Over 50 years of studies in the field of blood-forming stem cells i.e. hematopoietic stem cells (HSC), researchers have developed significant understanding to use HSCs as a therapy. At present, no type of stem cell, adult, embryonic or fetal has attained such sufficient status. Hematopoietic stem cell transplantation (HSCT) is now routinely used for treating patients with malignant and non-malignant disorders of blood and the immune system. Currently, researchers have observed that through animal studies HSCs have the ability to form other cells such as blood vessels, muscles, and bone.

Market competition is intense. CBR Systems, China Cord Blood Corporation, ViaCord, Thermo Fisher Scientific, STEMCELL Technologies etc. are the leaders of the industry, and they hold key technologies and patents, with high-end customers; with the development of society and the changing of consumer demand, there will be more companies enter this industry. Top 5 players accounted for about 32.09% market share.

This report is a detailed and comprehensive analysis for global Hematopoietic Stem Cells Transplantation market. Both quantitative and qualitative analyses are presented by company, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Hematopoietic Stem Cells Transplantation market size and forecasts, in consumption value ($ Million), 2018-2029

Global Hematopoietic Stem Cells Transplantation market size and forecasts by region and country, in consumption value ($ Million), 2018-2029

Global Hematopoietic Stem Cells Transplantation market size and forecasts, by Type and by Application, in consumption value ($ Million), 2018-2029

Global Hematopoietic Stem Cells Transplantation market shares of main players, in revenue ($ Million), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Hematopoietic Stem Cells Transplantation

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Hematopoietic Stem Cells Transplantation market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

CBR Systems

China Cord Blood Corporation

ViaCord

Thermo Fisher Scientific

STEMCELL Technologies

Vcanbio

Merck Millipore

Lonza Group

CellGenix Technologie Transfer

ThermoGenesis

Segmentation By Type

Stem Cells Storage

Stem Cells Consumables

Segmentation By Application

Leukemia

Lymphoproliferative Disorders

Solid Tumors

Non-Malignant Disorders

Segmentation By Region

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia and Rest of Asia-Pacific)

South America (Brazil, Argentina and Rest of South America)

Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Hematopoietic Stem Cells Transplantation Market in 2025?

Advancements in stem cell research and technology are enhancing the success rates of hematopoietic stem cell transplants, creating strong growth opportunities in the market. The increasing number of chronic diseases, cancers, and genetic disorders requiring these treatments also supports market growth.

What are the weaknesses of the Hematopoietic Stem Cells Transplantation Market in 2025?

High treatment costs and the need for specialized healthcare infrastructure can limit the accessibility of hematopoietic stem cell transplants, particularly in low-resource regions. Additionally, there are challenges related to patient recruitment and the risk of transplant rejection.

What are the opportunities in the Hematopoietic Stem Cells Transplantation Market in 2025?

The market can expand with the development of improved stem cell therapies, better patient management techniques, and advances in personalized medicine. Emerging markets, such as Asia-Pacific, present significant growth opportunities as healthcare systems improve and awareness of these treatments increases.

What are the threats to the Hematopoietic Stem Cells Transplantation Market in 2025?

Regulatory hurdles, ethical concerns regarding stem cell sourcing, and competition from alternative therapies like gene editing and immunotherapy could potentially pose threats. Furthermore, the market may face challenges from insufficient donor availability and complications in patient compatibility.

Market PESTEL Analysis

What are the political factors influencing the Hematopoietic Stem Cells Transplantation Market in 2025?

Government policies and regulations related to healthcare funding, stem cell research, and medical procedures significantly impact the market. Political stability and support for medical innovation are crucial for the growth of hematopoietic stem cell transplantation programs.

What are the economic factors affecting the Hematopoietic Stem Cells Transplantation Market in 2025?

Economic conditions such as healthcare budgets, insurance coverage, and the affordability of advanced medical procedures play a key role. In developed markets, higher disposable incomes may support access to these treatments, while in emerging markets, cost barriers may limit growth.

What are the social factors influencing the Hematopoietic Stem Cells Transplantation Market in 2025?

Increasing awareness of stem cell therapies and their benefits, along with a rising prevalence of chronic diseases and cancers, creates higher demand for these treatments. However, social acceptance of stem cell-based therapies may vary by region due to cultural or ethical concerns.

What are the technological factors impacting the Hematopoietic Stem Cells Transplantation Market in 2025?

Advances in stem cell research, gene editing, and transplant technologies are likely to drive innovation and improve the success rates of transplants. Emerging technologies such as artificial intelligence and personalized medicine are also enhancing patient outcomes and efficiency.

What are the environmental factors affecting the Hematopoietic Stem Cells Transplantation Market in 2025?

