c-Met inhibitors are a class of small molecules that inhibit the enzymatic activity of the c-Met tyrosine kinase, the receptor of hepatocyte growth factor/scatter factor (HGF/SF).

There are three kinds of C-MET / HGF Inhibitors, which are Cabozantinib, Crizotinib and Others. Cabozantinib hold the largest share of the C-MET / HGF Inhibitors market, with a revenue market share nearly 66% in 2019. C-MET / HGF Inhibitors is sold through Hospitals and Drugs Store. The most proportion of C-MET / HGF Inhibitors is sold through Hospitals, and the market share in 2019 is about 77%. North America is the largest consumption place, with a consumption market share nearly 60% in 2019. Following North America, Europe is the second largest consumption place with the consumption market share of about 34%. Shandong Exelixis, Ipsen, Pfizer, etc. are the leader of the industry, and top 3 players hold about 100% revenue market share.

This report is a detailed and comprehensive analysis for global C-MET & HGF Inhibitors market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2023, are provided.

Key Features:

Global C-MET & HGF Inhibitors market size and forecasts, in consumption value ($ Million), sales quantity (K Units), and average selling prices (US$/Unit), 2018-2029

Global C-MET & HGF Inhibitors market size and forecasts by region and country, in consumption value ($ Million), sales quantity (K Units), and average selling prices (US$/Unit), 2018-2029

Global C-MET & HGF Inhibitors market size and forecasts, by Type and by Application, in consumption value ($ Million), sales quantity (K Units), and average selling prices (US$/Unit), 2018-2029

Global C-MET & HGF Inhibitors market shares of main players, shipments in revenue ($ Million), sales quantity (K Units), and ASP (US$/Unit), 2018-2023

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for C-MET & HGF Inhibitors

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report profiles key players in the global C-MET & HGF Inhibitors market based on the following parameters - company overview, production, value, price, gross margin, product portfolio, geographical presence, and key developments.

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, COVID-19 and Russia-Ukraine War Influence.

Key Market Players

Exelixis

Ipsen

Pfizer

Novartis

Takeda

Merck KGaA

Merck

Daiichi Sankyo

GSK

Bristol-Myers Squibb(BMS)

Roche

AVEO Pharmaceuticals

Amgen

AstraZeneca

Mirati Therapeutics

Eli Lilly

Johnson & Johnson

Eisai

Hutchison MediPharma

Kringle Pharmaceuticals

Segmentation By Type

Cabozantinib

Crizotinib

Others

Segmentation By Application

Hospital

Drug Store

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Market SWOT Analysis

What are the strengths of the C-MET & HGF inhibitors market in 2025?

The C-MET & HGF inhibitors market in 2025 is expected to witness rapid growth due to the increasing prevalence of cancers and other diseases linked to the C-MET receptor and HGF pathway. Advancements in personalized medicine and targeted therapies will drive demand for these inhibitors. Furthermore, a robust pipeline of drug candidates from major pharmaceutical companies is anticipated to accelerate market expansion.

What are the weaknesses of the C-MET & HGF inhibitors market in 2025?

A key weakness in the market is the high cost of research and development, which can delay product commercialization. The complexity of targeting the C-MET and HGF pathways, along with potential off-target effects, also presents challenges. Regulatory hurdles and safety concerns, especially in clinical trials, could further hinder market growth.

What opportunities exist in the C-MET & HGF inhibitors market in 2025?

There are significant opportunities in expanding the use of these inhibitors beyond cancer, targeting diseases like fibrosis, neurodegenerative disorders, and cardiovascular conditions. Moreover, the ongoing trend toward precision medicine offers an opportunity to tailor treatments to individual patient profiles, enhancing therapeutic efficacy and market penetration.

What threats are faced by the C-MET & HGF inhibitors market in 2025?

One of the primary threats is the competition from alternative therapies, including immune checkpoint inhibitors and other targeted treatments. Additionally, the rapid pace of technological advancements and discovery of new therapeutic targets could potentially overshadow C-MET & HGF inhibitors. Intellectual property challenges and market entry of generic alternatives could also impact market profitability.

Market PESTEL Analysis

What political factors affect the C-MET & HGF inhibitors market in 2025?

Political factors, such as government regulations regarding drug approvals, healthcare policies, and funding for cancer research, play a crucial role. Changes in policy on drug pricing and reimbursement could also significantly impact the market. Political instability in certain regions may disrupt the supply chain and delay market access for new therapies.

How do economic factors influence the C-MET & HGF inhibitors market in 2025?

Economic factors such as healthcare spending, economic growth, and disposable income impact the affordability and accessibility of C-MET & HGF inhibitors. In regions with strong healthcare infrastructure and high spending, the adoption of these therapies is likely to increase. Conversely, in lower-income regions, economic constraints may limit the growth of the market.

What social factors contribute to the growth of the C-MET & HGF inhibitors market in 2025?

Rising awareness of cancer treatments, growing patient advocacy groups, and a demand for personalized medicine are key social drivers. The increasing focus on health and wellness, coupled with the aging population, further enhances the need for targeted therapies. Social acceptance of advanced treatments will help accelerate market growth.

What technological factors impact the C-MET & HGF inhibitors market in 2025?

Advancements in biotechnology and genomics are crucial in the development of C-MET & HGF inhibitors. Technologies such as CRISPR and AI-driven drug discovery will enable faster, more accurate identification of effective inhibitors. Innovations in delivery systems and biomarker testing will also enhance the market's ability to offer personalized treatment options.

What environmental factors are relevant to the C-MET & HGF inhibitors market in 2025?

Environmental factors like the growing focus on sustainability in pharmaceutical manufacturing and the need for eco-friendly practices in production and packaging can influence the market. Regulatory pressure to reduce carbon footprints and waste in drug manufacturing processes could lead to higher costs or innovation in sustainable practices.

What legal factors affect the C-MET & HGF inhibitors market in 2025?

Legal factors include patent laws, intellectual property rights, and regulations governing clinical trials and drug approvals. Stricter compliance with regulatory bodies such as the FDA and EMA is essential for market entry. Legal challenges related to patent disputes and generic drugs can affect pricing and profitability in the market.

Market SIPOC Analysis

What are the suppliers in the C-MET & HGF inhibitors market in 2025?

Suppliers include biotechnology firms, pharmaceutical companies, contract research organizations (CROs), and suppliers of raw materials for drug formulation. Additionally, academic research institutions and clinical trial service providers also play a crucial role in supplying the necessary data and resources for development.

What are the inputs needed in the C-MET & HGF inhibitors market in 2025?

