Refractive Surgery Market 2025: Emerging Trends, Technology Shifts, and Global Opportunities

The refractive surgery market is entering a transformative phase, with 2025 shaping up to be a landmark year for global vision correction advancements. Traditionally perceived as an elective procedure for vision enhancement, refractive surgery is now seen as a practical solution to the growing global burden of uncorrected refractive errors such as myopia, hyperopia, and astigmatism.

As innovation reshapes ophthalmology and patient expectations evolve, this sector is being redefined by minimally invasive techniques, broader accessibility, and increased medical acceptance. The convergence of digital diagnostics, laser precision, and changing lifestyle preferences is creating new momentum in both mature and emerging healthcare markets.

Key Market Drivers Influencing Growth

- Rising Prevalence of Refractive Disorders

The escalating incidence of myopia and digital eye strain is a critical factor fueling the refractive surgery market. With increased screen exposure and sedentary habits, younger populations are developing visual impairments earlier in life, prompting long-term corrective solutions. - Lifestyle-Centric Healthcare Demand

Patients across age groups are prioritizing procedures that align with convenience and long-term wellness. Refractive surgery eliminates dependence on eyeglasses and contact lenses, offering permanent correction for those seeking active lifestyles and low-maintenance visual freedom. - Advancements in Affordability and Financing

As procedures become more standardized, the cost of refractive surgery is decreasing. Clinics are offering flexible financing, EMI plans, and bundled packages, expanding access to a wider consumer base, particularly in urban centers across Asia-Pacific and Latin America. - Medical Tourism and Cross-Border Demand

Destinations known for ophthalmic expertise and cost-effective care—such as India, Thailand, and parts of Eastern Europe—are witnessing a surge in international patients seeking high-quality refractive surgery. This trend is contributing to market expansion and global procedural volume.

Technological Innovation Driving Market Evolution

- Precision-Guided Procedures

The rise of wavefront-guided LASIK and topography-customized treatments is transforming outcomes and patient satisfaction. These advancements allow for personalized surgical planning based on detailed corneal mapping, ensuring enhanced accuracy and fewer post-op complications. - SMILE and Minimally Invasive Options

Procedures like SMILE (Small Incision Lenticule Extraction) offer flapless alternatives to traditional LASIK, resulting in faster healing, reduced dry eye symptoms, and better corneal biomechanical stability. These options are expanding the eligible patient base. - Artificial Intelligence in Diagnostics

AI-powered imaging and analysis tools are now being used in preoperative planning. These systems predict outcomes more accurately and help identify ideal candidates, improving surgical efficiency and overall clinical results. - Integration with Telehealth Platforms

The digital transformation of healthcare is extending into ophthalmology. Pre-screening, follow-up consultations, and patient education are now facilitated through telehealth platforms, streamlining the surgical journey and enhancing patient engagement.

Regional Market Dynamics

- North America

This mature market continues to grow steadily, driven by early adoption of premium procedures and strong consumer awareness. Clinics focus on high-precision technologies and patient-centered care models, positioning refractive surgery as both a lifestyle and medical solution. - Europe

Regulatory cohesion across the EU is supporting consistent surgical standards. In Western Europe, demand is driven by aging populations and advanced optical care systems, while Eastern Europe benefits from growing private sector investment and cross-border patient inflows. - Asia-Pacific

Asia-Pacific is the fastest-growing market due to high myopia prevalence, growing middle-class income, and regional manufacturing of surgical devices. Countries like China, India, and South Korea are leading innovation and adoption at scale. - Latin America and Middle East

These regions are witnessing moderate growth as urbanization improves healthcare infrastructure. Brazil, Mexico, and UAE are key players, with private clinics expanding access to advanced refractive care in metropolitan areas.

Strategic Considerations for Industry Players

- Focus on Patient Education: Clinics that provide clear, accessible information on procedures, risks, and outcomes can build trust and drive conversions in a competitive space.

- Invest in Surgeon Training: As techniques evolve, consistent skill development is essential for ensuring safety and optimal outcomes across regions.

- Leverage Digital Marketing: Search-optimized content, online reviews, and virtual consultations are now central to patient acquisition and brand visibility.

- Develop Scalable Tech Solutions: Manufacturers offering modular, cost-effective platforms tailored for both high-end and budget-conscious markets can expand global reach.

- Embrace Eco-Responsibility: Sustainable surgical practices and materials are becoming increasingly relevant, especially in environmentally conscious healthcare systems.

Conclusion: Refractive Surgery in 2025 and Beyond

By 2025, the refractive surgery market is set to become a cornerstone of global vision care, offering precise, personalized, and permanent solutions to millions. Its evolution reflects broader shifts in consumer health behavior, innovation priorities, and healthcare accessibility.

Market leaders who combine cutting-edge technology with patient-centered strategies will not only drive procedural growth but also redefine the future of eye care. As the focus sharpens on efficiency, outcomes, and affordability, refractive surgery is moving from luxury to necessity for a generation seeking visual independence and improved quality of life.

NOTE:

Quants and Trends is proud to offer an extensive portfolio of meticulously researched healthcare market reports, numbering in the thousands. We also provide tailored customization services to ensure our insights align precisely with your strategic objectives and informational needs. For personalized assistance or to discuss your specific requirements, we invite you to get in touch with our team. We also encourage you to request a complimentary sample PDF report. Please visit our Sample Request Page to receive yours today.

Key Market Players

Bascom Palmer Eye Institute

Wills Eye Hospital

EuroEyes

Juntendo University Hospital

Teikyo University Hospital

Aier Eye Hospital Group

Huaxia Eye Hospital Group

Sanno Hospital

Optical Express

Optimax

Ultralase

Optegra

Focus Clinics

University of Iowa Hospitals & Clinics

National University Hospital

Bumrungrad International Hospital

Ottawa General Hospital

UCSF Health

Guangzheng Eye Hospital

C-Mer Eye Care

Liaoning He Eye Hospital

Beijing Tongren Hospital

Eye-Q

Aravind

Segmentation By Type

Corneal Refractive Surgery

ICL Surgery

Segmentation By Application

Hospital

Eye Clinic

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the refractive surgery market in 2025?

The refractive surgery market in 2025 benefits from advanced technologies like femtosecond lasers and improved surgical techniques, leading to better patient outcomes. The growing awareness about vision correction and increasing preference for laser surgeries are strong drivers. Moreover, the expansion of minimally invasive procedures attracts more patients seeking alternatives to glasses and contact lenses.

