Hemostasis valves, which is used primarily in interventional cardiology and angioplasty procedures. Designed to minimize fluid loss and backflow, the valves are available in a range of styles with a variety of features.

Global Hemostatic Valves companies include Boston Scientific, Freudenberg Medical, Argon Medical, DeRoyal Industries and Teleflex, etc. Global top 5 companies hold a share over 39%, and the largest company is Boston Scientific.

This report is a detailed and comprehensive analysis for global Hemostatic Valves market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Hemostatic Valves market size and forecasts, in consumption value ($ Million), sales quantity (K Units), and average selling prices (US$/Unit), 2018-2029

Global Hemostatic Valves market size and forecasts by region and country, in consumption value ($ Million), sales quantity (K Units), and average selling prices (US$/Unit), 2018-2029

Global Hemostatic Valves market size and forecasts, by Type and by Application, in consumption value ($ Million), sales quantity (K Units), and average selling prices (US$/Unit), 2018-2029

Global Hemostatic Valves market shares of main players, shipments in revenue ($ Million), sales quantity (K Units), and ASP (US$/Unit), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Hemostatic Valves

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Hemostatic Valves market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Boston Scientific

Freudenberg Medical

Argon Medical

DeRoyal Industries, Inc.

Teleflex

Galt Medical Corp.

Scitech

Medtronic

Excel Medical Products

Segmentation By Type

Hemostasis Valve Y-Connectors

Double Y-Connector Hemostasis Valves

One-Handed Hemostasis Valves

Others

Segmentation By Application

Hospitals

Clinics

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the hemostatic valves market in 2025?

The hemostatic valves market in 2025 benefits from increased demand for minimally invasive surgeries, driving the need for advanced hemostatic solutions. Additionally, innovations in valve design, enhanced patient outcomes, and growing awareness among healthcare providers contribute to its strength.

What weaknesses could impact the hemostatic valves market in 2025?

High costs associated with advanced hemostatic valves may limit their adoption, particularly in developing regions. Furthermore, a lack of standardization in valve types and inconsistent regulatory approvals could hinder market growth.

What opportunities exist for the hemostatic valves market in 2025?

There is significant potential in expanding applications for hemostatic valves in emerging medical fields like robotic surgeries and cardiovascular treatments. Additionally, increasing healthcare expenditure and technological advancements present opportunities for growth.

What threats might affect the hemostatic valves market in 2025?

The hemostatic valves market could face threats from rising competition, with new players entering the market and offering lower-cost alternatives. Additionally, evolving regulatory challenges and potential safety concerns could pose risks to market stability.

Market PESTEL Analysis

What are the political factors influencing the hemostatic valves market in 2025?

Government regulations and healthcare policies can significantly affect the adoption and approval of hemostatic valves. Stringent medical device regulations and reimbursement policies will shape the market landscape, particularly in regions with complex healthcare systems.

How do economic factors impact the hemostatic valves market in 2025?

Economic conditions, such as healthcare funding and hospital budgets, play a crucial role in the market. In countries with limited healthcare budgets, high-cost products like hemostatic valves may face slower adoption, while higher healthcare spending in developed regions could drive growth.

What social factors are relevant to the hemostatic valves market in 2025?

There is a growing demand for minimally invasive procedures due to patient preferences for quicker recovery times and reduced risk. Social awareness regarding advanced medical technologies and improved healthcare outcomes also contributes to the increasing adoption of hemostatic valves.

What technological factors are driving the hemostatic valves market in 2025?

Advancements in medical device technology, including more efficient and reliable hemostatic valves, are crucial to market growth. Integration with robotic and minimally invasive surgery platforms, along with enhanced biocompatibility, are key technological developments that enhance their value.

What environmental factors affect the hemostatic valves market in 2025?

Environmental concerns related to medical waste and the sustainability of materials used in hemostatic valves are gaining importance. Manufacturers are under pressure to design eco-friendly products and reduce the environmental footprint of their devices.

What legal factors impact the hemostatic valves market in 2025?

Legal issues, including intellectual property rights and liability concerns, influence the market. Compliance with international standards for medical device safety and efficacy is crucial, while patent disputes may hinder innovation and competition within the market.

Market SIPOC Analysis

Who are the suppliers in the hemostatic valves market in 2025?

Suppliers include manufacturers of raw materials, such as biocompatible polymers, metals, and advanced materials. Additionally, suppliers of medical equipment and technology providers that specialize in valve components and robotic surgical systems play a crucial role.

What inputs are needed for the hemostatic valves market in 2025?

The key inputs required are high-quality materials for valve construction, advanced manufacturing technologies, regulatory compliance documentation, and skilled labor. Research and development investments are also necessary to innovate and improve valve designs.

What are the processes involved in the hemostatic valves market in 2025?

