Market Outlook

The global In-Vitro Colorectal Cancer Screening Tests market size was valued at USD 1075.1 million in 2022 and is forecast to a readjusted size of USD 1539.6 million by 2029 with a CAGR of 5.3% during review period.

In-Vitro colorectal cancer screening tests use various methods to determine whether a patient has colorectal cancer.

The industry's leading producers are Alere (Abbott), Beckman Coulter and Siemens Healthcare, which accounted for 31.59%, 18.71% and 10.67% of revenue in 2019, respectively.

This report is a detailed and comprehensive analysis for global In-Vitro Colorectal Cancer Screening Tests market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global In-Vitro Colorectal Cancer Screening Tests market size and forecasts, in consumption value ($ Million), 2018-2029

Global In-Vitro Colorectal Cancer Screening Tests market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global In-Vitro Colorectal Cancer Screening Tests market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global In-Vitro Colorectal Cancer Screening Tests market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for In-Vitro Colorectal Cancer Screening Tests

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global In-Vitro Colorectal Cancer Screening Tests market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Alere(Abbott)

Beckman Coulter

Siemens Healthcare

Eiken Chemical

Hitachi Chemical (Kyowa Medex)

Clinical Genomics Pty Ltd (Quest Diagnostics)

Sysmex

QIAGEN

R-Biopharm

Immunostics

Segmentation By Type

Biomarker Tests

Fecal Occult Blood Tests

CRC DNA Screening Tests

Segmentation By Application

Hospital and Clinics

Ambulatory

Home Care

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The market's strengths include the increasing demand for early cancer detection, growing awareness among the population, and advancements in non-invasive testing methods. Additionally, the market benefits from technological innovations that improve test accuracy and reduce costs.

What are the weaknesses of the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

One weakness is the high cost of some screening tests, which may limit accessibility in lower-income populations. Additionally, there may be concerns about the accuracy and reliability of certain tests, which could hinder widespread adoption.

What are the opportunities in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

There is a significant opportunity to expand into emerging markets where awareness and access to colorectal cancer screening are still developing. Moreover, integrating AI and machine learning into screening tests could enhance diagnostic accuracy and efficiency, creating new market potential.

What are the threats to the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Threats include regulatory challenges, as new screening tests may face delays in approval processes. Competition from alternative screening methods, such as imaging technologies, could also impact market growth. Additionally, any concerns about the reliability or safety of screening tests could affect consumer trust and adoption.

Market PESTEL Analysis

What are the political factors affecting the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Political factors include government policies related to healthcare funding, reimbursement rates for screening tests, and public health initiatives aimed at increasing cancer awareness. Changes in healthcare regulations and insurance coverage can directly impact market accessibility and affordability.

What are the economic factors affecting the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Economic factors such as the affordability of in-vitro screening tests, disposable incomes, and healthcare budgets influence market growth. Economic downturns may reduce consumer spending on health screening, while rising healthcare investments in developed countries may create more demand for advanced screening technologies.

What are the social factors affecting the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Social factors include increasing awareness of colorectal cancer and the importance of early detection. As public health education improves, more individuals are likely to opt for screening. Additionally, a growing aging population may drive demand for colorectal cancer screening services.

What are the technological factors affecting the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Technological advancements in molecular diagnostics, AI-powered tools, and non-invasive testing methods are key drivers of innovation in the market. The ability to improve accuracy, speed, and cost-effectiveness of screening tests through technology is expected to increase market adoption.

What are the environmental factors affecting the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Environmental factors, such as the growing emphasis on sustainability and eco-friendly manufacturing, may influence production and packaging of screening tests. Additionally, there may be regulatory pressure to minimize the environmental impact of medical waste generated by in-vitro diagnostic tests.

What are the legal factors affecting the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Legal factors include compliance with international and local health regulations, such as approval processes for new diagnostic tests and intellectual property laws. Laws surrounding patient privacy and data protection, especially with digital diagnostics, also affect how companies operate within the market.

