream activities face in the Vitamin C market in 2025?

Downstream activities face challenges such as price competition, evolving consumer preferences, and regulatory pressures around marketing claims. Additionally, the rise of e-commerce and direct-to-consumer models requires brands to manage complex digital marketing strategies, customer engagement, and logistics. Ensuring consistent product quality and maintaining trust across diverse consumer segments are ongoing challenges.

Chapter 1, to describe Vitamin C product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Vitamin C, with price, sales, revenue and global market share of Vitamin C from 2018 to 2023.

Chapter 3, the Vitamin C competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Vitamin C breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Vitamin C market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of Vitamin C.

Chapter 14 and 15, to describe Vitamin C sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Vitamin C

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Vitamin C Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 Food Grade Vitamin C

1.3.3 Pharmaceutical Grade Vitamin C

1.3.4 Feed Grade Vitamin C

1.4 Market Analysis by Application

1.4.1 Overview: Global Vitamin C Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Food & Beverage

1.4.3 Pharmaceuticals & Healthcare

1.4.4 Feed

1.4.5 Cosmetics

1.5 Global Vitamin C Market Size & Forecast

1.5.1 Global Vitamin C Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Vitamin C Sales Quantity (2018-2029)

1.5.3 Global Vitamin C Average Price (2018-2029)

2 Manufacturers Profiles

2.1 DSM

2.1.1 DSM Details

2.1.2 DSM Major Business

2.1.3 DSM Vitamin C Product and Services

2.1.4 DSM Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 DSM Recent Developments/Updates

2.2 CSPC Pharma

2.2.1 CSPC Pharma Details

2.2.2 CSPC Pharma Major Business

2.2.3 CSPC Pharma Vitamin C Product and Services

2.2.4 CSPC Pharma Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 CSPC Pharma Recent Developments/Updates

2.3 Northeast Pharma

2.3.1 Northeast Pharma Details

2.3.2 Northeast Pharma Major Business

2.3.3 Northeast Pharma Vitamin C Product and Services

2.3.4 Northeast Pharma Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Northeast Pharma Recent Developments/Updates

2.4 Shandong Luwei

2.4.1 Shandong Luwei Details

2.4.2 Shandong Luwei Major Business

2.4.3 Shandong Luwei Vitamin C Product and Services

2.4.4 Shandong Luwei Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Shandong Luwei Recent Developments/Updates

2.5 Shandong Tianli

2.5.1 Shandong Tianli Details

2.5.2 Shandong Tianli Major Business

2.5.3 Shandong Tianli Vitamin C Product and Services

2.5.4 Shandong Tianli Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Shandong Tianli Recent Developments/Updates

2.6 Anhui Tiger

2.6.1 Anhui Tiger Details

2.6.2 Anhui Tiger Major Business

2.6.3 Anhui Tiger Vitamin C Product and Services

2.6.4 Anhui Tiger Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Anhui Tiger Recent Developments/Updates

2.7 Ningxia Qiyuan

2.7.1 Ningxia Qiyuan Details

2.7.2 Ningxia Qiyuan Major Business

2.7.3 Ningxia Qiyuan Vitamin C Product and Services

2.7.4 Ningxia Qiyuan Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Ningxia Qiyuan Recent Developments/Updates

2.8 Zhengzhou Tuoyang

2.8.1 Zhengzhou Tuoyang Details

2.8.2 Zhengzhou Tuoyang Major Business

2.8.3 Zhengzhou Tuoyang Vitamin C Product and Services

2.8.4 Zhengzhou Tuoyang Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Zhengzhou Tuoyang Recent Developments/Updates

2.9 Henan Huaxing

2.9.1 Henan Huaxing Details

2.9.2 Henan Huaxing Major Business

2.9.3 Henan Huaxing Vitamin C Product and Services

2.9.4 Henan Huaxing Vitamin C Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Henan Huaxing Recent Developments/Updates

3 Competitive Environment: Vitamin C by Manufacturer

3.1 Global Vitamin C Sales Quantity by Manufacturer (2018-2023)

3.2 Global Vitamin C Revenue by Manufacturer (2018-2023)

3.3 Global Vitamin C Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Vitamin C by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Vitamin C Manufacturer Market Share in 2022

