Market Outlook

The global Ionomer Market size was valued at USD 504.2 million in 2022 and is forecast to a readjusted size of USD 950.1 million by 2029 with a CAGR of 9.5% during review period.

Introduction: Why the Ionomer Market Matters in 2025

The Ionomer Market is experiencing robust growth in 2025, driven by its unique combination of polymer properties such as toughness, clarity, and chemical resistance. Ionomers find extensive use in packaging films, coatings, adhesives, and automotive components. The growing demand for high-performance materials in food packaging, sports equipment, and electronics propels the ionomer market forward, making it vital for polymer manufacturers and end-use industries focused on durability and safety.

Market Drivers: What’s Fueling the Ionomer Boom?

Increased Demand for Flexible Packaging: Ionomers provide excellent sealability and puncture resistance.

Automotive Industry Growth: Use in impact-resistant parts and coatings.

Consumer Electronics: Protective films requiring clarity and toughness.

Sustainability Focus: Ionomers contribute to lightweight packaging, reducing material use.

Innovation in Focus: How Manufacturers Are Leading

Modified Ionomers: Enhanced adhesion and flexibility for specialized applications.

Blends and Composites: Combining ionomers with other polymers for improved performance.

Bio-based Ionomers: Emerging eco-friendly alternatives aligning with green trends.

Process Optimization: Improved extrusion and film-forming technologies increasing production efficiency.

Regional Breakdown: Where Demand Is Shifting

North America and Europe: Strong demand in packaging and automotive sectors.

Asia-Pacific: Fastest growth due to expanding consumer goods and automotive markets.

Latin America & MEA: Emerging adoption in food packaging and industrial uses.

Strategic Considerations: How to Compete in 2025

Develop Application-Specific Grades: Tailor ionomers for packaging, automotive, or electronics.

Focus on Sustainability: Introduce bio-based and recyclable ionomers.

Enhance Supply Chain Integration: Ensure timely delivery and quality consistency.

Collaborate with End-Users: Drive innovation through partnerships.

Conclusion: The Ionomer Market - Driving Versatility in Polymer Applications

In 2025, ionomers continue to be indispensable for industries demanding durable, flexible, and lightweight polymer solutions. Innovation and sustainability will determine market leaders.

Key Market Players

DuPont

Honeywell

Asahi Kasei

Exxon Chemical Company

Asahi Glass

Solvay

Dongyue Group

Segmentation By Type

EAA Copolymers

PFSA Ionomer

Others

Segmentation By Application

Golf Ball Covers

Food Packaging

Cosmetics and Medical Device Packaging

Others

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Ionomer Market in 2025?

Ionomers, due to their excellent mechanical properties, adhesion, and chemical resistance, are widely used in packaging, automotive, and biomedical applications, ensuring strong market growth.

What are the weaknesses of the Ionomer Market in 2025?

The relatively high production cost and limited availability of some ionomer-based products may restrict market expansion in certain applications.

What are the opportunities for the Ionomer Market in 2025?

Rising demand for high-performance materials in packaging and automotive applications, along with the development of eco-friendly ionomer solutions, creates substantial growth opportunities.

What are the threats to the Ionomer Market in 2025?

Competition from other high-performance polymers and fluctuations in raw material prices could hinder the growth of the ionomer market.

Market PESTEL Analysis

How do political factors impact the Ionomer Market in 2025?

Government policies regarding the use of ionomers in packaging materials, construction, and healthcare products, as well as regulations on chemical safety, affect market demand. Political decisions on trade tariffs and environmental regulations also influence the global supply chain and production costs of ionomers.

What economic factors affect the Ionomer Market in 2025?

Economic growth in sectors like packaging, automotive, and construction, where ionomers are used for their durability and versatility, boosts market demand. The increasing focus on sustainable and cost-effective materials, alongside fluctuations in raw material prices, also shapes the ionomer market's financial landscape.

How do social factors shape the Ionomer Market in 2025?

Rising consumer awareness of sustainability and demand for eco-friendly materials in packaging and consumer products lead to increased adoption of ionomers. The growing preference for durable and high-performance materials in various industries also contributes to the market's expansion.

What technological factors are relevant to the Ionomer Market in 2025?