Key inputs include advanced technologies for drug discovery, research data, high-quality raw materials for drug production, regulatory approvals, and skilled labor for clinical trials. Access to large patient populations for clinical testing is also a critical input in the development phase.

What are the processes involved in the C-MET & HGF inhibitors market in 2025?

The processes include drug discovery and development, pre-clinical and clinical trials, regulatory approval procedures, manufacturing, marketing, and distribution. Post-launch activities such as monitoring drug effectiveness and safety in real-world settings also form an important part of the market process.

What are the outputs of the C-MET & HGF inhibitors market in 2025?

The outputs are innovative, approved C-MET & HGF inhibitors, market-ready therapies, and scientific publications detailing clinical trial results. Additionally, commercialization of new drugs, increased awareness, and the establishment of patient support programs for these therapies contribute to the market output.

What are the customers in the C-MET & HGF inhibitors market in 2025?

Customers include healthcare providers (hospitals, clinics, oncologists), patients requiring targeted therapies, pharmaceutical distributors, insurance companies, and regulatory agencies. Patients with cancers or other conditions related to the C-MET & HGF pathways are the primary end-users, while medical professionals are key decision-makers.

Market Porter's Five Forces

What is the threat of new entrants in the C-MET & HGF inhibitors market in 2025?

The threat of new entrants is moderate, as the C-MET & HGF inhibitors market requires significant investment in research and development, regulatory approvals, and clinical trials. Established pharmaceutical companies with expertise in oncology and targeted therapies have a strong hold on the market, making it difficult for new entrants to compete. However, advancements in biotechnology may lower entry barriers over time.

What is the bargaining power of suppliers in the C-MET & HGF inhibitors market in 2025?

The bargaining power of suppliers is moderate. While raw materials and specialized research technologies are essential for drug development, there are multiple suppliers in the market. However, for cutting-edge biotechnology tools or proprietary compounds, suppliers with unique offerings can have greater power in influencing prices and availability.

What is the bargaining power of buyers in the C-MET & HGF inhibitors market in 2025?

The bargaining power of buyers is moderate to high, as healthcare providers and insurance companies often negotiate prices for treatments. With increasing awareness of alternative therapies and personalized medicine, buyers have more options and can exert pressure on pricing. However, the limited availability of highly effective C-MET & HGF inhibitors in the market reduces buyer power to some extent.

What is the threat of substitute products in the C-MET & HGF inhibitors market in 2025?

The threat of substitutes is moderate. While C-MET & HGF inhibitors offer targeted therapies, other cancer treatments, such as immune checkpoint inhibitors, chemotherapy, and monoclonal antibodies, can serve as alternatives. However, the specificity of C-MET & HGF inhibitors for certain cancers provides a competitive edge over general therapies, mitigating the threat from substitutes.

What is the intensity of competitive rivalry in the C-MET & HGF inhibitors market in 2025?

The intensity of competitive rivalry is high. Several established pharmaceutical companies are focusing on developing and commercializing C-MET & HGF inhibitors. As the market is highly lucrative and the number of therapies in the pipeline is growing, competition among players for market share, pricing, and regulatory approvals will intensify, driving innovation and pricing pressure.

Market Upstream Analysis

What are the key upstream factors affecting the C-MET & HGF inhibitors market in 2025?

Key upstream factors include the availability of advanced research tools, the development of cutting-edge biotechnology, and the supply of raw materials necessary for drug development. Additionally, the regulatory landscape and the availability of funding for early-stage research play significant roles in shaping the market.

How do research and development (R&D) activities impact the C-MET & HGF inhibitors market in 2025?

R&D activities are critical in the upstream phase as they drive the discovery of new C-MET & HGF inhibitors. The success of early-stage research, clinical trials, and the discovery of novel drug candidates will determine the future supply of innovative therapies. Heavy investment in R&D is essential to ensure a continuous pipeline of new treatments.

What role do suppliers of raw materials and biotechnology tools play in the C-MET & HGF inhibitors market in 2025?

Suppliers of raw materials, such as chemicals, biological agents, and laboratory equipment, are essential to the production of C-MET & HGF inhibitors. Additionally, suppliers of biotechnology tools and technologies, such as gene-editing platforms and high-throughput screening methods, enable the discovery and development of effective inhibitors, impacting the market's growth.

How do partnerships and collaborations influence the upstream dynamics of the C-MET & HGF inhibitors market in 2025?

Strategic partnerships and collaborations between pharmaceutical companies, biotech firms, and research institutions can accelerate the development of C-MET & HGF inhibitors. Collaborations allow for sharing of expertise, resources, and technologies, leading to faster innovation and more effective inhibitors entering the market.

How does the regulatory environment affect upstream activities in the C-MET & HGF inhibitors market in 2025?

The regulatory environment plays a significant role in upstream activities, as the approval processes for clinical trials and drugs directly impact timelines and costs. Stringent regulations can slow down development and increase R&D expenses. Conversely, streamlined regulatory pathways for breakthrough therapies can accelerate the progression of promising drug candidates to market.

Market Midstream Analysis

What are the key midstream factors affecting the C-MET & HGF inhibitors market in 2025?

Key midstream factors include the clinical development process, which encompasses phase trials, regulatory approvals, and the commercialization phase. Collaboration between biotech firms, pharmaceutical companies, and contract manufacturers also plays a crucial role in ensuring efficient production, timely distribution, and meeting regulatory standards.

How does the clinical trial process impact the C-MET & HGF inhibitors market in 2025?

The clinical trial process is a critical component of the midstream phase, influencing the speed at which C-MET & HGF inhibitors can reach the market. Successful trials help secure regulatory approvals and validate the effectiveness and safety of the drugs, while failures can delay progress and incur significant costs, affecting market dynamics.

What is the role of manufacturing and production in the midstream phase of the C-MET & HGF inhibitors market?

Manufacturing and production are vital in the midstream phase, as companies must scale up production once clinical trials succeed. The ability to efficiently manufacture these inhibitors while maintaining quality control is essential for meeting market demand. Partnerships with contract manufacturers and establishing reliable supply chains are key to this process.

How do distribution and supply chain management impact the C-MET & HGF inhibitors market in 2025?

Effective distribution and supply chain management ensure that C-MET & HGF inhibitors are delivered to healthcare providers on time and at the right cost. Any disruptions in the supply chain, such as shortages of raw materials or logistics challenges, can impact the availability of these drugs and affect market performance.

How does regulatory approval in the midstream phase affect the C-MET & HGF inhibitors market?

