The main ingredient of minocycline hydrochloride capsules is minocycline hydrochloride, which is mostly used to treat infections caused by Staphylococcus aureus, Streptococcus aureus, Pneumococcus aureus, Neisseria gonorrhoeae, Shigella dysenteriae, Klebsiella pneumoniae, Pseudomonas aeruginosa and Chlamydia. Infectious diseases, such as pharyngitis, tonsillitis, urethritis, acne, genital warts, syphilis, etc.

The global pharmaceutical market is 1475 billion USD in 2022, growing at a CAGR of 5% during the next six years. The pharmaceutical market includes chemical drugs and biological drugs. For biologics is expected to 381 billion USD in 2022. In comparison, the chemical drug market is estimated to increase from 1005 billion in 2018 to 1094 billion U.S. dollars in 2022. The pharmaceutical market factors such as increasing demand for healthcare, technological advancements, and the rising prevalence of chronic diseases, increase in funding from private & government organizations for development of pharmaceutical manufacturing segments and rise in R&D activities for drugs. However, the industry also faces challenges such as stringent regulations, high costs of research and development, and patent expirations. Companies need to continuously innovate and adapt to these challenges to stay competitive in the market and ensure their products reach patients in need. Additionally, the COVID-19 pandemic has highlighted the importance of vaccine development and supply chain management, further emphasizing the need for pharmaceutical companies to be agile and responsive to emerging public health needs.

Report includes an overview of the development of the Minocycline Hydrochloride Capsules industry chain, the market status of Hospital (50mg, 100mg), Clinic (50mg, 100mg), and key enterprises in developed and developing market, and analysed the cutting-edge technology, patent, hot applications and market trends of Minocycline Hydrochloride Capsules.

Regionally, the report analyzes the Minocycline Hydrochloride Capsules markets in key regions. North America and Europe are experiencing steady growth, driven by government initiatives and increasing consumer awareness. Asia-Pacific, particularly China, leads the global Minocycline Hydrochloride Capsules market, with robust domestic demand, supportive policies, and a strong manufacturing base.

Key Features:

The report presents comprehensive understanding of the Minocycline Hydrochloride Capsules market. It provides a holistic view of the industry, as well as detailed insights into individual components and stakeholders. The report analysis market dynamics, trends, challenges, and opportunities within the Minocycline Hydrochloride Capsules industry.

The report involves analyzing the market at a macro level:

Market Sizing and Segmentation: Report collect data on the overall market size, including the sales quantity (K Units), revenue generated, and market share of different by Type (e.g., 50mg, 100mg).

Industry Analysis: Report analyse the broader industry trends, such as government policies and regulations, technological advancements, consumer preferences, and market dynamics. This analysis helps in understanding the key drivers and challenges influencing the Minocycline Hydrochloride Capsules market.

Regional Analysis: The report involves examining the Minocycline Hydrochloride Capsules market at a regional or national level. Report analyses regional factors such as government incentives, infrastructure development, economic conditions, and consumer behaviour to identify variations and opportunities within different markets.

Market Projections: Report covers the gathered data and analysis to make future projections and forecasts for the Minocycline Hydrochloride Capsules market. This may include estimating market growth rates, predicting market demand, and identifying emerging trends.

The report also involves a more granular approach to Minocycline Hydrochloride Capsules:

Company Analysis: Report covers individual Minocycline Hydrochloride Capsules manufacturers, suppliers, and other relevant industry players. This analysis includes studying their financial performance, market positioning, product portfolios, partnerships, and strategies.

Consumer Analysis: Report covers data on consumer behaviour, preferences, and attitudes towards Minocycline Hydrochloride Capsules This may involve surveys, interviews, and analysis of consumer reviews and feedback from different by Application (Hospital, Clinic).

Technology Analysis: Report covers specific technologies relevant to Minocycline Hydrochloride Capsules. It assesses the current state, advancements, and potential future developments in Minocycline Hydrochloride Capsules areas.

Competitive Landscape: By analyzing individual companies, suppliers, and consumers, the report present insights into the competitive landscape of the Minocycline Hydrochloride Capsules market. This analysis helps understand market share, competitive advantages, and potential areas for differentiation among industry players.

Market Validation: The report involves validating findings and projections through primary research, such as surveys, interviews, and focus groups.

Key Market Players

Chongqing Kerui Pharmaceutical

Shanghai Huayuan Anhui Renji Pharmaceutical

Guangzhou Baiyunshan Guanghua Pharmaceutical

Dequan Pharmaceuticals

Haikou Pharmaceutical Factory

North China Pharmaceutical

Harbin Pharmaceutical Group

Hanhui Pharmaceutical

Diao Group Chengdu Pharmaceutical

Shanghai Meiyou Pharmaceutical

Kunyao Group

Amri

Hovione

CIPAN

Euticals

HISUN

Segmentation By Type

50mg

100mg

Segmentation By Application

Hospital

Clinic

Other

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Minocycline Hydrochloride Capsules market in 2025?

The Minocycline Hydrochloride Capsules market benefits from its established efficacy in treating a range of bacterial infections, making it a trusted option among healthcare providers. Additionally, ongoing research into its applications beyond traditional uses, such as in acne treatment and inflammatory conditions, is likely to enhance its market position. The growing awareness of antibiotic resistance may also lead to increased demand for effective treatments like minocycline.

What weaknesses might affect the Minocycline Hydrochloride Capsules market in 2025?

One significant weakness is the rising concern about antibiotic resistance, which can limit the effectiveness of minocycline and lead to a decrease in prescribing rates. Moreover, potential side effects associated with its use, such as skin reactions or gastrointestinal issues, could deter patients and physicians. The presence of alternative antibiotics with broader efficacy or fewer side effects may also pose a challenge to market growth.

What opportunities are present for the Minocycline Hydrochloride Capsules market in 2025?

There are opportunities for growth in the Minocycline Hydrochloride Capsules market through expanded indications and formulations, such as extended-release versions or combination therapies. Increased investment in research and development could lead to new applications in chronic inflammatory diseases, potentially broadening the target patient population. Additionally, the rise in telehealth and online pharmacies may enhance access to minocycline, promoting its usage.