Processes include designing and developing hemostatic valves, testing for biocompatibility and safety, obtaining regulatory approvals, manufacturing the valves using specialized equipment, and distribution through medical device channels. Ongoing quality assurance and feedback integration are also part of the process.

Who are the customers in the hemostatic valves market in 2025?

Customers include hospitals, surgical centers, and healthcare providers, particularly those specializing in minimally invasive surgeries, cardiovascular procedures, and other specialties requiring hemostatic solutions. Additionally, medical device distributors and health insurance companies are key customers.

What outputs are delivered to the hemostatic valves market in 2025?

The primary output is the hemostatic valves themselves, designed for use in medical procedures. Other outputs include related surgical instruments, educational resources for healthcare providers, and ongoing customer support and maintenance services for the valves.

Market Porter's Five Forces

What is the threat of new entrants in the hemostatic valves market in 2025?

The threat of new entrants is moderate. While technological barriers and regulatory requirements pose challenges for new companies, the growing demand for minimally invasive procedures and the potential for innovation in hemostatic valve design attract new players into the market.

How intense is the bargaining power of suppliers in the hemostatic valves market in 2025?

The bargaining power of suppliers is moderate. The market relies on specialized materials and advanced manufacturing technologies, which are provided by a limited number of suppliers. However, established manufacturers have the capacity to negotiate favorable terms due to their scale and market position.

What is the bargaining power of buyers in the hemostatic valves market in 2025?

The bargaining power of buyers is relatively high. Hospitals and surgical centers often purchase in bulk and seek cost-effective solutions. Additionally, the growing variety of valve products and alternatives in the market allows buyers to choose from different suppliers, increasing their negotiating power.

How strong is the threat of substitute products in the hemostatic valves market in 2025?

The threat of substitutes is low to moderate. While there are alternative hemostatic solutions such as manual compression or other hemostatic devices, hemostatic valves remain a critical component for specific surgical needs. However, advancements in competing technologies could introduce substitutes over time.

How competitive is the hemostatic valves market in 2025?

The market is moderately competitive. A few key players dominate, but smaller companies are entering with innovative products. The competition is driven by technological advancements, price differentiation, and the ability to meet regulatory standards. Continuous product development is crucial for staying ahead in the market.

Market Upstream Analysis

What are the key raw materials needed for the hemostatic valves market in 2025?

The key raw materials include biocompatible polymers, metals like titanium or stainless steel, and advanced composite materials for valve construction. Additionally, materials that offer durability, flexibility, and resistance to biological environments are essential.

What suppliers or partners are critical to the hemostatic valves market in 2025?

Suppliers of high-quality raw materials for manufacturing the valves, such as specialized material providers and component manufacturers, are crucial. Additionally, suppliers of precision manufacturing equipment and technology partners who offer research and development support play a key role.

What are the primary challenges faced by upstream players in the hemostatic valves market in 2025?

Upstream players face challenges in sourcing high-quality, cost-effective materials that meet the strict regulatory requirements for medical devices. Additionally, the pressure to innovate while maintaining compliance with safety standards and managing supply chain disruptions is significant.

How does the regulatory environment affect upstream players in the hemostatic valves market in 2025?

The regulatory environment greatly impacts upstream players by imposing strict guidelines for materials used in medical devices. Compliance with international and regional regulations, such as FDA approvals and CE certifications, is necessary to bring products to market, which increases time and cost for upstream suppliers.

What role does technology play in the upstream segment of the hemostatic valves market in 2025?

Technological advancements in material science and manufacturing processes are essential for upstream players to meet the growing demand for more efficient and reliable hemostatic valves. Automation, 3D printing, and new material innovations will enhance production quality and cost-efficiency in the upstream sector.

Market Midstream Analysis

What is the role of manufacturers in the hemostatic valves market in 2025?

Manufacturers play a central role in the midstream segment by designing, producing, and assembling hemostatic valves. They are responsible for ensuring product quality, meeting regulatory standards, and implementing technological innovations to enhance valve performance and efficiency.

What are the key challenges faced by manufacturers in the hemostatic valves market in 2025?

Manufacturers face challenges related to high production costs, particularly in the development of advanced, high-quality materials for valves. Additionally, maintaining compliance with varying international regulations, managing production scalability, and dealing with supply chain disruptions are ongoing concerns.

How does the distribution channel affect the midstream players in the hemostatic valves market in 2025?

The distribution channel is critical for midstream players, as it determines how quickly and efficiently hemostatic valves reach healthcare providers. Distribution partners, including medical device distributors and hospitals, influence pricing strategies, stock availability, and the overall market penetration of the product.

What impact do technological advancements have on midstream players in the hemostatic valves market in 2025?

