Dialysis is a technique used to remove waste products such as urea and creatinine from blood, which occurs from inappropriate functioning of kidneys and is usually required for people suffering from chronic renal failure.

The classification of Hemodialysis and Peritoneal Dialysis includes Service, Device and Consumables, and the proportion of Service in 2019 is about 81.39%. Hemodialysis and Peritoneal Dialysis sold through in Hospital, Dialysis Center and other. The most of Hemodialysis and Peritoneal Dialysis sold through Dialysis Center, and the market share of that is about 65.29% in 2019.

Market competition is intense. Fresenius, DaVita, Baxter, US rental care, B.Braun, Diaverum, etc. are the leaders of the industry. Production areas mainly include North America, Europe, China and Japan. North America is the largest consumption place, with a consumption market share nearly 35.08% in 2019. Following North America, Asia-Pacific is the second largest consumption place with the consumption market share of 28.67% in 2019.

This report is a detailed and comprehensive analysis for global Hemodialysis and Peritoneal Dialysis market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Hemodialysis and Peritoneal Dialysis market size and forecasts, in consumption value ($ Million), 2018-2029

Global Hemodialysis and Peritoneal Dialysis market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global Hemodialysis and Peritoneal Dialysis market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global Hemodialysis and Peritoneal Dialysis market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Hemodialysis and Peritoneal Dialysis

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Hemodialysis and Peritoneal Dialysis market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Fresenius

DaVita

Baxter

US rental care

B.Braun

Diaverum

Nipro

Asahi Kasei

Nikkiso

Toray

WEGO

JMS

Medtronic

Rockwell Medical

SWS Hemodialysis Care

Segmentation By Type

Service

Device

Consumables

Segmentation By Application

Hospital

Dialysis Centers

Other

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the hemodialysis and peritoneal dialysis market in 2025?

The market benefits from increasing prevalence of chronic kidney diseases globally, driving demand for dialysis treatments. The advancements in technology, such as automated dialysis machines and improved dialysis solutions, enhance treatment efficiency and patient outcomes. Additionally, the growing number of dialysis centers and enhanced healthcare infrastructure contribute to market growth.

What are the weaknesses of the market in 2025?

Despite technological advances, dialysis treatments remain costly, leading to affordability concerns in emerging economies. Moreover, the complexity and time-consuming nature of the dialysis process can result in reduced patient compliance and dissatisfaction. There's also a shortage of skilled professionals to manage these treatments effectively, especially in rural areas.

What opportunities exist for the hemodialysis and peritoneal dialysis market in 2025?

There is an opportunity to expand the market in developing regions where the incidence of kidney diseases is rising but access to dialysis treatments remains limited. Innovations like portable dialysis devices and home-based dialysis solutions also provide opportunities for better patient engagement and cost reduction. Additionally, partnerships with healthcare providers to offer comprehensive treatment packages can boost market potential.

What threats face the market in 2025?

The market faces competition from alternative therapies like kidney transplants, which may reduce the demand for long-term dialysis. Economic challenges, such as healthcare budget constraints and reimbursement issues, could also hinder market growth. Furthermore, regulatory hurdles and the potential for adverse outcomes or complications related to dialysis may limit broader adoption of certain treatments.

Market PESTEL Analysis

What are the political factors influencing the hemodialysis and peritoneal dialysis market in 2025?

Government policies regarding healthcare funding, insurance reimbursements, and access to dialysis services significantly impact the market. Public health initiatives aimed at reducing the prevalence of kidney diseases and increasing awareness can drive demand. However, political instability or changes in healthcare policies could disrupt market growth.

How do economic factors affect the hemodialysis and peritoneal dialysis market in 2025?

Economic conditions influence the affordability and accessibility of dialysis treatments, particularly in lower-income regions. Rising healthcare costs and budget constraints in healthcare systems could hinder patient access to dialysis. However, economic growth in emerging markets presents opportunities for expansion.

What social factors shape the hemodialysis and peritoneal dialysis market in 2025?

Society's growing awareness of chronic kidney disease and its treatment options contributes to market growth. Aging populations worldwide also increase demand for dialysis services. Furthermore, cultural attitudes towards healthcare and lifestyle changes in diet and exercise impact kidney disease prevention efforts, affecting market dynamics.

What technological factors are driving change in the hemodialysis and peritoneal dialysis market in 2025?

Technological advancements, such as improved dialysis machines, portable devices, and wearable dialysis systems, are revolutionizing patient care. Automation and innovation in dialysis solutions increase treatment efficiency, reducing complications and improving patient compliance. Ongoing research into artificial kidneys and remote monitoring systems is also shaping the future of dialysis.

