Generic injectables refer to sterile solutions (including emulsions and suspensions) made of drugs for injection into the body, and sterile powders or concentrated solutions that are prepared into solutions or suspensions before use.

The injection is fast and reliable, not affected by pH, enzymes, food, etc., has no first-pass effect, and can play a systemic or local positioning effect. It is suitable for patients who are not suitable for oral medicine and patients who cannot be taken orally. However, the development and production process of injections is complicated and safe. The body has poor adaptability and high cost.

In the segment of generic sterile injectables, the Hospira (Pfizer Inc.) is the largest player, and Fresenius Kabi is the second. Top two players hold a share about 27% in 2019. The US market is dominated by two players like Hospira (Pfizer Inc.), Fresenius Kabi, Sandoz (Novartis), Hikma Pharmaceuticals PLC, Dr. Reddy’s Laboratories Ltd, Grifols, Nichi-Iko Group (Sagent), Teva Pharmaceutical, Auromedics, Sanofi, Gland Pharma and Endo International PLC.

This report is a detailed and comprehensive analysis for global Generic Injectables market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Generic Injectables market size and forecasts, in consumption value ($ Million), 2018-2029

Global Generic Injectables market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global Generic Injectables market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global Generic Injectables market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Generic Injectables

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Generic Injectables market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Hospira (Pfizer Inc.)

Fresenius Kabi

Sandoz (Novartis)

Hikma Pharmaceuticals PLC

Dr. Reddy’s Laboratories Ltd

Grifols

Nichi-Iko Group (Sagent)

Teva Pharmaceutical

Auromedics

Sanofi

Gland Pharma

Endo International PLC

Segmentation By Type

Small Molecule

Large Molecule

Segmentation By Application

Oncology

Anesthesia

Anti-Infectives

Parenteral Nutrition

Cardiovascular Diseases

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Generic Injectables Market in 2025?

The Generic Injectables Market is driven by cost-effective alternatives to branded injectable drugs, offering significant savings to both healthcare systems and patients. As patents for branded injectables expire, generic versions become more accessible, increasing the market share for generics in various therapeutic areas. Moreover, increased healthcare coverage globally supports the demand for affordable treatments.

What are the weaknesses of the Generic Injectables Market in 2025?

Despite their affordability, generic injectables face challenges related to regulatory complexities and longer approval times, which can delay market entry. Additionally, the market may encounter concerns over product quality, as some generic injectables might be perceived as inferior to their branded counterparts. There is also a risk of limited innovation due to the nature of generics being copies of existing drugs.

What opportunities exist for the Generic Injectables Market in 2025?

There are ample opportunities for market growth, particularly with the rising demand for injectables in oncology, anesthesia, and pain management. The increasing focus on biologics and biosimilars also presents an avenue for generics. Expanding into emerging markets and advancing manufacturing technologies to streamline production processes further enhance growth potential.

What threats could affect the Generic Injectables Market in 2025?

The market faces competitive pressure from both branded drug manufacturers and other generics companies, which may lead to price wars. Moreover, regulatory hurdles and potential changes in healthcare policies could impact pricing and reimbursement structures. Additionally, the rise of advanced therapies like gene therapy may diminish the demand for certain generic injectables in the long run.

Market PESTEL Analysis

What are the political factors influencing the Generic Injectables Market in 2025?

Government policies related to healthcare cost control and drug pricing regulations significantly impact the market. Favorable policies for generics, such as expedited approval processes, can boost market growth. However, changing political landscapes or shifts in government priorities could lead to stricter regulations or altered reimbursement policies, affecting market dynamics.

What are the economic factors affecting the Generic Injectables Market in 2025?

The economic environment plays a crucial role in shaping demand for generic injectables. In regions with cost-conscious healthcare systems, generics offer a more affordable solution, which can drive growth. However, economic downturns or financial instability in key markets might reduce spending on healthcare, including generic medications, hindering market expansion.

What are the social factors impacting the Generic Injectables Market in 2025?

Growing awareness about the cost-effectiveness and safety of generic medications among patients and healthcare providers is a key social driver. As healthcare becomes more patient-centric, there’s an increasing preference for affordable options. However, concerns regarding the perceived quality of generic injectables could influence patient and physician acceptance.

What are the technological factors influencing the Generic Injectables Market in 2025?

Advancements in manufacturing technologies, such as improved production processes and quality control, help ensure that generic injectables meet safety standards. Innovations in drug formulation and delivery systems also contribute to the market's growth, providing more effective and convenient treatment options. Moreover, technology integration in regulatory procedures streamlines approval processes, benefitting the generic injectable market.

What are the environmental factors affecting the Generic Injectables Market in 2025?

