Market Outlook

The global 1,2-Pentanediol Market size was valued at USD 76 million in 2022 and is forecast to a readjusted size of USD 85 million by 2029 with a CAGR of 1.6% during review period.

Introduction: Why the 1,2-Pentanediol Market Matters in 2025

The 1,2-Pentanediol Market in 2025 is evolving swiftly, driven by growing industrial demand for this versatile chemical intermediate and specialty solvent. 1,2-Pentanediol, a diol compound characterized by its excellent solubility and moisturizing properties, finds extensive use across personal care, pharmaceuticals, and food industries. Its ability to serve as a humectant, solvent, and preservative enhancer makes it indispensable in formulations ranging from skincare products to flavor carriers.

As consumers worldwide increasingly prefer multifunctional and naturally derived ingredients, 1,2-pentanediol's role in green chemistry and sustainable product formulations is amplifying. This rise is attracting attention from chemical manufacturers, formulators, and investors seeking to capitalize on expanding end-use markets and regulatory environments favoring safe, effective additives.

Market Drivers: What’s Fueling the 1,2-Pentanediol Market Growth?

Rising Demand from Cosmetics and Personal Care Sector

Growing awareness around skin hydration and product safety propels the use of 1,2-pentanediol as a natural, non-toxic moisturizer and preservative booster in creams, lotions, and serums globally.Pharmaceutical Applications Expanding

1,2-Pentanediol serves as a solvent and stabilizer in topical and oral drug formulations, increasing demand in the pharmaceutical industry driven by the rise in chronic disease treatments and specialty drugs.Food and Beverage Industry Usage

As a flavor carrier and humectant, 1,2-pentanediol is increasingly incorporated in processed foods and beverages to improve taste stability and shelf life, responding to consumer expectations for quality and safety.Sustainability and Regulatory Encouragement

Strict regulations on volatile organic compounds (VOCs) and synthetic preservatives push manufacturers towards safer, biodegradable alternatives like 1,2-pentanediol, fostering broader adoption.

Innovation in Focus: How Manufacturers Are Raising the Bar

Bio-Based Production Technologies

Leading producers are investing in renewable feedstock-based synthesis methods, reducing environmental impact and aligning with circular economy principles.Enhanced Purity and Functionality Grades

Development of high-purity 1,2-pentanediol variants tailored for sensitive applications such as infant care products and pharmaceutical excipients is expanding market versatility.Formulation Synergies

Innovative blends combining 1,2-pentanediol with natural extracts and antimicrobial agents boost preservative efficacy while maintaining skin-friendly profiles.Packaging and Logistics Improvements

Optimized packaging solutions ensuring stability and ease of transport are enhancing supply chain reliability and reducing product loss during shipment.

Regional Breakdown: Where the Market is Growing Fastest

Asia-Pacific (APAC)

APAC leads the global 1,2-pentanediol market, driven by booming cosmetics manufacturing hubs in China, South Korea, and India, coupled with expanding pharmaceutical industries.North America

Growth in North America is supported by consumer preference for clean-label personal care products, robust pharmaceutical R&D, and stringent regulatory frameworks encouraging safer ingredients.Europe

Europe’s demand is buoyed by strong green chemistry initiatives, eco-certifications, and high adoption of natural-based cosmetic formulations, particularly in Germany, France, and the UK.Latin America and Middle East & Africa (MEA)

Emerging markets here show promising growth potential due to urbanization, rising disposable incomes, and increasing awareness of personal health and hygiene products.

Strategic Considerations: How to Succeed in the 1,2-Pentanediol Market 2025

Compliance with Global Safety and Environmental Standards

Meeting regulations such as REACH, FDA, and COSMOS ensures market access and builds trust among end-users and formulators.Product Portfolio Diversification

Offering grades specific to different industries - cosmetics, pharmaceuticals, and food - enables penetration into niche segments and reduces dependence on any single application.Localized Production and Distribution

Establishing manufacturing and warehousing hubs near key markets in APAC and Europe cuts delivery times and lowers operational costs.Collaborative R&D with End-Users

Partnering with cosmetic and pharmaceutical companies to co-develop innovative formulations can fast-track product adoption and brand loyalty.Leverage Digital Marketing and Thought Leadership

Utilizing data-driven content, webinars, and case studies educates potential buyers on the benefits and applications of 1,2-pentanediol, strengthening market presence.