Regulatory approvals are crucial for transitioning C-MET & HGF inhibitors from clinical trials to commercial availability. Delays in the approval process can significantly affect time-to-market and profitability, while successful approvals allow companies to launch their products and capture market share quickly. Regulatory bodies, such as the FDA and EMA, are key players in this phase.

Market Downstream Analysis

What are the key downstream factors affecting the C-MET & HGF inhibitors market in 2025?

Key downstream factors include market access, pricing strategies, distribution channels, and the adoption of C-MET & HGF inhibitors by healthcare providers. Additionally, the post-launch support and patient access programs significantly influence market penetration and the long-term success of these therapies.

How does pricing and reimbursement affect the downstream dynamics of the C-MET & HGF inhibitors market?

Pricing and reimbursement policies play a critical role in the downstream phase. High treatment costs may limit the accessibility of C-MET & HGF inhibitors to patients, especially in regions with limited healthcare budgets. Effective reimbursement strategies, however, can enhance market adoption and accessibility, driving growth.

What role do healthcare providers play in the downstream phase of the C-MET & HGF inhibitors market?

Healthcare providers, including oncologists, hospitals, and clinics, are crucial in the downstream phase. Their decisions to prescribe C-MET & HGF inhibitors depend on factors like drug efficacy, safety profiles, and treatment costs. Physicians’ trust in these therapies, along with their familiarity with the drugs, significantly impacts market uptake.

How does patient access and support impact the C-MET & HGF inhibitors market in 2025?

Patient access and support programs are vital for ensuring that C-MET & HGF inhibitors reach patients who need them. These programs may include financial assistance, education, and logistical support, which help overcome barriers to access. Effective support systems can increase patient adherence and contribute to higher market growth.

How do competition and market saturation affect the downstream phase of the C-MET & HGF inhibitors market?

As the market matures, the intensity of competition increases with the introduction of alternative therapies and generics. This can lead to price reductions and market fragmentation, potentially impacting profitability. However, differentiation based on unique efficacy or fewer side effects can help maintain competitive advantage.

Chapter 1, to describe C-MET & HGF Inhibitors product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of C-MET & HGF Inhibitors, with price, sales, revenue and global market share of C-MET & HGF Inhibitors from 2018 to 2023.

Chapter 3, the C-MET & HGF Inhibitors competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the C-MET & HGF Inhibitors breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and C-MET & HGF Inhibitors market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of C-MET & HGF Inhibitors.

Chapter 14 and 15, to describe C-MET & HGF Inhibitors sales channel, distributors, customers, research findings and conclusion.

1 Market Overview

1.1 Product Overview and Scope of C-MET & HGF Inhibitors

1.2 Market Estimation Caveats and Base Year

1.3 Market Analysis by Type

1.3.1 Overview: Global C-MET & HGF Inhibitors Consumption Value by Type: 2018 Versus 2022 Versus 2029

1.3.2 Cabozantinib

1.3.3 Crizotinib

1.3.4 Others

1.4 Market Analysis by Application

1.4.1 Overview: Global C-MET & HGF Inhibitors Consumption Value by Application: 2018 Versus 2022 Versus 2029

1.4.2 Hospital

1.4.3 Drug Store

1.5 Global C-MET & HGF Inhibitors Market Size & Forecast

1.5.1 Global C-MET & HGF Inhibitors Consumption Value (2018 & 2022 & 2029)

1.5.2 Global C-MET & HGF Inhibitors Sales Quantity (2018-2029)

1.5.3 Global C-MET & HGF Inhibitors Average Price (2018-2029)

2 Manufacturers Profiles

2.1 Exelixis

2.1.1 Exelixis Details

2.1.2 Exelixis Major Business

2.1.3 Exelixis C-MET & HGF Inhibitors Product and Services

2.1.4 Exelixis C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Exelixis Recent Developments/Updates

2.2 Ipsen

2.2.1 Ipsen Details

2.2.2 Ipsen Major Business

2.2.3 Ipsen C-MET & HGF Inhibitors Product and Services

2.2.4 Ipsen C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Ipsen Recent Developments/Updates

2.3 Pfizer

2.3.1 Pfizer Details

2.3.2 Pfizer Major Business

2.3.3 Pfizer C-MET & HGF Inhibitors Product and Services

2.3.4 Pfizer C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 Pfizer Recent Developments/Updates

2.4 Novartis

2.4.1 Novartis Details

2.4.2 Novartis Major Business

2.4.3 Novartis C-MET & HGF Inhibitors Product and Services

2.4.4 Novartis C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 Novartis Recent Developments/Updates

2.5 Takeda

2.5.1 Takeda Details

2.5.2 Takeda Major Business

2.5.3 Takeda C-MET & HGF Inhibitors Product and Services

2.5.4 Takeda C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Takeda Recent Developments/Updates

2.6 Merck KGaA

2.6.1 Merck KGaA Details

2.6.2 Merck KGaA Major Business

2.6.3 Merck KGaA C-MET & HGF Inhibitors Product and Services

2.6.4 Merck KGaA C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Merck KGaA Recent Developments/Updates

2.7 Merck

2.7.1 Merck Details

2.7.2 Merck Major Business

2.7.3 Merck C-MET & HGF Inhibitors Product and Services

2.7.4 Merck C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 Merck Recent Developments/Updates

2.8 Daiichi Sankyo

2.8.1 Daiichi Sankyo Details

2.8.2 Daiichi Sankyo Major Business

2.8.3 Daiichi Sankyo C-MET & HGF Inhibitors Product and Services

2.8.4 Daiichi Sankyo C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Daiichi Sankyo Recent Developments/Updates

2.9 GSK

2.9.1 GSK Details

2.9.2 GSK Major Business

2.9.3 GSK C-MET & HGF Inhibitors Product and Services

2.9.4 GSK C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.9.5 GSK Recent Developments/Updates

2.10 Bristol-Myers Squibb(BMS)

2.10.1 Bristol-Myers Squibb(BMS) Details

2.10.2 Bristol-Myers Squibb(BMS) Major Business

2.10.3 Bristol-Myers Squibb(BMS) C-MET & HGF Inhibitors Product and Services

2.10.4 Bristol-Myers Squibb(BMS) C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.10.5 Bristol-Myers Squibb(BMS) Recent Developments/Updates

2.11 Roche

2.11.1 Roche Details

2.11.2 Roche Major Business

2.11.3 Roche C-MET & HGF Inhibitors Product and Services

2.11.4 Roche C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Roche Recent Developments/Updates

2.12 AVEO Pharmaceuticals

2.12.1 AVEO Pharmaceuticals Details

2.12.2 AVEO Pharmaceuticals Major Business

2.12.3 AVEO Pharmaceuticals C-MET & HGF Inhibitors Product and Services

2.12.4 AVEO Pharmaceuticals C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 AVEO Pharmaceuticals Recent Developments/Updates

