Dry Eye Drugs Market 2025: Trends, Drivers, and Strategic Insights

The dry eye drugs market is rapidly evolving as dry eye disease (DED) becomes an increasingly common health concern worldwide. Characterized by tear film instability and ocular surface inflammation, dry eye disease affects millions and significantly impacts quality of life. As of 2025, rising awareness, technological advancements, and changing lifestyle factors are fueling growth in this market. This report explores key drivers, innovations, regional dynamics, and strategic considerations shaping the future of dry eye therapeutics.

Market Drivers Shaping Growth

- Increasing Prevalence of Dry Eye Disease

One of the main growth catalysts is the widespread increase in dry eye cases. Prolonged screen exposure due to smartphones, tablets, and computers leads to reduced blink rates and tear evaporation, intensifying symptoms across all age groups. The modern digital lifestyle has brought dry eye disease to the forefront as a major ocular health issue. - Aging Population and Demographic Changes

Aging is directly linked to declining tear production and dry eye prevalence. Globally, the aging population is expanding, particularly in developed countries, increasing the number of patients requiring effective dry eye treatment. Age-related hormonal changes and chronic health conditions further compound this demand. - Environmental and Lifestyle Factors

Environmental pollutants, climate conditions such as low humidity, and widespread use of air conditioning worsen dry eye symptoms. Urbanization and increased exposure to harsh environments accelerate the need for therapeutic interventions. - Post-Surgical Care and Ophthalmic Procedures

With rising rates of ophthalmic surgeries such as LASIK and cataract removal, post-operative dry eye management has become essential. These procedures often disrupt the tear film temporarily, driving demand for supportive drug therapies.

Innovations Driving Market Transformation

- Advanced Drug Formulations

The market is shifting from traditional lubricants to advanced anti-inflammatory and immunomodulatory agents. These treatments target the root causes of inflammation rather than just offering symptomatic relief, enhancing long-term patient outcomes. - Cutting-Edge Drug Delivery Systems

Innovations like sustained-release formulations, nanoparticle carriers, and ocular inserts improve drug bioavailability and reduce dosing frequency. These technologies increase patient compliance and therapeutic effectiveness. - Personalized Medicine Approaches

Tailoring treatment to individual patient profiles, considering factors such as disease severity and lifestyle, is gaining traction. Personalized therapies provide more targeted and effective management, fostering better patient satisfaction.

Regional Market Dynamics

- North America

North America remains a dominant force due to its advanced healthcare infrastructure, strong pharmaceutical industry presence, and high patient awareness. Government support for ophthalmic research and favorable reimbursement policies contribute to robust market growth. - Europe

Europe’s growth is driven by its aging demographic and increasing healthcare investments. Regulatory frameworks that encourage innovation and emphasis on preventive eye care further support market expansion. - Asia-Pacific

The Asia-Pacific region is emerging as the fastest-growing market. Rising incomes, improving healthcare access, and growing awareness about eye health are key contributors. However, regulatory variability and infrastructure disparities present challenges. - Latin America and Middle East & Africa

These regions are gradually developing their ophthalmic care landscape, supported by government initiatives and increasing healthcare expenditure. Strategic collaborations and localized marketing efforts will be crucial to capitalize on growth opportunities.

Strategic Considerations for Market Players

- Focus on Innovation and Differentiation

Developing novel therapeutics that go beyond symptom management and address underlying pathology is vital. Continuous investment in R&D to innovate new drugs and delivery platforms will differentiate products in this competitive space. - Enhancing Stakeholder Engagement

Collaborations with healthcare professionals, patient advocacy groups, and regulatory bodies help improve product acceptance and market reach. Educational initiatives raise awareness about dry eye disease and available treatments, driving demand. - Expanding Presence in Emerging Markets

Tailoring strategies to meet local regulatory requirements, economic conditions, and cultural nuances is essential for success in emerging regions. Utilizing digital health tools and telemedicine can broaden access to care. - Sustainability and Corporate Responsibility

Environmental sustainability in production and packaging is increasingly important. Companies adopting eco-friendly practices may gain competitive advantage and align with growing consumer expectations.

Conclusion

The dry eye drugs market 2025 is poised for significant growth driven by increasing disease prevalence, demographic shifts, and continuous innovation. Addressing the needs of a diverse patient population through advanced therapeutics and personalized approaches will define market success. Regional dynamics present both opportunities and challenges, emphasizing the importance of adaptive strategies.

Stakeholders who prioritize innovation, education, and strategic expansion will be best positioned to capitalize on the evolving landscape. As dry eye disease continues to impact millions globally, the demand for effective, accessible treatments will remain a key focus, propelling this market toward a promising future.

NOTE:

Quants and Trends is proud to offer an extensive portfolio of meticulously researched healthcare market reports, numbering in the thousands. We also provide tailored customization services to ensure our insights align precisely with your strategic objectives and informational needs. For personalized assistance or to discuss your specific requirements, we invite you to get in touch with our team. We also encourage you to request a complimentary sample PDF report. Please visit our Sample Request Page to receive yours today.

Key Market Players

Allergan

Novartis AG

Bausch Health

Santen Pharma

Takeda

Johnson & Johnson

United Laboratories

Senju Pharmaceutical

Jianfeng Group

Eusan GMBH

Segmentation By Type

Artificial Tears

Anti-inflammatory Drugs

Other

Segmentation By Application

Hospital

Drug Stores

Online Pharmacies

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the Dry Eye Drugs Market 2025?

