Women who’ve been recently diagnosed with breast cancer are almost immediately faced with treatment choices. The most common options are to remove the cancerous tissue in part of the breast (lumpectomy) or to remove the entire breast (mastectomy).

A lumpectomy is a form of breast-conserving and preservation surgery used for the removal of breast tumor or some surrounding tissues. It is also known as a partial mastectomy because a part of breast tissue is removed in this procedure, whereas in mastectomy, the full breast is removed to avoid chances of cancer development in future.

The industry's leading producers are Hologic, BD and Danaher, which accounted for 40.13%, 11.79% and 11.27% of revenue in 2019, respectively.

This report is a detailed and comprehensive analysis for global Lumpectomy market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Lumpectomy market size and forecasts, in consumption value ($ Million), 2018-2029

Global Lumpectomy market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global Lumpectomy market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global Lumpectomy market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Lumpectomy

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Lumpectomy market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Hologic

BD

Danaher

Cook Medical

Carl Zeiss Meditech

Merit Medical

Argon Medical Devices

Eckert & Ziegler

Theragenics

Sanarus

IsoAid

SOMATEX Medical

Ranfac

STERYLAB

Endomagnetics

Segmentation By Type

Lumpectomy Systems

Lumpectomy Surgical Tools

Segmentation By Application

Hospitals

Ambulatory Surgical Centers

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Lumpectomy market in 2025?

The Lumpectomy market in 2025 benefits from increasing awareness of breast cancer and the growing preference for less invasive surgical options. Advancements in minimally invasive technologies and better post-surgical recovery options are also key strengths, as well as the rising availability of specialized healthcare providers.

What are the weaknesses in the Lumpectomy market in 2025?

One weakness is the limited access to high-quality healthcare services in rural and underserved regions. High costs associated with advanced surgical equipment and treatments may also restrict market growth in certain economies. Additionally, the risk of recurrence and the need for further treatments post-lumpectomy can deter some patients.

What opportunities exist for the Lumpectomy market in 2025?

Opportunities for market growth lie in expanding global awareness campaigns, especially in emerging markets. Increased investment in research for improving surgical outcomes and post-surgery care, as well as the growing trend of personalized medicine, offer potential for new product developments and service offerings.

What threats could impact the Lumpectomy market in 2025?

The main threats include the risk of regulatory changes that may affect surgical procedures and equipment, as well as competition from alternative treatments like mastectomy or radiation therapy. Economic downturns and shifts in healthcare spending priorities may also impact the market’s growth trajectory.

Market PESTEL Analysis

What political factors affect the Lumpectomy market in 2025?

Government policies regarding healthcare funding and reimbursement play a crucial role in the accessibility and affordability of lumpectomy procedures. Political stability and regulatory frameworks also influence the development and approval of medical technologies related to surgery.

What economic factors impact the Lumpectomy market in 2025?

Economic conditions directly affect healthcare expenditure, influencing both patient affordability and the availability of funding for healthcare facilities. In times of economic downturn, reduced healthcare budgets may lead to fewer surgeries, while increasing disposable income in emerging markets may expand the market.

What social factors shape the Lumpectomy market in 2025?

There is a growing societal focus on health and wellness, particularly regarding cancer awareness. Changing perceptions about women’s health, body image, and preference for less invasive treatment options support the rising demand for lumpectomies over more aggressive treatments like mastectomy.

What technological factors influence the Lumpectomy market in 2025?

Advancements in surgical techniques and technology, such as minimally invasive methods and robotic-assisted surgery, improve the outcomes of lumpectomies. Additionally, innovations in imaging and diagnostic tools lead to more accurate tumor detection, enabling better treatment planning.

What environmental factors affect the Lumpectomy market in 2025?

Environmental sustainability in healthcare practices is becoming more important. Efforts to reduce the carbon footprint of healthcare facilities and minimize waste from medical procedures may impact the market, pushing for greener alternatives in surgical tools and packaging.

What legal factors influence the Lumpectomy market in 2025?

Legal regulations surrounding patient rights, medical malpractice, and safety standards directly influence the lumpectomy market. Stringent guidelines for surgical procedures and ethical considerations around treatment options are crucial for maintaining the trust and safety of patients.

Market SIPOC Analysis

Who are the suppliers in the Lumpectomy market in 2025?

Suppliers include manufacturers of surgical instruments, imaging equipment, and diagnostic tools. Pharmaceutical companies that produce drugs for pre- and post-operative care, as well as medical facilities that provide the surgical services, are also key suppliers in the market.