3.4.2 Top 6 Vitamin C Manufacturer Market Share in 2022

3.5 Vitamin C Market: Overall Company Footprint Analysis

3.5.1 Vitamin C Market: Region Footprint

3.5.2 Vitamin C Market: Company Product Type Footprint

3.5.3 Vitamin C Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Vitamin C Market Size by Region

4.1.1 Global Vitamin C Sales Quantity by Region (2018-2029)

4.1.2 Global Vitamin C Consumption Value by Region (2018-2029)

4.1.3 Global Vitamin C Average Price by Region (2018-2029)

4.2 North America Vitamin C Consumption Value (2018-2029)

4.3 Europe Vitamin C Consumption Value (2018-2029)

4.4 Asia-Pacific Vitamin C Consumption Value (2018-2029)

4.5 South America Vitamin C Consumption Value (2018-2029)

4.6 Middle East and Africa Vitamin C Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Vitamin C Sales Quantity by Type (2018-2029)

5.2 Global Vitamin C Consumption Value by Type (2018-2029)

5.3 Global Vitamin C Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Vitamin C Sales Quantity by Application (2018-2029)

6.2 Global Vitamin C Consumption Value by Application (2018-2029)

6.3 Global Vitamin C Average Price by Application (2018-2029)

7 North America

7.1 North America Vitamin C Sales Quantity by Type (2018-2029)

7.2 North America Vitamin C Sales Quantity by Application (2018-2029)

7.3 North America Vitamin C Market Size by Country

7.3.1 North America Vitamin C Sales Quantity by Country (2018-2029)

7.3.2 North America Vitamin C Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Vitamin C Sales Quantity by Type (2018-2029)

8.2 Europe Vitamin C Sales Quantity by Application (2018-2029)

8.3 Europe Vitamin C Market Size by Country

8.3.1 Europe Vitamin C Sales Quantity by Country (2018-2029)

8.3.2 Europe Vitamin C Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Vitamin C Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Vitamin C Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Vitamin C Market Size by Region

9.3.1 Asia-Pacific Vitamin C Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Vitamin C Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Vitamin C Sales Quantity by Type (2018-2029)

10.2 South America Vitamin C Sales Quantity by Application (2018-2029)

10.3 South America Vitamin C Market Size by Country

10.3.1 South America Vitamin C Sales Quantity by Country (2018-2029)

10.3.2 South America Vitamin C Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Vitamin C Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Vitamin C Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Vitamin C Market Size by Country

11.3.1 Middle East & Africa Vitamin C Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Vitamin C Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Vitamin C Market Drivers