What are the weaknesses of the refractive surgery market in 2025?

One of the key weaknesses is the high cost associated with these procedures, which may limit accessibility for a wider audience. Additionally, some patients may experience side effects, such as dry eyes or halos, which can lead to dissatisfaction. The requirement for post-surgery follow-ups and the risk of complications, though rare, also contributes to a hesitation in patients opting for surgery.

What opportunities exist for the refractive surgery market in 2025?

The ongoing development of more personalized treatments and non-invasive technologies offers significant opportunities. As telemedicine grows, consultations for refractive surgery could become more accessible. Expanding markets in developing countries, where the demand for quality vision care is rising, also present growth potential. Collaboration with optometry professionals could lead to greater awareness and adoption of refractive procedures.

What are the threats to the refractive surgery market in 2025?

Competition from alternative vision correction solutions like contact lenses, glasses, and pharmaceutical treatments could pose a challenge to the growth of the refractive surgery market. In addition, potential regulatory changes and economic downturns may impact the affordability and demand for surgeries. Growing concerns about the long-term effects of refractive surgeries might also discourage new patients from opting for such procedures.

Market PESTEL Analysis

What are the political factors affecting the refractive surgery market in 2025?

Government regulations and policies regarding healthcare and medical devices significantly impact the refractive surgery market. In many regions, reimbursement policies for these surgeries can affect their accessibility and affordability. Political stability also influences healthcare investments and the introduction of new technologies in the market.

What are the economic factors affecting the refractive surgery market in 2025?

Economic conditions play a crucial role in shaping the demand for refractive surgeries. In times of economic growth, individuals are more likely to invest in elective procedures. However, during economic downturns, people might prioritize essential healthcare services over elective surgeries due to cost concerns. The affordability of treatments and insurance coverage are also key economic considerations.

What are the social factors affecting the refractive surgery market in 2025?

Social acceptance and awareness of refractive surgery procedures have grown, with more individuals seeking alternatives to glasses and contact lenses. Changing lifestyle choices, such as increased screen time and desire for convenience, contribute to the rising demand. Additionally, societal shifts towards cosmetic and aesthetic procedures play a role in increasing interest in vision correction surgeries.

What are the technological factors affecting the refractive surgery market in 2025?

Advancements in laser technology, precision tools, and diagnostic systems are pivotal in shaping the refractive surgery market. Newer, more effective technologies ensure higher success rates and faster recovery times, driving patient confidence. Continued research into improving surgical techniques and post-surgery treatments is expected to enhance the market's growth.

What are the environmental factors affecting the refractive surgery market in 2025?

Environmental sustainability is becoming increasingly relevant in healthcare, with a growing emphasis on eco-friendly practices. As medical facilities become more environmentally conscious, there may be pressure to adopt sustainable technologies and practices. However, the refractive surgery market itself doesn't directly face significant environmental challenges compared to other healthcare sectors.

What are the legal factors affecting the refractive surgery market in 2025?

Legal considerations, such as malpractice laws and patient rights, influence the refractive surgery market. Stringent regulations surrounding medical devices, including the lasers used in these surgeries, must be followed to ensure safety and efficacy. Additionally, evolving laws regarding patient privacy and data protection can affect how patient information is managed throughout the surgery process.

Market SIPOC Analysis

Who are the suppliers in the refractive surgery market in 2025?

Suppliers in the refractive surgery market include medical device manufacturers, particularly those producing advanced lasers, diagnostic equipment, and surgical instruments. Pharmaceutical companies providing pre- and post-surgery medications also play a key role. Additionally, healthcare providers, such as hospitals and clinics, supply the necessary infrastructure and skilled personnel for performing the surgeries.

What are the inputs for the refractive surgery market in 2025?

Inputs include cutting-edge technologies like femtosecond lasers and other precision instruments required for vision correction procedures. Research and development are essential inputs for continuously improving surgical techniques and recovery methods. Skilled surgeons, medical staff, and patient data for personalized treatments also serve as vital inputs.

What processes are involved in the refractive surgery market in 2025?

The process begins with patient consultations and pre-surgical assessments. Then, advanced surgical procedures, like LASIK or SMILE, are performed using specialized lasers and tools. Post-surgery follow-ups and patient care to ensure proper recovery and monitor outcomes are also essential. Continuous monitoring of advancements in technology and patient outcomes further shapes the process.

Who are the customers in the refractive surgery market in 2025?

Customers include individuals seeking vision correction due to refractive errors such as myopia, hyperopia, and astigmatism. This market also includes patients opting for these surgeries as a cosmetic choice to avoid glasses or contacts. Additionally, healthcare insurance providers and public health organizations, which cover or facilitate access to these procedures, also function as indirect customers.

What are the outputs of the refractive surgery market in 2025?

Outputs include successful vision correction results, offering patients improved quality of life, convenience, and satisfaction. These outcomes are accompanied by advancements in surgical techniques, enhanced post-operative care, and the development of newer, more efficient technologies. The market also generates financial returns for healthcare providers and suppliers involved in these procedures.

Market Porter's Five Forces

What is the threat of new entrants in the refractive surgery market in 2025?

The threat of new entrants in the refractive surgery market is moderate. While the market offers lucrative opportunities, the high costs associated with technology, expertise, and regulatory compliance act as significant barriers to entry. Additionally, established brands and healthcare providers have built strong trust and reputation, making it challenging for new players to gain a foothold.

What is the bargaining power of suppliers in the refractive surgery market in 2025?

The bargaining power of suppliers is relatively high. Suppliers of critical components like lasers, diagnostic equipment, and specialized instruments dominate the market, and their prices can significantly affect the cost structure of refractive surgery. However, as technological advancements continue, new suppliers and alternative technologies could reduce supplier power to some extent over time.

What is the bargaining power of buyers in the refractive surgery market in 2025?

The bargaining power of buyers is moderate to high, particularly as more patients become educated about alternative options for vision correction. With the availability of multiple surgery centers and the growing number of professionals offering these services, patients have more choices, which increases their negotiating power. However, factors like surgery success rates and quality of care still make buyers cautious.

What is the threat of substitutes in the refractive surgery market in 2025?