What threats could impact the Minocycline Hydrochloride Capsules market in 2025?

The Minocycline Hydrochloride Capsules market may face threats from stringent regulatory changes and increased scrutiny on antibiotic prescribing practices due to public health campaigns against overprescription. The entry of generic competitors could drive down prices, impacting profitability. Furthermore, the emergence of new antibiotics and innovative treatments could overshadow minocycline, leading to a decline in its market share.

Market PESTEL Analysis

What are the political factors influencing the Minocycline Hydrochloride Capsules market in 2025?

Political factors such as government regulations on antibiotics and healthcare policies directly impact the Minocycline Hydrochloride Capsules market. Policies aiming to reduce antibiotic resistance through stricter prescription guidelines could limit the market's growth. However, supportive healthcare policies and public health campaigns advocating for effective treatments could create opportunities for growth in the market.

How do economic factors affect the Minocycline Hydrochloride Capsules market in 2025?

Economic factors such as healthcare spending and the affordability of treatments are critical for the Minocycline Hydrochloride Capsules market. Economic downturns may lead to cost-cutting measures in healthcare, potentially reducing access to branded medications. However, the availability of generic versions of minocycline could provide more affordable options, promoting wider market penetration.

What social factors influence the Minocycline Hydrochloride Capsules market in 2025?

Social factors, including rising health awareness and increasing demand for effective treatments, could drive the market for Minocycline Hydrochloride Capsules. With a growing focus on managing bacterial infections, especially in chronic conditions like acne, there is likely to be greater patient interest. However, public concern over antibiotic resistance may cause hesitation in patients using antibiotics, which could impact the market negatively.

What technological factors affect the Minocycline Hydrochloride Capsules market in 2025?

Technological advancements in drug delivery systems, such as extended-release capsules, could positively influence the market. Additionally, new research technologies could lead to novel applications for minocycline beyond traditional uses, expanding its market potential. On the downside, advancements in alternative treatment options may limit minocycline's market share.

What environmental factors are relevant to the Minocycline Hydrochloride Capsules market in 2025?

Environmental factors like sustainability in pharmaceutical production are becoming more important. Companies may face increased pressure to adopt eco-friendly practices in manufacturing, packaging, and distribution. Moreover, concerns about the environmental impact of antibiotics in wastewater may lead to stricter regulations on pharmaceutical production, influencing the market.

What legal factors impact the Minocycline Hydrochloride Capsules market in 2025?

Legal factors such as intellectual property rights and patent expirations are significant for the Minocycline Hydrochloride Capsules market. The expiration of patents for branded versions could open the door for generic competition, driving down prices. Furthermore, stricter regulations regarding antibiotic prescription and usage could influence market dynamics and demand for minocycline.

Market SIPOC Analysis

Who are the suppliers in the Minocycline Hydrochloride Capsules market in 2025?

Suppliers include raw material providers for the active pharmaceutical ingredient (API), manufacturers of the capsules, and companies that supply the necessary packaging materials. Additionally, suppliers of research services, regulatory compliance support, and distribution logistics also play a role in the market.

What are the inputs required for the Minocycline Hydrochloride Capsules market in 2025?

The key inputs are the raw materials for producing Minocycline Hydrochloride, such as minocycline hydrochloride itself, excipients for capsule formation, and packaging materials. Additionally, regulatory approvals, manufacturing technologies, and clinical trial data for market expansion are essential inputs.

What are the processes involved in the Minocycline Hydrochloride Capsules market in 2025?

Processes include the synthesis of Minocycline Hydrochloride, formulation into capsules, quality control and testing, regulatory approval processes, packaging, distribution, and marketing. Additionally, research and development efforts to explore new therapeutic uses or improve formulations are part of the overall process.

Who are the customers in the Minocycline Hydrochloride Capsules market in 2025?

Customers include healthcare providers such as hospitals, clinics, and physicians who prescribe Minocycline Hydrochloride Capsules. The end users are patients suffering from bacterial infections or chronic conditions like acne. Additionally, pharmacies and healthcare distributors play a role in reaching the end users.

What are the outputs in the Minocycline Hydrochloride Capsules market in 2025?

The primary output is the Minocycline Hydrochloride Capsules available for prescription and use. Secondary outputs include related educational materials for patients and healthcare providers, marketing campaigns, and reports on product efficacy and safety data.

Market Porter's Five Forces

How strong is the threat of new entrants in the Minocycline Hydrochloride Capsules market in 2025?

The threat of new entrants is moderate. While the market has established players with regulatory hurdles and significant capital requirements to enter, the increasing demand for generics and growing applications for minocycline create opportunities for new companies. However, the complexity of manufacturing and compliance with health regulations can act as barriers to entry.

How intense is the bargaining power of suppliers in the Minocycline Hydrochloride Capsules market in 2025?

The bargaining power of suppliers is relatively low to moderate. While suppliers of raw materials for the active pharmaceutical ingredient (API) and excipients play an important role, there are multiple suppliers in the market, which helps reduce their power. However, high-quality and compliant suppliers may have more influence, especially in the face of regulatory challenges.

How strong is the bargaining power of buyers in the Minocycline Hydrochloride Capsules market in 2025?

The bargaining power of buyers is moderate. Physicians and healthcare providers typically make the decision to prescribe minocycline, but patient preferences and growing awareness of antibiotic resistance could influence demand. However, competition from generics and alternative antibiotics can increase price sensitivity, enhancing buyer power.

What is the threat of substitute products in the Minocycline Hydrochloride Capsules market in 2025?

The threat of substitutes is high. There are several alternative antibiotics and treatments available for bacterial infections, as well as newer options with fewer side effects. The rise of more effective and widely accepted treatments, including non-antibiotic therapies for chronic conditions like acne, could reduce minocycline's market share.

How competitive is the rivalry among existing players in the Minocycline Hydrochloride Capsules market in 2025?

The rivalry among existing players is moderate to high. While Minocycline Hydrochloride is a well-established product, the presence of generics and the development of newer antibiotics create competition. Companies are also competing on factors like cost, formulation improvements, and marketing efforts, driving moderate to high competitive pressure in the market.

