Sepsis is usually treated with intravenous fluids and antibiotics. Typically, antibiotics are given as soon as possible. Often, ongoing care is performed in an intensive care unit. If fluid replacement is not enough to maintain blood pressure, medications that raise blood pressure may be used. Mechanical ventilation and dialysis may be needed to support the function of the lungs and kidneys, respectively. To guide treatment, a central venous catheter and an arterial catheter may be placed for access to the bloodstream. Other measurements such as cardiac output and superior vena cava oxygen saturation may be used. People with sepsis need preventive measures for deep vein thrombosis, stress ulcers and pressure ulcers, unless other conditions prevent such interventions. Some might benefit from tight control of blood sugar levels with insulin. The use of corticosteroids is controversial, with some reviews finding benefit, and others not.

Market competition is intense. Pfizer, NCPC, Bayer, Shanghai Pharmaceuticals, Johnson & Johnson, Novartis, GlaxoSmithKline etc. are the leaders of the industry, and they hold key technologies and patents, with high-end customers; with the development of society and the changing of consumer demand, there will be more companies enter this industry. Pfizer accounted for largest market share of about 3% in 2019.

This report is a detailed and comprehensive analysis for global Sepsis Treatment market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Sepsis Treatment market size and forecasts, in consumption value ($ Million), 2018-2029

Global Sepsis Treatment market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global Sepsis Treatment market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global Sepsis Treatment market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Sepsis Treatment

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Sepsis Treatment market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Pfizer

NCPC

Bayer

Shanghai Pharmaceuticals

Johnson & Johnson

Novartis

GlaxoSmithKline

TEVA

Mylan

Allergan

Merck & Co

Asahi Kasei Corporation

AtoxBio

INOTREM

Adrenomed

Endacea

Segmentation By Type

Cephalosporin

Pencillin

Macrolides

Others

Segmentation By Application

Sepsis

Severe Sepsis

Septic Shock

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the sepsis treatment market in 2025?

The sepsis treatment market benefits from advanced diagnostic technologies and improved awareness among healthcare professionals, leading to quicker identification and treatment of sepsis. Additionally, the increasing prevalence of sepsis and rising investments in research and development for novel therapies strengthen the market.

What weaknesses does the sepsis treatment market face in 2025?

Despite advancements, the market still struggles with high mortality rates and the complexity of treatment protocols. Limited access to healthcare in certain regions and variability in treatment guidelines can hinder effective management of sepsis cases.

What opportunities exist for the sepsis treatment market in 2025?

There are significant opportunities for growth through the development of new antibiotics and immunotherapies. Collaborations between pharmaceutical companies and healthcare providers, along with the expansion of telemedicine and remote monitoring technologies, can enhance patient management and treatment outcomes.

What threats could impact the sepsis treatment market in 2025?

The market faces threats from antibiotic resistance, which can complicate treatment and increase mortality rates. Additionally, economic constraints and budget cuts in healthcare spending may limit investment in sepsis research and the implementation of innovative treatment solutions.

Market PESTEL Analysis

How do political factors influence the sepsis treatment market in 2025?

Government policies on healthcare funding, antibiotic regulations, and infection control play a crucial role in shaping the market. Supportive policies promoting research and faster drug approvals can accelerate market growth, while stringent regulations on drug pricing and reimbursement may create challenges.

What economic factors impact the sepsis treatment market in 2025?

The market is influenced by global economic conditions, healthcare budgets, and insurance coverage for sepsis treatment. High treatment costs may limit access in low-income regions, but increased healthcare spending and investments in critical care infrastructure can drive market expansion.

How do social factors affect the sepsis treatment market in 2025?

Growing awareness about sepsis and its early symptoms has led to improved diagnosis and treatment rates. However, disparities in healthcare access, aging populations, and lifestyle changes increasing the risk of infections continue to shape the demand for effective sepsis management.

What technological factors play a role in the sepsis treatment market in 2025?

Advancements in rapid diagnostic tools, AI-powered predictive analytics, and innovative treatment options, such as precision medicine and new antimicrobial therapies, enhance patient outcomes. However, the high cost of technology adoption and integration into healthcare systems may pose barriers.

How do environmental factors impact the sepsis treatment market in 2025?

The rise of antibiotic-resistant pathogens due to environmental factors like improper pharmaceutical waste disposal and overuse of antibiotics presents a major challenge. Additionally, climate change-related increases in infectious disease prevalence may contribute to a higher incidence of sepsis.

What legal factors shape the sepsis treatment market in 2025?

Regulatory frameworks governing drug development, clinical trials, and patient safety significantly influence market dynamics. Stricter antimicrobial stewardship policies and litigation risks related to medical negligence or delayed sepsis diagnosis can also impact healthcare providers and pharmaceutical companies.