Technological innovations in polymerization and material science, leading to more efficient and high-performance ionomer formulations, drive market growth. Advancements in recycling technologies for ionomers and the development of new applications in medical devices, packaging, and coatings expand the market's reach.

What environmental factors influence the Ionomer Market in 2025?

Environmental regulations promoting sustainable, recyclable, and low-toxicity materials push the demand for ionomers, which offer eco-friendly alternatives to traditional plastics. The pressure to reduce waste and carbon footprints in manufacturing and packaging further boosts market adoption of ionomers.

How do legal factors impact the Ionomer Market in 2025?

Legal regulations surrounding chemical safety, packaging standards, and recycling laws influence the development and use of ionomers. Intellectual property rights for new ionomer formulations and patents for innovative applications also impact the competitiveness and growth of the market.

Market SIPOC Analysis

Who are the suppliers in the Ionomer Market 2025?

Suppliers include chemical companies that specialize in producing ionomer resins, polymer manufacturers, and suppliers of materials for use in high-performance applications like packaging, electronics, and automotive.

What are the inputs in the Ionomer Market 2025?

Inputs include ethylene and acid monomers (like acrylic acid), catalysts, and specialized polymerization processes used to create ionomers with unique properties such as enhanced adhesion, strength, and resistance.

What processes are involved in the Ionomer Market 2025?

Processes include the polymerization of ionomer resins, followed by extrusion, molding, or film production to create materials with desired mechanical, chemical, and electrical properties for various industrial applications.

Who are the customers in the Ionomer Market 2025?

Customers include packaging companies, automotive manufacturers, and industries requiring ionomers for applications in films, coatings, adhesives, and seals.

What are the outcomes in the Ionomer Market 2025?

Outcomes include increasing demand for ionomer materials in high-performance packaging, automotive components, and consumer goods, with a focus on durability, chemical resistance, and sustainability.

Market Porter's Five Forces

What is the threat of new entrants in the Ionomer Market in 2025?

The threat of new entrants is moderate. While ionomers are widely used in various applications like packaging and automotive, entering the market requires advanced polymerization technology and significant investment in production facilities.

What is the bargaining power of suppliers in the Ionomer Market in 2025?

The bargaining power of suppliers is moderate. Suppliers of base materials like resins and chemicals have some control over pricing, but the growing availability of raw materials and technological advancements help reduce their power.

What is the bargaining power of buyers in the Ionomer Market in 2025?

The bargaining power of buyers is moderate. While ionomer products are used across industries like packaging, automotive, and electronics, the specialized nature of ionomers reduces buyers’ ability to negotiate prices, especially when unique material properties are required.

What is the threat of substitute products in the Ionomer Market in 2025?

The threat of substitutes is moderate. While alternative materials such as other types of resins and polymers can be used in some applications, ionomers offer specific properties such as heat resistance and flexibility, which reduces the threat of substitution.

What is the intensity of competitive rivalry in the Ionomer Market in 2025?

The intensity of competitive rivalry is high. With the growing demand for ionomer materials in various industries, companies are competing on product quality, performance, and innovation, pushing up the intensity of rivalry in the market.

Market Upstream Analysis

What are the key raw materials in the Ionomer Market in 2025?

Key raw materials for ionomers include ethylene, methacrylic acid, and other copolymer resins, which are combined to form ionomer resins. These materials are used in applications such as food packaging, automotive, and sports equipment due to their unique combination of strength, durability, and flexibility.

What role do suppliers play in the Ionomer Market in 2025?

Suppliers provide the necessary monomers, resins, and additives required to produce ionomer resins. They also offer specialized technologies for the polymerization process, ensuring the ionomers meet performance requirements for applications like packaging films, coatings, and molded products.

How does the regulatory environment affect upstream factors in this market?

Regulations on the safety and environmental impact of plastic materials, especially in food contact applications, affect the production and use of ionomers. Suppliers must ensure their ionomers comply with regulatory standards such as FDA approvals for food packaging and sustainability regulations regarding plastic use.

What technological advancements influence upstream production in the Ionomer Market in 2025?

Advancements in copolymerization techniques and the development of more sustainable production methods are improving the properties of ionomers. Innovations in the use of renewable feedstocks and recycling methods are also pushing the market toward more environmentally friendly production processes.

