Hazardous Drugs Closed System Transfer Device is a drug transfer device that mechanically prohibits the transfer of environmental contaminants into a system and the escape of hazardous drug or vapor concentrations outside the system, which designed to prevent the escape of hazardous drug vapors into the environment during drug reconstitution and administration.

United States is dominating the global Hazardous Drugs Closed System Transfer Device market. There are four key players are dominating the global market, BD Medical, Equashield, ICU Medical and Teva Medical Ltd, etc. The global top four players have a share over 80 percent.

This report is a detailed and comprehensive analysis for global Hazardous Drugs Closed System Transfer Device market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global Hazardous Drugs Closed System Transfer Device market size and forecasts, in consumption value ($ Million), sales quantity (M Units), and average selling prices (US$/Unit), 2018-2029

Global Hazardous Drugs Closed System Transfer Device market size and forecasts by region and country, in consumption value ($ Million), sales quantity (M Units), and average selling prices (US$/Unit), 2018-2029

Global Hazardous Drugs Closed System Transfer Device market size and forecasts, by Type and by Application, in consumption value ($ Million), sales quantity (M Units), and average selling prices (US$/Unit), 2018-2029

Global Hazardous Drugs Closed System Transfer Device market shares of main players, shipments in revenue ($ Million), sales quantity (M Units), and ASP (US$/Unit), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Hazardous Drugs Closed System Transfer Device

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global Hazardous Drugs Closed System Transfer Device market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

BD Medical, Inc

Equashield

ICU Medical

Teva Medical Ltd

Corvida Medical

B. Braun

Simplivia Healthcare Ltd.

Segmentation By Type

Closed Vial Access Devices

Closed Syringe Safety Devices

Closed Bag/Line Access Devices

Segmentation By Application

Hospital

Clinic

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Hazardous Drugs Closed System Transfer Device (CSTD) Market in 2025?

The strengths lie in the increasing adoption of CSTDs due to growing awareness about the safety of healthcare workers handling hazardous drugs. Stringent regulations around safe handling and storage of such drugs further drive market growth. Additionally, the rising number of cancer treatments and therapies that involve hazardous drugs creates a continuous demand for CSTDs.

What are the weaknesses in the Hazardous Drugs Closed System Transfer Device Market?

A significant weakness is the high initial cost of CSTDs, which can deter smaller healthcare facilities or independent pharmacies from investing in these devices. Moreover, technical complexity and the need for regular maintenance and training for healthcare workers to operate them can be challenging.

What opportunities exist in the Hazardous Drugs Closed System Transfer Device Market?

Opportunities for market growth include increasing regulatory pressure for safer drug handling, as well as innovations in CSTD technology. Expansion into emerging markets with less developed healthcare infrastructure presents an additional growth avenue. Collaboration with pharmaceutical companies to develop more efficient and cost-effective devices could also enhance market potential.

What are the threats to the Hazardous Drugs Closed System Transfer Device Market?

The primary threat is the introduction of alternative technologies or products that could provide safer or more cost-effective solutions for hazardous drug handling. Additionally, the market could face disruption from regulatory changes or economic downturns that limit healthcare spending. Increased competition from lower-priced, lower-quality products could also impact market growth.

Market PESTEL Analysis

What political factors influence the Hazardous Drugs Closed System Transfer Device (CSTD) Market in 2025?

Political factors such as increasing government regulations on drug safety and worker protection are key drivers in the market. Governments worldwide are implementing stricter guidelines for the handling and disposal of hazardous drugs, which boosts the demand for CSTDs. Additionally, public funding for healthcare infrastructure in certain regions may influence the adoption of such devices.

How do economic factors affect the Hazardous Drugs Closed System Transfer Device Market?

Economic factors, such as healthcare budgets and spending constraints, can impact market growth. High upfront costs of CSTDs may be a barrier for smaller institutions or countries with limited healthcare budgets. However, the long-term cost-saving benefits of reducing occupational hazards and healthcare worker compensation claims can help offset initial costs.

What social factors are driving the Hazardous Drugs Closed System Transfer Device Market?

Growing awareness of workplace safety, especially in healthcare settings, is driving the demand for CSTDs. The increased focus on worker health, particularly in oncology and pharmacies where hazardous drugs are often handled, is influencing market growth. Moreover, there is a societal push towards safer healthcare environments and reducing the risk of drug exposure.

How do technological factors affect the Hazardous Drugs Closed System Transfer Device Market?

Advancements in CSTD technology, such as improved ergonomics, better compatibility with various drug formulations, and enhanced leak-proof designs, are encouraging greater adoption. Continuous innovation and integration of digital monitoring systems into CSTDs to track usage and ensure safety can further propel the market.