Environmental sustainability concerns regarding stem cell sourcing, particularly from non-renewable resources, may influence ethical debates around transplantation practices. Regulations related to sustainable healthcare practices could also affect the market’s development.

What are the legal factors influencing the Hematopoietic Stem Cells Transplantation Market in 2025?

The legal landscape surrounding stem cell research, including intellectual property rights, clinical trials, and medical regulations, is crucial. Countries with clear and supportive regulations will likely see faster market growth, while stringent laws may limit expansion in certain regions.

Market SIPOC Analysis

What are the suppliers in the Hematopoietic Stem Cells Transplantation Market in 2025?

Suppliers include stem cell banks, healthcare providers, research institutions, pharmaceutical companies involved in cell therapies, and medical equipment manufacturers that provide the necessary tools for transplantation procedures.

What are the inputs in the Hematopoietic Stem Cells Transplantation Market in 2025?

The key inputs include hematopoietic stem cells (either autologous or allogeneic), donor matching data, medical supplies (e.g., immunosuppressive drugs), skilled healthcare professionals, and advanced medical technologies for transplant procedures.

What are the processes in the Hematopoietic Stem Cells Transplantation Market in 2025?

Processes involve patient assessment and donor matching, collection of stem cells, conditioning treatments (e.g., chemotherapy or radiation), transplantation of stem cells, post-transplant care, and monitoring of recovery and immune response.

What are the outputs in the Hematopoietic Stem Cells Transplantation Market in 2025?

Outputs include successful hematopoietic stem cell transplants, improved patient outcomes, long-term recovery of blood and immune function, and research data on transplant efficacy and new treatments.

What are the customers in the Hematopoietic Stem Cells Transplantation Market in 2025?

Customers include hospitals, transplant centers, healthcare providers, patients with hematologic diseases (e.g., leukemia, lymphoma), and healthcare insurance providers covering transplant procedures.

Market Porter's Five Forces

What is the threat of new entrants in the Hematopoietic Stem Cells Transplantation Market in 2025?

The threat of new entrants is moderate. While the market requires significant expertise, advanced technology, and regulatory compliance, the rising demand for stem cell therapies and the potential for innovation in treatment options may encourage new companies to enter the market.

What is the bargaining power of suppliers in the Hematopoietic Stem Cells Transplantation Market in 2025?

The bargaining power of suppliers is high. Stem cell suppliers, especially those providing unique and rare cell types, hold significant leverage as their products are critical to successful transplantation. Additionally, specialized equipment and technologies are essential to the process.

What is the bargaining power of buyers in the Hematopoietic Stem Cells Transplantation Market in 2025?

The bargaining power of buyers is moderate to low. While patients and healthcare providers demand high-quality treatments, the specialized nature of the procedures and limited availability of suitable stem cells reduce the ability of buyers to negotiate prices significantly.

What is the threat of substitute products or services in the Hematopoietic Stem Cells Transplantation Market in 2025?

The threat of substitutes is moderate. Alternative treatments such as gene therapy, immunotherapy, and targeted drug therapies offer potential options for certain conditions, but hematopoietic stem cell transplantation remains a critical solution for a variety of blood disorders and cancers.

What is the intensity of competitive rivalry in the Hematopoietic Stem Cells Transplantation Market in 2025?

The intensity of competitive rivalry is high. Numerous established hospitals, research institutions, and pharmaceutical companies are actively involved in hematopoietic stem cell therapies, and competition is strong for both research advancements and patient outcomes in this specialized field.

Market Upstream Analysis

What are the key suppliers in the Hematopoietic Stem Cells Transplantation Market in 2025?

Key suppliers include stem cell banks, biotechnology companies involved in stem cell processing, pharmaceutical companies providing immunosuppressive drugs, and medical equipment manufacturers who supply devices necessary for collection, transplantation, and post-procedure care.

What are the essential raw materials or inputs in the Hematopoietic Stem Cells Transplantation Market in 2025?

The essential inputs include hematopoietic stem cells (autologous or allogeneic), donor matching technologies, cell preservation solutions, immunosuppressive drugs, medical equipment for transplantation, and reagents for cell processing and analysis.

What are the challenges in the upstream part of the Hematopoietic Stem Cells Transplantation Market in 2025?

Challenges include sourcing compatible and healthy stem cells, ensuring quality control in stem cell preparation, the high cost of stem cell collection and processing, and regulatory hurdles related to stem cell sourcing, including ethical considerations.

What is the role of research and development in the upstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Research and development play a crucial role in advancing stem cell therapy techniques, improving stem cell collection and preservation methods, and developing novel drugs for post-transplant care, helping to improve patient outcomes and increase the success rates of procedures.