Technological advancements directly influence midstream players by enabling more precise manufacturing processes, enhancing product quality, and reducing costs. Innovations like automation in manufacturing, advanced sterilization techniques, and integration with robotic surgery systems allow for more efficient and reliable production of hemostatic valves.

How does the regulatory environment impact midstream players in the hemostatic valves market in 2025?

Regulatory requirements impose significant constraints on midstream players, influencing product development timelines, manufacturing processes, and market entry. Compliance with stringent medical device regulations, such as FDA and CE certifications, is necessary to avoid delays and ensure the safety and effectiveness of hemostatic valves.

Market Downstream Analysis

What role do healthcare providers play in the hemostatic valves market in 2025?

Healthcare providers, including hospitals, surgical centers, and clinics, are key players in the downstream segment, as they are the end-users of hemostatic valves. They make purchasing decisions based on product performance, cost-effectiveness, and the specific needs of surgical procedures, influencing the market demand.

What are the main challenges faced by downstream players in the hemostatic valves market in 2025?

Downstream players face challenges such as managing the high costs of advanced hemostatic valves, navigating complex reimbursement policies, and dealing with variability in product availability. Additionally, ensuring proper training for medical staff on using these advanced devices is crucial for optimal outcomes.

How does the demand from healthcare providers impact the hemostatic valves market in 2025?

The demand from healthcare providers drives the growth of the hemostatic valves market, as their need for efficient, reliable, and cost-effective devices directly influences purchasing decisions. The shift towards minimally invasive surgeries and the adoption of newer technologies are significant factors shaping demand.

What are the key trends in the downstream segment of the hemostatic valves market in 2025?

Key trends include the increasing adoption of robotic surgeries and minimally invasive procedures, which require more sophisticated hemostatic solutions. Additionally, healthcare providers are focusing on improving patient outcomes and reducing recovery times, which drives demand for innovative valve designs and materials.

How does the regulatory environment affect downstream players in the hemostatic valves market in 2025?

The regulatory environment plays a significant role in ensuring that downstream players, such as healthcare providers, comply with safety and quality standards. The need to adhere to regulatory guidelines on the use of medical devices can influence purchasing decisions and impact how hemostatic valves are used in clinical settings.

Chapter 1, to describe Hemostatic Valves product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Hemostatic Valves, with price, sales, revenue and global market share of Hemostatic Valves from 2018 to 2023.

Chapter 3, the Hemostatic Valves competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Hemostatic Valves breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Hemostatic Valves market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of Hemostatic Valves.

Chapter 14 and 15, to describe Hemostatic Valves sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Hemostatic Valves

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Hemostatic Valves Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 Hemostasis Valve Y-Connectors

1.3.3 Double Y-Connector Hemostasis Valves

1.3.4 One-Handed Hemostasis Valves

1.3.5 Others

1.4 Market Analysis by Application

1.4.1 Overview: Global Hemostatic Valves Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospitals

1.4.3 Clinics

1.5 Global Hemostatic Valves Market Size & Forecast

1.5.1 Global Hemostatic Valves Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Hemostatic Valves Sales Quantity (2018-2029)

1.5.3 Global Hemostatic Valves Average Price (2018-2029)

2 Manufacturers Profiles

2.1 Boston Scientific

2.1.1 Boston Scientific Details

2.1.2 Boston Scientific Major Business

2.1.3 Boston Scientific Hemostatic Valves Product and Services

2.1.4 Boston Scientific Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Boston Scientific Recent Developments/Updates

2.2 Freudenberg Medical

2.2.1 Freudenberg Medical Details

2.2.2 Freudenberg Medical Major Business

2.2.3 Freudenberg Medical Hemostatic Valves Product and Services

2.2.4 Freudenberg Medical Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Freudenberg Medical Recent Developments/Updates

2.3 Argon Medical

2.3.1 Argon Medical Details

2.3.2 Argon Medical Major Business

2.3.3 Argon Medical Hemostatic Valves Product and Services

2.3.4 Argon Medical Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Argon Medical Recent Developments/Updates

2.4 DeRoyal Industries, Inc.

2.4.1 DeRoyal Industries, Inc. Details

2.4.2 DeRoyal Industries, Inc. Major Business

2.4.3 DeRoyal Industries, Inc. Hemostatic Valves Product and Services

2.4.4 DeRoyal Industries, Inc. Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 DeRoyal Industries, Inc. Recent Developments/Updates

2.5 Teleflex

2.5.1 Teleflex Details

2.5.2 Teleflex Major Business

2.5.3 Teleflex Hemostatic Valves Product and Services

2.5.4 Teleflex Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Teleflex Recent Developments/Updates

2.6 Galt Medical Corp.

2.6.1 Galt Medical Corp. Details

2.6.2 Galt Medical Corp. Major Business

2.6.3 Galt Medical Corp. Hemostatic Valves Product and Services

2.6.4 Galt Medical Corp. Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Galt Medical Corp. Recent Developments/Updates