What challenges do upstream suppliers face in this market?

Suppliers face challenges related to sourcing high-quality raw materials at competitive prices, maintaining consistent product performance, and responding to increasing demand for environmentally friendly and sustainable ionomers, which are driving changes in material sourcing and manufacturing practices.

Market Midstream Analysis

What are the key processes involved in the midstream of the Ionomer Market in 2025?

The key processes involve the synthesis of ionomers by polymerizing monomers with ionic functional groups, followed by extrusion, molding, and packaging for distribution to industries like packaging, automotive, and coatings.

How do manufacturers contribute to the Ionomer Market in 2025?

Manufacturers focus on producing ionomers that offer enhanced mechanical properties, chemical resistance, and processing ease, serving industries that require materials with high strength and flexibility, such as packaging, automotive, and industrial applications.

What is the role of packaging in the midstream of this market?

Packaging ensures that ionomer materials are safely transported, preventing contamination and moisture exposure, preserving their integrity and functional properties for use in manufacturing durable goods and packaging products.

What challenges do companies face in the midstream of this market?

Challenges include managing production costs, ensuring consistent material properties, and addressing growing demand for sustainable, recyclable ionomer products in response to environmental concerns.

How do distribution channels affect the Ionomer Market in 2025?

Distribution channels play an important role in ensuring that ionomers reach the various manufacturing sectors like packaging, automotive, and coatings, supporting the production of high-performance and durable products.

Market Downstream Analysis

What are the key consumer segments in the Ionomer Market in 2025?

Key consumers include the packaging industry for durable, heat-sealable films, the automotive sector for lightweight, impact-resistant materials, and the sports and leisure industry for specialized coatings and products.

What role do distributors and suppliers play in the Ionomer Market in 2025?

Distributors and suppliers provide ionomers to manufacturers, ensuring access to this versatile polymer for applications that require high mechanical strength, impact resistance, and heat sealability, while meeting global supply and quality standards.

What challenges do companies face in the downstream market of this industry?

Challenges include ensuring the consistent quality and performance of ionomer products, meeting increasing demand for sustainable alternatives, and addressing the high cost of raw materials and production processes.

How does consumer feedback influence the Ionomer Market in 2025?

Consumer feedback encourages the development of more durable and sustainable ionomer products, leading to innovations in product formulations that improve their environmental footprint and extend their functional applications in packaging, automotive, and sports goods.

Chapter 1, to describe Ionomer product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Ionomer, with price, sales, revenue and global market share of Ionomer from 2018 to 2023.

Chapter 3, the Ionomer competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Ionomer breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Ionomer market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of Ionomer.

Chapter 14 and 15, to describe Ionomer sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Ionomer

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Ionomer Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 EAA Copolymers

1.3.3 PFSA Ionomer

1.3.4 Others

1.4 Market Analysis by Application

1.4.1 Overview: Global Ionomer Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Golf Ball Covers

1.4.3 Food Packaging

1.4.4 Cosmetics and Medical Device Packaging

1.4.5 Others

1.5 Global Ionomer Market Size & Forecast

1.5.1 Global Ionomer Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Ionomer Sales Quantity (2018-2029)

1.5.3 Global Ionomer Average Price (2018-2029)

2 Manufacturers Profiles

2.1 DuPont

2.1.1 DuPont Details

2.1.2 DuPont Major Business

2.1.3 DuPont Ionomer Product and Services

2.1.4 DuPont Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 DuPont Recent Developments/Updates

2.2 Honeywell

2.2.1 Honeywell Details

2.2.2 Honeywell Major Business

2.2.3 Honeywell Ionomer Product and Services

2.2.4 Honeywell Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Honeywell Recent Developments/Updates

2.3 Asahi Kasei

2.3.1 Asahi Kasei Details

2.3.2 Asahi Kasei Major Business

2.3.3 Asahi Kasei Ionomer Product and Services

2.3.4 Asahi Kasei Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Asahi Kasei Recent Developments/Updates

2.4 Exxon Chemical Company

2.4.1 Exxon Chemical Company Details

2.4.2 Exxon Chemical Company Major Business

2.4.3 Exxon Chemical Company Ionomer Product and Services

2.4.4 Exxon Chemical Company Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Exxon Chemical Company Recent Developments/Updates