Market Upstream Analysis

What are the key raw materials required for the Minocycline Hydrochloride Capsules market in 2025?

The key raw materials include the active pharmaceutical ingredient (API) minocycline hydrochloride, excipients for capsule formulation such as fillers, binders, and stabilizers, and packaging materials. Additionally, specific chemicals and solvents used in the synthesis and purification of minocycline are essential for the manufacturing process.

How do regulatory factors impact the upstream activities for the Minocycline Hydrochloride Capsules market in 2025?

Regulatory factors significantly impact upstream activities, especially regarding the approval of raw materials, manufacturing processes, and product formulations. Compliance with good manufacturing practices (GMP), safety standards, and environmental regulations is required, which can impact sourcing, production timelines, and costs. Additionally, any changes in regulatory requirements for antibiotic usage can affect market dynamics.

What role do suppliers play in the upstream segment of the Minocycline Hydrochloride Capsules market in 2025?

Suppliers of raw materials, including minocycline hydrochloride, excipients, and packaging materials, play a critical role in ensuring consistent product quality and supply chain reliability. Their ability to provide high-quality, cost-effective materials and adhere to regulatory standards directly impacts the cost structure and production efficiency of minocycline capsules.

How does technology affect the upstream processes in the Minocycline Hydrochloride Capsules market in 2025?

Advances in technology influence the upstream processes by enabling more efficient and scalable manufacturing methods, improving the purity and consistency of minocycline hydrochloride, and optimizing the formulation process. Technology also helps in ensuring compliance with regulations, reducing production costs, and speeding up time-to-market for new formulations or improvements.

What are the potential challenges faced by upstream activities in the Minocycline Hydrochloride Capsules market in 2025?

Challenges include the increasing complexity of regulatory requirements, potential disruptions in the supply of raw materials, and the rising cost of quality-controlled ingredients. Additionally, there is growing pressure to adopt sustainable manufacturing practices, which could lead to higher production costs and the need for investments in cleaner technologies.

Market Midstream Analysis

What are the key midstream activities in the Minocycline Hydrochloride Capsules market in 2025?

Key midstream activities include the manufacturing of Minocycline Hydrochloride Capsules, quality control, packaging, and warehousing. Additionally, regulatory compliance processes, clinical trials for new indications, and scaling up production for distribution are essential midstream functions.

How does the manufacturing process affect the Minocycline Hydrochloride Capsules market in 2025?

The manufacturing process is crucial as it impacts the cost, quality, and scalability of Minocycline Hydrochloride Capsules. Efficient production ensures consistent supply and competitive pricing, while any inefficiencies or regulatory non-compliance can cause delays, increase costs, and affect market availability.

What role does distribution play in the Minocycline Hydrochloride Capsules market in 2025?

Distribution plays a significant role in ensuring the availability of Minocycline Hydrochloride Capsules to healthcare providers and pharmacies. Timely and reliable distribution channels are necessary to maintain market presence and ensure that the capsules reach end users in various regions, especially in markets with growing healthcare demands.

How do regulatory factors affect the midstream activities in the Minocycline Hydrochloride Capsules market in 2025?

Regulatory factors influence midstream activities through the approval processes for manufacturing facilities, quality control standards, and product testing. Ensuring compliance with regulatory bodies like the FDA or EMA is critical for market entry and ongoing sales. Any changes in regulations could impact production timelines, costs, and market access.

What challenges are faced in the midstream segment of the Minocycline Hydrochloride Capsules market in 2025?

Challenges include the need for continuous compliance with ever-evolving manufacturing regulations, managing production costs, and ensuring efficient distribution networks. Additionally, potential disruptions in the supply chain, such as raw material shortages or transportation issues, could affect production timelines and market availability.

Market Downstream Analysis

What are the key downstream activities in the Minocycline Hydrochloride Capsules market in 2025?

Key downstream activities include the distribution of Minocycline Hydrochloride Capsules to healthcare providers, such as hospitals, clinics, and pharmacies. Additionally, marketing and promotional activities to raise awareness among physicians and patients, post-market surveillance, and ensuring access for patients are crucial components.

How does the pricing strategy affect the downstream market for Minocycline Hydrochloride Capsules in 2025?

Pricing strategies significantly impact demand, as competitive pricing for branded and generic Minocycline Hydrochloride Capsules will influence their adoption. Affordability for healthcare providers and patients, especially in cost-sensitive markets, can drive sales. The introduction of generics could further pressure prices and affect market share distribution.

What role do healthcare providers play in the downstream segment of the Minocycline Hydrochloride Capsules market in 2025?

Healthcare providers, including doctors and pharmacists, are critical in prescribing Minocycline Hydrochloride Capsules to patients. Their awareness of the drug’s benefits, effectiveness, and side effects influences patient uptake. Educating healthcare providers about the evolving indications and updated clinical data is key to ensuring widespread adoption.

How does patient awareness impact the downstream market for Minocycline Hydrochloride Capsules in 2025?

Patient awareness plays an important role in driving demand, as patients who are knowledgeable about Minocycline Hydrochloride’s effectiveness in treating conditions like acne or bacterial infections are more likely to seek prescriptions. Public health campaigns and educational initiatives can encourage patient engagement and increase the use of the product.

What challenges exist in the downstream segment of the Minocycline Hydrochloride Capsules market in 2025?

Challenges include ensuring effective distribution to meet demand, particularly in remote or underserved areas, and navigating market competition from generics. Additionally, regulatory changes or growing concerns about antibiotic resistance could lead to reduced prescriptions, impacting the downstream market. Educating healthcare providers and patients about the appropriate use of the drug also remains an ongoing challenge.

Chapter 1, to describe Minocycline Hydrochloride Capsules product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Minocycline Hydrochloride Capsules, with price, sales, revenue and global market share of Minocycline Hydrochloride Capsules from 2018 to 2023.

Chapter 3, the Minocycline Hydrochloride Capsules competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Minocycline Hydrochloride Capsules breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Minocycline Hydrochloride Capsules market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends and Porters Five Forces analysis.

Chapter 13, the key raw materials and key suppliers, and industry chain of Minocycline Hydrochloride Capsules.