Market SIPOC Analysis

Who are the suppliers in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Suppliers include manufacturers of diagnostic kits, raw materials for test development (such as reagents and biomaterials), and technology providers offering AI or machine learning algorithms for test analysis. Additionally, laboratories and healthcare providers who perform the screening tests play an important role as suppliers.

What are the inputs required for the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Inputs include scientific research, advanced diagnostic technologies, biomaterial resources, regulatory approvals, funding for R&D, and expertise in molecular biology. Efficient distribution channels for getting tests to healthcare providers and patients are also crucial inputs.

What are the processes involved in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The processes involve research and development of in-vitro diagnostic tests, clinical trials for regulatory approval, manufacturing and quality control of testing kits, distribution to healthcare providers, and training professionals to administer the tests. After testing, data collection, analysis, and reporting also form part of the process.

What are the outputs of the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Outputs include in-vitro colorectal cancer screening test kits, diagnostic reports, and actionable insights for healthcare providers. The results help in detecting early-stage colorectal cancer and can lead to patient referrals for further medical procedures or treatment.

Who are the customers in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Customers include hospitals, diagnostic laboratories, clinics, healthcare providers, insurance companies, and patients themselves. The market also targets government health programs and organizations aiming to promote cancer awareness and screening in different demographics.

Market Porter's Five Forces

How strong is the threat of new entrants in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The threat of new entrants is moderate. While there is significant potential in the market, the high costs associated with R&D, regulatory approvals, and establishing trust in the accuracy of tests create barriers to entry. Existing players with established brands and technologies hold a competitive advantage.

How intense is the bargaining power of suppliers in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The bargaining power of suppliers is moderate. Key suppliers of raw materials, diagnostic reagents, and technology components are crucial, but there is competition among suppliers, which helps balance power. However, for highly specialized materials or technologies, supplier power may be stronger.

How strong is the bargaining power of buyers in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The bargaining power of buyers is moderate to high. As more screening options become available, healthcare providers and patients can compare and choose tests based on price, accuracy, and convenience. However, limited availability of innovative or highly accurate tests can lower buyer power to some extent.

What is the threat of substitute products in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The threat of substitutes is moderate. While non-invasive alternatives like imaging and stool-based tests are available, in-vitro diagnostics provide more accurate and detailed results. However, advances in competing diagnostic technologies or non-traditional approaches could pose a challenge.

How intense is the competitive rivalry in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The competitive rivalry is high. The market is crowded with established players, including large diagnostic companies and biotech firms. Companies are constantly innovating to improve test accuracy, reduce costs, and differentiate themselves through technology. This creates intense competition for market share.

Market Upstream Analysis

What are the key raw materials involved in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

The key raw materials include biological reagents, chemical compounds, enzymes, and diagnostic kits components. High-quality biomaterials for sample collection and processing are also crucial, as well as advanced technologies like sensors, diagnostic software, and AI algorithms for data analysis.

What are the main suppliers in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Main suppliers are companies that specialize in providing reagents, diagnostic equipment, and technological solutions for screening tests. These include suppliers of laboratory equipment, bioinformatics software providers, manufacturers of specialized diagnostic kits, and biotechnology firms focused on molecular diagnostics.

What are the major technological requirements for the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Technological requirements include advanced diagnostic platforms that can perform accurate molecular analysis, AI-driven diagnostic tools, and software for interpreting test results. Additionally, innovations in automation and integration of test results into electronic health records are essential for smooth workflow in healthcare settings.

What are the regulatory and compliance challenges in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Regulatory challenges include obtaining necessary certifications and approvals from health authorities such as the FDA, EMA, and other local regulatory bodies. Compliance with standards for patient data protection and quality control in manufacturing processes also represents a significant hurdle for companies in the market.

What are the key distribution channels for the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Key distribution channels include direct sales to hospitals, diagnostic labs, and healthcare providers. Distributors, online healthcare platforms, and partnerships with large healthcare organizations also play a critical role in getting the products to the end users.