2.13 Amgen

2.13.1 Amgen Details

2.13.2 Amgen Major Business

2.13.3 Amgen C-MET & HGF Inhibitors Product and Services

2.13.4 Amgen C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Amgen Recent Developments/Updates

2.14 AstraZeneca

2.14.1 AstraZeneca Details

2.14.2 AstraZeneca Major Business

2.14.3 AstraZeneca C-MET & HGF Inhibitors Product and Services

2.14.4 AstraZeneca C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.14.5 AstraZeneca Recent Developments/Updates

2.15 Mirati Therapeutics

2.15.1 Mirati Therapeutics Details

2.15.2 Mirati Therapeutics Major Business

2.15.3 Mirati Therapeutics C-MET & HGF Inhibitors Product and Services

2.15.4 Mirati Therapeutics C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 Mirati Therapeutics Recent Developments/Updates

2.16 Eli Lilly

2.16.1 Eli Lilly Details

2.16.2 Eli Lilly Major Business

2.16.3 Eli Lilly C-MET & HGF Inhibitors Product and Services

2.16.4 Eli Lilly C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.16.5 Eli Lilly Recent Developments/Updates

2.17 Johnson & Johnson

2.17.1 Johnson & Johnson Details

2.17.2 Johnson & Johnson Major Business

2.17.3 Johnson & Johnson C-MET & HGF Inhibitors Product and Services

2.17.4 Johnson & Johnson C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.17.5 Johnson & Johnson Recent Developments/Updates

2.18 Eisai

2.18.1 Eisai Details

2.18.2 Eisai Major Business

2.18.3 Eisai C-MET & HGF Inhibitors Product and Services

2.18.4 Eisai C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.18.5 Eisai Recent Developments/Updates

2.19 Hutchison MediPharma

2.19.1 Hutchison MediPharma Details

2.19.2 Hutchison MediPharma Major Business

2.19.3 Hutchison MediPharma C-MET & HGF Inhibitors Product and Services

2.19.4 Hutchison MediPharma C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.19.5 Hutchison MediPharma Recent Developments/Updates

2.20 Kringle Pharmaceuticals

2.20.1 Kringle Pharmaceuticals Details

2.20.2 Kringle Pharmaceuticals Major Business

2.20.3 Kringle Pharmaceuticals C-MET & HGF Inhibitors Product and Services

2.20.4 Kringle Pharmaceuticals C-MET & HGF Inhibitors Sales Quantity, Average Price, Revenue, Gross Margin and Market Share (2018-2023)

2.20.5 Kringle Pharmaceuticals Recent Developments/Updates

3 Competitive Environment: C-MET & HGF Inhibitors by Manufacturer

3.1 Global C-MET & HGF Inhibitors Sales Quantity by Manufacturer (2018-2023)

3.2 Global C-MET & HGF Inhibitors Revenue by Manufacturer (2018-2023)

3.3 Global C-MET & HGF Inhibitors Average Price by Manufacturer (2018-2023)

3.4 Market Share Analysis (2022)

3.4.1 Producer Shipments of C-MET & HGF Inhibitors by Manufacturer Revenue ($MM) and Market Share (%): 2022

3.4.2 Top 3 C-MET & HGF Inhibitors Manufacturer Market Share in 2022

3.4.2 Top 6 C-MET & HGF Inhibitors Manufacturer Market Share in 2022

3.5 C-MET & HGF Inhibitors Market: Overall Company Footprint Analysis

3.5.1 C-MET & HGF Inhibitors Market: Region Footprint

3.5.2 C-MET & HGF Inhibitors Market: Company Product Type Footprint

3.5.3 C-MET & HGF Inhibitors Market: Company Product Application Footprint

3.6 New Market Entrants and Barriers to Market Entry

3.7 Mergers, Acquisition, Agreements, and Collaborations

4 Consumption Analysis by Region

4.1 Global C-MET & HGF Inhibitors Market Size by Region

4.1.1 Global C-MET & HGF Inhibitors Sales Quantity by Region (2018-2029)

4.1.2 Global C-MET & HGF Inhibitors Consumption Value by Region (2018-2029)

4.1.3 Global C-MET & HGF Inhibitors Average Price by Region (2018-2029)

4.2 North America C-MET & HGF Inhibitors Consumption Value (2018-2029)

4.3 Europe C-MET & HGF Inhibitors Consumption Value (2018-2029)

4.4 Asia-Pacific C-MET & HGF Inhibitors Consumption Value (2018-2029)

4.5 South America C-MET & HGF Inhibitors Consumption Value (2018-2029)

4.6 Middle East and Africa C-MET & HGF Inhibitors Consumption Value (2018-2029)

5 Market Segment by Type

5.1 Global C-MET & HGF Inhibitors Sales Quantity by Type (2018-2029)

5.2 Global C-MET & HGF Inhibitors Consumption Value by Type (2018-2029)

5.3 Global C-MET & HGF Inhibitors Average Price by Type (2018-2029)

6 Market Segment by Application

6.1 Global C-MET & HGF Inhibitors Sales Quantity by Application (2018-2029)

6.2 Global C-MET & HGF Inhibitors Consumption Value by Application (2018-2029)

6.3 Global C-MET & HGF Inhibitors Average Price by Application (2018-2029)

7 North America

7.1 North America C-MET & HGF Inhibitors Sales Quantity by Type (2018-2029)

7.2 North America C-MET & HGF Inhibitors Sales Quantity by Application (2018-2029)

7.3 North America C-MET & HGF Inhibitors Market Size by Country

7.3.1 North America C-MET & HGF Inhibitors Sales Quantity by Country (2018-2029)

7.3.2 North America C-MET & HGF Inhibitors Consumption Value by Country (2018-2029)

7.3.3 United States Market Size and Forecast (2018-2029)

7.3.4 Canada Market Size and Forecast (2018-2029)

7.3.5 Mexico Market Size and Forecast (2018-2029)

8 Europe

8.1 Europe C-MET & HGF Inhibitors Sales Quantity by Type (2018-2029)

8.2 Europe C-MET & HGF Inhibitors Sales Quantity by Application (2018-2029)

8.3 Europe C-MET & HGF Inhibitors Market Size by Country

8.3.1 Europe C-MET & HGF Inhibitors Sales Quantity by Country (2018-2029)

8.3.2 Europe C-MET & HGF Inhibitors Consumption Value by Country (2018-2029)

8.3.3 Germany Market Size and Forecast (2018-2029)

8.3.4 France Market Size and Forecast (2018-2029)

8.3.5 United Kingdom Market Size and Forecast (2018-2029)

8.3.6 Russia Market Size and Forecast (2018-2029)

8.3.7 Italy Market Size and Forecast (2018-2029)

9 Asia-Pacific

9.1 Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Type (2018-2029)