How does the environment influence the hemodialysis and peritoneal dialysis market in 2025?

Environmental factors such as climate change can affect the availability and quality of water, which is critical for dialysis procedures. Additionally, sustainability concerns about the disposal of dialysis-related waste and materials may lead to innovations in eco-friendly products and more sustainable treatment methods.

What legal factors impact the hemodialysis and peritoneal dialysis market in 2025?

Stringent regulations governing medical devices and healthcare services influence product development and market entry. Legal issues related to patient safety, data privacy, and treatment standards must be adhered to by manufacturers and healthcare providers. Changes in healthcare laws and reimbursement policies also play a critical role in market expansion.

Market SIPOC Analysis

Who are the suppliers in the hemodialysis and peritoneal dialysis market in 2025?

Suppliers include manufacturers of dialysis machines, equipment, consumables (such as dialyzers, filters, and catheters), and pharmaceutical companies providing dialysis solutions and medications. Additionally, healthcare institutions and laboratories that produce diagnostic tools for kidney disease play a key role.

What inputs are required for the hemodialysis and peritoneal dialysis market in 2025?

Inputs include medical devices, dialysis solutions, skilled healthcare professionals, research and development for new technologies, regulatory approvals, and patient data management systems. Availability of clean water and power for dialysis treatment is also crucial.

Who are the customers in the hemodialysis and peritoneal dialysis market in 2025?

Customers include patients suffering from chronic kidney diseases, hospitals, dialysis centers, and healthcare providers. Insurance companies and government healthcare programs are also key customers, as they manage the reimbursement of dialysis treatments.

What processes are involved in the hemodialysis and peritoneal dialysis market in 2025?

Processes include the development and manufacturing of dialysis equipment, healthcare service delivery, patient treatment planning, and ongoing monitoring. Clinical processes also involve diagnosis, prescription, and patient care management, while administrative processes ensure billing, reimbursement, and regulatory compliance.

What are the outputs of the hemodialysis and peritoneal dialysis market in 2025?

Outputs include effective dialysis treatments, patient care reports, and improved quality of life for kidney disease patients. Market outputs also involve innovations in treatment technologies, educational materials for patients, and healthcare data for research and analysis.

Market Porter's Five Forces

How does the threat of new entrants affect the hemodialysis and peritoneal dialysis market in 2025?

The threat of new entrants is moderate due to high barriers to entry such as stringent regulatory requirements, significant capital investment for research and manufacturing, and the need for specialized knowledge in dialysis treatments. However, advancements in portable devices and home dialysis options may encourage new players to enter the market.

How does the bargaining power of suppliers influence the hemodialysis and peritoneal dialysis market in 2025?

Suppliers hold moderate bargaining power, as specialized equipment and dialysis solutions are critical for treatment. However, the market has multiple suppliers of essential components, which can reduce the overall power of any single supplier. Additionally, innovation in production technologies and alternative treatment options can affect supplier influence.

How does the bargaining power of buyers impact the hemodialysis and peritoneal dialysis market in 2025?

The bargaining power of buyers is moderate to high, as healthcare providers and patients increasingly demand better treatment options, improved service, and lower costs. Reimbursement policies from insurers and government programs can further empower buyers, forcing manufacturers and service providers to offer competitive pricing and value-added services.

How does the threat of substitute products or services affect the hemodialysis and peritoneal dialysis market in 2025?

The threat of substitutes is moderate, as kidney transplants are an alternative treatment for end-stage renal disease. However, the limited availability of donor organs and the complexity of transplant procedures make dialysis the preferred option for many patients, reducing the impact of substitutes in the short term.

How does industry rivalry influence the hemodialysis and peritoneal dialysis market in 2025?

Industry rivalry is high, as the market includes numerous players competing on the basis of product innovation, quality, pricing, and service offerings. The continuous advancement in dialysis technologies, along with the growing demand for home-based and portable dialysis solutions, intensifies competition among existing companies and drives innovation.

Market Upstream Analysis

What are the key upstream factors influencing the hemodialysis and peritoneal dialysis market in 2025?

Key upstream factors include the availability and cost of raw materials required for manufacturing dialysis equipment, such as specialized filters, dialyzers, and other consumables. Research and development investments in new technologies and innovations also play a crucial role in shaping the upstream supply chain.

How does the supply of technology impact the hemodialysis and peritoneal dialysis market in 2025?

The supply of advanced technology, including automated dialysis systems, wearable devices, and portable dialysis units, directly influences the market. Manufacturers' ability to source cutting-edge technology and integrate it into new products drives competition and market growth.

