Medical Catheters Market 2025: Key Trends, Growth Drivers, and Strategic Outlook

The medical catheters market is witnessing dynamic growth as advances in healthcare and rising chronic disease prevalence drive increasing demand for catheter-based procedures. Medical catheters play a crucial role across diverse clinical applications including cardiovascular interventions, urology, and critical care, making them essential in modern medical practice. Heading into 2025, this market is poised for significant transformation, propelled by technological innovation, expanding patient populations, and evolving regional healthcare dynamics.

What’s Driving the Growth of the Medical Catheters Market?

Several critical factors are fueling the expansion of the medical catheters market globally:

- Rising Chronic Disease Burden: The increasing prevalence of cardiovascular diseases, kidney disorders, and urinary tract complications necessitates frequent catheter use for diagnosis and treatment.

- Aging Population: With the global population aging rapidly, age-related medical conditions requiring catheterization, such as urinary retention and vascular access for therapies, are on the rise.

- Minimally Invasive Procedures: The shift towards minimally invasive surgeries boosts catheter demand as these devices offer safer, less painful alternatives with faster recovery.

- Expanding Healthcare Infrastructure: Especially in emerging economies, improvements in hospitals and clinics, along with rising healthcare spending, increase access to advanced catheter technologies.

- Awareness and Accessibility: Greater patient awareness about catheter-based treatments and improved insurance coverage drive adoption and market penetration.

Innovations Revolutionizing Medical Catheters

Technology remains the cornerstone of growth and differentiation in the catheter market. Manufacturers are innovating to enhance device safety, performance, and patient comfort.

Key innovations include:

- Antimicrobial and Anti-Thrombogenic Coatings: These coatings help reduce infection risks and blood clot formation, two major concerns associated with catheter use.

- Smart Catheters: Integration of sensors and IoT technology enables real-time monitoring of physiological data, allowing healthcare providers to track patient conditions closely and respond proactively.

- Advanced Materials: Use of biocompatible, flexible, and durable materials reduces patient discomfort and enhances catheter lifespan.

- Eco-Friendly Designs: Increasing focus on sustainability has led to the development of biodegradable and recyclable catheters, aligning with global environmental initiatives.

- Digital Integration: Catheters paired with digital health platforms facilitate remote monitoring, data analytics, and improved patient management.

Regional Market Dynamics: Opportunities and Challenges

The medical catheters market’s growth varies across regions, shaped by healthcare maturity, regulatory frameworks, and economic factors.

- North America

North America dominates the market with its well-established healthcare infrastructure, high adoption of minimally invasive techniques, and strong regulatory environment. The U.S. leads innovation and demand, supported by robust reimbursement policies and advanced patient care standards. - Europe

Europe shows steady growth driven by aging demographics and increasing chronic disease rates. Regulatory rigor ensures product safety and quality, while digital health adoption supports advanced catheter usage. - Asia-Pacific

Asia-Pacific is the fastest-growing market, fueled by rapid urbanization, rising healthcare expenditure, and expanding access to quality medical facilities. Countries like China, India, and Japan offer vast growth potential, although affordability and regulatory complexity present challenges. - Latin America, Middle East & Africa

These emerging regions are beginning to embrace catheterization more widely due to rising disease awareness and healthcare infrastructure improvements. However, economic disparities and supply chain issues require customized approaches.

Strategic Considerations for Market Leaders

To capture market share and sustain growth, companies should focus on the following strategic priorities:

- Innovation and R&D Investment: Developing safer, smarter, and more patient-friendly catheter technologies to meet evolving clinical needs.

- Expansion into Emerging Markets: Tailoring pricing, distribution, and product offerings to suit local healthcare environments and economic conditions.

- Regulatory Excellence: Maintaining compliance with international and regional standards to ensure market access and build stakeholder trust.

- Sustainability Initiatives: Incorporating eco-friendly materials and manufacturing practices to address environmental concerns.

- Patient and Provider Education: Enhancing training programs to improve catheter use, adherence, and clinical outcomes.

- Strategic Partnerships: Collaborating with healthcare providers, technology companies, and research institutions to foster innovation and market reach.

Conclusion: A Robust Outlook for the Medical Catheters Market in 2025

The medical catheters market is set for sustained expansion through 2025, driven by increasing chronic disease prevalence, technological breakthroughs, and growing healthcare accessibility worldwide. As patient-centric care and minimally invasive procedures become standard, catheters will remain vital tools in improving clinical outcomes and patient quality of life.

Industry players that combine innovation with strategic market penetration, regulatory agility, and sustainability focus are best positioned to lead the market forward. By addressing region-specific needs and integrating digital health solutions, companies can unlock new growth avenues and contribute meaningfully to global healthcare advancement.

NOTE:

Quants and Trends is proud to offer an extensive portfolio of meticulously researched healthcare market reports, numbering in the thousands. We also provide tailored customization services to ensure our insights align precisely with your strategic objectives and informational needs. For personalized assistance or to discuss your specific requirements, we invite you to get in touch with our team. We also encourage you to request a complimentary sample PDF report. Please visit our Sample Request Page to receive yours today.