Market Midstream Analysis

What are the key processes involved in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Key processes include the manufacturing of diagnostic kits, quality control to ensure reliability and accuracy, clinical validation of tests, and regulatory compliance. Additionally, the packaging, labeling, and distribution of screening tests to healthcare providers are critical processes that ensure market delivery.

What are the critical players in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Critical players include diagnostic companies, biotechnology firms, and manufacturers of medical devices who produce and distribute colorectal cancer screening tests. Partnerships with healthcare providers, laboratories, and research institutions also contribute to the effective implementation of screening programs.

What are the key technologies used in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Key technologies include molecular diagnostics, PCR (Polymerase Chain Reaction) technologies, immunoassay platforms, and AI-driven data analysis systems. These technologies enable higher accuracy and faster results, improving the effectiveness of early detection and diagnosis.

What are the major challenges faced in the midstream phase of the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Major challenges include maintaining quality control in the manufacturing process, ensuring the scalability of diagnostic tests, and addressing supply chain inefficiencies. Additionally, the complexity of regulatory compliance across different regions and the cost of ensuring reliable, high-quality production can be challenging.

What are the collaboration opportunities in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Collaboration opportunities exist in partnering with healthcare institutions for clinical trials, teaming up with research organizations to innovate new test methods, and working with insurance companies to improve reimbursement policies. Collaborations with AI and machine learning firms also provide significant potential for enhancing diagnostic capabilities.

Market Downstream Analysis

What are the key customers in the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Key customers include hospitals, diagnostic laboratories, clinics, healthcare providers, and insurance companies. Additionally, government health programs and individuals seeking early detection and prevention of colorectal cancer also represent important customer segments.

What are the primary distribution channels for the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Primary distribution channels include direct sales to healthcare institutions, online platforms for at-home testing kits, partnerships with insurance companies, and collaborations with public health programs. Additionally, diagnostic laboratories and medical distributors are key players in getting tests to the end-users.

What are the major trends driving the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Major trends include the increasing demand for non-invasive and easy-to-use screening tests, advancements in molecular diagnostics and AI-driven technologies, and a growing focus on personalized healthcare. Moreover, there is a rise in public awareness and government initiatives supporting cancer screening programs.

What are the challenges faced in the downstream phase of the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Challenges include ensuring broad access to tests in underserved areas, overcoming hesitancy around early screening, and managing the logistical complexities of test distribution. Additionally, ensuring accurate interpretation of results by healthcare providers and addressing patient concerns about the affordability of tests are significant hurdles.

What are the key opportunities in the downstream phase of the In-Vitro Colorectal Cancer Screening Tests Market in 2025?

Opportunities include expanding into emerging markets with growing healthcare infrastructure, leveraging digital platforms for at-home testing and result reporting, and collaborating with insurance providers to make tests more affordable. There is also potential for integrating AI and big data into post-screening care for better decision-making.

Chapter 1, to describe In-Vitro Colorectal Cancer Screening Tests product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of In-Vitro Colorectal Cancer Screening Tests, with revenue, gross margin and global market share of In-Vitro Colorectal Cancer Screening Tests from 2018 to 2023.

Chapter 3, the In-Vitro Colorectal Cancer Screening Tests competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and In-Vitro Colorectal Cancer Screening Tests market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of In-Vitro Colorectal Cancer Screening Tests.

