Introduction

The Monocyte Activation Test (MAT) has quickly become a pivotal technology in pyrogen testing, providing a humane and scientifically advanced alternative to traditional animal-based testing methods. With the increasing need for reliable, ethical testing practices in the biopharmaceutical industry, the MAT market is set for significant growth in 2025. This report explores key factors driving the growth of the Monocyte Activation Test market, emerging innovations, regional market trends, and strategic insights to help market research clients navigate this evolving sector.

Market Drivers: What’s Driving Growth in the MAT Market?

The MAT market is growing rapidly, propelled by several key drivers that align with global trends in pharmaceutical development and testing standards:

- Regulatory Advancements: Regulatory bodies such as the European Pharmacopeia and U.S. Pharmacopeia have recognized MAT as a validated method for pyrogen detection. This regulatory backing encourages its adoption across industries like vaccines, biologics, and medical devices, where pyrogen-free products are critical for safety.

- Ethical Shifts Toward Animal-Free Testing: As concerns about animal testing intensify, MAT offers an ethical, in vitro solution to pyrogen testing. The push for cruelty-free testing in both pharmaceuticals and cosmetics industries aligns with MAT’s growing adoption.

- Biopharmaceutical Safety Concerns: The rapid growth in biologics and vaccine development is driving the demand for more reliable and efficient pyrogen detection methods. MAT plays a crucial role in ensuring the safety of these products by detecting endotoxins and non-endotoxin pyrogens.

- Technological Advancements: Innovations in assay sensitivity, automation, and data analytics have made MAT testing faster, more cost-effective, and more reliable, making it increasingly appealing to manufacturers and regulators alike.

Key Innovations Reshaping the MAT Market

Several innovations are enhancing the capabilities and applications of the Monocyte Activation Test:

- Enhanced Sensitivity of Assays: Recent developments in MAT assays have significantly improved the detection of pyrogens with greater sensitivity and specificity. This enables the detection of even the smallest traces of endotoxins and non-endotoxin pyrogens, enhancing the safety of pharmaceutical products.

- Automation for Efficiency: Automated MAT platforms are transforming testing workflows by increasing throughput and reducing the chances of human error. Automation is also driving down labor costs and making MAT more scalable for large-scale testing.

- Integration of AI and Machine Learning: By incorporating artificial intelligence (AI) and machine learning algorithms, MAT platforms are becoming smarter, providing more accurate and faster test results. These technologies enhance data interpretation and result reproducibility, which is crucial for regulatory compliance and large-scale production.

- Portable MAT Devices: The rise of point-of-care and portable MAT devices is making pyrogen testing more accessible and practical, especially in decentralized settings, improving testing efficiency in clinical trials and emergency medical situations.

Regional Market Dynamics: A Global Perspective

The Monocyte Activation Test market is seeing varied growth trends across different regions. Understanding these regional dynamics is essential for stakeholders looking to capitalize on market opportunities:

- North America: North America leads the global MAT market, with a well-established biopharmaceutical industry and stringent regulatory requirements. The U.S. is the dominant market, driven by strong governmental support for non-animal testing methods and the presence of major pharmaceutical companies.

- Europe: Europe is another key market, with a strong focus on ethical testing practices. The European Union's commitment to reducing animal testing aligns with MAT adoption in sectors like pharmaceuticals and cosmetics. European countries are also at the forefront of developing new regulatory guidelines for MAT.

- Asia-Pacific: The Asia-Pacific region is poised for the highest growth rate due to rapid advancements in biopharmaceutical development, particularly in China, India, and Japan. Increasing regulatory reforms and the growing biopharmaceutical market are driving the demand for MAT in these countries.

- Latin America and Rest of World: Markets in Latin America, Middle East, and Africa are growing at a steady pace. The demand for ethical testing solutions and advancements in regional pharmaceutical sectors are contributing to MAT adoption.

Strategic Considerations for Market Research Clients

For companies looking to succeed in the MAT market, understanding and adapting to these strategic considerations is critical:

- Stay Ahead of Regulatory Changes: With regulatory frameworks continuously evolving, especially concerning ethical testing standards, staying informed about global regulatory updates is crucial for market compliance.

- Leverage Technological Advancements: Continuous investment in automation, AI, and data analytics is vital for staying competitive. Developing next-gen MAT platforms that deliver faster, more accurate, and more cost-effective results will be a key differentiator.

- Form Strategic Partnerships: Collaborations with regulatory bodies, research institutions, and other pharmaceutical companies will help foster innovation and improve product development. Partnerships can also enhance market access and expand reach across different regions.

- Adopt Sustainable Practices: Given the increasing focus on ethical and sustainable business practices, aligning with animal-free testing solutions like MAT will not only meet regulatory standards but also improve brand reputation.

Conclusion: A Growing Opportunity for Stakeholders in the MAT Market

The Monocyte Activation Test market in 2025 presents a dynamic and fast-growing opportunity for stakeholders across various industries. With increasing regulatory support, a shift toward ethical testing, and ongoing technological innovations, MAT is set to play a pivotal role in ensuring the safety and efficacy of pharmaceutical products. By staying informed about market trends, regulatory changes, and technological advancements, companies can capitalize on this expanding market and position themselves as leaders in the field of pyrogen testing.