What environmental factors impact the Hazardous Drugs Closed System Transfer Device Market?

Environmental regulations aimed at reducing contamination and waste from hazardous drug handling are prompting the adoption of CSTDs. These devices contribute to a cleaner, safer environment by minimizing spills and exposure risks, aligning with the growing demand for sustainable and environmentally friendly healthcare practices.

How do legal factors influence the Hazardous Drugs Closed System Transfer Device Market?

Legal factors such as stringent occupational safety laws and liability concerns significantly influence the demand for CSTDs. Lawsuits and worker compensation claims due to exposure to hazardous drugs can prompt healthcare facilities to invest in these systems to minimize legal risks and ensure compliance with safety standards.

Market SIPOC Analysis

Who are the suppliers in the Hazardous Drugs Closed System Transfer Device (CSTD) Market?

Suppliers include manufacturers of closed system transfer devices, raw material providers for device production (e.g., plastics, seals), and technology companies developing integrated monitoring and safety systems. Key players may also include regulatory bodies that set safety standards for device manufacturing.

What inputs are required for the Hazardous Drugs Closed System Transfer Device Market?

The key inputs are raw materials for device production, such as durable, non-permeable materials for seals and closures, as well as technology for leak-proof designs. Skilled labor for manufacturing, as well as research and development resources for innovation and compliance, also play a crucial role.

What processes are involved in the Hazardous Drugs Closed System Transfer Device Market?

The processes include product development and design, ensuring compliance with safety and regulatory standards, manufacturing the devices, and distribution to healthcare facilities. Additionally, after-sales services like training, maintenance, and support are critical components of the process.

Who are the customers in the Hazardous Drugs Closed System Transfer Device Market?

The primary customers are hospitals, oncology clinics, pharmacies, and healthcare facilities that handle hazardous drugs. Regulatory bodies that mandate the use of safe transfer devices also indirectly influence demand. Pharmaceutical companies involved in the production of hazardous drugs are another key customer segment.

What are the outputs of the Hazardous Drugs Closed System Transfer Device Market?

The outputs are finished closed system transfer devices that ensure safe handling, transfer, and disposal of hazardous drugs. These devices contribute to the safety of healthcare workers and patients by minimizing contamination and exposure to dangerous substances.

Market Porter's Five Forces

What is the threat of new entrants in the Hazardous Drugs Closed System Transfer Device Market in 2025?

The threat of new entrants is moderate. While the market presents opportunities, the high cost of development, regulatory compliance, and the technical expertise required to produce safe and effective devices act as significant barriers to entry. Established players with strong brand recognition and trust among healthcare providers dominate the market.

What is the bargaining power of suppliers in the Hazardous Drugs Closed System Transfer Device Market?

The bargaining power of suppliers is moderate. Key suppliers of raw materials, such as durable seals and specialized components, play a crucial role in the manufacturing process. However, the presence of multiple suppliers for these materials and the increasing trend of vertical integration within companies reduces their power to a certain extent.

What is the bargaining power of buyers in the Hazardous Drugs Closed System Transfer Device Market?

The bargaining power of buyers is moderate to high. Healthcare providers and large institutions, especially those in competitive regions, can negotiate prices and demand high-quality products. However, the specialized nature of CSTDs, combined with regulatory requirements, limits the number of alternative products available, reducing buyers' ability to easily switch suppliers.

What is the threat of substitutes in the Hazardous Drugs Closed System Transfer Device Market?

The threat of substitutes is low. Although alternative drug handling systems or safety measures exist, CSTDs are specifically designed to prevent hazardous drug exposure and comply with regulatory standards. Other solutions often do not provide the same level of safety or convenience, making substitutes less viable for healthcare providers.

What is the level of industry rivalry in the Hazardous Drugs Closed System Transfer Device Market?

The level of industry rivalry is moderate. There are several established players in the market, and while the demand for CSTDs is growing, companies must constantly innovate to differentiate their products in terms of design, ease of use, and safety features. The market is competitive but not overly saturated, with room for growth and technological advancement.

Market Upstream Analysis

What are the key upstream factors influencing the Hazardous Drugs Closed System Transfer Device Market in 2025?

The key upstream factors include the supply of raw materials such as durable plastics, seals, and components needed to manufacture the devices. Additionally, technological advancements in materials science, as well as innovation in safety features for drug handling, significantly influence the development of CSTDs. Supplier relationships and the cost of raw materials also play a critical role.

How do regulatory requirements affect the upstream market for CSTDs?