Chapter 14 and 15, to describe Minocycline Hydrochloride Capsules sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Minocycline Hydrochloride Capsules

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Minocycline Hydrochloride Capsules Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 50mg

1.3.3 100mg

1.4 Market Analysis by Application

1.4.1 Overview: Global Minocycline Hydrochloride Capsules Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital

1.4.3 Clinic

1.4.4 Other

1.5 Global Minocycline Hydrochloride Capsules Market Size & Forecast

1.5.1 Global Minocycline Hydrochloride Capsules Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Minocycline Hydrochloride Capsules Sales Quantity (2018-2029)

1.5.3 Global Minocycline Hydrochloride Capsules Average Price (2018-2029)

2 Manufacturers Profiles

2.1 Chongqing Kerui Pharmaceutical

2.1.1 Chongqing Kerui Pharmaceutical Details

2.1.2 Chongqing Kerui Pharmaceutical Major Business

2.1.3 Chongqing Kerui Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.1.4 Chongqing Kerui Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Chongqing Kerui Pharmaceutical Recent Developments/Updates

2.2 Shanghai Huayuan Anhui Renji Pharmaceutical

2.2.1 Shanghai Huayuan Anhui Renji Pharmaceutical Details

2.2.2 Shanghai Huayuan Anhui Renji Pharmaceutical Major Business

2.2.3 Shanghai Huayuan Anhui Renji Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.2.4 Shanghai Huayuan Anhui Renji Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Shanghai Huayuan Anhui Renji Pharmaceutical Recent Developments/Updates

2.3 Guangzhou Baiyunshan Guanghua Pharmaceutical

2.3.1 Guangzhou Baiyunshan Guanghua Pharmaceutical Details

2.3.2 Guangzhou Baiyunshan Guanghua Pharmaceutical Major Business

2.3.3 Guangzhou Baiyunshan Guanghua Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.3.4 Guangzhou Baiyunshan Guanghua Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Guangzhou Baiyunshan Guanghua Pharmaceutical Recent Developments/Updates

2.4 Dequan Pharmaceuticals

2.4.1 Dequan Pharmaceuticals Details

2.4.2 Dequan Pharmaceuticals Major Business

2.4.3 Dequan Pharmaceuticals Minocycline Hydrochloride Capsules Product and Services

2.4.4 Dequan Pharmaceuticals Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Dequan Pharmaceuticals Recent Developments/Updates

2.5 Haikou Pharmaceutical Factory

2.5.1 Haikou Pharmaceutical Factory Details

2.5.2 Haikou Pharmaceutical Factory Major Business

2.5.3 Haikou Pharmaceutical Factory Minocycline Hydrochloride Capsules Product and Services

2.5.4 Haikou Pharmaceutical Factory Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Haikou Pharmaceutical Factory Recent Developments/Updates

2.6 North China Pharmaceutical

2.6.1 North China Pharmaceutical Details

2.6.2 North China Pharmaceutical Major Business

2.6.3 North China Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.6.4 North China Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 North China Pharmaceutical Recent Developments/Updates

2.7 Harbin Pharmaceutical Group

2.7.1 Harbin Pharmaceutical Group Details

2.7.2 Harbin Pharmaceutical Group Major Business

2.7.3 Harbin Pharmaceutical Group Minocycline Hydrochloride Capsules Product and Services

2.7.4 Harbin Pharmaceutical Group Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Harbin Pharmaceutical Group Recent Developments/Updates

2.8 Hanhui Pharmaceutical

2.8.1 Hanhui Pharmaceutical Details

2.8.2 Hanhui Pharmaceutical Major Business

2.8.3 Hanhui Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.8.4 Hanhui Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Hanhui Pharmaceutical Recent Developments/Updates

2.9 Diao Group Chengdu Pharmaceutical

2.9.1 Diao Group Chengdu Pharmaceutical Details

2.9.2 Diao Group Chengdu Pharmaceutical Major Business

2.9.3 Diao Group Chengdu Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.9.4 Diao Group Chengdu Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Diao Group Chengdu Pharmaceutical Recent Developments/Updates

2.10 Shanghai Meiyou Pharmaceutical

2.10.1 Shanghai Meiyou Pharmaceutical Details

2.10.2 Shanghai Meiyou Pharmaceutical Major Business

2.10.3 Shanghai Meiyou Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

2.10.4 Shanghai Meiyou Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Shanghai Meiyou Pharmaceutical Recent Developments/Updates

2.11 Kunyao Group

2.11.1 Kunyao Group Details

2.11.2 Kunyao Group Major Business

2.11.3 Kunyao Group Minocycline Hydrochloride Capsules Product and Services

2.11.4 Kunyao Group Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Kunyao Group Recent Developments/Updates

2.12 Amri

2.12.1 Amri Details

2.12.2 Amri Major Business

2.12.3 Amri Minocycline Hydrochloride Capsules Product and Services

2.12.4 Amri Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 Amri Recent Developments/Updates

2.13 Hovione

2.13.1 Hovione Details

2.13.2 Hovione Major Business

2.13.3 Hovione Minocycline Hydrochloride Capsules Product and Services

2.13.4 Hovione Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Hovione Recent Developments/Updates

2.14 CIPAN

2.14.1 CIPAN Details

2.14.2 CIPAN Major Business

2.14.3 CIPAN Minocycline Hydrochloride Capsules Product and Services

2.14.4 CIPAN Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 CIPAN Recent Developments/Updates

2.15 Euticals

2.15.1 Euticals Details

2.15.2 Euticals Major Business

2.15.3 Euticals Minocycline Hydrochloride Capsules Product and Services

2.15.4 Euticals Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 Euticals Recent Developments/Updates

2.16 HISUN

2.16.1 HISUN Details

2.16.2 HISUN Major Business

2.16.3 HISUN Minocycline Hydrochloride Capsules Product and Services

2.16.4 HISUN Minocycline Hydrochloride Capsules Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.16.5 HISUN Recent Developments/Updates