NOTE:

Quants and Trends is proud to offer an extensive portfolio of meticulously researched healthcare market reports, numbering in the thousands. We also provide tailored customization services to ensure our insights align precisely with your strategic objectives and informational needs. For personalized assistance or to discuss your specific requirements, we invite you to get in touch with our team. We also encourage you to request a complimentary sample PDF report. Please visit our Sample Request Page to receive yours today.

Key Market Players

Merck KGaA

Thermo Fisher Scientific

Mindray

Microcoat Biotechnologie GmbH

Charles River Laboratories International, Inc.

Becton, Dickinson and Company

Lonza Group

SOLVIAS AG

Landfar

Segmentation By Type

MAT Kits

Reagents

Segmentation By Application

Pharmaceutical Industry

Biotechnology Industry

Medical Device Industry

Others

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Monocyte Activation Test (MAT) market in 2025?

The Monocyte Activation Test market in 2025 benefits from its ability to offer a more accurate and reliable alternative to animal testing, aligning with increasing regulatory pressures to move toward non-animal testing methods. Additionally, MAT is gaining recognition for its efficiency in detecting pyrogens, which is essential for the pharmaceutical and biotechnology industries.

What are the weaknesses of the MAT market in 2025?

Despite its advantages, MAT still faces limitations related to its high costs and the need for specialized equipment, which could make it less accessible to smaller laboratories. Moreover, it requires skilled personnel for accurate interpretation, which may hinder its widespread adoption.

What are the opportunities in the MAT market for 2025?

The growing shift towards ethical and animal-free testing methods presents a significant opportunity for the MAT market to expand. Furthermore, advancements in automation and AI-driven analysis could streamline the process, making MAT more cost-effective and accessible to a broader range of industries.

What are the threats to the MAT market in 2025?

A key threat to the MAT market is the potential development of competing technologies that could offer faster, more cost-efficient alternatives. Additionally, regulatory uncertainties and slow global acceptance of MAT in certain regions could limit its growth potential.

Market PESTEL Analysis

What are the political factors influencing the Monocyte Activation Test (MAT) market in 2025?

Political factors, particularly increasing government regulations and policies that push for the reduction of animal testing, significantly support the growth of the MAT market. Policies favoring ethical and non-animal testing methods are expected to drive adoption, particularly in regions with strict animal welfare laws.

How do economic factors affect the MAT market in 2025?

Economic factors such as the high initial investment required for MAT technology may limit its accessibility, especially in low-resource settings. However, as the market matures, advancements in technology could reduce costs, making MAT more economically viable for a broader range of industries.

What social factors are shaping the MAT market in 2025?

Social awareness and demand for ethical alternatives to animal testing are key drivers in the MAT market. As consumers and companies place more importance on animal welfare and ethical practices, the MAT market is likely to benefit from increased demand for non-animal testing solutions.

What technological factors impact the MAT market in 2025?

Technological advancements in automation, data analysis, and artificial intelligence are expected to enhance the MAT's efficiency and accuracy. These innovations could help reduce costs, streamline testing processes, and improve the overall reliability of the test, boosting its adoption across industries.

What environmental factors influence the MAT market in 2025?

Environmental factors play a role in driving MAT adoption, as its non-animal nature aligns with the growing global focus on sustainability and reducing environmental impact. Moreover, MAT helps reduce waste generated from animal testing, further supporting its appeal in environmentally conscious markets.

What legal factors are relevant to the MAT market in 2025?

Legal factors such as evolving regulations in pharmaceutical and biotechnology industries, which increasingly require non-animal testing methods for product safety, directly impact the MAT market. Compliance with global standards and local regulations will be crucial for the widespread adoption of MAT technology.

Market SIPOC Analysis

Who are the suppliers in the Monocyte Activation Test (MAT) market in 2025?

The suppliers in the MAT market include biotechnology and pharmaceutical companies that manufacture the reagents, equipment, and kits necessary for conducting the test. Additionally, suppliers of automation technologies and AI-based analytical tools also play a key role.

What inputs are required for the Monocyte Activation Test (MAT) in 2025?

The primary inputs for the MAT include monocyte cells, reagents to stimulate monocyte activation, laboratory equipment, and trained personnel to perform the test. Specialized software for data analysis and interpretation is also becoming increasingly important.

What is the process involved in the Monocyte Activation Test in 2025?

The process involves isolating monocytes from human blood, exposing them to potential pyrogens, and measuring the activation of these cells. The test then assesses cytokine production as a marker for pyrogenic activity, helping determine the safety of pharmaceutical products and medical devices.

What are the outputs of the Monocyte Activation Test in 2025?

The primary outputs of the MAT are data on cytokine production, which indicates the presence of pyrogens. This data is used to evaluate the safety of pharmaceutical and biotechnology products, especially in regulatory environments that require pyrogen testing.

Who are the customers of the Monocyte Activation Test (MAT) market in 2025?

The customers of the MAT market include pharmaceutical companies, biotech firms, medical device manufacturers, contract research organizations (CROs), and regulatory bodies that require non-animal testing methods for product safety and compliance.

Market Porter's Five Forces

What is the threat of new entrants in the Monocyte Activation Test (MAT) market in 2025?

The threat of new entrants is moderate in the MAT market. While the growing demand for non-animal testing methods creates opportunities, the high cost of developing and manufacturing the required technology and reagents, as well as regulatory barriers, limits the ability of new players to easily enter the market.

How intense is the bargaining power of suppliers in the MAT market in 2025?