Regulatory requirements have a strong influence on the upstream market. Manufacturers must ensure compliance with safety standards set by regulatory bodies like the FDA and EMA, which impacts product development and material selection. Changes in regulations, such as stricter workplace safety laws or drug handling guidelines, can drive demand for higher-quality and more advanced transfer devices.

What role do pharmaceutical companies play in the upstream market for CSTDs?

Pharmaceutical companies play an important role by influencing the demand for CSTDs based on the types of hazardous drugs they manufacture and distribute. Their commitment to safety protocols and their need to comply with regulations around hazardous drug handling encourage the development of more efficient and safe closed system transfer devices. They also contribute to technological advancements by partnering with CSTD manufacturers for tailored solutions.

How does innovation in materials impact the upstream market for CSTDs?

Innovation in materials science is a key driver for the upstream market. Advances in non-permeable, durable, and cost-effective materials for seals, gaskets, and other components can improve the quality and performance of CSTDs. These innovations lead to better safety features, longer device lifespans, and more efficient manufacturing processes, benefiting both suppliers and manufacturers.

What are the supply chain challenges faced by the upstream market for CSTDs?

The upstream market faces challenges like fluctuating costs of raw materials, supply chain disruptions, and the need for consistent quality control in materials used in CSTD production. Additionally, global trade tensions or shipping delays can impact the timely supply of components, leading to production bottlenecks. Companies must also manage the complexity of sourcing specialized materials that meet regulatory and safety standards.

Market Midstream Analysis

What are the key midstream factors influencing the Hazardous Drugs Closed System Transfer Device (CSTD) Market in 2025?

Key midstream factors include the manufacturing processes involved in producing CSTDs, the technology integration within the devices, and the distribution channels. Manufacturers need to focus on streamlining production to meet demand while ensuring the devices are both cost-effective and compliant with regulatory standards. Additionally, logistics and supply chain management play an important role in getting products to healthcare providers.

How does manufacturing efficiency affect the midstream market for CSTDs?

Manufacturing efficiency is crucial in reducing production costs and meeting market demand. Innovations in production techniques, automation, and quality control are essential to keep up with the growing demand for CSTDs. Efficient manufacturing processes can lead to lower device prices, increasing adoption among healthcare facilities, and helping companies stay competitive.

What role does quality control play in the midstream market for CSTDs?

Quality control is vital in the midstream market, as CSTDs must meet stringent safety and regulatory standards. Any defects or inconsistencies in the production process could compromise the safety of healthcare workers and patients, which can lead to legal and financial repercussions. Ensuring high-quality manufacturing is necessary to maintain brand trust and prevent costly recalls.

How do distribution networks impact the midstream market for CSTDs?

Distribution networks play a critical role in delivering CSTDs to healthcare facilities in a timely manner. A robust distribution system ensures that products reach hospitals, pharmacies, and clinics with minimal delays, which is crucial for maintaining continuous drug safety protocols. Strong relationships with distributors, along with an efficient supply chain, can improve product availability in global markets.

What are the challenges faced in the midstream market for CSTDs?

Challenges include ensuring that the manufacturing process remains scalable to meet the growing demand without compromising product quality. Supply chain disruptions, whether due to geopolitical issues or raw material shortages, can also impact production and distribution timelines. Furthermore, the increasing complexity of device designs requires advanced technical expertise, which can present a challenge for manufacturers.

Market Downstream Analysis

What are the key downstream factors influencing the Hazardous Drugs Closed System Transfer Device (CSTD) Market in 2025?

Key downstream factors include the adoption of CSTDs by healthcare providers, regulatory compliance demands, and the increasing awareness of occupational health risks associated with hazardous drug exposure. Healthcare providers, such as hospitals and pharmacies, are the primary end users, and their decisions are influenced by the safety standards, cost-effectiveness, and performance of CSTDs.

How do healthcare providers impact the downstream market for CSTDs?

Healthcare providers play a central role in the downstream market by determining the demand for CSTDs based on regulatory requirements and safety standards. Their purchase decisions are also driven by the need to protect workers from exposure to hazardous drugs and ensure compliance with local or international safety regulations. The willingness to invest in these devices is influenced by factors like cost, training, and device reliability.

What role do patients play in the downstream market for CSTDs?

Patients indirectly influence the downstream market, as the use of CSTDs helps reduce the risk of contamination during drug administration, leading to better treatment outcomes and improved safety. With growing awareness about patient safety, healthcare providers are increasingly adopting CSTDs to protect both workers and patients, ensuring a safer treatment environment.