The threat of substitutes is moderate. While refractive surgeries provide permanent solutions, alternatives like corrective eyewear, contact lenses, and new pharmaceutical treatments for vision correction remain common substitutes. However, many patients prefer the long-term benefits and convenience of refractive surgery, reducing the overall impact of substitutes.

What is the intensity of competitive rivalry in the refractive surgery market in 2025?

The intensity of competitive rivalry in the refractive surgery market is high. Numerous well-established clinics and hospitals compete for a share of the growing market, utilizing advanced technology and offering differentiated services. As more providers enter the space and demand increases, competition will likely continue to intensify, leading to price pressures and innovations in treatment options.

Market Upstream Analysis

What are the key raw materials and components required for refractive surgeries in 2025?

The key components required for refractive surgeries include advanced laser systems, surgical instruments, and diagnostic tools like corneal mapping devices. The lasers, such as femtosecond and excimer lasers, are essential for performing precise surgical cuts. Other materials include medical-grade equipment like surgical blades, microkeratomes, and post-surgical pharmaceutical supplies like eye drops and healing ointments.

Who are the primary suppliers in the refractive surgery market in 2025?

Primary suppliers include manufacturers of laser systems and medical devices like Abbott, Johnson & Johnson, and Zeiss. These companies provide the high-tech lasers and imaging systems used in the surgeries. Additionally, suppliers of medical consumables such as sterilized surgical tools and post-operative medications play a key role. Suppliers of data management systems for patient tracking and follow-up care are also crucial in the market.

What technological innovations are influencing the upstream supply chain for refractive surgeries in 2025?

Technological innovations such as improved laser precision, femtosecond laser advancements, and 3D imaging systems are influencing the supply chain. Automation in diagnostics and surgery is reducing the margin of error and increasing patient safety, while newer non-invasive technologies, like SMILE (Small Incision Lenticule Extraction), are creating demand for updated equipment. Innovations in data management systems are enhancing post-operative care and monitoring.

What are the regulatory challenges faced by suppliers in the refractive surgery market in 2025?

Suppliers face regulatory challenges related to the approval of new medical devices and technologies, which require rigorous testing and compliance with health authorities like the FDA and CE. The need for constant adherence to safety standards and periodic inspections also adds to the complexity. Additionally, new regulations on patient data privacy and environmental sustainability practices are becoming increasingly important.

How do supply chain disruptions impact the refractive surgery market in 2025?

Supply chain disruptions can delay the production and delivery of essential surgical instruments, lasers, and consumables, leading to increased costs and delays in surgeries. The reliance on global suppliers for key components exposes the market to risks from geopolitical tensions, natural disasters, or pandemics. These disruptions could also hinder innovation by slowing down the development of next-generation surgical technologies.

Market Midstream Analysis

What are the main activities in the midstream of the refractive surgery market in 2025?

In the midstream, activities focus on the distribution and integration of advanced medical devices, like laser systems, into healthcare facilities. This includes logistics, ensuring that surgical equipment, tools, and pharmaceuticals reach the clinics and hospitals. Additionally, training healthcare professionals, such as ophthalmologists and technicians, to effectively use these technologies is a critical midstream activity.

Who are the key players in the midstream of the refractive surgery market in 2025?

Key players include medical device distributors, surgical equipment suppliers, and training organizations. Prominent distribution companies partner with manufacturers like Zeiss, Alcon, and Bausch & Lomb to ensure the supply of laser systems and surgical instruments. Moreover, ophthalmic clinics and surgery centers play an essential role in implementing the procedures and ensuring patient care post-surgery.

How does the integration of technology impact the midstream of the refractive surgery market in 2025?

Technology integration greatly improves the efficiency and accuracy of surgeries. Advances in surgical equipment, like femtosecond lasers and diagnostic imaging systems, enhance surgical precision, which is crucial in the midstream. Furthermore, data management systems help streamline patient care, ensuring better tracking and monitoring of outcomes. Training and certification in these advanced technologies are also vital in maintaining high standards of care.

What challenges do midstream players face in the refractive surgery market in 2025?

Midstream players face challenges related to the cost of high-tech equipment and the need for continuous training and certification of healthcare providers. Another challenge is ensuring the timely delivery and maintenance of specialized equipment, which can be costly and require specialized knowledge. Regulatory pressures around safety and quality standards also create hurdles for smooth operations in the midstream.

How does the demand for refractive surgery impact midstream operations in 2025?

As demand for refractive surgeries grows, midstream operations must scale to meet the increased need for surgical tools, lasers, and diagnostic systems. More clinics and hospitals are expanding their services to meet patient expectations, which drives demand for both equipment and trained professionals. Efficient distribution networks and a steady supply of advanced technology are critical to sustaining this growth.

Market Downstream Analysis

What are the main activities in the downstream of the refractive surgery market in 2025?

In the downstream, activities revolve around the delivery of refractive surgeries to patients, including the actual surgical procedures and post-surgical care. This includes pre-surgery consultations, patient education, performing surgeries like LASIK and SMILE, and providing follow-up care to monitor recovery and outcomes. Marketing and patient acquisition are also key downstream activities for clinics and surgery centers.

Who are the key players in the downstream of the refractive surgery market in 2025?

Key players include ophthalmic surgery centers, hospitals, and specialized refractive surgery clinics. These entities perform the actual surgeries and are directly responsible for patient care. Additionally, optometrists, healthcare providers offering post-surgery support, and marketing agencies targeting potential patients play crucial roles in the downstream ecosystem.

How does the patient experience impact the downstream of the refractive surgery market in 2025?

The patient experience is critical in the downstream as it influences satisfaction, word-of-mouth referrals, and repeat business. A positive experience with minimal complications, fast recovery times, and clear communication can build patient loyalty and enhance clinic reputations. On the other hand, complications or dissatisfaction could negatively impact market growth.

What are the challenges faced by downstream players in the refractive surgery market in 2025?

Downstream players face challenges such as maintaining high-quality patient care, managing patient expectations, and addressing post-surgery complications. Additionally, competition is intense, with numerous clinics and hospitals offering similar services. Regulatory compliance, especially with safety standards and patient data protection, is another critical challenge in this sector.

How does market demand affect downstream operations in the refractive surgery market in 2025?