Sustainability in manufacturing processes is becoming increasingly important in the healthcare industry. As environmental regulations tighten, companies may need to invest in eco-friendly production practices. Additionally, the environmental impact of pharmaceutical waste, such as unused injectables, could lead to more stringent disposal regulations, influencing market strategies.

What are the legal factors impacting the Generic Injectables Market in 2025?

Intellectual property laws and patent expirations are crucial legal factors in the market. As patents for branded injectables expire, the generics market expands. However, any changes in patent law or patent litigation could delay the launch of generic versions. Legal challenges related to product safety, labeling, and market access also pose risks to the growth of the market.

Market SIPOC Analysis

Who are the suppliers in the Generic Injectables Market in 2025?

Suppliers in the generic injectables market include active pharmaceutical ingredient (API) manufacturers, raw material providers, and contract manufacturers who produce the injectables. Suppliers also consist of packaging companies and technology firms that provide manufacturing equipment and solutions for efficient production.

What are the inputs required for the Generic Injectables Market in 2025?

The primary inputs include raw materials like active pharmaceutical ingredients (APIs), excipients, and other chemical compounds required for production. Other inputs include advanced manufacturing technology, regulatory documentation, skilled labor, and quality control processes to ensure the safety and efficacy of the injectables.

What are the processes involved in the Generic Injectables Market in 2025?

The processes in the generic injectables market include drug development, formulation, testing, regulatory approval, manufacturing, and distribution. Key steps involve stringent quality checks, meeting regulatory standards, and ensuring that production follows good manufacturing practices (GMP) to deliver safe and effective generics.

Who are the customers in the Generic Injectables Market in 2025?

The customers include healthcare providers such as hospitals, clinics, and pharmacies, which purchase generic injectables for patient treatment. Additionally, government health agencies, insurance companies, and patients, particularly in cost-conscious regions, are key stakeholders in driving demand for affordable generic alternatives.

What are the outputs in the Generic Injectables Market in 2025?

The primary outputs are generic injectable drugs that are distributed to healthcare providers and pharmacies. These include a wide range of therapeutic products, such as those used in oncology, anesthesia, and pain management. Additionally, the market outputs consist of regulatory compliance documents, packaging, and branded products for distribution.

Market Porter's Five Forces

What is the threat of new entrants in the Generic Injectables Market in 2025?

The threat of new entrants is moderate. While the generic injectables market offers significant growth opportunities due to increasing demand for affordable medications, high barriers to entry such as strict regulatory requirements, capital investment in manufacturing facilities, and technological expertise limit new players from easily entering the market.

What is the bargaining power of suppliers in the Generic Injectables Market in 2025?

The bargaining power of suppliers is moderate to high. Suppliers of active pharmaceutical ingredients (APIs) and raw materials hold a certain level of power, especially when there are limited sources for specific ingredients. However, the competitive nature of the market and the increasing number of suppliers reduces the overall influence of individual suppliers.

What is the bargaining power of buyers in the Generic Injectables Market in 2025?

The bargaining power of buyers is high. Healthcare providers, pharmacies, and government organizations have significant leverage in negotiating prices due to the availability of multiple generic options and the growing focus on cost-effective treatment. Additionally, increasing patient awareness about generics boosts their demand and empowers buyers.

What is the threat of substitute products in the Generic Injectables Market in 2025?

The threat of substitutes is moderate. While there are alternatives to injectables, such as oral medications, the increasing reliance on injectables for specific treatments (like in oncology and anesthesia) reduces the threat. However, innovations in biologics and biosimilars could serve as substitutes, especially in specialized therapeutic areas.

What is the level of industry rivalry in the Generic Injectables Market in 2025?

The level of industry rivalry is high. The market is highly competitive, with numerous pharmaceutical companies vying for market share in the generic injectable space. Price competition, combined with the need for regulatory compliance and effective distribution, intensifies rivalry among existing players.

Market Upstream Analysis

What are the key inputs in the upstream process of the Generic Injectables Market in 2025?

The key inputs include raw materials such as active pharmaceutical ingredients (APIs), excipients, and packaging materials. Additionally, specialized manufacturing equipment, technology for production, and skilled labor are essential for producing high-quality generic injectables.

What is the role of suppliers in the upstream process of the Generic Injectables Market in 2025?

Suppliers of APIs, raw materials, and manufacturing equipment play a critical role in the upstream process by providing the necessary resources for production. Their ability to meet quality standards and regulatory requirements is vital to ensure the final products are safe and effective. Timely delivery of these materials also influences the overall efficiency of the manufacturing process.

What are the challenges in the upstream process of the Generic Injectables Market in 2025?

Challenges in the upstream process include the increasing cost of raw materials, especially APIs, and the complexity of meeting stringent regulatory requirements. Additionally, fluctuations in raw material supply due to global disruptions or geopolitical factors can affect production schedules and costs.