12.2 Vitamin C Market Restraints

12.3 Vitamin C Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of Vitamin C and Key Manufacturers

13.2 Manufacturing Costs Percentage of Vitamin C

13.3 Vitamin C Production Process

13.4 Vitamin C Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Vitamin C Typical Distributors

14.3 Vitamin C Typical Customers

15 Research Findings and Conclusion

16 Appendix

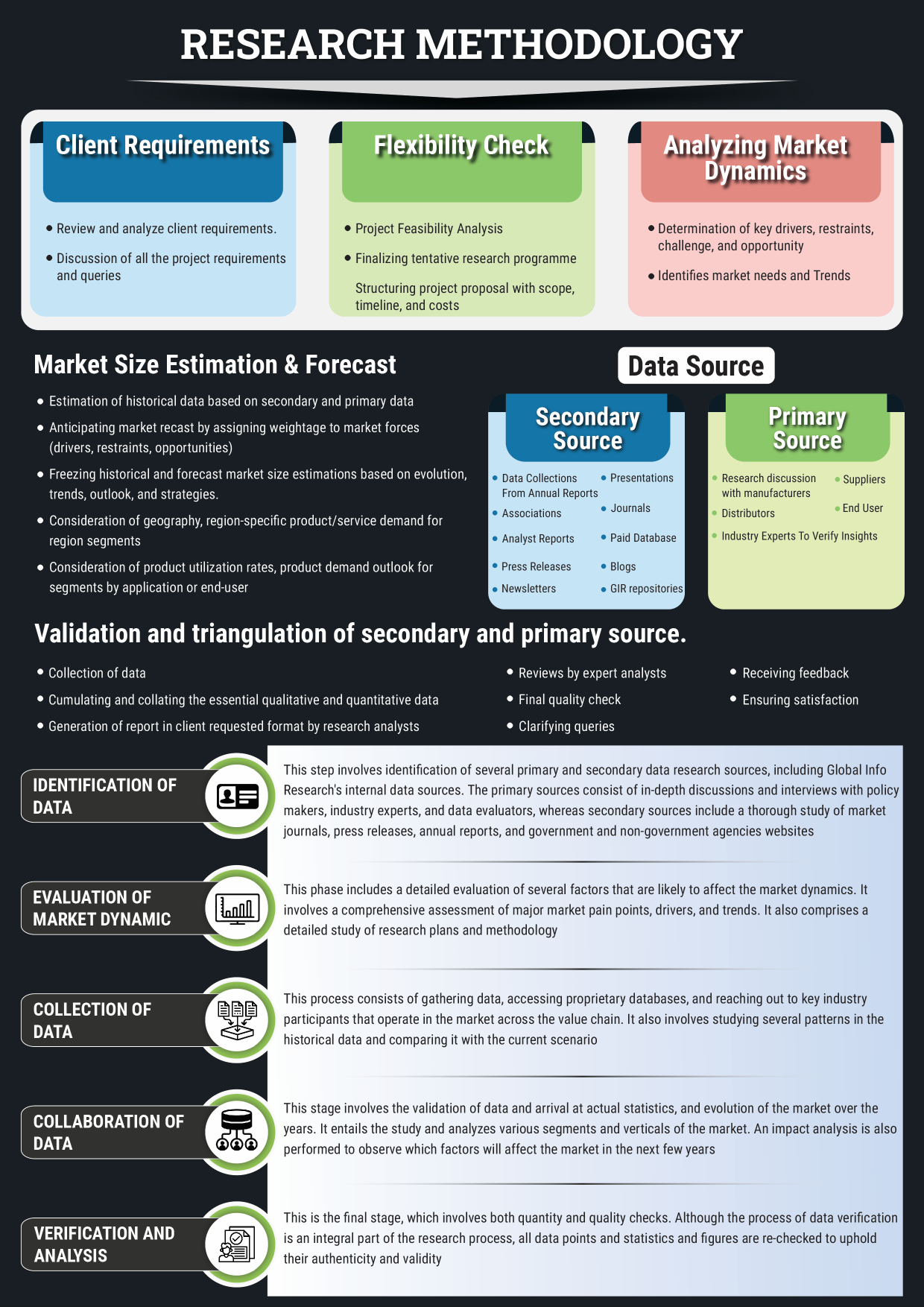

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Vitamin C Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Vitamin C Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. DSM Basic Information, Manufacturing Base and Competitors

Table 4. DSM Major Business

Table 5. DSM Vitamin C Product and Services

Table 6. DSM Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. DSM Recent Developments/Updates

Table 8. CSPC Pharma Basic Information, Manufacturing Base and Competitors

Table 9. CSPC Pharma Major Business

Table 10. CSPC Pharma Vitamin C Product and Services

Table 11. CSPC Pharma Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. CSPC Pharma Recent Developments/Updates

Table 13. Northeast Pharma Basic Information, Manufacturing Base and Competitors

Table 14. Northeast Pharma Major Business

Table 15. Northeast Pharma Vitamin C Product and Services

Table 16. Northeast Pharma Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Northeast Pharma Recent Developments/Updates

Table 18. Shandong Luwei Basic Information, Manufacturing Base and Competitors

Table 19. Shandong Luwei Major Business

Table 20. Shandong Luwei Vitamin C Product and Services

Table 21. Shandong Luwei Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Shandong Luwei Recent Developments/Updates

Table 23. Shandong Tianli Basic Information, Manufacturing Base and Competitors

Table 24. Shandong Tianli Major Business

Table 25. Shandong Tianli Vitamin C Product and Services

Table 26. Shandong Tianli Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Shandong Tianli Recent Developments/Updates

Table 28. Anhui Tiger Basic Information, Manufacturing Base and Competitors

Table 29. Anhui Tiger Major Business

Table 30. Anhui Tiger Vitamin C Product and Services

Table 31. Anhui Tiger Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. Anhui Tiger Recent Developments/Updates