The growing awareness and diagnosis of dry eye disease is driving demand for effective treatments. Additionally, continuous advancements in drug formulations and delivery methods offer improved patient outcomes, creating opportunities for market growth.

What are the weaknesses in the Dry Eye Drugs Market 2025?

High treatment costs and the need for long-term use of medications can limit market accessibility for some patients. Moreover, there is still a lack of standardized treatment guidelines, which can result in inconsistent therapy options.

What opportunities exist in the Dry Eye Drugs Market 2025?

The market presents significant opportunities in the development of combination therapies and novel drug formulations that target the underlying causes of dry eye disease. Furthermore, increased adoption of personalized medicine and growing geriatric populations could expand the market.

What are the threats to the Dry Eye Drugs Market 2025?

Intense competition from generic drugs and alternative therapies such as over-the-counter eye drops may limit market growth. Regulatory challenges and the complexity of clinical trials for novel drugs also pose risks to new product approvals.

Market PESTEL Analysis

What political factors impact the Dry Eye Drugs Market 2025?

Government regulations and approval processes for new drugs play a significant role in shaping the market. Additionally, healthcare policies related to insurance coverage and reimbursement for dry eye treatments can influence market access and affordability.

How do economic factors affect the Dry Eye Drugs Market 2025?

The cost of treatment, coupled with economic conditions like healthcare spending, influences market demand. In regions with rising healthcare costs, patients may prioritize cost-effective treatments, affecting sales of premium dry eye drugs.

What social factors are relevant to the Dry Eye Drugs Market 2025?

Increasing awareness of dry eye disease among the general population, especially in aging demographics, drives demand for treatment. Societal trends like more people spending extended hours in front of screens contribute to the rising prevalence of the condition.

What technological factors impact the Dry Eye Drugs Market 2025?

Advancements in drug delivery systems, such as sustained-release formulations and smart contact lenses, are improving treatment options. Research into biologics and regenerative medicine is also opening up new avenues for more effective treatments.

What environmental factors affect the Dry Eye Drugs Market 2025?

Environmental factors like pollution and dry climates can contribute to the prevalence of dry eye disease, creating a larger patient base for related drugs. Additionally, there is increasing demand for eco-friendly packaging and sustainable drug manufacturing practices.

What legal factors influence the Dry Eye Drugs Market 2025?

Patents and intellectual property rights for dry eye drug formulations can create market exclusivity for manufacturers. Legal issues related to drug safety, side effects, and product liability are also critical, influencing both regulatory compliance and consumer trust.

Market SIPOC Analysis

What are the suppliers in the Dry Eye Drugs Market 2025?

Suppliers in this market include pharmaceutical companies that manufacture active pharmaceutical ingredients (APIs), packaging companies, and raw material providers. Contract research organizations (CROs) also supply clinical trial and research services.

Who are the inputs in the Dry Eye Drugs Market 2025?

Inputs include research and development for new drugs, clinical trial data, regulatory approvals, active ingredients, manufacturing processes, and distribution networks for raw materials.

What are the processes involved in the Dry Eye Drugs Market 2025?

Key processes include drug discovery, clinical testing, regulatory submission and approval, marketing, and distribution. Post-market surveillance and patient feedback also play vital roles in refining existing treatments.

Who are the outputs in the Dry Eye Drugs Market 2025?

Outputs include newly developed dry eye medications, over-the-counter eye drops, prescription treatments, patient education materials, and treatment guidelines that are made available to healthcare providers and consumers.

Who are the customers in the Dry Eye Drugs Market 2025?

Customers include individuals suffering from dry eye disease, healthcare providers like ophthalmologists and general practitioners, and distribution channels such as pharmacies, hospitals, and online platforms for retail sales.

Market Porter's Five Forces

How strong is the threat of new entrants in the Dry Eye Drugs Market 2025?

The threat of new entrants is moderate. While the market is lucrative, the high barriers to entry due to regulatory approval processes, research and development costs, and the need for specialized knowledge make it challenging for new companies to enter.

How strong is the bargaining power of suppliers in the Dry Eye Drugs Market 2025?

The bargaining power of suppliers is moderate. While there are multiple suppliers of raw materials and APIs, the specialized nature of pharmaceutical ingredients used in dry eye drugs gives suppliers some leverage, especially for novel formulations.

How strong is the bargaining power of buyers in the Dry Eye Drugs Market 2025?

The bargaining power of buyers is moderate to high. Patients and healthcare providers have access to a variety of over-the-counter and prescription treatments, which can drive demand for better prices and more effective drugs. However, treatment decisions are often influenced by medical professionals, limiting buyer power to an extent.

How high is the threat of substitute products in the Dry Eye Drugs Market 2025?

The threat of substitutes is high. Alternatives such as over-the-counter eye drops, natural remedies, and lifestyle changes (e.g., reducing screen time) can replace prescription medications, offering consumers a wide range of options to manage dry eye symptoms.

How intense is the competitive rivalry in the Dry Eye Drugs Market 2025?