What are the regulatory and ethical considerations in the upstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Regulations around stem cell sourcing, especially the use of human embryos, genetic modifications, and clinical trials, are critical. Ethical concerns, including donor consent and the use of stem cells from diverse sources, influence the availability and cost of stem cells for transplants.

Market Midstream Analysis

What are the key players in the midstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Key players include hospitals, transplant centers, stem cell processing facilities, and medical professionals (such as hematologists and transplant specialists) who manage the collection, processing, and transplantation of hematopoietic stem cells.

What are the critical processes in the midstream part of the Hematopoietic Stem Cells Transplantation Market in 2025?

Critical processes include the collection of stem cells from donors, processing and matching stem cells with patients, preparing patients with conditioning treatments, performing the transplant procedure, and providing immediate post-transplant care and monitoring.

What are the challenges faced by the midstream segment in the Hematopoietic Stem Cells Transplantation Market in 2025?

Challenges include maintaining high standards of stem cell processing to ensure quality and compatibility, managing patient safety during transplantation, overcoming complications such as graft-versus-host disease, and ensuring proper healthcare infrastructure to handle complex procedures.

What technological advancements are impacting the midstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Technological advancements like improved stem cell processing and cryopreservation methods, better matching algorithms, and enhanced monitoring systems for patient recovery are helping to improve the efficiency and success of transplants.

How do healthcare providers collaborate in the midstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Healthcare providers collaborate through integrated networks of transplant centers, stem cell banks, and research institutions to ensure a seamless process for patient evaluation, donor matching, transplant procedures, and follow-up care, often sharing patient data to optimize outcomes.

Market Downstream Analysis

What are the key customers in the downstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Key customers include patients with blood disorders, cancer, or genetic conditions, hospitals and transplant centers offering specialized care, healthcare providers and insurance companies managing patient treatments, and research institutions conducting post-transplant studies.

What are the major services offered in the downstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Services include post-transplant care and monitoring, management of transplant-related complications, long-term follow-up for patient recovery and immune system restoration, and personalized rehabilitation to enhance overall health after the procedure.

What are the challenges faced by the downstream segment in the Hematopoietic Stem Cells Transplantation Market in 2025?

Challenges include ensuring long-term patient survival, managing transplant rejection, preventing complications such as graft-versus-host disease, maintaining high-quality follow-up care, and dealing with the emotional and psychological effects of long-term treatment.

How is patient care evolving in the downstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Patient care is evolving with a focus on personalized post-transplant treatments, improved immune modulation, better patient education on recovery, and telemedicine solutions for ongoing monitoring and support, ensuring better long-term health outcomes.

What are the market dynamics influencing customer demand in the downstream segment of the Hematopoietic Stem Cells Transplantation Market in 2025?

Customer demand is influenced by the increasing prevalence of hematologic diseases, advances in transplant success rates, the growing availability of specialized healthcare services, and increasing awareness of stem cell therapies as an effective treatment option.

Chapter 1, to describe Hematopoietic Stem Cells Transplantation product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top players of Hematopoietic Stem Cells Transplantation, with revenue, gross margin and global market share of Hematopoietic Stem Cells Transplantation from 2018 to 2023.

Chapter 3, the Hematopoietic Stem Cells Transplantation competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast.

Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2018 to 2029.

Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2018 to 2023.and Hematopoietic Stem Cells Transplantation market forecast, by regions, type and application, with consumption value, from 2024 to 2029.

Chapter 11, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War

Chapter 12, the key raw materials and key suppliers, and industry chain of Hematopoietic Stem Cells Transplantation.

Chapter 13, to describe Hematopoietic Stem Cells Transplantation research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Hematopoietic Stem Cells Transplantation