The bargaining power of suppliers is relatively high. Key suppliers, such as those providing monocyte cells, reagents, and specialized equipment, hold leverage due to the niche nature of the market and the technical expertise required. The limited number of suppliers with the necessary quality standards makes it difficult for buyers to switch easily.

What is the bargaining power of buyers in the MAT market in 2025?

The bargaining power of buyers is moderate. While buyers such as pharmaceutical and biotech companies have significant purchasing power, the specialized nature of the MAT and the lack of widespread alternatives to meet regulatory requirements give suppliers some control over pricing.

What is the threat of substitute products in the MAT market in 2025?

The threat of substitutes is moderate. Although there are other pyrogen testing methods, such as the Limulus Amebocyte Lysate (LAL) assay, the increasing regulatory pressure for animal-free testing solutions makes MAT a preferred option. However, new technologies could emerge that challenge MAT's dominance.

How competitive is the rivalry among existing firms in the MAT market in 2025?

Rivalry among existing firms is moderate. While there are a few key players in the MAT market, competition is still developing as demand grows. Firms need to innovate with automation, data analysis, and integration to stay ahead in this niche but expanding market.

Market Upstream Analysis

What are the key raw materials and components required for the Monocyte Activation Test (MAT) market in 2025?

The key raw materials for the MAT market include monocyte cells, reagents for stimulating monocyte activation, and specialized laboratory consumables. Additionally, high-quality equipment for cell isolation, processing, and cytokine analysis are essential components of the upstream supply chain.

What are the major suppliers in the upstream of the MAT market?

The major suppliers include biotechnology companies that produce cell culture media and reagents, as well as specialized manufacturers of laboratory equipment and automation tools. These suppliers provide the critical inputs needed for developing and conducting the MAT, such as monocyte cell lines and cytokine assays.

How does research and development (R&D) impact the upstream segment of the MAT market?

R&D plays a significant role in the upstream segment by driving the innovation of new reagents, improving the efficiency of cell-based assays, and developing more advanced technologies for automation and data analysis. Advances in R&D enhance the effectiveness and cost-efficiency of the MAT, further fueling its adoption in the market.

What are the regulatory considerations impacting the upstream supply chain of the MAT market?

Regulatory considerations, particularly related to the safety and quality standards of reagents and laboratory equipment, are crucial for upstream suppliers. These regulations ensure that the raw materials and components used in MAT meet the strict standards required for medical testing and regulatory approvals, particularly in pharmaceutical and biotech industries.

What are the challenges faced by suppliers in the upstream of the MAT market?

Suppliers face challenges such as maintaining the quality and consistency of biologics used in the test, managing the high costs of specialized equipment, and complying with stringent regulatory standards. Additionally, supply chain disruptions, particularly in the availability of raw materials like monocytes, could pose risks to the upstream segment of the MAT market.

Market Midstream Analysis

What are the main activities in the midstream segment of the Monocyte Activation Test (MAT) market in 2025?

The midstream activities in the MAT market involve the processing and testing of samples using monocyte activation assays. This includes the preparation of monocyte cells, exposure to pyrogens, measurement of cytokine production, and data analysis to assess the pyrogenic potential. This stage is critical for ensuring accurate test results and compliance with regulatory standards.

What role do testing laboratories play in the midstream of the MAT market?

Testing laboratories play a pivotal role in the midstream of the MAT market by performing the actual Monocyte Activation Test. These labs must maintain high-quality standards and ensure the proper handling, processing, and analysis of samples. They are responsible for generating reliable and accurate data that will be used by pharmaceutical and biotech companies for safety assessments.

What challenges do companies face in the midstream segment of the MAT market?

Companies face challenges such as maintaining the integrity and accuracy of tests, which can be influenced by variables like sample quality, reagent reliability, and laboratory conditions. Additionally, the need for skilled personnel and the cost of advanced technology can make this stage resource-intensive and affect the scalability of testing.

What technologies are used in the midstream of the MAT market?

Technologies such as automated cell culture systems, advanced cytokine detection methods (e.g., ELISA or flow cytometry), and AI-powered data analytics platforms are commonly used in the midstream of the MAT market. These technologies enhance the accuracy, speed, and cost-efficiency of the testing process, improving overall productivity and reliability.

What is the role of data analysis in the midstream segment of the MAT market?

Data analysis plays a crucial role in the midstream of the MAT market by interpreting the results of cytokine production and determining whether a product contains harmful pyrogens. The integration of advanced analytics tools and software allows for more precise interpretation, helping to identify potential safety issues early in the testing process.

Market Downstream Analysis

What are the key downstream activities in the Monocyte Activation Test (MAT) market in 2025?

The key downstream activities in the MAT market involve the use of test results by pharmaceutical companies, medical device manufacturers, and regulatory agencies. These stakeholders rely on MAT data to assess the pyrogenic safety of products, ensure compliance with regulatory standards, and make informed decisions about product development and market approval.

How do pharmaceutical and biotech companies benefit from the MAT market?

Pharmaceutical and biotech companies benefit from the MAT market by using the test results to ensure the safety of their products, particularly in relation to pyrogens. MAT offers a reliable and non-animal alternative to traditional testing, helping these companies meet regulatory requirements and avoid potential product recalls due to pyrogen contamination.

What is the role of regulatory bodies in the downstream of the MAT market?

Regulatory bodies play a significant role in the downstream segment by setting and enforcing standards for pyrogen testing. These organizations, such as the FDA and EMA, rely on MAT to assess product safety and ensure that pharmaceutical and medical device products comply with safety regulations before they are introduced to the market.