The competitive rivalry is high. The market is filled with established pharmaceutical companies, generic drug manufacturers, and new entrants all vying to offer effective treatments for dry eye disease. Continuous innovation, pricing strategies, and brand loyalty are key factors in this competitive environment.

Market Upstream Analysis

What are the key suppliers in the Dry Eye Drugs Market 2025?

The key suppliers include manufacturers of active pharmaceutical ingredients (APIs), raw material suppliers for packaging, and specialized equipment providers for the production of drug formulations. Additionally, contract research organizations (CROs) contribute by offering research and clinical trial services.

What raw materials are essential in the Dry Eye Drugs Market 2025?

Essential raw materials include active ingredients such as cyclosporine, corticosteroids, and lubricants like hyaluronic acid. Packaging materials and preservatives used in the formulation of eye drops also play a crucial role.

How does the regulatory environment impact upstream activities in the Dry Eye Drugs Market 2025?

Regulatory bodies such as the FDA and EMA have strict guidelines that impact the development, manufacturing, and approval processes. These regulations influence the sourcing of ingredients, manufacturing practices, and testing protocols, which may delay product launch or increase development costs.

What are the technological advancements affecting upstream activities in the Dry Eye Drugs Market 2025?

Advancements in drug delivery systems, such as sustained-release formulations and new preservative-free technologies, influence upstream manufacturing. Moreover, research into biologics and personalized treatments is changing how raw materials and APIs are sourced and processed.

How do supply chain dynamics affect the Dry Eye Drugs Market 2025?

Supply chain challenges such as fluctuating costs of raw materials, transportation delays, and dependency on specific suppliers can affect the production timeline and cost structure. These factors require strategic partnerships with reliable suppliers to ensure a smooth production process.

Market Midstream Analysis

What are the key activities in the midstream of the Dry Eye Drugs Market 2025?

Key activities in the midstream include the manufacturing of drug formulations, quality control, and packaging. This stage also involves the testing and validation of drugs through clinical trials to ensure efficacy and safety before reaching the market.

How do distribution channels impact the Dry Eye Drugs Market 2025?

Distribution channels such as wholesalers, retail pharmacies, and hospitals are crucial in ensuring that dry eye drugs are accessible to patients. The rise of online pharmacies is also changing how products are distributed, providing more direct access to consumers.

What role does packaging play in the midstream of the Dry Eye Drugs Market 2025?

Packaging is vital for preserving the integrity and sterility of dry eye medications, especially for those in dropper or gel forms. Innovations in preservative-free packaging are also becoming important as patients seek options that minimize irritation.

How do regulatory requirements affect midstream activities in the Dry Eye Drugs Market 2025?

Regulatory approvals are essential in the midstream to ensure that drugs meet safety, efficacy, and quality standards. Compliance with regulations, such as Good Manufacturing Practices (GMP), ensures that drugs are produced to the highest standards and are safe for public use.

What are the challenges faced in the midstream of the Dry Eye Drugs Market 2025?

Challenges include ensuring a consistent supply of raw materials, managing manufacturing costs, and adhering to stringent regulatory requirements. Additionally, scaling up production for newer formulations or biologics can be resource-intensive and complex.

Market Downstream Analysis

What are the key activities in the downstream of the Dry Eye Drugs Market 2025?

Key activities in the downstream include marketing, sales, and distribution to end-users. This stage also involves educating healthcare providers and consumers about new treatment options and the proper use of dry eye medications.

How do healthcare providers influence the downstream of the Dry Eye Drugs Market 2025?

Healthcare providers play a critical role by prescribing treatments, advising patients on their usage, and providing access to newer drug formulations. Their recommendations significantly influence the demand and success of specific products in the market.

What role do pharmacies and online platforms play in the downstream of the Dry Eye Drugs Market 2025?

Pharmacies and online platforms serve as essential points of access for patients, allowing them to purchase prescribed or over-the-counter dry eye medications. The convenience and increasing reliance on online platforms are making them key players in product distribution.

How does patient education affect the downstream of the Dry Eye Drugs Market 2025?

Patient education is vital for proper drug adherence and optimal treatment outcomes. Informing patients about dry eye disease, the correct usage of medications, and potential side effects helps improve customer satisfaction and loyalty, driving long-term market success.

What challenges exist in the downstream of the Dry Eye Drugs Market 2025?

Challenges include competition from generic alternatives and OTC products, as well as managing patient adherence to prescribed treatments. Additionally, educating patients and healthcare providers about new treatments in a crowded market can be difficult.

Chapter 1, to describe Dry Eye Drugs product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of Dry Eye Drugs, with price, sales, revenue and global market share of Dry Eye Drugs from 2018 to 2023.

Chapter 3, the Dry Eye Drugs competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Dry Eye Drugs breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and Dry Eye Drugs market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of Dry Eye Drugs.