Conclusion: The 1,2-Pentanediol Market 2025 - A Multifunctional Chemical with Broad Potential

The 1,2-Pentanediol Market in 2025 represents a vibrant intersection of chemical innovation, sustainability, and end-user demand across multiple industries. Its unique properties as a safe, effective solvent and moisturizer underpin robust growth prospects fueled by evolving consumer preferences and tightening regulatory standards.

For investors, manufacturers, and formulators, the market offers a fertile ground for innovation-led expansion. Staying ahead requires an agile approach focused on regulatory compliance, product customization, and strategic partnerships to unlock the full potential of this valuable diol compound.

Key Market Players

BASF

Evonik

Lanxess

Minasolve

Kokyu

Realsun Chemical

Jujing Chemical

Jiangsu First

Segmentation By Type

Cosmetic Grade

Industrial Grade

Segmentation By Application

Pesticide Intermediates

Cosmetic

Others

Segmentation By Region

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

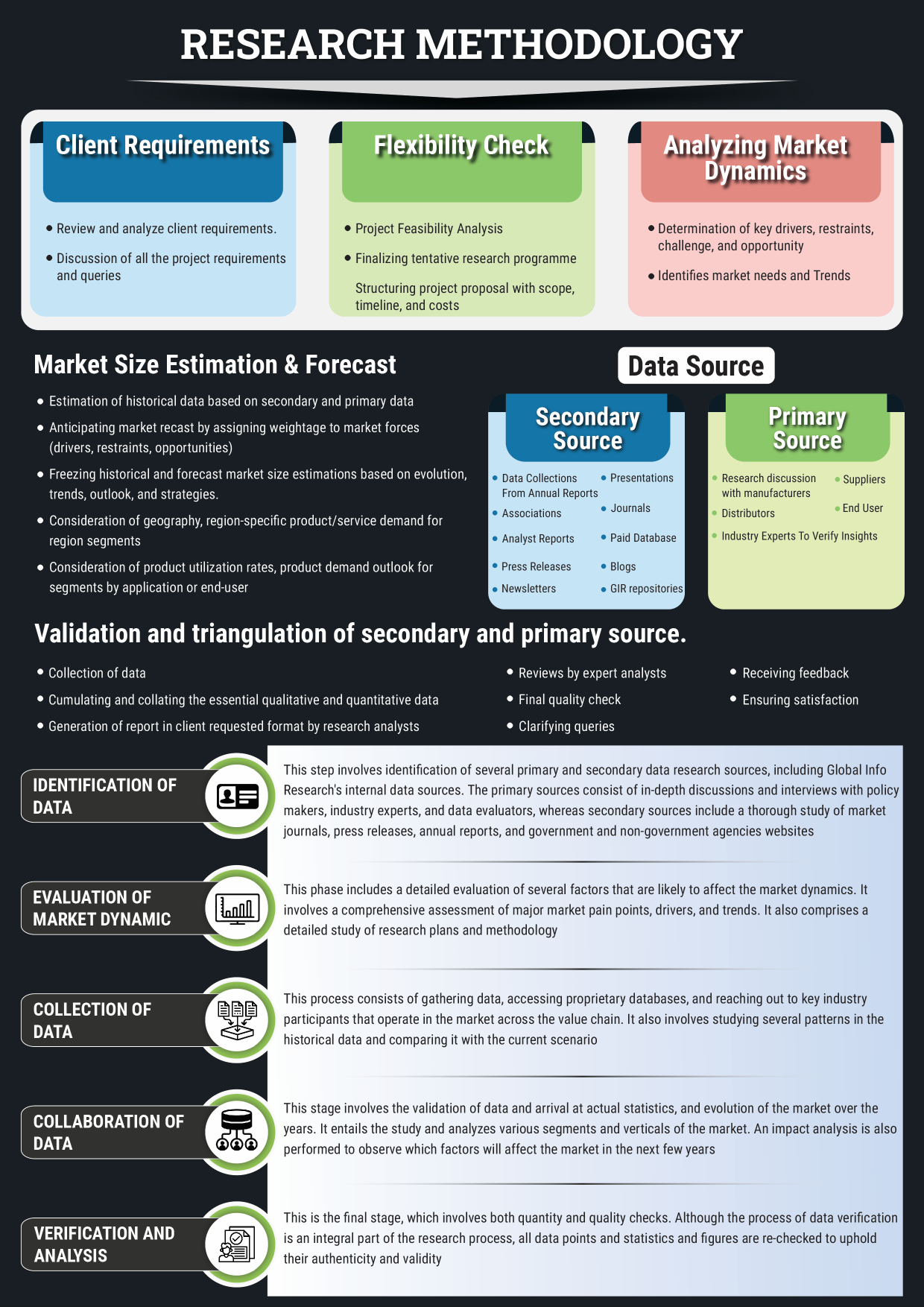

Chapter 1, to describe 1,2-Pentanediol product scope, market overview, market estimation caveats and base year.