3 Competitive Environment: Minocycline Hydrochloride Capsules by Manufacturer

3.1 Global Minocycline Hydrochloride Capsules Sales Quantity by Manufacturer (2018-2023)

3.2 Global Minocycline Hydrochloride Capsules Revenue by Manufacturer (2018-2023)

3.3 Global Minocycline Hydrochloride Capsules Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Minocycline Hydrochloride Capsules by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Minocycline Hydrochloride Capsules Manufacturer Market Share in 2022

3.4.2 Top 6 Minocycline Hydrochloride Capsules Manufacturer Market Share in 2022

3.5 Minocycline Hydrochloride Capsules Market: Overall Company Footprint Analysis

3.5.1 Minocycline Hydrochloride Capsules Market: Region Footprint

3.5.2 Minocycline Hydrochloride Capsules Market: Company Product Type Footprint

3.5.3 Minocycline Hydrochloride Capsules Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Minocycline Hydrochloride Capsules Market Size by Region

4.1.1 Global Minocycline Hydrochloride Capsules Sales Quantity by Region (2018-2029)

4.1.2 Global Minocycline Hydrochloride Capsules Consumption Value by Region (2018-2029)

4.1.3 Global Minocycline Hydrochloride Capsules Average Price by Region (2018-2029)

4.2 North America Minocycline Hydrochloride Capsules Consumption Value (2018-2029)

4.3 Europe Minocycline Hydrochloride Capsules Consumption Value (2018-2029)

4.4 Asia-Pacific Minocycline Hydrochloride Capsules Consumption Value (2018-2029)

4.5 South America Minocycline Hydrochloride Capsules Consumption Value (2018-2029)

4.6 Middle East and Africa Minocycline Hydrochloride Capsules Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2029)

5.2 Global Minocycline Hydrochloride Capsules Consumption Value by Type (2018-2029)

5.3 Global Minocycline Hydrochloride Capsules Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2029)

6.2 Global Minocycline Hydrochloride Capsules Consumption Value by Application (2018-2029)

6.3 Global Minocycline Hydrochloride Capsules Average Price by Application (2018-2029)

7 North America

7.1 North America Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2029)

7.2 North America Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2029)

7.3 North America Minocycline Hydrochloride Capsules Market Size by Country

7.3.1 North America Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2029)

7.3.2 North America Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2029)

8.2 Europe Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2029)

8.3 Europe Minocycline Hydrochloride Capsules Market Size by Country

8.3.1 Europe Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2029)

8.3.2 Europe Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Minocycline Hydrochloride Capsules Market Size by Region

9.3.1 Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Minocycline Hydrochloride Capsules Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2029)

10.2 South America Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2029)

10.3 South America Minocycline Hydrochloride Capsules Market Size by Country

10.3.1 South America Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2029)

10.3.2 South America Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Minocycline Hydrochloride Capsules Market Size by Country

11.3.1 Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Minocycline Hydrochloride Capsules Market Drivers

12.2 Minocycline Hydrochloride Capsules Market Restraints

12.3 Minocycline Hydrochloride Capsules Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

13 Raw Material and Industry Chain

13.1 Raw Material of Minocycline Hydrochloride Capsules and Key Manufacturers

13.2 Manufacturing Costs Percentage of Minocycline Hydrochloride Capsules

13.3 Minocycline Hydrochloride Capsules Production Process

13.4 Minocycline Hydrochloride Capsules Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Minocycline Hydrochloride Capsules Typical Distributors