Chapter 13, to describe In-Vitro Colorectal Cancer Screening Tests research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of In-Vitro Colorectal Cancer Screening Tests

1.2 Market Estimation Caveats and Base Year

1.3 Classification of In-Vitro Colorectal Cancer Screening Tests by Type

1.3.1 Overview: Global In-Vitro Colorectal Cancer Screening Tests Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type in 2022

1.3.3 Biomarker Tests

1.3.4 Fecal Occult Blood Tests

1.3.5 CRC DNA Screening Tests

1.4 Global In-Vitro Colorectal Cancer Screening Tests Market by Application

1.4.1 Overview: Global In-Vitro Colorectal Cancer Screening Tests Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital and Clinics

1.4.3 Ambulatory

1.4.4 Home Care

1.5 Global In-Vitro Colorectal Cancer Screening Tests Market Size & Forecast

1.6 Global In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast by Region

1.6.1 Global In-Vitro Colorectal Cancer Screening Tests Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global In-Vitro Colorectal Cancer Screening Tests Market Size by Region, (2018-2029)

1.6.3 North America In-Vitro Colorectal Cancer Screening Tests Market Size and Prospect (2018-2029)

1.6.4 Europe In-Vitro Colorectal Cancer Screening Tests Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market Size and Prospect (2018-2029)

1.6.6 South America In-Vitro Colorectal Cancer Screening Tests Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa In-Vitro Colorectal Cancer Screening Tests Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Alere(Abbott)

2.1.1 Alere(Abbott) Details

2.1.2 Alere(Abbott) Major Business

2.1.3 Alere(Abbott) In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.1.4 Alere(Abbott) In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Alere(Abbott) Recent Developments and Future Plans

2.2 Beckman Coulter

2.2.1 Beckman Coulter Details

2.2.2 Beckman Coulter Major Business

2.2.3 Beckman Coulter In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.2.4 Beckman Coulter In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Beckman Coulter Recent Developments and Future Plans

2.3 Siemens Healthcare

2.3.1 Siemens Healthcare Details

2.3.2 Siemens Healthcare Major Business

2.3.3 Siemens Healthcare In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.3.4 Siemens Healthcare In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Siemens Healthcare Recent Developments and Future Plans

2.4 Eiken Chemical

2.4.1 Eiken Chemical Details

2.4.2 Eiken Chemical Major Business

2.4.3 Eiken Chemical In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.4.4 Eiken Chemical In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Eiken Chemical Recent Developments and Future Plans

2.5 Hitachi Chemical (Kyowa Medex)

2.5.1 Hitachi Chemical (Kyowa Medex) Details

2.5.2 Hitachi Chemical (Kyowa Medex) Major Business

2.5.3 Hitachi Chemical (Kyowa Medex) In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.5.4 Hitachi Chemical (Kyowa Medex) In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Hitachi Chemical (Kyowa Medex) Recent Developments and Future Plans

2.6 Clinical Genomics Pty Ltd (Quest Diagnostics)

2.6.1 Clinical Genomics Pty Ltd (Quest Diagnostics) Details

2.6.2 Clinical Genomics Pty Ltd (Quest Diagnostics) Major Business

2.6.3 Clinical Genomics Pty Ltd (Quest Diagnostics) In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.6.4 Clinical Genomics Pty Ltd (Quest Diagnostics) In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Clinical Genomics Pty Ltd (Quest Diagnostics) Recent Developments and Future Plans

2.7 Sysmex

2.7.1 Sysmex Details

2.7.2 Sysmex Major Business

2.7.3 Sysmex In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.7.4 Sysmex In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Sysmex Recent Developments and Future Plans

2.8 QIAGEN

2.8.1 QIAGEN Details

2.8.2 QIAGEN Major Business

2.8.3 QIAGEN In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.8.4 QIAGEN In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 QIAGEN Recent Developments and Future Plans

2.9 R-Biopharm

2.9.1 R-Biopharm Details

2.9.2 R-Biopharm Major Business

2.9.3 R-Biopharm In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.9.4 R-Biopharm In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 R-Biopharm Recent Developments and Future Plans

2.10 Immunostics

2.10.1 Immunostics Details

2.10.2 Immunostics Major Business

2.10.3 Immunostics In-Vitro Colorectal Cancer Screening Tests Product and Solutions

2.10.4 Immunostics In-Vitro Colorectal Cancer Screening Tests Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Immunostics Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global In-Vitro Colorectal Cancer Screening Tests Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of In-Vitro Colorectal Cancer Screening Tests by Company Revenue