How do regulatory requirements affect the upstream process in the Generic Injectables Market in 2025?

Regulatory requirements significantly impact the upstream process by dictating the standards for raw materials, manufacturing processes, and product quality. Companies must ensure compliance with Good Manufacturing Practices (GMP) and other regulatory frameworks, which can increase both time and cost in the production of generic injectables.

How is innovation impacting the upstream process of the Generic Injectables Market in 2025?

Innovation in manufacturing technologies, such as automation and advanced quality control systems, is enhancing the upstream process. These innovations help improve efficiency, reduce costs, and ensure the consistent quality of generic injectables, driving overall market competitiveness and meeting regulatory demands.

Market Midstream Analysis

What are the key activities in the midstream process of the Generic Injectables Market in 2025?

Key activities in the midstream process include manufacturing, quality control, regulatory compliance, and packaging. After the production of the generic injectables, they undergo rigorous testing to ensure they meet safety and efficacy standards, followed by packaging for distribution to healthcare providers and pharmacies.

How does quality control impact the midstream process in the Generic Injectables Market in 2025?

Quality control is crucial in the midstream process to ensure that the generic injectables meet the necessary regulatory standards. Any deviation in quality can lead to regulatory issues, product recalls, or harm to patients, making stringent quality checks and adherence to Good Manufacturing Practices (GMP) vital for maintaining market trust and ensuring product safety.

What are the challenges in the midstream process of the Generic Injectables Market in 2025?

Challenges in the midstream process include ensuring consistent product quality across large-scale production, managing the complexities of packaging for injectables, and staying compliant with constantly evolving regulatory requirements. Additionally, maintaining an efficient supply chain for timely distribution can be challenging, especially in the face of global disruptions.

How does regulatory compliance affect the midstream process of the Generic Injectables Market in 2025?

Regulatory compliance is a key driver in the midstream process. Manufacturers must ensure that every stage of production, from formulation to packaging, adheres to local and international regulations. This can add time and cost but is essential to avoid penalties, delays in market entry, and potential safety risks for patients.

What role do logistics and distribution play in the midstream process of the Generic Injectables Market in 2025?

Logistics and distribution are critical in ensuring that the generic injectables reach healthcare providers and pharmacies on time. Efficient distribution channels, including cold chain management for temperature-sensitive products, are essential for maintaining the integrity of the products and meeting market demand without delays.

Market Downstream Analysis

What are the key activities in the downstream process of the Generic Injectables Market in 2025?

Key activities in the downstream process include distribution, marketing, and sales to healthcare providers, pharmacies, and hospitals. It also involves post-market surveillance to monitor product safety and effectiveness, as well as customer support and training for healthcare professionals on proper usage.

How does distribution impact the downstream process in the Generic Injectables Market in 2025?

Distribution is critical in the downstream process, ensuring that generic injectables reach the right markets efficiently and safely. Effective distribution networks, including cold chain management for temperature-sensitive products, are essential to maintain product integrity and meet global demand while minimizing delays or stockouts.

What are the challenges in the downstream process of the Generic Injectables Market in 2025?

Challenges include managing complex logistics for a diverse range of injectables, dealing with regional variations in regulatory requirements, and ensuring that healthcare providers and pharmacies have timely access to the products. Additionally, the need to compete with branded drugs on price and effectiveness remains a constant challenge in the downstream market.

How does pricing affect the downstream process in the Generic Injectables Market in 2025?

Pricing plays a significant role in the downstream process as generic injectables are often priced lower than branded alternatives, making them an attractive option for cost-conscious healthcare providers and patients. However, pricing pressures from insurance companies and healthcare systems can limit profitability, especially in highly competitive markets.

What role do customer relationships play in the downstream process of the Generic Injectables Market in 2025?

Customer relationships are essential for brand loyalty and repeat business. Establishing strong relationships with healthcare providers, pharmacies, and wholesalers can lead to greater product adoption and sustained sales. Effective customer support and education on the benefits of generic injectables also help build trust and maintain a competitive edge.

Chapter 1, to describe Generic Injectables product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Generic Injectables, with revenue, gross margin and global market share of Generic Injectables from 2018 to 2023.

Chapter 3, the Generic Injectables competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Generic Injectables market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Generic Injectables.

