Injectables refer to drug delivery system which acts as an alternative to oral drugs. As injectables are rapidly inserted into the human body using a syringe, they bypass the first-pass metabolism. In tablet form, some of the drugs become ineffective as they get dismantled in the stomach owing to the digestive enzymes. Generic injectables are pharmaceutical drugs that are bioequivalent of a branded injectable in terms of dosage, strength, performance, intended use, side-effects and route of administration.

In 2019, North America held the main share in global hospital injectable drugs market, with the proportion of 35%, Europe followed loosely, at the proportion of 33%. Hospira (Pfizer Inc.) occupied the biggest global hospital injectable drugs market share (13%), Fresenius Kabi followed closely at the propotion of 13%, Baxter and Sichuan Kelun Pharmaceutical also played a virtal role in the market.

This report is a detailed and comprehensive analysis for global Hospital Injectable Drugs market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Hospital Injectable Drugs market size and forecasts, in consumption value ($ Million), 2018-2029

Global Hospital Injectable Drugs market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global Hospital Injectable Drugs market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global Hospital Injectable Drugs market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Hospital Injectable Drugs

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Hospital Injectable Drugs market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Hospira (Pfizer Inc.)

Baxter

Fresenius Kabi

Sandoz (Novartis)

Hikma Pharmaceuticals PLC

Dr. Reddy’s Laboratories Ltd

Grifols

Nichi-Iko Group (Sagent)

Teva Pharmaceutical

Otsuka

B.Braun

JW Life Science

Auromedics

Sanofi

Gland Pharma

Endo International PLC

Sichuan Kelun Pharmaceutical

Cisen Pharmaceutical

Shijiazhuang No. 4 Pharmaceutical

Shandong Hualu Pharmaceutical

CR Double-Crane

Segmentation By Type

Generic Sterile Injectables

Sterile Intravenous (IV) Solutions

Segmentation By Application

Oncology

Anesthesia

Anti-Infectives

Parenteral Nutrition

Cardiovascular Diseases

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the hospital injectable drugs market in 2025?

The hospital injectable drugs market in 2025 benefits from the increasing demand for advanced treatments, especially for critical care patients. With the rise in chronic diseases and complex medical conditions, injectable drugs are gaining preference due to their rapid absorption and effectiveness. Furthermore, innovations in drug delivery technologies are enhancing the precision and safety of these treatments.

What are the weaknesses of the hospital injectable drugs market in 2025?

The primary challenge in the market is the high cost associated with injectable drugs, which can limit accessibility for patients in low-income regions. Additionally, the complexity of manufacturing and distribution can lead to supply chain issues, and adverse reactions or complications related to improper administration can impact market growth.

What are the opportunities for the hospital injectable drugs market in 2025?

There is significant potential for growth in the development of biosimilars and specialty injectable drugs. As the market for biologics expands, so does the opportunity for hospitals to offer cutting-edge treatments. Additionally, increasing healthcare infrastructure in emerging economies opens up new markets for injectable drugs.

What are the threats to the hospital injectable drugs market in 2025?

Stringent regulatory requirements and rising competition from alternative drug delivery methods such as oral or transdermal treatments pose a threat. Moreover, the potential for drug shortages, pricing pressures from healthcare payers, and concerns over the misuse or over-prescription of injectable drugs can impact the market's stability.

Market PESTEL Analysis

What are the political factors influencing the hospital injectable drugs market in 2025?

Political stability and healthcare policies significantly impact the availability and pricing of injectable drugs. Government regulations on drug approval, pricing controls, and reimbursement policies play a key role in shaping the market. Political pressure to reduce healthcare costs can affect drug pricing, impacting hospital budgets and access to injectable drugs.

How do economic factors affect the hospital injectable drugs market in 2025?

Economic conditions influence hospital spending on healthcare, particularly in resource-limited settings where cost constraints may limit access to injectable drugs. However, economic growth in emerging markets could increase demand for injectable drugs as healthcare infrastructure expands. Economic downturns or recessions may result in cost-cutting measures affecting injectable drug utilization.

What are the social factors impacting the hospital injectable drugs market in 2025?

Increasing awareness of chronic diseases and aging populations are driving the demand for injectable drugs, especially for conditions requiring long-term management. Patients and healthcare professionals are increasingly favoring injectable treatments for their efficacy in managing severe health conditions, influencing the social acceptance of injectable drugs in hospitals.

What technological factors are influencing the hospital injectable drugs market in 2025?

Advancements in drug delivery systems, such as automated injectors and improved drug formulations, are enhancing the effectiveness and safety of injectable drugs. Technological innovations in biotechnology, including the development of biosimilars, are creating opportunities for market growth. Additionally, digital health tools for monitoring patient responses to injectable drugs are shaping treatment protocols.

How do environmental factors affect the hospital injectable drugs market in 2025?

Environmental regulations around the production and disposal of injectable drugs are becoming stricter, influencing the manufacturing processes. Hospitals are also increasingly prioritizing sustainability, which may lead to changes in the types of injectable drugs used or the packaging solutions adopted. Environmental concerns may affect the sourcing of raw materials for injectable drug production.

What legal factors influence the hospital injectable drugs market in 2025?

Compliance with global healthcare regulations, intellectual property rights, and patents on new injectable drugs are crucial legal factors shaping the market. Legal challenges related to biosimilars, counterfeit drugs, and clinical trial regulations can also impact market dynamics. Stringent regulatory frameworks in different regions affect how injectable drugs are marketed and distributed.

Market SIPOC Analysis

Who are the suppliers in the hospital injectable drugs market in 2025?

Suppliers include pharmaceutical manufacturers, raw material providers, biotechnology companies, and specialized packaging suppliers. These suppliers provide the ingredients, technology, and equipment needed for the production and distribution of injectable drugs.

What are the inputs required in the hospital injectable drugs market in 2025?