2.7 Scitech

2.7.1 Scitech Details

2.7.2 Scitech Major Business

2.7.3 Scitech Hemostatic Valves Product and Services

2.7.4 Scitech Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Scitech Recent Developments/Updates

2.8 Medtronic

2.8.1 Medtronic Details

2.8.2 Medtronic Major Business

2.8.3 Medtronic Hemostatic Valves Product and Services

2.8.4 Medtronic Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Medtronic Recent Developments/Updates

2.9 Excel Medical Products

2.9.1 Excel Medical Products Details

2.9.2 Excel Medical Products Major Business

2.9.3 Excel Medical Products Hemostatic Valves Product and Services

2.9.4 Excel Medical Products Hemostatic Valves Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Excel Medical Products Recent Developments/Updates

3 Competitive Environment: Hemostatic Valves by Manufacturer

3.1 Global Hemostatic Valves Sales Quantity by Manufacturer (2018-2023)

3.2 Global Hemostatic Valves Revenue by Manufacturer (2018-2023)

3.3 Global Hemostatic Valves Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Hemostatic Valves by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Hemostatic Valves Manufacturer Market Share in 2022

3.4.2 Top 6 Hemostatic Valves Manufacturer Market Share in 2022

3.5 Hemostatic Valves Market: Overall Company Footprint Analysis

3.5.1 Hemostatic Valves Market: Region Footprint

3.5.2 Hemostatic Valves Market: Company Product Type Footprint

3.5.3 Hemostatic Valves Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Hemostatic Valves Market Size by Region

4.1.1 Global Hemostatic Valves Sales Quantity by Region (2018-2029)

4.1.2 Global Hemostatic Valves Consumption Value by Region (2018-2029)

4.1.3 Global Hemostatic Valves Average Price by Region (2018-2029)

4.2 North America Hemostatic Valves Consumption Value (2018-2029)

4.3 Europe Hemostatic Valves Consumption Value (2018-2029)

4.4 Asia-Pacific Hemostatic Valves Consumption Value (2018-2029)

4.5 South America Hemostatic Valves Consumption Value (2018-2029)

4.6 Middle East and Africa Hemostatic Valves Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Hemostatic Valves Sales Quantity by Type (2018-2029)

5.2 Global Hemostatic Valves Consumption Value by Type (2018-2029)

5.3 Global Hemostatic Valves Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Hemostatic Valves Sales Quantity by Application (2018-2029)

6.2 Global Hemostatic Valves Consumption Value by Application (2018-2029)

6.3 Global Hemostatic Valves Average Price by Application (2018-2029)

7 North America

7.1 North America Hemostatic Valves Sales Quantity by Type (2018-2029)

7.2 North America Hemostatic Valves Sales Quantity by Application (2018-2029)

7.3 North America Hemostatic Valves Market Size by Country

7.3.1 North America Hemostatic Valves Sales Quantity by Country (2018-2029)

7.3.2 North America Hemostatic Valves Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Hemostatic Valves Sales Quantity by Type (2018-2029)

8.2 Europe Hemostatic Valves Sales Quantity by Application (2018-2029)

8.3 Europe Hemostatic Valves Market Size by Country

8.3.1 Europe Hemostatic Valves Sales Quantity by Country (2018-2029)

8.3.2 Europe Hemostatic Valves Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Hemostatic Valves Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Hemostatic Valves Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Hemostatic Valves Market Size by Region

9.3.1 Asia-Pacific Hemostatic Valves Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Hemostatic Valves Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Hemostatic Valves Sales Quantity by Type (2018-2029)

10.2 South America Hemostatic Valves Sales Quantity by Application (2018-2029)

10.3 South America Hemostatic Valves Market Size by Country

10.3.1 South America Hemostatic Valves Sales Quantity by Country (2018-2029)

10.3.2 South America Hemostatic Valves Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Hemostatic Valves Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Hemostatic Valves Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Hemostatic Valves Market Size by Country

11.3.1 Middle East & Africa Hemostatic Valves Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Hemostatic Valves Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Hemostatic Valves Market Drivers