Chapter 14 and 15, to describe Dry Eye Drugs sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of Dry Eye Drugs

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global Dry Eye Drugs Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 Artificial Tears

1.3.3 Anti-inflammatory Drugs

1.3.4 Other

1.4 Market Analysis by Application

1.4.1 Overview: Global Dry Eye Drugs Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital

1.4.3 Drug Stores

1.4.4 Online Pharmacies

1.5 Global Dry Eye Drugs Market Size & Forecast

1.5.1 Global Dry Eye Drugs Consumption Value (2018 & 2022 & 2029)

1.5.2 Global Dry Eye Drugs Sales Quantity (2018-2029)

1.5.3 Global Dry Eye Drugs Average Price (2018-2029)

2 Manufacturers Profiles

2.1 Allergan

2.1.1 Allergan Details

2.1.2 Allergan Major Business

2.1.3 Allergan Dry Eye Drugs Product and Services

2.1.4 Allergan Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Allergan Recent Developments/Updates

2.2 Novartis AG

2.2.1 Novartis AG Details

2.2.2 Novartis AG Major Business

2.2.3 Novartis AG Dry Eye Drugs Product and Services

2.2.4 Novartis AG Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Novartis AG Recent Developments/Updates

2.3 Bausch Health

2.3.1 Bausch Health Details

2.3.2 Bausch Health Major Business

2.3.3 Bausch Health Dry Eye Drugs Product and Services

2.3.4 Bausch Health Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Bausch Health Recent Developments/Updates

2.4 Santen Pharma

2.4.1 Santen Pharma Details

2.4.2 Santen Pharma Major Business

2.4.3 Santen Pharma Dry Eye Drugs Product and Services

2.4.4 Santen Pharma Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Santen Pharma Recent Developments/Updates

2.5 Takeda

2.5.1 Takeda Details

2.5.2 Takeda Major Business

2.5.3 Takeda Dry Eye Drugs Product and Services

2.5.4 Takeda Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Takeda Recent Developments/Updates

2.6 Johnson & Johnson

2.6.1 Johnson & Johnson Details

2.6.2 Johnson & Johnson Major Business

2.6.3 Johnson & Johnson Dry Eye Drugs Product and Services

2.6.4 Johnson & Johnson Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Johnson & Johnson Recent Developments/Updates

2.7 United Laboratories

2.7.1 United Laboratories Details

2.7.2 United Laboratories Major Business

2.7.3 United Laboratories Dry Eye Drugs Product and Services

2.7.4 United Laboratories Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 United Laboratories Recent Developments/Updates

2.8 Senju Pharmaceutical

2.8.1 Senju Pharmaceutical Details

2.8.2 Senju Pharmaceutical Major Business

2.8.3 Senju Pharmaceutical Dry Eye Drugs Product and Services

2.8.4 Senju Pharmaceutical Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Senju Pharmaceutical Recent Developments/Updates

2.9 Jianfeng Group

2.9.1 Jianfeng Group Details

2.9.2 Jianfeng Group Major Business

2.9.3 Jianfeng Group Dry Eye Drugs Product and Services

2.9.4 Jianfeng Group Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 Jianfeng Group Recent Developments/Updates

2.10 Eusan GMBH

2.10.1 Eusan GMBH Details

2.10.2 Eusan GMBH Major Business

2.10.3 Eusan GMBH Dry Eye Drugs Product and Services

2.10.4 Eusan GMBH Dry Eye Drugs Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Eusan GMBH Recent Developments/Updates

3 Competitive Environment: Dry Eye Drugs by Manufacturer

3.1 Global Dry Eye Drugs Sales Quantity by Manufacturer (2018-2023)

3.2 Global Dry Eye Drugs Revenue by Manufacturer (2018-2023)

3.3 Global Dry Eye Drugs Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of Dry Eye Drugs by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 Dry Eye Drugs Manufacturer Market Share in 2022

3.4.2 Top 6 Dry Eye Drugs Manufacturer Market Share in 2022

3.5 Dry Eye Drugs Market: Overall Company Footprint Analysis

3.5.1 Dry Eye Drugs Market: Region Footprint

3.5.2 Dry Eye Drugs Market: Company Product Type Footprint

3.5.3 Dry Eye Drugs Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global Dry Eye Drugs Market Size by Region

4.1.1 Global Dry Eye Drugs Sales Quantity by Region (2018-2029)

4.1.2 Global Dry Eye Drugs Consumption Value by Region (2018-2029)

4.1.3 Global Dry Eye Drugs Average Price by Region (2018-2029)

4.2 North America Dry Eye Drugs Consumption Value (2018-2029)

4.3 Europe Dry Eye Drugs Consumption Value (2018-2029)

4.4 Asia-Pacific Dry Eye Drugs Consumption Value (2018-2029)

4.5 South America Dry Eye Drugs Consumption Value (2018-2029)

4.6 Middle East and Africa Dry Eye Drugs Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global Dry Eye Drugs Sales Quantity by Type (2018-2029)

5.2 Global Dry Eye Drugs Consumption Value by Type (2018-2029)

5.3 Global Dry Eye Drugs Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global Dry Eye Drugs Sales Quantity by Application (2018-2029)

6.2 Global Dry Eye Drugs Consumption Value by Application (2018-2029)

6.3 Global Dry Eye Drugs Average Price by Application (2018-2029)

7 North America

7.1 North America Dry Eye Drugs Sales Quantity by Type (2018-2029)

7.2 North America Dry Eye Drugs Sales Quantity by Application (2018-2029)

7.3 North America Dry Eye Drugs Market Size by Country

7.3.1 North America Dry Eye Drugs Sales Quantity by Country (2018-2029)

7.3.2 North America Dry Eye Drugs Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe Dry Eye Drugs Sales Quantity by Type (2018-2029)