Market SIPOC Analysis

Who are the key suppliers in the sepsis treatment market in 2025?

Pharmaceutical companies, biotechnology firms, medical device manufacturers, and diagnostic tool providers are the primary suppliers. Research institutions and government agencies also play a crucial role in developing new therapies and guidelines.

What are the main inputs in the sepsis treatment process?

Essential inputs include antibiotics, intravenous fluids, vasopressors, diagnostic kits, biomarker-based tests, and advanced medical equipment like blood culture analyzers. Trained healthcare professionals and evidence-based treatment protocols are also critical components.

What processes are involved in sepsis treatment?

The process starts with early diagnosis through rapid testing and clinical assessment, followed by immediate administration of antibiotics and supportive care. Continuous monitoring of vital signs, fluid management, and critical interventions like mechanical ventilation or dialysis may be required in severe cases.

Who are the primary outputs of the sepsis treatment market?

Successful treatment outcomes include reduced mortality rates, faster recovery times, and improved patient management strategies. Other outputs include new drug formulations, advanced diagnostic technologies, and updated clinical guidelines for sepsis care.

Who are the key customers in the sepsis treatment market in 2025?

Hospitals, intensive care units, emergency departments, and outpatient clinics are the primary customers. Additionally, governments, insurance providers, and patients seeking affordable and effective treatment options also shape market demand.

Market Porter's Five Forces

How strong is the competitive rivalry in the sepsis treatment market in 2025?

The market is highly competitive, with pharmaceutical giants, biotech firms, and medical device manufacturers continuously innovating. The race to develop novel antibiotics, rapid diagnostics, and AI-driven sepsis management solutions drives intense competition.

What is the threat of new entrants in the sepsis treatment market in 2025?

High research and development costs, strict regulatory approvals, and the need for strong clinical evidence create significant barriers for new entrants. However, startups focusing on advanced diagnostics or AI-driven treatment solutions may disrupt the market.

How much bargaining power do suppliers have in the sepsis treatment market in 2025?

Suppliers, including pharmaceutical companies and diagnostic tool manufacturers, hold moderate bargaining power due to the high demand for effective treatments. However, government regulations, generic drug competition, and cost-containment pressures limit excessive pricing power.

What is the bargaining power of buyers in the sepsis treatment market in 2025?

Hospitals, healthcare providers, and insurance companies exert strong bargaining power by demanding cost-effective and evidence-based treatments. Patients also seek affordable options, pushing pharmaceutical companies to balance pricing with accessibility.

What is the threat of substitutes in the sepsis treatment market in 2025?

The threat of substitutes is low, as sepsis requires immediate and specialized treatment. While alternative therapies like immunomodulators and AI-assisted early detection tools improve management, they complement rather than replace conventional antibiotics and critical care interventions.

Market Upstream Analysis

Who are the key upstream suppliers in the sepsis treatment market in 2025?

Pharmaceutical companies, biotech firms, and chemical manufacturers supplying active pharmaceutical ingredients (APIs) are critical upstream suppliers. Additionally, diagnostic kit manufacturers, medical device producers, and research institutions contribute essential components for sepsis detection and treatment.

What raw materials are essential for sepsis treatment production?

Key raw materials include antibiotics, biologics, intravenous fluids, and diagnostic reagents. Advanced materials for medical devices, such as blood culture analyzers and biosensors, are also crucial for accurate and timely sepsis diagnosis.

How do supply chain factors impact the sepsis treatment market in 2025?

Global supply chain disruptions, raw material shortages, and regulatory compliance requirements can affect the availability of essential drugs and diagnostic tools. Dependence on specific regions for raw material production also influences market stability.

What role does research and development play in the upstream process?

R&D is a vital component, driving innovation in new antimicrobial therapies, rapid diagnostics, and AI-powered sepsis detection tools. Collaborations between academic institutions, pharmaceutical companies, and government agencies enhance the development of cutting-edge solutions.

How do regulatory policies influence the upstream segment of the sepsis treatment market?

Strict regulations on drug manufacturing, quality control, and clinical trials impact how quickly new treatments reach the market. Compliance with Good Manufacturing Practices (GMP) and antimicrobial stewardship policies adds complexity but ensures patient safety and efficacy.

Market Midstream Analysis

Who are the key players in the midstream segment of the sepsis treatment market in 2025?

Pharmaceutical companies, biotechnology firms, and medical device manufacturers are central to the midstream segment. Hospitals, diagnostic laboratories, and healthcare distributors also play a crucial role in ensuring treatment accessibility.

What processes take place in the midstream stage of the sepsis treatment market?

The midstream stage involves drug formulation, large-scale production of antibiotics and biologics, and manufacturing of diagnostic tools. It also includes regulatory approvals, packaging, distribution, and supply chain management to deliver products to healthcare providers.