What are the challenges faced by stakeholders in the downstream of the MAT market?

Challenges include navigating complex regulatory frameworks, interpreting test results accurately, and ensuring the consistency of test outcomes across different laboratories. Additionally, companies may face delays in obtaining approval or encountering market resistance if there are uncertainties about the widespread acceptance of MAT over traditional methods.

How does customer demand influence the downstream segment of the MAT market?

Customer demand for non-animal testing methods and the increasing need for safer, more efficient pyrogen testing directly influence the downstream segment. As consumers and companies push for ethical and scientifically advanced solutions, the MAT market is seeing greater adoption, prompting further integration into industry standards and regulatory processes.

Chapter 1, to describe Monocyte Activation Test product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Monocyte Activation Test, with revenue, gross margin, and global market share of Monocyte Activation Test from 2020 to 2025.

Chapter 3, the Monocyte Activation Test competitive situation, revenue, and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and by Application, with consumption value and growth rate by Type, by Application, from 2020 to 2031

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2020 to 2025.and Monocyte Activation Test market forecast, by regions, by Type and by Application, with consumption value, from 2026 to 2031.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis.

Chapter 12, the key raw materials and key suppliers, and industry chain of Monocyte Activation Test.

Chapter 13, to describe Monocyte Activation Test research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Monocyte Activation Test by Type

1.3.1 Overview: Global Monocyte Activation Test Market Size by Type: 2020 Versus 2024 Versus 2031

1.3.2 Global Monocyte Activation Test Consumption Value Market Share by Type in 2024

1.3.3 MAT Kits

1.3.4 Reagents

1.4 Global Monocyte Activation Test Market by Application

1.4.1 Overview: Global Monocyte Activation Test Market Size by Application: 2020 Versus 2024 Versus 2031

1.4.2 Pharmaceutical Industry

1.4.3 Biotechnology Industry

1.4.4 Medical Device Industry

1.4.5 Others

1.5 Global Monocyte Activation Test Market Size & Forecast

1.6 Global Monocyte Activation Test Market Size and Forecast by Region

1.6.1 Global Monocyte Activation Test Market Size by Region: 2020 VS 2024 VS 2031

1.6.2 Global Monocyte Activation Test Market Size by Region, (2020-2031)

1.6.3 North America Monocyte Activation Test Market Size and Prospect (2020-2031)

1.6.4 Europe Monocyte Activation Test Market Size and Prospect (2020-2031)

1.6.5 Asia-Pacific Monocyte Activation Test Market Size and Prospect (2020-2031)

1.6.6 South America Monocyte Activation Test Market Size and Prospect (2020-2031)

1.6.7 Middle East & Africa Monocyte Activation Test Market Size and Prospect (2020-2031)

2 Company Profiles

2.1 Merck KGaA

2.1.1 Merck KGaA Details

2.1.2 Merck KGaA Major Business

2.1.3 Merck KGaA Monocyte Activation Test Product and Solutions

2.1.4 Merck KGaA Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.1.5 Merck KGaA Recent Developments and Future Plans

2.2 Thermo Fisher Scientific

2.2.1 Thermo Fisher Scientific Details

2.2.2 Thermo Fisher Scientific Major Business

2.2.3 Thermo Fisher Scientific Monocyte Activation Test Product and Solutions

2.2.4 Thermo Fisher Scientific Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.2.5 Thermo Fisher Scientific Recent Developments and Future Plans

2.3 Mindray

2.3.1 Mindray Details

2.3.2 Mindray Major Business

2.3.3 Mindray Monocyte Activation Test Product and Solutions

2.3.4 Mindray Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.3.5 Mindray Recent Developments and Future Plans

2.4 Microcoat Biotechnologie GmbH

2.4.1 Microcoat Biotechnologie GmbH Details

2.4.2 Microcoat Biotechnologie GmbH Major Business

2.4.3 Microcoat Biotechnologie GmbH Monocyte Activation Test Product and Solutions

2.4.4 Microcoat Biotechnologie GmbH Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.4.5 Microcoat Biotechnologie GmbH Recent Developments and Future Plans

2.5 Charles River Laboratories International, Inc.

2.5.1 Charles River Laboratories International, Inc. Details

2.5.2 Charles River Laboratories International, Inc. Major Business

2.5.3 Charles River Laboratories International, Inc. Monocyte Activation Test Product and Solutions

2.5.4 Charles River Laboratories International, Inc. Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.5.5 Charles River Laboratories International, Inc. Recent Developments and Future Plans

2.6 Becton, Dickinson and Company

2.6.1 Becton, Dickinson and Company Details

2.6.2 Becton, Dickinson and Company Major Business

2.6.3 Becton, Dickinson and Company Monocyte Activation Test Product and Solutions

2.6.4 Becton, Dickinson and Company Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.6.5 Becton, Dickinson and Company Recent Developments and Future Plans

2.7 Lonza Group

2.7.1 Lonza Group Details

2.7.2 Lonza Group Major Business

2.7.3 Lonza Group Monocyte Activation Test Product and Solutions

2.7.4 Lonza Group Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.7.5 Lonza Group Recent Developments and Future Plans

2.8 SOLVIAS AG

2.8.1 SOLVIAS AG Details

2.8.2 SOLVIAS AG Major Business

2.8.3 SOLVIAS AG Monocyte Activation Test Product and Solutions

2.8.4 SOLVIAS AG Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.8.5 SOLVIAS AG Recent Developments and Future Plans