3.2.2 Top 3 In-Vitro Colorectal Cancer Screening Tests Players Market Share in 2022

3.2.3 Top 6 In-Vitro Colorectal Cancer Screening Tests Players Market Share in 2022

3.3 In-Vitro Colorectal Cancer Screening Tests Market: Overall Company Footprint Analysis

3.3.1 In-Vitro Colorectal Cancer Screening Tests Market: Region Footprint

3.3.2 In-Vitro Colorectal Cancer Screening Tests Market: Company Product Type Footprint

3.3.3 In-Vitro Colorectal Cancer Screening Tests Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global In-Vitro Colorectal Cancer Screening Tests Consumption Value and Market Share by Type (2018-2023)

4.2 Global In-Vitro Colorectal Cancer Screening Tests Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application (2018-2023)

5.2 Global In-Vitro Colorectal Cancer Screening Tests Market Forecast by Application (2024-2029)

6 North America

6.1 North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2029)

6.2 North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2029)

6.3 North America In-Vitro Colorectal Cancer Screening Tests Market Size by Country

6.3.1 North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2029)

6.3.2 United States In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

6.3.3 Canada In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

6.3.4 Mexico In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2029)

7.2 Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2029)

7.3 Europe In-Vitro Colorectal Cancer Screening Tests Market Size by Country

7.3.1 Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2029)

7.3.2 Germany In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

7.3.3 France In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

7.3.4 United Kingdom In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

7.3.5 Russia In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

7.3.6 Italy In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2029)

8.2 Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2029)

8.3 Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market Size by Region

8.3.1 Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Region (2018-2029)

8.3.2 China In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

8.3.3 Japan In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

8.3.4 South Korea In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

8.3.5 India In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

8.3.7 Australia In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

9 South America

9.1 South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2029)

9.2 South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2029)

9.3 South America In-Vitro Colorectal Cancer Screening Tests Market Size by Country

9.3.1 South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2029)

9.3.2 Brazil In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

9.3.3 Argentina In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2029)

10.2 Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2029)

10.3 Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Market Size by Country

10.3.1 Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2029)

10.3.2 Turkey In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

10.3.4 UAE In-Vitro Colorectal Cancer Screening Tests Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 In-Vitro Colorectal Cancer Screening Tests Market Drivers

11.2 In-Vitro Colorectal Cancer Screening Tests Market Restraints

11.3 In-Vitro Colorectal Cancer Screening Tests Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 In-Vitro Colorectal Cancer Screening Tests Industry Chain