2.5 Asahi Glass

2.5.1 Asahi Glass Details

2.5.2 Asahi Glass Major Business

2.5.3 Asahi Glass Ionomer Product and Services

2.5.4 Asahi Glass Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Asahi Glass Recent Developments/Updates

2.6 Solvay

2.6.1 Solvay Details

2.6.2 Solvay Major Business

2.6.3 Solvay Ionomer Product and Services

2.6.4 Solvay Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Solvay Recent Developments/Updates

2.7 Dongyue Group

2.7.1 Dongyue Group Details

2.7.2 Dongyue Group Major Business

2.7.3 Dongyue Group Ionomer Product and Services

2.7.4 Dongyue Group Ionomer Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Dongyue Group Recent Developments/Updates

3 Competitive Environment: Ionomer by Manufacturer

3.1 Global Ionomer Sales Quantity by Manufacturer (2018-2023)

3.2 Global Ionomer Revenue by Manufacturer (2018-2023)

3.3 Global Ionomer Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Ionomer by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Ionomer Manufacturer Market Share in 2022

3.4.2 Top 6 Ionomer Manufacturer Market Share in 2022

3.5 Ionomer Market: Overall Company Footprint Analysis

3.5.1 Ionomer Market: Region Footprint

3.5.2 Ionomer Market: Company Product Type Footprint

3.5.3 Ionomer Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Ionomer Market Size by Region

4.1.1 Global Ionomer Sales Quantity by Region (2018-2029)

4.1.2 Global Ionomer Consumption Value by Region (2018-2029)

4.1.3 Global Ionomer Average Price by Region (2018-2029)

4.2 North America Ionomer Consumption Value (2018-2029)

4.3 Europe Ionomer Consumption Value (2018-2029)

4.4 Asia-Pacific Ionomer Consumption Value (2018-2029)

4.5 South America Ionomer Consumption Value (2018-2029)

4.6 Middle East and Africa Ionomer Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Ionomer Sales Quantity by Type (2018-2029)

5.2 Global Ionomer Consumption Value by Type (2018-2029)

5.3 Global Ionomer Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Ionomer Sales Quantity by Application (2018-2029)

6.2 Global Ionomer Consumption Value by Application (2018-2029)

6.3 Global Ionomer Average Price by Application (2018-2029)

7 North America

7.1 North America Ionomer Sales Quantity by Type (2018-2029)

7.2 North America Ionomer Sales Quantity by Application (2018-2029)

7.3 North America Ionomer Market Size by Country

7.3.1 North America Ionomer Sales Quantity by Country (2018-2029)

7.3.2 North America Ionomer Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Ionomer Sales Quantity by Type (2018-2029)

8.2 Europe Ionomer Sales Quantity by Application (2018-2029)

8.3 Europe Ionomer Market Size by Country

8.3.1 Europe Ionomer Sales Quantity by Country (2018-2029)

8.3.2 Europe Ionomer Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Ionomer Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Ionomer Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Ionomer Market Size by Region

9.3.1 Asia-Pacific Ionomer Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Ionomer Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Ionomer Sales Quantity by Type (2018-2029)

10.2 South America Ionomer Sales Quantity by Application (2018-2029)

10.3 South America Ionomer Market Size by Country

10.3.1 South America Ionomer Sales Quantity by Country (2018-2029)

10.3.2 South America Ionomer Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Ionomer Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Ionomer Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Ionomer Market Size by Country

11.3.1 Middle East & Africa Ionomer Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Ionomer Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Ionomer Market Drivers