2.9 Landfar

2.9.1 Landfar Details

2.9.2 Landfar Major Business

2.9.3 Landfar Monocyte Activation Test Product and Solutions

2.9.4 Landfar Monocyte Activation Test Revenue, Gross Margin and Market Share (2020-2025)

2.9.5 Landfar Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Monocyte Activation Test Revenue and Share by Players (2020-2025)

3.2 Market Share Analysis (2024)

3.2.1 Market Share of Monocyte Activation Test by Company Revenue

3.2.2 Top 3 Monocyte Activation Test Players Market Share in 2024

3.2.3 Top 6 Monocyte Activation Test Players Market Share in 2024

3.3 Monocyte Activation Test Market: Overall Company Footprint Analysis

3.3.1 Monocyte Activation Test Market: Region Footprint

3.3.2 Monocyte Activation Test Market: Company Product Type Footprint

3.3.3 Monocyte Activation Test Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Monocyte Activation Test Consumption Value and Market Share by Type (2020-2025)

4.2 Global Monocyte Activation Test Market Forecast by Type (2026-2031)

5 Market Size Segment by Application

5.1 Global Monocyte Activation Test Consumption Value Market Share by Application (2020-2025)

5.2 Global Monocyte Activation Test Market Forecast by Application (2026-2031)

6 North America

6.1 North America Monocyte Activation Test Consumption Value by Type (2020-2031)

6.2 North America Monocyte Activation Test Market Size by Application (2020-2031)

6.3 North America Monocyte Activation Test Market Size by Country

6.3.1 North America Monocyte Activation Test Consumption Value by Country (2020-2031)

6.3.2 United States Monocyte Activation Test Market Size and Forecast (2020-2031)

6.3.3 Canada Monocyte Activation Test Market Size and Forecast (2020-2031)

6.3.4 Mexico Monocyte Activation Test Market Size and Forecast (2020-2031)

7 Europe

7.1 Europe Monocyte Activation Test Consumption Value by Type (2020-2031)

7.2 Europe Monocyte Activation Test Consumption Value by Application (2020-2031)

7.3 Europe Monocyte Activation Test Market Size by Country

7.3.1 Europe Monocyte Activation Test Consumption Value by Country (2020-2031)

7.3.2 Germany Monocyte Activation Test Market Size and Forecast (2020-2031)

7.3.3 France Monocyte Activation Test Market Size and Forecast (2020-2031)

7.3.4 United Kingdom Monocyte Activation Test Market Size and Forecast (2020-2031)

7.3.5 Russia Monocyte Activation Test Market Size and Forecast (2020-2031)

7.3.6 Italy Monocyte Activation Test Market Size and Forecast (2020-2031)

8 Asia-Pacific

8.1 Asia-Pacific Monocyte Activation Test Consumption Value by Type (2020-2031)

8.2 Asia-Pacific Monocyte Activation Test Consumption Value by Application (2020-2031)

8.3 Asia-Pacific Monocyte Activation Test Market Size by Region

8.3.1 Asia-Pacific Monocyte Activation Test Consumption Value by Region (2020-2031)

8.3.2 China Monocyte Activation Test Market Size and Forecast (2020-2031)

8.3.3 Japan Monocyte Activation Test Market Size and Forecast (2020-2031)

8.3.4 South Korea Monocyte Activation Test Market Size and Forecast (2020-2031)

8.3.5 India Monocyte Activation Test Market Size and Forecast (2020-2031)

8.3.6 Southeast Asia Monocyte Activation Test Market Size and Forecast (2020-2031)

8.3.7 Australia Monocyte Activation Test Market Size and Forecast (2020-2031)

9 South America

9.1 South America Monocyte Activation Test Consumption Value by Type (2020-2031)