Chapter 13, to describe Generic Injectables research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Generic Injectables

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Generic Injectables by Type

1.3.1 Overview: Global Generic Injectables Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Generic Injectables Consumption Value Market Share by Type in 2022

1.3.3 Small Molecule

1.3.4 Large Molecule

1.4 Global Generic Injectables Market by Application

1.4.1 Overview: Global Generic Injectables Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Oncology

1.4.3 Anesthesia

1.4.4 Anti-Infectives

1.4.5 Parenteral Nutrition

1.4.6 Cardiovascular Diseases

1.5 Global Generic Injectables Market Size & Forecast

1.6 Global Generic Injectables Market Size and Forecast by Region

1.6.1 Global Generic Injectables Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Generic Injectables Market Size by Region, (2018-2029)

1.6.3 North America Generic Injectables Market Size and Prospect (2018-2029)

1.6.4 Europe Generic Injectables Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Generic Injectables Market Size and Prospect (2018-2029)

1.6.6 South America Generic Injectables Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Generic Injectables Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Hospira (Pfizer Inc.)

2.1.1 Hospira (Pfizer Inc.) Details

2.1.2 Hospira (Pfizer Inc.) Major Business

2.1.3 Hospira (Pfizer Inc.) Generic Injectables Product and Solutions

2.1.4 Hospira (Pfizer Inc.) Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Hospira (Pfizer Inc.) Recent Developments and Future Plans

2.2 Fresenius Kabi

2.2.1 Fresenius Kabi Details

2.2.2 Fresenius Kabi Major Business

2.2.3 Fresenius Kabi Generic Injectables Product and Solutions

2.2.4 Fresenius Kabi Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Fresenius Kabi Recent Developments and Future Plans

2.3 Sandoz (Novartis)

2.3.1 Sandoz (Novartis) Details

2.3.2 Sandoz (Novartis) Major Business

2.3.3 Sandoz (Novartis) Generic Injectables Product and Solutions

2.3.4 Sandoz (Novartis) Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Sandoz (Novartis) Recent Developments and Future Plans

2.4 Hikma Pharmaceuticals PLC

2.4.1 Hikma Pharmaceuticals PLC Details

2.4.2 Hikma Pharmaceuticals PLC Major Business

2.4.3 Hikma Pharmaceuticals PLC Generic Injectables Product and Solutions

2.4.4 Hikma Pharmaceuticals PLC Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Hikma Pharmaceuticals PLC Recent Developments and Future Plans

2.5 Dr. Reddy’s Laboratories Ltd

2.5.1 Dr. Reddy’s Laboratories Ltd Details

2.5.2 Dr. Reddy’s Laboratories Ltd Major Business

2.5.3 Dr. Reddy’s Laboratories Ltd Generic Injectables Product and Solutions

2.5.4 Dr. Reddy’s Laboratories Ltd Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Dr. Reddy’s Laboratories Ltd Recent Developments and Future Plans

2.6 Grifols

2.6.1 Grifols Details

2.6.2 Grifols Major Business

2.6.3 Grifols Generic Injectables Product and Solutions

2.6.4 Grifols Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Grifols Recent Developments and Future Plans

2.7 Nichi-Iko Group (Sagent)

2.7.1 Nichi-Iko Group (Sagent) Details

2.7.2 Nichi-Iko Group (Sagent) Major Business

2.7.3 Nichi-Iko Group (Sagent) Generic Injectables Product and Solutions

2.7.4 Nichi-Iko Group (Sagent) Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Nichi-Iko Group (Sagent) Recent Developments and Future Plans

2.8 Teva Pharmaceutical

2.8.1 Teva Pharmaceutical Details

2.8.2 Teva Pharmaceutical Major Business

2.8.3 Teva Pharmaceutical Generic Injectables Product and Solutions

2.8.4 Teva Pharmaceutical Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Teva Pharmaceutical Recent Developments and Future Plans

2.9 Auromedics

2.9.1 Auromedics Details

2.9.2 Auromedics Major Business

2.9.3 Auromedics Generic Injectables Product and Solutions

2.9.4 Auromedics Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Auromedics Recent Developments and Future Plans

2.10 Sanofi

2.10.1 Sanofi Details

2.10.2 Sanofi Major Business

2.10.3 Sanofi Generic Injectables Product and Solutions

2.10.4 Sanofi Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Sanofi Recent Developments and Future Plans

2.11 Gland Pharma

2.11.1 Gland Pharma Details

2.11.2 Gland Pharma Major Business

2.11.3 Gland Pharma Generic Injectables Product and Solutions

2.11.4 Gland Pharma Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Gland Pharma Recent Developments and Future Plans

2.12 Endo International PLC

2.12.1 Endo International PLC Details

2.12.2 Endo International PLC Major Business

2.12.3 Endo International PLC Generic Injectables Product and Solutions

2.12.4 Endo International PLC Generic Injectables Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 Endo International PLC Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Generic Injectables Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Generic Injectables by Company Revenue

3.2.2 Top 3 Generic Injectables Players Market Share in 2022

3.2.3 Top 6 Generic Injectables Players Market Share in 2022

3.3 Generic Injectables Market: Overall Company Footprint Analysis

3.3.1 Generic Injectables Market: Region Footprint

3.3.2 Generic Injectables Market: Company Product Type Footprint

3.3.3 Generic Injectables Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Generic Injectables Consumption Value and Market Share by Type (2018-2023)