Increasing demand for vision correction procedures boosts the downstream operations, leading to higher patient volumes and the need for expanded facilities and staffing. Clinics and hospitals must adapt by upgrading technologies, increasing surgical capacity, and ensuring consistent quality in patient care. Effective marketing and patient retention strategies are also essential to meet growing demand.

Chapter 1, to describe Refractive Surgery product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Refractive Surgery, with revenue, gross margin and global market share of Refractive Surgery from 2018 to 2023.

Chapter 3, the Refractive Surgery competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Refractive Surgery market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Refractive Surgery.

Chapter 13, to describe Refractive Surgery research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Refractive Surgery

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Refractive Surgery by Type

1.3.1 Overview: Global Refractive Surgery Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Refractive Surgery Consumption Value Market Share by Type in 2022

1.3.3 Corneal Refractive Surgery

1.3.4 ICL Surgery

1.4 Global Refractive Surgery Market by Application

1.4.1 Overview: Global Refractive Surgery Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital

1.4.3 Eye Clinic

1.5 Global Refractive Surgery Market Size & Forecast

1.6 Global Refractive Surgery Market Size and Forecast by Region

1.6.1 Global Refractive Surgery Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Refractive Surgery Market Size by Region, (2018-2029)

1.6.3 North America Refractive Surgery Market Size and Prospect (2018-2029)

1.6.4 Europe Refractive Surgery Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Refractive Surgery Market Size and Prospect (2018-2029)

1.6.6 South America Refractive Surgery Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Refractive Surgery Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Bascom Palmer Eye Institute

2.1.1 Bascom Palmer Eye Institute Details

2.1.2 Bascom Palmer Eye Institute Major Business

2.1.3 Bascom Palmer Eye Institute Refractive Surgery Product and Solutions

2.1.4 Bascom Palmer Eye Institute Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Bascom Palmer Eye Institute Recent Developments and Future Plans

2.2 Wills Eye Hospital

2.2.1 Wills Eye Hospital Details

2.2.2 Wills Eye Hospital Major Business

2.2.3 Wills Eye Hospital Refractive Surgery Product and Solutions

2.2.4 Wills Eye Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Wills Eye Hospital Recent Developments and Future Plans

2.3 EuroEyes

2.3.1 EuroEyes Details

2.3.2 EuroEyes Major Business

2.3.3 EuroEyes Refractive Surgery Product and Solutions

2.3.4 EuroEyes Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 EuroEyes Recent Developments and Future Plans

2.4 Juntendo University Hospital

2.4.1 Juntendo University Hospital Details

2.4.2 Juntendo University Hospital Major Business

2.4.3 Juntendo University Hospital Refractive Surgery Product and Solutions

2.4.4 Juntendo University Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Juntendo University Hospital Recent Developments and Future Plans

2.5 Teikyo University Hospital

2.5.1 Teikyo University Hospital Details

2.5.2 Teikyo University Hospital Major Business

2.5.3 Teikyo University Hospital Refractive Surgery Product and Solutions

2.5.4 Teikyo University Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Teikyo University Hospital Recent Developments and Future Plans

2.6 Aier Eye Hospital Group

2.6.1 Aier Eye Hospital Group Details

2.6.2 Aier Eye Hospital Group Major Business

2.6.3 Aier Eye Hospital Group Refractive Surgery Product and Solutions

2.6.4 Aier Eye Hospital Group Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Aier Eye Hospital Group Recent Developments and Future Plans

2.7 Huaxia Eye Hospital Group

2.7.1 Huaxia Eye Hospital Group Details

2.7.2 Huaxia Eye Hospital Group Major Business

2.7.3 Huaxia Eye Hospital Group Refractive Surgery Product and Solutions

2.7.4 Huaxia Eye Hospital Group Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Huaxia Eye Hospital Group Recent Developments and Future Plans

2.8 Sanno Hospital

2.8.1 Sanno Hospital Details

2.8.2 Sanno Hospital Major Business

2.8.3 Sanno Hospital Refractive Surgery Product and Solutions

2.8.4 Sanno Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Sanno Hospital Recent Developments and Future Plans

2.9 Optical Express

2.9.1 Optical Express Details

2.9.2 Optical Express Major Business

2.9.3 Optical Express Refractive Surgery Product and Solutions

2.9.4 Optical Express Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Optical Express Recent Developments and Future Plans

2.10 Optimax

2.10.1 Optimax Details

2.10.2 Optimax Major Business

2.10.3 Optimax Refractive Surgery Product and Solutions

2.10.4 Optimax Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Optimax Recent Developments and Future Plans

2.11 Ultralase

2.11.1 Ultralase Details

2.11.2 Ultralase Major Business

2.11.3 Ultralase Refractive Surgery Product and Solutions

2.11.4 Ultralase Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Ultralase Recent Developments and Future Plans

2.12 Optegra

2.12.1 Optegra Details

2.12.2 Optegra Major Business

2.12.3 Optegra Refractive Surgery Product and Solutions

2.12.4 Optegra Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 Optegra Recent Developments and Future Plans

2.13 Focus Clinics

2.13.1 Focus Clinics Details

2.13.2 Focus Clinics Major Business

2.13.3 Focus Clinics Refractive Surgery Product and Solutions

2.13.4 Focus Clinics Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Focus Clinics Recent Developments and Future Plans

2.14 University of Iowa Hospitals & Clinics

2.14.1 University of Iowa Hospitals & Clinics Details

2.14.2 University of Iowa Hospitals & Clinics Major Business

2.14.3 University of Iowa Hospitals & Clinics Refractive Surgery Product and Solutions

2.14.4 University of Iowa Hospitals & Clinics Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 University of Iowa Hospitals & Clinics Recent Developments and Future Plans

2.15 National University Hospital

2.15.1 National University Hospital Details

2.15.2 National University Hospital Major Business

2.15.3 National University Hospital Refractive Surgery Product and Solutions

2.15.4 National University Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 National University Hospital Recent Developments and Future Plans

2.16 Bumrungrad International Hospital

2.16.1 Bumrungrad International Hospital Details

2.16.2 Bumrungrad International Hospital Major Business

2.16.3 Bumrungrad International Hospital Refractive Surgery Product and Solutions

2.16.4 Bumrungrad International Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.16.5 Bumrungrad International Hospital Recent Developments and Future Plans