9.2 South America Monocyte Activation Test Consumption Value by Application (2020-2031)

9.3 South America Monocyte Activation Test Market Size by Country

9.3.1 South America Monocyte Activation Test Consumption Value by Country (2020-2031)

9.3.2 Brazil Monocyte Activation Test Market Size and Forecast (2020-2031)

9.3.3 Argentina Monocyte Activation Test Market Size and Forecast (2020-2031)

10 Middle East & Africa

10.1 Middle East & Africa Monocyte Activation Test Consumption Value by Type (2020-2031)

10.2 Middle East & Africa Monocyte Activation Test Consumption Value by Application (2020-2031)

10.3 Middle East & Africa Monocyte Activation Test Market Size by Country

10.3.1 Middle East & Africa Monocyte Activation Test Consumption Value by Country (2020-2031)

10.3.2 Turkey Monocyte Activation Test Market Size and Forecast (2020-2031)

10.3.3 Saudi Arabia Monocyte Activation Test Market Size and Forecast (2020-2031)

10.3.4 UAE Monocyte Activation Test Market Size and Forecast (2020-2031)

11 Market Dynamics

11.1 Monocyte Activation Test Market Drivers

11.2 Monocyte Activation Test Market Restraints

11.3 Monocyte Activation Test Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

12 Industry Chain Analysis

12.1 Monocyte Activation Test Industry Chain

12.2 Monocyte Activation Test Upstream Analysis

12.3 Monocyte Activation Test Midstream Analysis

12.4 Monocyte Activation Test Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

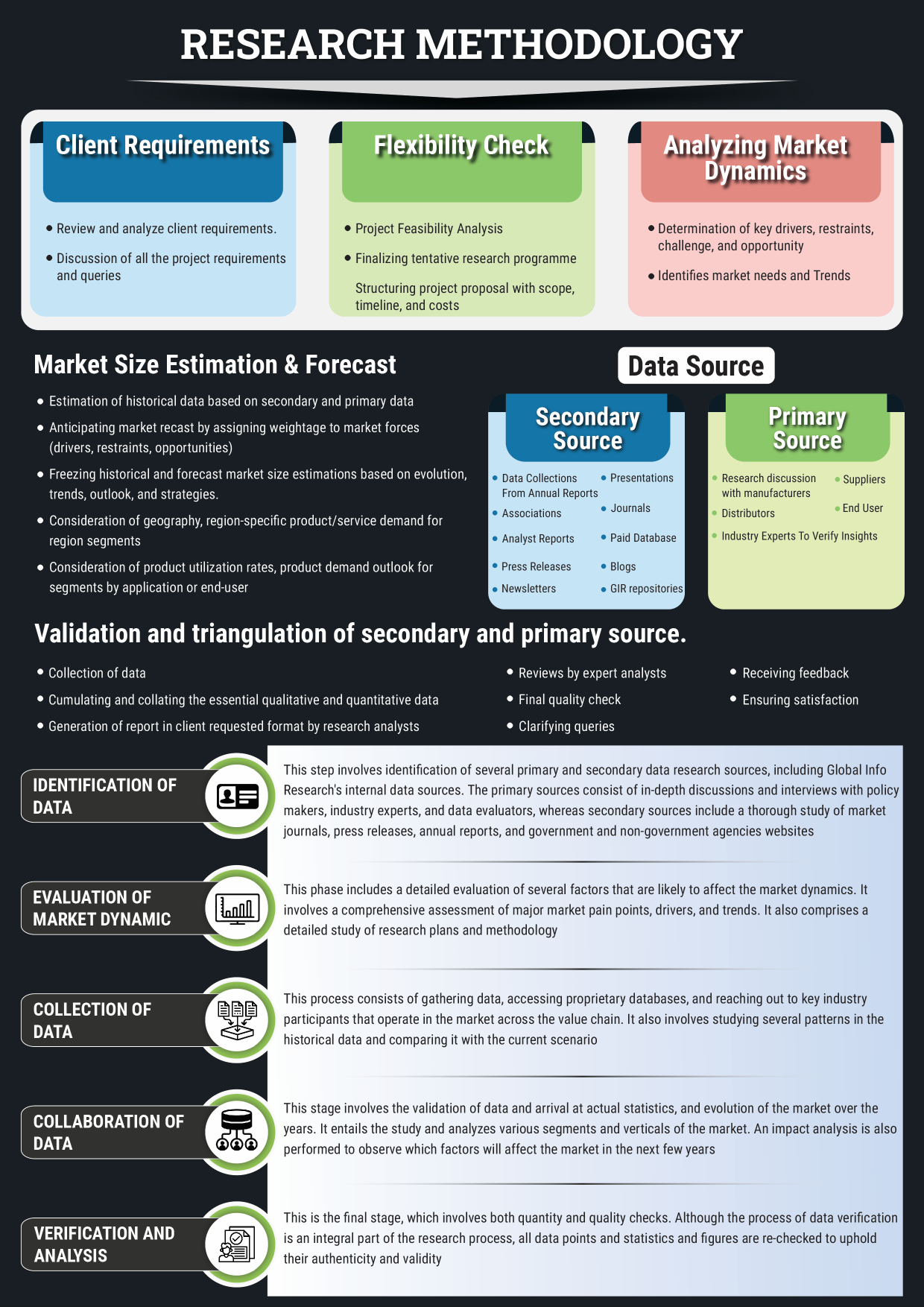

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Monocyte Activation Test Consumption Value by Type, (USD Million), 2020 & 2024 & 2031

Table 2. Global Monocyte Activation Test Consumption Value by Application, (USD Million), 2020 & 2024 & 2031

Table 3. Global Monocyte Activation Test Consumption Value by Region (2020-2025) & (USD Million)

Table 4. Global Monocyte Activation Test Consumption Value by Region (2026-2031) & (USD Million)

Table 5. Merck KGaA Company Information, Head Office, and Major Competitors

Table 6. Merck KGaA Major Business

Table 7. Merck KGaA Monocyte Activation Test Product and Solutions

Table 8. Merck KGaA Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 9. Merck KGaA Recent Developments and Future Plans

Table 10. Thermo Fisher Scientific Company Information, Head Office, and Major Competitors

Table 11. Thermo Fisher Scientific Major Business

Table 12. Thermo Fisher Scientific Monocyte Activation Test Product and Solutions

Table 13. Thermo Fisher Scientific Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 14. Thermo Fisher Scientific Recent Developments and Future Plans

Table 15. Mindray Company Information, Head Office, and Major Competitors

Table 16. Mindray Major Business

Table 17. Mindray Monocyte Activation Test Product and Solutions

Table 18. Mindray Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 19. Microcoat Biotechnologie GmbH Company Information, Head Office, and Major Competitors

Table 20. Microcoat Biotechnologie GmbH Major Business

Table 21. Microcoat Biotechnologie GmbH Monocyte Activation Test Product and Solutions

Table 22. Microcoat Biotechnologie GmbH Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 23. Microcoat Biotechnologie GmbH Recent Developments and Future Plans

Table 24. Charles River Laboratories International, Inc. Company Information, Head Office, and Major Competitors