How does distribution impact the sepsis treatment market in 2025?

Efficient distribution networks ensure that antibiotics, intravenous fluids, and diagnostic kits reach hospitals and clinics on time. Logistics challenges, such as cold chain storage for biologics, influence the availability and effectiveness of treatments.

What role do healthcare providers play in the midstream segment?

Hospitals, intensive care units, and emergency departments act as primary treatment centers, administering antibiotics and life-saving interventions. Their adoption of new technologies, adherence to treatment guidelines, and participation in clinical trials shape market demand.

How do regulations influence the midstream segment of the sepsis treatment market?

Stringent quality control measures, drug approval processes, and adherence to antimicrobial stewardship guidelines affect market dynamics. Regulatory agencies oversee manufacturing standards and clinical trial outcomes to ensure patient safety and treatment efficacy.

Market Downstream Analysis

Who are the key consumers in the downstream segment of the sepsis treatment market in 2025?

Hospitals, intensive care units, emergency departments, and outpatient clinics are the primary consumers. Patients, insurance providers, and government healthcare programs also play a crucial role in driving demand for sepsis treatment solutions.

How do patients access sepsis treatment in 2025?

Patients receive treatment through hospital admissions, emergency care, and specialized critical care units. Early diagnosis using rapid testing and telemedicine support improves accessibility, especially in remote and underserved areas.

What factors influence the adoption of sepsis treatments?

Treatment adoption depends on physician awareness, hospital protocols, drug availability, and healthcare reimbursement policies. The effectiveness of new antibiotics, immunotherapies, and AI-driven diagnostic tools also impacts clinical decision-making.

How do pricing and reimbursement affect the downstream market?

High treatment costs can be a barrier, but insurance coverage and government-funded healthcare programs help improve affordability. Pricing strategies for antibiotics and biologics are influenced by regulatory policies, market competition, and cost-effectiveness evaluations.

What are the key challenges in the downstream segment of the sepsis treatment market?

Challenges include delays in diagnosis, antibiotic resistance, disparities in healthcare access, and financial constraints in lower-income regions. Ensuring timely and effective treatment remains a priority to reduce mortality and improve patient outcomes.

Chapter 1, to describe Sepsis Treatment product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Sepsis Treatment, with revenue, gross margin and global market share of Sepsis Treatment from 2018 to 2023.

Chapter 3, the Sepsis Treatment competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Sepsis Treatment market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Sepsis Treatment.

Chapter 13, to describe Sepsis Treatment research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Sepsis Treatment

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Sepsis Treatment by Type

1.3.1 Overview: Global Sepsis Treatment Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Sepsis Treatment Consumption Value Market Share by Type in 2022

1.3.3 Cephalosporin

1.3.4 Pencillin

1.3.5 Macrolides

1.3.6 Others

1.4 Global Sepsis Treatment Market by Application

1.4.1 Overview: Global Sepsis Treatment Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Sepsis

1.4.3 Severe Sepsis

1.4.4 Septic Shock

1.5 Global Sepsis Treatment Market Size & Forecast

1.6 Global Sepsis Treatment Market Size and Forecast by Region

1.6.1 Global Sepsis Treatment Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Sepsis Treatment Market Size by Region, (2018-2029)

1.6.3 North America Sepsis Treatment Market Size and Prospect (2018-2029)

1.6.4 Europe Sepsis Treatment Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Sepsis Treatment Market Size and Prospect (2018-2029)

1.6.6 South America Sepsis Treatment Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Sepsis Treatment Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Pfizer

2.1.1 Pfizer Details

2.1.2 Pfizer Major Business

2.1.3 Pfizer Sepsis Treatment Product and Solutions

2.1.4 Pfizer Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Pfizer Recent Developments and Future Plans

2.2 NCPC

2.2.1 NCPC Details

2.2.2 NCPC Major Business

2.2.3 NCPC Sepsis Treatment Product and Solutions

2.2.4 NCPC Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 NCPC Recent Developments and Future Plans

2.3 Bayer

2.3.1 Bayer Details

2.3.2 Bayer Major Business

2.3.3 Bayer Sepsis Treatment Product and Solutions

2.3.4 Bayer Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Bayer Recent Developments and Future Plans

2.4 Shanghai Pharmaceuticals

2.4.1 Shanghai Pharmaceuticals Details

2.4.2 Shanghai Pharmaceuticals Major Business

2.4.3 Shanghai Pharmaceuticals Sepsis Treatment Product and Solutions

2.4.4 Shanghai Pharmaceuticals Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Shanghai Pharmaceuticals Recent Developments and Future Plans