What role do manufacturers play in the upstream analysis of the hemodialysis and peritoneal dialysis market in 2025?

Manufacturers are critical in producing the necessary dialysis equipment, consumables, and solutions. Their ability to ensure product quality, meet regulatory standards, and manage production costs significantly impacts market supply. Furthermore, collaboration with research institutions for innovation is a key driver in this upstream segment.

How does the regulatory environment affect the upstream sector of the hemodialysis and peritoneal dialysis market in 2025?

Regulatory requirements for medical devices, clinical trials, and safety standards play a significant role in shaping the upstream market. Stricter regulations around product approvals and quality control can slow down production and increase costs. However, compliance ensures the safety and effectiveness of dialysis treatments.

What challenges are faced in the upstream segment of the hemodialysis and peritoneal dialysis market in 2025?

Challenges in the upstream segment include rising costs of raw materials, supply chain disruptions, and fluctuations in the availability of key components. Additionally, the complexity of developing innovative products that comply with regulatory standards can delay market entry and increase development costs.

Market Midstream Analysis

What are the key midstream factors influencing the hemodialysis and peritoneal dialysis market in 2025?

Midstream factors include the distribution networks that deliver dialysis equipment, consumables, and medications to healthcare providers. Partnerships between manufacturers, distributors, and healthcare institutions play a significant role in ensuring timely delivery and efficient supply chain management.

How does the availability of healthcare infrastructure impact the midstream sector of the hemodialysis and peritoneal dialysis market in 2025?

Healthcare infrastructure, such as dialysis centers, hospitals, and clinics, directly affects the accessibility and quality of dialysis treatments. Adequate infrastructure is essential for the effective distribution and administration of dialysis procedures, particularly in emerging markets where healthcare resources may be limited.

What is the role of healthcare providers in the midstream analysis of the hemodialysis and peritoneal dialysis market in 2025?

Healthcare providers, including nephrologists, dialysis nurses, and technicians, are critical in ensuring the proper administration of dialysis treatments. Their expertise impacts patient outcomes and the overall success of treatment plans. Collaboration with suppliers and manufacturers is also key to maintaining high-quality care.

How do regulations affect the midstream sector of the hemodialysis and peritoneal dialysis market in 2025?

Regulations governing the administration of dialysis treatments, including quality standards and safety protocols, play a crucial role in the midstream sector. Compliance with these regulations ensures the proper handling and delivery of dialysis services, which is vital for patient safety and treatment efficacy.

What challenges are faced in the midstream segment of the hemodialysis and peritoneal dialysis market in 2025?

Challenges include logistical issues such as supply chain disruptions, delays in the delivery of critical supplies, and variability in product quality. Additionally, the increasing demand for home dialysis solutions places pressure on healthcare providers to adapt their services and infrastructure to meet changing patient needs.

Market Downstream Analysis

What are the key downstream factors influencing the hemodialysis and peritoneal dialysis market in 2025?

Downstream factors include the growing demand for dialysis services driven by increasing rates of chronic kidney disease. Patient access to dialysis treatments, healthcare provider capabilities, and reimbursement policies are crucial in shaping the downstream market. Additionally, patient preference for home-based dialysis solutions is affecting service delivery models.

How does the role of healthcare providers impact the downstream sector of the hemodialysis and peritoneal dialysis market in 2025?

Healthcare providers, including hospitals, dialysis centers, and home healthcare agencies, play a pivotal role in delivering dialysis services to patients. Their ability to offer personalized care and provide quality treatment options influences patient satisfaction and market growth. The expansion of specialized care units will be essential to meet rising demand.

How do insurance and reimbursement policies affect the downstream market of hemodialysis and peritoneal dialysis in 2025?

Insurance and reimbursement policies are critical in determining patient access to dialysis treatments. Changes in coverage options or reimbursement rates can impact treatment affordability and market expansion. Countries with comprehensive healthcare systems and favorable reimbursement frameworks experience higher adoption of dialysis services.

How does patient demand influence the downstream market in 2025?

Patient demand is rising, particularly as the prevalence of chronic kidney disease increases globally. There is a growing preference for more flexible treatment options like home-based dialysis, which influences the services offered by healthcare providers. Patient-driven demand for innovation, comfort, and ease of treatment delivery is shaping the downstream market.

What challenges are faced in the downstream segment of the hemodialysis and peritoneal dialysis market in 2025?