12.2 In-Vitro Colorectal Cancer Screening Tests Upstream Analysis

12.3 In-Vitro Colorectal Cancer Screening Tests Midstream Analysis

12.4 In-Vitro Colorectal Cancer Screening Tests Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

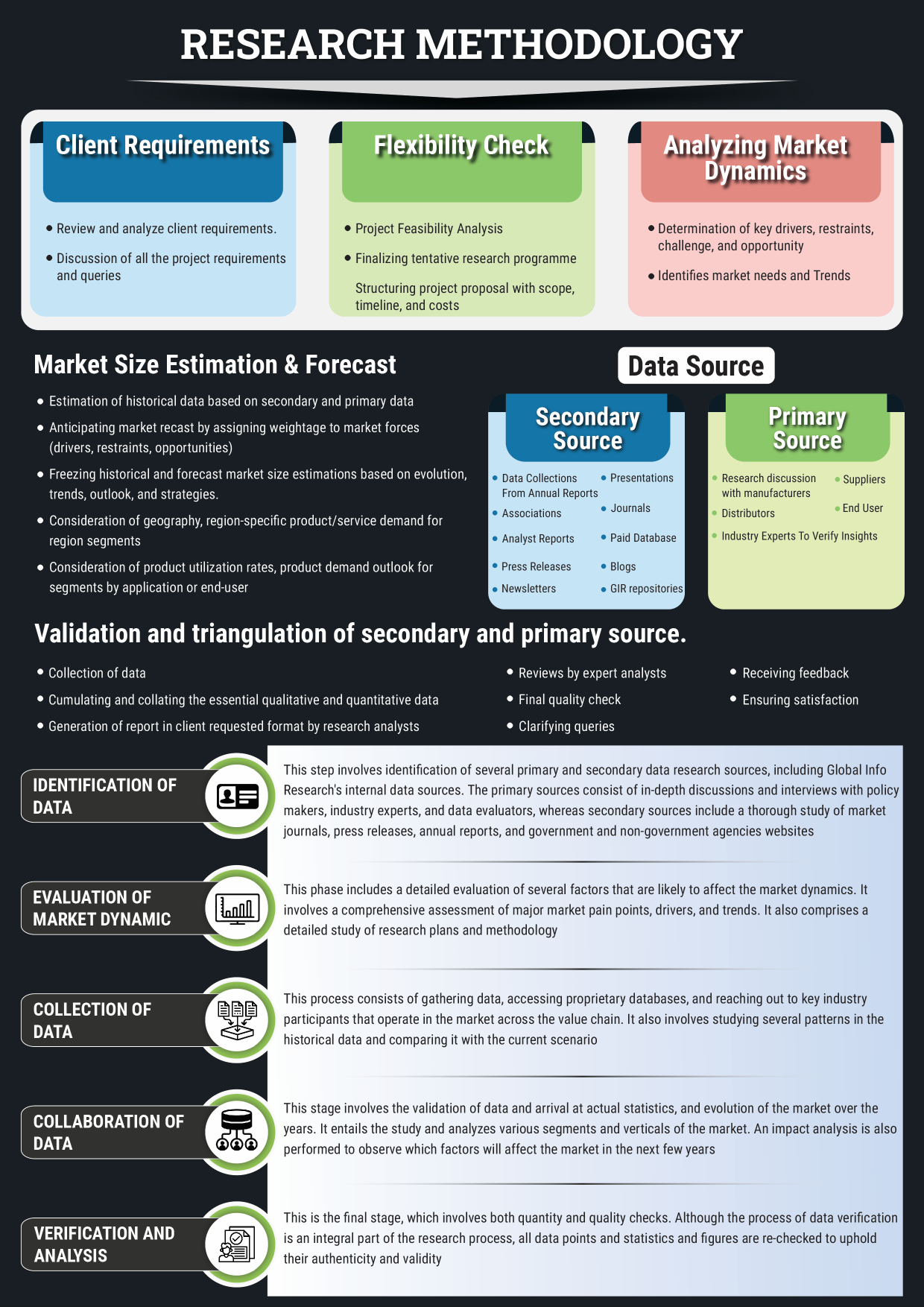

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Alere(Abbott) Company Information, Head Office, and Major Competitors

Table 6. Alere(Abbott) Major Business

Table 7. Alere(Abbott) In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 8. Alere(Abbott) In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Alere(Abbott) Recent Developments and Future Plans

Table 10. Beckman Coulter Company Information, Head Office, and Major Competitors

Table 11. Beckman Coulter Major Business

Table 12. Beckman Coulter In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 13. Beckman Coulter In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. Beckman Coulter Recent Developments and Future Plans

Table 15. Siemens Healthcare Company Information, Head Office, and Major Competitors

Table 16. Siemens Healthcare Major Business

Table 17. Siemens Healthcare In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 18. Siemens Healthcare In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. Siemens Healthcare Recent Developments and Future Plans

Table 20. Eiken Chemical Company Information, Head Office, and Major Competitors

Table 21. Eiken Chemical Major Business

Table 22. Eiken Chemical In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 23. Eiken Chemical In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Eiken Chemical Recent Developments and Future Plans

Table 25. Hitachi Chemical (Kyowa Medex) Company Information, Head Office, and Major Competitors

Table 26. Hitachi Chemical (Kyowa Medex) Major Business

Table 27. Hitachi Chemical (Kyowa Medex) In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 28. Hitachi Chemical (Kyowa Medex) In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. Hitachi Chemical (Kyowa Medex) Recent Developments and Future Plans