2.5 Johnson & Johnson

2.5.1 Johnson & Johnson Details

2.5.2 Johnson & Johnson Major Business

2.5.3 Johnson & Johnson Sepsis Treatment Product and Solutions

2.5.4 Johnson & Johnson Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Johnson & Johnson Recent Developments and Future Plans

2.6 Novartis

2.6.1 Novartis Details

2.6.2 Novartis Major Business

2.6.3 Novartis Sepsis Treatment Product and Solutions

2.6.4 Novartis Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Novartis Recent Developments and Future Plans

2.7 GlaxoSmithKline

2.7.1 GlaxoSmithKline Details

2.7.2 GlaxoSmithKline Major Business

2.7.3 GlaxoSmithKline Sepsis Treatment Product and Solutions

2.7.4 GlaxoSmithKline Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 GlaxoSmithKline Recent Developments and Future Plans

2.8 TEVA

2.8.1 TEVA Details

2.8.2 TEVA Major Business

2.8.3 TEVA Sepsis Treatment Product and Solutions

2.8.4 TEVA Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 TEVA Recent Developments and Future Plans

2.9 Mylan

2.9.1 Mylan Details

2.9.2 Mylan Major Business

2.9.3 Mylan Sepsis Treatment Product and Solutions

2.9.4 Mylan Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Mylan Recent Developments and Future Plans

2.10 Allergan

2.10.1 Allergan Details

2.10.2 Allergan Major Business

2.10.3 Allergan Sepsis Treatment Product and Solutions

2.10.4 Allergan Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Allergan Recent Developments and Future Plans

2.11 Merck & Co

2.11.1 Merck & Co Details

2.11.2 Merck & Co Major Business

2.11.3 Merck & Co Sepsis Treatment Product and Solutions

2.11.4 Merck & Co Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Merck & Co Recent Developments and Future Plans

2.12 Asahi Kasei Corporation

2.12.1 Asahi Kasei Corporation Details

2.12.2 Asahi Kasei Corporation Major Business

2.12.3 Asahi Kasei Corporation Sepsis Treatment Product and Solutions

2.12.4 Asahi Kasei Corporation Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 Asahi Kasei Corporation Recent Developments and Future Plans

2.13 AtoxBio

2.13.1 AtoxBio Details

2.13.2 AtoxBio Major Business

2.13.3 AtoxBio Sepsis Treatment Product and Solutions

2.13.4 AtoxBio Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 AtoxBio Recent Developments and Future Plans

2.14 INOTREM

2.14.1 INOTREM Details

2.14.2 INOTREM Major Business

2.14.3 INOTREM Sepsis Treatment Product and Solutions

2.14.4 INOTREM Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 INOTREM Recent Developments and Future Plans

2.15 Adrenomed

2.15.1 Adrenomed Details

2.15.2 Adrenomed Major Business

2.15.3 Adrenomed Sepsis Treatment Product and Solutions

2.15.4 Adrenomed Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 Adrenomed Recent Developments and Future Plans

2.16 Endacea

2.16.1 Endacea Details

2.16.2 Endacea Major Business

2.16.3 Endacea Sepsis Treatment Product and Solutions

2.16.4 Endacea Sepsis Treatment Revenue, Gross Margin and Market Share (2018-2023)

2.16.5 Endacea Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Sepsis Treatment Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Sepsis Treatment by Company Revenue

3.2.2 Top 3 Sepsis Treatment Players Market Share in 2022

3.2.3 Top 6 Sepsis Treatment Players Market Share in 2022

3.3 Sepsis Treatment Market: Overall Company Footprint Analysis

3.3.1 Sepsis Treatment Market: Region Footprint

3.3.2 Sepsis Treatment Market: Company Product Type Footprint

3.3.3 Sepsis Treatment Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Sepsis Treatment Consumption Value and Market Share by Type (2018-2023)

4.2 Global Sepsis Treatment Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Sepsis Treatment Consumption Value Market Share by Application (2018-2023)

5.2 Global Sepsis Treatment Market Forecast by Application (2024-2029)

6 North America

6.1 North America Sepsis Treatment Consumption Value by Type (2018-2029)

6.2 North America Sepsis Treatment Consumption Value by Application (2018-2029)

6.3 North America Sepsis Treatment Market Size by Country

6.3.1 North America Sepsis Treatment Consumption Value by Country (2018-2029)

6.3.2 United States Sepsis Treatment Market Size and Forecast (2018-2029)

6.3.3 Canada Sepsis Treatment Market Size and Forecast (2018-2029)

6.3.4 Mexico Sepsis Treatment Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Sepsis Treatment Consumption Value by Type (2018-2029)

7.2 Europe Sepsis Treatment Consumption Value by Application (2018-2029)

7.3 Europe Sepsis Treatment Market Size by Country

7.3.1 Europe Sepsis Treatment Consumption Value by Country (2018-2029)

7.3.2 Germany Sepsis Treatment Market Size and Forecast (2018-2029)

7.3.3 France Sepsis Treatment Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Sepsis Treatment Market Size and Forecast (2018-2029)