2.17 Ottawa General Hospital

2.17.1 Ottawa General Hospital Details

2.17.2 Ottawa General Hospital Major Business

2.17.3 Ottawa General Hospital Refractive Surgery Product and Solutions

2.17.4 Ottawa General Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.17.5 Ottawa General Hospital Recent Developments and Future Plans

2.18 UCSF Health

2.18.1 UCSF Health Details

2.18.2 UCSF Health Major Business

2.18.3 UCSF Health Refractive Surgery Product and Solutions

2.18.4 UCSF Health Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.18.5 UCSF Health Recent Developments and Future Plans

2.19 Guangzheng Eye Hospital

2.19.1 Guangzheng Eye Hospital Details

2.19.2 Guangzheng Eye Hospital Major Business

2.19.3 Guangzheng Eye Hospital Refractive Surgery Product and Solutions

2.19.4 Guangzheng Eye Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.19.5 Guangzheng Eye Hospital Recent Developments and Future Plans

2.20 C-Mer Eye Care

2.20.1 C-Mer Eye Care Details

2.20.2 C-Mer Eye Care Major Business

2.20.3 C-Mer Eye Care Refractive Surgery Product and Solutions

2.20.4 C-Mer Eye Care Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.20.5 C-Mer Eye Care Recent Developments and Future Plans

2.21 Liaoning He Eye Hospital

2.21.1 Liaoning He Eye Hospital Details

2.21.2 Liaoning He Eye Hospital Major Business

2.21.3 Liaoning He Eye Hospital Refractive Surgery Product and Solutions

2.21.4 Liaoning He Eye Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.21.5 Liaoning He Eye Hospital Recent Developments and Future Plans

2.22 Beijing Tongren Hospital

2.22.1 Beijing Tongren Hospital Details

2.22.2 Beijing Tongren Hospital Major Business

2.22.3 Beijing Tongren Hospital Refractive Surgery Product and Solutions

2.22.4 Beijing Tongren Hospital Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.22.5 Beijing Tongren Hospital Recent Developments and Future Plans

2.23 Eye-Q

2.23.1 Eye-Q Details

2.23.2 Eye-Q Major Business

2.23.3 Eye-Q Refractive Surgery Product and Solutions

2.23.4 Eye-Q Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.23.5 Eye-Q Recent Developments and Future Plans

2.24 Aravind

2.24.1 Aravind Details

2.24.2 Aravind Major Business

2.24.3 Aravind Refractive Surgery Product and Solutions

2.24.4 Aravind Refractive Surgery Revenue, Gross Margin and Market Share (2018-2023)

2.24.5 Aravind Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Refractive Surgery Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Refractive Surgery by Company Revenue

3.2.2 Top 3 Refractive Surgery Players Market Share in 2022

3.2.3 Top 6 Refractive Surgery Players Market Share in 2022

3.3 Refractive Surgery Market: Overall Company Footprint Analysis

3.3.1 Refractive Surgery Market: Region Footprint

3.3.2 Refractive Surgery Market: Company Product Type Footprint

3.3.3 Refractive Surgery Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Refractive Surgery Consumption Value and Market Share by Type (2018-2023)

4.2 Global Refractive Surgery Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Refractive Surgery Consumption Value Market Share by Application (2018-2023)

5.2 Global Refractive Surgery Market Forecast by Application (2024-2029)

6 North America

6.1 North America Refractive Surgery Consumption Value by Type (2018-2029)

6.2 North America Refractive Surgery Consumption Value by Application (2018-2029)

6.3 North America Refractive Surgery Market Size by Country

6.3.1 North America Refractive Surgery Consumption Value by Country (2018-2029)

6.3.2 United States Refractive Surgery Market Size and Forecast (2018-2029)

6.3.3 Canada Refractive Surgery Market Size and Forecast (2018-2029)

6.3.4 Mexico Refractive Surgery Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Refractive Surgery Consumption Value by Type (2018-2029)

7.2 Europe Refractive Surgery Consumption Value by Application (2018-2029)

7.3 Europe Refractive Surgery Market Size by Country

7.3.1 Europe Refractive Surgery Consumption Value by Country (2018-2029)

7.3.2 Germany Refractive Surgery Market Size and Forecast (2018-2029)

7.3.3 France Refractive Surgery Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Refractive Surgery Market Size and Forecast (2018-2029)

7.3.5 Russia Refractive Surgery Market Size and Forecast (2018-2029)

7.3.6 Italy Refractive Surgery Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Refractive Surgery Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Refractive Surgery Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Refractive Surgery Market Size by Region

8.3.1 Asia-Pacific Refractive Surgery Consumption Value by Region (2018-2029)

8.3.2 China Refractive Surgery Market Size and Forecast (2018-2029)

8.3.3 Japan Refractive Surgery Market Size and Forecast (2018-2029)

8.3.4 South Korea Refractive Surgery Market Size and Forecast (2018-2029)

8.3.5 India Refractive Surgery Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Refractive Surgery Market Size and Forecast (2018-2029)

8.3.7 Australia Refractive Surgery Market Size and Forecast (2018-2029)

9 South America

9.1 South America Refractive Surgery Consumption Value by Type (2018-2029)

9.2 South America Refractive Surgery Consumption Value by Application (2018-2029)

9.3 South America Refractive Surgery Market Size by Country

9.3.1 South America Refractive Surgery Consumption Value by Country (2018-2029)

9.3.2 Brazil Refractive Surgery Market Size and Forecast (2018-2029)

9.3.3 Argentina Refractive Surgery Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Refractive Surgery Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Refractive Surgery Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Refractive Surgery Market Size by Country

10.3.1 Middle East & Africa Refractive Surgery Consumption Value by Country (2018-2029)

10.3.2 Turkey Refractive Surgery Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Refractive Surgery Market Size and Forecast (2018-2029)