9.2 Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Application (2018-2029)

9.3 Asia-Pacific C-MET & HGF Inhibitors Market Size by Region

9.3.1 Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Region (2018-2029)

9.3.2 Asia-Pacific C-MET & HGF Inhibitors Consumption Value by Region (2018-2029)

9.3.3 China Market Size and Forecast (2018-2029)

9.3.4 Japan Market Size and Forecast (2018-2029)

9.3.5 Korea Market Size and Forecast (2018-2029)

9.3.6 India Market Size and Forecast (2018-2029)

9.3.7 Southeast Asia Market Size and Forecast (2018-2029)

9.3.8 Australia Market Size and Forecast (2018-2029)

10 South America

10.1 South America C-MET & HGF Inhibitors Sales Quantity by Type (2018-2029)

10.2 South America C-MET & HGF Inhibitors Sales Quantity by Application (2018-2029)

10.3 South America C-MET & HGF Inhibitors Market Size by Country

10.3.1 South America C-MET & HGF Inhibitors Sales Quantity by Country (2018-2029)

10.3.2 South America C-MET & HGF Inhibitors Consumption Value by Country (2018-2029)

10.3.3 Brazil Market Size and Forecast (2018-2029)

10.3.4 Argentina Market Size and Forecast (2018-2029)

11 Middle East & Africa

11.1 Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Type (2018-2029)

11.2 Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Application (2018-2029)

11.3 Middle East & Africa C-MET & HGF Inhibitors Market Size by Country

11.3.1 Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Country (2018-2029)

11.3.2 Middle East & Africa C-MET & HGF Inhibitors Consumption Value by Country (2018-2029)

11.3.3 Turkey Market Size and Forecast (2018-2029)

11.3.4 Egypt Market Size and Forecast (2018-2029)

11.3.5 Saudi Arabia Market Size and Forecast (2018-2029)

11.3.6 South Africa Market Size and Forecast (2018-2029)

12 Market Dynamics

12.1 C-MET & HGF Inhibitors Market Drivers

12.2 C-MET & HGF Inhibitors Market Restraints

12.3 C-MET & HGF Inhibitors Trends Analysis

12.4 Porters Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

12.5 Influence of COVID-19 and Russia-Ukraine War

12.5.1 Influence of COVID-19

12.5.2 Influence of Russia-Ukraine War

13 Raw Material and Industry Chain

13.1 Raw Material of C-MET & HGF Inhibitors and Key Manufacturers

13.2 Manufacturing Costs Percentage of C-MET & HGF Inhibitors

13.3 C-MET & HGF Inhibitors Production Process

13.4 C-MET & HGF Inhibitors Industrial Chain

14 Shipments by Distribution Channel

14.1 Sales Channel

14.1.1 Direct to End-User

14.1.2 Distributors

14.2 C-MET & HGF Inhibitors Typical Distributors

14.3 C-MET & HGF Inhibitors Typical Customers

15 Research Findings and Conclusion

16 Appendix

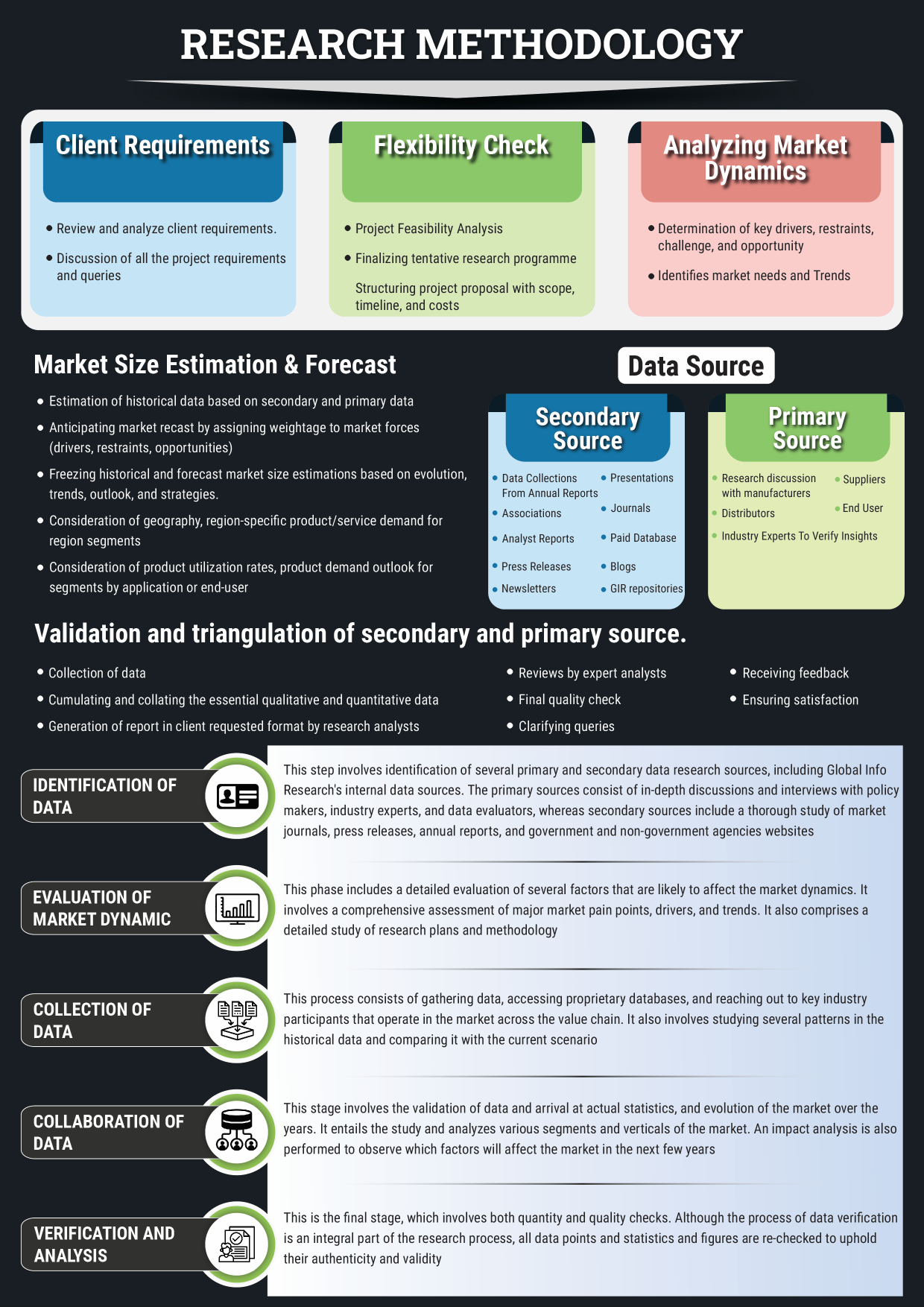

16.1 Methodology

16.2 Research Process and Data Source

16.3 Disclaimer

List of Tables

Table 1. Global C-MET & HGF Inhibitors Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global C-MET & HGF Inhibitors Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. Exelixis Basic Information, Manufacturing Base and Competitors