Table 30. Clinical Genomics Pty Ltd (Quest Diagnostics) Company Information, Head Office, and Major Competitors

Table 31. Clinical Genomics Pty Ltd (Quest Diagnostics) Major Business

Table 32. Clinical Genomics Pty Ltd (Quest Diagnostics) In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 33. Clinical Genomics Pty Ltd (Quest Diagnostics) In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Clinical Genomics Pty Ltd (Quest Diagnostics) Recent Developments and Future Plans

Table 35. Sysmex Company Information, Head Office, and Major Competitors

Table 36. Sysmex Major Business

Table 37. Sysmex In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 38. Sysmex In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Sysmex Recent Developments and Future Plans

Table 40. QIAGEN Company Information, Head Office, and Major Competitors

Table 41. QIAGEN Major Business

Table 42. QIAGEN In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 43. QIAGEN In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. QIAGEN Recent Developments and Future Plans

Table 45. R-Biopharm Company Information, Head Office, and Major Competitors

Table 46. R-Biopharm Major Business

Table 47. R-Biopharm In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 48. R-Biopharm In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. R-Biopharm Recent Developments and Future Plans

Table 50. Immunostics Company Information, Head Office, and Major Competitors

Table 51. Immunostics Major Business

Table 52. Immunostics In-Vitro Colorectal Cancer Screening Tests Product and Solutions

Table 53. Immunostics In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Immunostics Recent Developments and Future Plans

Table 55. Global In-Vitro Colorectal Cancer Screening Tests Revenue (USD Million) by Players (2018-2023)

Table 56. Global In-Vitro Colorectal Cancer Screening Tests Revenue Share by Players (2018-2023)

Table 57. Breakdown of In-Vitro Colorectal Cancer Screening Tests by Company Type (Tier 1, Tier 2, and Tier 3)

Table 58. Market Position of Players in In-Vitro Colorectal Cancer Screening Tests, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 59. Head Office of Key In-Vitro Colorectal Cancer Screening Tests Players

Table 60. In-Vitro Colorectal Cancer Screening Tests Market: Company Product Type Footprint

Table 61. In-Vitro Colorectal Cancer Screening Tests Market: Company Product Application Footprint

Table 62. In-Vitro Colorectal Cancer Screening Tests New Market Entrants and Barriers to Market Entry

Table 63. In-Vitro Colorectal Cancer Screening Tests Mergers, Acquisition, Agreements, and Collaborations

Table 64. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value (USD Million) by Type (2018-2023)

Table 65. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Share by Type (2018-2023)

Table 66. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Forecast by Type (2024-2029)

Table 67. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2023)

Table 68. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Forecast by Application (2024-2029)

Table 69. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2023) & (USD Million)

Table 70. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2024-2029) & (USD Million)

Table 71. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2023) & (USD Million)

Table 72. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2024-2029) & (USD Million)

Table 73. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2023) & (USD Million)

Table 74. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2024-2029) & (USD Million)

Table 75. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2023) & (USD Million)

Table 76. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2024-2029) & (USD Million)

Table 77. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2023) & (USD Million)

Table 78. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2024-2029) & (USD Million)

Table 79. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2023) & (USD Million)

Table 80. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2024-2029) & (USD Million)

Table 81. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2023) & (USD Million)

Table 82. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2024-2029) & (USD Million)

Table 83. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2023) & (USD Million)

Table 84. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2024-2029) & (USD Million)

Table 85. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Region (2018-2023) & (USD Million)

Table 86. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value by Region (2024-2029) & (USD Million)

Table 87. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2023) & (USD Million)

Table 88. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2024-2029) & (USD Million)

Table 89. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2023) & (USD Million)

Table 90. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2024-2029) & (USD Million)

Table 91. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2023) & (USD Million)

Table 92. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2024-2029) & (USD Million)