12.2 Hemostatic Valves Market Restraints

12.3 Hemostatic Valves Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of Hemostatic Valves and Key Manufacturers

13.2 Manufacturing Costs Percentage of Hemostatic Valves

13.3 Hemostatic Valves Production Process

13.4 Hemostatic Valves Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Hemostatic Valves Typical Distributors

14.3 Hemostatic Valves Typical Customers

15 Research Findings and Conclusion

16 Appendix

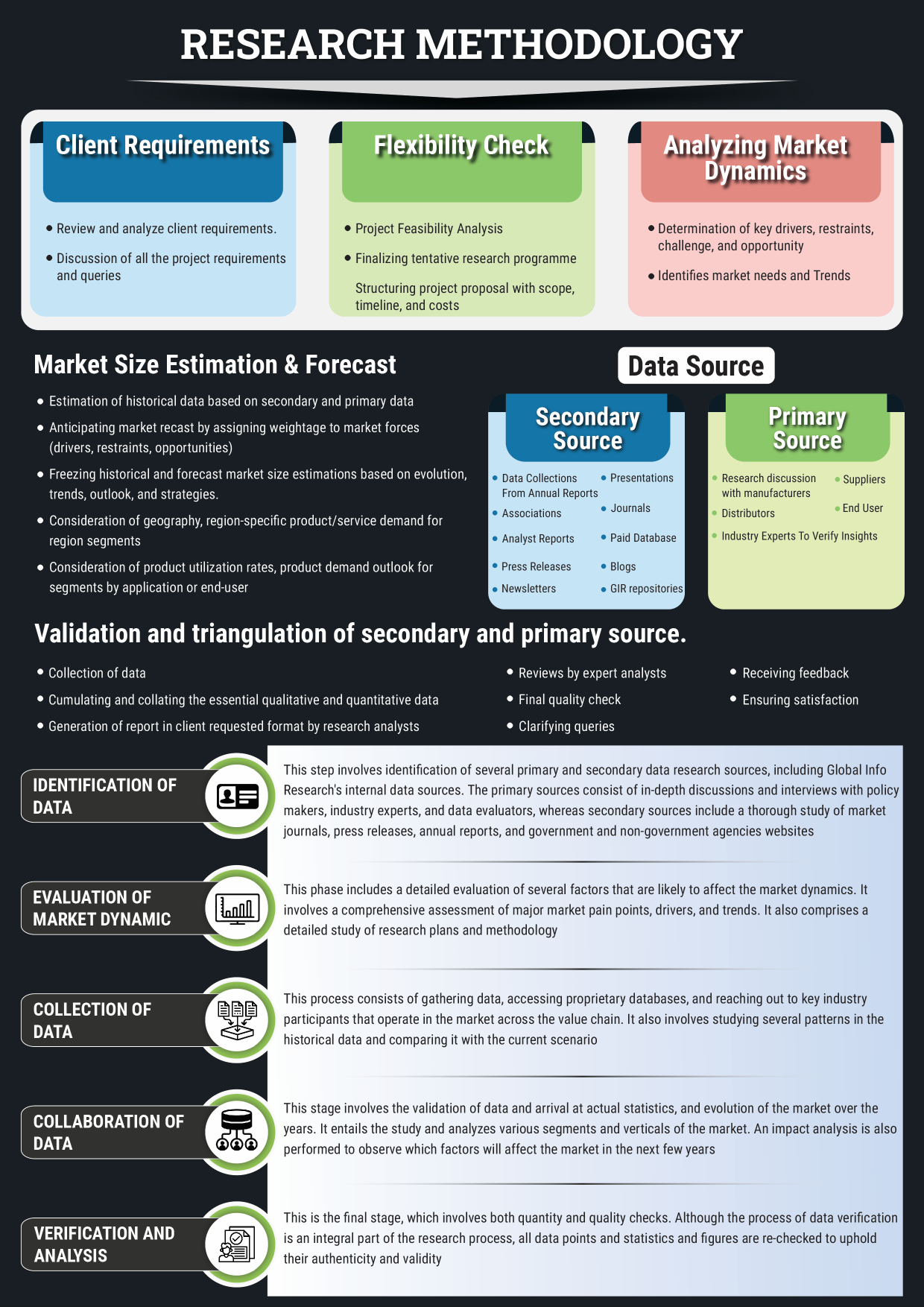

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Hemostatic Valves Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Hemostatic Valves Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Boston Scientific Basic Information, Manufacturing Base and Competitors

Table 4. Boston Scientific Major Business

Table 5. Boston Scientific Hemostatic Valves Product and Services

Table 6. Boston Scientific Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. Boston Scientific Recent Developments/Updates

Table 8. Freudenberg Medical Basic Information, Manufacturing Base and Competitors

Table 9. Freudenberg Medical Major Business

Table 10. Freudenberg Medical Hemostatic Valves Product and Services

Table 11. Freudenberg Medical Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Freudenberg Medical Recent Developments/Updates

Table 13. Argon Medical Basic Information, Manufacturing Base and Competitors

Table 14. Argon Medical Major Business

Table 15. Argon Medical Hemostatic Valves Product and Services

Table 16. Argon Medical Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Argon Medical Recent Developments/Updates

Table 18. DeRoyal Industries, Inc. Basic Information, Manufacturing Base and Competitors