10.3.4 UAE Refractive Surgery Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Refractive Surgery Market Drivers

11.2 Refractive Surgery Market Restraints

11.3 Refractive Surgery Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Refractive Surgery Industry Chain

12.2 Refractive Surgery Upstream Analysis

12.3 Refractive Surgery Midstream Analysis

12.4 Refractive Surgery Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

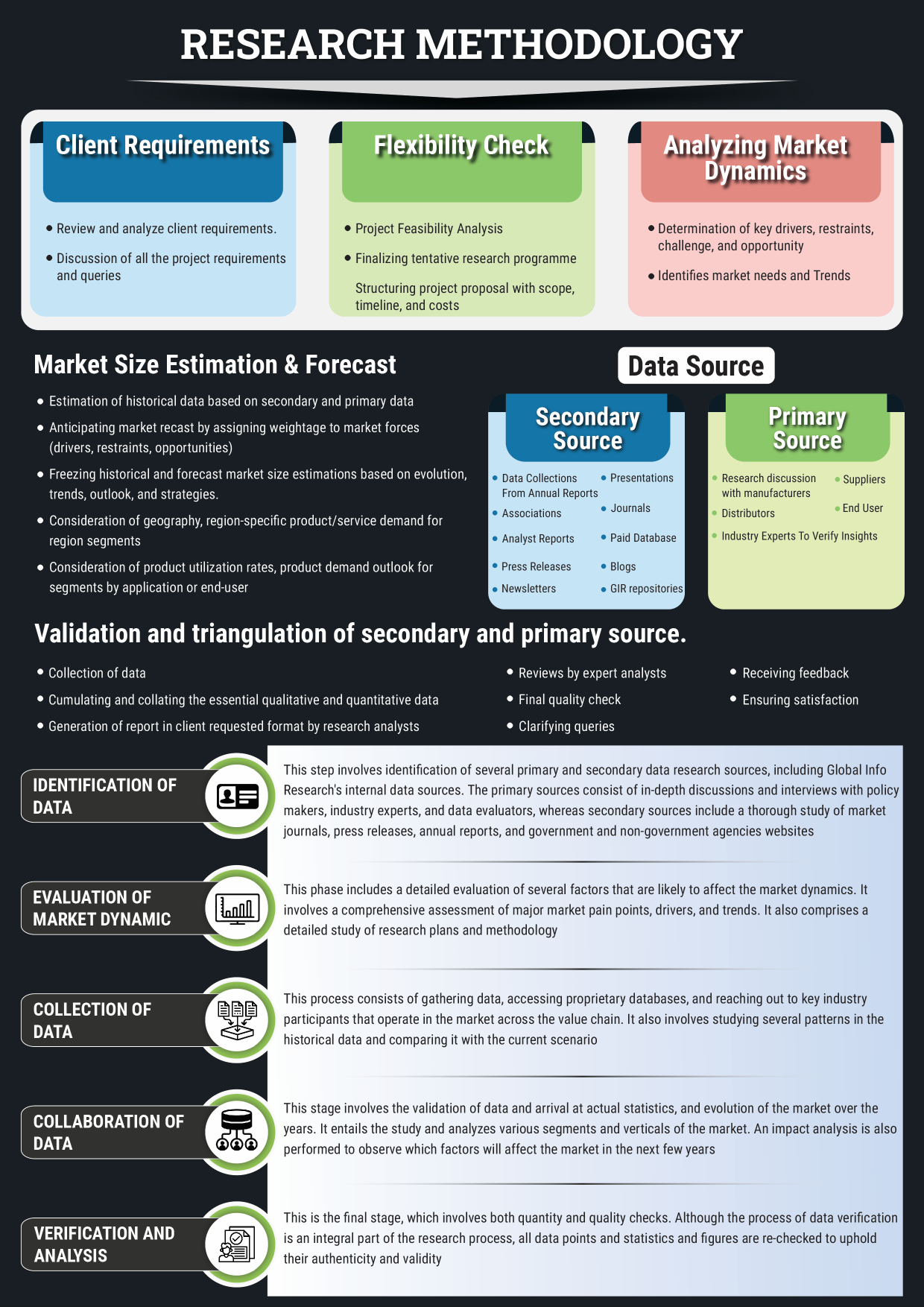

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Refractive Surgery Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Refractive Surgery Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Refractive Surgery Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Refractive Surgery Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Bascom Palmer Eye Institute Company Information, Head Office, and Major Competitors

Table 6. Bascom Palmer Eye Institute Major Business

Table 7. Bascom Palmer Eye Institute Refractive Surgery Product and Solutions

Table 8. Bascom Palmer Eye Institute Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Bascom Palmer Eye Institute Recent Developments and Future Plans

Table 10. Wills Eye Hospital Company Information, Head Office, and Major Competitors

Table 11. Wills Eye Hospital Major Business

Table 12. Wills Eye Hospital Refractive Surgery Product and Solutions

Table 13. Wills Eye Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. Wills Eye Hospital Recent Developments and Future Plans

Table 15. EuroEyes Company Information, Head Office, and Major Competitors

Table 16. EuroEyes Major Business

Table 17. EuroEyes Refractive Surgery Product and Solutions

Table 18. EuroEyes Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. EuroEyes Recent Developments and Future Plans

Table 20. Juntendo University Hospital Company Information, Head Office, and Major Competitors

Table 21. Juntendo University Hospital Major Business

Table 22. Juntendo University Hospital Refractive Surgery Product and Solutions

Table 23. Juntendo University Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Juntendo University Hospital Recent Developments and Future Plans

Table 25. Teikyo University Hospital Company Information, Head Office, and Major Competitors

Table 26. Teikyo University Hospital Major Business

Table 27. Teikyo University Hospital Refractive Surgery Product and Solutions

Table 28. Teikyo University Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. Teikyo University Hospital Recent Developments and Future Plans

Table 30. Aier Eye Hospital Group Company Information, Head Office, and Major Competitors

Table 31. Aier Eye Hospital Group Major Business

Table 32. Aier Eye Hospital Group Refractive Surgery Product and Solutions

Table 33. Aier Eye Hospital Group Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Aier Eye Hospital Group Recent Developments and Future Plans

Table 35. Huaxia Eye Hospital Group Company Information, Head Office, and Major Competitors

Table 36. Huaxia Eye Hospital Group Major Business

Table 37. Huaxia Eye Hospital Group Refractive Surgery Product and Solutions

Table 38. Huaxia Eye Hospital Group Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Huaxia Eye Hospital Group Recent Developments and Future Plans

Table 40. Sanno Hospital Company Information, Head Office, and Major Competitors

Table 41. Sanno Hospital Major Business

Table 42. Sanno Hospital Refractive Surgery Product and Solutions

Table 43. Sanno Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. Sanno Hospital Recent Developments and Future Plans

Table 45. Optical Express Company Information, Head Office, and Major Competitors

Table 46. Optical Express Major Business

Table 47. Optical Express Refractive Surgery Product and Solutions

Table 48. Optical Express Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. Optical Express Recent Developments and Future Plans