What are the inputs required for the Lumpectomy market in 2025?

Inputs include advanced surgical technologies, trained healthcare professionals (surgeons, nurses), medical supplies, and diagnostic imaging tools. Additionally, patient data for treatment planning and pharmaceuticals for anesthesia and pain management are essential.

What are the processes involved in the Lumpectomy market in 2025?

Processes include patient screening and diagnosis, pre-surgical preparation, the surgical procedure itself, post-operative care, and follow-up treatments. These are typically managed through a coordinated effort between healthcare providers, technicians, and support staff.

Who are the customers in the Lumpectomy market in 2025?

Customers include patients diagnosed with breast cancer or early-stage tumors, as well as healthcare providers and institutions like hospitals, surgical centers, and oncology clinics that perform the procedures and manage patient care.

What are the outputs of the Lumpectomy market in 2025?

Outputs include successful lumpectomy surgeries, improved patient outcomes, reduced recurrence rates, and high-quality post-surgical care. Additionally, advancements in surgical techniques and treatment options are significant outputs of the market, aimed at enhancing the patient experience and recovery.

Market Porter's Five Forces

What is the threat of new entrants in the Lumpectomy market in 2025?

The threat of new entrants is moderate. While the demand for lumpectomies is growing, the high capital investment needed for medical equipment, specialized staff, and adherence to strict healthcare regulations makes it challenging for new players to enter the market.

How intense is the bargaining power of suppliers in the Lumpectomy market in 2025?

The bargaining power of suppliers is moderate to high. Surgical equipment manufacturers, pharmaceutical companies, and healthcare providers that offer advanced technologies have significant influence due to the specialized nature of the products required for lumpectomies.

What is the bargaining power of buyers in the Lumpectomy market in 2025?

The bargaining power of buyers is relatively low. Patients typically have limited control over the pricing of lumpectomy procedures, as costs are heavily influenced by healthcare providers, insurance coverage, and regulatory frameworks. However, increasing awareness and treatment options may give patients more influence in choosing healthcare providers.

What is the threat of substitute products or services in the Lumpectomy market in 2025?

The threat of substitutes is moderate. While alternatives like mastectomy and radiation therapy exist, the growing preference for less invasive options like lumpectomy, supported by advancements in surgical techniques and outcomes, reduces the appeal of substitutes.

How competitive is the Lumpectomy market in 2025?

The market is moderately competitive. While there are established players providing surgical tools, diagnostic services, and post-surgical care, competition is mainly based on quality, technological advancements, and healthcare provider networks. However, there’s room for innovation and differentiation in treatment options and patient care.

Market Upstream Analysis

What are the key upstream factors influencing the Lumpectomy market in 2025?

Upstream factors include the development and manufacturing of advanced surgical instruments, imaging technologies, and diagnostic tools. The supply chain for high-quality medical devices and pharmaceuticals also plays a critical role in supporting lumpectomy procedures.

How do suppliers impact the Lumpectomy market in 2025?

Suppliers of surgical tools, medical imaging equipment, and anesthetics directly affect the quality and availability of lumpectomy procedures. Their ability to innovate and offer reliable, cost-effective solutions ensures that healthcare providers can deliver optimal patient outcomes.

What role does technology innovation play in the upstream aspects of the Lumpectomy market?

Technology innovation drives the development of minimally invasive surgical methods, precision imaging, and robotic-assisted surgery. These innovations enhance surgical precision and reduce recovery times, significantly influencing the efficiency and effectiveness of lumpectomies.

How do regulatory factors influence the upstream aspects of the Lumpectomy market?

Regulatory factors such as safety standards, approvals for new medical devices, and drug regulations impact the development and availability of surgical tools and treatments for lumpectomy procedures. Compliance with regulations ensures that suppliers meet the required safety and quality standards.

What are the challenges faced by suppliers in the Lumpectomy market in 2025?

Suppliers face challenges in terms of maintaining product innovation, adhering to regulatory requirements, and managing costs in the production of advanced medical technologies. Additionally, global supply chain disruptions and the high cost of research and development can also pose significant barriers.

Market Midstream Analysis

What are the key midstream factors affecting the Lumpectomy market in 2025?

Midstream factors include the healthcare providers that perform the lumpectomy procedures, such as hospitals, surgical centers, and oncology clinics. These institutions manage patient care, including diagnosis, surgery, and post-operative follow-up.

How do healthcare providers impact the Lumpectomy market in 2025?