1.2 Market Estimation Caveats and Base Year

1.3 Classification of Hematopoietic Stem Cells Transplantation by Type

1.3.1 Overview: Global Hematopoietic Stem Cells Transplantation Market Size by Type: 2018 Versus 2022 Versus 2029

1.3.2 Global Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type in 2022

1.3.3 Stem Cells Storage

1.3.4 Stem Cells Consumables

1.4 Global Hematopoietic Stem Cells Transplantation Market by Application

1.4.1 Overview: Global Hematopoietic Stem Cells Transplantation Market Size by Application: 2018 Versus 2022 Versus 2029

1.4.2 Leukemia

1.4.3 Lymphoproliferative Disorders

1.4.4 Solid Tumors

1.4.5 Non-Malignant Disorders

1.5 Global Hematopoietic Stem Cells Transplantation Market Size & Forecast

1.6 Global Hematopoietic Stem Cells Transplantation Market Size and Forecast by Region

1.6.1 Global Hematopoietic Stem Cells Transplantation Market Size by Region: 2018 VS 2022 VS 2029

1.6.2 Global Hematopoietic Stem Cells Transplantation Market Size by Region, (2018-2029)

1.6.3 North America Hematopoietic Stem Cells Transplantation Market Size and Prospect (2018-2029)

1.6.4 Europe Hematopoietic Stem Cells Transplantation Market Size and Prospect (2018-2029)

1.6.5 Asia-Pacific Hematopoietic Stem Cells Transplantation Market Size and Prospect (2018-2029)

1.6.6 South America Hematopoietic Stem Cells Transplantation Market Size and Prospect (2018-2029)

1.6.7 Middle East and Africa Hematopoietic Stem Cells Transplantation Market Size and Prospect (2018-2029)

2 Company Profiles

2.1 CBR Systems

2.1.1 CBR Systems Details

2.1.2 CBR Systems Major Business

2.1.3 CBR Systems Hematopoietic Stem Cells Transplantation Product and Solutions

2.1.4 CBR Systems Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 CBR Systems Recent Developments and Future Plans

2.2 China Cord Blood Corporation

2.2.1 China Cord Blood Corporation Details

2.2.2 China Cord Blood Corporation Major Business

2.2.3 China Cord Blood Corporation Hematopoietic Stem Cells Transplantation Product and Solutions

2.2.4 China Cord Blood Corporation Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 China Cord Blood Corporation Recent Developments and Future Plans

2.3 ViaCord

2.3.1 ViaCord Details

2.3.2 ViaCord Major Business

2.3.3 ViaCord Hematopoietic Stem Cells Transplantation Product and Solutions

2.3.4 ViaCord Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 ViaCord Recent Developments and Future Plans

2.4 Thermo Fisher Scientific

2.4.1 Thermo Fisher Scientific Details

2.4.2 Thermo Fisher Scientific Major Business

2.4.3 Thermo Fisher Scientific Hematopoietic Stem Cells Transplantation Product and Solutions

2.4.4 Thermo Fisher Scientific Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Thermo Fisher Scientific Recent Developments and Future Plans

2.5 STEMCELL Technologies

2.5.1 STEMCELL Technologies Details

2.5.2 STEMCELL Technologies Major Business

2.5.3 STEMCELL Technologies Hematopoietic Stem Cells Transplantation Product and Solutions

2.5.4 STEMCELL Technologies Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 STEMCELL Technologies Recent Developments and Future Plans

2.6 Vcanbio

2.6.1 Vcanbio Details

2.6.2 Vcanbio Major Business

2.6.3 Vcanbio Hematopoietic Stem Cells Transplantation Product and Solutions

2.6.4 Vcanbio Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Vcanbio Recent Developments and Future Plans

2.7 Merck Millipore

2.7.1 Merck Millipore Details

2.7.2 Merck Millipore Major Business

2.7.3 Merck Millipore Hematopoietic Stem Cells Transplantation Product and Solutions

2.7.4 Merck Millipore Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Merck Millipore Recent Developments and Future Plans

2.8 Lonza Group

2.8.1 Lonza Group Details

2.8.2 Lonza Group Major Business

2.8.3 Lonza Group Hematopoietic Stem Cells Transplantation Product and Solutions

2.8.4 Lonza Group Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Lonza Group Recent Developments and Future Plans

2.9 CellGenix Technologie Transfer

2.9.1 CellGenix Technologie Transfer Details

2.9.2 CellGenix Technologie Transfer Major Business

2.9.3 CellGenix Technologie Transfer Hematopoietic Stem Cells Transplantation Product and Solutions

2.9.4 CellGenix Technologie Transfer Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 CellGenix Technologie Transfer Recent Developments and Future Plans

2.10 ThermoGenesis

2.10.1 ThermoGenesis Details

2.10.2 ThermoGenesis Major Business

2.10.3 ThermoGenesis Hematopoietic Stem Cells Transplantation Product and Solutions

2.10.4 ThermoGenesis Hematopoietic Stem Cells Transplantation Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 ThermoGenesis Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Hematopoietic Stem Cells Transplantation Revenue and Share by Players (2018-2023)