The key inputs include active pharmaceutical ingredients (APIs), excipients, drug delivery devices, advanced packaging materials, and production technology. Additionally, research and development (R&D) data, regulatory approvals, and clinical trial results are essential for introducing new injectable drugs.

What are the processes involved in the hospital injectable drugs market in 2025?

The processes involve drug development, formulation, testing, manufacturing, quality control, packaging, distribution, and regulatory compliance. Hospitals and healthcare providers also play a role in administering and monitoring the injectable drugs for patients.

Who are the customers in the hospital injectable drugs market in 2025?

Customers include hospitals, clinics, healthcare providers, and patients requiring injectable treatments. Key segments include oncology, critical care, chronic disease management, and emergency care, where injectable drugs are frequently used.

What are the outputs in the hospital injectable drugs market in 2025?

The outputs include finished injectable drugs, ready for administration to patients, along with related support services such as drug delivery systems, patient monitoring devices, and educational resources. These outputs aim to improve patient outcomes, safety, and overall treatment effectiveness.

Market Porter's Five Forces

What is the threat of new entrants in the hospital injectable drugs market in 2025?

The threat of new entrants is moderate to low due to the high barriers to entry. The market requires significant capital investment in research, development, and regulatory approvals. Additionally, established companies have strong brand recognition and established distribution channels, making it challenging for new competitors to gain a foothold.

What is the bargaining power of suppliers in the hospital injectable drugs market in 2025?

The bargaining power of suppliers is moderate. While there are a few key suppliers of raw materials and manufacturing technology, many pharmaceutical companies rely on diversified sources for their inputs. However, specialized ingredients or technologies used in advanced injectables can give certain suppliers more leverage.

What is the bargaining power of buyers in the hospital injectable drugs market in 2025?

The bargaining power of buyers, particularly large hospital networks and healthcare systems, is moderate to high. As they purchase in bulk, they can negotiate better pricing and demand high-quality standards. However, the high specificity and efficacy of injectable drugs reduce their ability to switch to alternatives easily.

What is the threat of substitute products in the hospital injectable drugs market in 2025?

The threat of substitutes is moderate. While oral medications and alternative delivery methods like transdermal patches are growing, injectable drugs remain a preferred option for many critical and chronic conditions due to their rapid effectiveness. The development of biosimilars and new drug delivery systems could shift this balance over time.

What is the intensity of competitive rivalry in the hospital injectable drugs market in 2025?

The competitive rivalry is high. The market is dominated by several large pharmaceutical companies, which invest heavily in R&D and have established brands. There is also growing competition from biosimilars, generic injectables, and new entrants looking to capitalize on the increasing demand for injectable treatments.

Market Upstream Analysis

What are the key upstream factors influencing the hospital injectable drugs market in 2025?

Upstream factors include the availability of raw materials, particularly active pharmaceutical ingredients (APIs) and excipients. Additionally, the technological capabilities of manufacturing facilities, including automation and precision in drug delivery systems, play a crucial role. Regulatory requirements for quality and safety standards also impact upstream activities in drug production.

How do suppliers affect the hospital injectable drugs market in 2025?

Suppliers of APIs, raw materials, and specialized equipment have significant influence over production timelines and costs. Disruptions in the supply chain, such as shortages or price fluctuations of key ingredients, can affect the availability and cost of injectable drugs. Additionally, suppliers of packaging materials and drug delivery systems contribute to the final product's efficacy and safety.

What role does research and development (R&D) play in the upstream dynamics of the hospital injectable drugs market in 2025?

R&D is critical in the upstream process, as it drives the innovation of new injectable drug formulations and delivery technologies. The development of biosimilars, novel drug delivery systems, and targeted therapies is shaping the future of injectable drugs. R&D investments ensure that hospitals can access more effective treatments with fewer side effects.

How do regulatory authorities impact upstream activities in the hospital injectable drugs market in 2025?

Regulatory authorities set the standards for quality, safety, and efficacy, which shape upstream activities, including the manufacturing and approval processes. Strict regulatory oversight ensures that injectable drugs meet required standards before reaching the market, and this impacts the costs and timelines associated with drug development and production.

What are the challenges faced by upstream players in the hospital injectable drugs market in 2025?

Upstream players face challenges such as rising raw material costs, stringent regulatory compliance, and the need for constant innovation in drug formulations and delivery technologies. Supply chain disruptions, such as delays in the procurement of APIs or packaging materials, can affect production timelines and drug availability. Additionally, maintaining high production standards while managing costs remains a key challenge for upstream stakeholders.

Market Midstream Analysis

What are the key midstream factors influencing the hospital injectable drugs market in 2025?

Midstream factors focus on the manufacturing, quality control, and distribution processes. Efficient manufacturing facilities are essential for producing injectable drugs at scale, while strict quality control ensures compliance with safety standards. Distribution networks must be able to handle sensitive products, requiring proper storage and transportation to ensure product integrity and timely delivery.

How do manufacturing capabilities impact the hospital injectable drugs market in 2025?

Manufacturing capabilities play a critical role in meeting the growing demand for injectable drugs. Facilities that are capable of producing large quantities while adhering to Good Manufacturing Practices (GMP) can support the timely availability of injectable treatments. The scalability and flexibility of manufacturing processes also determine the market’s capacity to handle new product launches or increased demand.

What role does quality control play in the midstream dynamics of the hospital injectable drugs market in 2025?

Quality control is vital in ensuring that injectable drugs meet the required safety, efficacy, and regulatory standards. Midstream players must implement rigorous testing and validation processes to avoid product recalls and prevent adverse health outcomes. Quality assurance processes also affect the reputation and reliability of drug manufacturers, influencing their market position.

How does distribution affect the hospital injectable drugs market in 2025?