Healthcare providers are crucial in delivering lumpectomy procedures and determining the quality of care. Their access to advanced surgical technologies, skilled surgeons, and comprehensive patient support services directly impacts patient outcomes and market growth.

What role does patient care and follow-up play in the midstream of the Lumpectomy market?

Post-operative care and patient follow-up are essential in the midstream, ensuring that patients recover properly, avoid complications, and receive ongoing monitoring for recurrence. Enhanced care models, such as personalized recovery plans, improve outcomes and influence market dynamics.

How does the collaboration between surgeons, medical staff, and technology impact the Lumpectomy market?

Collaboration between surgeons, nurses, imaging specialists, and medical technology is vital for successful lumpectomies. The integration of advanced diagnostic tools, real-time imaging, and minimally invasive techniques enhances surgical precision and patient recovery, driving market growth.

What are the challenges in the midstream of the Lumpectomy market in 2025?

Challenges include maintaining consistency in the quality of care across different healthcare institutions, ensuring that all patients have access to the latest surgical technologies and expert professionals, and managing costs associated with advanced treatment options and post-operative care.

Market Downstream Analysis

What are the key downstream factors influencing the Lumpectomy market in 2025?

Downstream factors include patient access to post-operative care, rehabilitation services, and long-term follow-up treatments. Additionally, insurance providers and reimbursement policies also play a significant role in ensuring that patients can afford lumpectomy procedures and subsequent care.

How do patients influence the Lumpectomy market in 2025?

Patients are key drivers in the lumpectomy market through their choices of treatment options and healthcare providers. Increasing patient awareness about breast cancer treatment alternatives, like lumpectomies, and growing demand for minimally invasive procedures influence market trends.

What role does insurance and reimbursement play in the downstream aspects of the Lumpectomy market?

Insurance and reimbursement policies significantly affect the affordability and accessibility of lumpectomies. Coverage for the procedure, follow-up treatments, and post-surgical care directly impacts patient decision-making and healthcare provider offerings.

How does patient satisfaction affect the Lumpectomy market?

Patient satisfaction with outcomes, including recovery time and aesthetic results, influences their choice of healthcare providers and their likelihood of recommending lumpectomy procedures. Positive experiences contribute to greater market adoption and loyalty, benefiting both providers and suppliers.

What are the challenges in the downstream aspects of the Lumpectomy market in 2025?

Challenges include variations in insurance coverage across regions, ensuring equal access to high-quality post-operative care, and managing long-term follow-up treatments to prevent recurrence. Additionally, patient preferences for alternative treatments may reduce the demand for lumpectomies in some cases.

Chapter 1, to describe Lumpectomy product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Lumpectomy, with revenue, gross margin and global market share of Lumpectomy from 2018 to 2023.

Chapter 3, the Lumpectomy competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Lumpectomy market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Lumpectomy.

Chapter 13, to describe Lumpectomy research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Lumpectomy

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Lumpectomy by Type

1.3.1 Overview: Global Lumpectomy Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Lumpectomy Consumption Value Market Share by Type in 2022

1.3.3 Lumpectomy Systems

1.3.4 Lumpectomy Surgical Tools

1.4 Global Lumpectomy Market by Application

1.4.1 Overview: Global Lumpectomy Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospitals

1.4.3 Ambulatory Surgical Centers

1.5 Global Lumpectomy Market Size & Forecast

1.6 Global Lumpectomy Market Size and Forecast by Region

1.6.1 Global Lumpectomy Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Lumpectomy Market Size by Region, (2018-2029)

1.6.3 North America Lumpectomy Market Size and Prospect (2018-2029)

1.6.4 Europe Lumpectomy Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Lumpectomy Market Size and Prospect (2018-2029)

1.6.6 South America Lumpectomy Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Lumpectomy Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Hologic

2.1.1 Hologic Details

2.1.2 Hologic Major Business

2.1.3 Hologic Lumpectomy Product and Solutions

2.1.4 Hologic Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Hologic Recent Developments and Future Plans

2.2 BD

2.2.1 BD Details

2.2.2 BD Major Business

2.2.3 BD Lumpectomy Product and Solutions

2.2.4 BD Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 BD Recent Developments and Future Plans

2.3 Danaher

2.3.1 Danaher Details

2.3.2 Danaher Major Business

2.3.3 Danaher Lumpectomy Product and Solutions

2.3.4 Danaher Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Danaher Recent Developments and Future Plans

2.4 Cook Medical

2.4.1 Cook Medical Details

2.4.2 Cook Medical Major Business

2.4.3 Cook Medical Lumpectomy Product and Solutions

2.4.4 Cook Medical Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Cook Medical Recent Developments and Future Plans

2.5 Carl Zeiss Meditech

2.5.1 Carl Zeiss Meditech Details

2.5.2 Carl Zeiss Meditech Major Business

2.5.3 Carl Zeiss Meditech Lumpectomy Product and Solutions

2.5.4 Carl Zeiss Meditech Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Carl Zeiss Meditech Recent Developments and Future Plans