Table 33. Ningxia Qiyuan Basic Information, Manufacturing Base and Competitors

Table 34. Ningxia Qiyuan Major Business

Table 35. Ningxia Qiyuan Vitamin C Product and Services

Table 36. Ningxia Qiyuan Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Ningxia Qiyuan Recent Developments/Updates

Table 38. Zhengzhou Tuoyang Basic Information, Manufacturing Base and Competitors

Table 39. Zhengzhou Tuoyang Major Business

Table 40. Zhengzhou Tuoyang Vitamin C Product and Services

Table 41. Zhengzhou Tuoyang Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Zhengzhou Tuoyang Recent Developments/Updates

Table 43. Henan Huaxing Basic Information, Manufacturing Base and Competitors

Table 44. Henan Huaxing Major Business

Table 45. Henan Huaxing Vitamin C Product and Services

Table 46. Henan Huaxing Vitamin C Sales Quantity (Kg), Average Price (USD/Kg), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 47. Henan Huaxing Recent Developments/Updates

Table 48. Global Vitamin C Sales Quantity by Manufacturer (2018-2023) & (Kg)

Table 49. Global Vitamin C Revenue by Manufacturer (2018-2023) & (USD Million)

Table 50. Global Vitamin C Average Price by Manufacturer (2018-2023) & (USD/Kg)

Table 51. Market Position of Manufacturers in Vitamin C, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 52. Head Office and Vitamin C Production Site of Key Manufacturer

Table 53. Vitamin C Market: Company Product Type Footprint

Table 54. Vitamin C Market: Company Product Application Footprint

Table 55. Vitamin C New Market Entrants and Barriers to Market Entry

Table 56. Vitamin C Mergers, Acquisition, Agreements, and Collaborations

Table 57. Global Vitamin C Sales Quantity by Region (2018-2023) & (Kg)

Table 58. Global Vitamin C Sales Quantity by Region (2024-2029) & (Kg)

Table 59. Global Vitamin C Consumption Value by Region (2018-2023) & (USD Million)

Table 60. Global Vitamin C Consumption Value by Region (2024-2029) & (USD Million)

Table 61. Global Vitamin C Average Price by Region (2018-2023) & (USD/Kg)

Table 62. Global Vitamin C Average Price by Region (2024-2029) & (USD/Kg)

Table 63. Global Vitamin C Sales Quantity by Type (2018-2023) & (Kg)

Table 64. Global Vitamin C Sales Quantity by Type (2024-2029) & (Kg)

Table 65. Global Vitamin C Consumption Value by Type (2018-2023) & (USD Million)

Table 66. Global Vitamin C Consumption Value by Type (2024-2029) & (USD Million)

Table 67. Global Vitamin C Average Price by Type (2018-2023) & (USD/Kg)

Table 68. Global Vitamin C Average Price by Type (2024-2029) & (USD/Kg)

Table 69. Global Vitamin C Sales Quantity by Application (2018-2023) & (Kg)

Table 70. Global Vitamin C Sales Quantity by Application (2024-2029) & (Kg)

Table 71. Global Vitamin C Consumption Value by Application (2018-2023) & (USD Million)

Table 72. Global Vitamin C Consumption Value by Application (2024-2029) & (USD Million)

Table 73. Global Vitamin C Average Price by Application (2018-2023) & (USD/Kg)

Table 74. Global Vitamin C Average Price by Application (2024-2029) & (USD/Kg)

Table 75. North America Vitamin C Sales Quantity by Type (2018-2023) & (Kg)

Table 76. North America Vitamin C Sales Quantity by Type (2024-2029) & (Kg)

Table 77. North America Vitamin C Sales Quantity by Application (2018-2023) & (Kg)

Table 78. North America Vitamin C Sales Quantity by Application (2024-2029) & (Kg)

Table 79. North America Vitamin C Sales Quantity by Country (2018-2023) & (Kg)

Table 80. North America Vitamin C Sales Quantity by Country (2024-2029) & (Kg)

Table 81. North America Vitamin C Consumption Value by Country (2018-2023) & (USD Million)

Table 82. North America Vitamin C Consumption Value by Country (2024-2029) & (USD Million)

Table 83. Europe Vitamin C Sales Quantity by Type (2018-2023) & (Kg)

Table 84. Europe Vitamin C Sales Quantity by Type (2024-2029) & (Kg)

Table 85. Europe Vitamin C Sales Quantity by Application (2018-2023) & (Kg)