8.2 Europe Dry Eye Drugs Sales Quantity by Application (2018-2029)

8.3 Europe Dry Eye Drugs Market Size by Country

8.3.1 Europe Dry Eye Drugs Sales Quantity by Country (2018-2029)

8.3.2 Europe Dry Eye Drugs Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific Dry Eye Drugs Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific Dry Eye Drugs Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific Dry Eye Drugs Market Size by Region

9.3.1 Asia-Pacific Dry Eye Drugs Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific Dry Eye Drugs Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America Dry Eye Drugs Sales Quantity by Type (2018-2029)

10.2 South America Dry Eye Drugs Sales Quantity by Application (2018-2029)

10.3 South America Dry Eye Drugs Market Size by Country

10.3.1 South America Dry Eye Drugs Sales Quantity by Country (2018-2029)

10.3.2 South America Dry Eye Drugs Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa Dry Eye Drugs Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa Dry Eye Drugs Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa Dry Eye Drugs Market Size by Country

11.3.1 Middle East & Africa Dry Eye Drugs Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa Dry Eye Drugs Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 Dry Eye Drugs Market Drivers

12.2 Dry Eye Drugs Market Restraints

12.3 Dry Eye Drugs Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of Dry Eye Drugs and Key Manufacturers

13.2 Manufacturing Costs Percentage of Dry Eye Drugs

13.3 Dry Eye Drugs Production Process

13.4 Dry Eye Drugs Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 Dry Eye Drugs Typical Distributors

14.3 Dry Eye Drugs Typical Customers

15 Research Findings and Conclusion

16 Appendix

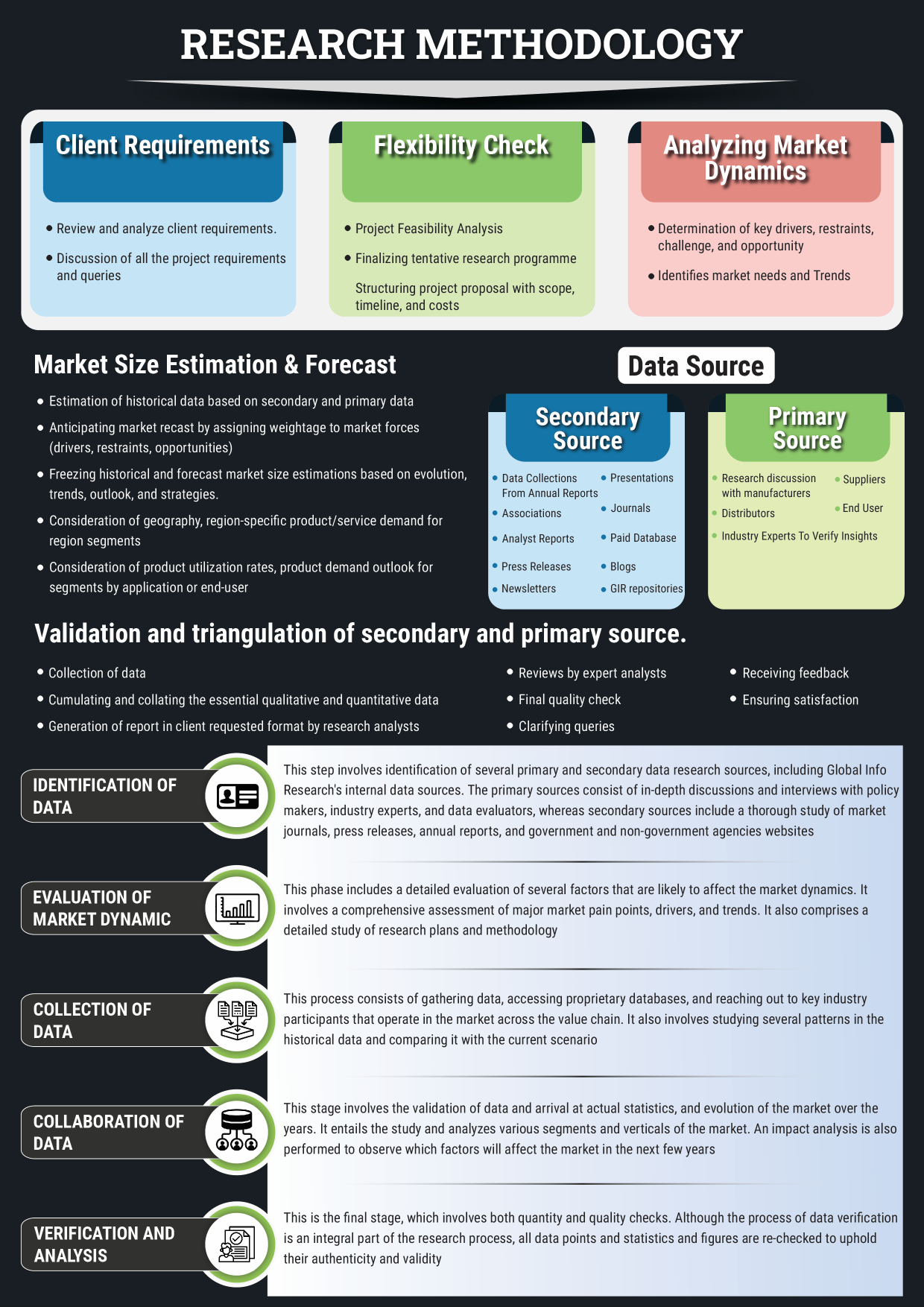

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global Dry Eye Drugs Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global Dry Eye Drugs Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Allergan Basic Information, Manufacturing Base and Competitors