2.6 Merit Medical

2.6.1 Merit Medical Details

2.6.2 Merit Medical Major Business

2.6.3 Merit Medical Lumpectomy Product and Solutions

2.6.4 Merit Medical Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Merit Medical Recent Developments and Future Plans

2.7 Argon Medical Devices

2.7.1 Argon Medical Devices Details

2.7.2 Argon Medical Devices Major Business

2.7.3 Argon Medical Devices Lumpectomy Product and Solutions

2.7.4 Argon Medical Devices Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Argon Medical Devices Recent Developments and Future Plans

2.8 Eckert & Ziegler

2.8.1 Eckert & Ziegler Details

2.8.2 Eckert & Ziegler Major Business

2.8.3 Eckert & Ziegler Lumpectomy Product and Solutions

2.8.4 Eckert & Ziegler Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Eckert & Ziegler Recent Developments and Future Plans

2.9 Theragenics

2.9.1 Theragenics Details

2.9.2 Theragenics Major Business

2.9.3 Theragenics Lumpectomy Product and Solutions

2.9.4 Theragenics Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Theragenics Recent Developments and Future Plans

2.10 Sanarus

2.10.1 Sanarus Details

2.10.2 Sanarus Major Business

2.10.3 Sanarus Lumpectomy Product and Solutions

2.10.4 Sanarus Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Sanarus Recent Developments and Future Plans

2.11 IsoAid

2.11.1 IsoAid Details

2.11.2 IsoAid Major Business

2.11.3 IsoAid Lumpectomy Product and Solutions

2.11.4 IsoAid Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 IsoAid Recent Developments and Future Plans

2.12 SOMATEX Medical

2.12.1 SOMATEX Medical Details

2.12.2 SOMATEX Medical Major Business

2.12.3 SOMATEX Medical Lumpectomy Product and Solutions

2.12.4 SOMATEX Medical Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 SOMATEX Medical Recent Developments and Future Plans

2.13 Ranfac

2.13.1 Ranfac Details

2.13.2 Ranfac Major Business

2.13.3 Ranfac Lumpectomy Product and Solutions

2.13.4 Ranfac Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Ranfac Recent Developments and Future Plans

2.14 STERYLAB

2.14.1 STERYLAB Details

2.14.2 STERYLAB Major Business

2.14.3 STERYLAB Lumpectomy Product and Solutions

2.14.4 STERYLAB Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 STERYLAB Recent Developments and Future Plans

2.15 Endomagnetics

2.15.1 Endomagnetics Details

2.15.2 Endomagnetics Major Business

2.15.3 Endomagnetics Lumpectomy Product and Solutions

2.15.4 Endomagnetics Lumpectomy Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 Endomagnetics Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Lumpectomy Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Lumpectomy by Company Revenue

3.2.2 Top 3 Lumpectomy Players Market Share in 2022

3.2.3 Top 6 Lumpectomy Players Market Share in 2022

3.3 Lumpectomy Market: Overall Company Footprint Analysis

3.3.1 Lumpectomy Market: Region Footprint

3.3.2 Lumpectomy Market: Company Product Type Footprint

3.3.3 Lumpectomy Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Lumpectomy Consumption Value and Market Share by Type (2018-2023)

4.2 Global Lumpectomy Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Lumpectomy Consumption Value Market Share by Application (2018-2023)

5.2 Global Lumpectomy Market Forecast by Application (2024-2029)

6 North America

6.1 North America Lumpectomy Consumption Value by Type (2018-2029)

6.2 North America Lumpectomy Consumption Value by Application (2018-2029)

6.3 North America Lumpectomy Market Size by Country

6.3.1 North America Lumpectomy Consumption Value by Country (2018-2029)

6.3.2 United States Lumpectomy Market Size and Forecast (2018-2029)

6.3.3 Canada Lumpectomy Market Size and Forecast (2018-2029)

6.3.4 Mexico Lumpectomy Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Lumpectomy Consumption Value by Type (2018-2029)