3.2 Market Share Analysis (2022)

3.2.1 Market Share of Hematopoietic Stem Cells Transplantation by Company Revenue

3.2.2 Top 3 Hematopoietic Stem Cells Transplantation Players Market Share in 2022

3.2.3 Top 6 Hematopoietic Stem Cells Transplantation Players Market Share in 2022

3.3 Hematopoietic Stem Cells Transplantation Market: Overall Company Footprint Analysis

3.3.1 Hematopoietic Stem Cells Transplantation Market: Region Footprint

3.3.2 Hematopoietic Stem Cells Transplantation Market: Company Product Type Footprint

3.3.3 Hematopoietic Stem Cells Transplantation Market: Company Product Application Footprint

3.4 New Market Entrants and Barriers to Market Entry

3.5 Mergers, Acquisition, Agreements, and Collaborations

4 Market Size Segment by Type

4.1 Global Hematopoietic Stem Cells Transplantation Consumption Value and Market Share by Type (2018-2023)

4.2 Global Hematopoietic Stem Cells Transplantation Market Forecast by Type (2024-2029)

5 Market Size Segment by Application

5.1 Global Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application (2018-2023)

5.2 Global Hematopoietic Stem Cells Transplantation Market Forecast by Application (2024-2029)

6 North America

6.1 North America Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2029)

6.2 North America Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2029)

6.3 North America Hematopoietic Stem Cells Transplantation Market Size by Country

6.3.1 North America Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2029)

6.3.2 United States Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

6.3.3 Canada Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

6.3.4 Mexico Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

7 Europe

7.1 Europe Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2029)

7.2 Europe Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2029)

7.3 Europe Hematopoietic Stem Cells Transplantation Market Size by Country

7.3.1 Europe Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2029)

7.3.2 Germany Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

7.3.3 France Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

7.3.4 United Kingdom Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

7.3.5 Russia Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

7.3.6 Italy Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

8 Asia-Pacific

8.1 Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2029)

8.2 Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2029)

8.3 Asia-Pacific Hematopoietic Stem Cells Transplantation Market Size by Region

8.3.1 Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Region (2018-2029)

8.3.2 China Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

8.3.3 Japan Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

8.3.4 South Korea Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

8.3.5 India Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

8.3.6 Southeast Asia Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

8.3.7 Australia Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

9 South America

9.1 South America Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2029)

9.2 South America Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2029)

9.3 South America Hematopoietic Stem Cells Transplantation Market Size by Country

9.3.1 South America Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2029)

9.3.2 Brazil Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

9.3.3 Argentina Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

10 Middle East & Africa

10.1 Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2029)

10.2 Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2029)

10.3 Middle East & Africa Hematopoietic Stem Cells Transplantation Market Size by Country

10.3.1 Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2029)