7.3.5 Russia Sepsis Treatment Market Size and Forecast (2018-2029)

7.3.6 Italy Sepsis Treatment Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Sepsis Treatment Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Sepsis Treatment Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Sepsis Treatment Market Size by Region

8.3.1 Asia-Pacific Sepsis Treatment Consumption Value by Region (2018-2029)

8.3.2 China Sepsis Treatment Market Size and Forecast (2018-2029)

8.3.3 Japan Sepsis Treatment Market Size and Forecast (2018-2029)

8.3.4 South Korea Sepsis Treatment Market Size and Forecast (2018-2029)

8.3.5 India Sepsis Treatment Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Sepsis Treatment Market Size and Forecast (2018-2029)

8.3.7 Australia Sepsis Treatment Market Size and Forecast (2018-2029)

9 South America

9.1 South America Sepsis Treatment Consumption Value by Type (2018-2029)

9.2 South America Sepsis Treatment Consumption Value by Application (2018-2029)

9.3 South America Sepsis Treatment Market Size by Country

9.3.1 South America Sepsis Treatment Consumption Value by Country (2018-2029)

9.3.2 Brazil Sepsis Treatment Market Size and Forecast (2018-2029)

9.3.3 Argentina Sepsis Treatment Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Sepsis Treatment Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Sepsis Treatment Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Sepsis Treatment Market Size by Country

10.3.1 Middle East & Africa Sepsis Treatment Consumption Value by Country (2018-2029)

10.3.2 Turkey Sepsis Treatment Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Sepsis Treatment Market Size and Forecast (2018-2029)