Key Market Players

Teleflex

Edwards Lifesciences

Coloplast

B. Braun

BD

TuoRen

Smith Medical

Baihe Medical

Cook Medical

WellLead

Sewoon Medical

Medtronic

Lepu Medical

SCW MEDICATH

Medi-Globe

Segmentation By Type

Cardiovascular Catheters

Neurovascular Catheters

Intravenous Catheters

Urology Catheters

Others

Segmentation By Application

Hospitals

Clinic

Others

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the medical catheters market in 2025?

The medical catheters market in 2025 benefits from technological advancements, leading to the development of innovative and safer catheter designs. Additionally, the increasing prevalence of chronic diseases and the growing demand for minimally invasive procedures drive market growth.

What are the weaknesses of the medical catheters market in 2025?

One significant weakness is the risk of infections associated with catheter use, which can lead to complications and increased healthcare costs. Furthermore, the high cost of advanced catheters may limit access for smaller healthcare facilities.

What are the opportunities for the medical catheters market in 2025?

The market presents opportunities for expansion in emerging economies where healthcare infrastructure is improving. Additionally, increasing investments in research and development can lead to the introduction of advanced catheter technologies, enhancing patient outcomes.

What are the threats to the medical catheters market in 2025?

The medical catheters market faces threats from stringent regulatory requirements and potential product recalls that can hinder market growth. Moreover, competition from alternative treatment options and the rise of telemedicine may impact the demand for traditional catheter products.

Market PESTEL Analysis

What are the political factors affecting the medical catheters market in 2025?

Government regulations on medical devices, including strict approval processes and quality control standards, impact market growth. Additionally, policies related to healthcare funding and reimbursement influence the accessibility of catheter-based treatments.

What are the economic factors influencing the medical catheters market in 2025?

Economic growth in emerging markets creates opportunities for expansion, while fluctuating raw material costs may affect pricing. Healthcare budget constraints in certain regions could also limit the adoption of advanced catheter technologies.

What are the social factors shaping the medical catheters market in 2025?

An aging global population and the rising prevalence of chronic conditions, such as cardiovascular diseases and urinary disorders, drive demand. Additionally, growing awareness about infection control promotes the use of antimicrobial-coated catheters.

What are the technological factors impacting the medical catheters market in 2025?

Advancements in material science and smart catheter technologies improve product performance and patient safety. The integration of sensors and AI-driven monitoring systems enhances real-time diagnostics and treatment outcomes.

What are the environmental factors affecting the medical catheters market in 2025?

Sustainability concerns drive innovation in biodegradable and eco-friendly catheter materials. Additionally, stringent waste disposal regulations for single-use medical devices increase the focus on sustainable manufacturing practices.

What are the legal factors influencing the medical catheters market in 2025?

Compliance with international medical device regulations, such as FDA and CE Marking requirements, remains crucial. Intellectual property rights and patent disputes also play a role in shaping market competition and innovation.

Market SIPOC Analysis

What are the suppliers in the medical catheters market in 2025?

Suppliers in the medical catheters market include manufacturers of raw materials such as polymers, metals, and biocompatible coatings. Additionally, equipment providers for catheter production and research organizations contribute to the supply chain.

Who are the inputs in the medical catheters market in 2025?

Inputs consist of high-quality raw materials used in catheter production, advanced manufacturing technologies, and skilled labor. Regulatory standards and research data on materials and designs also serve as essential inputs for development.

What are the processes involved in the medical catheters market in 2025?

Key processes include product design and development, material selection, manufacturing, quality control, and regulatory compliance. Additionally, marketing and distribution strategies play a crucial role in bringing products to market.

Who are the outputs in the medical catheters market in 2025?

Outputs include a variety of medical catheters, such as intravenous catheters, urinary catheters, and cardiovascular catheters. These products are designed to meet specific clinical needs and improve patient outcomes.

Who are the customers in the medical catheters market in 2025?

Customers include hospitals, outpatient surgical centers, clinics, and healthcare professionals who require medical catheters for patient care. Additionally, distributors and healthcare organizations play a role in purchasing and supplying these products to end-users.

Market Porter's Five Forces

What is the competitive rivalry in the medical catheters market in 2025?

The market is highly competitive, with major players investing in research and development to introduce innovative catheter designs. Price competition, product differentiation, and brand reputation play a significant role in market positioning.

What is the threat of new entrants in the medical catheters market in 2025?

High regulatory barriers, the need for advanced manufacturing capabilities, and significant research costs make entry challenging for new companies. However, emerging startups with breakthrough technologies may disrupt the market.

What is the bargaining power of suppliers in the medical catheters market in 2025?

Suppliers of raw materials, such as polymers and coatings, hold moderate power due to the specialized nature of medical-grade materials. However, established manufacturers can negotiate favorable terms by leveraging bulk purchasing.

What is the bargaining power of buyers in the medical catheters market in 2025?

Hospitals and healthcare providers have strong bargaining power, demanding high-quality catheters at competitive prices. Bulk purchasing agreements and long-term supplier contracts further influence pricing and product availability.

What is the threat of substitutes in the medical catheters market in 2025?

The threat of substitutes is low, as catheters play a critical role in various medical procedures. However, advancements in non-invasive treatment options and alternative drug therapies may reduce demand in specific applications.

Market Upstream Analysis

What are the key raw materials used in the medical catheters market in 2025?