How does regulatory pressure affect the downstream market for CSTDs?

Regulatory pressure is a significant driver for the downstream market. Governments and regulatory agencies are enforcing stricter guidelines and safety standards around the handling and disposal of hazardous drugs, which compels healthcare providers to adopt CSTDs. Compliance with these regulations not only protects workers but also helps avoid penalties and legal repercussions.

What challenges exist in the downstream market for CSTDs?

Challenges in the downstream market include the high initial cost of CSTDs, which can be a barrier for smaller healthcare facilities with limited budgets. Additionally, there may be a lack of awareness or training among healthcare workers regarding the proper use of CSTDs. The integration of CSTDs into existing workflows and ensuring long-term maintenance and support can also be challenging for healthcare providers.

Chapter 1, to describe Hazardous Drugs Closed System Transfer Device product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Hazardous Drugs Closed System Transfer Device, with price, sales, revenue and global market share of Hazardous Drugs Closed System Transfer Device from 2018 to 2023.

Chapter 3, the Hazardous Drugs Closed System Transfer Device competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Hazardous Drugs Closed System Transfer Device breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Hazardous Drugs Closed System Transfer Device market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of Hazardous Drugs Closed System Transfer Device.

Chapter 14 and 15, to describe Hazardous Drugs Closed System Transfer Device sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Hazardous Drugs Closed System Transfer Device

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Hazardous Drugs Closed System Transfer Device Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 Closed Vial Access Devices

1.3.3 Closed Syringe Safety Devices

1.3.4 Closed Bag/Line Access Devices

1.4 Market Analysis by Application

1.4.1 Overview: Global Hazardous Drugs Closed System Transfer Device Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital

1.4.3 Clinic

1.5 Global Hazardous Drugs Closed System Transfer Device Market Size & Forecast

1.5.1 Global Hazardous Drugs Closed System Transfer Device Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Hazardous Drugs Closed System Transfer Device Sales Quantity (2018-2029)

1.5.3 Global Hazardous Drugs Closed System Transfer Device Average Price (2018-2029)

2 Manufacturers Profiles

2.1 BD Medical, Inc

2.1.1 BD Medical, Inc Details

2.1.2 BD Medical, Inc Major Business

2.1.3 BD Medical, Inc Hazardous Drugs Closed System Transfer Device Product and Services

2.1.4 BD Medical, Inc Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 BD Medical, Inc Recent Developments/Updates

2.2 Equashield

2.2.1 Equashield Details

2.2.2 Equashield Major Business

2.2.3 Equashield Hazardous Drugs Closed System Transfer Device Product and Services

2.2.4 Equashield Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Equashield Recent Developments/Updates

2.3 ICU Medical

2.3.1 ICU Medical Details

2.3.2 ICU Medical Major Business

2.3.3 ICU Medical Hazardous Drugs Closed System Transfer Device Product and Services

2.3.4 ICU Medical Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 ICU Medical Recent Developments/Updates

2.4 Teva Medical Ltd

2.4.1 Teva Medical Ltd Details

2.4.2 Teva Medical Ltd Major Business

2.4.3 Teva Medical Ltd Hazardous Drugs Closed System Transfer Device Product and Services

2.4.4 Teva Medical Ltd Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Teva Medical Ltd Recent Developments/Updates

2.5 Corvida Medical

2.5.1 Corvida Medical Details

2.5.2 Corvida Medical Major Business

2.5.3 Corvida Medical Hazardous Drugs Closed System Transfer Device Product and Services

2.5.4 Corvida Medical Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Corvida Medical Recent Developments/Updates

2.6 B. Braun

2.6.1 B. Braun Details

2.6.2 B. Braun Major Business

2.6.3 B. Braun Hazardous Drugs Closed System Transfer Device Product and Services

2.6.4 B. Braun Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 B. Braun Recent Developments/Updates

2.7 Simplivia Healthcare Ltd.

2.7.1 Simplivia Healthcare Ltd. Details

2.7.2 Simplivia Healthcare Ltd. Major Business

2.7.3 Simplivia Healthcare Ltd. Hazardous Drugs Closed System Transfer Device Product and Services

2.7.4 Simplivia Healthcare Ltd. Hazardous Drugs Closed System Transfer Device Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Simplivia Healthcare Ltd. Recent Developments/Updates

3 Competitive Environment: Hazardous Drugs Closed System Transfer Device by Manufacturer

3.1 Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Manufacturer (2018-2023)

3.2 Global Hazardous Drugs Closed System Transfer Device Revenue by Manufacturer (2018-2023)

3.3 Global Hazardous Drugs Closed System Transfer Device Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Hazardous Drugs Closed System Transfer Device by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Hazardous Drugs Closed System Transfer Device Manufacturer Market Share in 2022