7.2 Europe Lumpectomy Consumption Value by Application (2018-2029)

7.3 Europe Lumpectomy Market Size by Country

7.3.1 Europe Lumpectomy Consumption Value by Country (2018-2029)

7.3.2 Germany Lumpectomy Market Size and Forecast (2018-2029)

7.3.3 France Lumpectomy Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Lumpectomy Market Size and Forecast (2018-2029)

7.3.5 Russia Lumpectomy Market Size and Forecast (2018-2029)

7.3.6 Italy Lumpectomy Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Lumpectomy Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Lumpectomy Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Lumpectomy Market Size by Region

8.3.1 Asia-Pacific Lumpectomy Consumption Value by Region (2018-2029)

8.3.2 China Lumpectomy Market Size and Forecast (2018-2029)

8.3.3 Japan Lumpectomy Market Size and Forecast (2018-2029)

8.3.4 South Korea Lumpectomy Market Size and Forecast (2018-2029)

8.3.5 India Lumpectomy Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Lumpectomy Market Size and Forecast (2018-2029)

8.3.7 Australia Lumpectomy Market Size and Forecast (2018-2029)

9 South America

9.1 South America Lumpectomy Consumption Value by Type (2018-2029)

9.2 South America Lumpectomy Consumption Value by Application (2018-2029)

9.3 South America Lumpectomy Market Size by Country

9.3.1 South America Lumpectomy Consumption Value by Country (2018-2029)

9.3.2 Brazil Lumpectomy Market Size and Forecast (2018-2029)

9.3.3 Argentina Lumpectomy Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Lumpectomy Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Lumpectomy Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Lumpectomy Market Size by Country

10.3.1 Middle East & Africa Lumpectomy Consumption Value by Country (2018-2029)

10.3.2 Turkey Lumpectomy Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Lumpectomy Market Size and Forecast (2018-2029)