Medical catheters are primarily made from biocompatible materials such as silicone, polyurethane, and latex. Additionally, specialized coatings like hydrophilic and antimicrobial layers enhance performance and safety.

Who are the major suppliers in the upstream medical catheters market in 2025?

Suppliers include manufacturers of medical-grade polymers, metal components, and coatings required for catheter production. Global chemical companies and specialized medical material providers play a crucial role in the supply chain.

What are the challenges faced in the upstream supply chain of the medical catheters market in 2025?

Supply chain disruptions, fluctuating raw material costs, and stringent regulatory requirements pose significant challenges. Ensuring a consistent supply of high-quality materials remains a priority for manufacturers.

How does technological advancement impact the upstream medical catheters market in 2025?

Innovations in material science and manufacturing techniques improve catheter performance and durability. Advanced 3D printing and automation streamline production, reducing waste and enhancing efficiency.

What role do regulations play in the upstream medical catheters market in 2025?

Regulatory bodies impose strict quality and safety standards on raw materials to ensure patient safety. Compliance with FDA, CE, and ISO guidelines is essential for suppliers to maintain market access.

Market Midstream Analysis

What are the key processes involved in the midstream medical catheters market in 2025?

The midstream segment includes catheter manufacturing, quality control, sterilization, and packaging. Advanced production techniques, such as extrusion and 3D printing, ensure precision and consistency in catheter design.

Who are the major players in the midstream medical catheters market in 2025?

Leading medical device manufacturers, contract manufacturing organizations, and specialized catheter producers dominate this stage. These companies focus on innovation, regulatory compliance, and large-scale production to meet global demand.

What are the quality and safety considerations in the midstream medical catheters market in 2025?

Strict adherence to Good Manufacturing Practices (GMP) and ISO standards is crucial to ensure product safety. Sterilization methods, such as ethylene oxide and gamma radiation, play a key role in preventing infections.

How does technology impact the midstream medical catheters market in 2025?

Automation, artificial intelligence, and robotics enhance production efficiency and reduce human errors. Smart catheter technologies with embedded sensors improve functionality and expand the scope of medical applications.

What are the challenges faced in the midstream medical catheters market in 2025?

Rising production costs, regulatory scrutiny, and supply chain disruptions pose challenges. Additionally, the need for continuous innovation to differentiate products in a competitive market adds pressure on manufacturers.

Market Downstream Analysis

What are the key distribution channels in the downstream medical catheters market in 2025?

Medical catheters are distributed through hospitals, clinics, online medical suppliers, and specialized distributors. Bulk purchasing agreements and direct partnerships with healthcare providers streamline supply chains.

Who are the primary end-users in the medical catheters market in 2025?

Hospitals, surgical centers, home healthcare providers, and outpatient clinics are the main end-users. Increasing demand for minimally invasive procedures and chronic disease management drives catheter adoption.

How does customer demand shape the downstream medical catheters market in 2025?

Rising awareness of infection control, preference for single-use catheters, and demand for technologically advanced products influence purchasing decisions. Healthcare providers seek high-quality, cost-effective solutions for better patient outcomes.

What challenges exist in the downstream medical catheters market in 2025?

Price sensitivity, reimbursement complexities, and regulatory requirements impact sales and distribution. Additionally, competition from alternative treatment options may affect long-term demand.

How do service and support play a role in the downstream medical catheters market in 2025?

After-sales support, including training for healthcare professionals and customer service for troubleshooting, enhances product adoption. Manufacturers offer warranties and educational resources to ensure optimal catheter use.

Chapter 1, to describe Medical Catheters product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Medical Catheters, with price, sales, revenue and global market share of Medical Catheters from 2018 to 2023.

Chapter 3, the Medical Catheters competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Medical Catheters breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Medical Catheters market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of Medical Catheters.

Chapter 14 and 15, to describe Medical Catheters sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Medical Catheters

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Medical Catheters Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 Cardiovascular Catheters

1.3.3 Neurovascular Catheters

1.3.4 Intravenous Catheters

1.3.5 Urology Catheters

1.3.6 Others

1.4 Market Analysis by Application

1.4.1 Overview: Global Medical Catheters Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospitals

1.4.3 Clinic

1.4.4 Others

1.5 Global Medical Catheters Market Size & Forecast

1.5.1 Global Medical Catheters Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Medical Catheters Sales Quantity (2018-2029)

1.5.3 Global Medical Catheters Average Price (2018-2029)

2 Manufacturers Profiles

2.1 Teleflex

2.1.1 Teleflex Details

2.1.2 Teleflex Major Business

2.1.3 Teleflex Medical Catheters Product and Services

2.1.4 Teleflex Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Teleflex Recent Developments/Updates

2.2 Edwards Lifesciences

2.2.1 Edwards Lifesciences Details

2.2.2 Edwards Lifesciences Major Business

2.2.3 Edwards Lifesciences Medical Catheters Product and Services

2.2.4 Edwards Lifesciences Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Edwards Lifesciences Recent Developments/Updates