Table 4. Exelixis Major Business

Table 5. Exelixis C-MET & HGF Inhibitors Product and Services

Table 6. Exelixis C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. Exelixis Recent Developments/Updates

Table 8. Ipsen Basic Information, Manufacturing Base and Competitors

Table 9. Ipsen Major Business

Table 10. Ipsen C-MET & HGF Inhibitors Product and Services

Table 11. Ipsen C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Ipsen Recent Developments/Updates

Table 13. Pfizer Basic Information, Manufacturing Base and Competitors

Table 14. Pfizer Major Business

Table 15. Pfizer C-MET & HGF Inhibitors Product and Services

Table 16. Pfizer C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Pfizer Recent Developments/Updates

Table 18. Novartis Basic Information, Manufacturing Base and Competitors

Table 19. Novartis Major Business

Table 20. Novartis C-MET & HGF Inhibitors Product and Services

Table 21. Novartis C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Novartis Recent Developments/Updates

Table 23. Takeda Basic Information, Manufacturing Base and Competitors

Table 24. Takeda Major Business

Table 25. Takeda C-MET & HGF Inhibitors Product and Services

Table 26. Takeda C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Takeda Recent Developments/Updates

Table 28. Merck KGaA Basic Information, Manufacturing Base and Competitors

Table 29. Merck KGaA Major Business

Table 30. Merck KGaA C-MET & HGF Inhibitors Product and Services

Table 31. Merck KGaA C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. Merck KGaA Recent Developments/Updates

Table 33. Merck Basic Information, Manufacturing Base and Competitors

Table 34. Merck Major Business

Table 35. Merck C-MET & HGF Inhibitors Product and Services

Table 36. Merck C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Merck Recent Developments/Updates

Table 38. Daiichi Sankyo Basic Information, Manufacturing Base and Competitors

Table 39. Daiichi Sankyo Major Business

Table 40. Daiichi Sankyo C-MET & HGF Inhibitors Product and Services

Table 41. Daiichi Sankyo C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Daiichi Sankyo Recent Developments/Updates

Table 43. GSK Basic Information, Manufacturing Base and Competitors

Table 44. GSK Major Business

Table 45. GSK C-MET & HGF Inhibitors Product and Services

Table 46. GSK C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 47. GSK Recent Developments/Updates

Table 48. Bristol-Myers Squibb(BMS) Basic Information, Manufacturing Base and Competitors

Table 49. Bristol-Myers Squibb(BMS) Major Business

Table 50. Bristol-Myers Squibb(BMS) C-MET & HGF Inhibitors Product and Services

Table 51. Bristol-Myers Squibb(BMS) C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 52. Bristol-Myers Squibb(BMS) Recent Developments/Updates

Table 53. Roche Basic Information, Manufacturing Base and Competitors

Table 54. Roche Major Business

Table 55. Roche C-MET & HGF Inhibitors Product and Services

Table 56. Roche C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 57. Roche Recent Developments/Updates

Table 58. AVEO Pharmaceuticals Basic Information, Manufacturing Base and Competitors

Table 59. AVEO Pharmaceuticals Major Business

Table 60. AVEO Pharmaceuticals C-MET & HGF Inhibitors Product and Services

Table 61. AVEO Pharmaceuticals C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 62. AVEO Pharmaceuticals Recent Developments/Updates

Table 63. Amgen Basic Information, Manufacturing Base and Competitors

Table 64. Amgen Major Business

Table 65. Amgen C-MET & HGF Inhibitors Product and Services

Table 66. Amgen C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 67. Amgen Recent Developments/Updates

Table 68. AstraZeneca Basic Information, Manufacturing Base and Competitors

Table 69. AstraZeneca Major Business

Table 70. AstraZeneca C-MET & HGF Inhibitors Product and Services

Table 71. AstraZeneca C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 72. AstraZeneca Recent Developments/Updates

Table 73. Mirati Therapeutics Basic Information, Manufacturing Base and Competitors

Table 74. Mirati Therapeutics Major Business

Table 75. Mirati Therapeutics C-MET & HGF Inhibitors Product and Services

Table 76. Mirati Therapeutics C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 77. Mirati Therapeutics Recent Developments/Updates

Table 78. Eli Lilly Basic Information, Manufacturing Base and Competitors

Table 79. Eli Lilly Major Business

Table 80. Eli Lilly C-MET & HGF Inhibitors Product and Services

Table 81. Eli Lilly C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 82. Eli Lilly Recent Developments/Updates

Table 83. Johnson & Johnson Basic Information, Manufacturing Base and Competitors

Table 84. Johnson & Johnson Major Business

Table 85. Johnson & Johnson C-MET & HGF Inhibitors Product and Services

Table 86. Johnson & Johnson C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 87. Johnson & Johnson Recent Developments/Updates

Table 88. Eisai Basic Information, Manufacturing Base and Competitors

Table 89. Eisai Major Business

Table 90. Eisai C-MET & HGF Inhibitors Product and Services

Table 91. Eisai C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 92. Eisai Recent Developments/Updates

Table 93. Hutchison MediPharma Basic Information, Manufacturing Base and Competitors

Table 94. Hutchison MediPharma Major Business

Table 95. Hutchison MediPharma C-MET & HGF Inhibitors Product and Services

Table 96. Hutchison MediPharma C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 97. Hutchison MediPharma Recent Developments/Updates

Table 98. Kringle Pharmaceuticals Basic Information, Manufacturing Base and Competitors

Table 99. Kringle Pharmaceuticals Major Business

Table 100. Kringle Pharmaceuticals C-MET & HGF Inhibitors Product and Services

Table 101. Kringle Pharmaceuticals C-MET & HGF Inhibitors Sales Quantity (K Units), Average Price (US$/Unit), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 102. Kringle Pharmaceuticals Recent Developments/Updates