3.4.2 Top 6 Hazardous Drugs Closed System Transfer Device Manufacturer Market Share in 2022

3.5 Hazardous Drugs Closed System Transfer Device Market: Overall Company Footprint Analysis

3.5.1 Hazardous Drugs Closed System Transfer Device Market: Region Footprint

3.5.2 Hazardous Drugs Closed System Transfer Device Market: Company Product Type Footprint

3.5.3 Hazardous Drugs Closed System Transfer Device Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Hazardous Drugs Closed System Transfer Device Market Size by Region

4.1.1 Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2018-2029)

4.1.2 Global Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2018-2029)

4.1.3 Global Hazardous Drugs Closed System Transfer Device Average Price by Region (2018-2029)

4.2 North America Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029)

4.3 Europe Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029)

4.4 Asia-Pacific Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029)

4.5 South America Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029)

4.6 Middle East and Africa Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2029)

5.2 Global Hazardous Drugs Closed System Transfer Device Consumption Value by Type (2018-2029)

5.3 Global Hazardous Drugs Closed System Transfer Device Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2029)

6.2 Global Hazardous Drugs Closed System Transfer Device Consumption Value by Application (2018-2029)

6.3 Global Hazardous Drugs Closed System Transfer Device Average Price by Application (2018-2029)

7 North America

7.1 North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2029)

7.2 North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2029)

7.3 North America Hazardous Drugs Closed System Transfer Device Market Size by Country

7.3.1 North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2029)

7.3.2 North America Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2029)

8.2 Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2029)

8.3 Europe Hazardous Drugs Closed System Transfer Device Market Size by Country

8.3.1 Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2029)

8.3.2 Europe Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Hazardous Drugs Closed System Transfer Device Market Size by Region

9.3.1 Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2029)

10.2 South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2029)

10.3 South America Hazardous Drugs Closed System Transfer Device Market Size by Country

10.3.1 South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2029)

10.3.2 South America Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Hazardous Drugs Closed System Transfer Device Market Size by Country

11.3.1 Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Hazardous Drugs Closed System Transfer Device Market Drivers

12.2 Hazardous Drugs Closed System Transfer Device Market Restraints

12.3 Hazardous Drugs Closed System Transfer Device Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of Hazardous Drugs Closed System Transfer Device and Key Manufacturers

13.2 Manufacturing Costs Percentage of Hazardous Drugs Closed System Transfer Device

13.3 Hazardous Drugs Closed System Transfer Device Production Process

13.4 Hazardous Drugs Closed System Transfer Device Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Hazardous Drugs Closed System Transfer Device Typical Distributors