Table 25. Charles River Laboratories International, Inc. Major Business

Table 26. Charles River Laboratories International, Inc. Monocyte Activation Test Product and Solutions

Table 27. Charles River Laboratories International, Inc. Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 28. Charles River Laboratories International, Inc. Recent Developments and Future Plans

Table 29. Becton, Dickinson and Company Company Information, Head Office, and Major Competitors

Table 30. Becton, Dickinson and Company Major Business

Table 31. Becton, Dickinson and Company Monocyte Activation Test Product and Solutions

Table 32. Becton, Dickinson and Company Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 33. Becton, Dickinson and Company Recent Developments and Future Plans

Table 34. Lonza Group Company Information, Head Office, and Major Competitors

Table 35. Lonza Group Major Business

Table 36. Lonza Group Monocyte Activation Test Product and Solutions

Table 37. Lonza Group Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 38. Lonza Group Recent Developments and Future Plans

Table 39. SOLVIAS AG Company Information, Head Office, and Major Competitors

Table 40. SOLVIAS AG Major Business

Table 41. SOLVIAS AG Monocyte Activation Test Product and Solutions

Table 42. SOLVIAS AG Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 43. SOLVIAS AG Recent Developments and Future Plans

Table 44. Landfar Company Information, Head Office, and Major Competitors

Table 45. Landfar Major Business

Table 46. Landfar Monocyte Activation Test Product and Solutions

Table 47. Landfar Monocyte Activation Test Revenue (USD Million), Gross Margin and Market Share (2020-2025)

Table 48. Landfar Recent Developments and Future Plans

Table 49. Global Monocyte Activation Test Revenue (USD Million) by Players (2020-2025)

Table 50. Global Monocyte Activation Test Revenue Share by Players (2020-2025)

Table 51. Breakdown of Monocyte Activation Test by Company Type (Tier 1, Tier 2, and Tier 3)

Table 52. Market Position of Players in Monocyte Activation Test, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2024

Table 53. Head Office of Key Monocyte Activation Test Players

Table 54. Monocyte Activation Test Market: Company Product Type Footprint

Table 55. Monocyte Activation Test Market: Company Product Application Footprint

Table 56. Monocyte Activation Test New Market Entrants and Barriers to Market Entry

Table 57. Monocyte Activation Test Mergers, Acquisition, Agreements, and Collaborations

Table 58. Global Monocyte Activation Test Consumption Value (USD Million) by Type (2020-2025)

Table 59. Global Monocyte Activation Test Consumption Value Share by Type (2020-2025)

Table 60. Global Monocyte Activation Test Consumption Value Forecast by Type (2026-2031)

Table 61. Global Monocyte Activation Test Consumption Value by Application (2020-2025)

Table 62. Global Monocyte Activation Test Consumption Value Forecast by Application (2026-2031)

Table 63. North America Monocyte Activation Test Consumption Value by Type (2020-2025) & (USD Million)

Table 64. North America Monocyte Activation Test Consumption Value by Type (2026-2031) & (USD Million)

Table 65. North America Monocyte Activation Test Consumption Value by Application (2020-2025) & (USD Million)

Table 66. North America Monocyte Activation Test Consumption Value by Application (2026-2031) & (USD Million)

Table 67. North America Monocyte Activation Test Consumption Value by Country (2020-2025) & (USD Million)

Table 68. North America Monocyte Activation Test Consumption Value by Country (2026-2031) & (USD Million)

Table 69. Europe Monocyte Activation Test Consumption Value by Type (2020-2025) & (USD Million)

Table 70. Europe Monocyte Activation Test Consumption Value by Type (2026-2031) & (USD Million)

Table 71. Europe Monocyte Activation Test Consumption Value by Application (2020-2025) & (USD Million)

Table 72. Europe Monocyte Activation Test Consumption Value by Application (2026-2031) & (USD Million)

Table 73. Europe Monocyte Activation Test Consumption Value by Country (2020-2025) & (USD Million)

Table 74. Europe Monocyte Activation Test Consumption Value by Country (2026-2031) & (USD Million)

Table 75. Asia-Pacific Monocyte Activation Test Consumption Value by Type (2020-2025) & (USD Million)

Table 76. Asia-Pacific Monocyte Activation Test Consumption Value by Type (2026-2031) & (USD Million)

Table 77. Asia-Pacific Monocyte Activation Test Consumption Value by Application (2020-2025) & (USD Million)

Table 78. Asia-Pacific Monocyte Activation Test Consumption Value by Application (2026-2031) & (USD Million)

Table 79. Asia-Pacific Monocyte Activation Test Consumption Value by Region (2020-2025) & (USD Million)

Table 80. Asia-Pacific Monocyte Activation Test Consumption Value by Region (2026-2031) & (USD Million)

Table 81. South America Monocyte Activation Test Consumption Value by Type (2020-2025) & (USD Million)

Table 82. South America Monocyte Activation Test Consumption Value by Type (2026-2031) & (USD Million)

Table 83. South America Monocyte Activation Test Consumption Value by Application (2020-2025) & (USD Million)

Table 84. South America Monocyte Activation Test Consumption Value by Application (2026-2031) & (USD Million)

Table 85. South America Monocyte Activation Test Consumption Value by Country (2020-2025) & (USD Million)

Table 86. South America Monocyte Activation Test Consumption Value by Country (2026-2031) & (USD Million)