12.2 Ionomer Market Restraints

12.3 Ionomer Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of Ionomer and Key Manufacturers

13.2 Manufacturing Costs Percentage of Ionomer

13.3 Ionomer Production Process

13.4 Ionomer Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Ionomer Typical Distributors

14.3 Ionomer Typical Customers

15 Research Findings and Conclusion

16 Appendix

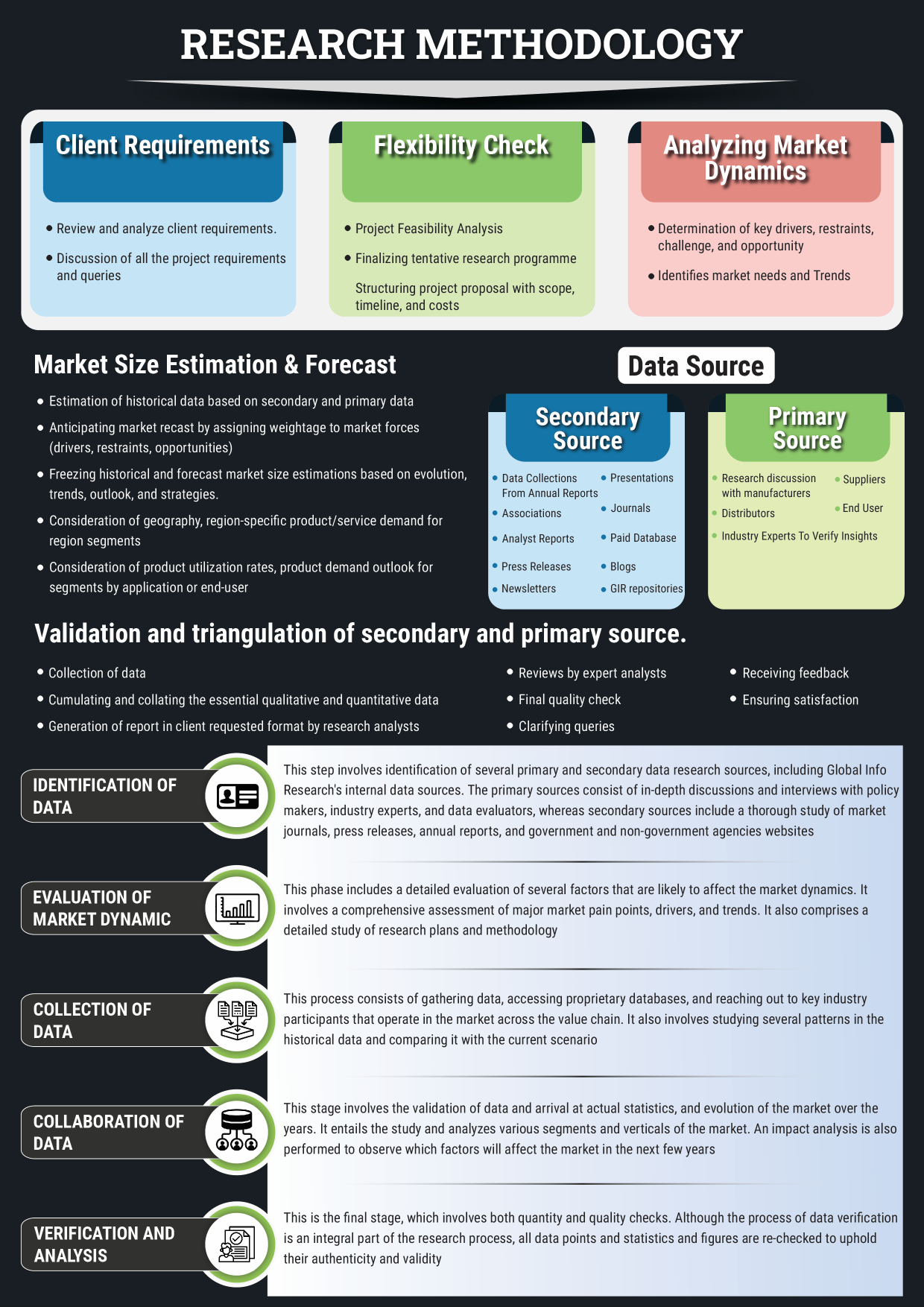

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Ionomer Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Ionomer Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. DuPont Basic Information, Manufacturing Base and Competitors

Table 4. DuPont Major Business

Table 5. DuPont Ionomer Product and Services

Table 6. DuPont Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. DuPont Recent Developments/Updates

Table 8. Honeywell Basic Information, Manufacturing Base and Competitors

Table 9. Honeywell Major Business

Table 10. Honeywell Ionomer Product and Services

Table 11. Honeywell Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Honeywell Recent Developments/Updates

Table 13. Asahi Kasei Basic Information, Manufacturing Base and Competitors

Table 14. Asahi Kasei Major Business

Table 15. Asahi Kasei Ionomer Product and Services

Table 16. Asahi Kasei Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Asahi Kasei Recent Developments/Updates