Chapter 2, to profile the top manufacturers of 1,2-Pentanediol, with price, sales, revenue and global market share of 1,2-Pentanediol from 2018 to 2023.

Chapter 3, the 1,2-Pentanediol competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the 1,2-Pentanediol breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2018 to 2029.

Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2018 to 2029.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2022.and 1,2-Pentanediol market forecast, by regions, type and application, with sales and revenue, from 2024 to 2029.

Chapter 12, market dynamics, drivers, restraints, trends, Porters Five Forces analysis, and Influence of COVID-19 and Russia-Ukraine War.

Chapter 13, the key raw materials and key suppliers, and industry chain of 1,2-Pentanediol.

Chapter 14 and 15, to describe 1,2-Pentanediol sales channel, distributors, customers, research findings and conclusion.

List of Tables

Table 1. Global 1,2-Pentanediol Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Table 2. Global 1,2-Pentanediol Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Table 3. BASF Basic Information, Manufacturing Base and Competitors

Table 4. BASF Major Business

Table 5. BASF 1,2-Pentanediol Product and Services

Table 6. BASF 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 7. BASF Recent Developments/Updates

Table 8. Evonik Basic Information, Manufacturing Base and Competitors

Table 9. Evonik Major Business

Table 10. Evonik 1,2-Pentanediol Product and Services

Table 11. Evonik 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 12. Evonik Recent Developments/Updates

Table 13. Lanxess Basic Information, Manufacturing Base and Competitors

Table 14. Lanxess Major Business

Table 15. Lanxess 1,2-Pentanediol Product and Services

Table 16. Lanxess 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 17. Lanxess Recent Developments/Updates

Table 18. Minasolve Basic Information, Manufacturing Base and Competitors

Table 19. Minasolve Major Business

Table 20. Minasolve 1,2-Pentanediol Product and Services

Table 21. Minasolve 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 22. Minasolve Recent Developments/Updates

Table 23. Kokyu Basic Information, Manufacturing Base and Competitors

Table 24. Kokyu Major Business

Table 25. Kokyu 1,2-Pentanediol Product and Services

Table 26. Kokyu 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 27. Kokyu Recent Developments/Updates

Table 28. Realsun Chemical Basic Information, Manufacturing Base and Competitors

Table 29. Realsun Chemical Major Business

Table 30. Realsun Chemical 1,2-Pentanediol Product and Services

Table 31. Realsun Chemical 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 32. Realsun Chemical Recent Developments/Updates

Table 33. Jujing Chemical Basic Information, Manufacturing Base and Competitors

Table 34. Jujing Chemical Major Business

Table 35. Jujing Chemical 1,2-Pentanediol Product and Services

Table 36. Jujing Chemical 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 37. Jujing Chemical Recent Developments/Updates

Table 38. Jiangsu First Basic Information, Manufacturing Base and Competitors

Table 39. Jiangsu First Major Business

Table 40. Jiangsu First 1,2-Pentanediol Product and Services

Table 41. Jiangsu First 1,2-Pentanediol Sales Quantity (Ton), Average Price (USD/Ton), Revenue (USD Million), Gross Margin and Market Share (2018-2023)

Table 42. Jiangsu First Recent Developments/Updates

Table 43. Global 1,2-Pentanediol Sales Quantity by Manufacturer (2018-2023) & (Ton)

Table 44. Global 1,2-Pentanediol Revenue by Manufacturer (2018-2023) & (USD Million)

Table 45. Global 1,2-Pentanediol Average Price by Manufacturer (2018-2023) & (USD/Ton)

Table 46. Market Position of Manufacturers in 1,2-Pentanediol, (Tier 1, Tier 2, and Tier 3), Based on Consumption Value in 2022

Table 47. Head Office and 1,2-Pentanediol Production Site of Key Manufacturer

Table 48. 1,2-Pentanediol Market: Company Product Type Footprint

Table 49. 1,2-Pentanediol Market: Company Product Application Footprint

Table 50. 1,2-Pentanediol New Market Entrants and Barriers to Market Entry

Table 51. 1,2-Pentanediol Mergers, Acquisition, Agreements, and Collaborations

Table 52. Global 1,2-Pentanediol Sales Quantity by Region (2018-2023) & (Ton)