4.2 Global Generic Injectables Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Generic Injectables Consumption Value Market Share by Application (2018-2023)

5.2 Global Generic Injectables Market Forecast by Application (2024-2029)

6 North America

6.1 North America Generic Injectables Consumption Value by Type (2018-2029)

6.2 North America Generic Injectables Consumption Value by Application (2018-2029)

6.3 North America Generic Injectables Market Size by Country

6.3.1 North America Generic Injectables Consumption Value by Country (2018-2029)

6.3.2 United States Generic Injectables Market Size and Forecast (2018-2029)

6.3.3 Canada Generic Injectables Market Size and Forecast (2018-2029)

6.3.4 Mexico Generic Injectables Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Generic Injectables Consumption Value by Type (2018-2029)

7.2 Europe Generic Injectables Consumption Value by Application (2018-2029)

7.3 Europe Generic Injectables Market Size by Country

7.3.1 Europe Generic Injectables Consumption Value by Country (2018-2029)

7.3.2 Germany Generic Injectables Market Size and Forecast (2018-2029)

7.3.3 France Generic Injectables Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Generic Injectables Market Size and Forecast (2018-2029)

7.3.5 Russia Generic Injectables Market Size and Forecast (2018-2029)

7.3.6 Italy Generic Injectables Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Generic Injectables Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Generic Injectables Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Generic Injectables Market Size by Region

8.3.1 Asia-Pacific Generic Injectables Consumption Value by Region (2018-2029)

8.3.2 China Generic Injectables Market Size and Forecast (2018-2029)

8.3.3 Japan Generic Injectables Market Size and Forecast (2018-2029)

8.3.4 South Korea Generic Injectables Market Size and Forecast (2018-2029)

8.3.5 India Generic Injectables Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Generic Injectables Market Size and Forecast (2018-2029)

8.3.7 Australia Generic Injectables Market Size and Forecast (2018-2029)

9 South America

9.1 South America Generic Injectables Consumption Value by Type (2018-2029)

9.2 South America Generic Injectables Consumption Value by Application (2018-2029)

9.3 South America Generic Injectables Market Size by Country

9.3.1 South America Generic Injectables Consumption Value by Country (2018-2029)

9.3.2 Brazil Generic Injectables Market Size and Forecast (2018-2029)

9.3.3 Argentina Generic Injectables Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Generic Injectables Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Generic Injectables Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Generic Injectables Market Size by Country

10.3.1 Middle East & Africa Generic Injectables Consumption Value by Country (2018-2029)

10.3.2 Turkey Generic Injectables Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Generic Injectables Market Size and Forecast (2018-2029)