14.3 Hazardous Drugs Closed System Transfer Device Typical Customers

15 Research Findings and Conclusion

16 Appendix

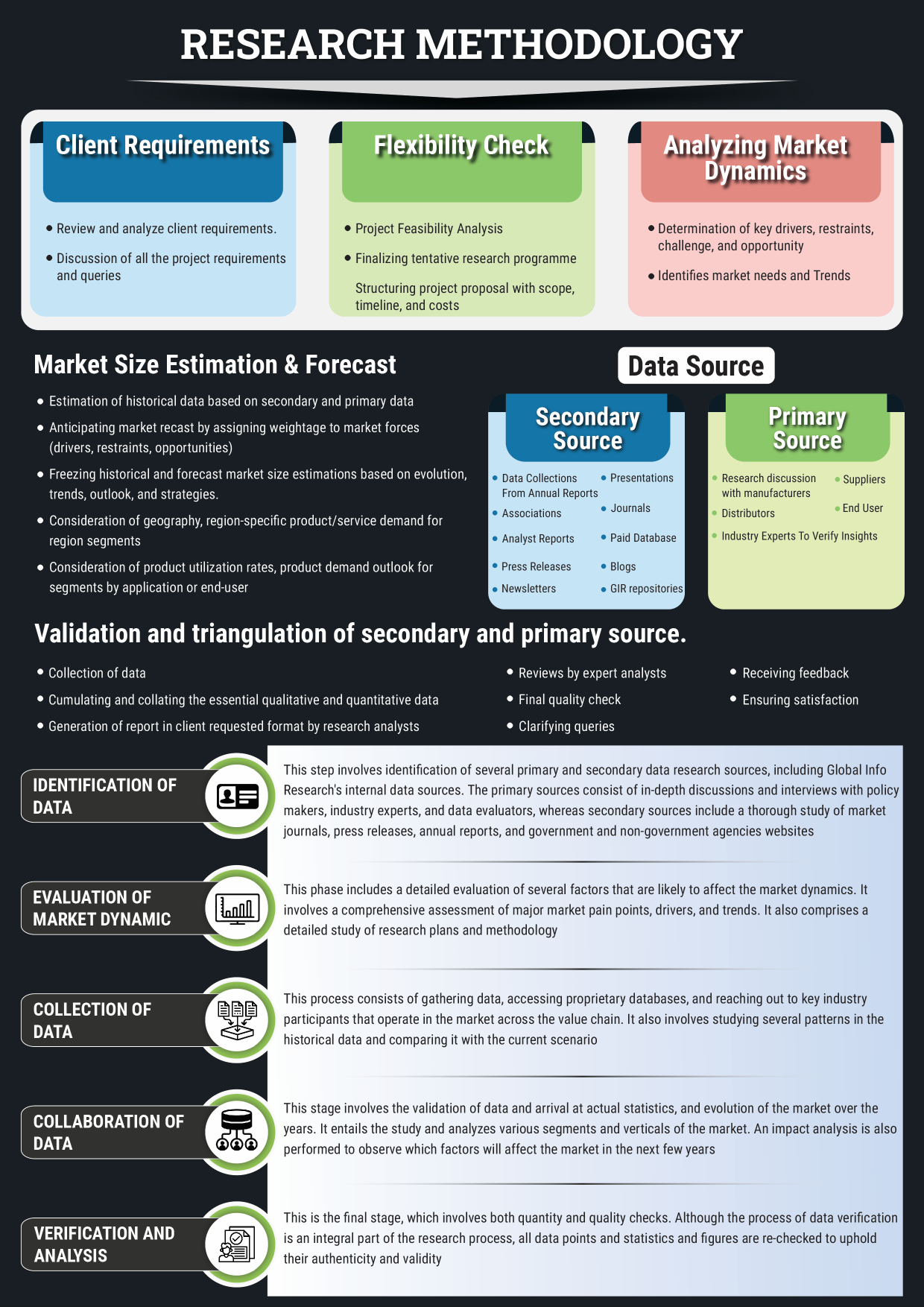

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. BD Medical, Inc Basic Information, Manufacturing Base and Competitors

Table 4. BD Medical, Inc Major Business

Table 5. BD Medical, Inc Hazardous Drugs Closed System Transfer Device Product and Services

Table 6. BD Medical, Inc Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. BD Medical, Inc Recent Developments/Updates

Table 8. Equashield Basic Information, Manufacturing Base and Competitors

Table 9. Equashield Major Business

Table 10. Equashield Hazardous Drugs Closed System Transfer Device Product and Services

Table 11. Equashield Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Equashield Recent Developments/Updates

Table 13. ICU Medical Basic Information, Manufacturing Base and Competitors

Table 14. ICU Medical Major Business

Table 15. ICU Medical Hazardous Drugs Closed System Transfer Device Product and Services

Table 16. ICU Medical Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. ICU Medical Recent Developments/Updates

Table 18. Teva Medical Ltd Basic Information, Manufacturing Base and Competitors

Table 19. Teva Medical Ltd Major Business

Table 20. Teva Medical Ltd Hazardous Drugs Closed System Transfer Device Product and Services

Table 21. Teva Medical Ltd Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Teva Medical Ltd Recent Developments/Updates

Table 23. Corvida Medical Basic Information, Manufacturing Base and Competitors

Table 24. Corvida Medical Major Business

Table 25. Corvida Medical Hazardous Drugs Closed System Transfer Device Product and Services

Table 26. Corvida Medical Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Corvida Medical Recent Developments/Updates

Table 28. B. Braun Basic Information, Manufacturing Base and Competitors

Table 29. B. Braun Major Business

Table 30. B. Braun Hazardous Drugs Closed System Transfer Device Product and Services

Table 31. B. Braun Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. B. Braun Recent Developments/Updates

Table 33. Simplivia Healthcare Ltd. Basic Information, Manufacturing Base and Competitors

Table 34. Simplivia Healthcare Ltd. Major Business

Table 35. Simplivia Healthcare Ltd. Hazardous Drugs Closed System Transfer Device Product and Services

Table 36. Simplivia Healthcare Ltd. Hazardous Drugs Closed System Transfer Device Sales Quantity (M Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Simplivia Healthcare Ltd. Recent Developments/Updates

Table 38. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Manufacturer (2018-2023) & (M Units)

Table 39. Global Hazardous Drugs Closed System Transfer Device Revenue by Manufacturer (2018-2023) & (USD Million)