Challenges in the downstream market include limited access to dialysis treatments in rural or underserved regions, which impacts overall patient outcomes. Additionally, the high costs associated with dialysis services and equipment may limit access for low-income populations, despite government or insurance coverage. The need for specialized care also places pressure on healthcare systems to meet demand.

Chapter 1, to describe Hemodialysis and Peritoneal Dialysis product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Hemodialysis and Peritoneal Dialysis, with revenue, gross margin and global market share of Hemodialysis and Peritoneal Dialysis from 2018 to 2023.

Chapter 3, the Hemodialysis and Peritoneal Dialysis competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Hemodialysis and Peritoneal Dialysis market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Hemodialysis and Peritoneal Dialysis.

Chapter 13, to describe Hemodialysis and Peritoneal Dialysis research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Hemodialysis and Peritoneal Dialysis

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Hemodialysis and Peritoneal Dialysis by Type

1.3.1 Overview: Global Hemodialysis and Peritoneal Dialysis Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type in 2022

1.3.3 Service

1.3.4 Device

1.3.5 Consumables

1.4 Global Hemodialysis and Peritoneal Dialysis Market by Application

1.4.1 Overview: Global Hemodialysis and Peritoneal Dialysis Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital

1.4.3 Dialysis Centers

1.4.4 Other

1.5 Global Hemodialysis and Peritoneal Dialysis Market Size & Forecast

1.6 Global Hemodialysis and Peritoneal Dialysis Market Size and Forecast by Region

1.6.1 Global Hemodialysis and Peritoneal Dialysis Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Hemodialysis and Peritoneal Dialysis Market Size by Region, (2018-2029)

1.6.3 North America Hemodialysis and Peritoneal Dialysis Market Size and Prospect (2018-2029)

1.6.4 Europe Hemodialysis and Peritoneal Dialysis Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Hemodialysis and Peritoneal Dialysis Market Size and Prospect (2018-2029)

1.6.6 South America Hemodialysis and Peritoneal Dialysis Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Hemodialysis and Peritoneal Dialysis Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 Fresenius

2.1.1 Fresenius Details

2.1.2 Fresenius Major Business

2.1.3 Fresenius Hemodialysis and Peritoneal Dialysis Product and Solutions

2.1.4 Fresenius Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Fresenius Recent Developments and Future Plans

2.2 DaVita

2.2.1 DaVita Details

2.2.2 DaVita Major Business

2.2.3 DaVita Hemodialysis and Peritoneal Dialysis Product and Solutions

2.2.4 DaVita Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 DaVita Recent Developments and Future Plans

2.3 Baxter

2.3.1 Baxter Details

2.3.2 Baxter Major Business

2.3.3 Baxter Hemodialysis and Peritoneal Dialysis Product and Solutions

2.3.4 Baxter Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Baxter Recent Developments and Future Plans

2.4 US rental care

2.4.1 US rental care Details

2.4.2 US rental care Major Business

2.4.3 US rental care Hemodialysis and Peritoneal Dialysis Product and Solutions

2.4.4 US rental care Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 US rental care Recent Developments and Future Plans