14.3 Minocycline Hydrochloride Capsules Typical Customers

15 Research Findings and Conclusion

16 Appendix

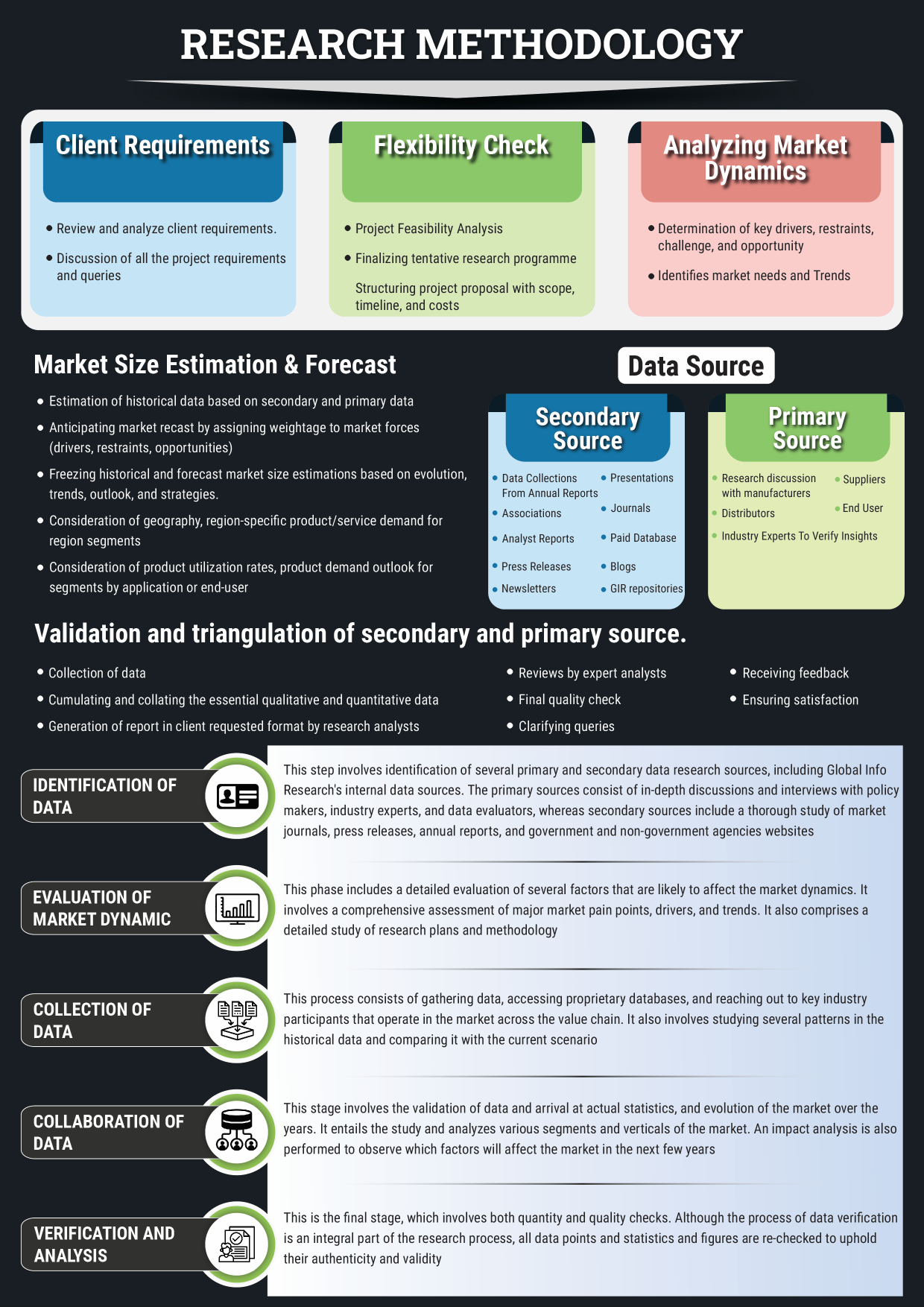

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Minocycline Hydrochloride Capsules Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Minocycline Hydrochloride Capsules Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Chongqing Kerui Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 4. Chongqing Kerui Pharmaceutical Major Business

Table 5. Chongqing Kerui Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 6. Chongqing Kerui Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. Chongqing Kerui Pharmaceutical Recent Developments/Updates

Table 8. Shanghai Huayuan Anhui Renji Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 9. Shanghai Huayuan Anhui Renji Pharmaceutical Major Business

Table 10. Shanghai Huayuan Anhui Renji Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 11. Shanghai Huayuan Anhui Renji Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Shanghai Huayuan Anhui Renji Pharmaceutical Recent Developments/Updates

Table 13. Guangzhou Baiyunshan Guanghua Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 14. Guangzhou Baiyunshan Guanghua Pharmaceutical Major Business

Table 15. Guangzhou Baiyunshan Guanghua Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 16. Guangzhou Baiyunshan Guanghua Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Guangzhou Baiyunshan Guanghua Pharmaceutical Recent Developments/Updates

Table 18. Dequan Pharmaceuticals Basic Information, Manufacturing Base and Competitors

Table 19. Dequan Pharmaceuticals Major Business

Table 20. Dequan Pharmaceuticals Minocycline Hydrochloride Capsules Product and Services

Table 21. Dequan Pharmaceuticals Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Dequan Pharmaceuticals Recent Developments/Updates

Table 23. Haikou Pharmaceutical Factory Basic Information, Manufacturing Base and Competitors

Table 24. Haikou Pharmaceutical Factory Major Business

Table 25. Haikou Pharmaceutical Factory Minocycline Hydrochloride Capsules Product and Services

Table 26. Haikou Pharmaceutical Factory Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Haikou Pharmaceutical Factory Recent Developments/Updates

Table 28. North China Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 29. North China Pharmaceutical Major Business

Table 30. North China Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 31. North China Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. North China Pharmaceutical Recent Developments/Updates

Table 33. Harbin Pharmaceutical Group Basic Information, Manufacturing Base and Competitors

Table 34. Harbin Pharmaceutical Group Major Business

Table 35. Harbin Pharmaceutical Group Minocycline Hydrochloride Capsules Product and Services

Table 36. Harbin Pharmaceutical Group Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Harbin Pharmaceutical Group Recent Developments/Updates

Table 38. Hanhui Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 39. Hanhui Pharmaceutical Major Business

Table 40. Hanhui Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 41. Hanhui Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Hanhui Pharmaceutical Recent Developments/Updates

Table 43. Diao Group Chengdu Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 44. Diao Group Chengdu Pharmaceutical Major Business

Table 45. Diao Group Chengdu Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 46. Diao Group Chengdu Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 47. Diao Group Chengdu Pharmaceutical Recent Developments/Updates

Table 48. Shanghai Meiyou Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 49. Shanghai Meiyou Pharmaceutical Major Business

Table 50. Shanghai Meiyou Pharmaceutical Minocycline Hydrochloride Capsules Product and Services

Table 51. Shanghai Meiyou Pharmaceutical Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 52. Shanghai Meiyou Pharmaceutical Recent Developments/Updates

Table 53. Kunyao Group Basic Information, Manufacturing Base and Competitors

Table 54. Kunyao Group Major Business

Table 55. Kunyao Group Minocycline Hydrochloride Capsules Product and Services

Table 56. Kunyao Group Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 57. Kunyao Group Recent Developments/Updates

Table 58. Amri Basic Information, Manufacturing Base and Competitors

Table 59. Amri Major Business

Table 60. Amri Minocycline Hydrochloride Capsules Product and Services

Table 61. Amri Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 62. Amri Recent Developments/Updates

Table 63. Hovione Basic Information, Manufacturing Base and Competitors

Table 64. Hovione Major Business

Table 65. Hovione Minocycline Hydrochloride Capsules Product and Services

Table 66. Hovione Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 67. Hovione Recent Developments/Updates

Table 68. CIPAN Basic Information, Manufacturing Base and Competitors

Table 69. CIPAN Major Business

Table 70. CIPAN Minocycline Hydrochloride Capsules Product and Services

Table 71. CIPAN Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 72. CIPAN Recent Developments/Updates

Table 73. Euticals Basic Information, Manufacturing Base and Competitors

Table 74. Euticals Major Business

Table 75. Euticals Minocycline Hydrochloride Capsules Product and Services

Table 76. Euticals Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 77. Euticals Recent Developments/Updates

Table 78. HISUN Basic Information, Manufacturing Base and Competitors

Table 79. HISUN Major Business

Table 80. HISUN Minocycline Hydrochloride Capsules Product and Services

Table 81. HISUN Minocycline Hydrochloride Capsules Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 82. HISUN Recent Developments/Updates

Table 83. Global Minocycline Hydrochloride Capsules Sales Quantity by Manufacturer (2018-2023) & (K Units)

Table 84. Global Minocycline Hydrochloride Capsules Revenue by Manufacturer (2018-2023) & (USD Million)

Table 85. Global Minocycline Hydrochloride Capsules Average Price by Manufacturer (2018-2023) & (US$/Unit)