10.3.4 UAE Generic Injectables Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Generic Injectables Market Drivers

11.2 Generic Injectables Market Restraints

11.3 Generic Injectables Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Generic Injectables Industry Chain

12.2 Generic Injectables Upstream Analysis

12.3 Generic Injectables Midstream Analysis

12.4 Generic Injectables Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

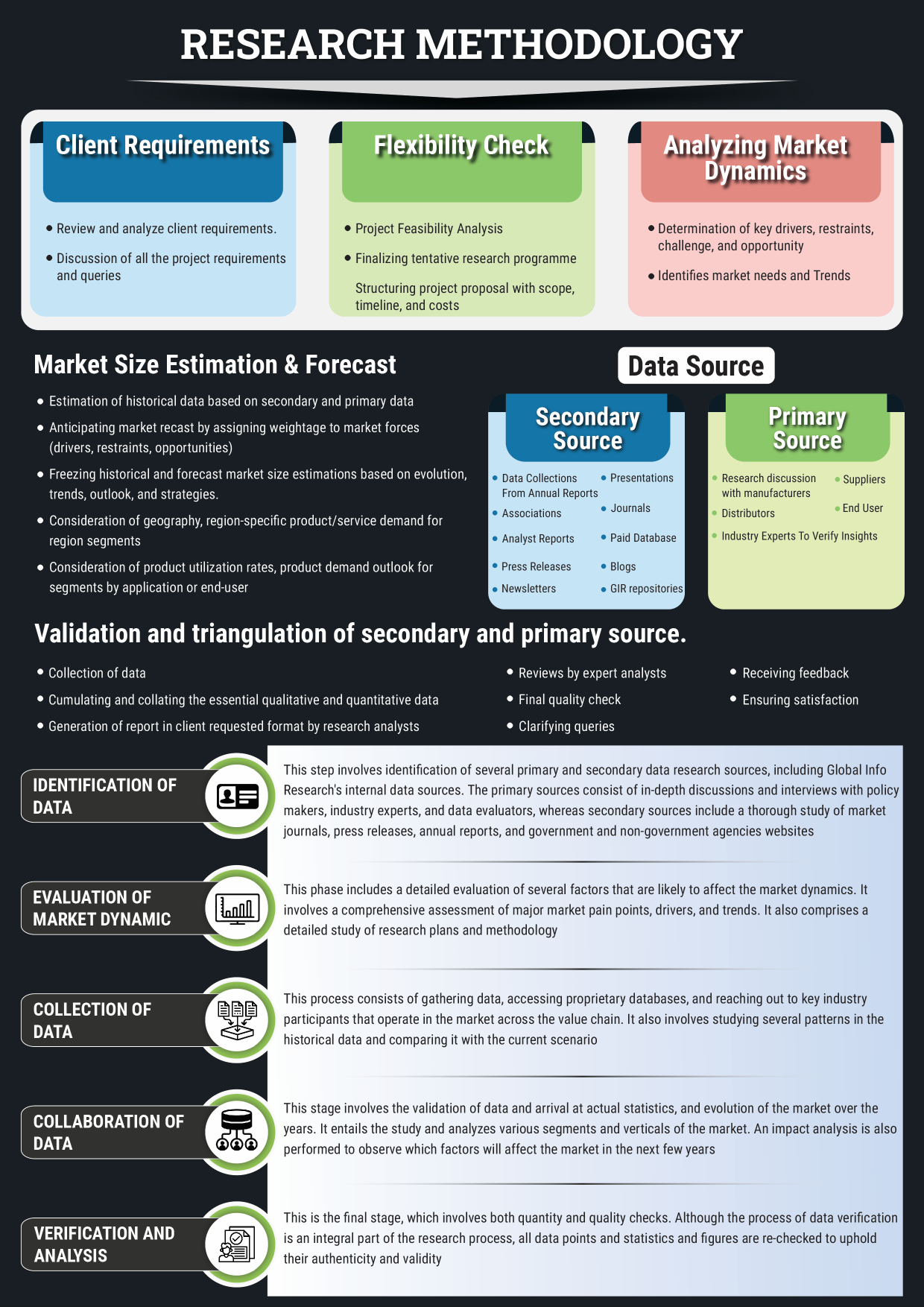

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Generic Injectables Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Generic Injectables Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Generic Injectables Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Generic Injectables Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Hospira (Pfizer Inc.) Company Information, Head Office, and Major Competitors

Table 6. Hospira (Pfizer Inc.) Major Business

Table 7. Hospira (Pfizer Inc.) Generic Injectables Product and Solutions

Table 8. Hospira (Pfizer Inc.) Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Hospira (Pfizer Inc.) Recent Developments and Future Plans

Table 10. Fresenius Kabi Company Information, Head Office, and Major Competitors

Table 11. Fresenius Kabi Major Business

Table 12. Fresenius Kabi Generic Injectables Product and Solutions

Table 13. Fresenius Kabi Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. Fresenius Kabi Recent Developments and Future Plans

Table 15. Sandoz (Novartis) Company Information, Head Office, and Major Competitors

Table 16. Sandoz (Novartis) Major Business

Table 17. Sandoz (Novartis) Generic Injectables Product and Solutions

Table 18. Sandoz (Novartis) Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. Sandoz (Novartis) Recent Developments and Future Plans

Table 20. Hikma Pharmaceuticals PLC Company Information, Head Office, and Major Competitors

Table 21. Hikma Pharmaceuticals PLC Major Business

Table 22. Hikma Pharmaceuticals PLC Generic Injectables Product and Solutions

Table 23. Hikma Pharmaceuticals PLC Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Hikma Pharmaceuticals PLC Recent Developments and Future Plans

Table 25. Dr. Reddy’s Laboratories Ltd Company Information, Head Office, and Major Competitors

Table 26. Dr. Reddy’s Laboratories Ltd Major Business

Table 27. Dr. Reddy’s Laboratories Ltd Generic Injectables Product and Solutions

Table 28. Dr. Reddy’s Laboratories Ltd Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. Dr. Reddy’s Laboratories Ltd Recent Developments and Future Plans

Table 30. Grifols Company Information, Head Office, and Major Competitors

Table 31. Grifols Major Business

Table 32. Grifols Generic Injectables Product and Solutions

Table 33. Grifols Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Grifols Recent Developments and Future Plans

Table 35. Nichi-Iko Group (Sagent) Company Information, Head Office, and Major Competitors

Table 36. Nichi-Iko Group (Sagent) Major Business

Table 37. Nichi-Iko Group (Sagent) Generic Injectables Product and Solutions

Table 38. Nichi-Iko Group (Sagent) Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Nichi-Iko Group (Sagent) Recent Developments and Future Plans

Table 40. Teva Pharmaceutical Company Information, Head Office, and Major Competitors