2.5 B.Braun

2.5.1 B.Braun Details

2.5.2 B.Braun Major Business

2.5.3 B.Braun Hemodialysis and Peritoneal Dialysis Product and Solutions

2.5.4 B.Braun Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 B.Braun Recent Developments and Future Plans

2.6 Diaverum

2.6.1 Diaverum Details

2.6.2 Diaverum Major Business

2.6.3 Diaverum Hemodialysis and Peritoneal Dialysis Product and Solutions

2.6.4 Diaverum Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Diaverum Recent Developments and Future Plans

2.7 Nipro

2.7.1 Nipro Details

2.7.2 Nipro Major Business

2.7.3 Nipro Hemodialysis and Peritoneal Dialysis Product and Solutions

2.7.4 Nipro Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Nipro Recent Developments and Future Plans

2.8 Asahi Kasei

2.8.1 Asahi Kasei Details

2.8.2 Asahi Kasei Major Business

2.8.3 Asahi Kasei Hemodialysis and Peritoneal Dialysis Product and Solutions

2.8.4 Asahi Kasei Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Asahi Kasei Recent Developments and Future Plans

2.9 Nikkiso

2.9.1 Nikkiso Details

2.9.2 Nikkiso Major Business

2.9.3 Nikkiso Hemodialysis and Peritoneal Dialysis Product and Solutions

2.9.4 Nikkiso Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Nikkiso Recent Developments and Future Plans

2.10 Toray

2.10.1 Toray Details

2.10.2 Toray Major Business

2.10.3 Toray Hemodialysis and Peritoneal Dialysis Product and Solutions

2.10.4 Toray Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Toray Recent Developments and Future Plans

2.11 WEGO

2.11.1 WEGO Details

2.11.2 WEGO Major Business

2.11.3 WEGO Hemodialysis and Peritoneal Dialysis Product and Solutions

2.11.4 WEGO Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 WEGO Recent Developments and Future Plans

2.12 JMS

2.12.1 JMS Details

2.12.2 JMS Major Business

2.12.3 JMS Hemodialysis and Peritoneal Dialysis Product and Solutions

2.12.4 JMS Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 JMS Recent Developments and Future Plans

2.13 Medtronic

2.13.1 Medtronic Details

2.13.2 Medtronic Major Business

2.13.3 Medtronic Hemodialysis and Peritoneal Dialysis Product and Solutions

2.13.4 Medtronic Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Medtronic Recent Developments and Future Plans

2.14 Rockwell Medical

2.14.1 Rockwell Medical Details

2.14.2 Rockwell Medical Major Business

2.14.3 Rockwell Medical Hemodialysis and Peritoneal Dialysis Product and Solutions

2.14.4 Rockwell Medical Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 Rockwell Medical Recent Developments and Future Plans

2.15 SWS Hemodialysis Care

2.15.1 SWS Hemodialysis Care Details

2.15.2 SWS Hemodialysis Care Major Business

2.15.3 SWS Hemodialysis Care Hemodialysis and Peritoneal Dialysis Product and Solutions

2.15.4 SWS Hemodialysis Care Hemodialysis and Peritoneal Dialysis Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 SWS Hemodialysis Care Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Hemodialysis and Peritoneal Dialysis Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Hemodialysis and Peritoneal Dialysis by Company Revenue

3.2.2 Top 3 Hemodialysis and Peritoneal Dialysis Players Market Share in 2022

3.2.3 Top 6 Hemodialysis and Peritoneal Dialysis Players Market Share in 2022

3.3 Hemodialysis and Peritoneal Dialysis Market: Overall Company Footprint Analysis

3.3.1 Hemodialysis and Peritoneal Dialysis Market: Region Footprint

3.3.2 Hemodialysis and Peritoneal Dialysis Market: Company Product Type Footprint

3.3.3 Hemodialysis and Peritoneal Dialysis Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Hemodialysis and Peritoneal Dialysis Consumption Value and Market Share by Type (2018-2023)

4.2 Global Hemodialysis and Peritoneal Dialysis Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application (2018-2023)

5.2 Global Hemodialysis and Peritoneal Dialysis Market Forecast by Application (2024-2029)

6 North America

6.1 North America Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2029)

6.2 North America Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2029)

6.3 North America Hemodialysis and Peritoneal Dialysis Market Size by Country

6.3.1 North America Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2029)

6.3.2 United States Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

6.3.3 Canada Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

6.3.4 Mexico Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2029)

7.2 Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2029)

7.3 Europe Hemodialysis and Peritoneal Dialysis Market Size by Country

7.3.1 Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2029)

7.3.2 Germany Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

7.3.3 France Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

7.3.5 Russia Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

7.3.6 Italy Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Hemodialysis and Peritoneal Dialysis Market Size by Region

8.3.1 Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Region (2018-2029)

8.3.2 China Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

8.3.3 Japan Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

8.3.4 South Korea Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

8.3.5 India Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

8.3.7 Australia Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

9 South America

9.1 South America Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2029)

9.2 South America Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2029)

9.3 South America Hemodialysis and Peritoneal Dialysis Market Size by Country

9.3.1 South America Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2029)

9.3.2 Brazil Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

9.3.3 Argentina Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Hemodialysis and Peritoneal Dialysis Market Size by Country

10.3.1 Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2029)

10.3.2 Turkey Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

10.3.4 UAE Hemodialysis and Peritoneal Dialysis Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Hemodialysis and Peritoneal Dialysis Market Drivers

11.2 Hemodialysis and Peritoneal Dialysis Market Restraints

11.3 Hemodialysis and Peritoneal Dialysis Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Hemodialysis and Peritoneal Dialysis Industry Chain