Table 4. Allergan Major Business

Table 5. Allergan Dry Eye Drugs Product and Services

Table 6. Allergan Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. Allergan Recent Developments/Updates

Table 8. Novartis AG Basic Information, Manufacturing Base and Competitors

Table 9. Novartis AG Major Business

Table 10. Novartis AG Dry Eye Drugs Product and Services

Table 11. Novartis AG Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Novartis AG Recent Developments/Updates

Table 13. Bausch Health Basic Information, Manufacturing Base and Competitors

Table 14. Bausch Health Major Business

Table 15. Bausch Health Dry Eye Drugs Product and Services

Table 16. Bausch Health Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Bausch Health Recent Developments/Updates

Table 18. Santen Pharma Basic Information, Manufacturing Base and Competitors

Table 19. Santen Pharma Major Business

Table 20. Santen Pharma Dry Eye Drugs Product and Services

Table 21. Santen Pharma Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Santen Pharma Recent Developments/Updates

Table 23. Takeda Basic Information, Manufacturing Base and Competitors

Table 24. Takeda Major Business

Table 25. Takeda Dry Eye Drugs Product and Services

Table 26. Takeda Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Takeda Recent Developments/Updates

Table 28. Johnson & Johnson Basic Information, Manufacturing Base and Competitors

Table 29. Johnson & Johnson Major Business

Table 30. Johnson & Johnson Dry Eye Drugs Product and Services

Table 31. Johnson & Johnson Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. Johnson & Johnson Recent Developments/Updates

Table 33. United Laboratories Basic Information, Manufacturing Base and Competitors

Table 34. United Laboratories Major Business

Table 35. United Laboratories Dry Eye Drugs Product and Services

Table 36. United Laboratories Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. United Laboratories Recent Developments/Updates

Table 38. Senju Pharmaceutical Basic Information, Manufacturing Base and Competitors

Table 39. Senju Pharmaceutical Major Business

Table 40. Senju Pharmaceutical Dry Eye Drugs Product and Services

Table 41. Senju Pharmaceutical Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Senju Pharmaceutical Recent Developments/Updates

Table 43. Jianfeng Group Basic Information, Manufacturing Base and Competitors

Table 44. Jianfeng Group Major Business

Table 45. Jianfeng Group Dry Eye Drugs Product and Services

Table 46. Jianfeng Group Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 47. Jianfeng Group Recent Developments/Updates

Table 48. Eusan GMBH Basic Information, Manufacturing Base and Competitors

Table 49. Eusan GMBH Major Business

Table 50. Eusan GMBH Dry Eye Drugs Product and Services

Table 51. Eusan GMBH Dry Eye Drugs Sales Quantity (K Units), Average Price (USD/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 52. Eusan GMBH Recent Developments/Updates

Table 53. Global Dry Eye Drugs Sales Quantity by Manufacturer (2018-2023) & (K Units)

Table 54. Global Dry Eye Drugs Revenue by Manufacturer (2018-2023) & (USD Million)

Table 55. Global Dry Eye Drugs Average Price by Manufacturer (2018-2023) & (USD/Unit)

Table 56. Market Position of Manufacturers in Dry Eye Drugs, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 57. Head Office and Dry Eye Drugs Production Site of Key Manufacturer

Table 58. Dry Eye Drugs Market: Company Product Type Footprint

Table 59. Dry Eye Drugs Market: Company Product Application Footprint

Table 60. Dry Eye Drugs New Market Entrants and Barriers to Market Entry

Table 61. Dry Eye Drugs Mergers, Acquisition, Agreements, and Collaborations

Table 62. Global Dry Eye Drugs Sales Quantity by Region (2018-2023) & (K Units)

Table 63. Global Dry Eye Drugs Sales Quantity by Region (2024-2029) & (K Units)

Table 64. Global Dry Eye Drugs Consumption Value by Region (2018-2023) & (USD Million)

Table 65. Global Dry Eye Drugs Consumption Value by Region (2024-2029) & (USD Million)

Table 66. Global Dry Eye Drugs Average Price by Region (2018-2023) & (USD/Unit)

Table 67. Global Dry Eye Drugs Average Price by Region (2024-2029) & (USD/Unit)

Table 68. Global Dry Eye Drugs Sales Quantity by Type (2018-2023) & (K Units)

Table 69. Global Dry Eye Drugs Sales Quantity by Type (2024-2029) & (K Units)

Table 70. Global Dry Eye Drugs Consumption Value by Type (2018-2023) & (USD Million)

Table 71. Global Dry Eye Drugs Consumption Value by Type (2024-2029) & (USD Million)

Table 72. Global Dry Eye Drugs Average Price by Type (2018-2023) & (USD/Unit)

Table 73. Global Dry Eye Drugs Average Price by Type (2024-2029) & (USD/Unit)

Table 74. Global Dry Eye Drugs Sales Quantity by Application (2018-2023) & (K Units)

Table 75. Global Dry Eye Drugs Sales Quantity by Application (2024-2029) & (K Units)