Table 18. Exxon Chemical Company Basic Information, Manufacturing Base and Competitors

Table 19. Exxon Chemical Company Major Business

Table 20. Exxon Chemical Company Ionomer Product and Services

Table 21. Exxon Chemical Company Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Exxon Chemical Company Recent Developments/Updates

Table 23. Asahi Glass Basic Information, Manufacturing Base and Competitors

Table 24. Asahi Glass Major Business

Table 25. Asahi Glass Ionomer Product and Services

Table 26. Asahi Glass Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Asahi Glass Recent Developments/Updates

Table 28. Solvay Basic Information, Manufacturing Base and Competitors

Table 29. Solvay Major Business

Table 30. Solvay Ionomer Product and Services

Table 31. Solvay Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. Solvay Recent Developments/Updates

Table 33. Dongyue Group Basic Information, Manufacturing Base and Competitors

Table 34. Dongyue Group Major Business

Table 35. Dongyue Group Ionomer Product and Services

Table 36. Dongyue Group Ionomer Sales Quantity (MT), Average Price (USD/MT), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Dongyue Group Recent Developments/Updates

Table 38. Global Ionomer Sales Quantity by Manufacturer (2018-2023) & (MT)

Table 39. Global Ionomer Revenue by Manufacturer (2018-2023) & (USD Million)

Table 40. Global Ionomer Average Price by Manufacturer (2018-2023) & (USD/MT)

Table 41. Market Position of Manufacturers in Ionomer, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 42. Head Office and Ionomer Production Site of Key Manufacturer

Table 43. Ionomer Market: Company Product Type Footprint

Table 44. Ionomer Market: Company Product Application Footprint

Table 45. Ionomer New Market Entrants and Barriers to Market Entry

Table 46. Ionomer Mergers, Acquisition, Agreements, and Collaborations

Table 47. Global Ionomer Sales Quantity by Region (2018-2023) & (MT)

Table 48. Global Ionomer Sales Quantity by Region (2024-2029) & (MT)

Table 49. Global Ionomer Consumption Value by Region (2018-2023) & (USD Million)

Table 50. Global Ionomer Consumption Value by Region (2024-2029) & (USD Million)

Table 51. Global Ionomer Average Price by Region (2018-2023) & (USD/MT)

Table 52. Global Ionomer Average Price by Region (2024-2029) & (USD/MT)

Table 53. Global Ionomer Sales Quantity by Type (2018-2023) & (MT)

Table 54. Global Ionomer Sales Quantity by Type (2024-2029) & (MT)

Table 55. Global Ionomer Consumption Value by Type (2018-2023) & (USD Million)

Table 56. Global Ionomer Consumption Value by Type (2024-2029) & (USD Million)

Table 57. Global Ionomer Average Price by Type (2018-2023) & (USD/MT)

Table 58. Global Ionomer Average Price by Type (2024-2029) & (USD/MT)

Table 59. Global Ionomer Sales Quantity by Application (2018-2023) & (MT)

Table 60. Global Ionomer Sales Quantity by Application (2024-2029) & (MT)

Table 61. Global Ionomer Consumption Value by Application (2018-2023) & (USD Million)

Table 62. Global Ionomer Consumption Value by Application (2024-2029) & (USD Million)

Table 63. Global Ionomer Average Price by Application (2018-2023) & (USD/MT)

Table 64. Global Ionomer Average Price by Application (2024-2029) & (USD/MT)

Table 65. North America Ionomer Sales Quantity by Type (2018-2023) & (MT)

Table 66. North America Ionomer Sales Quantity by Type (2024-2029) & (MT)

Table 67. North America Ionomer Sales Quantity by Application (2018-2023) & (MT)

Table 68. North America Ionomer Sales Quantity by Application (2024-2029) & (MT)

Table 69. North America Ionomer Sales Quantity by Country (2018-2023) & (MT)

Table 70. North America Ionomer Sales Quantity by Country (2024-2029) & (MT)

Table 71. North America Ionomer Consumption Value by Country (2018-2023) & (USD Million)

Table 72. North America Ionomer Consumption Value by Country (2024-2029) & (USD Million)