10.3.4 UAE Sepsis Treatment Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Sepsis Treatment Market Drivers

11.2 Sepsis Treatment Market Restraints

11.3 Sepsis Treatment Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Sepsis Treatment Industry Chain

12.2 Sepsis Treatment Upstream Analysis

12.3 Sepsis Treatment Midstream Analysis

12.4 Sepsis Treatment Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

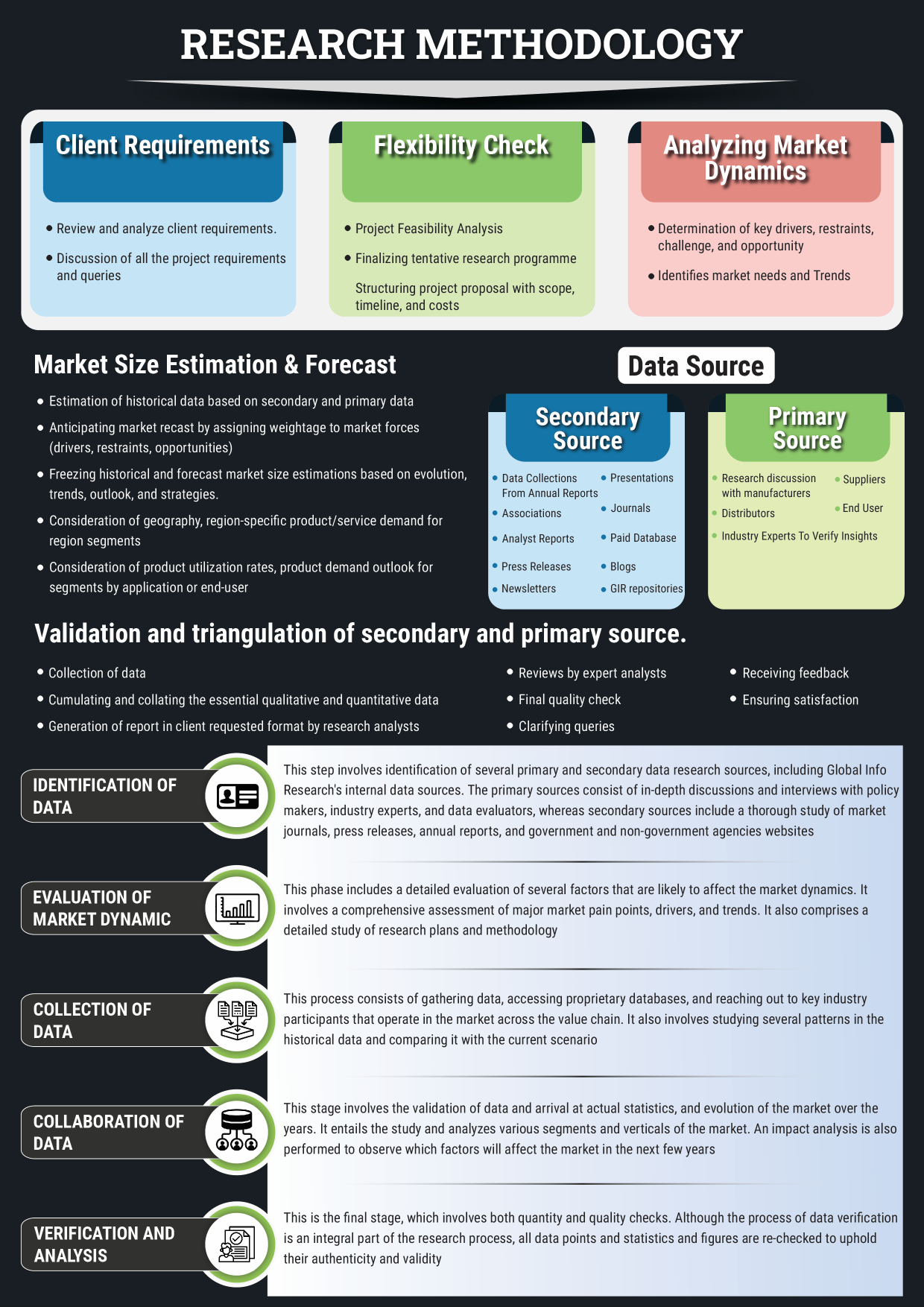

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Sepsis Treatment Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Sepsis Treatment Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Sepsis Treatment Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Sepsis Treatment Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Pfizer Company Information, Head Office, and Major Competitors

Table 6. Pfizer Major Business

Table 7. Pfizer Sepsis Treatment Product and Solutions

Table 8. Pfizer Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Pfizer Recent Developments and Future Plans

Table 10. NCPC Company Information, Head Office, and Major Competitors

Table 11. NCPC Major Business

Table 12. NCPC Sepsis Treatment Product and Solutions

Table 13. NCPC Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. NCPC Recent Developments and Future Plans

Table 15. Bayer Company Information, Head Office, and Major Competitors

Table 16. Bayer Major Business

Table 17. Bayer Sepsis Treatment Product and Solutions

Table 18. Bayer Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. Bayer Recent Developments and Future Plans

Table 20. Shanghai Pharmaceuticals Company Information, Head Office, and Major Competitors

Table 21. Shanghai Pharmaceuticals Major Business

Table 22. Shanghai Pharmaceuticals Sepsis Treatment Product and Solutions

Table 23. Shanghai Pharmaceuticals Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Shanghai Pharmaceuticals Recent Developments and Future Plans

Table 25. Johnson & Johnson Company Information, Head Office, and Major Competitors

Table 26. Johnson & Johnson Major Business

Table 27. Johnson & Johnson Sepsis Treatment Product and Solutions

Table 28. Johnson & Johnson Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. Johnson & Johnson Recent Developments and Future Plans

Table 30. Novartis Company Information, Head Office, and Major Competitors

Table 31. Novartis Major Business

Table 32. Novartis Sepsis Treatment Product and Solutions

Table 33. Novartis Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Novartis Recent Developments and Future Plans

Table 35. GlaxoSmithKline Company Information, Head Office, and Major Competitors

Table 36. GlaxoSmithKline Major Business

Table 37. GlaxoSmithKline Sepsis Treatment Product and Solutions

Table 38. GlaxoSmithKline Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. GlaxoSmithKline Recent Developments and Future Plans

Table 40. TEVA Company Information, Head Office, and Major Competitors

Table 41. TEVA Major Business

Table 42. TEVA Sepsis Treatment Product and Solutions

Table 43. TEVA Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. TEVA Recent Developments and Future Plans

Table 45. Mylan Company Information, Head Office, and Major Competitors

Table 46. Mylan Major Business

Table 47. Mylan Sepsis Treatment Product and Solutions

Table 48. Mylan Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. Mylan Recent Developments and Future Plans

Table 50. Allergan Company Information, Head Office, and Major Competitors

Table 51. Allergan Major Business

Table 52. Allergan Sepsis Treatment Product and Solutions

Table 53. Allergan Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Allergan Recent Developments and Future Plans

Table 55. Merck & Co Company Information, Head Office, and Major Competitors

Table 56. Merck & Co Major Business

Table 57. Merck & Co Sepsis Treatment Product and Solutions

Table 58. Merck & Co Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 59. Merck & Co Recent Developments and Future Plans

Table 60. Asahi Kasei Corporation Company Information, Head Office, and Major Competitors

Table 61. Asahi Kasei Corporation Major Business

Table 62. Asahi Kasei Corporation Sepsis Treatment Product and Solutions

Table 63. Asahi Kasei Corporation Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 64. Asahi Kasei Corporation Recent Developments and Future Plans

Table 65. AtoxBio Company Information, Head Office, and Major Competitors

Table 66. AtoxBio Major Business

Table 67. AtoxBio Sepsis Treatment Product and Solutions

Table 68. AtoxBio Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 69. AtoxBio Recent Developments and Future Plans