12.2 Hemodialysis and Peritoneal Dialysis Upstream Analysis

12.3 Hemodialysis and Peritoneal Dialysis Midstream Analysis

12.4 Hemodialysis and Peritoneal Dialysis Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

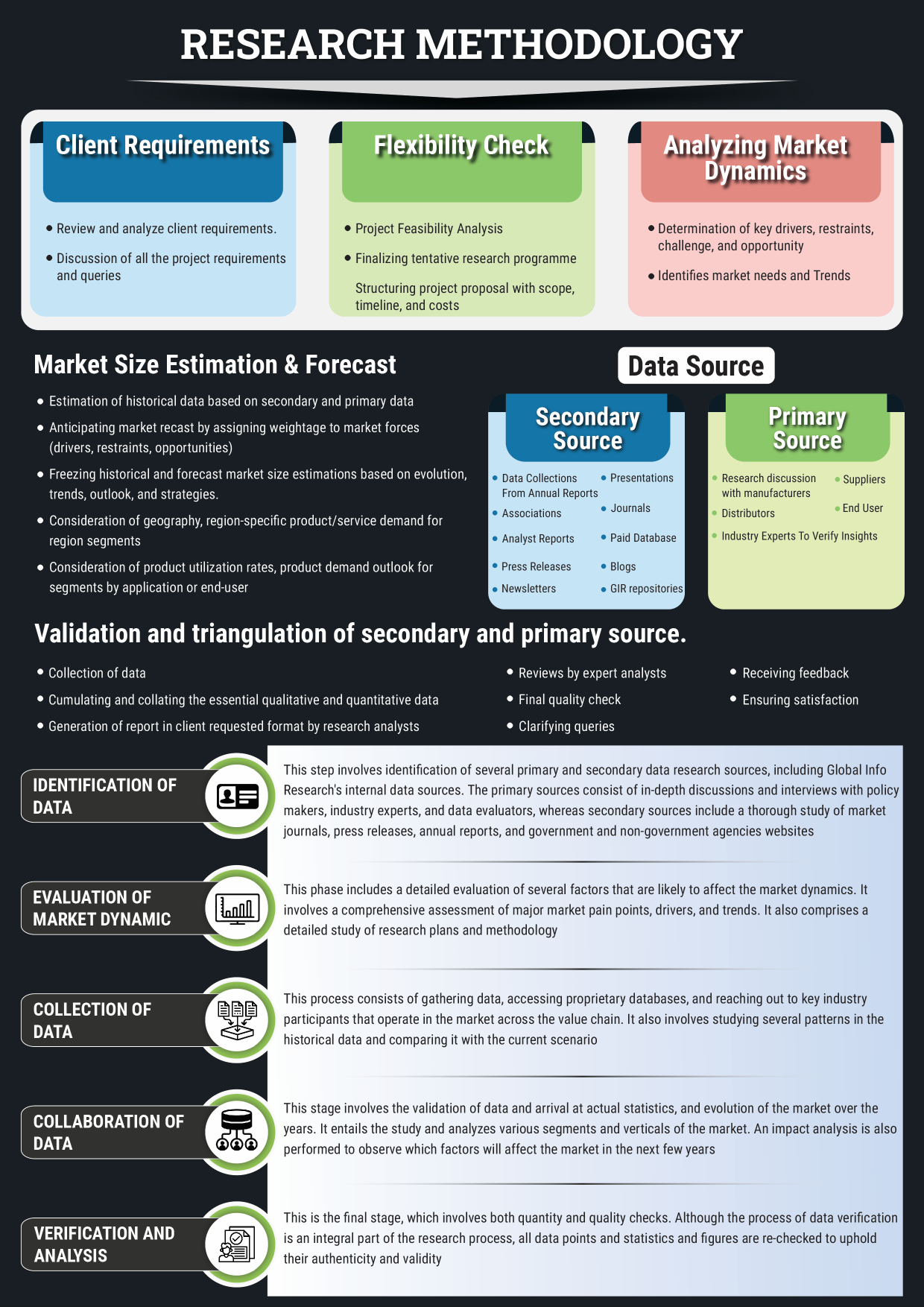

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Region (2024-2029) & (USD Million)

Table 5. Fresenius Company Information, Head Office, and Major Competitors

Table 6. Fresenius Major Business

Table 7. Fresenius Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 8. Fresenius Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. Fresenius Recent Developments and Future Plans

Table 10. DaVita Company Information, Head Office, and Major Competitors

Table 11. DaVita Major Business

Table 12. DaVita Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 13. DaVita Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. DaVita Recent Developments and Future Plans

Table 15. Baxter Company Information, Head Office, and Major Competitors

Table 16. Baxter Major Business

Table 17. Baxter Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 18. Baxter Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. Baxter Recent Developments and Future Plans

Table 20. US rental care Company Information, Head Office, and Major Competitors

Table 21. US rental care Major Business

Table 22. US rental care Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 23. US rental care Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. US rental care Recent Developments and Future Plans

Table 25. B.Braun Company Information, Head Office, and Major Competitors

Table 26. B.Braun Major Business

Table 27. B.Braun Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 28. B.Braun Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. B.Braun Recent Developments and Future Plans