Distribution networks are essential to ensuring that injectable drugs are delivered efficiently to hospitals, clinics, and healthcare providers. Timely and secure distribution is crucial, as injectable drugs often require specific handling conditions, such as temperature-controlled storage. Efficient logistics systems are needed to reduce delays and maintain product quality.

What are the challenges faced by midstream players in the hospital injectable drugs market in 2025?

Midstream players face challenges such as managing complex supply chains, ensuring compliance with regulatory requirements, and handling the logistics of temperature-sensitive injectable drugs. Moreover, disruptions in the global supply chain or changes in demand can cause delays or shortages. Balancing cost-efficiency with high standards of production and distribution is an ongoing challenge.

Market Downstream Analysis

What are the key downstream factors influencing the hospital injectable drugs market in 2025?

Downstream factors focus on the final stages of the market, including hospital and healthcare provider purchasing decisions, drug administration, and patient outcomes. Hospital formularies, pricing negotiations, and insurance coverage all play a significant role in drug accessibility. The increasing demand for specialized care and the efficiency of injectable drugs in treating severe conditions also drive market growth.

How do hospital and healthcare provider purchasing decisions impact the hospital injectable drugs market in 2025?

Hospital and healthcare provider purchasing decisions are influenced by factors such as drug efficacy, cost, availability, and patient needs. Hospitals typically prioritize injectable drugs that offer fast-acting and reliable results, especially for critical care. Pricing negotiations, insurance reimbursement rates, and treatment protocols also significantly impact which drugs are selected.

What role do patient outcomes play in the downstream dynamics of the hospital injectable drugs market in 2025?

Patient outcomes are central to the continued use and adoption of injectable drugs. The effectiveness of these drugs in improving recovery rates, reducing complications, and providing better therapeutic results encourages healthcare providers to prioritize them in treatment regimens. Positive patient outcomes lead to greater demand and influence market growth.

How does insurance and reimbursement affect the hospital injectable drugs market in 2025?

Insurance policies and reimbursement structures play a crucial role in determining which injectable drugs are accessible to patients. If injectable drugs are covered by insurance at favorable reimbursement rates, they are more likely to be prescribed and administered. Changes in reimbursement policies could impact the affordability and accessibility of injectable treatments, especially in healthcare systems with strict cost controls.

What challenges do downstream players face in the hospital injectable drugs market in 2025?

Downstream players face challenges such as high drug costs, the complexity of negotiating pricing with healthcare payers, and the growing need for specialized injectable drugs. There are also issues related to ensuring timely drug administration, managing potential adverse reactions, and navigating evolving regulations related to drug safety and efficacy. Balancing cost with the increasing demand for high-quality, innovative injectable treatments is a major challenge.

Chapter 1, to describe Hospital Injectable Drugs product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Hospital Injectable Drugs, with revenue, gross margin and global market share of Hospital Injectable Drugs from 2018 to 2023.

Chapter 3, the Hospital Injectable Drugs competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Hospital Injectable Drugs market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Hospital Injectable Drugs.

Chapter 13, to describe Hospital Injectable Drugs research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Hospital Injectable Drugs

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Hospital Injectable Drugs by Type

1.3.1 Overview: Global Hospital Injectable Drugs Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Hospital Injectable Drugs Consumption Value Market Share by Type in 2022

1.3.3 Generic Sterile Injectables

1.3.4 Sterile Intravenous (IV) Solutions

1.4 Global Hospital Injectable Drugs Market by Application

1.4.1 Overview: Global Hospital Injectable Drugs Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Oncology

1.4.3 Anesthesia

1.4.4 Anti-Infectives

1.4.5 Parenteral Nutrition

1.4.6 Cardiovascular Diseases

1.5 Global Hospital Injectable Drugs Market Size & Forecast

1.6 Global Hospital Injectable Drugs Market Size and Forecast by Region

1.6.1 Global Hospital Injectable Drugs Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Hospital Injectable Drugs Market Size by Region, (2018-2029)

1.6.3 North America Hospital Injectable Drugs Market Size and Prospect (2018-2029)

1.6.4 Europe Hospital Injectable Drugs Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Hospital Injectable Drugs Market Size and Prospect (2018-2029)

1.6.6 South America Hospital Injectable Drugs Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Hospital Injectable Drugs Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Hospira (Pfizer Inc.)

2.1.1 Hospira (Pfizer Inc.) Details

2.1.2 Hospira (Pfizer Inc.) Major Business

2.1.3 Hospira (Pfizer Inc.) Hospital Injectable Drugs Product and Solutions

2.1.4 Hospira (Pfizer Inc.) Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Hospira (Pfizer Inc.) Recent Developments and Future Plans

2.2 Baxter

2.2.1 Baxter Details

2.2.2 Baxter Major Business

2.2.3 Baxter Hospital Injectable Drugs Product and Solutions

2.2.4 Baxter Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Baxter Recent Developments and Future Plans

2.3 Fresenius Kabi

2.3.1 Fresenius Kabi Details

2.3.2 Fresenius Kabi Major Business

2.3.3 Fresenius Kabi Hospital Injectable Drugs Product and Solutions

2.3.4 Fresenius Kabi Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Fresenius Kabi Recent Developments and Future Plans

2.4 Sandoz (Novartis)

2.4.1 Sandoz (Novartis) Details

2.4.2 Sandoz (Novartis) Major Business

2.4.3 Sandoz (Novartis) Hospital Injectable Drugs Product and Solutions

2.4.4 Sandoz (Novartis) Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Sandoz (Novartis) Recent Developments and Future Plans

2.5 Hikma Pharmaceuticals PLC

2.5.1 Hikma Pharmaceuticals PLC Details

2.5.2 Hikma Pharmaceuticals PLC Major Business

2.5.3 Hikma Pharmaceuticals PLC Hospital Injectable Drugs Product and Solutions

2.5.4 Hikma Pharmaceuticals PLC Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Hikma Pharmaceuticals PLC Recent Developments and Future Plans