Table 76. Global Dry Eye Drugs Consumption Value by Application (2018-2023) & (USD Million)

Table 77. Global Dry Eye Drugs Consumption Value by Application (2024-2029) & (USD Million)

Table 78. Global Dry Eye Drugs Average Price by Application (2018-2023) & (USD/Unit)

Table 79. Global Dry Eye Drugs Average Price by Application (2024-2029) & (USD/Unit)

Table 80. North America Dry Eye Drugs Sales Quantity by Type (2018-2023) & (K Units)

Table 81. North America Dry Eye Drugs Sales Quantity by Type (2024-2029) & (K Units)

Table 82. North America Dry Eye Drugs Sales Quantity by Application (2018-2023) & (K Units)

Table 83. North America Dry Eye Drugs Sales Quantity by Application (2024-2029) & (K Units)

Table 84. North America Dry Eye Drugs Sales Quantity by Country (2018-2023) & (K Units)

Table 85. North America Dry Eye Drugs Sales Quantity by Country (2024-2029) & (K Units)

Table 86. North America Dry Eye Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 87. North America Dry Eye Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 88. Europe Dry Eye Drugs Sales Quantity by Type (2018-2023) & (K Units)

Table 89. Europe Dry Eye Drugs Sales Quantity by Type (2024-2029) & (K Units)

Table 90. Europe Dry Eye Drugs Sales Quantity by Application (2018-2023) & (K Units)

Table 91. Europe Dry Eye Drugs Sales Quantity by Application (2024-2029) & (K Units)

Table 92. Europe Dry Eye Drugs Sales Quantity by Country (2018-2023) & (K Units)

Table 93. Europe Dry Eye Drugs Sales Quantity by Country (2024-2029) & (K Units)

Table 94. Europe Dry Eye Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 95. Europe Dry Eye Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 96. Asia-Pacific Dry Eye Drugs Sales Quantity by Type (2018-2023) & (K Units)

Table 97. Asia-Pacific Dry Eye Drugs Sales Quantity by Type (2024-2029) & (K Units)

Table 98. Asia-Pacific Dry Eye Drugs Sales Quantity by Application (2018-2023) & (K Units)

Table 99. Asia-Pacific Dry Eye Drugs Sales Quantity by Application (2024-2029) & (K Units)

Table 100. Asia-Pacific Dry Eye Drugs Sales Quantity by Region (2018-2023) & (K Units)

Table 101. Asia-Pacific Dry Eye Drugs Sales Quantity by Region (2024-2029) & (K Units)

Table 102. Asia-Pacific Dry Eye Drugs Consumption Value by Region (2018-2023) & (USD Million)

Table 103. Asia-Pacific Dry Eye Drugs Consumption Value by Region (2024-2029) & (USD Million)

Table 104. South America Dry Eye Drugs Sales Quantity by Type (2018-2023) & (K Units)

Table 105. South America Dry Eye Drugs Sales Quantity by Type (2024-2029) & (K Units)

Table 106. South America Dry Eye Drugs Sales Quantity by Application (2018-2023) & (K Units)

Table 107. South America Dry Eye Drugs Sales Quantity by Application (2024-2029) & (K Units)

Table 108. South America Dry Eye Drugs Sales Quantity by Country (2018-2023) & (K Units)

Table 109. South America Dry Eye Drugs Sales Quantity by Country (2024-2029) & (K Units)

Table 110. South America Dry Eye Drugs Consumption Value by Country (2018-2023) & (USD Million)

Table 111. South America Dry Eye Drugs Consumption Value by Country (2024-2029) & (USD Million)

Table 112. Middle East & Africa Dry Eye Drugs Sales Quantity by Type (2018-2023) & (K Units)

Table 113. Middle East & Africa Dry Eye Drugs Sales Quantity by Type (2024-2029) & (K Units)

Table 114. Middle East & Africa Dry Eye Drugs Sales Quantity by Application (2018-2023) & (K Units)

Table 115. Middle East & Africa Dry Eye Drugs Sales Quantity by Application (2024-2029) & (K Units)

Table 116. Middle East & Africa Dry Eye Drugs Sales Quantity by Region (2018-2023) & (K Units)

Table 117. Middle East & Africa Dry Eye Drugs Sales Quantity by Region (2024-2029) & (K Units)

Table 118. Middle East & Africa Dry Eye Drugs Consumption Value by Region (2018-2023) & (USD Million)

Table 119. Middle East & Africa Dry Eye Drugs Consumption Value by Region (2024-2029) & (USD Million)

Table 120. Dry Eye Drugs Raw Material

Table 121. Key Manufacturers of Dry Eye Drugs Raw Materials

Table 122. Dry Eye Drugs Typical Distributors

Table 123. Dry Eye Drugs Typical Customers

List of Figures

Figure 1. Dry Eye Drugs Picture

Figure 2. Global Dry Eye Drugs Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global Dry Eye Drugs Consumption Value Market Share by Type in 2022

Figure 4. Artificial Tears Examples

Figure 5. Anti-inflammatory Drugs Examples

Figure 6. Other Examples

Figure 7. Global Dry Eye Drugs Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 8. Global Dry Eye Drugs Consumption Value Market Share by Application in 2022