Table 19. DeRoyal Industries, Inc. Major Business

Table 20. DeRoyal Industries, Inc. Hemostatic Valves Product and Services

Table 21. DeRoyal Industries, Inc. Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. DeRoyal Industries, Inc. Recent Developments/Updates

Table 23. Teleflex Basic Information, Manufacturing Base and Competitors

Table 24. Teleflex Major Business

Table 25. Teleflex Hemostatic Valves Product and Services

Table 26. Teleflex Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Teleflex Recent Developments/Updates

Table 28. Galt Medical Corp. Basic Information, Manufacturing Base and Competitors

Table 29. Galt Medical Corp. Major Business

Table 30. Galt Medical Corp. Hemostatic Valves Product and Services

Table 31. Galt Medical Corp. Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. Galt Medical Corp. Recent Developments/Updates

Table 33. Scitech Basic Information, Manufacturing Base and Competitors

Table 34. Scitech Major Business

Table 35. Scitech Hemostatic Valves Product and Services

Table 36. Scitech Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Scitech Recent Developments/Updates

Table 38. Medtronic Basic Information, Manufacturing Base and Competitors

Table 39. Medtronic Major Business

Table 40. Medtronic Hemostatic Valves Product and Services

Table 41. Medtronic Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Medtronic Recent Developments/Updates

Table 43. Excel Medical Products Basic Information, Manufacturing Base and Competitors

Table 44. Excel Medical Products Major Business

Table 45. Excel Medical Products Hemostatic Valves Product and Services

Table 46. Excel Medical Products Hemostatic Valves Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 47. Excel Medical Products Recent Developments/Updates

Table 48. Global Hemostatic Valves Sales Quantity by Manufacturer (2018-2023) & (K Units)

Table 49. Global Hemostatic Valves Revenue by Manufacturer (2018-2023) & (USD Million)

Table 50. Global Hemostatic Valves Average Price by Manufacturer (2018-2023) & (US$/Unit)

Table 51. Market Position of Manufacturers in Hemostatic Valves, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 52. Head Office and Hemostatic Valves Production Site of Key Manufacturer

Table 53. Hemostatic Valves Market: Company Product Type Footprint

Table 54. Hemostatic Valves Market: Company Product Application Footprint

Table 55. Hemostatic Valves New Market Entrants and Barriers to Market Entry

Table 56. Hemostatic Valves Mergers, Acquisition, Agreements, and Collaborations

Table 57. Global Hemostatic Valves Sales Quantity by Region (2018-2023) & (K Units)

Table 58. Global Hemostatic Valves Sales Quantity by Region (2024-2029) & (K Units)

Table 59. Global Hemostatic Valves Consumption Value by Region (2018-2023) & (USD Million)

Table 60. Global Hemostatic Valves Consumption Value by Region (2024-2029) & (USD Million)

Table 61. Global Hemostatic Valves Average Price by Region (2018-2023) & (US$/Unit)

Table 62. Global Hemostatic Valves Average Price by Region (2024-2029) & (US$/Unit)

Table 63. Global Hemostatic Valves Sales Quantity by Type (2018-2023) & (K Units)

Table 64. Global Hemostatic Valves Sales Quantity by Type (2024-2029) & (K Units)

Table 65. Global Hemostatic Valves Consumption Value by Type (2018-2023) & (USD Million)

Table 66. Global Hemostatic Valves Consumption Value by Type (2024-2029) & (USD Million)

Table 67. Global Hemostatic Valves Average Price by Type (2018-2023) & (US$/Unit)

Table 68. Global Hemostatic Valves Average Price by Type (2024-2029) & (US$/Unit)

Table 69. Global Hemostatic Valves Sales Quantity by Application (2018-2023) & (K Units)

Table 70. Global Hemostatic Valves Sales Quantity by Application (2024-2029) & (K Units)

Table 71. Global Hemostatic Valves Consumption Value by Application (2018-2023) & (USD Million)

Table 72. Global Hemostatic Valves Consumption Value by Application (2024-2029) & (USD Million)

Table 73. Global Hemostatic Valves Average Price by Application (2018-2023) & (US$/Unit)

Table 74. Global Hemostatic Valves Average Price by Application (2024-2029) & (US$/Unit)

Table 75. North America Hemostatic Valves Sales Quantity by Type (2018-2023) & (K Units)

Table 76. North America Hemostatic Valves Sales Quantity by Type (2024-2029) & (K Units)

Table 77. North America Hemostatic Valves Sales Quantity by Application (2018-2023) & (K Units)

Table 78. North America Hemostatic Valves Sales Quantity by Application (2024-2029) & (K Units)

Table 79. North America Hemostatic Valves Sales Quantity by Country (2018-2023) & (K Units)

Table 80. North America Hemostatic Valves Sales Quantity by Country (2024-2029) & (K Units)

Table 81. North America Hemostatic Valves Consumption Value by Country (2018-2023) & (USD Million)