2.3 Coloplast

2.3.1 Coloplast Details

2.3.2 Coloplast Major Business

2.3.3 Coloplast Medical Catheters Product and Services

2.3.4 Coloplast Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Coloplast Recent Developments/Updates

2.4 B. Braun

2.4.1 B. Braun Details

2.4.2 B. Braun Major Business

2.4.3 B. Braun Medical Catheters Product and Services

2.4.4 B. Braun Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 B. Braun Recent Developments/Updates

2.5 BD

2.5.1 BD Details

2.5.2 BD Major Business

2.5.3 BD Medical Catheters Product and Services

2.5.4 BD Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 BD Recent Developments/Updates

2.6 TuoRen

2.6.1 TuoRen Details

2.6.2 TuoRen Major Business

2.6.3 TuoRen Medical Catheters Product and Services

2.6.4 TuoRen Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 TuoRen Recent Developments/Updates

2.7 Smith Medical

2.7.1 Smith Medical Details

2.7.2 Smith Medical Major Business

2.7.3 Smith Medical Medical Catheters Product and Services

2.7.4 Smith Medical Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Smith Medical Recent Developments/Updates

2.8 Baihe Medical

2.8.1 Baihe Medical Details

2.8.2 Baihe Medical Major Business

2.8.3 Baihe Medical Medical Catheters Product and Services

2.8.4 Baihe Medical Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Baihe Medical Recent Developments/Updates

2.9 Cook Medical

2.9.1 Cook Medical Details

2.9.2 Cook Medical Major Business

2.9.3 Cook Medical Medical Catheters Product and Services

2.9.4 Cook Medical Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Cook Medical Recent Developments/Updates

2.10 WellLead

2.10.1 WellLead Details

2.10.2 WellLead Major Business

2.10.3 WellLead Medical Catheters Product and Services

2.10.4 WellLead Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 WellLead Recent Developments/Updates

2.11 Sewoon Medical

2.11.1 Sewoon Medical Details

2.11.2 Sewoon Medical Major Business

2.11.3 Sewoon Medical Medical Catheters Product and Services

2.11.4 Sewoon Medical Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Sewoon Medical Recent Developments/Updates

2.12 Medtronic

2.12.1 Medtronic Details

2.12.2 Medtronic Major Business

2.12.3 Medtronic Medical Catheters Product and Services

2.12.4 Medtronic Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 Medtronic Recent Developments/Updates

2.13 Lepu Medical

2.13.1 Lepu Medical Details

2.13.2 Lepu Medical Major Business

2.13.3 Lepu Medical Medical Catheters Product and Services

2.13.4 Lepu Medical Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Lepu Medical Recent Developments/Updates

2.14 SCW MEDICATH

2.14.1 SCW MEDICATH Details

2.14.2 SCW MEDICATH Major Business

2.14.3 SCW MEDICATH Medical Catheters Product and Services

2.14.4 SCW MEDICATH Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 SCW MEDICATH Recent Developments/Updates

2.15 Medi-Globe

2.15.1 Medi-Globe Details

2.15.2 Medi-Globe Major Business

2.15.3 Medi-Globe Medical Catheters Product and Services

2.15.4 Medi-Globe Medical Catheters Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 Medi-Globe Recent Developments/Updates

3 Competitive Environment: Medical Catheters by Manufacturer

3.1 Global Medical Catheters Sales Quantity by Manufacturer (2018-2023)

3.2 Global Medical Catheters Revenue by Manufacturer (2018-2023)

3.3 Global Medical Catheters Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Medical Catheters by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Medical Catheters Manufacturer Market Share in 2022

3.4.2 Top 6 Medical Catheters Manufacturer Market Share in 2022

3.5 Medical Catheters Market: Overall Company Footprint Analysis

3.5.1 Medical Catheters Market: Region Footprint

3.5.2 Medical Catheters Market: Company Product Type Footprint

3.5.3 Medical Catheters Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Medical Catheters Market Size by Region

4.1.1 Global Medical Catheters Sales Quantity by Region (2018-2029)

4.1.2 Global Medical Catheters Consumption Value by Region (2018-2029)

4.1.3 Global Medical Catheters Average Price by Region (2018-2029)

4.2 North America Medical Catheters Consumption Value (2018-2029)

4.3 Europe Medical Catheters Consumption Value (2018-2029)

4.4 Asia-Pacific Medical Catheters Consumption Value (2018-2029)

4.5 South America Medical Catheters Consumption Value (2018-2029)

4.6 Middle East and Africa Medical Catheters Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Medical Catheters Sales Quantity by Type (2018-2029)

5.2 Global Medical Catheters Consumption Value by Type (2018-2029)

5.3 Global Medical Catheters Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Medical Catheters Sales Quantity by Application (2018-2029)

6.2 Global Medical Catheters Consumption Value by Application (2018-2029)

6.3 Global Medical Catheters Average Price by Application (2018-2029)

7 North America

7.1 North America Medical Catheters Sales Quantity by Type (2018-2029)

7.2 North America Medical Catheters Sales Quantity by Application (2018-2029)

7.3 North America Medical Catheters Market Size by Country

7.3.1 North America Medical Catheters Sales Quantity by Country (2018-2029)

7.3.2 North America Medical Catheters Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Medical Catheters Sales Quantity by Type (2018-2029)

8.2 Europe Medical Catheters Sales Quantity by Application (2018-2029)

8.3 Europe Medical Catheters Market Size by Country

8.3.1 Europe Medical Catheters Sales Quantity by Country (2018-2029)

8.3.2 Europe Medical Catheters Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Medical Catheters Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Medical Catheters Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Medical Catheters Market Size by Region