Table 103. Global C-MET & HGF Inhibitors Sales Quantity by Manufacturer (2018-2023) & (K Units)

Table 104. Global C-MET & HGF Inhibitors Revenue by Manufacturer (2018-2023) & (USD Million)

Table 105. Global C-MET & HGF Inhibitors Average Price by Manufacturer (2018-2023) & (US$/Unit)

Table 106. Market Position of Manufacturers in C-MET & HGF Inhibitors, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 107. Head Office and C-MET & HGF Inhibitors Production Site of Key Manufacturer

Table 108. C-MET & HGF Inhibitors Market: Company Product Type Footprint

Table 109. C-MET & HGF Inhibitors Market: Company Product Application Footprint

Table 110. C-MET & HGF Inhibitors New Market Entrants and Barriers to Market Entry

Table 111. C-MET & HGF Inhibitors Mergers, Acquisition, Agreements, and Collaborations

Table 112. Global C-MET & HGF Inhibitors Sales Quantity by Region (2018-2023) & (K Units)

Table 113. Global C-MET & HGF Inhibitors Sales Quantity by Region (2024-2029) & (K Units)

Table 114. Global C-MET & HGF Inhibitors Consumption Value by Region (2018-2023) & (USD Million)

Table 115. Global C-MET & HGF Inhibitors Consumption Value by Region (2024-2029) & (USD Million)

Table 116. Global C-MET & HGF Inhibitors Average Price by Region (2018-2023) & (US$/Unit)

Table 117. Global C-MET & HGF Inhibitors Average Price by Region (2024-2029) & (US$/Unit)

Table 118. Global C-MET & HGF Inhibitors Sales Quantity by Type (2018-2023) & (K Units)

Table 119. Global C-MET & HGF Inhibitors Sales Quantity by Type (2024-2029) & (K Units)

Table 120. Global C-MET & HGF Inhibitors Consumption Value by Type (2018-2023) & (USD Million)

Table 121. Global C-MET & HGF Inhibitors Consumption Value by Type (2024-2029) & (USD Million)

Table 122. Global C-MET & HGF Inhibitors Average Price by Type (2018-2023) & (US$/Unit)

Table 123. Global C-MET & HGF Inhibitors Average Price by Type (2024-2029) & (US$/Unit)

Table 124. Global C-MET & HGF Inhibitors Sales Quantity by Application (2018-2023) & (K Units)

Table 125. Global C-MET & HGF Inhibitors Sales Quantity by Application (2024-2029) & (K Units)

Table 126. Global C-MET & HGF Inhibitors Consumption Value by Application (2018-2023) & (USD Million)

Table 127. Global C-MET & HGF Inhibitors Consumption Value by Application (2024-2029) & (USD Million)

Table 128. Global C-MET & HGF Inhibitors Average Price by Application (2018-2023) & (US$/Unit)

Table 129. Global C-MET & HGF Inhibitors Average Price by Application (2024-2029) & (US$/Unit)

Table 130. North America C-MET & HGF Inhibitors Sales Quantity by Type (2018-2023) & (K Units)

Table 131. North America C-MET & HGF Inhibitors Sales Quantity by Type (2024-2029) & (K Units)

Table 132. North America C-MET & HGF Inhibitors Sales Quantity by Application (2018-2023) & (K Units)

Table 133. North America C-MET & HGF Inhibitors Sales Quantity by Application (2024-2029) & (K Units)

Table 134. North America C-MET & HGF Inhibitors Sales Quantity by Country (2018-2023) & (K Units)

Table 135. North America C-MET & HGF Inhibitors Sales Quantity by Country (2024-2029) & (K Units)

Table 136. North America C-MET & HGF Inhibitors Consumption Value by Country (2018-2023) & (USD Million)

Table 137. North America C-MET & HGF Inhibitors Consumption Value by Country (2024-2029) & (USD Million)

Table 138. Europe C-MET & HGF Inhibitors Sales Quantity by Type (2018-2023) & (K Units)

Table 139. Europe C-MET & HGF Inhibitors Sales Quantity by Type (2024-2029) & (K Units)

Table 140. Europe C-MET & HGF Inhibitors Sales Quantity by Application (2018-2023) & (K Units)

Table 141. Europe C-MET & HGF Inhibitors Sales Quantity by Application (2024-2029) & (K Units)

Table 142. Europe C-MET & HGF Inhibitors Sales Quantity by Country (2018-2023) & (K Units)

Table 143. Europe C-MET & HGF Inhibitors Sales Quantity by Country (2024-2029) & (K Units)

Table 144. Europe C-MET & HGF Inhibitors Consumption Value by Country (2018-2023) & (USD Million)

Table 145. Europe C-MET & HGF Inhibitors Consumption Value by Country (2024-2029) & (USD Million)

Table 146. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Type (2018-2023) & (K Units)

Table 147. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Type (2024-2029) & (K Units)

Table 148. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Application (2018-2023) & (K Units)

Table 149. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Application (2024-2029) & (K Units)

Table 150. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Region (2018-2023) & (K Units)

Table 151. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity by Region (2024-2029) & (K Units)

Table 152. Asia-Pacific C-MET & HGF Inhibitors Consumption Value by Region (2018-2023) & (USD Million)

Table 153. Asia-Pacific C-MET & HGF Inhibitors Consumption Value by Region (2024-2029) & (USD Million)

Table 154. South America C-MET & HGF Inhibitors Sales Quantity by Type (2018-2023) & (K Units)

Table 155. South America C-MET & HGF Inhibitors Sales Quantity by Type (2024-2029) & (K Units)

Table 156. South America C-MET & HGF Inhibitors Sales Quantity by Application (2018-2023) & (K Units)

Table 157. South America C-MET & HGF Inhibitors Sales Quantity by Application (2024-2029) & (K Units)

Table 158. South America C-MET & HGF Inhibitors Sales Quantity by Country (2018-2023) & (K Units)

Table 159. South America C-MET & HGF Inhibitors Sales Quantity by Country (2024-2029) & (K Units)

Table 160. South America C-MET & HGF Inhibitors Consumption Value by Country (2018-2023) & (USD Million)

Table 161. South America C-MET & HGF Inhibitors Consumption Value by Country (2024-2029) & (USD Million)

Table 162. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Type (2018-2023) & (K Units)

Table 163. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Type (2024-2029) & (K Units)

Table 164. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Application (2018-2023) & (K Units)

Table 165. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Application (2024-2029) & (K Units)

Table 166. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Region (2018-2023) & (K Units)