2.6 Dr. Reddy’s Laboratories Ltd

2.6.1 Dr. Reddy’s Laboratories Ltd Details

2.6.2 Dr. Reddy’s Laboratories Ltd Major Business

2.6.3 Dr. Reddy’s Laboratories Ltd Hospital Injectable Drugs Product and Solutions

2.6.4 Dr. Reddy’s Laboratories Ltd Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Dr. Reddy’s Laboratories Ltd Recent Developments and Future Plans

2.7 Grifols

2.7.1 Grifols Details

2.7.2 Grifols Major Business

2.7.3 Grifols Hospital Injectable Drugs Product and Solutions

2.7.4 Grifols Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Grifols Recent Developments and Future Plans

2.8 Nichi-Iko Group (Sagent)

2.8.1 Nichi-Iko Group (Sagent) Details

2.8.2 Nichi-Iko Group (Sagent) Major Business

2.8.3 Nichi-Iko Group (Sagent) Hospital Injectable Drugs Product and Solutions

2.8.4 Nichi-Iko Group (Sagent) Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Nichi-Iko Group (Sagent) Recent Developments and Future Plans

2.9 Teva Pharmaceutical

2.9.1 Teva Pharmaceutical Details

2.9.2 Teva Pharmaceutical Major Business

2.9.3 Teva Pharmaceutical Hospital Injectable Drugs Product and Solutions

2.9.4 Teva Pharmaceutical Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Teva Pharmaceutical Recent Developments and Future Plans

2.10 Otsuka

2.10.1 Otsuka Details

2.10.2 Otsuka Major Business

2.10.3 Otsuka Hospital Injectable Drugs Product and Solutions

2.10.4 Otsuka Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Otsuka Recent Developments and Future Plans

2.11 B.Braun

2.11.1 B.Braun Details

2.11.2 B.Braun Major Business

2.11.3 B.Braun Hospital Injectable Drugs Product and Solutions

2.11.4 B.Braun Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 B.Braun Recent Developments and Future Plans

2.12 JW Life Science

2.12.1 JW Life Science Details

2.12.2 JW Life Science Major Business

2.12.3 JW Life Science Hospital Injectable Drugs Product and Solutions

2.12.4 JW Life Science Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 JW Life Science Recent Developments and Future Plans

2.13 Auromedics

2.13.1 Auromedics Details

2.13.2 Auromedics Major Business

2.13.3 Auromedics Hospital Injectable Drugs Product and Solutions

2.13.4 Auromedics Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Auromedics Recent Developments and Future Plans

2.14 Sanofi

2.14.1 Sanofi Details

2.14.2 Sanofi Major Business

2.14.3 Sanofi Hospital Injectable Drugs Product and Solutions

2.14.4 Sanofi Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 Sanofi Recent Developments and Future Plans

2.15 Gland Pharma

2.15.1 Gland Pharma Details

2.15.2 Gland Pharma Major Business

2.15.3 Gland Pharma Hospital Injectable Drugs Product and Solutions

2.15.4 Gland Pharma Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 Gland Pharma Recent Developments and Future Plans

2.16 Endo International PLC

2.16.1 Endo International PLC Details

2.16.2 Endo International PLC Major Business

2.16.3 Endo International PLC Hospital Injectable Drugs Product and Solutions

2.16.4 Endo International PLC Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.16.5 Endo International PLC Recent Developments and Future Plans

2.17 Sichuan Kelun Pharmaceutical

2.17.1 Sichuan Kelun Pharmaceutical Details

2.17.2 Sichuan Kelun Pharmaceutical Major Business

2.17.3 Sichuan Kelun Pharmaceutical Hospital Injectable Drugs Product and Solutions

2.17.4 Sichuan Kelun Pharmaceutical Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.17.5 Sichuan Kelun Pharmaceutical Recent Developments and Future Plans

2.18 Cisen Pharmaceutical

2.18.1 Cisen Pharmaceutical Details

2.18.2 Cisen Pharmaceutical Major Business

2.18.3 Cisen Pharmaceutical Hospital Injectable Drugs Product and Solutions

2.18.4 Cisen Pharmaceutical Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.18.5 Cisen Pharmaceutical Recent Developments and Future Plans

2.19 Shijiazhuang No. 4 Pharmaceutical

2.19.1 Shijiazhuang No. 4 Pharmaceutical Details

2.19.2 Shijiazhuang No. 4 Pharmaceutical Major Business

2.19.3 Shijiazhuang No. 4 Pharmaceutical Hospital Injectable Drugs Product and Solutions

2.19.4 Shijiazhuang No. 4 Pharmaceutical Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.19.5 Shijiazhuang No. 4 Pharmaceutical Recent Developments and Future Plans

2.20 Shandong Hualu Pharmaceutical

2.20.1 Shandong Hualu Pharmaceutical Details

2.20.2 Shandong Hualu Pharmaceutical Major Business

2.20.3 Shandong Hualu Pharmaceutical Hospital Injectable Drugs Product and Solutions

2.20.4 Shandong Hualu Pharmaceutical Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.20.5 Shandong Hualu Pharmaceutical Recent Developments and Future Plans

2.21 CR Double-Crane

2.21.1 CR Double-Crane Details

2.21.2 CR Double-Crane Major Business

2.21.3 CR Double-Crane Hospital Injectable Drugs Product and Solutions

2.21.4 CR Double-Crane Hospital Injectable Drugs Revenue, Gross Margin and Market Share (2018-2023)

2.21.5 CR Double-Crane Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Hospital Injectable Drugs Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Hospital Injectable Drugs by Company Revenue

3.2.2 Top 3 Hospital Injectable Drugs Players Market Share in 2022

3.2.3 Top 6 Hospital Injectable Drugs Players Market Share in 2022

3.3 Hospital Injectable Drugs Market: Overall Company Footprint Analysis

3.3.1 Hospital Injectable Drugs Market: Region Footprint

3.3.2 Hospital Injectable Drugs Market: Company Product Type Footprint

3.3.3 Hospital Injectable Drugs Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Hospital Injectable Drugs Consumption Value and Market Share by Type (2018-2023)