9.3.1 Asia-Pacific Medical Catheters Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Medical Catheters Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Medical Catheters Sales Quantity by Type (2018-2029)

10.2 South America Medical Catheters Sales Quantity by Application (2018-2029)

10.3 South America Medical Catheters Market Size by Country

10.3.1 South America Medical Catheters Sales Quantity by Country (2018-2029)

10.3.2 South America Medical Catheters Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Medical Catheters Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Medical Catheters Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Medical Catheters Market Size by Country

11.3.1 Middle East & Africa Medical Catheters Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Medical Catheters Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Medical Catheters Market Drivers

12.2 Medical Catheters Market Restraints

12.3 Medical Catheters Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of Medical Catheters and Key Manufacturers

13.2 Manufacturing Costs Percentage of Medical Catheters

13.3 Medical Catheters Production Process

13.4 Medical Catheters Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Medical Catheters Typical Distributors

14.3 Medical Catheters Typical Customers

15 Research Findings and Conclusion

16 Appendix

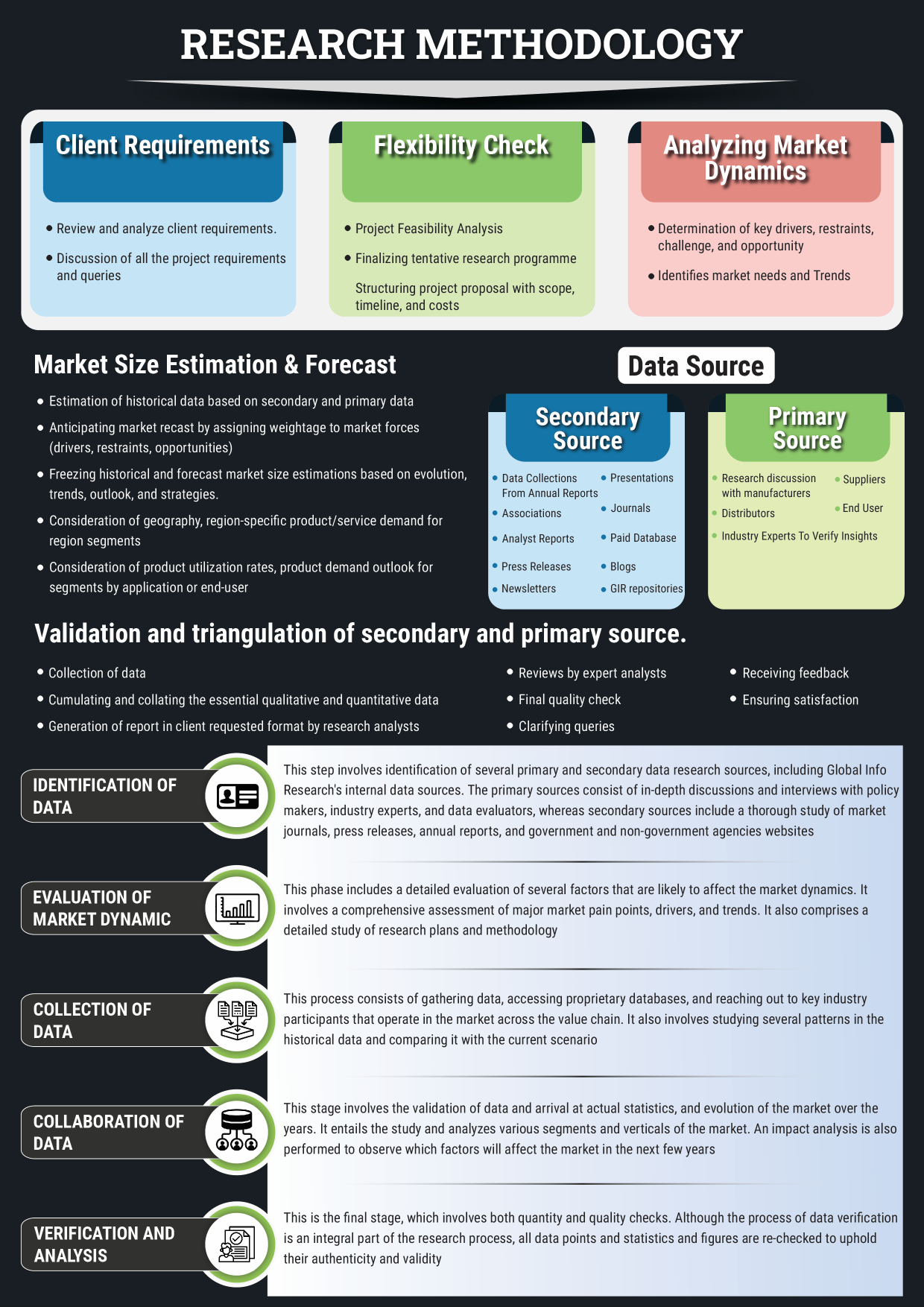

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Medical Catheters Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Medical Catheters Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Teleflex Basic Information, Manufacturing Base and Competitors

Table 4. Teleflex Major Business

Table 5. Teleflex Medical Catheters Product and Services

Table 6. Teleflex Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. Teleflex Recent Developments/Updates

Table 8. Edwards Lifesciences Basic Information, Manufacturing Base and Competitors