Table 53. Global 1,2-Pentanediol Sales Quantity by Region (2024-2029) & (Ton)

Table 54. Global 1,2-Pentanediol Consumption Value by Region (2018-2023) & (USD Million)

Table 55. Global 1,2-Pentanediol Consumption Value by Region (2024-2029) & (USD Million)

Table 56. Global 1,2-Pentanediol Average Price by Region (2018-2023) & (USD/Ton)

Table 57. Global 1,2-Pentanediol Average Price by Region (2024-2029) & (USD/Ton)

Table 58. Global 1,2-Pentanediol Sales Quantity by Type (2018-2023) & (Ton)

Table 59. Global 1,2-Pentanediol Sales Quantity by Type (2024-2029) & (Ton)

Table 60. Global 1,2-Pentanediol Consumption Value by Type (2018-2023) & (USD Million)

Table 61. Global 1,2-Pentanediol Consumption Value by Type (2024-2029) & (USD Million)

Table 62. Global 1,2-Pentanediol Average Price by Type (2018-2023) & (USD/Ton)

Table 63. Global 1,2-Pentanediol Average Price by Type (2024-2029) & (USD/Ton)

Table 64. Global 1,2-Pentanediol Sales Quantity by Application (2018-2023) & (Ton)

Table 65. Global 1,2-Pentanediol Sales Quantity by Application (2024-2029) & (Ton)

Table 66. Global 1,2-Pentanediol Consumption Value by Application (2018-2023) & (USD Million)

Table 67. Global 1,2-Pentanediol Consumption Value by Application (2024-2029) & (USD Million)

Table 68. Global 1,2-Pentanediol Average Price by Application (2018-2023) & (USD/Ton)

Table 69. Global 1,2-Pentanediol Average Price by Application (2024-2029) & (USD/Ton)

Table 70. North America 1,2-Pentanediol Sales Quantity by Type (2018-2023) & (Ton)

Table 71. North America 1,2-Pentanediol Sales Quantity by Type (2024-2029) & (Ton)

Table 72. North America 1,2-Pentanediol Sales Quantity by Application (2018-2023) & (Ton)

Table 73. North America 1,2-Pentanediol Sales Quantity by Application (2024-2029) & (Ton)

Table 74. North America 1,2-Pentanediol Sales Quantity by Country (2018-2023) & (Ton)

Table 75. North America 1,2-Pentanediol Sales Quantity by Country (2024-2029) & (Ton)

Table 76. North America 1,2-Pentanediol Consumption Value by Country (2018-2023) & (USD Million)

Table 77. North America 1,2-Pentanediol Consumption Value by Country (2024-2029) & (USD Million)

Table 78. Europe 1,2-Pentanediol Sales Quantity by Type (2018-2023) & (Ton)

Table 79. Europe 1,2-Pentanediol Sales Quantity by Type (2024-2029) & (Ton)

Table 80. Europe 1,2-Pentanediol Sales Quantity by Application (2018-2023) & (Ton)

Table 81. Europe 1,2-Pentanediol Sales Quantity by Application (2024-2029) & (Ton)

Table 82. Europe 1,2-Pentanediol Sales Quantity by Country (2018-2023) & (Ton)

Table 83. Europe 1,2-Pentanediol Sales Quantity by Country (2024-2029) & (Ton)

Table 84. Europe 1,2-Pentanediol Consumption Value by Country (2018-2023) & (USD Million)

Table 85. Europe 1,2-Pentanediol Consumption Value by Country (2024-2029) & (USD Million)

Table 86. Asia-Pacific 1,2-Pentanediol Sales Quantity by Type (2018-2023) & (Ton)

Table 87. Asia-Pacific 1,2-Pentanediol Sales Quantity by Type (2024-2029) & (Ton)

Table 88. Asia-Pacific 1,2-Pentanediol Sales Quantity by Application (2018-2023) & (Ton)

Table 89. Asia-Pacific 1,2-Pentanediol Sales Quantity by Application (2024-2029) & (Ton)

Table 90. Asia-Pacific 1,2-Pentanediol Sales Quantity by Region (2018-2023) & (Ton)

Table 91. Asia-Pacific 1,2-Pentanediol Sales Quantity by Region (2024-2029) & (Ton)