Table 86. Market Position of Manufacturers in Minocycline Hydrochloride Capsules, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 87. Head Office and Minocycline Hydrochloride Capsules Production Site of Key Manufacturer

Table 88. Minocycline Hydrochloride Capsules Market: Company Product Type Footprint

Table 89. Minocycline Hydrochloride Capsules Market: Company Product Application Footprint

Table 90. Minocycline Hydrochloride Capsules New Market Entrants and Barriers to Market Entry

Table 91. Minocycline Hydrochloride Capsules Mergers, Acquisition, Agreements, and Collaborations

Table 92. Global Minocycline Hydrochloride Capsules Sales Quantity by Region (2018-2023) & (K Units)

Table 93. Global Minocycline Hydrochloride Capsules Sales Quantity by Region (2024-2029) & (K Units)

Table 94. Global Minocycline Hydrochloride Capsules Consumption Value by Region (2018-2023) & (USD Million)

Table 95. Global Minocycline Hydrochloride Capsules Consumption Value by Region (2024-2029) & (USD Million)

Table 96. Global Minocycline Hydrochloride Capsules Average Price by Region (2018-2023) & (US$/Unit)

Table 97. Global Minocycline Hydrochloride Capsules Average Price by Region (2024-2029) & (US$/Unit)

Table 98. Global Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2023) & (K Units)

Table 99. Global Minocycline Hydrochloride Capsules Sales Quantity by Type (2024-2029) & (K Units)

Table 100. Global Minocycline Hydrochloride Capsules Consumption Value by Type (2018-2023) & (USD Million)

Table 101. Global Minocycline Hydrochloride Capsules Consumption Value by Type (2024-2029) & (USD Million)

Table 102. Global Minocycline Hydrochloride Capsules Average Price by Type (2018-2023) & (US$/Unit)

Table 103. Global Minocycline Hydrochloride Capsules Average Price by Type (2024-2029) & (US$/Unit)

Table 104. Global Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2023) & (K Units)

Table 105. Global Minocycline Hydrochloride Capsules Sales Quantity by Application (2024-2029) & (K Units)

Table 106. Global Minocycline Hydrochloride Capsules Consumption Value by Application (2018-2023) & (USD Million)

Table 107. Global Minocycline Hydrochloride Capsules Consumption Value by Application (2024-2029) & (USD Million)

Table 108. Global Minocycline Hydrochloride Capsules Average Price by Application (2018-2023) & (US$/Unit)

Table 109. Global Minocycline Hydrochloride Capsules Average Price by Application (2024-2029) & (US$/Unit)

Table 110. North America Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2023) & (K Units)

Table 111. North America Minocycline Hydrochloride Capsules Sales Quantity by Type (2024-2029) & (K Units)

Table 112. North America Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2023) & (K Units)

Table 113. North America Minocycline Hydrochloride Capsules Sales Quantity by Application (2024-2029) & (K Units)

Table 114. North America Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2023) & (K Units)

Table 115. North America Minocycline Hydrochloride Capsules Sales Quantity by Country (2024-2029) & (K Units)

Table 116. North America Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2023) & (USD Million)

Table 117. North America Minocycline Hydrochloride Capsules Consumption Value by Country (2024-2029) & (USD Million)

Table 118. Europe Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2023) & (K Units)

Table 119. Europe Minocycline Hydrochloride Capsules Sales Quantity by Type (2024-2029) & (K Units)

Table 120. Europe Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2023) & (K Units)

Table 121. Europe Minocycline Hydrochloride Capsules Sales Quantity by Application (2024-2029) & (K Units)

Table 122. Europe Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2023) & (K Units)

Table 123. Europe Minocycline Hydrochloride Capsules Sales Quantity by Country (2024-2029) & (K Units)

Table 124. Europe Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2023) & (USD Million)

Table 125. Europe Minocycline Hydrochloride Capsules Consumption Value by Country (2024-2029) & (USD Million)

Table 126. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2023) & (K Units)

Table 127. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Type (2024-2029) & (K Units)

Table 128. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2023) & (K Units)

Table 129. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Application (2024-2029) & (K Units)

Table 130. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Region (2018-2023) & (K Units)

Table 131. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity by Region (2024-2029) & (K Units)

Table 132. Asia-Pacific Minocycline Hydrochloride Capsules Consumption Value by Region (2018-2023) & (USD Million)

Table 133. Asia-Pacific Minocycline Hydrochloride Capsules Consumption Value by Region (2024-2029) & (USD Million)

Table 134. South America Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2023) & (K Units)

Table 135. South America Minocycline Hydrochloride Capsules Sales Quantity by Type (2024-2029) & (K Units)

Table 136. South America Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2023) & (K Units)

Table 137. South America Minocycline Hydrochloride Capsules Sales Quantity by Application (2024-2029) & (K Units)

Table 138. South America Minocycline Hydrochloride Capsules Sales Quantity by Country (2018-2023) & (K Units)

Table 139. South America Minocycline Hydrochloride Capsules Sales Quantity by Country (2024-2029) & (K Units)

Table 140. South America Minocycline Hydrochloride Capsules Consumption Value by Country (2018-2023) & (USD Million)

Table 141. South America Minocycline Hydrochloride Capsules Consumption Value by Country (2024-2029) & (USD Million)

Table 142. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Type (2018-2023) & (K Units)

Table 143. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Type (2024-2029) & (K Units)

Table 144. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Application (2018-2023) & (K Units)

Table 145. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Application (2024-2029) & (K Units)

Table 146. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Region (2018-2023) & (K Units)

Table 147. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity by Region (2024-2029) & (K Units)

Table 148. Middle East & Africa Minocycline Hydrochloride Capsules Consumption Value by Region (2018-2023) & (USD Million)

Table 149. Middle East & Africa Minocycline Hydrochloride Capsules Consumption Value by Region (2024-2029) & (USD Million)

Table 150. Minocycline Hydrochloride Capsules Raw Material

Table 151. Key Manufacturers of Minocycline Hydrochloride Capsules Raw Materials

Table 152. Minocycline Hydrochloride Capsules Typical Distributors

Table 153. Minocycline Hydrochloride Capsules Typical Customers

List of Figures

Figure 1. Minocycline Hydrochloride Capsules Picture

Figure 2. Global Minocycline Hydrochloride Capsules Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Minocycline Hydrochloride Capsules Consumption Value Market Share by Type in 2022