Table 70. INOTREM Company Information, Head Office, and Major Competitors

Table 71. INOTREM Major Business

Table 72. INOTREM Sepsis Treatment Product and Solutions

Table 73. INOTREM Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 74. INOTREM Recent Developments and Future Plans

Table 75. Adrenomed Company Information, Head Office, and Major Competitors

Table 76. Adrenomed Major Business

Table 77. Adrenomed Sepsis Treatment Product and Solutions

Table 78. Adrenomed Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 79. Adrenomed Recent Developments and Future Plans

Table 80. Endacea Company Information, Head Office, and Major Competitors

Table 81. Endacea Major Business

Table 82. Endacea Sepsis Treatment Product and Solutions

Table 83. Endacea Sepsis Treatment Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 84. Endacea Recent Developments and Future Plans

Table 85. Global Sepsis Treatment Revenue (USD Million) by Players (2018-2023)

Table 86. Global Sepsis Treatment Revenue Share by Players (2018-2023)

Table 87. Breakdown of Sepsis Treatment by Company Type (Tier 1, Tier 2, and Tier 3)

Table 88. Market Position of Players in Sepsis Treatment, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 89. Head Office of Key Sepsis Treatment Players

Table 90. Sepsis Treatment Market: Company Product Type Footprint

Table 91. Sepsis Treatment Market: Company Product Application Footprint

Table 92. Sepsis Treatment New Market Entrants and Barriers to Market Entry

Table 93. Sepsis Treatment Mergers, Acquisition, Agreements, and Collaborations

Table 94. Global Sepsis Treatment Consumption Value (USD Million) by Type (2018-2023)

Table 95. Global Sepsis Treatment Consumption Value Share by Type (2018-2023)

Table 96. Global Sepsis Treatment Consumption Value Forecast by Type (2024-2029)

Table 97. Global Sepsis Treatment Consumption Value by Application (2018-2023)

Table 98. Global Sepsis Treatment Consumption Value Forecast by Application (2024-2029)

Table 99. North America Sepsis Treatment Consumption Value by Type (2018-2023) & (USD Million)

Table 100. North America Sepsis Treatment Consumption Value by Type (2024-2029) & (USD Million)

Table 101. North America Sepsis Treatment Consumption Value by Application (2018-2023) & (USD Million)

Table 102. North America Sepsis Treatment Consumption Value by Application (2024-2029) & (USD Million)

Table 103. North America Sepsis Treatment Consumption Value by Country (2018-2023) & (USD Million)

Table 104. North America Sepsis Treatment Consumption Value by Country (2024-2029) & (USD Million)

Table 105. Europe Sepsis Treatment Consumption Value by Type (2018-2023) & (USD Million)

Table 106. Europe Sepsis Treatment Consumption Value by Type (2024-2029) & (USD Million)

Table 107. Europe Sepsis Treatment Consumption Value by Application (2018-2023) & (USD Million)

Table 108. Europe Sepsis Treatment Consumption Value by Application (2024-2029) & (USD Million)

Table 109. Europe Sepsis Treatment Consumption Value by Country (2018-2023) & (USD Million)

Table 110. Europe Sepsis Treatment Consumption Value by Country (2024-2029) & (USD Million)

Table 111. Asia-Pacific Sepsis Treatment Consumption Value by Type (2018-2023) & (USD Million)

Table 112. Asia-Pacific Sepsis Treatment Consumption Value by Type (2024-2029) & (USD Million)

Table 113. Asia-Pacific Sepsis Treatment Consumption Value by Application (2018-2023) & (USD Million)

Table 114. Asia-Pacific Sepsis Treatment Consumption Value by Application (2024-2029) & (USD Million)

Table 115. Asia-Pacific Sepsis Treatment Consumption Value by Region (2018-2023) & (USD Million)

Table 116. Asia-Pacific Sepsis Treatment Consumption Value by Region (2024-2029) & (USD Million)

Table 117. South America Sepsis Treatment Consumption Value by Type (2018-2023) & (USD Million)

Table 118. South America Sepsis Treatment Consumption Value by Type (2024-2029) & (USD Million)

Table 119. South America Sepsis Treatment Consumption Value by Application (2018-2023) & (USD Million)

Table 120. South America Sepsis Treatment Consumption Value by Application (2024-2029) & (USD Million)

Table 121. South America Sepsis Treatment Consumption Value by Country (2018-2023) & (USD Million)

Table 122. South America Sepsis Treatment Consumption Value by Country (2024-2029) & (USD Million)

Table 123. Middle East & Africa Sepsis Treatment Consumption Value by Type (2018-2023) & (USD Million)