Figure 9. Hospital Examples

Figure 10. Drug Stores Examples

Figure 11. Online Pharmacies Examples

Figure 12. Global Dry Eye Drugs Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 13. Global Dry Eye Drugs Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 14. Global Dry Eye Drugs Sales Quantity (2018-2029) & (K Units)

Figure 15. Global Dry Eye Drugs Average Price (2018-2029) & (USD/Unit)

Figure 16. Global Dry Eye Drugs Sales Quantity Market Share by Manufacturer in 2022

Figure 17. Global Dry Eye Drugs Consumption Value Market Share by Manufacturer in 2022

Figure 18. Producer Shipments of Dry Eye Drugs by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 19. Top 3 Dry Eye Drugs Manufacturer (Consumption Value) Market Share in 2022

Figure 20. Top 6 Dry Eye Drugs Manufacturer (Consumption Value) Market Share in 2022

Figure 21. Global Dry Eye Drugs Sales Quantity Market Share by Region (2018-2029)

Figure 22. Global Dry Eye Drugs Consumption Value Market Share by Region (2018-2029)

Figure 23. North America Dry Eye Drugs Consumption Value (2018-2029) & (USD Million)

Figure 24. Europe Dry Eye Drugs Consumption Value (2018-2029) & (USD Million)

Figure 25. Asia-Pacific Dry Eye Drugs Consumption Value (2018-2029) & (USD Million)

Figure 26. South America Dry Eye Drugs Consumption Value (2018-2029) & (USD Million)

Figure 27. Middle East & Africa Dry Eye Drugs Consumption Value (2018-2029) & (USD Million)

Figure 28. Global Dry Eye Drugs Sales Quantity Market Share by Type (2018-2029)

Figure 29. Global Dry Eye Drugs Consumption Value Market Share by Type (2018-2029)

Figure 30. Global Dry Eye Drugs Average Price by Type (2018-2029) & (USD/Unit)

Figure 31. Global Dry Eye Drugs Sales Quantity Market Share by Application (2018-2029)

Figure 32. Global Dry Eye Drugs Consumption Value Market Share by Application (2018-2029)

Figure 33. Global Dry Eye Drugs Average Price by Application (2018-2029) & (USD/Unit)

Figure 34. North America Dry Eye Drugs Sales Quantity Market Share by Type (2018-2029)

Figure 35. North America Dry Eye Drugs Sales Quantity Market Share by Application (2018-2029)

Figure 36. North America Dry Eye Drugs Sales Quantity Market Share by Country (2018-2029)

Figure 37. North America Dry Eye Drugs Consumption Value Market Share by Country (2018-2029)

Figure 38. United States Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 39. Canada Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Mexico Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 41. Europe Dry Eye Drugs Sales Quantity Market Share by Type (2018-2029)

Figure 42. Europe Dry Eye Drugs Sales Quantity Market Share by Application (2018-2029)

Figure 43. Europe Dry Eye Drugs Sales Quantity Market Share by Country (2018-2029)

Figure 44. Europe Dry Eye Drugs Consumption Value Market Share by Country (2018-2029)

Figure 45. Germany Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 46. France Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. United Kingdom Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. Russia Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Italy Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 50. Asia-Pacific Dry Eye Drugs Sales Quantity Market Share by Type (2018-2029)

Figure 51. Asia-Pacific Dry Eye Drugs Sales Quantity Market Share by Application (2018-2029)

Figure 52. Asia-Pacific Dry Eye Drugs Sales Quantity Market Share by Region (2018-2029)

Figure 53. Asia-Pacific Dry Eye Drugs Consumption Value Market Share by Region (2018-2029)

Figure 54. China Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 55. Japan Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. Korea Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. India Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Southeast Asia Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. Australia Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 60. South America Dry Eye Drugs Sales Quantity Market Share by Type (2018-2029)

Figure 61. South America Dry Eye Drugs Sales Quantity Market Share by Application (2018-2029)

Figure 62. South America Dry Eye Drugs Sales Quantity Market Share by Country (2018-2029)

Figure 63. South America Dry Eye Drugs Consumption Value Market Share by Country (2018-2029)

Figure 64. Brazil Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 65. Argentina Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 66. Middle East & Africa Dry Eye Drugs Sales Quantity Market Share by Type (2018-2029)

Figure 67. Middle East & Africa Dry Eye Drugs Sales Quantity Market Share by Application (2018-2029)

Figure 68. Middle East & Africa Dry Eye Drugs Sales Quantity Market Share by Region (2018-2029)

Figure 69. Middle East & Africa Dry Eye Drugs Consumption Value Market Share by Region (2018-2029)

Figure 70. Turkey Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 71. Egypt Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. Saudi Arabia Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. South Africa Dry Eye Drugs Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 74. Dry Eye Drugs Market Drivers

Figure 75. Dry Eye Drugs Market Restraints

Figure 76. Dry Eye Drugs Market Trends

Figure 77. Porters Five Forces Analysis

Figure 78. Manufacturing Cost Structure Analysis of Dry Eye Drugs in 2022

Figure 79. Manufacturing Process Analysis of Dry Eye Drugs

Figure 80. Dry Eye Drugs Industrial Chain

Figure 81. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 82. Direct Channel Pros & Cons

Figure 83. Indirect Channel Pros & Cons

Figure 84. Methodology

Figure 85. Research Process and Data Source