10.3.4 UAE Lumpectomy Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Lumpectomy Market Drivers

11.2 Lumpectomy Market Restraints

11.3 Lumpectomy Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Lumpectomy Industry Chain

12.2 Lumpectomy Upstream Analysis

12.3 Lumpectomy Midstream Analysis

12.4 Lumpectomy Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

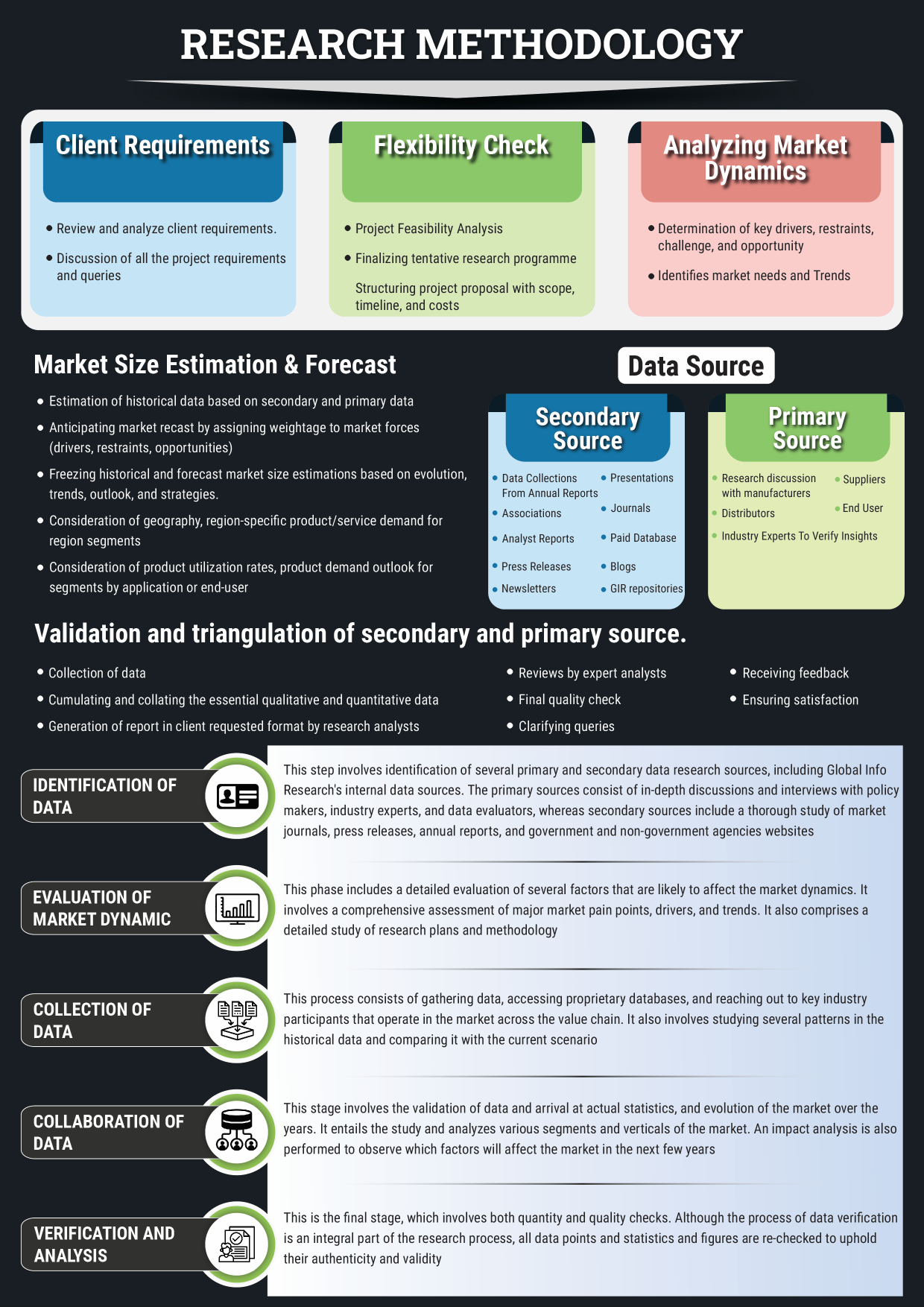

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Lumpectomy Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Lumpectomy Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Lumpectomy Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Lumpectomy Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Hologic Company Information, Head Office, and Major Competitors

Table 6. Hologic Major Business

Table 7. Hologic Lumpectomy Product and Solutions

Table 8. Hologic Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Hologic Recent Developments and Future Plans

Table 10. BD Company Information, Head Office, and Major Competitors

Table 11. BD Major Business

Table 12. BD Lumpectomy Product and Solutions

Table 13. BD Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. BD Recent Developments and Future Plans

Table 15. Danaher Company Information, Head Office, and Major Competitors

Table 16. Danaher Major Business

Table 17. Danaher Lumpectomy Product and Solutions

Table 18. Danaher Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. Danaher Recent Developments and Future Plans

Table 20. Cook Medical Company Information, Head Office, and Major Competitors

Table 21. Cook Medical Major Business

Table 22. Cook Medical Lumpectomy Product and Solutions

Table 23. Cook Medical Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Cook Medical Recent Developments and Future Plans

Table 25. Carl Zeiss Meditech Company Information, Head Office, and Major Competitors

Table 26. Carl Zeiss Meditech Major Business

Table 27. Carl Zeiss Meditech Lumpectomy Product and Solutions

Table 28. Carl Zeiss Meditech Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. Carl Zeiss Meditech Recent Developments and Future Plans

Table 30. Merit Medical Company Information, Head Office, and Major Competitors

Table 31. Merit Medical Major Business

Table 32. Merit Medical Lumpectomy Product and Solutions

Table 33. Merit Medical Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Merit Medical Recent Developments and Future Plans

Table 35. Argon Medical Devices Company Information, Head Office, and Major Competitors

Table 36. Argon Medical Devices Major Business

Table 37. Argon Medical Devices Lumpectomy Product and Solutions

Table 38. Argon Medical Devices Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Argon Medical Devices Recent Developments and Future Plans

Table 40. Eckert & Ziegler Company Information, Head Office, and Major Competitors

Table 41. Eckert & Ziegler Major Business

Table 42. Eckert & Ziegler Lumpectomy Product and Solutions

Table 43. Eckert & Ziegler Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. Eckert & Ziegler Recent Developments and Future Plans

Table 45. Theragenics Company Information, Head Office, and Major Competitors

Table 46. Theragenics Major Business

Table 47. Theragenics Lumpectomy Product and Solutions

Table 48. Theragenics Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. Theragenics Recent Developments and Future Plans

Table 50. Sanarus Company Information, Head Office, and Major Competitors

Table 51. Sanarus Major Business

Table 52. Sanarus Lumpectomy Product and Solutions

Table 53. Sanarus Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Sanarus Recent Developments and Future Plans

Table 55. IsoAid Company Information, Head Office, and Major Competitors

Table 56. IsoAid Major Business

Table 57. IsoAid Lumpectomy Product and Solutions

Table 58. IsoAid Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 59. IsoAid Recent Developments and Future Plans

Table 60. SOMATEX Medical Company Information, Head Office, and Major Competitors