Table 9. Edwards Lifesciences Major Business

Table 10. Edwards Lifesciences Medical Catheters Product and Services

Table 11. Edwards Lifesciences Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Edwards Lifesciences Recent Developments/Updates

Table 13. Coloplast Basic Information, Manufacturing Base and Competitors

Table 14. Coloplast Major Business

Table 15. Coloplast Medical Catheters Product and Services

Table 16. Coloplast Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Coloplast Recent Developments/Updates

Table 18. B. Braun Basic Information, Manufacturing Base and Competitors

Table 19. B. Braun Major Business

Table 20. B. Braun Medical Catheters Product and Services

Table 21. B. Braun Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. B. Braun Recent Developments/Updates

Table 23. BD Basic Information, Manufacturing Base and Competitors

Table 24. BD Major Business

Table 25. BD Medical Catheters Product and Services

Table 26. BD Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. BD Recent Developments/Updates

Table 28. TuoRen Basic Information, Manufacturing Base and Competitors

Table 29. TuoRen Major Business

Table 30. TuoRen Medical Catheters Product and Services

Table 31. TuoRen Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. TuoRen Recent Developments/Updates

Table 33. Smith Medical Basic Information, Manufacturing Base and Competitors

Table 34. Smith Medical Major Business

Table 35. Smith Medical Medical Catheters Product and Services

Table 36. Smith Medical Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Smith Medical Recent Developments/Updates

Table 38. Baihe Medical Basic Information, Manufacturing Base and Competitors

Table 39. Baihe Medical Major Business

Table 40. Baihe Medical Medical Catheters Product and Services

Table 41. Baihe Medical Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Baihe Medical Recent Developments/Updates

Table 43. Cook Medical Basic Information, Manufacturing Base and Competitors

Table 44. Cook Medical Major Business

Table 45. Cook Medical Medical Catheters Product and Services

Table 46. Cook Medical Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 47. Cook Medical Recent Developments/Updates

Table 48. WellLead Basic Information, Manufacturing Base and Competitors

Table 49. WellLead Major Business

Table 50. WellLead Medical Catheters Product and Services

Table 51. WellLead Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 52. WellLead Recent Developments/Updates

Table 53. Sewoon Medical Basic Information, Manufacturing Base and Competitors

Table 54. Sewoon Medical Major Business

Table 55. Sewoon Medical Medical Catheters Product and Services

Table 56. Sewoon Medical Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 57. Sewoon Medical Recent Developments/Updates

Table 58. Medtronic Basic Information, Manufacturing Base and Competitors

Table 59. Medtronic Major Business

Table 60. Medtronic Medical Catheters Product and Services

Table 61. Medtronic Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 62. Medtronic Recent Developments/Updates

Table 63. Lepu Medical Basic Information, Manufacturing Base and Competitors

Table 64. Lepu Medical Major Business

Table 65. Lepu Medical Medical Catheters Product and Services

Table 66. Lepu Medical Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 67. Lepu Medical Recent Developments/Updates

Table 68. SCW MEDICATH Basic Information, Manufacturing Base and Competitors

Table 69. SCW MEDICATH Major Business

Table 70. SCW MEDICATH Medical Catheters Product and Services

Table 71. SCW MEDICATH Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 72. SCW MEDICATH Recent Developments/Updates

Table 73. Medi-Globe Basic Information, Manufacturing Base and Competitors

Table 74. Medi-Globe Major Business

Table 75. Medi-Globe Medical Catheters Product and Services

Table 76. Medi-Globe Medical Catheters Sales Quantity (M Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 77. Medi-Globe Recent Developments/Updates

Table 78. Global Medical Catheters Sales Quantity by Manufacturer (2018-2023) & (M Units)

Table 79. Global Medical Catheters Revenue by Manufacturer (2018-2023) & (USD Million)

Table 80. Global Medical Catheters Average Price by Manufacturer (2018-2023) & (USD/Unit)

Table 81. Market Position of Manufacturers in Medical Catheters, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 82. Head Office and Medical Catheters Production Site of Key Manufacturer

Table 83. Medical Catheters Market: Company Product Type Footprint

Table 84. Medical Catheters Market: Company Product Application Footprint

Table 85. Medical Catheters New Market Entrants and Barriers to Market Entry

Table 86. Medical Catheters Mergers, Acquisition, Agreements, and Collaborations

Table 87. Global Medical Catheters Sales Quantity by Region (2018-2023) & (M Units)

Table 88. Global Medical Catheters Sales Quantity by Region (2024-2029) & (M Units)

Table 89. Global Medical Catheters Consumption Value by Region (2018-2023) & (USD Million)

Table 90. Global Medical Catheters Consumption Value by Region (2024-2029) & (USD Million)

Table 91. Global Medical Catheters Average Price by Region (2018-2023) & (USD/Unit)

Table 92. Global Medical Catheters Average Price by Region (2024-2029) & (USD/Unit)

Table 93. Global Medical Catheters Sales Quantity by Type (2018-2023) & (M Units)

Table 94. Global Medical Catheters Sales Quantity by Type (2024-2029) & (M Units)

Table 95. Global Medical Catheters Consumption Value by Type (2018-2023) & (USD Million)

Table 96. Global Medical Catheters Consumption Value by Type (2024-2029) & (USD Million)