Table 86. Europe Vitamin C Sales Quantity by Application (2024-2029) & (Kg)

Table 87. Europe Vitamin C Sales Quantity by Country (2018-2023) & (Kg)

Table 88. Europe Vitamin C Sales Quantity by Country (2024-2029) & (Kg)

Table 89. Europe Vitamin C Consumption Value by Country (2018-2023) & (USD Million)

Table 90. Europe Vitamin C Consumption Value by Country (2024-2029) & (USD Million)

Table 91. Asia-Pacific Vitamin C Sales Quantity by Type (2018-2023) & (Kg)

Table 92. Asia-Pacific Vitamin C Sales Quantity by Type (2024-2029) & (Kg)

Table 93. Asia-Pacific Vitamin C Sales Quantity by Application (2018-2023) & (Kg)

Table 94. Asia-Pacific Vitamin C Sales Quantity by Application (2024-2029) & (Kg)

Table 95. Asia-Pacific Vitamin C Sales Quantity by Region (2018-2023) & (Kg)

Table 96. Asia-Pacific Vitamin C Sales Quantity by Region (2024-2029) & (Kg)

Table 97. Asia-Pacific Vitamin C Consumption Value by Region (2018-2023) & (USD Million)

Table 98. Asia-Pacific Vitamin C Consumption Value by Region (2024-2029) & (USD Million)

Table 99. South America Vitamin C Sales Quantity by Type (2018-2023) & (Kg)

Table 100. South America Vitamin C Sales Quantity by Type (2024-2029) & (Kg)

Table 101. South America Vitamin C Sales Quantity by Application (2018-2023) & (Kg)

Table 102. South America Vitamin C Sales Quantity by Application (2024-2029) & (Kg)

Table 103. South America Vitamin C Sales Quantity by Country (2018-2023) & (Kg)

Table 104. South America Vitamin C Sales Quantity by Country (2024-2029) & (Kg)

Table 105. South America Vitamin C Consumption Value by Country (2018-2023) & (USD Million)

Table 106. South America Vitamin C Consumption Value by Country (2024-2029) & (USD Million)

Table 107. Middle East & Africa Vitamin C Sales Quantity by Type (2018-2023) & (Kg)

Table 108. Middle East & Africa Vitamin C Sales Quantity by Type (2024-2029) & (Kg)

Table 109. Middle East & Africa Vitamin C Sales Quantity by Application (2018-2023) & (Kg)

Table 110. Middle East & Africa Vitamin C Sales Quantity by Application (2024-2029) & (Kg)

Table 111. Middle East & Africa Vitamin C Sales Quantity by Region (2018-2023) & (Kg)

Table 112. Middle East & Africa Vitamin C Sales Quantity by Region (2024-2029) & (Kg)

Table 113. Middle East & Africa Vitamin C Consumption Value by Region (2018-2023) & (USD Million)

Table 114. Middle East & Africa Vitamin C Consumption Value by Region (2024-2029) & (USD Million)

Table 115. Vitamin C Raw Material

Table 116. Key Manufacturers of Vitamin C Raw Materials

Table 117. Vitamin C Typical Distributors

Table 118. Vitamin C Typical Customers

List of Figures

Figure 1. Vitamin C Picture

Figure 2. Global Vitamin C Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Vitamin C Consumption Value Market Share by Type in 2022

Figure 4. Food Grade Vitamin C Examples

Figure 5. Pharmaceutical Grade Vitamin C Examples

Figure 6. Feed Grade Vitamin C Examples

Figure 7. Global Vitamin C Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 8. Global Vitamin C Consumption Value Market Share by Application in 2022

Figure 9. Food & Beverage Examples

Figure 10. Pharmaceuticals & Healthcare Examples

Figure 11. Feed Examples

Figure 12. Cosmetics Examples

Figure 13. Global Vitamin C Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 14. Global Vitamin C Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 15. Global Vitamin C Sales Quantity (2018-2029) & (Kg)

Figure 16. Global Vitamin C Average Price (2018-2029) & (USD/Kg)

Figure 17. Global Vitamin C Sales Quantity Market Share by Manufacturer in 2022

Figure 18. Global Vitamin C Consumption Value Market Share by Manufacturer in 2022