Table 82. North America Hemostatic Valves Consumption Value by Country (2024-2029) & (USD Million)

Table 83. Europe Hemostatic Valves Sales Quantity by Type (2018-2023) & (K Units)

Table 84. Europe Hemostatic Valves Sales Quantity by Type (2024-2029) & (K Units)

Table 85. Europe Hemostatic Valves Sales Quantity by Application (2018-2023) & (K Units)

Table 86. Europe Hemostatic Valves Sales Quantity by Application (2024-2029) & (K Units)

Table 87. Europe Hemostatic Valves Sales Quantity by Country (2018-2023) & (K Units)

Table 88. Europe Hemostatic Valves Sales Quantity by Country (2024-2029) & (K Units)

Table 89. Europe Hemostatic Valves Consumption Value by Country (2018-2023) & (USD Million)

Table 90. Europe Hemostatic Valves Consumption Value by Country (2024-2029) & (USD Million)

Table 91. Asia-Pacific Hemostatic Valves Sales Quantity by Type (2018-2023) & (K Units)

Table 92. Asia-Pacific Hemostatic Valves Sales Quantity by Type (2024-2029) & (K Units)

Table 93. Asia-Pacific Hemostatic Valves Sales Quantity by Application (2018-2023) & (K Units)

Table 94. Asia-Pacific Hemostatic Valves Sales Quantity by Application (2024-2029) & (K Units)

Table 95. Asia-Pacific Hemostatic Valves Sales Quantity by Region (2018-2023) & (K Units)

Table 96. Asia-Pacific Hemostatic Valves Sales Quantity by Region (2024-2029) & (K Units)

Table 97. Asia-Pacific Hemostatic Valves Consumption Value by Region (2018-2023) & (USD Million)

Table 98. Asia-Pacific Hemostatic Valves Consumption Value by Region (2024-2029) & (USD Million)

Table 99. South America Hemostatic Valves Sales Quantity by Type (2018-2023) & (K Units)

Table 100. South America Hemostatic Valves Sales Quantity by Type (2024-2029) & (K Units)

Table 101. South America Hemostatic Valves Sales Quantity by Application (2018-2023) & (K Units)

Table 102. South America Hemostatic Valves Sales Quantity by Application (2024-2029) & (K Units)

Table 103. South America Hemostatic Valves Sales Quantity by Country (2018-2023) & (K Units)

Table 104. South America Hemostatic Valves Sales Quantity by Country (2024-2029) & (K Units)

Table 105. South America Hemostatic Valves Consumption Value by Country (2018-2023) & (USD Million)

Table 106. South America Hemostatic Valves Consumption Value by Country (2024-2029) & (USD Million)

Table 107. Middle East & Africa Hemostatic Valves Sales Quantity by Type (2018-2023) & (K Units)

Table 108. Middle East & Africa Hemostatic Valves Sales Quantity by Type (2024-2029) & (K Units)

Table 109. Middle East & Africa Hemostatic Valves Sales Quantity by Application (2018-2023) & (K Units)

Table 110. Middle East & Africa Hemostatic Valves Sales Quantity by Application (2024-2029) & (K Units)

Table 111. Middle East & Africa Hemostatic Valves Sales Quantity by Region (2018-2023) & (K Units)

Table 112. Middle East & Africa Hemostatic Valves Sales Quantity by Region (2024-2029) & (K Units)

Table 113. Middle East & Africa Hemostatic Valves Consumption Value by Region (2018-2023) & (USD Million)

Table 114. Middle East & Africa Hemostatic Valves Consumption Value by Region (2024-2029) & (USD Million)

Table 115. Hemostatic Valves Raw Material

Table 116. Key Manufacturers of Hemostatic Valves Raw Materials

Table 117. Hemostatic Valves Typical Distributors

Table 118. Hemostatic Valves Typical Customers

List of Figures

Figure 1. Hemostatic Valves Picture

Figure 2. Global Hemostatic Valves Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Hemostatic Valves Consumption Value Market Share by Type in 2022

Figure 4. Hemostasis Valve Y-Connectors Examples

Figure 5. Double Y-Connector Hemostasis Valves Examples

Figure 6. One-Handed Hemostasis Valves Examples

Figure 7. Others Examples

Figure 8. Global Hemostatic Valves Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 9. Global Hemostatic Valves Consumption Value Market Share by Application in 2022

Figure 10. Hospitals Examples

Figure 11. Clinics Examples

Figure 12. Global Hemostatic Valves Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 13. Global Hemostatic Valves Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 14. Global Hemostatic Valves Sales Quantity (2018-2029) & (K Units)

Figure 15. Global Hemostatic Valves Average Price (2018-2029) & (US$/Unit)