Table 73. Europe Ionomer Sales Quantity by Type (2018-2023) & (MT)

Table 74. Europe Ionomer Sales Quantity by Type (2024-2029) & (MT)

Table 75. Europe Ionomer Sales Quantity by Application (2018-2023) & (MT)

Table 76. Europe Ionomer Sales Quantity by Application (2024-2029) & (MT)

Table 77. Europe Ionomer Sales Quantity by Country (2018-2023) & (MT)

Table 78. Europe Ionomer Sales Quantity by Country (2024-2029) & (MT)

Table 79. Europe Ionomer Consumption Value by Country (2018-2023) & (USD Million)

Table 80. Europe Ionomer Consumption Value by Country (2024-2029) & (USD Million)

Table 81. Asia-Pacific Ionomer Sales Quantity by Type (2018-2023) & (MT)

Table 82. Asia-Pacific Ionomer Sales Quantity by Type (2024-2029) & (MT)

Table 83. Asia-Pacific Ionomer Sales Quantity by Application (2018-2023) & (MT)

Table 84. Asia-Pacific Ionomer Sales Quantity by Application (2024-2029) & (MT)

Table 85. Asia-Pacific Ionomer Sales Quantity by Region (2018-2023) & (MT)

Table 86. Asia-Pacific Ionomer Sales Quantity by Region (2024-2029) & (MT)

Table 87. Asia-Pacific Ionomer Consumption Value by Region (2018-2023) & (USD Million)

Table 88. Asia-Pacific Ionomer Consumption Value by Region (2024-2029) & (USD Million)

Table 89. South America Ionomer Sales Quantity by Type (2018-2023) & (MT)

Table 90. South America Ionomer Sales Quantity by Type (2024-2029) & (MT)

Table 91. South America Ionomer Sales Quantity by Application (2018-2023) & (MT)

Table 92. South America Ionomer Sales Quantity by Application (2024-2029) & (MT)

Table 93. South America Ionomer Sales Quantity by Country (2018-2023) & (MT)

Table 94. South America Ionomer Sales Quantity by Country (2024-2029) & (MT)

Table 95. South America Ionomer Consumption Value by Country (2018-2023) & (USD Million)

Table 96. South America Ionomer Consumption Value by Country (2024-2029) & (USD Million)

Table 97. Middle East & Africa Ionomer Sales Quantity by Type (2018-2023) & (MT)

Table 98. Middle East & Africa Ionomer Sales Quantity by Type (2024-2029) & (MT)

Table 99. Middle East & Africa Ionomer Sales Quantity by Application (2018-2023) & (MT)

Table 100. Middle East & Africa Ionomer Sales Quantity by Application (2024-2029) & (MT)

Table 101. Middle East & Africa Ionomer Sales Quantity by Region (2018-2023) & (MT)

Table 102. Middle East & Africa Ionomer Sales Quantity by Region (2024-2029) & (MT)

Table 103. Middle East & Africa Ionomer Consumption Value by Region (2018-2023) & (USD Million)

Table 104. Middle East & Africa Ionomer Consumption Value by Region (2024-2029) & (USD Million)

Table 105. Ionomer Raw Material

Table 106. Key Manufacturers of Ionomer Raw Materials

Table 107. Ionomer Typical Distributors

Table 108. Ionomer Typical Customers

List of Figures

Figure 1. Ionomer Picture

Figure 2. Global Ionomer Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Ionomer Consumption Value Market Share by Type in 2022

Figure 4. EAA Copolymers Examples

Figure 5. PFSA Ionomer Examples

Figure 6. Others Examples

Figure 7. Global Ionomer Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 8. Global Ionomer Consumption Value Market Share by Application in 2022

Figure 9. Golf Ball Covers Examples

Figure 10. Food Packaging Examples

Figure 11. Cosmetics and Medical Device Packaging Examples

Figure 12. Others Examples

Figure 13. Global Ionomer Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 14. Global Ionomer Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 15. Global Ionomer Sales Quantity (2018-2029) & (MT)

Figure 16. Global Ionomer Average Price (2018-2029) & (USD/MT)