Table 97. Global Medical Catheters Average Price by Type (2018-2023) & (USD/Unit)

Table 98. Global Medical Catheters Average Price by Type (2024-2029) & (USD/Unit)

Table 99. Global Medical Catheters Sales Quantity by Application (2018-2023) & (M Units)

Table 100. Global Medical Catheters Sales Quantity by Application (2024-2029) & (M Units)

Table 101. Global Medical Catheters Consumption Value by Application (2018-2023) & (USD Million)

Table 102. Global Medical Catheters Consumption Value by Application (2024-2029) & (USD Million)

Table 103. Global Medical Catheters Average Price by Application (2018-2023) & (USD/Unit)

Table 104. Global Medical Catheters Average Price by Application (2024-2029) & (USD/Unit)

Table 105. North America Medical Catheters Sales Quantity by Type (2018-2023) & (M Units)

Table 106. North America Medical Catheters Sales Quantity by Type (2024-2029) & (M Units)

Table 107. North America Medical Catheters Sales Quantity by Application (2018-2023) & (M Units)

Table 108. North America Medical Catheters Sales Quantity by Application (2024-2029) & (M Units)

Table 109. North America Medical Catheters Sales Quantity by Country (2018-2023) & (M Units)

Table 110. North America Medical Catheters Sales Quantity by Country (2024-2029) & (M Units)

Table 111. North America Medical Catheters Consumption Value by Country (2018-2023) & (USD Million)

Table 112. North America Medical Catheters Consumption Value by Country (2024-2029) & (USD Million)

Table 113. Europe Medical Catheters Sales Quantity by Type (2018-2023) & (M Units)

Table 114. Europe Medical Catheters Sales Quantity by Type (2024-2029) & (M Units)

Table 115. Europe Medical Catheters Sales Quantity by Application (2018-2023) & (M Units)

Table 116. Europe Medical Catheters Sales Quantity by Application (2024-2029) & (M Units)

Table 117. Europe Medical Catheters Sales Quantity by Country (2018-2023) & (M Units)

Table 118. Europe Medical Catheters Sales Quantity by Country (2024-2029) & (M Units)

Table 119. Europe Medical Catheters Consumption Value by Country (2018-2023) & (USD Million)

Table 120. Europe Medical Catheters Consumption Value by Country (2024-2029) & (USD Million)

Table 121. Asia-Pacific Medical Catheters Sales Quantity by Type (2018-2023) & (M Units)

Table 122. Asia-Pacific Medical Catheters Sales Quantity by Type (2024-2029) & (M Units)

Table 123. Asia-Pacific Medical Catheters Sales Quantity by Application (2018-2023) & (M Units)

Table 124. Asia-Pacific Medical Catheters Sales Quantity by Application (2024-2029) & (M Units)

Table 125. Asia-Pacific Medical Catheters Sales Quantity by Region (2018-2023) & (M Units)

Table 126. Asia-Pacific Medical Catheters Sales Quantity by Region (2024-2029) & (M Units)

Table 127. Asia-Pacific Medical Catheters Consumption Value by Region (2018-2023) & (USD Million)

Table 128. Asia-Pacific Medical Catheters Consumption Value by Region (2024-2029) & (USD Million)

Table 129. South America Medical Catheters Sales Quantity by Type (2018-2023) & (M Units)

Table 130. South America Medical Catheters Sales Quantity by Type (2024-2029) & (M Units)

Table 131. South America Medical Catheters Sales Quantity by Application (2018-2023) & (M Units)

Table 132. South America Medical Catheters Sales Quantity by Application (2024-2029) & (M Units)

Table 133. South America Medical Catheters Sales Quantity by Country (2018-2023) & (M Units)

Table 134. South America Medical Catheters Sales Quantity by Country (2024-2029) & (M Units)

Table 135. South America Medical Catheters Consumption Value by Country (2018-2023) & (USD Million)

Table 136. South America Medical Catheters Consumption Value by Country (2024-2029) & (USD Million)

Table 137. Middle East & Africa Medical Catheters Sales Quantity by Type (2018-2023) & (M Units)

Table 138. Middle East & Africa Medical Catheters Sales Quantity by Type (2024-2029) & (M Units)

Table 139. Middle East & Africa Medical Catheters Sales Quantity by Application (2018-2023) & (M Units)

Table 140. Middle East & Africa Medical Catheters Sales Quantity by Application (2024-2029) & (M Units)

Table 141. Middle East & Africa Medical Catheters Sales Quantity by Region (2018-2023) & (M Units)

Table 142. Middle East & Africa Medical Catheters Sales Quantity by Region (2024-2029) & (M Units)

Table 143. Middle East & Africa Medical Catheters Consumption Value by Region (2018-2023) & (USD Million)

Table 144. Middle East & Africa Medical Catheters Consumption Value by Region (2024-2029) & (USD Million)

Table 145. Medical Catheters Raw Material

Table 146. Key Manufacturers of Medical Catheters Raw Materials

Table 147. Medical Catheters Typical Distributors

Table 148. Medical Catheters Typical Customers

List of Figures

Figure 1. Medical Catheters Picture

Figure 2. Global Medical Catheters Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Medical Catheters Consumption Value Market Share by Type in 2022