Table 40. Global Hazardous Drugs Closed System Transfer Device Average Price by Manufacturer (2018-2023) & (US$/Unit)

Table 41. Market Position of Manufacturers in Hazardous Drugs Closed System Transfer Device, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 42. Head Office and Hazardous Drugs Closed System Transfer Device Production Site of Key Manufacturer

Table 43. Hazardous Drugs Closed System Transfer Device Market: Company Product Type Footprint

Table 44. Hazardous Drugs Closed System Transfer Device Market: Company Product Application Footprint

Table 45. Hazardous Drugs Closed System Transfer Device New Market Entrants and Barriers to Market Entry

Table 46. Hazardous Drugs Closed System Transfer Device Mergers, Acquisition, Agreements, and Collaborations

Table 47. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2018-2023) & (M Units)

Table 48. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2024-2029) & (M Units)

Table 49. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2018-2023) & (USD Million)

Table 50. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2024-2029) & (USD Million)

Table 51. Global Hazardous Drugs Closed System Transfer Device Average Price by Region (2018-2023) & (US$/Unit)

Table 52. Global Hazardous Drugs Closed System Transfer Device Average Price by Region (2024-2029) & (US$/Unit)

Table 53. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2023) & (M Units)

Table 54. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2024-2029) & (M Units)

Table 55. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Type (2018-2023) & (USD Million)

Table 56. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Type (2024-2029) & (USD Million)

Table 57. Global Hazardous Drugs Closed System Transfer Device Average Price by Type (2018-2023) & (US$/Unit)

Table 58. Global Hazardous Drugs Closed System Transfer Device Average Price by Type (2024-2029) & (US$/Unit)

Table 59. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2023) & (M Units)

Table 60. Global Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2024-2029) & (M Units)

Table 61. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Application (2018-2023) & (USD Million)

Table 62. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Application (2024-2029) & (USD Million)

Table 63. Global Hazardous Drugs Closed System Transfer Device Average Price by Application (2018-2023) & (US$/Unit)

Table 64. Global Hazardous Drugs Closed System Transfer Device Average Price by Application (2024-2029) & (US$/Unit)

Table 65. North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2023) & (M Units)

Table 66. North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2024-2029) & (M Units)

Table 67. North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2023) & (M Units)

Table 68. North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2024-2029) & (M Units)

Table 69. North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2023) & (M Units)

Table 70. North America Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2024-2029) & (M Units)

Table 71. North America Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2023) & (USD Million)

Table 72. North America Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2024-2029) & (USD Million)

Table 73. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2023) & (M Units)

Table 74. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2024-2029) & (M Units)

Table 75. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2023) & (M Units)

Table 76. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2024-2029) & (M Units)

Table 77. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2023) & (M Units)

Table 78. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2024-2029) & (M Units)

Table 79. Europe Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2023) & (USD Million)

Table 80. Europe Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2024-2029) & (USD Million)

Table 81. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2023) & (M Units)

Table 82. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2024-2029) & (M Units)

Table 83. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2023) & (M Units)

Table 84. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2024-2029) & (M Units)

Table 85. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2018-2023) & (M Units)

Table 86. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2024-2029) & (M Units)

Table 87. Asia-Pacific Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2018-2023) & (USD Million)

Table 88. Asia-Pacific Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2024-2029) & (USD Million)

Table 89. South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2023) & (M Units)

Table 90. South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2024-2029) & (M Units)

Table 91. South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2023) & (M Units)

Table 92. South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2024-2029) & (M Units)

Table 93. South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2018-2023) & (M Units)

Table 94. South America Hazardous Drugs Closed System Transfer Device Sales Quantity by Country (2024-2029) & (M Units)

Table 95. South America Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2018-2023) & (USD Million)

Table 96. South America Hazardous Drugs Closed System Transfer Device Consumption Value by Country (2024-2029) & (USD Million)

Table 97. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2018-2023) & (M Units)

Table 98. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Type (2024-2029) & (M Units)

Table 99. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2018-2023) & (M Units)

Table 100. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Application (2024-2029) & (M Units)

Table 101. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2018-2023) & (M Units)

Table 102. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity by Region (2024-2029) & (M Units)

Table 103. Middle East & Africa Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2018-2023) & (USD Million)

Table 104. Middle East & Africa Hazardous Drugs Closed System Transfer Device Consumption Value by Region (2024-2029) & (USD Million)

Table 105. Hazardous Drugs Closed System Transfer Device Raw Material

Table 106. Key Manufacturers of Hazardous Drugs Closed System Transfer Device Raw Materials