Table 92. Asia-Pacific 1,2-Pentanediol Consumption Value by Region (2018-2023) & (USD Million)

Table 93. Asia-Pacific 1,2-Pentanediol Consumption Value by Region (2024-2029) & (USD Million)

Table 94. South America 1,2-Pentanediol Sales Quantity by Type (2018-2023) & (Ton)

Table 95. South America 1,2-Pentanediol Sales Quantity by Type (2024-2029) & (Ton)

Table 96. South America 1,2-Pentanediol Sales Quantity by Application (2018-2023) & (Ton)

Table 97. South America 1,2-Pentanediol Sales Quantity by Application (2024-2029) & (Ton)

Table 98. South America 1,2-Pentanediol Sales Quantity by Country (2018-2023) & (Ton)

Table 99. South America 1,2-Pentanediol Sales Quantity by Country (2024-2029) & (Ton)

Table 100. South America 1,2-Pentanediol Consumption Value by Country (2018-2023) & (USD Million)

Table 101. South America 1,2-Pentanediol Consumption Value by Country (2024-2029) & (USD Million)

Table 102. Middle East & Africa 1,2-Pentanediol Sales Quantity by Type (2018-2023) & (Ton)

Table 103. Middle East & Africa 1,2-Pentanediol Sales Quantity by Type (2024-2029) & (Ton)

Table 104. Middle East & Africa 1,2-Pentanediol Sales Quantity by Application (2018-2023) & (Ton)

Table 105. Middle East & Africa 1,2-Pentanediol Sales Quantity by Application (2024-2029) & (Ton)

Table 106. Middle East & Africa 1,2-Pentanediol Sales Quantity by Region (2018-2023) & (Ton)

Table 107. Middle East & Africa 1,2-Pentanediol Sales Quantity by Region (2024-2029) & (Ton)

Table 108. Middle East & Africa 1,2-Pentanediol Consumption Value by Region (2018-2023) & (USD Million)

Table 109. Middle East & Africa 1,2-Pentanediol Consumption Value by Region (2024-2029) & (USD Million)

Table 110. 1,2-Pentanediol Raw Material

Table 111. Key Manufacturers of 1,2-Pentanediol Raw Materials

Table 112. 1,2-Pentanediol Typical Distributors

Table 113. 1,2-Pentanediol Typical Customers

List of Figures

Figure 1. 1,2-Pentanediol Picture

Figure 2. Global 1,2-Pentanediol Consumption Value by Type, (USD Million), 2018 & 2022 & 2029

Figure 3. Global 1,2-Pentanediol Consumption Value Market Share by Type in 2022

Figure 4. Cosmetic Grade Examples

Figure 5. Industrial Grade Examples

Figure 6. Global 1,2-Pentanediol Consumption Value by Application, (USD Million), 2018 & 2022 & 2029

Figure 7. Global 1,2-Pentanediol Consumption Value Market Share by Application in 2022

Figure 8. Pesticide Intermediates Examples

Figure 9. Cosmetic Examples

Figure 10. Others Examples

Figure 11. Global 1,2-Pentanediol Consumption Value, (USD Million): 2018 & 2022 & 2029

Figure 12. Global 1,2-Pentanediol Consumption Value and Forecast (2018-2029) & (USD Million)

Figure 13. Global 1,2-Pentanediol Sales Quantity (2018-2029) & (Ton)

Figure 14. Global 1,2-Pentanediol Average Price (2018-2029) & (USD/Ton)

Figure 15. Global 1,2-Pentanediol Sales Quantity Market Share by Manufacturer in 2022

Figure 16. Global 1,2-Pentanediol Consumption Value Market Share by Manufacturer in 2022

Figure 17. Producer Shipments of 1,2-Pentanediol by Manufacturer Sales Quantity ($MM) and Market Share (%): 2021

Figure 18. Top 3 1,2-Pentanediol Manufacturer (Consumption Value) Market Share in 2022

Figure 19. Top 6 1,2-Pentanediol Manufacturer (Consumption Value) Market Share in 2022

Figure 20. Global 1,2-Pentanediol Sales Quantity Market Share by Region (2018-2029)

Figure 21. Global 1,2-Pentanediol Consumption Value Market Share by Region (2018-2029)

Figure 22. North America 1,2-Pentanediol Consumption Value (2018-2029) & (USD Million)

Figure 23. Europe 1,2-Pentanediol Consumption Value (2018-2029) & (USD Million)