Table 61. SOMATEX Medical Major Business

Table 62. SOMATEX Medical Lumpectomy Product and Solutions

Table 63. SOMATEX Medical Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 64. SOMATEX Medical Recent Developments and Future Plans

Table 65. Ranfac Company Information, Head Office, and Major Competitors

Table 66. Ranfac Major Business

Table 67. Ranfac Lumpectomy Product and Solutions

Table 68. Ranfac Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 69. Ranfac Recent Developments and Future Plans

Table 70. STERYLAB Company Information, Head Office, and Major Competitors

Table 71. STERYLAB Major Business

Table 72. STERYLAB Lumpectomy Product and Solutions

Table 73. STERYLAB Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 74. STERYLAB Recent Developments and Future Plans

Table 75. Endomagnetics Company Information, Head Office, and Major Competitors

Table 76. Endomagnetics Major Business

Table 77. Endomagnetics Lumpectomy Product and Solutions

Table 78. Endomagnetics Lumpectomy Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 79. Endomagnetics Recent Developments and Future Plans

Table 80. Global Lumpectomy Revenue (USD Million) by Players (2018-2023)

Table 81. Global Lumpectomy Revenue Share by Players (2018-2023)

Table 82. Breakdown of Lumpectomy by Company Type (Tier 1, Tier 2, and Tier 3)

Table 83. Market Position of Players in Lumpectomy, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 84. Head Office of Key Lumpectomy Players

Table 85. Lumpectomy Market: Company Product Type Footprint

Table 86. Lumpectomy Market: Company Product Application Footprint

Table 87. Lumpectomy New Market Entrants and Barriers to Market Entry

Table 88. Lumpectomy Mergers, Acquisition, Agreements, and Collaborations

Table 89. Global Lumpectomy Consumption Value (USD Million) by Type (2018-2023)

Table 90. Global Lumpectomy Consumption Value Share by Type (2018-2023)

Table 91. Global Lumpectomy Consumption Value Forecast by Type (2024-2029)

Table 92. Global Lumpectomy Consumption Value by Application (2018-2023)

Table 93. Global Lumpectomy Consumption Value Forecast by Application (2024-2029)

Table 94. North America Lumpectomy Consumption Value by Type (2018-2023) & (USD Million)

Table 95. North America Lumpectomy Consumption Value by Type (2024-2029) & (USD Million)

Table 96. North America Lumpectomy Consumption Value by Application (2018-2023) & (USD Million)

Table 97. North America Lumpectomy Consumption Value by Application (2024-2029) & (USD Million)

Table 98. North America Lumpectomy Consumption Value by Country (2018-2023) & (USD Million)

Table 99. North America Lumpectomy Consumption Value by Country (2024-2029) & (USD Million)

Table 100. Europe Lumpectomy Consumption Value by Type (2018-2023) & (USD Million)

Table 101. Europe Lumpectomy Consumption Value by Type (2024-2029) & (USD Million)

Table 102. Europe Lumpectomy Consumption Value by Application (2018-2023) & (USD Million)

Table 103. Europe Lumpectomy Consumption Value by Application (2024-2029) & (USD Million)

Table 104. Europe Lumpectomy Consumption Value by Country (2018-2023) & (USD Million)

Table 105. Europe Lumpectomy Consumption Value by Country (2024-2029) & (USD Million)

Table 106. Asia-Pacific Lumpectomy Consumption Value by Type (2018-2023) & (USD Million)

Table 107. Asia-Pacific Lumpectomy Consumption Value by Type (2024-2029) & (USD Million)

Table 108. Asia-Pacific Lumpectomy Consumption Value by Application (2018-2023) & (USD Million)

Table 109. Asia-Pacific Lumpectomy Consumption Value by Application (2024-2029) & (USD Million)

Table 110. Asia-Pacific Lumpectomy Consumption Value by Region (2018-2023) & (USD Million)

Table 111. Asia-Pacific Lumpectomy Consumption Value by Region (2024-2029) & (USD Million)

Table 112. South America Lumpectomy Consumption Value by Type (2018-2023) & (USD Million)

Table 113. South America Lumpectomy Consumption Value by Type (2024-2029) & (USD Million)

Table 114. South America Lumpectomy Consumption Value by Application (2018-2023) & (USD Million)

Table 115. South America Lumpectomy Consumption Value by Application (2024-2029) & (USD Million)

Table 116. South America Lumpectomy Consumption Value by Country (2018-2023) & (USD Million)

Table 117. South America Lumpectomy Consumption Value by Country (2024-2029) & (USD Million)

Table 118. Middle East & Africa Lumpectomy Consumption Value by Type (2018-2023) & (USD Million)