4.2 Global Hospital Injectable Drugs Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Hospital Injectable Drugs Consumption Value Market Share by Application (2018-2023)

5.2 Global Hospital Injectable Drugs Market Forecast by Application (2024-2029)

6 North America

6.1 North America Hospital Injectable Drugs Consumption Value by Type (2018-2029)

6.2 North America Hospital Injectable Drugs Consumption Value by Application (2018-2029)

6.3 North America Hospital Injectable Drugs Market Size by Country

6.3.1 North America Hospital Injectable Drugs Consumption Value by Country (2018-2029)

6.3.2 United States Hospital Injectable Drugs Market Size and Forecast (2018-2029)

6.3.3 Canada Hospital Injectable Drugs Market Size and Forecast (2018-2029)

6.3.4 Mexico Hospital Injectable Drugs Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Hospital Injectable Drugs Consumption Value by Type (2018-2029)

7.2 Europe Hospital Injectable Drugs Consumption Value by Application (2018-2029)

7.3 Europe Hospital Injectable Drugs Market Size by Country

7.3.1 Europe Hospital Injectable Drugs Consumption Value by Country (2018-2029)

7.3.2 Germany Hospital Injectable Drugs Market Size and Forecast (2018-2029)

7.3.3 France Hospital Injectable Drugs Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Hospital Injectable Drugs Market Size and Forecast (2018-2029)

7.3.5 Russia Hospital Injectable Drugs Market Size and Forecast (2018-2029)

7.3.6 Italy Hospital Injectable Drugs Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Hospital Injectable Drugs Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Hospital Injectable Drugs Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Hospital Injectable Drugs Market Size by Region

8.3.1 Asia-Pacific Hospital Injectable Drugs Consumption Value by Region (2018-2029)

8.3.2 China Hospital Injectable Drugs Market Size and Forecast (2018-2029)

8.3.3 Japan Hospital Injectable Drugs Market Size and Forecast (2018-2029)

8.3.4 South Korea Hospital Injectable Drugs Market Size and Forecast (2018-2029)

8.3.5 India Hospital Injectable Drugs Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Hospital Injectable Drugs Market Size and Forecast (2018-2029)

8.3.7 Australia Hospital Injectable Drugs Market Size and Forecast (2018-2029)

9 South America

9.1 South America Hospital Injectable Drugs Consumption Value by Type (2018-2029)

9.2 South America Hospital Injectable Drugs Consumption Value by Application (2018-2029)

9.3 South America Hospital Injectable Drugs Market Size by Country

9.3.1 South America Hospital Injectable Drugs Consumption Value by Country (2018-2029)

9.3.2 Brazil Hospital Injectable Drugs Market Size and Forecast (2018-2029)

9.3.3 Argentina Hospital Injectable Drugs Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Hospital Injectable Drugs Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Hospital Injectable Drugs Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Hospital Injectable Drugs Market Size by Country

10.3.1 Middle East & Africa Hospital Injectable Drugs Consumption Value by Country (2018-2029)

10.3.2 Turkey Hospital Injectable Drugs Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Hospital Injectable Drugs Market Size and Forecast (2018-2029)

10.3.4 UAE Hospital Injectable Drugs Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Hospital Injectable Drugs Market Drivers

11.2 Hospital Injectable Drugs Market Restraints

11.3 Hospital Injectable Drugs Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Hospital Injectable Drugs Industry Chain