Table 41. Teva Pharmaceutical Major Business

Table 42. Teva Pharmaceutical Generic Injectables Product and Solutions

Table 43. Teva Pharmaceutical Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. Teva Pharmaceutical Recent Developments and Future Plans

Table 45. Auromedics Company Information, Head Office, and Major Competitors

Table 46. Auromedics Major Business

Table 47. Auromedics Generic Injectables Product and Solutions

Table 48. Auromedics Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. Auromedics Recent Developments and Future Plans

Table 50. Sanofi Company Information, Head Office, and Major Competitors

Table 51. Sanofi Major Business

Table 52. Sanofi Generic Injectables Product and Solutions

Table 53. Sanofi Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Sanofi Recent Developments and Future Plans

Table 55. Gland Pharma Company Information, Head Office, and Major Competitors

Table 56. Gland Pharma Major Business

Table 57. Gland Pharma Generic Injectables Product and Solutions

Table 58. Gland Pharma Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 59. Gland Pharma Recent Developments and Future Plans

Table 60. Endo International PLC Company Information, Head Office, and Major Competitors

Table 61. Endo International PLC Major Business

Table 62. Endo International PLC Generic Injectables Product and Solutions

Table 63. Endo International PLC Generic Injectables Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 64. Endo International PLC Recent Developments and Future Plans

Table 65. Global Generic Injectables Revenue (USD Million) by Players (2018-2023)

Table 66. Global Generic Injectables Revenue Share by Players (2018-2023)

Table 67. Breakdown of Generic Injectables by Company Type (Tier 1, Tier 2, and Tier 3)

Table 68. Market Position of Players in Generic Injectables, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 69. Head Office of Key Generic Injectables Players

Table 70. Generic Injectables Market: Company Product Type Footprint

Table 71. Generic Injectables Market: Company Product Application Footprint

Table 72. Generic Injectables New Market Entrants and Barriers to Market Entry

Table 73. Generic Injectables Mergers, Acquisition, Agreements, and Collaborations

Table 74. Global Generic Injectables Consumption Value (USD Million) by Type (2018-2023)

Table 75. Global Generic Injectables Consumption Value Share by Type (2018-2023)

Table 76. Global Generic Injectables Consumption Value Forecast by Type (2024-2029)

Table 77. Global Generic Injectables Consumption Value by Application (2018-2023)

Table 78. Global Generic Injectables Consumption Value Forecast by Application (2024-2029)

Table 79. North America Generic Injectables Consumption Value by Type (2018-2023) & (USD Million)

Table 80. North America Generic Injectables Consumption Value by Type (2024-2029) & (USD Million)

Table 81. North America Generic Injectables Consumption Value by Application (2018-2023) & (USD Million)

Table 82. North America Generic Injectables Consumption Value by Application (2024-2029) & (USD Million)

Table 83. North America Generic Injectables Consumption Value by Country (2018-2023) & (USD Million)

Table 84. North America Generic Injectables Consumption Value by Country (2024-2029) & (USD Million)

Table 85. Europe Generic Injectables Consumption Value by Type (2018-2023) & (USD Million)

Table 86. Europe Generic Injectables Consumption Value by Type (2024-2029) & (USD Million)

Table 87. Europe Generic Injectables Consumption Value by Application (2018-2023) & (USD Million)

Table 88. Europe Generic Injectables Consumption Value by Application (2024-2029) & (USD Million)

Table 89. Europe Generic Injectables Consumption Value by Country (2018-2023) & (USD Million)

Table 90. Europe Generic Injectables Consumption Value by Country (2024-2029) & (USD Million)

Table 91. Asia-Pacific Generic Injectables Consumption Value by Type (2018-2023) & (USD Million)

Table 92. Asia-Pacific Generic Injectables Consumption Value by Type (2024-2029) & (USD Million)

Table 93. Asia-Pacific Generic Injectables Consumption Value by Application (2018-2023) & (USD Million)

Table 94. Asia-Pacific Generic Injectables Consumption Value by Application (2024-2029) & (USD Million)

Table 95. Asia-Pacific Generic Injectables Consumption Value by Region (2018-2023) & (USD Million)

Table 96. Asia-Pacific Generic Injectables Consumption Value by Region (2024-2029) & (USD Million)

Table 97. South America Generic Injectables Consumption Value by Type (2018-2023) & (USD Million)

Table 98. South America Generic Injectables Consumption Value by Type (2024-2029) & (USD Million)

Table 99. South America Generic Injectables Consumption Value by Application (2018-2023) & (USD Million)

Table 100. South America Generic Injectables Consumption Value by Application (2024-2029) & (USD Million)

Table 101. South America Generic Injectables Consumption Value by Country (2018-2023) & (USD Million)