Table 107. Hazardous Drugs Closed System Transfer Device Typical Distributors

Table 108. Hazardous Drugs Closed System Transfer Device Typical Customers

List of Figures

Figure 1. Hazardous Drugs Closed System Transfer Device Picture

Figure 2. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Type in 2022

Figure 4. Closed Vial Access Devices Examples

Figure 5. Closed Syringe Safety Devices Examples

Figure 6. Closed Bag/Line Access Devices Examples

Figure 7. Global Hazardous Drugs Closed System Transfer Device Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 8. Global Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Application in 2022

Figure 9. Hospital Examples

Figure 10. Clinic Examples

Figure 11. Global Hazardous Drugs Closed System Transfer Device Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 12. Global Hazardous Drugs Closed System Transfer Device Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 13. Global Hazardous Drugs Closed System Transfer Device Sales Quantity (2018-2029) & (M Units)

Figure 14. Global Hazardous Drugs Closed System Transfer Device Average Price (2018-2029) & (US$/Unit)

Figure 15. Global Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Manufacturer in 2022

Figure 16. Global Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Manufacturer in 2022

Figure 17. Producer Shipments of Hazardous Drugs Closed System Transfer Device by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 18. Top 3 Hazardous Drugs Closed System Transfer Device Manufacturer (Consumption Value) Market Share in 2022

Figure 19. Top 6 Hazardous Drugs Closed System Transfer Device Manufacturer (Consumption Value) Market Share in 2022

Figure 20. Global Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Region (2018-2029)

Figure 21. Global Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Region (2018-2029)

Figure 22. North America Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029) & (USD Million)

Figure 23. Europe Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029) & (USD Million)

Figure 24. Asia-Pacific Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029) & (USD Million)

Figure 25. South America Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029) & (USD Million)

Figure 26. Middle East & Africa Hazardous Drugs Closed System Transfer Device Consumption Value (2018-2029) & (USD Million)

Figure 27. Global Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Type (2018-2029)

Figure 28. Global Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Type (2018-2029)

Figure 29. Global Hazardous Drugs Closed System Transfer Device Average Price by Type (2018-2029) & (US$/Unit)

Figure 30. Global Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Application (2018-2029)

Figure 31. Global Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Application (2018-2029)

Figure 32. Global Hazardous Drugs Closed System Transfer Device Average Price by Application (2018-2029) & (US$/Unit)

Figure 33. North America Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Type (2018-2029)

Figure 34. North America Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Application (2018-2029)

Figure 35. North America Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Country (2018-2029)

Figure 36. North America Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Country (2018-2029)

Figure 37. United States Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 38. Canada Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 39. Mexico Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Type (2018-2029)

Figure 41. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Application (2018-2029)

Figure 42. Europe Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Country (2018-2029)

Figure 43. Europe Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Country (2018-2029)

Figure 44. Germany Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 45. France Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 46. United Kingdom Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. Russia Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. Italy Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Type (2018-2029)

Figure 50. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Application (2018-2029)

Figure 51. Asia-Pacific Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Region (2018-2029)

Figure 52. Asia-Pacific Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Region (2018-2029)

Figure 53. China Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 54. Japan Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 55. Korea Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. India Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Southeast Asia Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Australia Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. South America Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Type (2018-2029)

Figure 60. South America Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Application (2018-2029)

Figure 61. South America Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Country (2018-2029)

Figure 62. South America Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Country (2018-2029)

Figure 63. Brazil Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 64. Argentina Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 65. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Type (2018-2029)

Figure 66. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Application (2018-2029)

Figure 67. Middle East & Africa Hazardous Drugs Closed System Transfer Device Sales Quantity Market Share by Region (2018-2029)

Figure 68. Middle East & Africa Hazardous Drugs Closed System Transfer Device Consumption Value Market Share by Region (2018-2029)

Figure 69. Turkey Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 70. Egypt Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 71. Saudi Arabia Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. South Africa Hazardous Drugs Closed System Transfer Device Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. Hazardous Drugs Closed System Transfer Device Market Drivers

Figure 74. Hazardous Drugs Closed System Transfer Device Market Restraints

Figure 75. Hazardous Drugs Closed System Transfer Device Market Trends

Figure 76. Porters Five Forces Analysis

Figure 77. Manufacturing Cost Structure Analysis of Hazardous Drugs Closed System Transfer Device in 2022

Figure 78. Manufacturing Process Analysis of Hazardous Drugs Closed System Transfer Device

Figure 79. Hazardous Drugs Closed System Transfer Device Industrial Chain

Figure 80. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 81. Direct Channel Pros & Cons

Figure 82. Indirect Channel Pros & Cons

Figure 83. Methodology

Figure 84. Research Process and Data Source