Figure 17. Global Ionomer Sales Quantity Market Share by Manufacturer in 2022

Figure 18. Global Ionomer Consumption Value Market Share by Manufacturer in 2022

Figure 19. Producer Shipments of Ionomer by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 20. Top 3 Ionomer Manufacturer (Consumption Value) Market Share in 2022

Figure 21. Top 6 Ionomer Manufacturer (Consumption Value) Market Share in 2022

Figure 22. Global Ionomer Sales Quantity Market Share by Region (2018-2029)

Figure 23. Global Ionomer Consumption Value Market Share by Region (2018-2029)

Figure 24. North America Ionomer Consumption Value (2018-2029) & (USD Million)

Figure 25. Europe Ionomer Consumption Value (2018-2029) & (USD Million)

Figure 26. Asia-Pacific Ionomer Consumption Value (2018-2029) & (USD Million)

Figure 27. South America Ionomer Consumption Value (2018-2029) & (USD Million)

Figure 28. Middle East & Africa Ionomer Consumption Value (2018-2029) & (USD Million)

Figure 29. Global Ionomer Sales Quantity Market Share by Type (2018-2029)

Figure 30. Global Ionomer Consumption Value Market Share by Type (2018-2029)

Figure 31. Global Ionomer Average Price by Type (2018-2029) & (USD/MT)

Figure 32. Global Ionomer Sales Quantity Market Share by Application (2018-2029)

Figure 33. Global Ionomer Consumption Value Market Share by Application (2018-2029)

Figure 34. Global Ionomer Average Price by Application (2018-2029) & (USD/MT)

Figure 35. North America Ionomer Sales Quantity Market Share by Type (2018-2029)

Figure 36. North America Ionomer Sales Quantity Market Share by Application (2018-2029)

Figure 37. North America Ionomer Sales Quantity Market Share by Country (2018-2029)

Figure 38. North America Ionomer Consumption Value Market Share by Country (2018-2029)

Figure 39. United States Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Canada Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 41. Mexico Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 42. Europe Ionomer Sales Quantity Market Share by Type (2018-2029)

Figure 43. Europe Ionomer Sales Quantity Market Share by Application (2018-2029)

Figure 44. Europe Ionomer Sales Quantity Market Share by Country (2018-2029)

Figure 45. Europe Ionomer Consumption Value Market Share by Country (2018-2029)

Figure 46. Germany Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. France Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. United Kingdom Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Russia Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 50. Italy Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 51. Asia-Pacific Ionomer Sales Quantity Market Share by Type (2018-2029)

Figure 52. Asia-Pacific Ionomer Sales Quantity Market Share by Application (2018-2029)

Figure 53. Asia-Pacific Ionomer Sales Quantity Market Share by Region (2018-2029)

Figure 54. Asia-Pacific Ionomer Consumption Value Market Share by Region (2018-2029)

Figure 55. China Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. Japan Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Korea Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. India Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. Southeast Asia Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 60. Australia Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 61. South America Ionomer Sales Quantity Market Share by Type (2018-2029)

Figure 62. South America Ionomer Sales Quantity Market Share by Application (2018-2029)

Figure 63. South America Ionomer Sales Quantity Market Share by Country (2018-2029)

Figure 64. South America Ionomer Consumption Value Market Share by Country (2018-2029)

Figure 65. Brazil Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 66. Argentina Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 67. Middle East & Africa Ionomer Sales Quantity Market Share by Type (2018-2029)

Figure 68. Middle East & Africa Ionomer Sales Quantity Market Share by Application (2018-2029)

Figure 69. Middle East & Africa Ionomer Sales Quantity Market Share by Region (2018-2029)

Figure 70. Middle East & Africa Ionomer Consumption Value Market Share by Region (2018-2029)

Figure 71. Turkey Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. Egypt Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. Saudi Arabia Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 74. South Africa Ionomer Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 75. Ionomer Market Drivers

Figure 76. Ionomer Market Restraints

Figure 77. Ionomer Market Trends

Figure 78. Porters Five Forces Analysis

Figure 79. Manufacturing Cost Structure Analysis of Ionomer in 2022

Figure 80. Manufacturing Process Analysis of Ionomer

Figure 81. Ionomer Industrial Chain

Figure 82. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 83. Direct Channel Pros & Cons

Figure 84. Indirect Channel Pros & Cons

Figure 85. Methodology

Figure 86. Research Process and Data Source