Table 50. Optimax Company Information, Head Office, and Major Competitors

Table 51. Optimax Major Business

Table 52. Optimax Refractive Surgery Product and Solutions

Table 53. Optimax Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Optimax Recent Developments and Future Plans

Table 55. Ultralase Company Information, Head Office, and Major Competitors

Table 56. Ultralase Major Business

Table 57. Ultralase Refractive Surgery Product and Solutions

Table 58. Ultralase Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 59. Ultralase Recent Developments and Future Plans

Table 60. Optegra Company Information, Head Office, and Major Competitors

Table 61. Optegra Major Business

Table 62. Optegra Refractive Surgery Product and Solutions

Table 63. Optegra Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 64. Optegra Recent Developments and Future Plans

Table 65. Focus Clinics Company Information, Head Office, and Major Competitors

Table 66. Focus Clinics Major Business

Table 67. Focus Clinics Refractive Surgery Product and Solutions

Table 68. Focus Clinics Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 69. Focus Clinics Recent Developments and Future Plans

Table 70. University of Iowa Hospitals & Clinics Company Information, Head Office, and Major Competitors

Table 71. University of Iowa Hospitals & Clinics Major Business

Table 72. University of Iowa Hospitals & Clinics Refractive Surgery Product and Solutions

Table 73. University of Iowa Hospitals & Clinics Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 74. University of Iowa Hospitals & Clinics Recent Developments and Future Plans

Table 75. National University Hospital Company Information, Head Office, and Major Competitors

Table 76. National University Hospital Major Business

Table 77. National University Hospital Refractive Surgery Product and Solutions

Table 78. National University Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 79. National University Hospital Recent Developments and Future Plans

Table 80. Bumrungrad International Hospital Company Information, Head Office, and Major Competitors

Table 81. Bumrungrad International Hospital Major Business

Table 82. Bumrungrad International Hospital Refractive Surgery Product and Solutions

Table 83. Bumrungrad International Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 84. Bumrungrad International Hospital Recent Developments and Future Plans

Table 85. Ottawa General Hospital Company Information, Head Office, and Major Competitors

Table 86. Ottawa General Hospital Major Business

Table 87. Ottawa General Hospital Refractive Surgery Product and Solutions

Table 88. Ottawa General Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 89. Ottawa General Hospital Recent Developments and Future Plans

Table 90. UCSF Health Company Information, Head Office, and Major Competitors

Table 91. UCSF Health Major Business

Table 92. UCSF Health Refractive Surgery Product and Solutions

Table 93. UCSF Health Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 94. UCSF Health Recent Developments and Future Plans

Table 95. Guangzheng Eye Hospital Company Information, Head Office, and Major Competitors

Table 96. Guangzheng Eye Hospital Major Business

Table 97. Guangzheng Eye Hospital Refractive Surgery Product and Solutions

Table 98. Guangzheng Eye Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 99. Guangzheng Eye Hospital Recent Developments and Future Plans

Table 100. C-Mer Eye Care Company Information, Head Office, and Major Competitors

Table 101. C-Mer Eye Care Major Business

Table 102. C-Mer Eye Care Refractive Surgery Product and Solutions

Table 103. C-Mer Eye Care Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 104. C-Mer Eye Care Recent Developments and Future Plans

Table 105. Liaoning He Eye Hospital Company Information, Head Office, and Major Competitors

Table 106. Liaoning He Eye Hospital Major Business

Table 107. Liaoning He Eye Hospital Refractive Surgery Product and Solutions

Table 108. Liaoning He Eye Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 109. Liaoning He Eye Hospital Recent Developments and Future Plans

Table 110. Beijing Tongren Hospital Company Information, Head Office, and Major Competitors

Table 111. Beijing Tongren Hospital Major Business

Table 112. Beijing Tongren Hospital Refractive Surgery Product and Solutions

Table 113. Beijing Tongren Hospital Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 114. Beijing Tongren Hospital Recent Developments and Future Plans

Table 115. Eye-Q Company Information, Head Office, and Major Competitors

Table 116. Eye-Q Major Business

Table 117. Eye-Q Refractive Surgery Product and Solutions

Table 118. Eye-Q Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 119. Eye-Q Recent Developments and Future Plans

Table 120. Aravind Company Information, Head Office, and Major Competitors

Table 121. Aravind Major Business

Table 122. Aravind Refractive Surgery Product and Solutions

Table 123. Aravind Refractive Surgery Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 124. Aravind Recent Developments and Future Plans

Table 125. Global Refractive Surgery Revenue (USD Million) by Players (2018-2023)

Table 126. Global Refractive Surgery Revenue Share by Players (2018-2023)

Table 127. Breakdown of Refractive Surgery by Company Type (Tier 1, Tier 2, and Tier 3)

Table 128. Market Position of Players in Refractive Surgery, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 129. Head Office of Key Refractive Surgery Players

Table 130. Refractive Surgery Market: Company Product Type Footprint

Table 131. Refractive Surgery Market: Company Product Application Footprint

Table 132. Refractive Surgery New Market Entrants and Barriers to Market Entry

Table 133. Refractive Surgery Mergers, Acquisition, Agreements, and Collaborations

Table 134. Global Refractive Surgery Consumption Value (USD Million) by Type (2018-2023)

Table 135. Global Refractive Surgery Consumption Value Share by Type (2018-2023)

Table 136. Global Refractive Surgery Consumption Value Forecast by Type (2024-2029)

Table 137. Global Refractive Surgery Consumption Value by Application (2018-2023)

Table 138. Global Refractive Surgery Consumption Value Forecast by Application (2024-2029)

Table 139. North America Refractive Surgery Consumption Value by Type (2018-2023) & (USD Million)

Table 140. North America Refractive Surgery Consumption Value by Type (2024-2029) & (USD Million)

Table 141. North America Refractive Surgery Consumption Value by Application (2018-2023) & (USD Million)

Table 142. North America Refractive Surgery Consumption Value by Application (2024-2029) & (USD Million)

Table 143. North America Refractive Surgery Consumption Value by Country (2018-2023) & (USD Million)

Table 144. North America Refractive Surgery Consumption Value by Country (2024-2029) & (USD Million)

Table 145. Europe Refractive Surgery Consumption Value by Type (2018-2023) & (USD Million)

Table 146. Europe Refractive Surgery Consumption Value by Type (2024-2029) & (USD Million)