10.3.2 Turkey Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

10.3.3 Saudi Arabia Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

10.3.4 UAE Hematopoietic Stem Cells Transplantation Market Size and Forecast (2018-2029)

11 Market Dynamics

11.1 Hematopoietic Stem Cells Transplantation Market Drivers

11.2 Hematopoietic Stem Cells Transplantation Market Restraints

11.3 Hematopoietic Stem Cells Transplantation Trends Analysis

11.4 Porters Five Forces Analysis

11.4.1 Threat of New Entrants

11.4.2 Bargaining Power of Suppliers

11.4.3 Bargaining Power of Buyers

11.4.4 Threat of Substitutes

11.4.5 Competitive Rivalry

11.5 Influence of COVID-19 and Russia-Ukraine War

11.5.1 Influence of COVID-19

11.5.2 Influence of Russia-Ukraine War

12 Industry Chain Analysis

12.1 Hematopoietic Stem Cells Transplantation Industry Chain

12.2 Hematopoietic Stem Cells Transplantation Upstream Analysis

12.3 Hematopoietic Stem Cells Transplantation Midstream Analysis

12.4 Hematopoietic Stem Cells Transplantation Downstream Analysis

13 Research Findings and Conclusion

14 Appendix

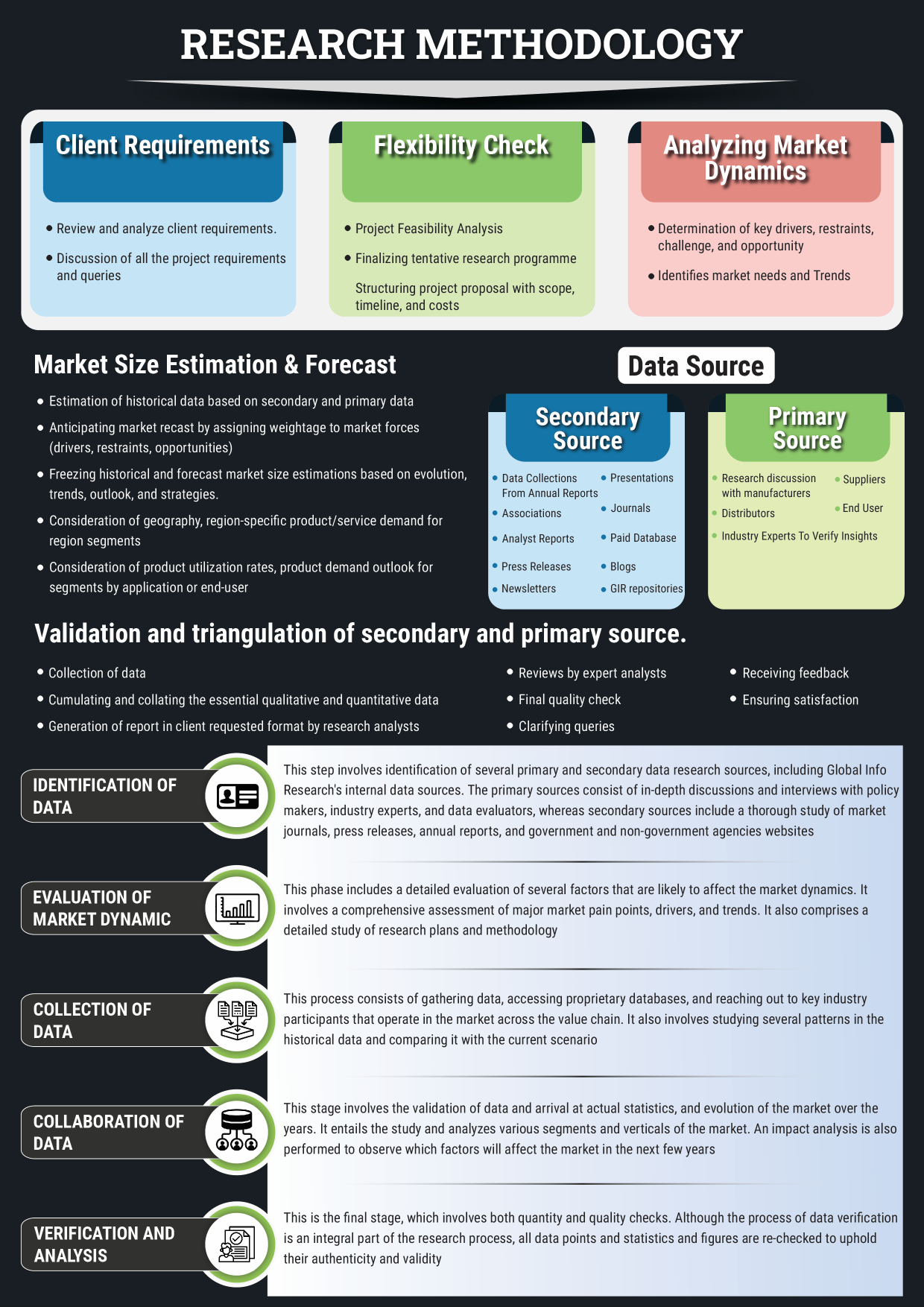

14.1 Methodology

14.2 Research Process and Data Source

14.3 Disclaimer

List of Tables

Table 1. Global Hematopoietic Stem Cells Transplantation Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Hematopoietic Stem Cells Transplantation Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Global Hematopoietic Stem Cells Transplantation Consumption Value by Region (2018-2023) & (USD Million)

Table 4. Global Hematopoietic Stem Cells Transplantation Consumption Value by Region (2024-2029) & (USD Million)

Table 5. CBR Systems Company Information, Head Office, and Major Competitors

Table 6. CBR Systems Major Business

Table 7. CBR Systems Hematopoietic Stem Cells Transplantation Product and Solutions

Table 8. CBR Systems Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 9. CBR Systems Recent Developments and Future Plans

Table 10. China Cord Blood Corporation Company Information, Head Office, and Major Competitors

Table 11. China Cord Blood Corporation Major Business

Table 12. China Cord Blood Corporation Hematopoietic Stem Cells Transplantation Product and Solutions

Table 13. China Cord Blood Corporation Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 14. China Cord Blood Corporation Recent Developments and Future Plans

Table 15. ViaCord Company Information, Head Office, and Major Competitors

Table 16. ViaCord Major Business

Table 17. ViaCord Hematopoietic Stem Cells Transplantation Product and Solutions

Table 18. ViaCord Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 19. ViaCord Recent Developments and Future Plans

Table 20. Thermo Fisher Scientific Company Information, Head Office, and Major Competitors

Table 21. Thermo Fisher Scientific Major Business

Table 22. Thermo Fisher Scientific Hematopoietic Stem Cells Transplantation Product and Solutions

Table 23. Thermo Fisher Scientific Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 24. Thermo Fisher Scientific Recent Developments and Future Plans

Table 25. STEMCELL Technologies Company Information, Head Office, and Major Competitors

Table 26. STEMCELL Technologies Major Business

Table 27. STEMCELL Technologies Hematopoietic Stem Cells Transplantation Product and Solutions

Table 28. STEMCELL Technologies Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 29. STEMCELL Technologies Recent Developments and Future Plans