Table 102. South America Generic Injectables Consumption Value by Country (2024-2029) & (USD Million)

Table 103. Middle East & Africa Generic Injectables Consumption Value by Type (2018-2023) & (USD Million)

Table 104. Middle East & Africa Generic Injectables Consumption Value by Type (2024-2029) & (USD Million)

Table 105. Middle East & Africa Generic Injectables Consumption Value by Application (2018-2023) & (USD Million)

Table 106. Middle East & Africa Generic Injectables Consumption Value by Application (2024-2029) & (USD Million)

Table 107. Middle East & Africa Generic Injectables Consumption Value by Country (2018-2023) & (USD Million)

Table 108. Middle East & Africa Generic Injectables Consumption Value by Country (2024-2029) & (USD Million)

Table 109. Generic Injectables Raw Material

Table 110. Key Suppliers of Generic Injectables Raw Materials

List of Figures

Figure 1. Generic Injectables Picture

Figure 2. Global Generic Injectables Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Generic Injectables Consumption Value Market Share by Type in 2022

Figure 4. Small Molecule

Figure 5. Large Molecule

Figure 6. Global Generic Injectables Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 7. Generic Injectables Consumption Value Market Share by Application in 2022

Figure 8. Oncology Picture

Figure 9. Anesthesia Picture

Figure 10. Anti-Infectives Picture

Figure 11. Parenteral Nutrition Picture

Figure 12. Cardiovascular Diseases Picture

Figure 13. Global Generic Injectables Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 14. Global Generic Injectables Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 15. Global Market Generic Injectables Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 16. Global Generic Injectables Consumption Value Market Share by Region (2018-2029)

Figure 17. Global Generic Injectables Consumption Value Market Share by Region in 2022

Figure 18. North America Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 19. Europe Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 20. Asia-Pacific Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 21. South America Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 22. Middle East and Africa Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 23. Global Generic Injectables Revenue Share by Players in 2022

Figure 24. Generic Injectables Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 25. Global Top 3 Players Generic Injectables Market Share in 2022

Figure 26. Global Top 6 Players Generic Injectables Market Share in 2022

Figure 27. Global Generic Injectables Consumption Value Share by Type (2018-2023)

Figure 28. Global Generic Injectables Market Share Forecast by Type (2024-2029)

Figure 29. Global Generic Injectables Consumption Value Share by Application (2018-2023)

Figure 30. Global Generic Injectables Market Share Forecast by Application (2024-2029)

Figure 31. North America Generic Injectables Consumption Value Market Share by Type (2018-2029)

Figure 32. North America Generic Injectables Consumption Value Market Share by Application (2018-2029)

Figure 33. North America Generic Injectables Consumption Value Market Share by Country (2018-2029)

Figure 34. United States Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 35. Canada Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 36. Mexico Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 37. Europe Generic Injectables Consumption Value Market Share by Type (2018-2029)

Figure 38. Europe Generic Injectables Consumption Value Market Share by Application (2018-2029)

Figure 39. Europe Generic Injectables Consumption Value Market Share by Country (2018-2029)

Figure 40. Germany Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 41. France Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 42. United Kingdom Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 43. Russia Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 44. Italy Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 45. Asia-Pacific Generic Injectables Consumption Value Market Share by Type (2018-2029)

Figure 46. Asia-Pacific Generic Injectables Consumption Value Market Share by Application (2018-2029)

Figure 47. Asia-Pacific Generic Injectables Consumption Value Market Share by Region (2018-2029)

Figure 48. China Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 49. Japan Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 50. South Korea Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 51. India Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 52. Southeast Asia Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 53. Australia Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 54. South America Generic Injectables Consumption Value Market Share by Type (2018-2029)

Figure 55. South America Generic Injectables Consumption Value Market Share by Application (2018-2029)

Figure 56. South America Generic Injectables Consumption Value Market Share by Country (2018-2029)

Figure 57. Brazil Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 58. Argentina Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 59. Middle East and Africa Generic Injectables Consumption Value Market Share by Type (2018-2029)

Figure 60. Middle East and Africa Generic Injectables Consumption Value Market Share by Application (2018-2029)

Figure 61. Middle East and Africa Generic Injectables Consumption Value Market Share by Country (2018-2029)

Figure 62. Turkey Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 63. Saudi Arabia Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 64. UAE Generic Injectables Consumption Value (2018-2029) & (USD Million)

Figure 65. Generic Injectables Market Drivers

Figure 66. Generic Injectables Market Restraints

Figure 67. Generic Injectables Market Trends

Figure 68. Porters Five Forces Analysis

Figure 69. Manufacturing Cost Structure Analysis of Generic Injectables in 2022

Figure 70. Manufacturing Process Analysis of Generic Injectables

Figure 71. Generic Injectables Industrial Chain

Figure 72. Methodology

Figure 73. Research Process and Data Source