Figure 4. 50mg Examples

Figure 5. 100mg Examples

Figure 6. Global Minocycline Hydrochloride Capsules Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 7. Global Minocycline Hydrochloride Capsules Consumption Value Market Share by Application in 2022

Figure 8. Hospital Examples

Figure 9. Clinic Examples

Figure 10. Other Examples

Figure 11. Global Minocycline Hydrochloride Capsules Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 12. Global Minocycline Hydrochloride Capsules Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 13. Global Minocycline Hydrochloride Capsules Sales Quantity (2018-2029) & (K Units)

Figure 14. Global Minocycline Hydrochloride Capsules Average Price (2018-2029) & (US$/Unit)

Figure 15. Global Minocycline Hydrochloride Capsules Sales Quantity Market Share by Manufacturer in 2022

Figure 16. Global Minocycline Hydrochloride Capsules Consumption Value Market Share by Manufacturer in 2022

Figure 17. Producer Shipments of Minocycline Hydrochloride Capsules by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 18. Top 3 Minocycline Hydrochloride Capsules Manufacturer (Consumption Value) Market Share in 2022

Figure 19. Top 6 Minocycline Hydrochloride Capsules Manufacturer (Consumption Value) Market Share in 2022

Figure 20. Global Minocycline Hydrochloride Capsules Sales Quantity Market Share by Region (2018-2029)

Figure 21. Global Minocycline Hydrochloride Capsules Consumption Value Market Share by Region (2018-2029)

Figure 22. North America Minocycline Hydrochloride Capsules Consumption Value (2018-2029) & (USD Million)

Figure 23. Europe Minocycline Hydrochloride Capsules Consumption Value (2018-2029) & (USD Million)

Figure 24. Asia-Pacific Minocycline Hydrochloride Capsules Consumption Value (2018-2029) & (USD Million)

Figure 25. South America Minocycline Hydrochloride Capsules Consumption Value (2018-2029) & (USD Million)

Figure 26. Middle East & Africa Minocycline Hydrochloride Capsules Consumption Value (2018-2029) & (USD Million)

Figure 27. Global Minocycline Hydrochloride Capsules Sales Quantity Market Share by Type (2018-2029)

Figure 28. Global Minocycline Hydrochloride Capsules Consumption Value Market Share by Type (2018-2029)

Figure 29. Global Minocycline Hydrochloride Capsules Average Price by Type (2018-2029) & (US$/Unit)

Figure 30. Global Minocycline Hydrochloride Capsules Sales Quantity Market Share by Application (2018-2029)

Figure 31. Global Minocycline Hydrochloride Capsules Consumption Value Market Share by Application (2018-2029)

Figure 32. Global Minocycline Hydrochloride Capsules Average Price by Application (2018-2029) & (US$/Unit)

Figure 33. North America Minocycline Hydrochloride Capsules Sales Quantity Market Share by Type (2018-2029)

Figure 34. North America Minocycline Hydrochloride Capsules Sales Quantity Market Share by Application (2018-2029)

Figure 35. North America Minocycline Hydrochloride Capsules Sales Quantity Market Share by Country (2018-2029)

Figure 36. North America Minocycline Hydrochloride Capsules Consumption Value Market Share by Country (2018-2029)

Figure 37. United States Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 38. Canada Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 39. Mexico Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Europe Minocycline Hydrochloride Capsules Sales Quantity Market Share by Type (2018-2029)

Figure 41. Europe Minocycline Hydrochloride Capsules Sales Quantity Market Share by Application (2018-2029)

Figure 42. Europe Minocycline Hydrochloride Capsules Sales Quantity Market Share by Country (2018-2029)

Figure 43. Europe Minocycline Hydrochloride Capsules Consumption Value Market Share by Country (2018-2029)

Figure 44. Germany Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 45. France Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 46. United Kingdom Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. Russia Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. Italy Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity Market Share by Type (2018-2029)

Figure 50. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity Market Share by Application (2018-2029)

Figure 51. Asia-Pacific Minocycline Hydrochloride Capsules Sales Quantity Market Share by Region (2018-2029)

Figure 52. Asia-Pacific Minocycline Hydrochloride Capsules Consumption Value Market Share by Region (2018-2029)

Figure 53. China Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 54. Japan Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 55. Korea Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. India Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Southeast Asia Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Australia Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. South America Minocycline Hydrochloride Capsules Sales Quantity Market Share by Type (2018-2029)

Figure 60. South America Minocycline Hydrochloride Capsules Sales Quantity Market Share by Application (2018-2029)

Figure 61. South America Minocycline Hydrochloride Capsules Sales Quantity Market Share by Country (2018-2029)

Figure 62. South America Minocycline Hydrochloride Capsules Consumption Value Market Share by Country (2018-2029)

Figure 63. Brazil Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 64. Argentina Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 65. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity Market Share by Type (2018-2029)

Figure 66. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity Market Share by Application (2018-2029)

Figure 67. Middle East & Africa Minocycline Hydrochloride Capsules Sales Quantity Market Share by Region (2018-2029)

Figure 68. Middle East & Africa Minocycline Hydrochloride Capsules Consumption Value Market Share by Region (2018-2029)

Figure 69. Turkey Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 70. Egypt Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 71. Saudi Arabia Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. South Africa Minocycline Hydrochloride Capsules Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. Minocycline Hydrochloride Capsules Market Drivers

Figure 74. Minocycline Hydrochloride Capsules Market Restraints

Figure 75. Minocycline Hydrochloride Capsules Market Trends

Figure 76. Porters Five Forces Analysis

Figure 77. Manufacturing Cost Structure Analysis of Minocycline Hydrochloride Capsules in 2022

Figure 78. Manufacturing Process Analysis of Minocycline Hydrochloride Capsules

Figure 79. Minocycline Hydrochloride Capsules Industrial Chain

Figure 80. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 81. Direct Channel Pros & Cons

Figure 82. Indirect Channel Pros & Cons

Figure 83. Methodology

Figure 84. Research Process and Data Source