Table 124. Middle East & Africa Sepsis Treatment Consumption Value by Type (2024-2029) & (USD Million)

Table 125. Middle East & Africa Sepsis Treatment Consumption Value by Application (2018-2023) & (USD Million)

Table 126. Middle East & Africa Sepsis Treatment Consumption Value by Application (2024-2029) & (USD Million)

Table 127. Middle East & Africa Sepsis Treatment Consumption Value by Country (2018-2023) & (USD Million)

Table 128. Middle East & Africa Sepsis Treatment Consumption Value by Country (2024-2029) & (USD Million)

Table 129. Sepsis Treatment Raw Material

Table 130. Key Suppliers of Sepsis Treatment Raw Materials

List of Figures

Figure 1. Sepsis Treatment Picture

Figure 2. Global Sepsis Treatment Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Sepsis Treatment Consumption Value Market Share by Type in 2022

Figure 4. Cephalosporin

Figure 5. Pencillin

Figure 6. Macrolides

Figure 7. Others

Figure 8. Global Sepsis Treatment Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 9. Sepsis Treatment Consumption Value Market Share by Application in 2022

Figure 10. Sepsis Picture

Figure 11. Severe Sepsis Picture

Figure 12. Septic Shock Picture

Figure 13. Global Sepsis Treatment Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 14. Global Sepsis Treatment Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 15. Global Market Sepsis Treatment Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 16. Global Sepsis Treatment Consumption Value Market Share by Region (2018-2029)

Figure 17. Global Sepsis Treatment Consumption Value Market Share by Region in 2022

Figure 18. North America Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 19. Europe Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 20. Asia-Pacific Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 21. South America Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 22. Middle East and Africa Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 23. Global Sepsis Treatment Revenue Share by Players in 2022

Figure 24. Sepsis Treatment Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 25. Global Top 3 Players Sepsis Treatment Market Share in 2022

Figure 26. Global Top 6 Players Sepsis Treatment Market Share in 2022

Figure 27. Global Sepsis Treatment Consumption Value Share by Type (2018-2023)

Figure 28. Global Sepsis Treatment Market Share Forecast by Type (2024-2029)

Figure 29. Global Sepsis Treatment Consumption Value Share by Application (2018-2023)

Figure 30. Global Sepsis Treatment Market Share Forecast by Application (2024-2029)

Figure 31. North America Sepsis Treatment Consumption Value Market Share by Type (2018-2029)

Figure 32. North America Sepsis Treatment Consumption Value Market Share by Application (2018-2029)

Figure 33. North America Sepsis Treatment Consumption Value Market Share by Country (2018-2029)

Figure 34. United States Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 35. Canada Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 36. Mexico Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 37. Europe Sepsis Treatment Consumption Value Market Share by Type (2018-2029)

Figure 38. Europe Sepsis Treatment Consumption Value Market Share by Application (2018-2029)

Figure 39. Europe Sepsis Treatment Consumption Value Market Share by Country (2018-2029)

Figure 40. Germany Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 41. France Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 42. United Kingdom Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 43. Russia Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 44. Italy Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 45. Asia-Pacific Sepsis Treatment Consumption Value Market Share by Type (2018-2029)

Figure 46. Asia-Pacific Sepsis Treatment Consumption Value Market Share by Application (2018-2029)

Figure 47. Asia-Pacific Sepsis Treatment Consumption Value Market Share by Region (2018-2029)

Figure 48. China Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 49. Japan Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 50. South Korea Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 51. India Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 52. Southeast Asia Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 53. Australia Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 54. South America Sepsis Treatment Consumption Value Market Share by Type (2018-2029)

Figure 55. South America Sepsis Treatment Consumption Value Market Share by Application (2018-2029)

Figure 56. South America Sepsis Treatment Consumption Value Market Share by Country (2018-2029)

Figure 57. Brazil Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 58. Argentina Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 59. Middle East and Africa Sepsis Treatment Consumption Value Market Share by Type (2018-2029)

Figure 60. Middle East and Africa Sepsis Treatment Consumption Value Market Share by Application (2018-2029)

Figure 61. Middle East and Africa Sepsis Treatment Consumption Value Market Share by Country (2018-2029)

Figure 62. Turkey Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 63. Saudi Arabia Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 64. UAE Sepsis Treatment Consumption Value (2018-2029) & (USD Million)

Figure 65. Sepsis Treatment Market Drivers

Figure 66. Sepsis Treatment Market Restraints

Figure 67. Sepsis Treatment Market Trends

Figure 68. Porters Five Forces Analysis

Figure 69. Manufacturing Cost Structure Analysis of Sepsis Treatment in 2022

Figure 70. Manufacturing Process Analysis of Sepsis Treatment

Figure 71. Sepsis Treatment Industrial Chain

Figure 72. Methodology

Figure 73. Research Process and Data Source