Table 30. Vcanbio Company Information, Head Office, and Major Competitors

Table 31. Vcanbio Major Business

Table 32. Vcanbio Hematopoietic Stem Cells Transplantation Product and Solutions

Table 33. Vcanbio Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 34. Vcanbio Recent Developments and Future Plans

Table 35. Merck Millipore Company Information, Head Office, and Major Competitors

Table 36. Merck Millipore Major Business

Table 37. Merck Millipore Hematopoietic Stem Cells Transplantation Product and Solutions

Table 38. Merck Millipore Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 39. Merck Millipore Recent Developments and Future Plans

Table 40. Lonza Group Company Information, Head Office, and Major Competitors

Table 41. Lonza Group Major Business

Table 42. Lonza Group Hematopoietic Stem Cells Transplantation Product and Solutions

Table 43. Lonza Group Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 44. Lonza Group Recent Developments and Future Plans

Table 45. CellGenix Technologie Transfer Company Information, Head Office, and Major Competitors

Table 46. CellGenix Technologie Transfer Major Business

Table 47. CellGenix Technologie Transfer Hematopoietic Stem Cells Transplantation Product and Solutions

Table 48. CellGenix Technologie Transfer Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 49. CellGenix Technologie Transfer Recent Developments and Future Plans

Table 50. ThermoGenesis Company Information, Head Office, and Major Competitors

Table 51. ThermoGenesis Major Business

Table 52. ThermoGenesis Hematopoietic Stem Cells Transplantation Product and Solutions

Table 53. ThermoGenesis Hematopoietic Stem Cells Transplantation Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 54. ThermoGenesis Recent Developments and Future Plans

Table 55. Global Hematopoietic Stem Cells Transplantation Revenue (USD Million) by Players (2018-2023)

Table 56. Global Hematopoietic Stem Cells Transplantation Revenue Share by Players (2018-2023)

Table 57. Breakdown of Hematopoietic Stem Cells Transplantation by Company Type (Tier 1, Tier 2, and Tier 3)

Table 58. Market Position of Players in Hematopoietic Stem Cells Transplantation, (Tier 1, Tier 2, and Tier 3), Based on Revenue in 2022

Table 59. Head Office of Key Hematopoietic Stem Cells Transplantation Players

Table 60. Hematopoietic Stem Cells Transplantation Market: Company Product Type Footprint

Table 61. Hematopoietic Stem Cells Transplantation Market: Company Product Application Footprint

Table 62. Hematopoietic Stem Cells Transplantation New Market Entrants and Barriers to Market Entry

Table 63. Hematopoietic Stem Cells Transplantation Mergers, Acquisition, Agreements, and Collaborations

Table 64. Global Hematopoietic Stem Cells Transplantation Consumption Value (USD Million) by Type (2018-2023)

Table 65. Global Hematopoietic Stem Cells Transplantation Consumption Value Share by Type (2018-2023)

Table 66. Global Hematopoietic Stem Cells Transplantation Consumption Value Forecast by Type (2024-2029)

Table 67. Global Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2023)

Table 68. Global Hematopoietic Stem Cells Transplantation Consumption Value Forecast by Application (2024-2029)

Table 69. North America Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2023) & (USD Million)

Table 70. North America Hematopoietic Stem Cells Transplantation Consumption Value by Type (2024-2029) & (USD Million)

Table 71. North America Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2023) & (USD Million)

Table 72. North America Hematopoietic Stem Cells Transplantation Consumption Value by Application (2024-2029) & (USD Million)

Table 73. North America Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2023) & (USD Million)

Table 74. North America Hematopoietic Stem Cells Transplantation Consumption Value by Country (2024-2029) & (USD Million)

Table 75. Europe Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2023) & (USD Million)

Table 76. Europe Hematopoietic Stem Cells Transplantation Consumption Value by Type (2024-2029) & (USD Million)

Table 77. Europe Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2023) & (USD Million)

Table 78. Europe Hematopoietic Stem Cells Transplantation Consumption Value by Application (2024-2029) & (USD Million)

Table 79. Europe Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2023) & (USD Million)

Table 80. Europe Hematopoietic Stem Cells Transplantation Consumption Value by Country (2024-2029) & (USD Million)

Table 81. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2023) & (USD Million)

Table 82. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Type (2024-2029) & (USD Million)

Table 83. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2023) & (USD Million)

Table 84. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Application (2024-2029) & (USD Million)

Table 85. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Region (2018-2023) & (USD Million)

Table 86. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value by Region (2024-2029) & (USD Million)

Table 87. South America Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2023) & (USD Million)

Table 88. South America Hematopoietic Stem Cells Transplantation Consumption Value by Type (2024-2029) & (USD Million)

Table 89. South America Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2023) & (USD Million)