Table 30. Diaverum Company Information, Head Office, and Major Competitors

Table 31. Diaverum Major Business

Table 32. Diaverum Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 33. Diaverum Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Diaverum Recent Developments and Future Plans

Table 35. Nipro Company Information, Head Office, and Major Competitors

Table 36. Nipro Major Business

Table 37. Nipro Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 38. Nipro Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Nipro Recent Developments and Future Plans

Table 40. Asahi Kasei Company Information, Head Office, and Major Competitors

Table 41. Asahi Kasei Major Business

Table 42. Asahi Kasei Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 43. Asahi Kasei Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. Asahi Kasei Recent Developments and Future Plans

Table 45. Nikkiso Company Information, Head Office, and Major Competitors

Table 46. Nikkiso Major Business

Table 47. Nikkiso Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 48. Nikkiso Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. Nikkiso Recent Developments and Future Plans

Table 50. Toray Company Information, Head Office, and Major Competitors

Table 51. Toray Major Business

Table 52. Toray Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 53. Toray Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. Toray Recent Developments and Future Plans

Table 55. WEGO Company Information, Head Office, and Major Competitors

Table 56. WEGO Major Business

Table 57. WEGO Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 58. WEGO Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 59. WEGO Recent Developments and Future Plans

Table 60. JMS Company Information, Head Office, and Major Competitors

Table 61. JMS Major Business

Table 62. JMS Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 63. JMS Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 64. JMS Recent Developments and Future Plans

Table 65. Medtronic Company Information, Head Office, and Major Competitors

Table 66. Medtronic Major Business

Table 67. Medtronic Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 68. Medtronic Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 69. Medtronic Recent Developments and Future Plans

Table 70. Rockwell Medical Company Information, Head Office, and Major Competitors

Table 71. Rockwell Medical Major Business

Table 72. Rockwell Medical Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 73. Rockwell Medical Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 74. Rockwell Medical Recent Developments and Future Plans

Table 75. SWS Hemodialysis Care Company Information, Head Office, and Major Competitors

Table 76. SWS Hemodialysis Care Major Business

Table 77. SWS Hemodialysis Care Hemodialysis and Peritoneal Dialysis Product and Solutions

Table 78. SWS Hemodialysis Care Hemodialysis and Peritoneal Dialysis Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 79. SWS Hemodialysis Care Recent Developments and Future Plans

Table 80. Global Hemodialysis and Peritoneal Dialysis Revenue (USD Million) by Players (2018-2023)

Table 81. Global Hemodialysis and Peritoneal Dialysis Revenue Share by Players (2018-2023)

Table 82. Breakdown of Hemodialysis and Peritoneal Dialysis by Company Type (Tier 1, Tier 2, and Tier 3)

Table 83. Market Position of Players in Hemodialysis and Peritoneal Dialysis, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 84. Head Office of Key Hemodialysis and Peritoneal Dialysis Players

Table 85. Hemodialysis and Peritoneal Dialysis Market: Company Product Type Footprint

Table 86. Hemodialysis and Peritoneal Dialysis Market: Company Product Application Footprint

Table 87. Hemodialysis and Peritoneal Dialysis New Market Entrants and Barriers to Market Entry

Table 88. Hemodialysis and Peritoneal Dialysis Mergers, Acquisition, Agreements, and Collaborations

Table 89. Global Hemodialysis and Peritoneal Dialysis Consumption Value (USD Million) by Type (2018-2023)

Table 90. Global Hemodialysis and Peritoneal Dialysis Consumption Value Share by Type (2018-2023)

Table 91. Global Hemodialysis and Peritoneal Dialysis Consumption Value Forecast by Type (2024-2029)

Table 92. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2023)

Table 93. Global Hemodialysis and Peritoneal Dialysis Consumption Value Forecast by Application (2024-2029)

Table 94. North America Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2023) & (USD Million)

Table 95. North America Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2024-2029) & (USD Million)

Table 96. North America Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2023) & (USD Million)

Table 97. North America Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2024-2029) & (USD Million)

Table 98. North America Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2023) & (USD Million)

Table 99. North America Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2024-2029) & (USD Million)

Table 100. Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2023) & (USD Million)

Table 101. Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2024-2029) & (USD Million)

Table 102. Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2023) & (USD Million)

Table 103. Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2024-2029) & (USD Million)

Table 104. Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2023) & (USD Million)

Table 105. Europe Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2024-2029) & (USD Million)

Table 106. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2023) & (USD Million)

Table 107. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2024-2029) & (USD Million)

Table 108. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2023) & (USD Million)

Table 109. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2024-2029) & (USD Million)