Table 167. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity by Region (2024-2029) & (K Units)

Table 168. Middle East & Africa C-MET & HGF Inhibitors Consumption Value by Region (2018-2023) & (USD Million)

Table 169. Middle East & Africa C-MET & HGF Inhibitors Consumption Value by Region (2024-2029) & (USD Million)

Table 170. C-MET & HGF Inhibitors Raw Material

Table 171. Key Manufacturers of C-MET & HGF Inhibitors Raw Materials

Table 172. C-MET & HGF Inhibitors Typical Distributors

Table 173. C-MET & HGF Inhibitors Typical Customers

List of Figures

Figure 1. C-MET & HGF Inhibitors Picture

Figure 2. Global C-MET & HGF Inhibitors Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global C-MET & HGF Inhibitors Consumption Value Market Share by Type in 2022

Figure 4. Cabozantinib Examples

Figure 5. Crizotinib Examples

Figure 6. Others Examples

Figure 7. Global C-MET & HGF Inhibitors Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 8. Global C-MET & HGF Inhibitors Consumption Value Market Share by Application in 2022

Figure 9. Hospital Examples

Figure 10. Drug Store Examples

Figure 11. Global C-MET & HGF Inhibitors Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 12. Global C-MET & HGF Inhibitors Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 13. Global C-MET & HGF Inhibitors Sales Quantity (2018-2029) & (K Units)

Figure 14. Global C-MET & HGF Inhibitors Average Price (2018-2029) & (US$/Unit)

Figure 15. Global C-MET & HGF Inhibitors Sales Quantity Market Share by Manufacturer in 2022

Figure 16. Global C-MET & HGF Inhibitors Consumption Value Market Share by Manufacturer in 2022

Figure 17. Producer Shipments of C-MET & HGF Inhibitors by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 18. Top 3 C-MET & HGF Inhibitors Manufacturer (Consumption Value) Market Share in 2022

Figure 19. Top 6 C-MET & HGF Inhibitors Manufacturer (Consumption Value) Market Share in 2022

Figure 20. Global C-MET & HGF Inhibitors Sales Quantity Market Share by Region (2018-2029)

Figure 21. Global C-MET & HGF Inhibitors Consumption Value Market Share by Region (2018-2029)

Figure 22. North America C-MET & HGF Inhibitors Consumption Value (2018-2029) & (USD Million)

Figure 23. Europe C-MET & HGF Inhibitors Consumption Value (2018-2029) & (USD Million)

Figure 24. Asia-Pacific C-MET & HGF Inhibitors Consumption Value (2018-2029) & (USD Million)

Figure 25. South America C-MET & HGF Inhibitors Consumption Value (2018-2029) & (USD Million)

Figure 26. Middle East & Africa C-MET & HGF Inhibitors Consumption Value (2018-2029) & (USD Million)

Figure 27. Global C-MET & HGF Inhibitors Sales Quantity Market Share by Type (2018-2029)

Figure 28. Global C-MET & HGF Inhibitors Consumption Value Market Share by Type (2018-2029)

Figure 29. Global C-MET & HGF Inhibitors Average Price by Type (2018-2029) & (US$/Unit)

Figure 30. Global C-MET & HGF Inhibitors Sales Quantity Market Share by Application (2018-2029)

Figure 31. Global C-MET & HGF Inhibitors Consumption Value Market Share by Application (2018-2029)

Figure 32. Global C-MET & HGF Inhibitors Average Price by Application (2018-2029) & (US$/Unit)

Figure 33. North America C-MET & HGF Inhibitors Sales Quantity Market Share by Type (2018-2029)

Figure 34. North America C-MET & HGF Inhibitors Sales Quantity Market Share by Application (2018-2029)

Figure 35. North America C-MET & HGF Inhibitors Sales Quantity Market Share by Country (2018-2029)

Figure 36. North America C-MET & HGF Inhibitors Consumption Value Market Share by Country (2018-2029)

Figure 37. United States C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 38. Canada C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 39. Mexico C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Europe C-MET & HGF Inhibitors Sales Quantity Market Share by Type (2018-2029)

Figure 41. Europe C-MET & HGF Inhibitors Sales Quantity Market Share by Application (2018-2029)

Figure 42. Europe C-MET & HGF Inhibitors Sales Quantity Market Share by Country (2018-2029)

Figure 43. Europe C-MET & HGF Inhibitors Consumption Value Market Share by Country (2018-2029)

Figure 44. Germany C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 45. France C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 46. United Kingdom C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. Russia C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. Italy C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity Market Share by Type (2018-2029)

Figure 50. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity Market Share by Application (2018-2029)

Figure 51. Asia-Pacific C-MET & HGF Inhibitors Sales Quantity Market Share by Region (2018-2029)

Figure 52. Asia-Pacific C-MET & HGF Inhibitors Consumption Value Market Share by Region (2018-2029)

Figure 53. China C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 54. Japan C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 55. Korea C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. India C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Southeast Asia C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Australia C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. South America C-MET & HGF Inhibitors Sales Quantity Market Share by Type (2018-2029)

Figure 60. South America C-MET & HGF Inhibitors Sales Quantity Market Share by Application (2018-2029)

Figure 61. South America C-MET & HGF Inhibitors Sales Quantity Market Share by Country (2018-2029)

Figure 62. South America C-MET & HGF Inhibitors Consumption Value Market Share by Country (2018-2029)

Figure 63. Brazil C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 64. Argentina C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 65. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity Market Share by Type (2018-2029)

Figure 66. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity Market Share by Application (2018-2029)

Figure 67. Middle East & Africa C-MET & HGF Inhibitors Sales Quantity Market Share by Region (2018-2029)

Figure 68. Middle East & Africa C-MET & HGF Inhibitors Consumption Value Market Share by Region (2018-2029)

Figure 69. Turkey C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 70. Egypt C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 71. Saudi Arabia C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. South Africa C-MET & HGF Inhibitors Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. C-MET & HGF Inhibitors Market Drivers

Figure 74. C-MET & HGF Inhibitors Market Restraints

Figure 75. C-MET & HGF Inhibitors Market Trends

Figure 76. Porters Five Forces Analysis

Figure 77. Manufacturing Cost Structure Analysis of C-MET & HGF Inhibitors in 2022

Figure 78. Manufacturing Process Analysis of C-MET & HGF Inhibitors

Figure 79. C-MET & HGF Inhibitors Industrial Chain

Figure 80. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 81. Direct Channel Pros & Cons

Figure 82. Indirect Channel Pros & Cons

Figure 83. Methodology

Figure 84. Research Process and Data Source