Figure 19. Producer Shipments of Vitamin C by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 20. Top 3 Vitamin C Manufacturer (Consumption Value) Market Share in 2022

Figure 21. Top 6 Vitamin C Manufacturer (Consumption Value) Market Share in 2022

Figure 22. Global Vitamin C Sales Quantity Market Share by Region (2018-2029)

Figure 23. Global Vitamin C Consumption Value Market Share by Region (2018-2029)

Figure 24. North America Vitamin C Consumption Value (2018-2029) & (USD Million)

Figure 25. Europe Vitamin C Consumption Value (2018-2029) & (USD Million)

Figure 26. Asia-Pacific Vitamin C Consumption Value (2018-2029) & (USD Million)

Figure 27. South America Vitamin C Consumption Value (2018-2029) & (USD Million)

Figure 28. Middle East & Africa Vitamin C Consumption Value (2018-2029) & (USD Million)

Figure 29. Global Vitamin C Sales Quantity Market Share by Type (2018-2029)

Figure 30. Global Vitamin C Consumption Value Market Share by Type (2018-2029)

Figure 31. Global Vitamin C Average Price by Type (2018-2029) & (USD/Kg)

Figure 32. Global Vitamin C Sales Quantity Market Share by Application (2018-2029)

Figure 33. Global Vitamin C Consumption Value Market Share by Application (2018-2029)

Figure 34. Global Vitamin C Average Price by Application (2018-2029) & (USD/Kg)

Figure 35. North America Vitamin C Sales Quantity Market Share by Type (2018-2029)

Figure 36. North America Vitamin C Sales Quantity Market Share by Application (2018-2029)

Figure 37. North America Vitamin C Sales Quantity Market Share by Country (2018-2029)

Figure 38. North America Vitamin C Consumption Value Market Share by Country (2018-2029)

Figure 39. United States Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Canada Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 41. Mexico Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 42. Europe Vitamin C Sales Quantity Market Share by Type (2018-2029)

Figure 43. Europe Vitamin C Sales Quantity Market Share by Application (2018-2029)

Figure 44. Europe Vitamin C Sales Quantity Market Share by Country (2018-2029)

Figure 45. Europe Vitamin C Consumption Value Market Share by Country (2018-2029)

Figure 46. Germany Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. France Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. United Kingdom Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Russia Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 50. Italy Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 51. Asia-Pacific Vitamin C Sales Quantity Market Share by Type (2018-2029)

Figure 52. Asia-Pacific Vitamin C Sales Quantity Market Share by Application (2018-2029)

Figure 53. Asia-Pacific Vitamin C Sales Quantity Market Share by Region (2018-2029)

Figure 54. Asia-Pacific Vitamin C Consumption Value Market Share by Region (2018-2029)

Figure 55. China Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. Japan Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Korea Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. India Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. Southeast Asia Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 60. Australia Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 61. South America Vitamin C Sales Quantity Market Share by Type (2018-2029)

Figure 62. South America Vitamin C Sales Quantity Market Share by Application (2018-2029)

Figure 63. South America Vitamin C Sales Quantity Market Share by Country (2018-2029)

Figure 64. South America Vitamin C Consumption Value Market Share by Country (2018-2029)

Figure 65. Brazil Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 66. Argentina Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 67. Middle East & Africa Vitamin C Sales Quantity Market Share by Type (2018-2029)

Figure 68. Middle East & Africa Vitamin C Sales Quantity Market Share by Application (2018-2029)

Figure 69. Middle East & Africa Vitamin C Sales Quantity Market Share by Region (2018-2029)

Figure 70. Middle East & Africa Vitamin C Consumption Value Market Share by Region (2018-2029)

Figure 71. Turkey Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. Egypt Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. Saudi Arabia Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 74. South Africa Vitamin C Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 75. Vitamin C Market Drivers

Figure 76. Vitamin C Market Restraints

Figure 77. Vitamin C Market Trends

Figure 78. Porters Five Forces Analysis

Figure 79. Manufacturing Cost Structure Analysis of Vitamin C in 2022

Figure 80. Manufacturing Process Analysis of Vitamin C

Figure 81. Vitamin C Industrial Chain

Figure 82. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 83. Direct Channel Pros & Cons

Figure 84. Indirect Channel Pros & Cons

Figure 85. Methodology

Figure 86. Research Process and Data Source