Table 119. Middle East & Africa Lumpectomy Consumption Value by Type (2024-2029) & (USD Million)

Table 120. Middle East & Africa Lumpectomy Consumption Value by Application (2018-2023) & (USD Million)

Table 121. Middle East & Africa Lumpectomy Consumption Value by Application (2024-2029) & (USD Million)

Table 122. Middle East & Africa Lumpectomy Consumption Value by Country (2018-2023) & (USD Million)

Table 123. Middle East & Africa Lumpectomy Consumption Value by Country (2024-2029) & (USD Million)

Table 124. Lumpectomy Raw Material

Table 125. Key Suppliers of Lumpectomy Raw Materials

List of Figures

Figure 1. Lumpectomy Picture

Figure 2. Global Lumpectomy Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Lumpectomy Consumption Value Market Share by Type in 2022

Figure 4. Lumpectomy Systems

Figure 5. Lumpectomy Surgical Tools

Figure 6. Global Lumpectomy Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 7. Lumpectomy Consumption Value Market Share by Application in 2022

Figure 8. Hospitals Picture

Figure 9. Ambulatory Surgical Centers Picture

Figure 10. Global Lumpectomy Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 11. Global Lumpectomy Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 12. Global Market Lumpectomy Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 13. Global Lumpectomy Consumption Value Market Share by Region (2018-2029)

Figure 14. Global Lumpectomy Consumption Value Market Share by Region in 2022

Figure 15. North America Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 16. Europe Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 17. Asia-Pacific Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 18. South America Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 19. Middle East and Africa Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 20. Global Lumpectomy Revenue Share by Players in 2022

Figure 21. Lumpectomy Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 22. Global Top 3 Players Lumpectomy Market Share in 2022

Figure 23. Global Top 6 Players Lumpectomy Market Share in 2022

Figure 24. Global Lumpectomy Consumption Value Share by Type (2018-2023)

Figure 25. Global Lumpectomy Market Share Forecast by Type (2024-2029)

Figure 26. Global Lumpectomy Consumption Value Share by Application (2018-2023)

Figure 27. Global Lumpectomy Market Share Forecast by Application (2024-2029)

Figure 28. North America Lumpectomy Consumption Value Market Share by Type (2018-2029)

Figure 29. North America Lumpectomy Consumption Value Market Share by Application (2018-2029)

Figure 30. North America Lumpectomy Consumption Value Market Share by Country (2018-2029)

Figure 31. United States Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 32. Canada Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 33. Mexico Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 34. Europe Lumpectomy Consumption Value Market Share by Type (2018-2029)

Figure 35. Europe Lumpectomy Consumption Value Market Share by Application (2018-2029)

Figure 36. Europe Lumpectomy Consumption Value Market Share by Country (2018-2029)

Figure 37. Germany Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 38. France Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 39. United Kingdom Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 40. Russia Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 41. Italy Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 42. Asia-Pacific Lumpectomy Consumption Value Market Share by Type (2018-2029)

Figure 43. Asia-Pacific Lumpectomy Consumption Value Market Share by Application (2018-2029)

Figure 44. Asia-Pacific Lumpectomy Consumption Value Market Share by Region (2018-2029)

Figure 45. China Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 46. Japan Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 47. South Korea Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 48. India Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 49. Southeast Asia Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 50. Australia Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 51. South America Lumpectomy Consumption Value Market Share by Type (2018-2029)

Figure 52. South America Lumpectomy Consumption Value Market Share by Application (2018-2029)

Figure 53. South America Lumpectomy Consumption Value Market Share by Country (2018-2029)

Figure 54. Brazil Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 55. Argentina Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 56. Middle East and Africa Lumpectomy Consumption Value Market Share by Type (2018-2029)

Figure 57. Middle East and Africa Lumpectomy Consumption Value Market Share by Application (2018-2029)

Figure 58. Middle East and Africa Lumpectomy Consumption Value Market Share by Country (2018-2029)

Figure 59. Turkey Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 60. Saudi Arabia Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 61. UAE Lumpectomy Consumption Value (2018-2029) & (USD Million)

Figure 62. Lumpectomy Market Drivers

Figure 63. Lumpectomy Market Restraints

Figure 64. Lumpectomy Market Trends

Figure 65. Porters Five Forces Analysis

Figure 66. Manufacturing Cost Structure Analysis of Lumpectomy in 2022

Figure 67. Manufacturing Process Analysis of Lumpectomy

Figure 68. Lumpectomy Industrial Chain

Figure 69. Methodology

Figure 70. Research Process and Data Source