Table 87. Middle East & Africa Monocyte Activation Test Consumption Value by Type (2020-2025) & (USD Million)

Table 88. Middle East & Africa Monocyte Activation Test Consumption Value by Type (2026-2031) & (USD Million)

Table 89. Middle East & Africa Monocyte Activation Test Consumption Value by Application (2020-2025) & (USD Million)

Table 90. Middle East & Africa Monocyte Activation Test Consumption Value by Application (2026-2031) & (USD Million)

Table 91. Middle East & Africa Monocyte Activation Test Consumption Value by Country (2020-2025) & (USD Million)

Table 92. Middle East & Africa Monocyte Activation Test Consumption Value by Country (2026-2031) & (USD Million)

Table 93. Global Key Players of Monocyte Activation Test Upstream (Raw Materials)

Table 94. Global Monocyte Activation Test Typical Customers

List of Figures

Figure 1. Monocyte Activation Test Picture

Figure 2. Global Monocyte Activation Test Consumption Value by Type, (USD Million), 2020 & 2024 & 2031

Figure 3. Global Monocyte Activation Test Consumption Value Market Share by Type in 2024

Figure 4. MAT Kits

Figure 5. Reagents

Figure 6. Global Monocyte Activation Test Consumption Value by Application, (USD Million), 2020 & 2024 & 2031

Figure 7. Monocyte Activation Test Consumption Value Market Share by Application in 2024

Figure 8. Pharmaceutical Industry Picture

Figure 9. Biotechnology Industry Picture

Figure 10. Medical Device Industry Picture

Figure 11. Others Picture

Figure 12. Global Monocyte Activation Test Consumption Value, (USD Million): 2020 & 2024 & 2031

Figure 13. Global Monocyte Activation Test Consumption Value and Forecast (2020-2031) & (USD Million)

Figure 14. Global Market Monocyte Activation Test Consumption Value (USD Million) Comparison by Region (2020 VS 2024 VS 2031)

Figure 15. Global Monocyte Activation Test Consumption Value Market Share by Region (2020-2031)

Figure 16. Global Monocyte Activation Test Consumption Value Market Share by Region in 2024

Figure 17. North America Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 18. Europe Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 19. Asia-Pacific Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 20. South America Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 21. Middle East & Africa Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 22. Company Three Recent Developments and Future Plans

Figure 23. Global Monocyte Activation Test Revenue Share by Players in 2024

Figure 24. Monocyte Activation Test Market Share by Company Type (Tier 1, Tier 2, and Tier 3) in 2024

Figure 25. Market Share of Monocyte Activation Test by Player Revenue in 2024

Figure 26. Top 3 Monocyte Activation Test Players Market Share in 2024

Figure 27. Top 6 Monocyte Activation Test Players Market Share in 2024

Figure 28. Global Monocyte Activation Test Consumption Value Share by Type (2020-2025)

Figure 29. Global Monocyte Activation Test Market Share Forecast by Type (2026-2031)

Figure 30. Global Monocyte Activation Test Consumption Value Share by Application (2020-2025)

Figure 31. Global Monocyte Activation Test Market Share Forecast by Application (2026-2031)

Figure 32. North America Monocyte Activation Test Consumption Value Market Share by Type (2020-2031)

Figure 33. North America Monocyte Activation Test Consumption Value Market Share by Application (2020-2031)

Figure 34. North America Monocyte Activation Test Consumption Value Market Share by Country (2020-2031)

Figure 35. United States Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 36. Canada Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 37. Mexico Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 38. Europe Monocyte Activation Test Consumption Value Market Share by Type (2020-2031)

Figure 39. Europe Monocyte Activation Test Consumption Value Market Share by Application (2020-2031)

Figure 40. Europe Monocyte Activation Test Consumption Value Market Share by Country (2020-2031)

Figure 41. Germany Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 42. France Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 43. United Kingdom Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 44. Russia Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 45. Italy Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 46. Asia-Pacific Monocyte Activation Test Consumption Value Market Share by Type (2020-2031)

Figure 47. Asia-Pacific Monocyte Activation Test Consumption Value Market Share by Application (2020-2031)

Figure 48. Asia-Pacific Monocyte Activation Test Consumption Value Market Share by Region (2020-2031)

Figure 49. China Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 50. Japan Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 51. South Korea Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 52. India Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 53. Southeast Asia Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 54. Australia Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 55. South America Monocyte Activation Test Consumption Value Market Share by Type (2020-2031)

Figure 56. South America Monocyte Activation Test Consumption Value Market Share by Application (2020-2031)

Figure 57. South America Monocyte Activation Test Consumption Value Market Share by Country (2020-2031)

Figure 58. Brazil Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 59. Argentina Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 60. Middle East & Africa Monocyte Activation Test Consumption Value Market Share by Type (2020-2031)

Figure 61. Middle East & Africa Monocyte Activation Test Consumption Value Market Share by Application (2020-2031)

Figure 62. Middle East & Africa Monocyte Activation Test Consumption Value Market Share by Country (2020-2031)

Figure 63. Turkey Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 64. Saudi Arabia Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 65. UAE Monocyte Activation Test Consumption Value (2020-2031) & (USD Million)

Figure 66. Monocyte Activation Test Market Drivers

Figure 67. Monocyte Activation Test Market Restraints

Figure 68. Monocyte Activation Test Market Trends

Figure 69. Porters Five Forces Analysis

Figure 70. Monocyte Activation Test Industrial Chain

Figure 71. Methodology

Figure 72. Research Process and Data Source