Figure 24. Asia-Pacific 1,2-Pentanediol Consumption Value (2018-2029) & (USD Million)

Figure 25. South America 1,2-Pentanediol Consumption Value (2018-2029) & (USD Million)

Figure 26. Middle East & Africa 1,2-Pentanediol Consumption Value (2018-2029) & (USD Million)

Figure 27. Global 1,2-Pentanediol Sales Quantity Market Share by Type (2018-2029)

Figure 28. Global 1,2-Pentanediol Consumption Value Market Share by Type (2018-2029)

Figure 29. Global 1,2-Pentanediol Average Price by Type (2018-2029) & (USD/Ton)

Figure 30. Global 1,2-Pentanediol Sales Quantity Market Share by Application (2018-2029)

Figure 31. Global 1,2-Pentanediol Consumption Value Market Share by Application (2018-2029)

Figure 32. Global 1,2-Pentanediol Average Price by Application (2018-2029) & (USD/Ton)

Figure 33. North America 1,2-Pentanediol Sales Quantity Market Share by Type (2018-2029)

Figure 34. North America 1,2-Pentanediol Sales Quantity Market Share by Application (2018-2029)

Figure 35. North America 1,2-Pentanediol Sales Quantity Market Share by Country (2018-2029)

Figure 36. North America 1,2-Pentanediol Consumption Value Market Share by Country (2018-2029)

Figure 37. United States 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 38. Canada 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 39. Mexico 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 40. Europe 1,2-Pentanediol Sales Quantity Market Share by Type (2018-2029)

Figure 41. Europe 1,2-Pentanediol Sales Quantity Market Share by Application (2018-2029)

Figure 42. Europe 1,2-Pentanediol Sales Quantity Market Share by Country (2018-2029)

Figure 43. Europe 1,2-Pentanediol Consumption Value Market Share by Country (2018-2029)

Figure 44. Germany 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 45. France 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 46. United Kingdom 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 47. Russia 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 48. Italy 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 49. Asia-Pacific 1,2-Pentanediol Sales Quantity Market Share by Type (2018-2029)

Figure 50. Asia-Pacific 1,2-Pentanediol Sales Quantity Market Share by Application (2018-2029)

Figure 51. Asia-Pacific 1,2-Pentanediol Sales Quantity Market Share by Region (2018-2029)

Figure 52. Asia-Pacific 1,2-Pentanediol Consumption Value Market Share by Region (2018-2029)

Figure 53. China 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 54. Japan 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 55. Korea 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 56. India 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 57. Southeast Asia 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 58. Australia 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 59. South America 1,2-Pentanediol Sales Quantity Market Share by Type (2018-2029)

Figure 60. South America 1,2-Pentanediol Sales Quantity Market Share by Application (2018-2029)

Figure 61. South America 1,2-Pentanediol Sales Quantity Market Share by Country (2018-2029)

Figure 62. South America 1,2-Pentanediol Consumption Value Market Share by Country (2018-2029)

Figure 63. Brazil 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 64. Argentina 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 65. Middle East & Africa 1,2-Pentanediol Sales Quantity Market Share by Type (2018-2029)

Figure 66. Middle East & Africa 1,2-Pentanediol Sales Quantity Market Share by Application (2018-2029)

Figure 67. Middle East & Africa 1,2-Pentanediol Sales Quantity Market Share by Region (2018-2029)

Figure 68. Middle East & Africa 1,2-Pentanediol Consumption Value Market Share by Region (2018-2029)

Figure 69. Turkey 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 70. Egypt 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 71. Saudi Arabia 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 72. South Africa 1,2-Pentanediol Consumption Value and Growth Rate (2018-2029) & (USD Million)

Figure 73. 1,2-Pentanediol Market Drivers

Figure 74. 1,2-Pentanediol Market Restraints

Figure 75. 1,2-Pentanediol Market Trends

Figure 76. Porters Five Forces Analysis

Figure 77. Manufacturing Cost Structure Analysis of 1,2-Pentanediol in 2022

Figure 78. Manufacturing Process Analysis of 1,2-Pentanediol

Figure 79. 1,2-Pentanediol Industrial Chain

Figure 80. Sales Quantity Channel: Direct to End-User vs Distributors

Figure 81. Direct Channel Pros & Cons

Figure 82. Indirect Channel Pros & Cons

Figure 83. Methodology

Figure 84. Research Process and Data Source