Figure 16. Global Hemostatic Valves Sales Quantity Market Share by Manufacturer in 2022

Figure 17. Global Hemostatic Valves Consumption Value Market Share by Manufacturer in 2022

Figure 18. Producer Shipments of Hemostatic Valves by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 19. Top 3 Hemostatic Valves Manufacturer (Consumption Value) Market Share in 2022

Figure 20. Top 6 Hemostatic Valves Manufacturer (Consumption Value) Market Share in 2022

Figure 21. Global Hemostatic Valves Sales Quantity Market Share by Region (2018-2029)

Figure 22. Global Hemostatic Valves Consumption Value Market Share by Region (2018-2029)

Figure 23. North America Hemostatic Valves Consumption Value (2018-2029) & (USD Million)

Figure 24. Europe Hemostatic Valves Consumption Value (2018-2029) & (USD Million)

Figure 25. Asia-Pacific Hemostatic Valves Consumption Value (2018-2029) & (USD Million)

Figure 26. South America Hemostatic Valves Consumption Value (2018-2029) & (USD Million)

Figure 27. Middle East & Africa Hemostatic Valves Consumption Value (2018-2029) & (USD Million)

Figure 28. Global Hemostatic Valves Sales Quantity Market Share by Type (2018-2029)

Figure 29. Global Hemostatic Valves Consumption Value Market Share by Type (2018-2029)

Figure 30. Global Hemostatic Valves Average Price by Type (2018-2029) & (US$/Unit)

Figure 31. Global Hemostatic Valves Sales Quantity Market Share by Application (2018-2029)

Figure 32. Global Hemostatic Valves Consumption Value Market Share by Application (2018-2029)

Figure 33. Global Hemostatic Valves Average Price by Application (2018-2029) & (US$/Unit)

Figure 34. North America Hemostatic Valves Sales Quantity Market Share by Type (2018-2029)

Figure 35. North America Hemostatic Valves Sales Quantity Market Share by Application (2018-2029)

Figure 36. North America Hemostatic Valves Sales Quantity Market Share by Country (2018-2029)

Figure 37. North America Hemostatic Valves Consumption Value Market Share by Country (2018-2029)

Figure 38. United States Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 39. Canada Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Mexico Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 41. Europe Hemostatic Valves Sales Quantity Market Share by Type (2018-2029)

Figure 42. Europe Hemostatic Valves Sales Quantity Market Share by Application (2018-2029)

Figure 43. Europe Hemostatic Valves Sales Quantity Market Share by Country (2018-2029)

Figure 44. Europe Hemostatic Valves Consumption Value Market Share by Country (2018-2029)

Figure 45. Germany Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 46. France Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. United Kingdom Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. Russia Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Italy Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 50. Asia-Pacific Hemostatic Valves Sales Quantity Market Share by Type (2018-2029)

Figure 51. Asia-Pacific Hemostatic Valves Sales Quantity Market Share by Application (2018-2029)

Figure 52. Asia-Pacific Hemostatic Valves Sales Quantity Market Share by Region (2018-2029)

Figure 53. Asia-Pacific Hemostatic Valves Consumption Value Market Share by Region (2018-2029)

Figure 54. China Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 55. Japan Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. Korea Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. India Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Southeast Asia Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. Australia Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 60. South America Hemostatic Valves Sales Quantity Market Share by Type (2018-2029)

Figure 61. South America Hemostatic Valves Sales Quantity Market Share by Application (2018-2029)

Figure 62. South America Hemostatic Valves Sales Quantity Market Share by Country (2018-2029)

Figure 63. South America Hemostatic Valves Consumption Value Market Share by Country (2018-2029)

Figure 64. Brazil Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 65. Argentina Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 66. Middle East & Africa Hemostatic Valves Sales Quantity Market Share by Type (2018-2029)

Figure 67. Middle East & Africa Hemostatic Valves Sales Quantity Market Share by Application (2018-2029)

Figure 68. Middle East & Africa Hemostatic Valves Sales Quantity Market Share by Region (2018-2029)

Figure 69. Middle East & Africa Hemostatic Valves Consumption Value Market Share by Region (2018-2029)

Figure 70. Turkey Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 71. Egypt Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. Saudi Arabia Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. South Africa Hemostatic Valves Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 74. Hemostatic Valves Market Drivers

Figure 75. Hemostatic Valves Market Restraints

Figure 76. Hemostatic Valves Market Trends

Figure 77. Porters Five Forces Analysis

Figure 78. Manufacturing Cost Structure Analysis of Hemostatic Valves in 2022

Figure 79. Manufacturing Process Analysis of Hemostatic Valves

Figure 80. Hemostatic Valves Industrial Chain

Figure 81. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 82. Direct Channel Pros & Cons

Figure 83. Indirect Channel Pros & Cons

Figure 84. Methodology

Figure 85. Research Process and Data Source