12.2 Hospital Injectable Drugs Upstream Analysis

12.3 Hospital Injectable Drugs Midstream Analysis

12.4 Hospital Injectable Drugs Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

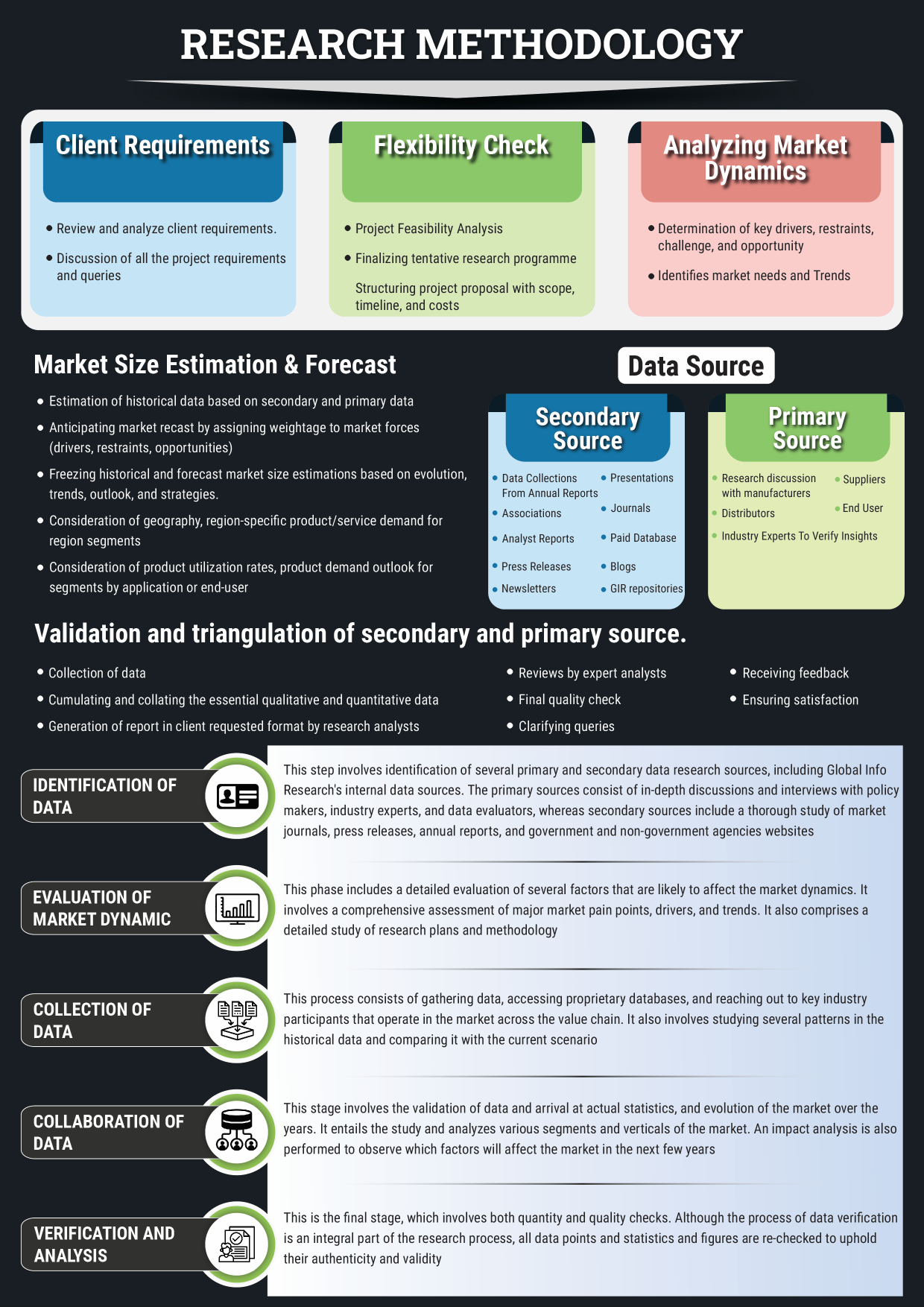

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Hospital Injectable Drugs Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Hospital Injectable Drugs Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Hospital Injectable Drugs Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Hospital Injectable Drugs Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Hospira (Pfizer Inc.) Company Information, Head Office, and Major Competitors

Table 6. Hospira (Pfizer Inc.) Major Business

Table 7. Hospira (Pfizer Inc.) Hospital Injectable Drugs Product and Solutions

Table 8. Hospira (Pfizer Inc.) Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Hospira (Pfizer Inc.) Recent Developments and Future Plans

Table 10. Baxter Company Information, Head Office, and Major Competitors

Table 11. Baxter Major Business

Table 12. Baxter Hospital Injectable Drugs Product and Solutions

Table 13. Baxter Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. Baxter Recent Developments and Future Plans

Table 15. Fresenius Kabi Company Information, Head Office, and Major Competitors

Table 16. Fresenius Kabi Major Business

Table 17. Fresenius Kabi Hospital Injectable Drugs Product and Solutions

Table 18. Fresenius Kabi Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. Fresenius Kabi Recent Developments and Future Plans

Table 20. Sandoz (Novartis) Company Information, Head Office, and Major Competitors

Table 21. Sandoz (Novartis) Major Business

Table 22. Sandoz (Novartis) Hospital Injectable Drugs Product and Solutions

Table 23. Sandoz (Novartis) Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Sandoz (Novartis) Recent Developments and Future Plans

Table 25. Hikma Pharmaceuticals PLC Company Information, Head Office, and Major Competitors

Table 26. Hikma Pharmaceuticals PLC Major Business

Table 27. Hikma Pharmaceuticals PLC Hospital Injectable Drugs Product and Solutions

Table 28. Hikma Pharmaceuticals PLC Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. Hikma Pharmaceuticals PLC Recent Developments and Future Plans

Table 30. Dr. Reddy’s Laboratories Ltd Company Information, Head Office, and Major Competitors

Table 31. Dr. Reddy’s Laboratories Ltd Major Business

Table 32. Dr. Reddy’s Laboratories Ltd Hospital Injectable Drugs Product and Solutions

Table 33. Dr. Reddy’s Laboratories Ltd Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Dr. Reddy’s Laboratories Ltd Recent Developments and Future Plans

Table 35. Grifols Company Information, Head Office, and Major Competitors

Table 36. Grifols Major Business

Table 37. Grifols Hospital Injectable Drugs Product and Solutions

Table 38. Grifols Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Grifols Recent Developments and Future Plans

Table 40. Nichi-Iko Group (Sagent) Company Information, Head Office, and Major Competitors

Table 41. Nichi-Iko Group (Sagent) Major Business

Table 42. Nichi-Iko Group (Sagent) Hospital Injectable Drugs Product and Solutions

Table 43. Nichi-Iko Group (Sagent) Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. Nichi-Iko Group (Sagent) Recent Developments and Future Plans

Table 45. Teva Pharmaceutical Company Information, Head Office, and Major Competitors

Table 46. Teva Pharmaceutical Major Business

Table 47. Teva Pharmaceutical Hospital Injectable Drugs Product and Solutions

Table 48. Teva Pharmaceutical Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. Teva Pharmaceutical Recent Developments and Future Plans

Table 50. Otsuka Company Information, Head Office, and Major Competitors

Table 51. Otsuka Major Business

Table 52. Otsuka Hospital Injectable Drugs Product and Solutions

Table 53. Otsuka Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Otsuka Recent Developments and Future Plans

Table 55. B.Braun Company Information, Head Office, and Major Competitors

Table 56. B.Braun Major Business

Table 57. B.Braun Hospital Injectable Drugs Product and Solutions

Table 58. B.Braun Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 59. B.Braun Recent Developments and Future Plans

Table 60. JW Life Science Company Information, Head Office, and Major Competitors

Table 61. JW Life Science Major Business

Table 62. JW Life Science Hospital Injectable Drugs Product and Solutions

Table 63. JW Life Science Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 64. JW Life Science Recent Developments and Future Plans