Table 90. South America Hematopoietic Stem Cells Transplantation Consumption Value by Application (2024-2029) & (USD Million)

Table 91. South America Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2023) & (USD Million)

Table 92. South America Hematopoietic Stem Cells Transplantation Consumption Value by Country (2024-2029) & (USD Million)

Table 93. Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Type (2018-2023) & (USD Million)

Table 94. Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Type (2024-2029) & (USD Million)

Table 95. Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Application (2018-2023) & (USD Million)

Table 96. Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Application (2024-2029) & (USD Million)

Table 97. Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Country (2018-2023) & (USD Million)

Table 98. Middle East & Africa Hematopoietic Stem Cells Transplantation Consumption Value by Country (2024-2029) & (USD Million)

Table 99. Hematopoietic Stem Cells Transplantation Raw Material

Table 100. Key Suppliers of Hematopoietic Stem Cells Transplantation Raw Materials

List of Figures

Figure 1. Hematopoietic Stem Cells Transplantation Picture

Figure 2. Global Hematopoietic Stem Cells Transplantation Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type in 2022

Figure 4. Stem Cells Storage

Figure 5. Stem Cells Consumables

Figure 6. Global Hematopoietic Stem Cells Transplantation Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 7. Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application in 2022

Figure 8. Leukemia Picture

Figure 9. Lymphoproliferative Disorders Picture

Figure 10. Solid Tumors Picture

Figure 11. Non-Malignant Disorders Picture

Figure 12. Global Hematopoietic Stem Cells Transplantation Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 13. Global Hematopoietic Stem Cells Transplantation Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 14. Global Market Hematopoietic Stem Cells Transplantation Consumption Value (USD Million) Comparison by Region (2018 & 2022 & 2029)

Figure 15. Global Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Region (2018-2029)

Figure 16. Global Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Region in 2022

Figure 17. North America Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 18. Europe Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 19. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 20. South America Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 21. Middle East and Africa Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 22. Global Hematopoietic Stem Cells Transplantation Revenue Share by Players in 2022

Figure 23. Hematopoietic Stem Cells Transplantation Market Share by Company Type (Tier 1, Tier 2 and Tier 3) in 2022

Figure 24. Global Top 3 Players Hematopoietic Stem Cells Transplantation Market Share in 2022

Figure 25. Global Top 6 Players Hematopoietic Stem Cells Transplantation Market Share in 2022

Figure 26. Global Hematopoietic Stem Cells Transplantation Consumption Value Share by Type (2018-2023)

Figure 27. Global Hematopoietic Stem Cells Transplantation Market Share Forecast by Type (2024-2029)

Figure 28. Global Hematopoietic Stem Cells Transplantation Consumption Value Share by Application (2018-2023)

Figure 29. Global Hematopoietic Stem Cells Transplantation Market Share Forecast by Application (2024-2029)

Figure 30. North America Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type (2018-2029)

Figure 31. North America Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application (2018-2029)

Figure 32. North America Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Country (2018-2029)

Figure 33. United States Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 34. Canada Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 35. Mexico Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 36. Europe Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type (2018-2029)

Figure 37. Europe Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application (2018-2029)

Figure 38. Europe Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Country (2018-2029)

Figure 39. Germany Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 40. France Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 41. United Kingdom Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 42. Russia Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 43. Italy Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 44. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type (2018-2029)

Figure 45. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application (2018-2029)

Figure 46. Asia-Pacific Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Region (2018-2029)

Figure 47. China Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 48. Japan Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 49. South Korea Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 50. India Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 51. Southeast Asia Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 52. Australia Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 53. South America Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type (2018-2029)

Figure 54. South America Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application (2018-2029)

Figure 55. South America Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Country (2018-2029)

Figure 56. Brazil Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 57. Argentina Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 58. Middle East and Africa Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Type (2018-2029)

Figure 59. Middle East and Africa Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Application (2018-2029)

Figure 60. Middle East and Africa Hematopoietic Stem Cells Transplantation Consumption Value Market Share by Country (2018-2029)

Figure 61. Turkey Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 62. Saudi Arabia Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 63. UAE Hematopoietic Stem Cells Transplantation Consumption Value (2018-2029) & (USD Million)

Figure 64. Hematopoietic Stem Cells Transplantation Market Drivers

Figure 65. Hematopoietic Stem Cells Transplantation Market Restraints

Figure 66. Hematopoietic Stem Cells Transplantation Market Trends

Figure 67. Porters Five Forces Analysis

Figure 68. Manufacturing Cost Structure Analysis of Hematopoietic Stem Cells Transplantation in 2022

Figure 69. Manufacturing Process Analysis of Hematopoietic Stem Cells Transplantation

Figure 70. Hematopoietic Stem Cells Transplantation Industrial Chain

Figure 71. Methodology

Figure 72. Research Process and Data Source