Table 147. Europe Refractive Surgery Consumption Value by Application (2018-2023) & (USD Million)

Table 148. Europe Refractive Surgery Consumption Value by Application (2024-2029) & (USD Million)

Table 149. Europe Refractive Surgery Consumption Value by Country (2018-2023) & (USD Million)

Table 150. Europe Refractive Surgery Consumption Value by Country (2024-2029) & (USD Million)

Table 151. Asia-Pacific Refractive Surgery Consumption Value by Type (2018-2023) & (USD Million)

Table 152. Asia-Pacific Refractive Surgery Consumption Value by Type (2024-2029) & (USD Million)

Table 153. Asia-Pacific Refractive Surgery Consumption Value by Application (2018-2023) & (USD Million)

Table 154. Asia-Pacific Refractive Surgery Consumption Value by Application (2024-2029) & (USD Million)

Table 155. Asia-Pacific Refractive Surgery Consumption Value by Region (2018-2023) & (USD Million)

Table 156. Asia-Pacific Refractive Surgery Consumption Value by Region (2024-2029) & (USD Million)

Table 157. South America Refractive Surgery Consumption Value by Type (2018-2023) & (USD Million)

Table 158. South America Refractive Surgery Consumption Value by Type (2024-2029) & (USD Million)

Table 159. South America Refractive Surgery Consumption Value by Application (2018-2023) & (USD Million)

Table 160. South America Refractive Surgery Consumption Value by Application (2024-2029) & (USD Million)

Table 161. South America Refractive Surgery Consumption Value by Country (2018-2023) & (USD Million)

Table 162. South America Refractive Surgery Consumption Value by Country (2024-2029) & (USD Million)

Table 163. Middle East & Africa Refractive Surgery Consumption Value by Type (2018-2023) & (USD Million)

Table 164. Middle East & Africa Refractive Surgery Consumption Value by Type (2024-2029) & (USD Million)

Table 165. Middle East & Africa Refractive Surgery Consumption Value by Application (2018-2023) & (USD Million)

Table 166. Middle East & Africa Refractive Surgery Consumption Value by Application (2024-2029) & (USD Million)

Table 167. Middle East & Africa Refractive Surgery Consumption Value by Country (2018-2023) & (USD Million)

Table 168. Middle East & Africa Refractive Surgery Consumption Value by Country (2024-2029) & (USD Million)

Table 169. Refractive Surgery Raw Material

Table 170. Key Suppliers of Refractive Surgery Raw Materials

List of Figures

Figure 1. Refractive Surgery Picture

Figure 2. Global Refractive Surgery Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Refractive Surgery Consumption Value Market Share by Type in 2022

Figure 4. Corneal Refractive Surgery

Figure 5. ICL Surgery

Figure 6. Global Refractive Surgery Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 7. Refractive Surgery Consumption Value Market Share by Application in 2022

Figure 8. Hospital Picture

Figure 9. Eye Clinic Picture

Figure 10. Global Refractive Surgery Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 11. Global Refractive Surgery Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 12. Global Market Refractive Surgery Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 13. Global Refractive Surgery Consumption Value Market Share by Region (2018-2029)

Figure 14. Global Refractive Surgery Consumption Value Market Share by Region in 2022

Figure 15. North America Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 16. Europe Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 17. Asia-Pacific Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 18. South America Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 19. Middle East and Africa Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 20. Global Refractive Surgery Revenue Share by Players in 2022

Figure 21. Refractive Surgery Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 22. Global Top 3 Players Refractive Surgery Market Share in 2022

Figure 23. Global Top 6 Players Refractive Surgery Market Share in 2022

Figure 24. Global Refractive Surgery Consumption Value Share by Type (2018-2023)

Figure 25. Global Refractive Surgery Market Share Forecast by Type (2024-2029)

Figure 26. Global Refractive Surgery Consumption Value Share by Application (2018-2023)

Figure 27. Global Refractive Surgery Market Share Forecast by Application (2024-2029)

Figure 28. North America Refractive Surgery Consumption Value Market Share by Type (2018-2029)

Figure 29. North America Refractive Surgery Consumption Value Market Share by Application (2018-2029)

Figure 30. North America Refractive Surgery Consumption Value Market Share by Country (2018-2029)

Figure 31. United States Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 32. Canada Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 33. Mexico Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 34. Europe Refractive Surgery Consumption Value Market Share by Type (2018-2029)

Figure 35. Europe Refractive Surgery Consumption Value Market Share by Application (2018-2029)

Figure 36. Europe Refractive Surgery Consumption Value Market Share by Country (2018-2029)

Figure 37. Germany Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 38. France Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 39. United Kingdom Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 40. Russia Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 41. Italy Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 42. Asia-Pacific Refractive Surgery Consumption Value Market Share by Type (2018-2029)

Figure 43. Asia-Pacific Refractive Surgery Consumption Value Market Share by Application (2018-2029)

Figure 44. Asia-Pacific Refractive Surgery Consumption Value Market Share by Region (2018-2029)

Figure 45. China Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 46. Japan Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 47. South Korea Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 48. India Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 49. Southeast Asia Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 50. Australia Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 51. South America Refractive Surgery Consumption Value Market Share by Type (2018-2029)

Figure 52. South America Refractive Surgery Consumption Value Market Share by Application (2018-2029)

Figure 53. South America Refractive Surgery Consumption Value Market Share by Country (2018-2029)

Figure 54. Brazil Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 55. Argentina Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 56. Middle East and Africa Refractive Surgery Consumption Value Market Share by Type (2018-2029)

Figure 57. Middle East and Africa Refractive Surgery Consumption Value Market Share by Application (2018-2029)

Figure 58. Middle East and Africa Refractive Surgery Consumption Value Market Share by Country (2018-2029)

Figure 59. Turkey Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 60. Saudi Arabia Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 61. UAE Refractive Surgery Consumption Value (2018-2029) & (USD Million)

Figure 62. Refractive Surgery Market Drivers

Figure 63. Refractive Surgery Market Restraints

Figure 64. Refractive Surgery Market Trends

Figure 65. Porters Five Forces Analysis

Figure 66. Manufacturing Cost Structure Analysis of Refractive Surgery in 2022

Figure 67. Manufacturing Process Analysis of Refractive Surgery

Figure 68. Refractive Surgery Industrial Chain

Figure 69. Methodology

Figure 70. Research Process and Data Source