Table 65. Auromedics Company Information, Head Office, and Major Competitors

Table 66. Auromedics Major Business

Table 67. Auromedics Hospital Injectable Drugs Product and Solutions

Table 68. Auromedics Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 69. Auromedics Recent Developments and Future Plans

Table 70. Sanofi Company Information, Head Office, and Major Competitors

Table 71. Sanofi Major Business

Table 72. Sanofi Hospital Injectable Drugs Product and Solutions

Table 73. Sanofi Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 74. Sanofi Recent Developments and Future Plans

Table 75. Gland Pharma Company Information, Head Office, and Major Competitors

Table 76. Gland Pharma Major Business

Table 77. Gland Pharma Hospital Injectable Drugs Product and Solutions

Table 78. Gland Pharma Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 79. Gland Pharma Recent Developments and Future Plans

Table 80. Endo International PLC Company Information, Head Office, and Major Competitors

Table 81. Endo International PLC Major Business

Table 82. Endo International PLC Hospital Injectable Drugs Product and Solutions

Table 83. Endo International PLC Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 84. Endo International PLC Recent Developments and Future Plans

Table 85. Sichuan Kelun Pharmaceutical Company Information, Head Office, and Major Competitors

Table 86. Sichuan Kelun Pharmaceutical Major Business

Table 87. Sichuan Kelun Pharmaceutical Hospital Injectable Drugs Product and Solutions

Table 88. Sichuan Kelun Pharmaceutical Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 89. Sichuan Kelun Pharmaceutical Recent Developments and Future Plans

Table 90. Cisen Pharmaceutical Company Information, Head Office, and Major Competitors

Table 91. Cisen Pharmaceutical Major Business

Table 92. Cisen Pharmaceutical Hospital Injectable Drugs Product and Solutions

Table 93. Cisen Pharmaceutical Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 94. Cisen Pharmaceutical Recent Developments and Future Plans

Table 95. Shijiazhuang No. 4 Pharmaceutical Company Information, Head Office, and Major Competitors

Table 96. Shijiazhuang No. 4 Pharmaceutical Major Business

Table 97. Shijiazhuang No. 4 Pharmaceutical Hospital Injectable Drugs Product and Solutions

Table 98. Shijiazhuang No. 4 Pharmaceutical Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 99. Shijiazhuang No. 4 Pharmaceutical Recent Developments and Future Plans

Table 100. Shandong Hualu Pharmaceutical Company Information, Head Office, and Major Competitors

Table 101. Shandong Hualu Pharmaceutical Major Business

Table 102. Shandong Hualu Pharmaceutical Hospital Injectable Drugs Product and Solutions

Table 103. Shandong Hualu Pharmaceutical Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 104. Shandong Hualu Pharmaceutical Recent Developments and Future Plans

Table 105. CR Double-Crane Company Information, Head Office, and Major Competitors

Table 106. CR Double-Crane Major Business

Table 107. CR Double-Crane Hospital Injectable Drugs Product and Solutions

Table 108. CR Double-Crane Hospital Injectable Drugs Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 109. CR Double-Crane Recent Developments and Future Plans

Table 110. Global Hospital Injectable Drugs Revenue (USD Million) by Players (2018-2023)

Table 111. Global Hospital Injectable Drugs Revenue Share by Players (2018-2023)

Table 112. Breakdown of Hospital Injectable Drugs by Company Type (Tier 1, Tier 2, and Tier 3)

Table 113. Market Position of Players in Hospital Injectable Drugs, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 114. Head Office of Key Hospital Injectable Drugs Players

Table 115. Hospital Injectable Drugs Market: Company Product Type Footprint

Table 116. Hospital Injectable Drugs Market: Company Product Application Footprint

Table 117. Hospital Injectable Drugs New Market Entrants and Barriers to Market Entry

Table 118. Hospital Injectable Drugs Mergers, Acquisition, Agreements, and Collaborations

Table 119. Global Hospital Injectable Drugs Consumption Value (USD Million) by Type (2018-2023)

Table 120. Global Hospital Injectable Drugs Consumption Value Share by Type (2018-2023)

Table 121. Global Hospital Injectable Drugs Consumption Value Forecast by Type (2024-2029)

Table 122. Global Hospital Injectable Drugs Consumption Value by Application (2018-2023)

Table 123. Global Hospital Injectable Drugs Consumption Value Forecast by Application (2024-2029)

Table 124. North America Hospital Injectable Drugs Consumption Value by Type (2018-2023) & (USD Million)

Table 125. North America Hospital Injectable Drugs Consumption Value by Type (2024-2029) & (USD Million)

Table 126. North America Hospital Injectable Drugs Consumption Value by Application (2018-2023) & (USD Million)

Table 127. North America Hospital Injectable Drugs Consumption Value by Application (2024-2029) & (USD Million)

Table 128. North America Hospital Injectable Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 129. North America Hospital Injectable Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 130. Europe Hospital Injectable Drugs Consumption Value by Type (2018-2023) & (USD Million)

Table 131. Europe Hospital Injectable Drugs Consumption Value by Type (2024-2029) & (USD Million)

Table 132. Europe Hospital Injectable Drugs Consumption Value by Application (2018-2023) & (USD Million)

Table 133. Europe Hospital Injectable Drugs Consumption Value by Application (2024-2029) & (USD Million)

Table 134. Europe Hospital Injectable Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 135. Europe Hospital Injectable Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 136. Asia-Pacific Hospital Injectable Drugs Consumption Value by Type (2018-2023) & (USD Million)

Table 137. Asia-Pacific Hospital Injectable Drugs Consumption Value by Type (2024-2029) & (USD Million)

Table 138. Asia-Pacific Hospital Injectable Drugs Consumption Value by Application (2018-2023) & (USD Million)

Table 139. Asia-Pacific Hospital Injectable Drugs Consumption Value by Application (2024-2029) & (USD Million)

Table 140. Asia-Pacific Hospital Injectable Drugs Consumption Value by Region (2018-2023) & (USD Million)