Table 110. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Region (2018-2023) & (USD Million)

Table 111. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value by Region (2024-2029) & (USD Million)

Table 112. South America Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2023) & (USD Million)

Table 113. South America Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2024-2029) & (USD Million)

Table 114. South America Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2023) & (USD Million)

Table 115. South America Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2024-2029) & (USD Million)

Table 116. South America Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2023) & (USD Million)

Table 117. South America Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2024-2029) & (USD Million)

Table 118. Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2018-2023) & (USD Million)

Table 119. Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Type (2024-2029) & (USD Million)

Table 120. Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2018-2023) & (USD Million)

Table 121. Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Application (2024-2029) & (USD Million)

Table 122. Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2018-2023) & (USD Million)

Table 123. Middle East & Africa Hemodialysis and Peritoneal Dialysis Consumption Value by Country (2024-2029) & (USD Million)

Table 124. Hemodialysis and Peritoneal Dialysis Raw Material

Table 125. Key Suppliers of Hemodialysis and Peritoneal Dialysis Raw Materials

List of Figures

Figure 1. Hemodialysis and Peritoneal Dialysis Picture

Figure 2. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type in 2022

Figure 4. Service

Figure 5. Device

Figure 6. Consumables

Figure 7. Global Hemodialysis and Peritoneal Dialysis Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 8. Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application in 2022

Figure 9. Hospital Picture

Figure 10. Dialysis Centers Picture

Figure 11. Other Picture

Figure 12. Global Hemodialysis and Peritoneal Dialysis Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 13. Global Hemodialysis and Peritoneal Dialysis Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 14. Global Market Hemodialysis and Peritoneal Dialysis Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 15. Global Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Region (2018-2029)

Figure 16. Global Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Region in 2022

Figure 17. North America Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 18. Europe Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 19. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 20. South America Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 21. Middle East and Africa Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 22. Global Hemodialysis and Peritoneal Dialysis Revenue Share by Players in 2022

Figure 23. Hemodialysis and Peritoneal Dialysis Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 24. Global Top 3 Players Hemodialysis and Peritoneal Dialysis Market Share in 2022

Figure 25. Global Top 6 Players Hemodialysis and Peritoneal Dialysis Market Share in 2022

Figure 26. Global Hemodialysis and Peritoneal Dialysis Consumption Value Share by Type (2018-2023)

Figure 27. Global Hemodialysis and Peritoneal Dialysis Market Share Forecast by Type (2024-2029)

Figure 28. Global Hemodialysis and Peritoneal Dialysis Consumption Value Share by Application (2018-2023)

Figure 29. Global Hemodialysis and Peritoneal Dialysis Market Share Forecast by Application (2024-2029)

Figure 30. North America Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type (2018-2029)

Figure 31. North America Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application (2018-2029)

Figure 32. North America Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Country (2018-2029)

Figure 33. United States Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 34. Canada Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 35. Mexico Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 36. Europe Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type (2018-2029)

Figure 37. Europe Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application (2018-2029)

Figure 38. Europe Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Country (2018-2029)

Figure 39. Germany Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 40. France Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 41. United Kingdom Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 42. Russia Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 43. Italy Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 44. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type (2018-2029)

Figure 45. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application (2018-2029)

Figure 46. Asia-Pacific Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Region (2018-2029)

Figure 47. China Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 48. Japan Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 49. South Korea Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 50. India Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 51. Southeast Asia Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 52. Australia Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 53. South America Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type (2018-2029)

Figure 54. South America Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application (2018-2029)

Figure 55. South America Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Country (2018-2029)

Figure 56. Brazil Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 57. Argentina Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 58. Middle East and Africa Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Type (2018-2029)

Figure 59. Middle East and Africa Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Application (2018-2029)

Figure 60. Middle East and Africa Hemodialysis and Peritoneal Dialysis Consumption Value Market Share by Country (2018-2029)

Figure 61. Turkey Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 62. Saudi Arabia Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 63. UAE Hemodialysis and Peritoneal Dialysis Consumption Value (2018-2029) & (USD Million)

Figure 64. Hemodialysis and Peritoneal Dialysis Market Drivers

Figure 65. Hemodialysis and Peritoneal Dialysis Market Restraints

Figure 66. Hemodialysis and Peritoneal Dialysis Market Trends

Figure 67. Porters Five Forces Analysis

Figure 68. Manufacturing Cost Structure Analysis of Hemodialysis and Peritoneal Dialysis in 2022

Figure 69. Manufacturing Process Analysis of Hemodialysis and Peritoneal Dialysis

Figure 70. Hemodialysis and Peritoneal Dialysis Industrial Chain

Figure 71. Methodology

Figure 72. Research Process and Data Source