Figure 4. Cardiovascular Catheters Examples

Figure 5. Neurovascular Catheters Examples

Figure 6. Intravenous Catheters Examples

Figure 7. Urology Catheters Examples

Figure 8. Others Examples

Figure 9. Global Medical Catheters Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 10. Global Medical Catheters Consumption Value Market Share by Application in 2022

Figure 11. Hospitals Examples

Figure 12. Clinic Examples

Figure 13. Others Examples

Figure 14. Global Medical Catheters Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 15. Global Medical Catheters Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 16. Global Medical Catheters Sales Quantity (2018-2029) & (M Units)

Figure 17. Global Medical Catheters Average Price (2018-2029) & (USD/Unit)

Figure 18. Global Medical Catheters Sales Quantity Market Share by Manufacturer in 2022

Figure 19. Global Medical Catheters Consumption Value Market Share by Manufacturer in 2022

Figure 20. Producer Shipments of Medical Catheters by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 21. Top 3 Medical Catheters Manufacturer (Consumption Value) Market Share in 2022

Figure 22. Top 6 Medical Catheters Manufacturer (Consumption Value) Market Share in 2022

Figure 23. Global Medical Catheters Sales Quantity Market Share by Region (2018-2029)

Figure 24. Global Medical Catheters Consumption Value Market Share by Region (2018-2029)

Figure 25. North America Medical Catheters Consumption Value (2018-2029) & (USD Million)

Figure 26. Europe Medical Catheters Consumption Value (2018-2029) & (USD Million)

Figure 27. Asia-Pacific Medical Catheters Consumption Value (2018-2029) & (USD Million)

Figure 28. South America Medical Catheters Consumption Value (2018-2029) & (USD Million)

Figure 29. Middle East & Africa Medical Catheters Consumption Value (2018-2029) & (USD Million)

Figure 30. Global Medical Catheters Sales Quantity Market Share by Type (2018-2029)

Figure 31. Global Medical Catheters Consumption Value Market Share by Type (2018-2029)

Figure 32. Global Medical Catheters Average Price by Type (2018-2029) & (USD/Unit)

Figure 33. Global Medical Catheters Sales Quantity Market Share by Application (2018-2029)

Figure 34. Global Medical Catheters Consumption Value Market Share by Application (2018-2029)

Figure 35. Global Medical Catheters Average Price by Application (2018-2029) & (USD/Unit)

Figure 36. North America Medical Catheters Sales Quantity Market Share by Type (2018-2029)

Figure 37. North America Medical Catheters Sales Quantity Market Share by Application (2018-2029)

Figure 38. North America Medical Catheters Sales Quantity Market Share by Country (2018-2029)

Figure 39. North America Medical Catheters Consumption Value Market Share by Country (2018-2029)

Figure 40. United States Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 41. Canada Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 42. Mexico Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 43. Europe Medical Catheters Sales Quantity Market Share by Type (2018-2029)

Figure 44. Europe Medical Catheters Sales Quantity Market Share by Application (2018-2029)

Figure 45. Europe Medical Catheters Sales Quantity Market Share by Country (2018-2029)

Figure 46. Europe Medical Catheters Consumption Value Market Share by Country (2018-2029)

Figure 47. Germany Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. France Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. United Kingdom Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 50. Russia Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 51. Italy Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 52. Asia-Pacific Medical Catheters Sales Quantity Market Share by Type (2018-2029)

Figure 53. Asia-Pacific Medical Catheters Sales Quantity Market Share by Application (2018-2029)

Figure 54. Asia-Pacific Medical Catheters Sales Quantity Market Share by Region (2018-2029)

Figure 55. Asia-Pacific Medical Catheters Consumption Value Market Share by Region (2018-2029)

Figure 56. China Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Japan Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Korea Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. India Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 60. Southeast Asia Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 61. Australia Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 62. South America Medical Catheters Sales Quantity Market Share by Type (2018-2029)

Figure 63. South America Medical Catheters Sales Quantity Market Share by Application (2018-2029)

Figure 64. South America Medical Catheters Sales Quantity Market Share by Country (2018-2029)

Figure 65. South America Medical Catheters Consumption Value Market Share by Country (2018-2029)

Figure 66. Brazil Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 67. Argentina Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 68. Middle East & Africa Medical Catheters Sales Quantity Market Share by Type (2018-2029)

Figure 69. Middle East & Africa Medical Catheters Sales Quantity Market Share by Application (2018-2029)

Figure 70. Middle East & Africa Medical Catheters Sales Quantity Market Share by Region (2018-2029)

Figure 71. Middle East & Africa Medical Catheters Consumption Value Market Share by Region (2018-2029)

Figure 72. Turkey Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. Egypt Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 74. Saudi Arabia Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 75. South Africa Medical Catheters Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 76. Medical Catheters Market Drivers

Figure 77. Medical Catheters Market Restraints

Figure 78. Medical Catheters Market Trends

Figure 79. Porters Five Forces Analysis

Figure 80. Manufacturing Cost Structure Analysis of Medical Catheters in 2022

Figure 81. Manufacturing Process Analysis of Medical Catheters

Figure 82. Medical Catheters Industrial Chain

Figure 83. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 84. Direct Channel Pros & Cons

Figure 85. Indirect Channel Pros & Cons

Figure 86. Methodology

Figure 87. Research Process and Data Source