Table 93. Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2018-2023) & (USD Million)

Table 94. Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type (2024-2029) & (USD Million)

Table 95. Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2018-2023) & (USD Million)

Table 96. Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Application (2024-2029) & (USD Million)

Table 97. Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2018-2023) & (USD Million)

Table 98. Middle East & Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value by Country (2024-2029) & (USD Million)

Table 99. In-Vitro Colorectal Cancer Screening Tests Raw Material

Table 100. Key Suppliers of In-Vitro Colorectal Cancer Screening Tests Raw Materials

List of Figures

Figure 1. In-Vitro Colorectal Cancer Screening Tests Picture

Figure 2. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type in 2022

Figure 4. Biomarker Tests

Figure 5. Fecal Occult Blood Tests

Figure 6. CRC DNA Screening Tests

Figure 7. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 8. In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application in 2022

Figure 9. Hospital and Clinics Picture

Figure 10. Ambulatory Picture

Figure 11. Home Care Picture

Figure 12. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 13. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 14. Global Market In-Vitro Colorectal Cancer Screening Tests Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 15. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Region (2018-2029)

Figure 16. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Region in 2022

Figure 17. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 18. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 19. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 20. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 21. Middle East and Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 22. Global In-Vitro Colorectal Cancer Screening Tests Revenue Share by Players in 2022

Figure 23. In-Vitro Colorectal Cancer Screening Tests Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 24. Global Top 3 Players In-Vitro Colorectal Cancer Screening Tests Market Share in 2022

Figure 25. Global Top 6 Players In-Vitro Colorectal Cancer Screening Tests Market Share in 2022

Figure 26. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Share by Type (2018-2023)

Figure 27. Global In-Vitro Colorectal Cancer Screening Tests Market Share Forecast by Type (2024-2029)

Figure 28. Global In-Vitro Colorectal Cancer Screening Tests Consumption Value Share by Application (2018-2023)

Figure 29. Global In-Vitro Colorectal Cancer Screening Tests Market Share Forecast by Application (2024-2029)

Figure 30. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type (2018-2029)

Figure 31. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application (2018-2029)

Figure 32. North America In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Country (2018-2029)

Figure 33. United States In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 34. Canada In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 35. Mexico In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 36. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type (2018-2029)

Figure 37. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application (2018-2029)

Figure 38. Europe In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Country (2018-2029)

Figure 39. Germany In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 40. France In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 41. United Kingdom In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 42. Russia In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 43. Italy In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 44. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type (2018-2029)

Figure 45. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application (2018-2029)

Figure 46. Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Region (2018-2029)

Figure 47. China In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 48. Japan In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 49. South Korea In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 50. India In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 51. Southeast Asia In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 52. Australia In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 53. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type (2018-2029)

Figure 54. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application (2018-2029)

Figure 55. South America In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Country (2018-2029)

Figure 56. Brazil In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 57. Argentina In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 58. Middle East and Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Type (2018-2029)

Figure 59. Middle East and Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Application (2018-2029)

Figure 60. Middle East and Africa In-Vitro Colorectal Cancer Screening Tests Consumption Value Market Share by Country (2018-2029)

Figure 61. Turkey In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 62. Saudi Arabia In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 63. UAE In-Vitro Colorectal Cancer Screening Tests Consumption Value (2018-2029) & (USD Million)

Figure 64. In-Vitro Colorectal Cancer Screening Tests Market Drivers

Figure 65. In-Vitro Colorectal Cancer Screening Tests Market Restraints

Figure 66. In-Vitro Colorectal Cancer Screening Tests Market Trends

Figure 67. Porters Five Forces Analysis

Figure 68. Manufacturing Cost Structure Analysis of In-Vitro Colorectal Cancer Screening Tests in 2022

Figure 69. Manufacturing Process Analysis of In-Vitro Colorectal Cancer Screening Tests

Figure 70. In-Vitro Colorectal Cancer Screening Tests Industrial Chain

Figure 71. Methodology

Figure 72. Research Process and Data Source