Table 141. Asia-Pacific Hospital Injectable Drugs Consumption Value by Region (2024-2029) & (USD Million)

Table 142. South America Hospital Injectable Drugs Consumption Value by Type (2018-2023) & (USD Million)

Table 143. South America Hospital Injectable Drugs Consumption Value by Type (2024-2029) & (USD Million)

Table 144. South America Hospital Injectable Drugs Consumption Value by Application (2018-2023) & (USD Million)

Table 145. South America Hospital Injectable Drugs Consumption Value by Application (2024-2029) & (USD Million)

Table 146. South America Hospital Injectable Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 147. South America Hospital Injectable Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 148. Middle East & Africa Hospital Injectable Drugs Consumption Value by Type (2018-2023) & (USD Million)

Table 149. Middle East & Africa Hospital Injectable Drugs Consumption Value by Type (2024-2029) & (USD Million)

Table 150. Middle East & Africa Hospital Injectable Drugs Consumption Value by Application (2018-2023) & (USD Million)

Table 151. Middle East & Africa Hospital Injectable Drugs Consumption Value by Application (2024-2029) & (USD Million)

Table 152. Middle East & Africa Hospital Injectable Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 153. Middle East & Africa Hospital Injectable Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 154. Hospital Injectable Drugs Raw Material

Table 155. Key Suppliers of Hospital Injectable Drugs Raw Materials

List of Figures

Figure 1. Hospital Injectable Drugs Picture

Figure 2. Global Hospital Injectable Drugs Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Hospital Injectable Drugs Consumption Value Market Share by Type in 2022

Figure 4. Generic Sterile Injectables

Figure 5. Sterile Intravenous (IV) Solutions

Figure 6. Global Hospital Injectable Drugs Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 7. Hospital Injectable Drugs Consumption Value Market Share by Application in 2022

Figure 8. Oncology Picture

Figure 9. Anesthesia Picture

Figure 10. Anti-Infectives Picture

Figure 11. Parenteral Nutrition Picture

Figure 12. Cardiovascular Diseases Picture

Figure 13. Global Hospital Injectable Drugs Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 14. Global Hospital Injectable Drugs Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 15. Global Market Hospital Injectable Drugs Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 16. Global Hospital Injectable Drugs Consumption Value Market Share by Region (2018-2029)

Figure 17. Global Hospital Injectable Drugs Consumption Value Market Share by Region in 2022

Figure 18. North America Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 19. Europe Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 20. Asia-Pacific Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 21. South America Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 22. Middle East and Africa Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 23. Global Hospital Injectable Drugs Revenue Share by Players in 2022

Figure 24. Hospital Injectable Drugs Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 25. Global Top 3 Players Hospital Injectable Drugs Market Share in 2022

Figure 26. Global Top 6 Players Hospital Injectable Drugs Market Share in 2022

Figure 27. Global Hospital Injectable Drugs Consumption Value Share by Type (2018-2023)

Figure 28. Global Hospital Injectable Drugs Market Share Forecast by Type (2024-2029)

Figure 29. Global Hospital Injectable Drugs Consumption Value Share by Application (2018-2023)

Figure 30. Global Hospital Injectable Drugs Market Share Forecast by Application (2024-2029)

Figure 31. North America Hospital Injectable Drugs Consumption Value Market Share by Type (2018-2029)

Figure 32. North America Hospital Injectable Drugs Consumption Value Market Share by Application (2018-2029)

Figure 33. North America Hospital Injectable Drugs Consumption Value Market Share by Country (2018-2029)

Figure 34. United States Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 35. Canada Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 36. Mexico Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 37. Europe Hospital Injectable Drugs Consumption Value Market Share by Type (2018-2029)

Figure 38. Europe Hospital Injectable Drugs Consumption Value Market Share by Application (2018-2029)

Figure 39. Europe Hospital Injectable Drugs Consumption Value Market Share by Country (2018-2029)

Figure 40. Germany Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 41. France Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 42. United Kingdom Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 43. Russia Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 44. Italy Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 45. Asia-Pacific Hospital Injectable Drugs Consumption Value Market Share by Type (2018-2029)

Figure 46. Asia-Pacific Hospital Injectable Drugs Consumption Value Market Share by Application (2018-2029)

Figure 47. Asia-Pacific Hospital Injectable Drugs Consumption Value Market Share by Region (2018-2029)

Figure 48. China Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 49. Japan Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 50. South Korea Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 51. India Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 52. Southeast Asia Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 53. Australia Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 54. South America Hospital Injectable Drugs Consumption Value Market Share by Type (2018-2029)

Figure 55. South America Hospital Injectable Drugs Consumption Value Market Share by Application (2018-2029)

Figure 56. South America Hospital Injectable Drugs Consumption Value Market Share by Country (2018-2029)

Figure 57. Brazil Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 58. Argentina Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 59. Middle East and Africa Hospital Injectable Drugs Consumption Value Market Share by Type (2018-2029)

Figure 60. Middle East and Africa Hospital Injectable Drugs Consumption Value Market Share by Application (2018-2029)

Figure 61. Middle East and Africa Hospital Injectable Drugs Consumption Value Market Share by Country (2018-2029)

Figure 62. Turkey Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 63. Saudi Arabia Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 64. UAE Hospital Injectable Drugs Consumption Value (2018-2029) & (USD Million)

Figure 65. Hospital Injectable Drugs Market Drivers

Figure 66. Hospital Injectable Drugs Market Restraints

Figure 67. Hospital Injectable Drugs Market Trends

Figure 68. Porters Five Forces Analysis

Figure 69. Manufacturing Cost Structure Analysis of Hospital Injectable Drugs in 2022

Figure 70. Manufacturing Process Analysis of Hospital Injectable Drugs

Figure 71. Hospital Injectable Drugs Industrial Chain

Figure 72. Methodology

Figure 73. Research Process and Data Source